Greek banks extended their share price growth in what was a strong second quarter for European lenders.

Among a sample of large European banks, Piraeus Financial Holdings SA registered the biggest total shareholder returns at just over 50%, S&P Global Market Intelligence data shows.

Alpha Services and Holdings SA and National Bank of Greece SA delivered returns of more than 33%, while Eurobank Ergasias Services and Holdings SA logged an increase of nearly 24%. The FTSE/ATHEX Banks Index rose 29% over the three-month period.

Greek bank shares have ticked up during 2023 but jumped in May following snap parliamentary elections, which resulted in the incumbent center-right Prime Minister Kyriakos Mitsotakis increasing his share of the vote and securing a majority.

Mitsotakis plans to regain Greece’s investment-grade status by the end of the year and repay bailout-era loans ahead of schedule, he said in an interview with Bloomberg TV.

Against a backdrop of inflationary pressures and a European energy crisis, the Greek economy grew 5.9% in 2022, outpacing most countries in the region. Improved fiscal consolidation and structural reforms, coupled with EU support, enabled the country to recover from years of austerity following the sovereign debt crisis, and its banks are now better equipped to withstand a downturn, S&P Global Ratings said in a report.

Turkey’s bank stocks rose as President Recep Tayyip Erdoğan also secured reelection during the quarter.

Under new central bank Governor Hafize Gaye Erkan, the country signaled a reversion to more orthodox monetary policy, hiking its key interest rate to 15% from 8.5%. Yapi ve Kredi Bankasi AŞ

Italy’s UniCredit SpA, whose shares have more than doubled in value over the past year thanks to strong profits and shareholder returns, saw its stock price rise. Polish lenders Bank Polska Kasa Opieki SA, PKO Bank Polski SA and Alior Bank SA also performed well during the quarter, even after being on the wrong end of a European Court of Justice ruling.

Two of the UK’s big four lenders, NatWest Group PLC and Lloyds Banking Group PLC, were among the worst-performing bank stocks in Europe with declines of 9% and 6%, respectively. Shares in mortgage lender Nationwide Building Society and merchant bank Close Brothers Group also fell during the quarter. This comes as the UK is set to hike rates further to tame rampant inflation, which is likely to prompt higher loan losses for banks.

The share price of a number of Swiss banks declined following UBS Group AG’s state-brokered acquisition of Credit Suisse Group AG. Italy’s FinecoBank Banca Fineco SpA was the worst-performing European bank stock in the sample, with a 13% drop in total returns.

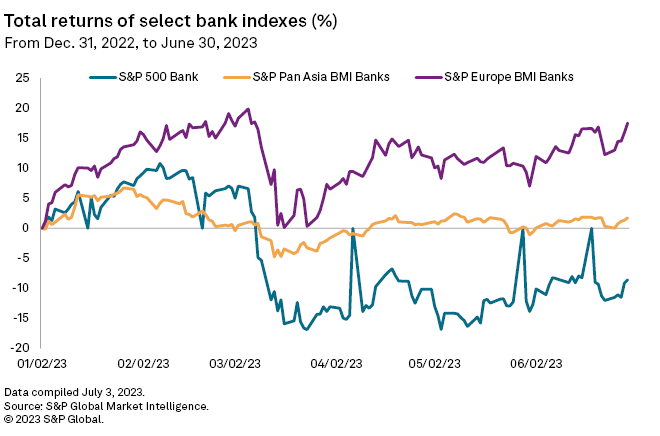

Overall, European bank stocks fared much better than their US and Asian counterparts. The S&P Europe BMI Banks index rose 17.5%, while the S&P 500 Bank index fell 8.6% and the equivalent Asian index ticked up just 1.7%.