The bank also agreed to forfeit $227m to the Department of Justice and signed a deferred prosecution agreement, meaning it avoided criminal action.

Standard Chartered escaped prosecution after the bank “accepted responsibility for its criminal conduct and that of its employees,” and took remedial action over the matter, a statement said at the time.

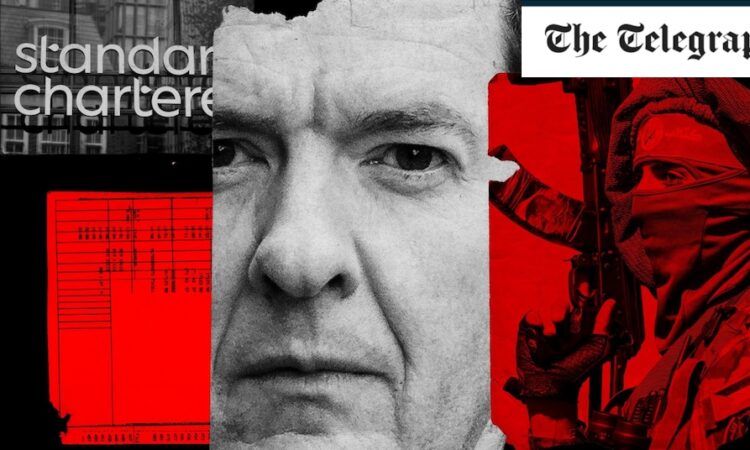

However, more than a decade later, fresh questions are emerging over the UK government’s judgment in helping Standard Chartered with its apparent get out of jail free card.

A new US court filing has alleged that Standard Chartered helped to facilitate payments to funders of Iranian-linked terrorist groups. A whistleblower in the US claimed the British banking giant carried out more than $100bn of transactions between 2008 and 2013 with Iranian-backed entities.

Julian Knight, a former Standard Chartered executive who wants the US government to bring a fresh case after it failed to prosecute the bank in 2012, claims that terror groups including Hamas, Hezbollah, the Taliban, and al-Qaeda benefited from Standard Chartered’s dealings with Iranian groups.

Knight alleges that previously undisclosed transactions show the bank helped Iranian-linked terrorist groups on a larger scale than previously thought.

“Standard Chartered Bank (SCB) transacted with Iranian entities and foreign terrorist organisations for years after it claimed to have stopped,” the claim alleges.

“SCB facilitated many billions of dollars in banking transactions for Iran, numerous international terror groups, and the front companies for those groups.”

The bank has called the claims “fabricated,” and pointed out that the whistleblowers have already tried to get the case heard in US courts but have consistently been rejected.

However, the new allegations raise questions about Osborne and the UK government’s judgment in the case.

Andy Agathangelou, head of campaign group Transparency Taskforce, said the UK government and Osborne had questions to answer.

He said: “This is yet another example that shows that those with a desire for a light-touch deregulatory agenda to boost the economy are playing with fire.

“We need a regulatory framework that is robust, with sufficiently high levels of enforcement for there to be real jeopardy in place for the individuals concerned.”

Osborne stands by his actions in 2012. A spokesman said: “The UK did not try to stop the US authorities investigating or prosecuting anyone for terrorist financing – but the public threat from a New York State regulator to remove the entire dollar licence from Standard Chartered sent the share price plummeting and threatened an imminent and disorderly bank failure, which would potentially require a Bank of England rescue and cost the UK taxpayer billions of pounds.

“Both at the Treasury and at the Bank of England we contacted our US counterparts on behalf of the UK that the Federal US authorities step in to bring the state-level regulator under control, which they did – and the crisis was averted. It was exactly what you would expect any competent government to do, and we did it successfully.

“The alternative was another bank failure and potentially another bank bailout funded by the British taxpayer.”

Standard Chartered may be headquartered in London but the majority of its business is in Asia and emerging markets, arguably leaving it more exposed to financial risks than other UK-headquartered banks.

The bank, which is best known in the UK as the shirt sponsor of Liverpool FC, has now been dealing with the fallout from its alleged business with Iran for more than 10 years.