- FTSE 100 nurses heavy losses, down 1.8%

- Banks and insurers slump on fears over US lender

- UK economy grows in January

11.20am: Berenberg upgrades UK growth forecasts

Berenberg Bank have upgraded its growth forecasts for the UK for the second time in as many weeks, after the economy grew by a stronger-than-expected 0.3% in January.

Berenberg now expect the economy to contract by 0.1% during 2023, up from negative 0.5% forecast before, while their calls for 2024 and 2025 have been left broadly unchanged at 1.5% and 1.7% (previously 1.6% and 1.7%) respectively.

Kallum Pickering of Berenberg said the UK now faces stagflation, instead of recession, this year.

At first glance, the degree of economic resilience the UK is “somewhat of a puzzle”, Pickering writes, adding: “Factors including falling real retail sales, the housing market correction and near-record low consumer confidence are strongly pointing to at least a mild downturn.”

“But headline GDP data continue to suggest stagflation rather than outright recession. As balance sheets across the private sector are in good health and the labour market is holding up well even as financial conditions tighten, our earlier calls for a historically mild recession now appear too pessimistic.”

“The tension between clear spots of weakness versus favourable fundamentals and robust aggregate output implies a high degree of uncertainty regarding our medium-term calls.”

10.45am: SVB crisis not a Lehman moment – Shore Capital

Gary Greenwood at Shore Capital has taken a look at events in the US with a read across to UK banks. He noted US bank shares fell sharply yesterday for two reasons – Silicon Valley Bank (SVB) got into difficulty due to mark downs on its security investments raising contagion fears and market fears increased that net interest margins are going to be squeezed by higher deposit betas (i.e. having to pass more of the recent rate rises to savers) along with a potential turn in the rate cycle.

He said the sharp rise in interest rates and bond yields that we have seen over the past year was always going to expose some issues in financial services.

He stressed for the most part, banks are well regulated and managed these days, but “clearly not all of them.”

SVB clearly was in the latter camp he said and, while there may be more examples like this to come, Greenwood said he doesn’t “see this as a ‘Lehman’s moment’ for the industry” and doesn’t expect any of the big UK banks getting themselves into this kind of trouble.

“Where I am much more fearful is for the shadow banking industry which has taken on a lot of the risk that banks have eschewed since the Financial Crisis and are also a lot less well regulated,” he explained.

Greenwood also noted concerns have been increasing around the degree to which interest rates increases are being passed through to depositors.

“To date, banks have benefited by withholding interest rate increases thus allowing deposit spreads to widen,” he noted.

But now depositors are starting to wise up and are beginning to shop around more for better rates with this happening more in the US than the UK, he suggested.

However, Greenwood said ultimately he does deposit beta to increase in the UK and this is reflected in guidance and forecasts, but it should also be remembered that the domestic UK banks retain a big tailwind from their structural hedges, which will reprice upwards over a number of years.

“Consequently, while NIM may have peaked on a sequential quarterly basis in the UK, I see this now stabilising rather than collapsing,” he added.

10.14am: FirstGroup forecasts raised after strong update

Away from the turmoil in the banking sector and a rare riser was FirstGroup PLC (LSE:FGP), up 1.8% after it said it anticipated profits for the financial year ending 25 March 2023 would be ahead of previous expectations following strong trading in its bus and rail operations.

In a statement, the FTSE 250-listed firm said the improved performance at First Bus was driven by higher passenger volumes in the second half of the financial year and driver resource pressures easing in certain locations.

Bus passenger volumes have increased to 83% of 2020 equivalent levels, with commercial and concessionary volumes at 87% and 75% respectively. The increase in demand has partially resulted from the £2 bus fare cap scheme introduced in England in January 2023, the company said.

Analysts at Liberum raised EPS forecasts for the financial year 2023 by 23% accordingly and reiterated a buy rating with an unchanged sum of the parts valuation of 165p.

9.40am: London rocking from the earthquake in Silicon Valley

“An earthquake in Silicon Valley led to aftershock on Wall Street and the tremors could still be felt in London on Friday morning.”

That was the view of AJ Bell investment director Russ Mould as the rout in UK banking stocks showed no signs of letting on Friday.

“Lending to tech start-ups is at the racier end of finance and in that context Silicon Valley Bank’s announcement of a US$2.25bn rescue share issue, after a period when appetite from lenders and investors towards this part of the market has dried up, should not have come as a major surprise.”

“However, in a heavily interconnected banking industry it’s not so easy to compartmentalise these sorts of events which often hint at vulnerabilities in the wider system. The fact SVB’s share placing has been accompanied by a fire sale of its bond portfolio raises concerns,” he felt.

“Lots of banks hold large portfolios of bonds and rising interest rates make these less valuable – the SVB situation is a reminder that many institutions are sitting on large unrealised losses on their fixed-income holdings.”

Banks and insurers continue to lead the FTSE 100 lower although it has pulled off worst levels for the session, now down 1.8%.

9.00am: Bank stocks extend falls but not a Lehman moment

UK equity markets in London remain firmly in the red led by a rout in UK banking and insurance stocks following sharp falls in US banks on Thursday.

At 9.00am the FTSE 100 was down 2% at 7,723.19, down 156.79 points while the FTSE 250 also fell 2% to 19,290.40, down 402.50 points.

Victoria Scholar, head of Investment, interactive investor noted the “negative momentum from last night’s sell-off on Wall Street has permeated across global markets with European indices opening lower.”

“Banks like Barclays, NatWest and Standard Chartered are trading at the bottom of the FTSE 100 while Frankfurt listings of the major Wall Street lenders continue to face selling pressure today. On the continent, Deutsche Bank, Commerzbank, Santander, and Credit Suisse are all down by more than 5% each.”

The falls were sparked after SVB Financial sank by more than 60%. This was after the bank, a prominent lender to tech startups, announced a US$2.25bn capital raise in response to a US$1.8bn loss on the sale of a portfolio marked at US$21bn. The portfolio included US Treasuries and mortgage-backed securities. The news knocked US banking stocks with big falls in a number of leading names such as Bank of America and Wells Fargo.

In London, banks also fell heavily with Barclays down by 5.5%, HSBC down 5.1%, Standard Chartered down 4.6%, Lloyds down 4.1% and NatWest down 4%. Insurers were also hit. Prudential tumbled 4.6% while Legal & General dipped 4%.

The mood was no brighter on the continent with the Dax in Frankfurt and the CAC 40 down 1.8% and 1.9% respectively. Across Europe bank stocks fell. Aaide from the falls in German banks outlined above Banco Santander (LSE:BNC) fell 6.2%, BNP Paribas slipped 4.6% and UBS by 4.4%.

Neil Wilson at markets.com asked whether this was Lehman moment. He felt not.

“SVB does not represent the wider US banking sector, albeit the plummet in SVB stock clearly hit sentiment. It seems as though SVB was just gripping the wrong end of the stick with regards to rising interest rates, parking way too much of its assets in long-dated bonds which it thought safe but are now worth a lot less,” he commented.

8.20am: FTSE 100 knocked by falls in the US

The FTSE 100 fell sharply in early exchanges on Friday rattled by heavy falls in US stocks amid fears over the health of the banking sector across the pond.

At 8.20am London’s lead index was down 119.53 points, or 1.5%, at 7,760.45 while the FTSE 250 slumped to 19,349.70, down 343.20, or 1.74%.

Investors wiped US$52.4bn off the market value of the four largest US banks by assets on Thursday amid a widespread sell-off of financial stocks that analysts linked to investor fears over the value of lenders’ bond portfolios.

The sell-off in JPMorgan Chase, Bank of America, Citigroup and Wells Fargo was sparked by difficulties at Silicon Valley Bank, a small, technology-focused lender.

In London, banks fell heavily. Lloyds Banking Group PLC (LSE:LLOY) fell 4.7%, HSBC Holdings PLC (LSE:HSBA) declined 4.3%, Barclays PLC (LSE:BARC) dipped 5.4% and NatWest Group PLC (LSE:NWG) slid 4.3%.

Insurance stocks also weakened. Legal & General fell 4.3% and Prudential by 3.3%.

Better news came from the Office for National Statistics which reported the UK economy grew 0.3% in January ahead of the City consensus for a rise of 0.1%.

Samuel Tombs, chief UK economist at Pantheon Macroeconomic, said the recovery in GDP in January comes as no surprise, he had forecast a 0.4% month-to-month increase, given that activity in December was depressed by several one-off factors.

He still thinks that a shallow recession is the most likely outcome. “Either way, the economy clearly is sluggish, and more importantly for the MPC, labour availability is improving and the rate of price increases is slowing.”

“The jump in markets’ rate expectations over the last month, therefore, looks detached from both the economic data and Governor Bailey’s recent comments,” he felt.

ING Economics said the increases was faster than expected, though underlying volatility in the data means that GDP is effectively flatlining.

“Lower gas prices mean that any recession is likely to be very modest now – and may technically be avoided altogether,” the suggested.

“Overall though, today’s figures raise the chances that UK growth could come in flat or only slightly negative in the first quarter overall,” ING said.

FirstGroup PLC (LSE:FGP) was little changed in early exchanges despite raising guidance for profit for the current financial year. The bus and rail operator said bus volumes had picked up in part reflecting the £2 fare cap introduced by the government and an improvement in the supply of bus drivers.

Housebuilder Berkeley Group PLC said trading was in line with the levels outlined back in December, when sales from the end of September were around 25% lower than the first five months of its financial year, which ends in April. It reaffirmed targets of pretax profit of £600mln with at least US$1.05bn in aggregate to follow over the next two years. Cash due on exchanged forward sales is anticipated to be above £2.0bn at year-end, down slightly from £2.17bn a year before. Shares fell 0.4%.

7.34am: UK economy grows in January

The UK economy grew in January and there were no revisions to December’s figures meaning the recession headlines can thankfully be put away for a few months at least.

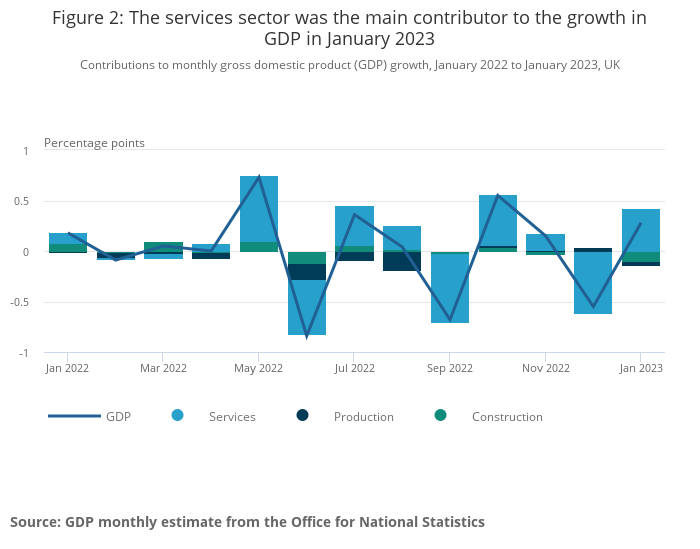

Monthly real gross domestic product (GDP) is estimated to have grown by 0.3% in January 2023, after falling by 0.5% in December 2022, according to figures from the Office for National Statistics (ONS). Analysts had expected a rise of 0.1%.

Looking at the broader picture, GDP was flat in the three months to January 2023.

.png)

The services sector grew by 0.5% in January, after falling by 0.8% in December, with the largest contributions to growth in January coming from education, transport and storage, human health activities, and arts, entertainment and recreation activities, all of which have rebounded after falls in December.

Output in consumer-facing services grew by 0.3% in January; this follows a fall of 1.2% in December.

Production output fell by 0.3% in January, following growth of 0.3% in December while the construction sector fell by 1.7% in January after being flat in December. There are no revisions to previously published data in this release.

7.28am: FirstGroup sees higher profits

FirstGroup PLC (LSE:FGP) said on Friday it anticipates profits for the 2023 financial year to be ahead of previous expectations following strong trading in its bus and rail operations.

In a statement the FTSE 250 listed firm said an improved performance at First Bus was driven by higher passenger volumes in second half of the financial year and driver resource pressures easing in certain locations.

Bus passenger volumes have increased to 83% of 2020 equivalent levels, with commercial and concessionary volumes at 87% and 75% respectively. The increase in demand has partially resulted from the £2 bus fare cap scheme introduced in England in January 2023, the company said.

First Rail open access operations benefited from stronger than anticipated passenger demand over the winter months, the company said.

As a result FirstGroup expects 2023 adjusted operating profit and adjusted attributable profit will be ahead of previous expectations. Company compiled consensus estimates adjusted operating profit and adjusted attributable profit are currently £137.4mln and £58.6mln respectively.

Expectations for the financial year 2024 remain unchanged.

FirstGroup said the final earnout consideration from the sale of First Transit by EQT Infrastructure is anticipated later in 2023.

7.00am: Bank rout in the US to weigh on London

The FTSE 100 is expected to nurse heavy losses at the open after US stocks tumbled hit by big falls in banking share prices.

Spread betting companies are calling London’s lead index down by around 116 points.

The Dow closed Thursday down 542 points, 1.7%, at 32,256, the Nasdaq Composite dropped 238 points, 2.1%, to 11,338 and the S&P 500 declined 74 points, 1.8%, to 3,918. The small-cap Russell 2000 index lost 51 points, 2.7%, to 1,828.

The S&P financial sector fell about 4%, its worst day since June 2020. Shares of SVB Financial slumped 61% after the firm announced a US$1.75 billion stock sale, and Silvergate stock tumbled 30% on news that it’s shutting down operations. Two bigger bellwethers, Bank of America and Wells Fargo, saw shares drop more than 6% each.

Ipek Ozkardeskaya senior analyst at Swissquote Bank noted “a severe rout in banking stocks spoiled what could’ve been a calm session on Thursday.“

“The collapse of Silvergate Capital and a severe rout in SVB stock plunged the banking sector into darkness yesterday. While Silvergate Capital’s fall was mainly crypto-related and didn’t spur worries for the rest of the banking sector, SVB’s plunge fueled fears that the rest of the banks could also experience similar issues.”

Asian markets were also weaker.The Nikkei 225 index in Tokyo closed down 1.7%, after the Bank of Japan left its ultra-easy monetary policy unchanged in Governor Haruhiko Kuroda’s last policy-setting meeting. In China, the Shanghai Composite was down 1.1%, while the Hang Seng index in Hong Kong was down 2.5%.

The early focus in London will be the GDP figure for January to see how the UK economy fared at the start of 2023. Panmure Gordon expects growth of 0.2% month-on-month. A trading statement from housebuilder Berkeley is also in the calendar.

Later today US non-farm payrolls figures take centre stage.