Published as part of the Financial Stability Review, November 2022.

Energy sector firms use energy derivatives under different strategies, depending on their main area of activity, business model and exposure to risk in physical markets. The significant volatility and a surge in prices seen in energy markets since March 2022 have resulted in large margin calls, generating liquidity risks for derivatives users. Strategies employed by companies to alleviate liquidity stress may lead to an accumulation of credit risk for their lenders or for their counterparties in less collateralised segments of the derivatives market. Further price increases would accentuate nascent vulnerabilities, creating additional stress in a concentrated market. These aspects underline the need to review margining practices and enhance the liquidity preparedness of all market participants to deal with large margin calls.

1 Extreme price dynamics in energy markets

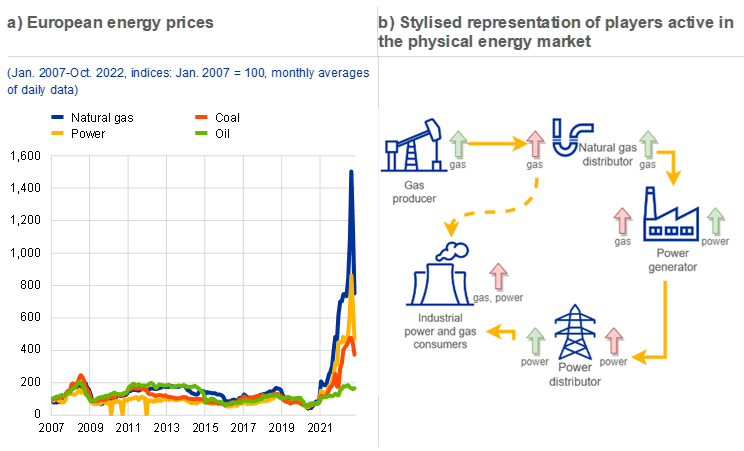

The Russian invasion of Ukraine prompted a surge in all major commodity prices in March 2022, with European energy products seeing the most striking and sustained increases. Energy-related commodity prices and volatility started rising in mid-2021 as the economy recovered from the coronavirus (COVID-19) pandemic and reached unprecedented heights in March and during the summer of 2022. The price of benchmark natural gas futures (Dutch TTF) reached 227 EUR/MWh on 7 March 2022, about 12 times the level of early 2021. By late August, it had climbed to 339 EUR/MWh, 18 times the level observed at the beginning of 2021 and almost double the mark following the Russian invasion of Ukraine (Chart A.1, panel a). Price dynamics varied across energy products, depending on factors such as ease of storage, transport and substitution. These differences were reflected in the more muted price dynamics of oil futures relative to natural gas and in the development of European power prices. The latter peaked in August 2022, aggravated by high summer temperatures and drought across Europe hampering nuclear and hydro power output.

Relatively inelastic demand and binding short-run supply constraints mean that energy prices are historically prone to bouts of extreme volatility. As fuel and power are essential for many production processes, the demand for energy commodities is relatively inelastic. Primary energy sources needed for power generation are hard to replace quickly, as supply is constrained by physical infrastructures, and the extraction of some commodities (e.g. natural gas, oil and coal) is concentrated at a limited number of sites. Episodes of high prices and volatility have been seen in the past. In the 1970s, oil shocks were triggered by geopolitical events in the Middle East, and the 2007-08 oil price surge was related to an increase in demand against a backdrop of stagnant supply exacerbated by some events in oil-producing countries such as Iraq or Nigeria.[1] Similarly, disruptions in Russian natural gas exports following the invasion of Ukraine have been the main trigger for the recent surge in energy commodity prices.

Chart A.1

European energy prices and stylised representation of players active in the physical energy market

Sources: Bloomberg Finance L.P. and ECB staff calculations.

Notes: Panel a: “Oil” is Brent Crude, “Natural gas” is the Dutch Title Transfer Facility (TTF), “Coal” is the Rotterdam Coal and “Power” is Dutch Base Load Power. Monthly averages for front-month futures traded on the Intercontinental Exchange (ICE). Panel b: this chart shows a stylised representation of players active in the energy market according to their role in the production chain. The arrow on the left (right) of each player represents the effect of price increases in the spot market when the commodity is used as an input (output). The arrow is red when a price increase of the relative commodity is detrimental to the firms, green otherwise. The expected positions in commodity derivatives are not included. The chart does not aim to be complete; for example, it does not treat commodity traders as a separate category, does not distinguish between energy distributors and energy transmission entities and does not account for the positions of players active in more than one step of the production process (vertical integration). Moreover, the chart does not aim to provide a full picture of the inputs used for power production or a full representation of the entire production chain in the energy market. On the contrary, we include the effect of the increase in gas prices as long as gas is used as input for power generation.

The extreme price movements over recent months highlight the importance of energy derivatives markets for hedging risks in the energy sector, as well as some of the pressures that can arise in these markets. Derivative contracts allow players active in the physical energy market to hedge the market risk arising from temporal – and to a lesser extent spatial – mismatches that possible future price fluctuations may cause along their supply and distribution chains (Chart A.1, panel b).[2] For instance, power generators use long positions to fix the purchase prices of the commodities (e.g. natural gas, oil or coal) they need for power generation and short positions on power futures to fix the prices of their output. When price moves are extreme, hedging against market risk is key for energy traders to continue their activity.[3] Nevertheless, in such circumstances market players are also exposed to higher residual market risk, as well as heightened credit and liquidity risk.

This special feature provides an overview of the European energy derivatives market, with a focus on natural gas and power. It analyses the impact of extreme energy prices on the structure of energy markets, the liquidity stress faced by entities with the largest exposures to market risk and the risks that their vulnerabilities may pose to their counterparties in derivatives and credit markets.

2 The structure of the euro area energy derivatives market

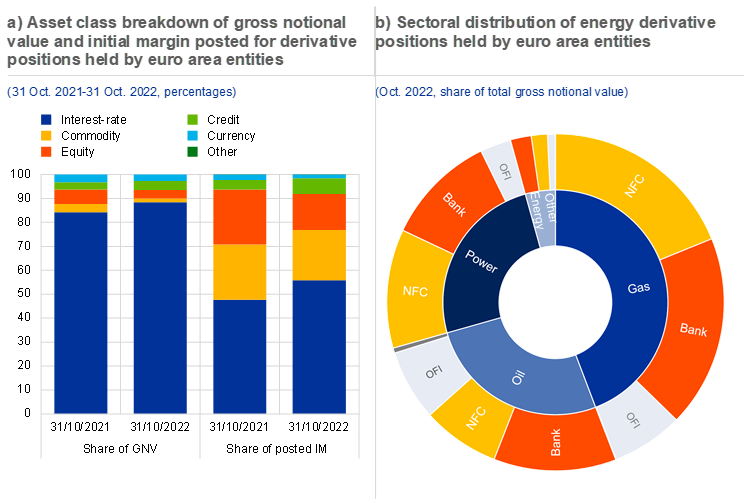

Energy sector companies are key users of energy derivatives, and the number of firms active in the market has increased in 2022. Banks account for the largest share of outstanding energy derivative positions in terms of gross notional value (Chart A.2, panel b), partly because of their role in intermediating transactions in the centrally cleared space. However, when measuring the market size by net notional, non-financial corporations (NFCs) appear to be the key participants and the main holders of market risk from energy derivatives. Of the 1,700 firms active in the euro area energy derivatives market between September 2021 and October 2022, a quarter belong to the energy production chain, meaning they are extracting oil and gas or distributing energy.[4] The remaining firms belong to energy-intensive sectors, like transport and manufacturing. On average, the number of firms active in energy derivatives increased by 30% between January and September 2022. While some firms might have exited the market over the course of 2022, other small players (around 615 firms accounting for about 1% of 2022 notional on energy derivatives) accessed it for the first time.

The high concentration of positions, especially in the centrally cleared space, may raise financial stability concerns. Most positions belong to a few large utilities or energy companies which use derivatives to hedge their operations against market risk.[5] Such a high concentration of positions might raise financial stability concerns, as it increases the risk of disorderly market functioning. In a concentrated market, a transaction concluded by a limited number of participants can significantly affect prices and incentivise or constrain others to trade in the same direction.

Some of the inherent risks in the market are mitigated by the dominance of centrally cleared transactions and the margining practices associated with them. Exchange-traded derivatives (ETDs) cleared by central counterparties (CCPs) account for almost three-quarters of the total gross notional value of outstanding positions. Compared with over-the-counter (OTC) markets, where participants are subject to less stringent collateralisation requirements, ETD contracts feature mandatory collateral posting via initial and variation margins to protect against counterparty risk.[6] In general, energy derivatives require relatively high margining, reflecting the generally large volatility of energy prices. For example, while the entire commodities segment represents roughly 2% of the gross notional value of positions in the euro area derivatives market,[7] this segment accounts for a much higher share in terms of initial margins posted, exceeding 20% (Chart A.2, panel a). When price levels and/or volatility increase, market players need to post additional margins to maintain their exposures.

Chart A.2

Breakdown of gross notional value and initial margin posted for derivative positions and sectoral distribution of energy derivative positions held by the euro area entities

Sources: EMIR data and ECB staff calculations.

Notes: Panel a: share of gross notional value (GNV) and posted IM, calculated for portfolios composed fully of instruments of the same asset class, for the sake of comparability due to margining on a portfolio level. Panel b: the structure of positions in terms of gross notional suffers from the caveat that, especially for the ETD segment, it also includes positions attributed to entities intermediating the execution and clearing of transactions concluded by the actual position holders.

3 Liquidity pressure may lead to market changes

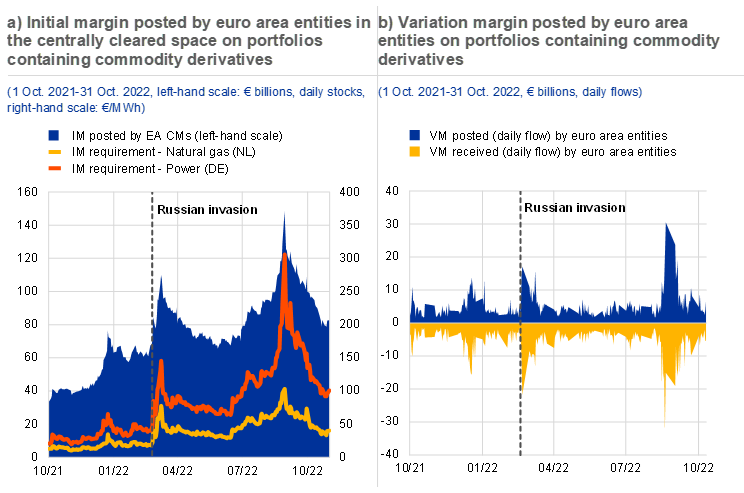

Since late 2021, high volatility and surging commodity prices have resulted in increased margin requirements for participants in the centrally cleared market (Chart A.3). In response to the increase in energy prices and volatility, initial margin requirements on commodity portfolios have risen periodically over the course of 2022, with about twice as much IM needing to be posted by mid-2022 as in late 2021 (Chart A.3, panel a). The large changes in the value of existing commodity derivative portfolios also triggered high variation margin (VM) calls in some periods (Chart A.3, panel b), and by late 2022 both initial and variation margins had reached record levels.

Chart A.3

Margin requirements are creating liquidity pressures

Sources: EMIR data, European Commodity Clearing and ECB calculations.

Notes: Margin data in EMIR are reported at portfolio level; for example, it is not possible to distinguish margins related to natural gas contracts from those related to metals contracts. Portfolios considered include at least one euro area counterparty and at least one commodity derivative trade. Panel a: initial margin requirements calculated as the average for 1-6-month Dutch TTF natural gas futures and 1-6-month German power base load futures listed on the European Energy Exchange.

Counterparties – including energy sector companies – came under pressure to meet large margin calls. In order to maintain their positions, energy derivative users needed to source cash or collateral to meet the elevated requirements.[8] In addition to using existing cash buffers, counterparties managed their liquidity needs by using a combination of credit lines and loans extended by banks, partially shifting to OTC transactions and strengthening margin optimisation strategies for centrally cleared ETD portfolios.

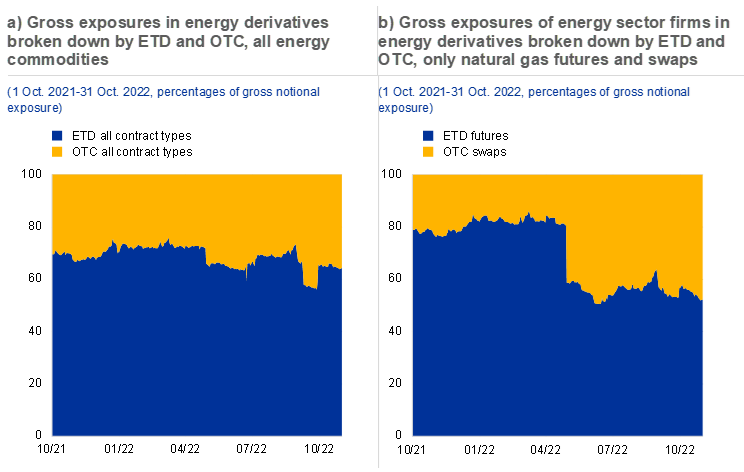

By early autumn 2022, data indicated only a minor increase in non-centrally cleared OTC trades in the overall market[9]; nevertheless, euro area energy traders shifted their activities to some extent. Market intelligence has suggested a possible shift in market activity from the centrally cleared to the non-centrally cleared space, as a result of the liquidity stress.[10] Looking at the overall market, trade repository data provide limited evidence of an OTC shift by the end of October 2022 (Chart A.4, panel a). However, some increase can be seen in the usage of non-centrally cleared swaps by euro area energy traders across different energy commodities (i.e. electricity, coal and natural gas) while their use of ETD futures (for natural gas, see Chart A.4, panel b) has declined.

Chart A.4

Overview of direct and indirect risks from increased volatility in energy markets and gross exposures in energy derivatives per market segment

Sources: EMIR data and authors’ calculations.

Notes: CCPs have been removed to avoid double-counting of gross notional in the direct clearing space. Swaps are exclusively non-centrally cleared, while futures are almost entirely centrally cleared. Panel b: only futures and swaps, only for natural gas underlying.

Commodity swaps traded in OTC markets can partially mitigate energy firms’ liquidity needs as margins are lower for bilaterally cleared trades. Banks might be using commodity swaps as part of alternative funding mechanisms for their clients, referred to as liquidity swaps or exchange of futures for swaps (EFS). In a liquidity swap, an entity hedging with a futures contract can exchange its position on futures for a bilateral contract (a commodity swap) with a bank. The client entering the liquidity swap pays no IM and only pays VM if a certain threshold is reached.[11] The bank taking over the futures contract posts the requested IM and VM to the CCP, alleviating the liquidity need of the client in exchange for a fee.

A more significant shift by utilities and energy firms towards the OTC space would imply greater risks for counterparties and the financial system. Non-centrally cleared contracts require less collateral for trading firms, but imply higher counterparty risk and less transparency for the wider market. Additional concerns arise from the fact that the partial move to the OTC space is occurring in an environment of higher volatility and hence of increased counterparty default risk.

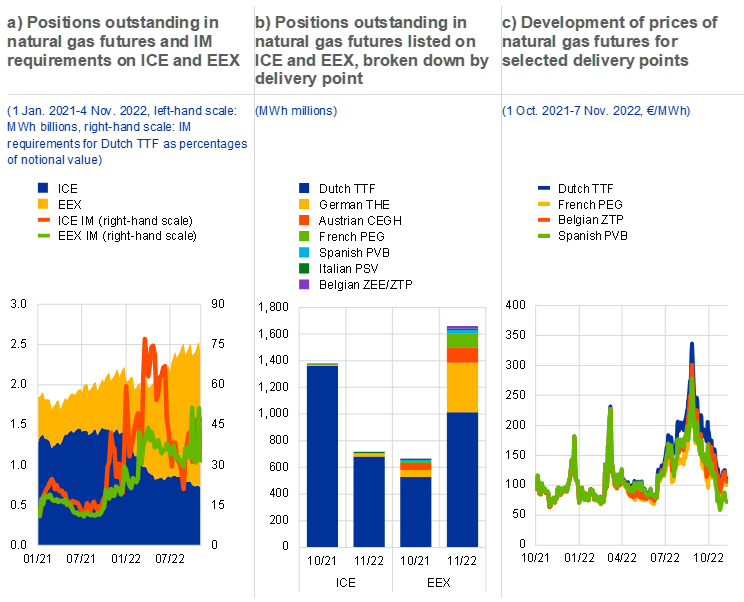

Chart A.5

Development of outstanding natural gas positions and prices

Sources: Bloomberg Finance L.P., ICE Clear Europe, European Commodity Clearing and ECB calculations.

Notes: Panels a) and b): weekly positions in natural gas contracts for the euro area trading points. IM requirements for the front-month natural gas benchmark (Dutch TTF) futures. Data on ICE margins are provided by ICE Clear Europe in accordance with the Terms of Use. Panel c: daily last price for front-month rolling futures traded on EEX.

Some market participants have shifted natural gas derivative contracts across the two main European energy exchanges, often facilitated by the same clearing member. Since late 2021, open interest for natural gas futures has been declining on the ICE Endex exchange and increased almost fourfold on the European Energy Exchange (EEX). As prices increased, it is plausible that some market players with electricity exposures consolidated their positions into a single CCP to exploit cross-commodity margin netting opportunities and thus reduce liquidity needs, for example by moving their gas positions to the same CCP where they were trading power. At this stage, the shift between exchanges is unlikely to pose financial stability concerns as it does not appear related to a race to the bottom in margin requirements (Chart A.5, panel a). At the same time, the future evolution of this shift should be monitored, as it may lead to an increase in concentration in one market and/or CCP, with implications for financial stability.

The shift between the two exchanges has been accompanied by a growing preference for trading in local natural gas indices, the prices of which started to diverge in the second quarter of 2022. The ETD market shift may be explained by a growing preference for local natural gas indices (primarily German, French and Austrian). This may be due to reduced risk tolerance for the exposure to price spreads between different natural gas delivery points (basis risk) or a possible increasing need for physical delivery as part of the derivatives contract (Chart A.5, panels b and c). These changes have been accompanied by some price fragmentation (Chart A.5, panel c), which sheds some doubt on the current representativeness of the Dutch TTF index as a single benchmark for all natural gas products across Europe.

4 Risks for non-financial corporations and banks stemming from commodity price disruptions

Risks for energy firms

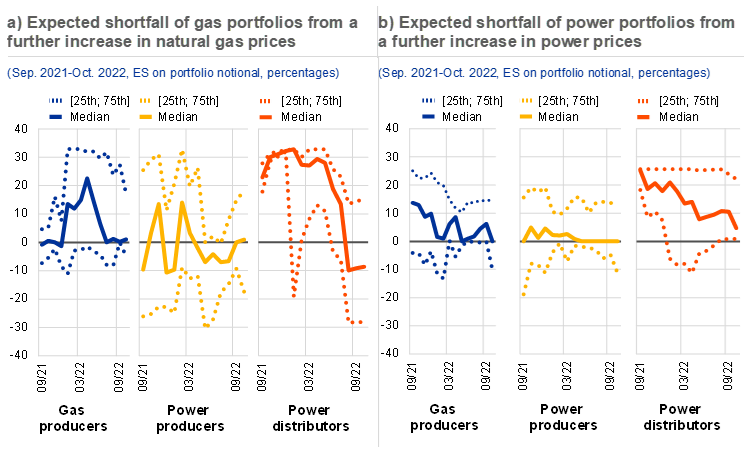

Although similar trading strategies would be expected from energy firms with different roles in the production chain, evidence points to heterogeneity within each subsector. A portfolio revaluation tool is used to compute the possible impact of a variety of scenarios projecting an increase in the prices of underlying commodities on firms’ energy derivatives portfolio positions.[12] This makes it possible to capture firms’ positioning in the market and quantify their risk, in the event of a prolonged increase in natural gas and electricity prices. This methodology extracts the expected shortfall (ES) of a portfolio in relation to the corresponding notional for each firm. A positive ES corresponds to a long strategy with respect to energy price increases, whereas a negative ES corresponds to a short position. While the former would result in liquidity inflows following price increases, the latter would imply liquidity stress – in the form of variation margin calls on the repriced portfolio.

Gas and electricity producers would, on average, gain from increases in the prices of their outputs, while power distributors appear to be more vulnerable to market developments. Gas producers have positive ES, which implies long positions on natural gas and power derivatives contracts (Chart A.6, panel a and panel b, left graph). Electricity producers have, on average, been shorting gas derivatives, but have moved more recently towards long positions in line with the rise in natural gas prices (Chart A.6, panel a, middle graph). With regards to power derivatives, the positioning of energy producers has been more stable over time, resulting in average expected gains (Chart A.6, panel b, middle graph). By contrast, power distributors are more vulnerable to unexpected margin calls as they have long positions in power derivatives that could expose them to a twofold risk. Should electricity prices fall, they would suffer losses in their output value and in their derivative portfolios (Chart A.6, panel a) and panel b, right graph). With regards to natural gas, they move towards long positions after prices drop, turning to short positions after the more recent spike.

Some utility companies would face a non-negligible loss in terms of the notional amount of their derivatives portfolio in the event of a further increase in energy prices. In particular, power distributors emerge as the most vulnerable in the sector, with one firm in three expecting liquidity outflows in September 2022, with a median value of -24% and a maximum value of -33% for the ratio between ES and portfolio notional. The positioning of most of the firms, deeply in the positive or negative territory, especially on natural gas derivatives, makes them highly vulnerable to prolonged volatility in the prices of the underlying.

Chart A.6

Different corporate business models have different positions in commodity derivatives markets and therefore different vulnerabilities to further price increases

Sources: EMIR data, RIAD data and ECB calculations.

Notes: The charts show the time-series (September 2021 to October 2022) evolution of the median (solid lines) and the 25th and 75th percentiles (lower and upper dotted lines respectively) from the distribution of the ratio between ES and notional of EU NFCs operating in gas production, power production and power distribution. The ES is computed on the tail of the joint distribution of simulated price variations for power and natural gas, assuming a minimum shock of 10% with respect to current prices.

Without additional information about the physical market positioning of these companies, the picture is only partial. Their observed positioning in the energy derivatives market might not be straightforward to interpret from a hedging perspective and could also hint at potential risk-taking behaviour. The overall hedging strategy adopted by these firms may involve a combination of financial and physical (e.g. storage, changes in production or substitute inputs) tools and may depend on intrinsic characteristics of the company (e.g. market power or vertical integration). For instance, a firm involved in both power generation and distribution might have a different net derivatives position from a firm involved in only one step of the value chain.

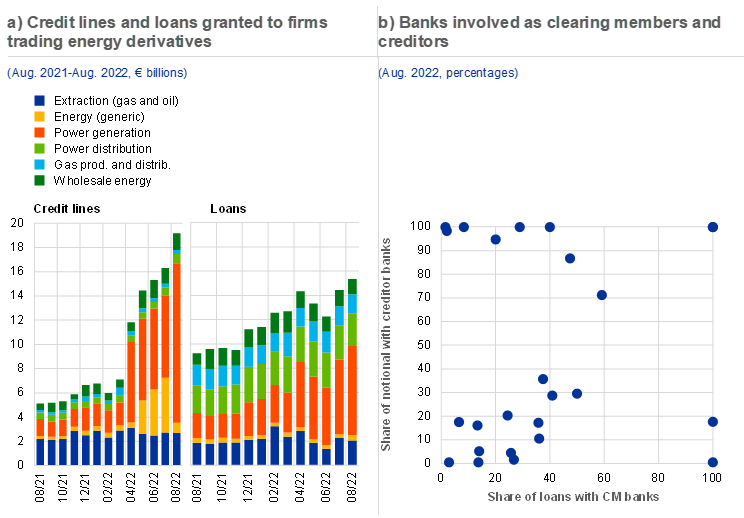

Risks transferred to banks through exposures to energy firms

Some firms trading energy derivatives are relying on bank credit to deal with the consequences of rising energy costs. Since the outbreak of the Russia-Ukraine war, firms exposed to the energy derivatives market have increased their bank exposures via either loans or credit lines. Overall, energy firms and power generators have enlarged their credit lines by around 200%. In particular, banks increased their credit lines to power producers from about €3 billion to more than €6 billion between March and April 2022. Overall, this evidence might signal energy firms’ needs to finance inflated working capital, precautionary inventories and high liquidity demand on energy spot and derivatives markets (Chart A.7, panel a). The bulk of the increase in such credit comes from Germany, where government-guaranteed credit lines have been rolled out to firms scrambling for liquidity to finance margin calls on energy derivatives.

Chart A.7

Euro area banks’ credit exposures to firms trading energy derivatives, and firms dealing with the same set of banks for clearing and borrowing

Sources: AnaCredit data, EMIR data, RIAD data and ECB calculations.

Notes: Panel a) includes committed and drawn credit lines, and loans granted by euro area credit institutions to firms involved in the energy production according to the NACE-4 digit classification. Panel b: CM stands for clearing member.

Most transactions in the ETD energy market are cleared by a few banks, which need to manage step-in liquidity risk. At the end of August 2022, four banks were directing approximately 85% of the positions in exchange-traded energy commodities to CCPs, as measured by gross notional value. Clearing banks pass on initial margin requirements from CCPs to their clients typically at the same or sometimes a higher amount (applying margin add-ons). However, in their role as clearing members, banks are liable for settling each transaction with CCPs, including on behalf of their clients, and are exposed to step-in liquidity risk if their clients are unable to meet margin calls. As counterparties to some of these clients in the OTC derivatives market, they are also exposed to counterparty credit risk in the event of their default.

Banks represent the first line of defence for firms to obtain short-term funding, and their dual role as clearing members and credit providers may lead to a concentration of exposures. Banks might have pre-existing credit relationships with their clients in the derivatives market, which might lead to a concentration of exposures. Additionally, banks might help firms meet margin calls by extending new loans or through committed credit lines, thereby increasing their exposures towards sectors where credit and liquidity risks have recently gone up. A quarter of energy firms deal with the same set of banks for obtaining credit and client-clearing services for derivatives. This sample of firms, on average, deals with three banks as clearing members and obtains credit from five banks. As of June 2022, the overall credit exposures of firms having at least one outstanding contract with the same bank for borrowing and clearing services were €2.8 billion, 16% of which was with the same set of banks that are also their clearing members. At the same date, their gross notional outstanding in commodity derivatives was €14 billion, of which 16% (€2.2 billion) was with the same set of banks providing credit (Chart A.7, panel b).

5 Conclusions

The volatility in both European and global energy markets in 2022 has also affected the derivatives markets which energy sector firms use to manage risk. As energy prices rose during 2022, margin requirements on futures and swaps contracts used by energy producers and distributors increased almost twofold. These increases are an intended effect to safeguard market participants from the heightened counterparty risk. At the same time, they put significant pressure on the cash and collateral positions of these firms, prompting them to draw on credit lines with their banks and explore ways to reduce margin requirements by shifting to different exchanges or towards OTC contracts. While market developments so far do not pose immediate financial stability concerns, a sustained reliance on the OTC segment may lead to an accumulation of counterparty credit risk, primarily for banks, generating market risk in the event of counterparty default.

The liquidity challenges imply a need to increase the predictability of IM models, to evaluate their responsiveness to market stress and to enhance the liquidity preparedness of all derivative market participants. Such measures, while relevant for the derivatives market as a whole, are important for the energy derivatives segment (and commodities derivatives in general) also owing to the link with physical markets, as liquidity challenges may affect the ability to hedge, and the provision of essential services to the real economy.

Around half of energy traders with exposures in power and gas derivatives appear exposed to further margin calls, should underlying energy prices see heightened volatility and additional price increases. Gains and losses are unevenly distributed within the energy sector, depending on firms’ business activity and the extent of their vertical integration. Price increases and heightened volatility may generate additional liquidity pressures and exacerbate stress in parts of the market which are particularly exposed. Some European governments have started to adopt measures to provide liquidity relief to energy derivatives market participants, and the European Commission has also put forward several proposals in this direction, the most recent of which was announced on 18 October.[13] One of the main policy challenges ahead is to ensure that energy traders can continue to properly hedge their risks and guarantee continuity in the essential services they provide to households and corporates.