The Financial Stability Review (FSR) assesses developments relevant for financial stability, including identifying and prioritising the main sources of systemic risk and vulnerabilities for the euro area financial system. It does so to promote awareness of these systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability.

Financial stability can be defined as a condition in which the financial system – which comprises financial intermediaries, markets and market infrastructures – is capable of withstanding shocks and the unravelling of financial imbalances. This mitigates the likelihood of disruptions in the financial intermediation process that are systemic, that is, severe enough to trigger a material contraction of real economic activity.

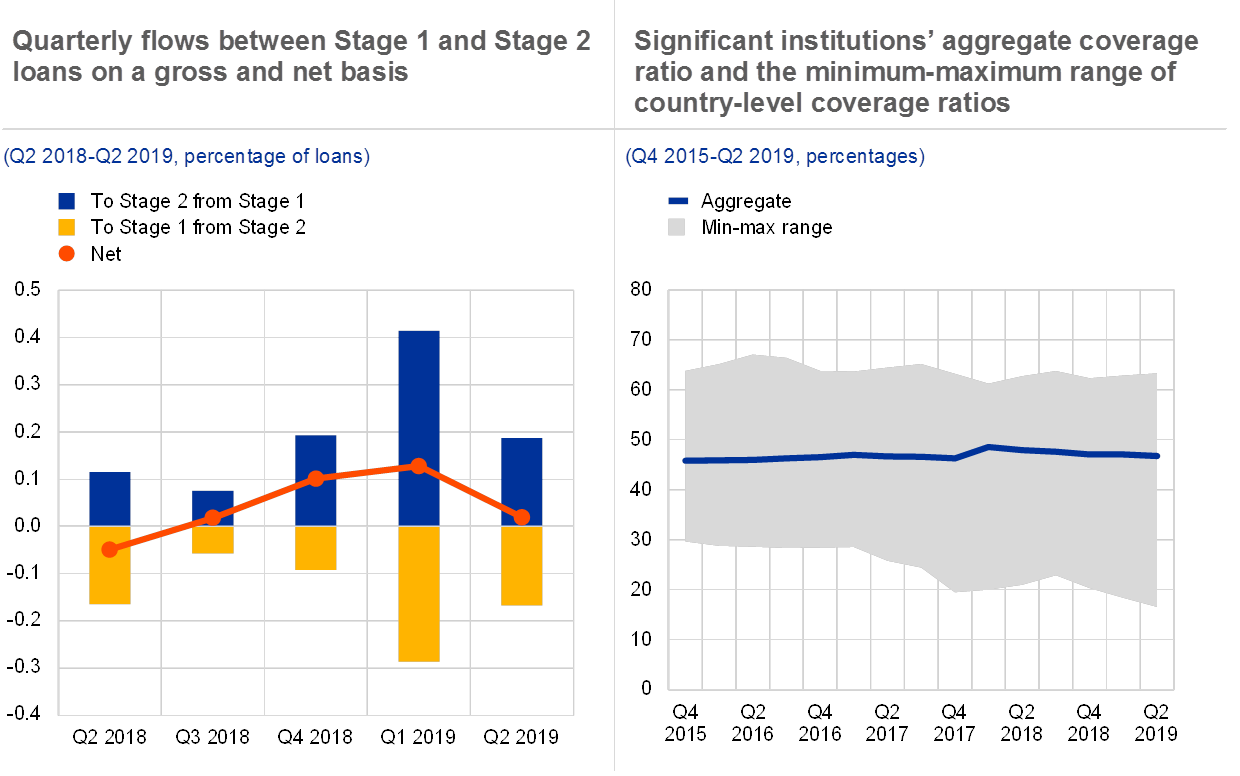

The FSR also plays an important role in relation to the ECB’s microprudential and macroprudential competences. By providing a financial system-wide assessment of risks and vulnerabilities, the Review provides key input to the ECB’s macroprudential policy analysis. Such a euro area system-wide dimension is an important complement to microprudential banking supervision, which is more focused on the soundness of individual institutions. While the ECB’s roles in the macroprudential and microprudential domains have a predominant banking sector focus, the FSR examines the risks and vulnerabilities of the financial system at large, including – in addition to banks – activities involving non-bank financial intermediaries.

In addition to its usual overview of current developments relevant for euro area financial stability, this Review includes two special features aimed at deepening the ECB’s financial stability analysis and broadening the basis for macroprudential policymaking. The first special feature focuses on the weakest performers in the euro area banking sector and evaluates the scope for bank consolidation to be a remedy for bank profitability challenges. The second discusses ways in which the measurement of the systemic footprint of euro area banks can be complemented with a set of new indicators.

The Review has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks.

Luis de Guindos

Vice-President of the European Central Bank

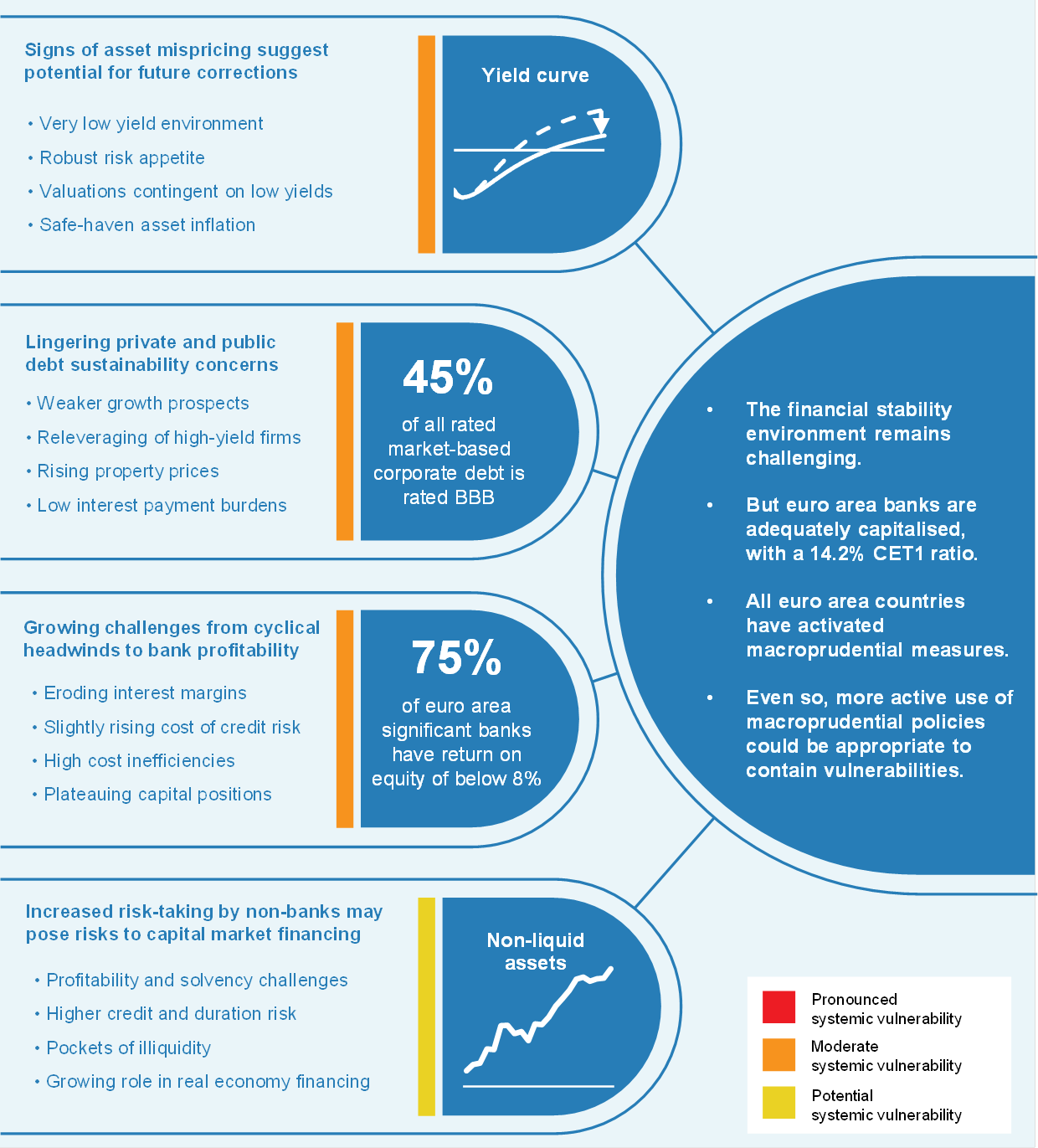

Amid prominent downside risks to economic growth, low interest rates support economic risk-taking and near-term debt sustainability

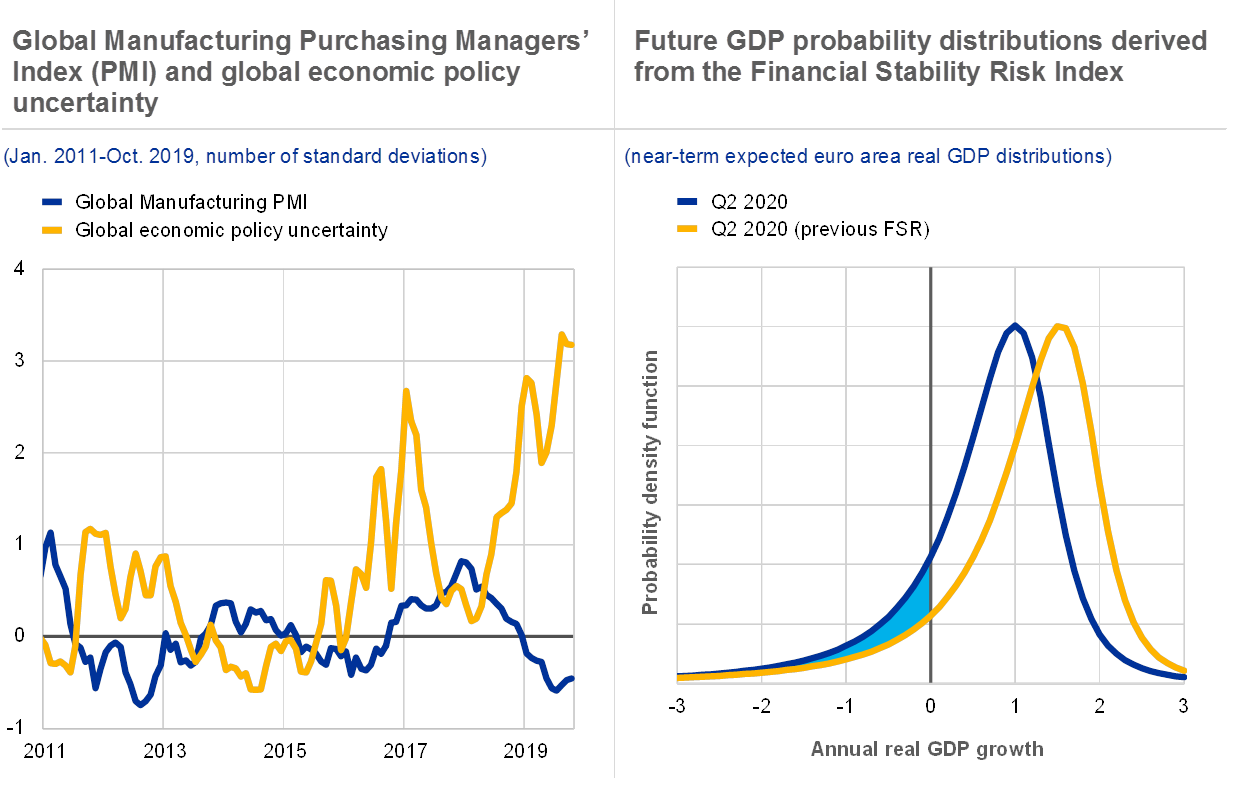

The euro area economic outlook has deteriorated, with growth expected to remain subdued for longer. Mirroring global growth patterns, information since the previous FSR indicates a more protracted weakness of the euro area economy, leading to a downward revision of real GDP growth forecasts for 2020-21.[1] This seems to reflect a combination of the ongoing weakness of global trade and the adverse impact of global political and policy uncertainties (see Chart 1, left panel), notably those related to global trade disputes as well as the continued lack of clarity on the future relations between the United Kingdom and the European Union. At the same time, inflationary pressures in the euro area are forecast to remain muted over the next two years, translating into overall weaker nominal growth prospects.

Chart 1

Tail risks to euro area growth have increased amid elevated global uncertainty

Sources: IHS Markit, www.policyuncertainty.com, ECB and ECB calculations.

Notes: Left panel: Global economic uncertainty is portrayed using three-month moving averages. Right panel: The distributions are based on the ECB’s Financial Stability Risk Index. For further details of the methodology, see the May 2018 FSR special feature entitled “A new Financial Stability Risk Index (FSRI) to predict near term risks of recessions”.

Downside risks to global and euro area economic growth have increased. The risks to the euro area growth outlook are tilted to the downside. These risks include the effects of persistent uncertainty, an escalation in trade protectionism, a no-deal Brexit and weak performance of emerging markets, in particular a sharper slowdown in China. Future GDP probability distributions derived from the Financial Stability Risk Index suggest a higher near-term tail risk to growth, with the probability of growth outturns below zero having risen by mid-2020 to approximately 20% (see Chart 1, right panel), in line with growing near-term recession risks suggested by market-based indicators (see Chart 2.7, right panel).

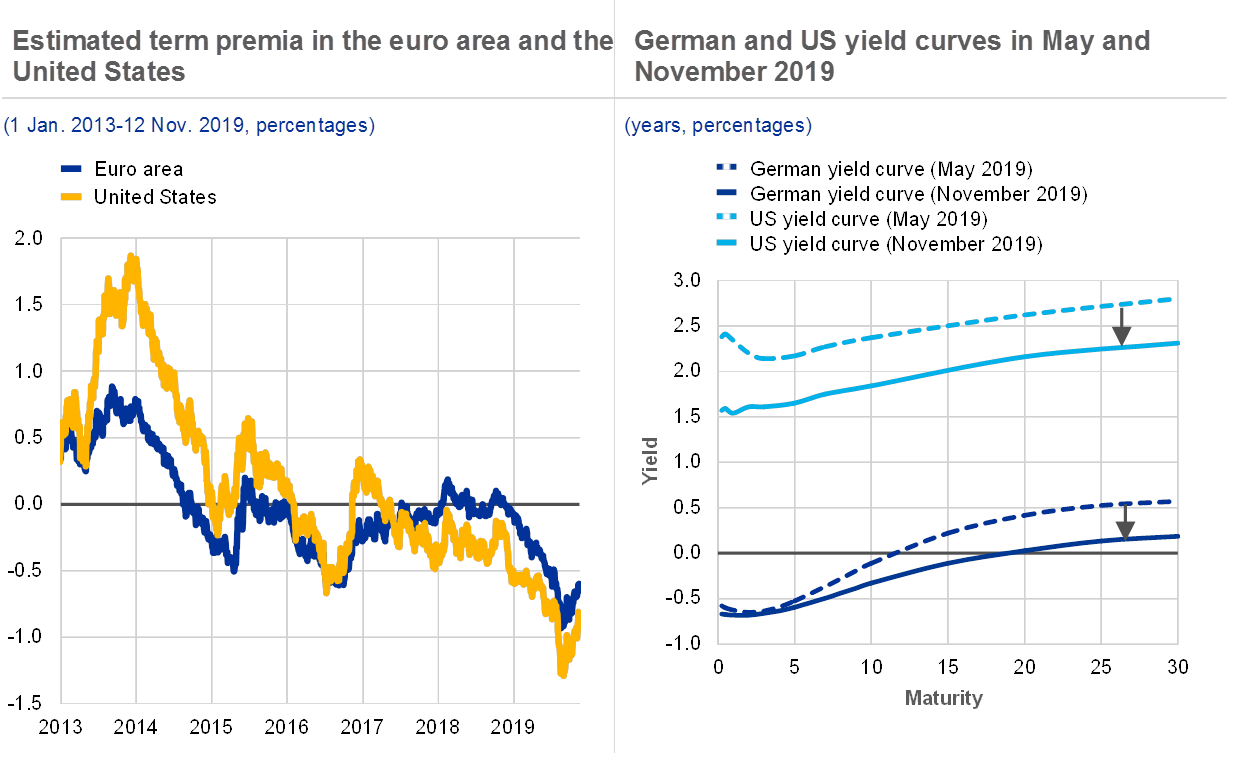

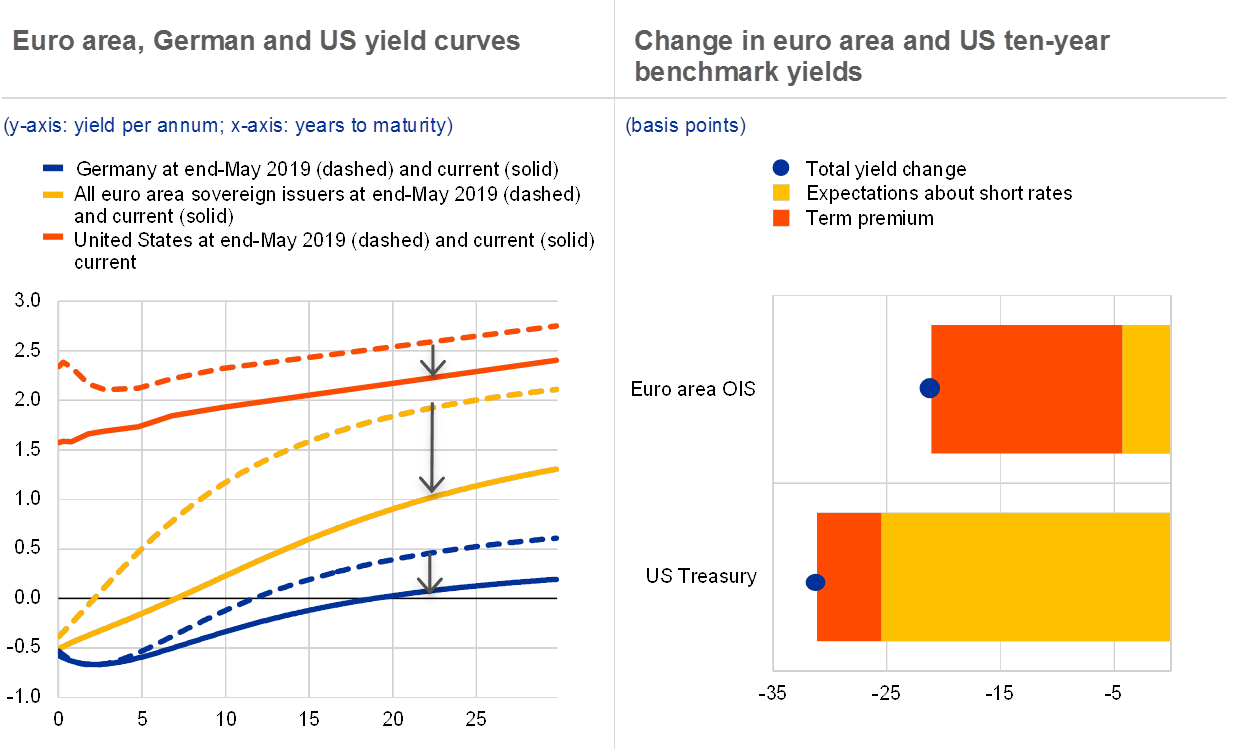

Risk-free rates have fallen, reflecting accommodative monetary policies and policy expectations. Action taken by the ECB’s Governing Council and the US Federal Open Market Committee in their respective September meetings extended market expectations that short-term rates would remain low. Since May benchmark yields in the United States and the euro area have declined sharply, with both short-term rate expectations and term premia reaching multi-year lows over the summer (see Chart 2, left panel). Global sovereign yield curves have flattened and shifted downwards (see Chart 2, right panel), with the yields up to ten years of many euro area sovereigns turning negative.

Chart 2

Downward pressure on global bond yields at all maturities has intensified in the United States and the euro area since the May 2019 FSR

Sources: Federal Reserve Bank of New York and Bloomberg.

Favourable financing conditions continue to mitigate sovereign risks at the current juncture. However, if economic conditions worsen significantly, underlying fiscal vulnerabilities may come to the fore again in those euro area countries with more fragile public finances. Similarly, renewed political and policy uncertainties could trigger a reassessment of sovereign risk and reignite pressures on more vulnerable sovereigns. In view of the weakening economic outlook and the continued prominence of downside risks, there is a strong case for governments with fiscal space to act in an effective and timely manner. In euro area countries with high debt levels and only limited or no fiscal room for manoeuvre, fiscal policy can support economic recovery through a more growth-friendly composition of public finances. Shifting expenditure to the most growth-enhancing categories or the tax burden to less distortive taxes can positively affect output growth and strengthen fiscal buffers.

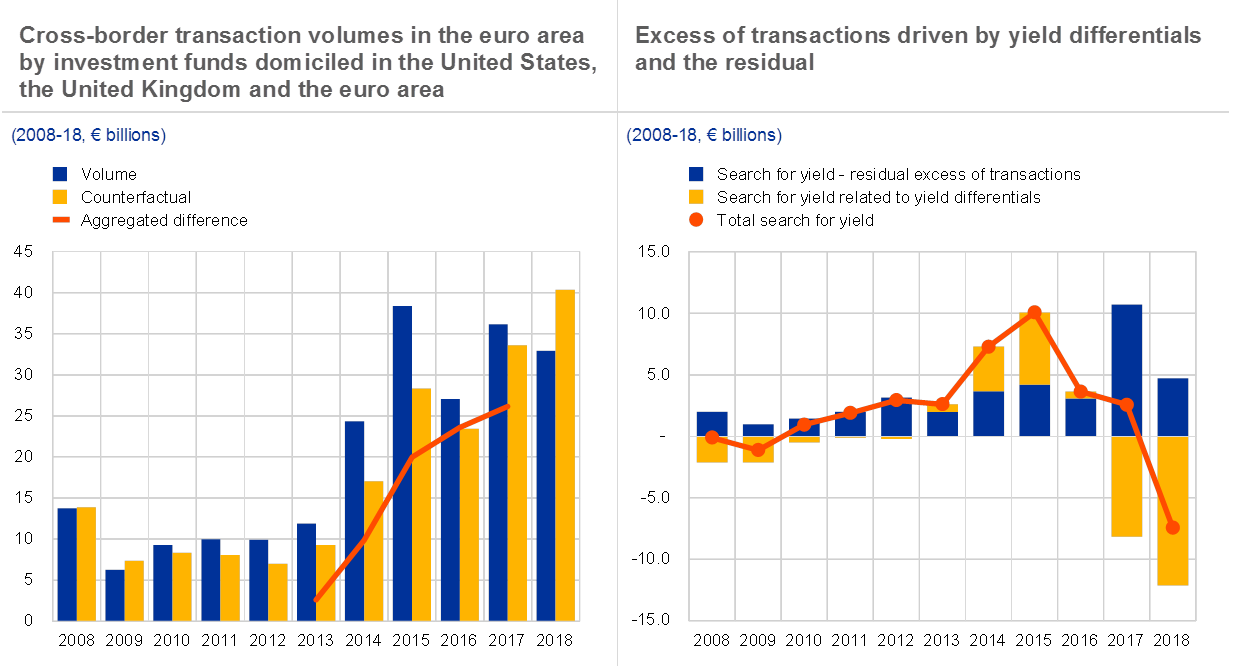

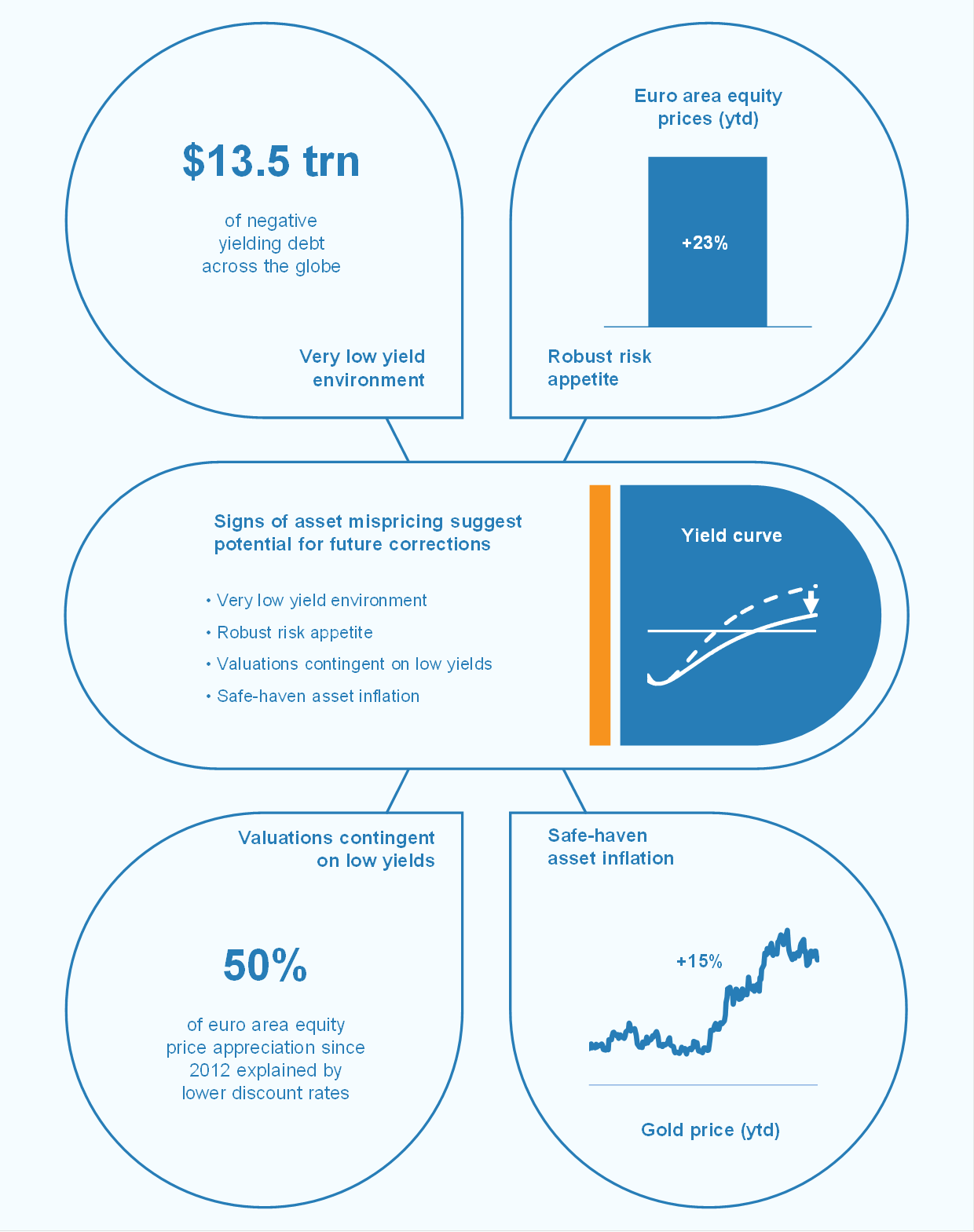

Asset valuations, reliant on low interest rates, could face future corrections

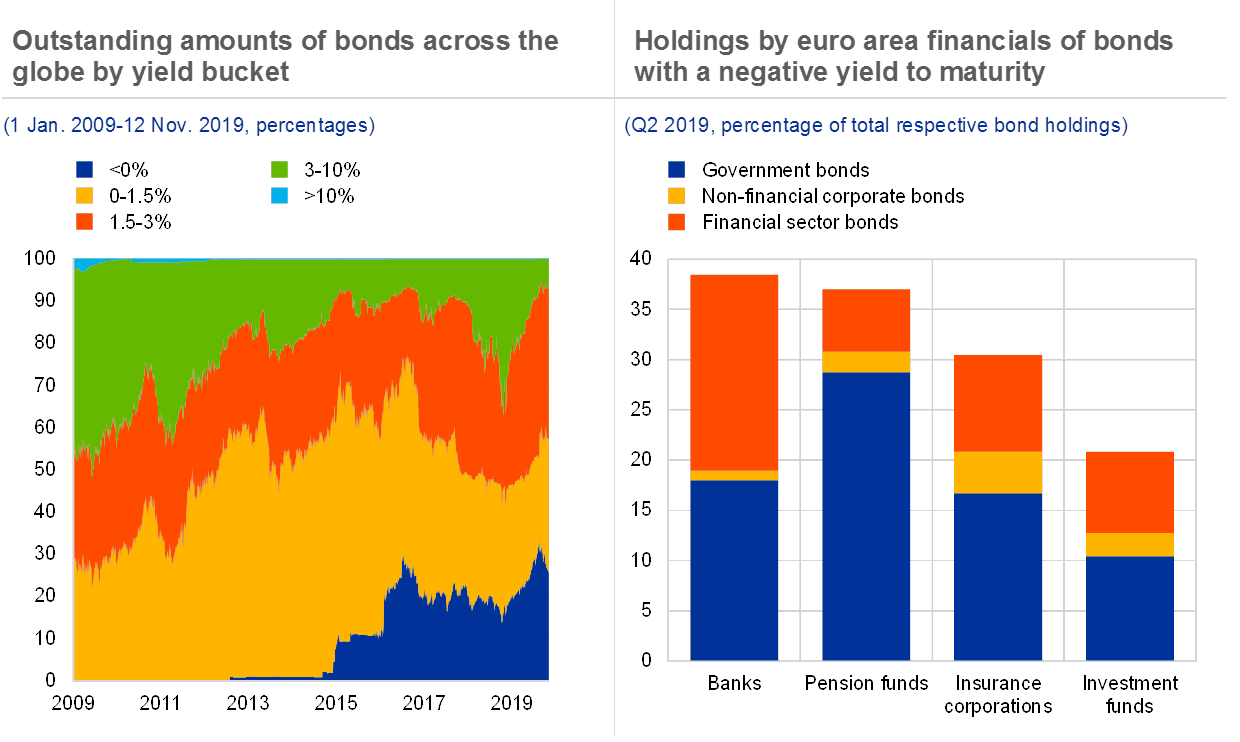

The search for yield has continued in the low interest rate environment. Risk-free yield curves are used to price many other financial instruments, from credit risk-bearing bonds to equities and derivatives. Therefore, lower yields have repercussions for asset prices benchmarked against the risk-free yield curve. The search for yield has intensified since the start of the year, with less than 10% of the bonds outstanding globally offering yields of 3% or more (see Chart 3, left panel).

Chart 3

Low rates support asset prices, but may prompt some investors to search for yield

Sources: IHS Markit and ECB Securities Holdings Statistics.

Notes: Right panel: Financial sector bonds comprise mainly bonds issued by banks, including straight bonds, euro medium-term notes and Pfandbriefe, as well as other instruments such as asset-backed securities, medium-term notes and money market instruments.

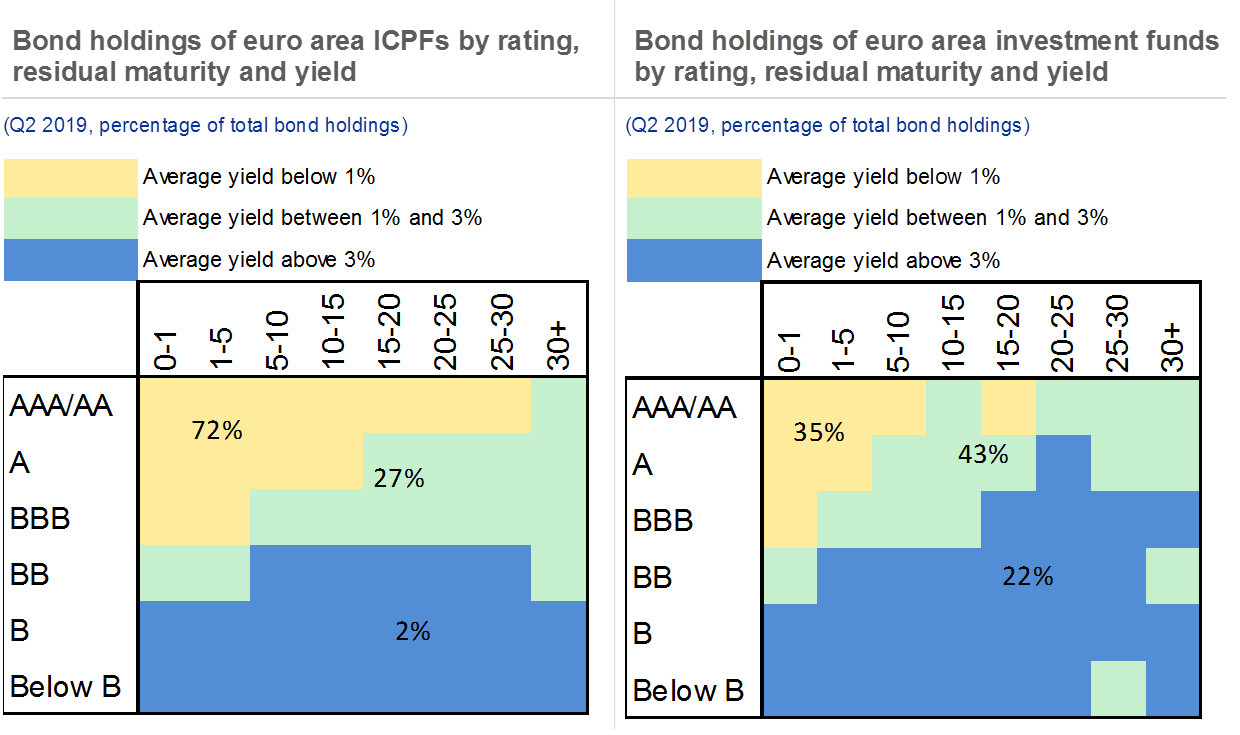

The amount of bonds with negative yields has grown markedly across the globe. As yield curves have flattened and credit spreads remain tight, the phenomenon of negative yields has extended to longer maturities as well as to lower-rated issuers. In sum, around USD 13.5 trillion (or one-quarter) of all bonds outstanding globally implicitly require investors to pay for holding the bond. Most of these bonds have been issued by sovereigns in currency areas with zero or negative rates, in particular Japan and the euro area, but the fraction of corporate bonds trading at sub-zero rates has increased markedly too. Negative-yielding debt holdings are sizeable in some segments of the euro area financial system (see Chart 3, right panel). While euro area financials have benefited from excess returns recently in the form of valuation gains, it is unlikely that this will continue.

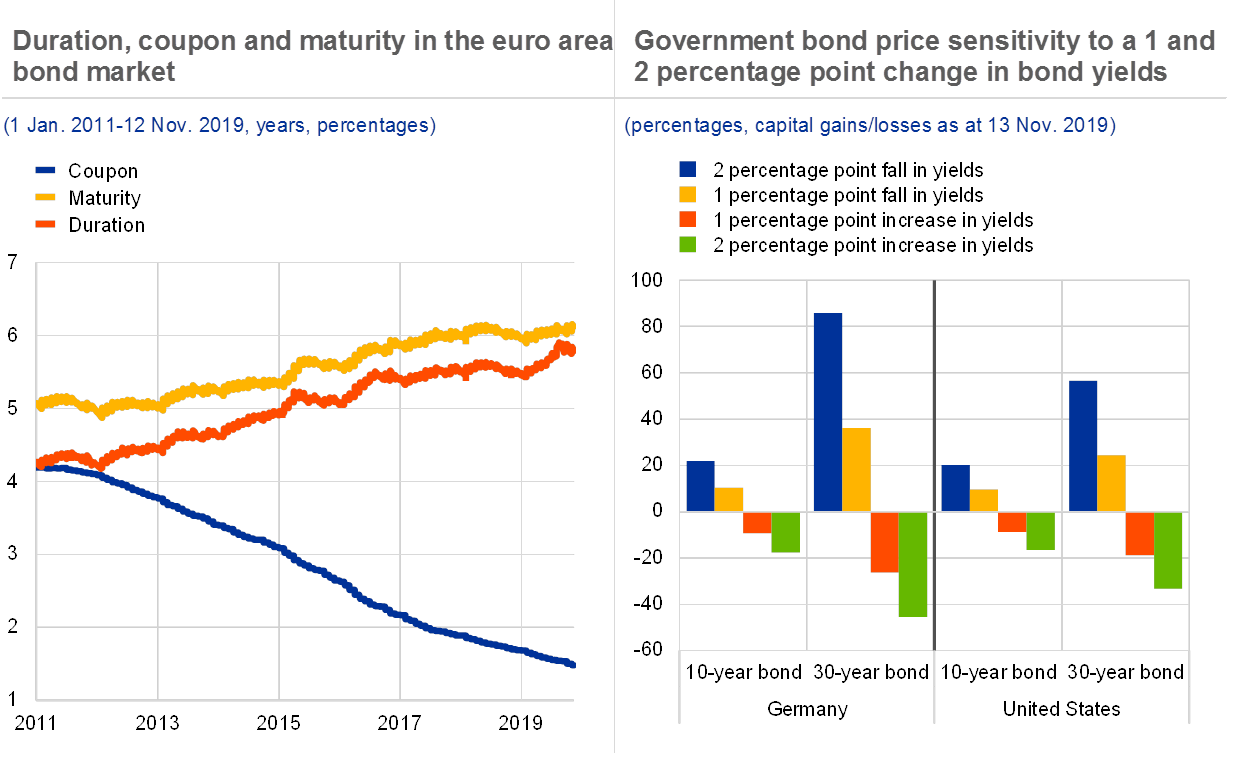

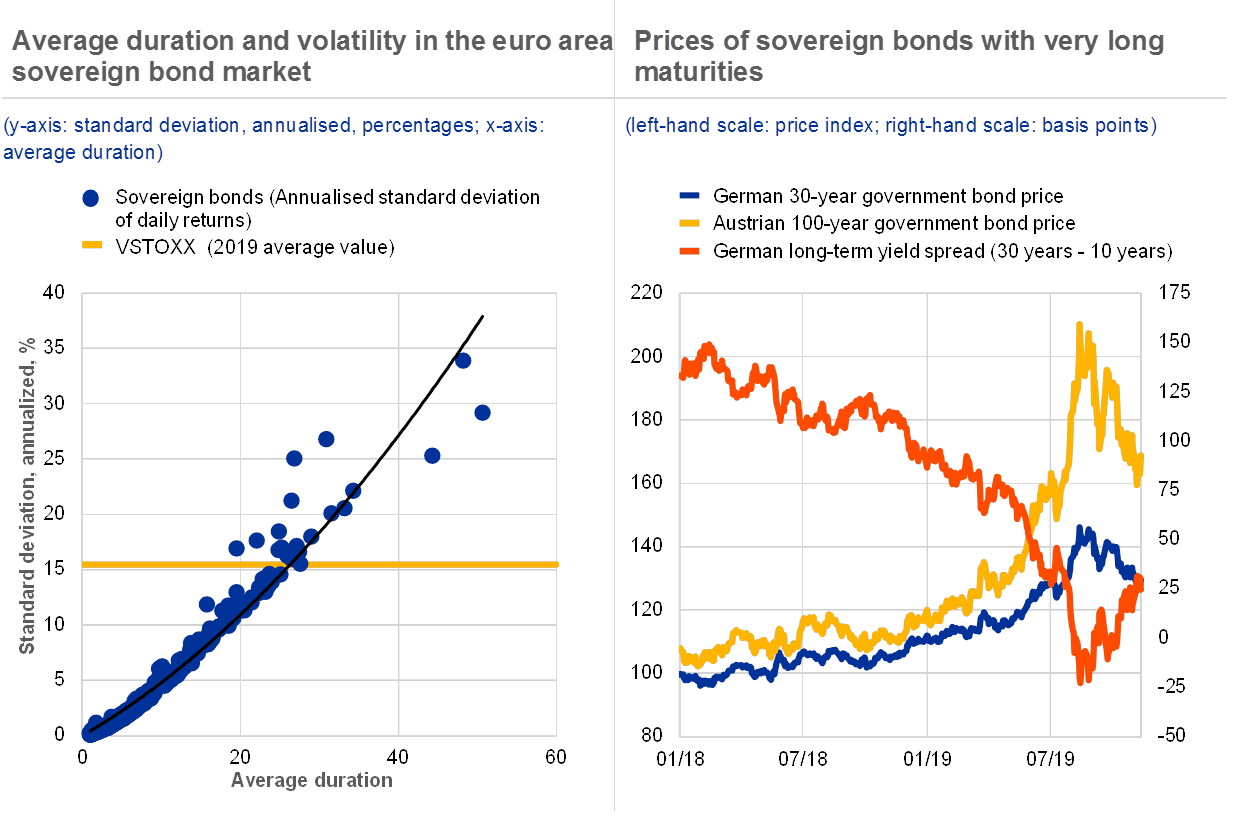

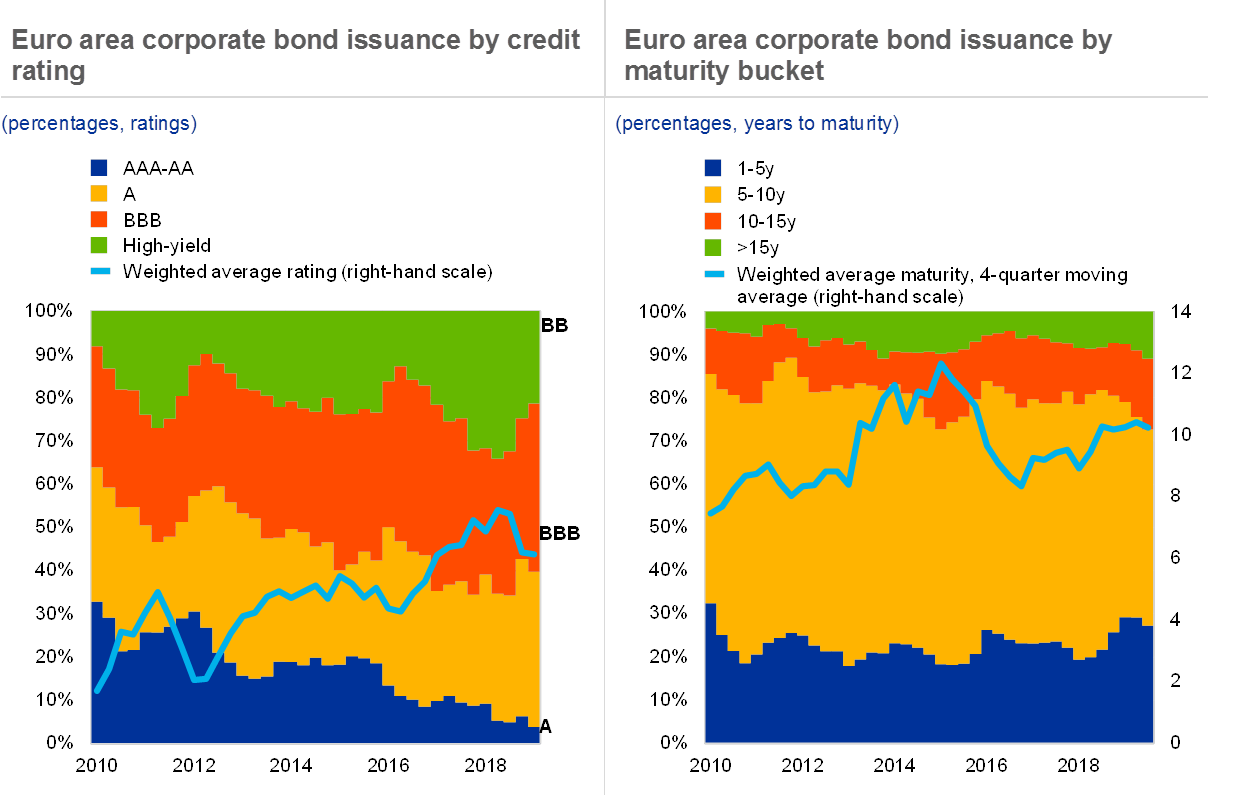

Financial institutions’ low-yielding/high-duration portfolios could come under pressure, if there were to be a repricing in bond markets. Beyond the mechanical effects on financial asset prices, lower yields on risk-free assets pose challenges for bond market investors, such as insurers and pension funds, which may increase the credit risk of their portfolios to maintain profitability. Duration risk has also increased. As average maturities have lengthened and coupon payments declined (see Chart 4, left panel), so has investors’ sensitivity to changes in interest rates and bond market volatility (see Chart 4, right panel). Very low interest rates, coupled with the large number of investors which have gradually increased the duration of their fixed income portfolios, could exacerbate potential losses if an abrupt repricing were to materialise in the medium-to-long run.

Chart 4

Capital losses for low-yielding/high-duration portfolios could be substantial in the event of a repricing in bond markets

Sources: IHS Markit and Bloomberg.

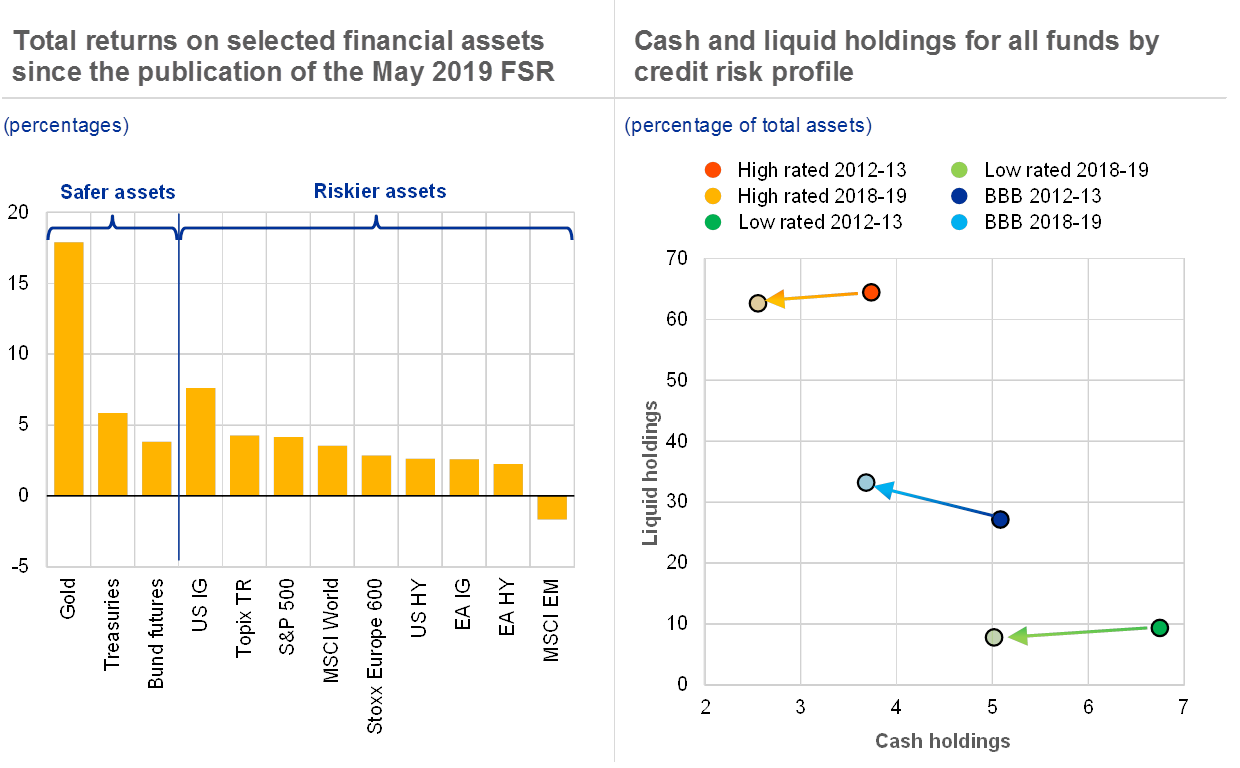

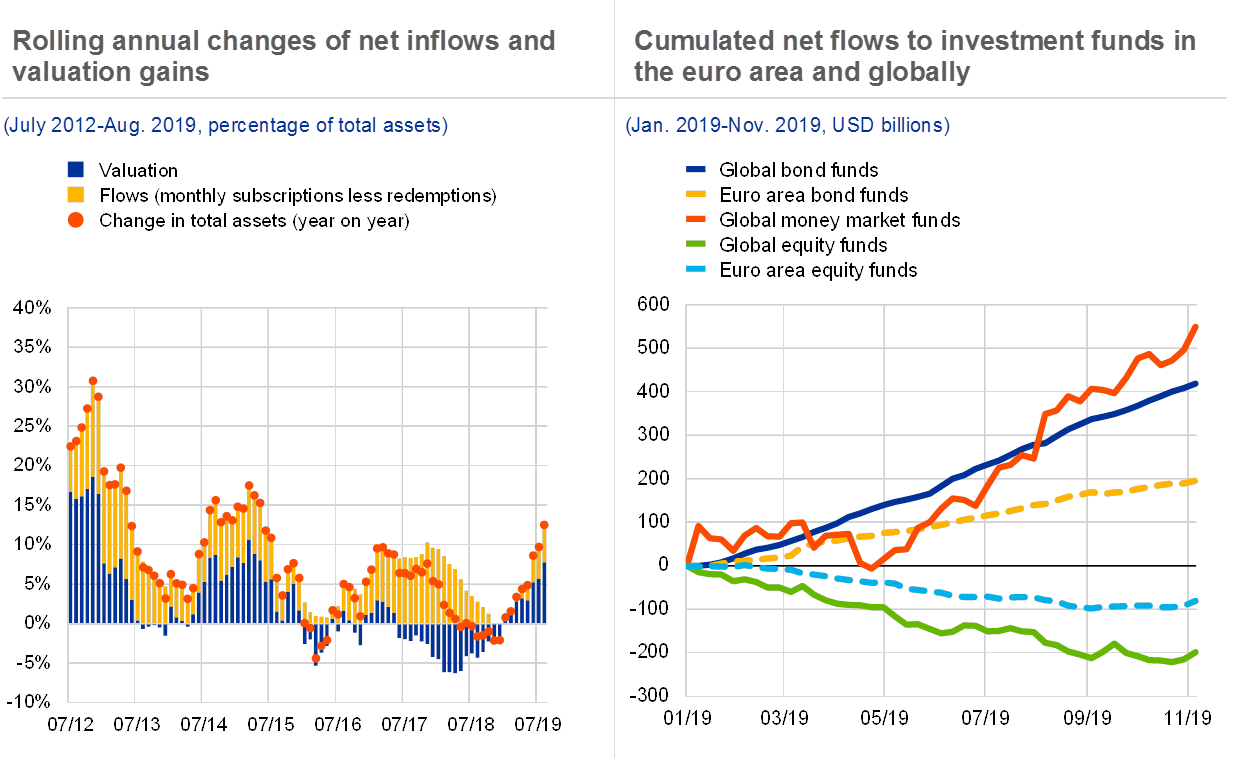

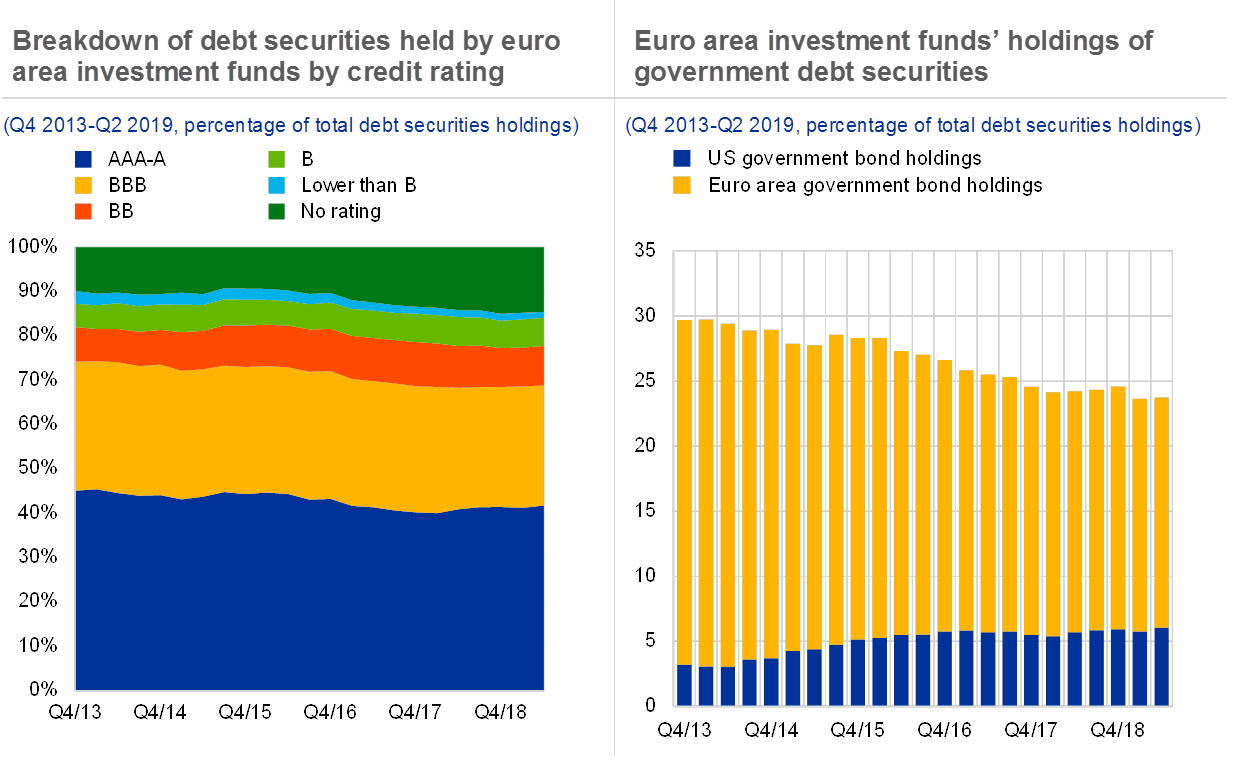

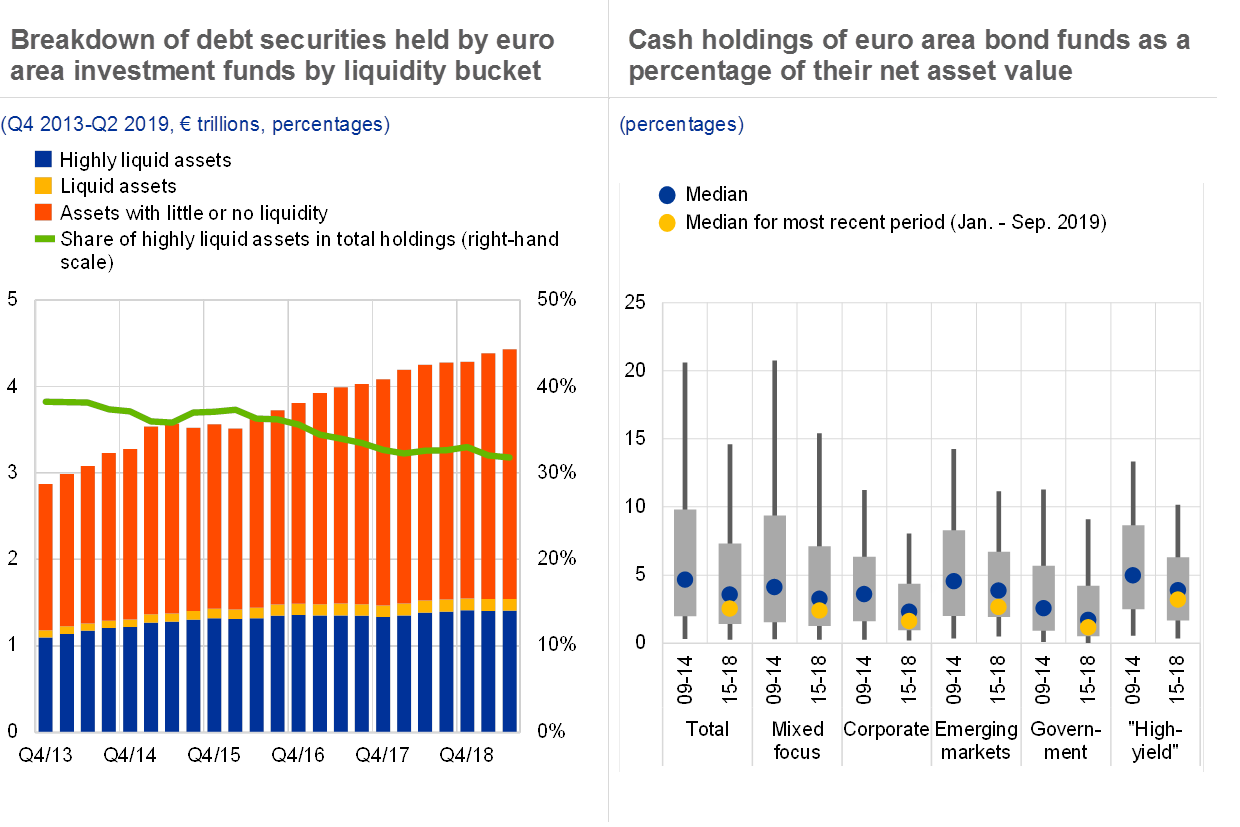

The higher valuation of some asset classes may leave them vulnerable to future market corrections. In tandem with the rally in risk-free asset markets, assets with higher credit risk extended the rally that had started early in the year following the market corrections at the turn of the year (see Chart 5, left panel). Equity and credit valuations in the euro area seem increasingly contingent on and sensitive to changes in the benchmark yield curve, whereas nominal growth and earnings expectations have played a less prominent role in explaining the equity price increases observed in recent years (see Box 2). Global equity and corporate bond prices that appear high by historical standards could adjust abruptly in the face of adverse shocks and fading investor risk appetite. Even so, the likelihood of a disorderly unwinding of risk premia in the near term is reduced as interest rates are expected to remain lower for longer, but this risk remains material in the longer term.

Chart 5

Disorderly asset price corrections may be amplified by procyclical investor behaviour

Sources: Bloomberg, Refinitiv Lipper and ECB Centralised Securities Database.

Notes: Left panel: IG: investment-grade; HY: high-yield. Right panel: Liquid holdings comprise Level 1 high-quality liquid assets with the following two layers: (i) euro-denominated bonds issued by EU governments; and (ii) non-euro-denominated bonds issued by foreign governments, rated at least AA. The high-rated (low-rated) category comprises funds investing more than 50% of their portfolio in bonds with a rating of A or higher (BB or lower). The BBB bucket covers the sample of funds investing more than 50% of their portfolio in bonds rated BBB.

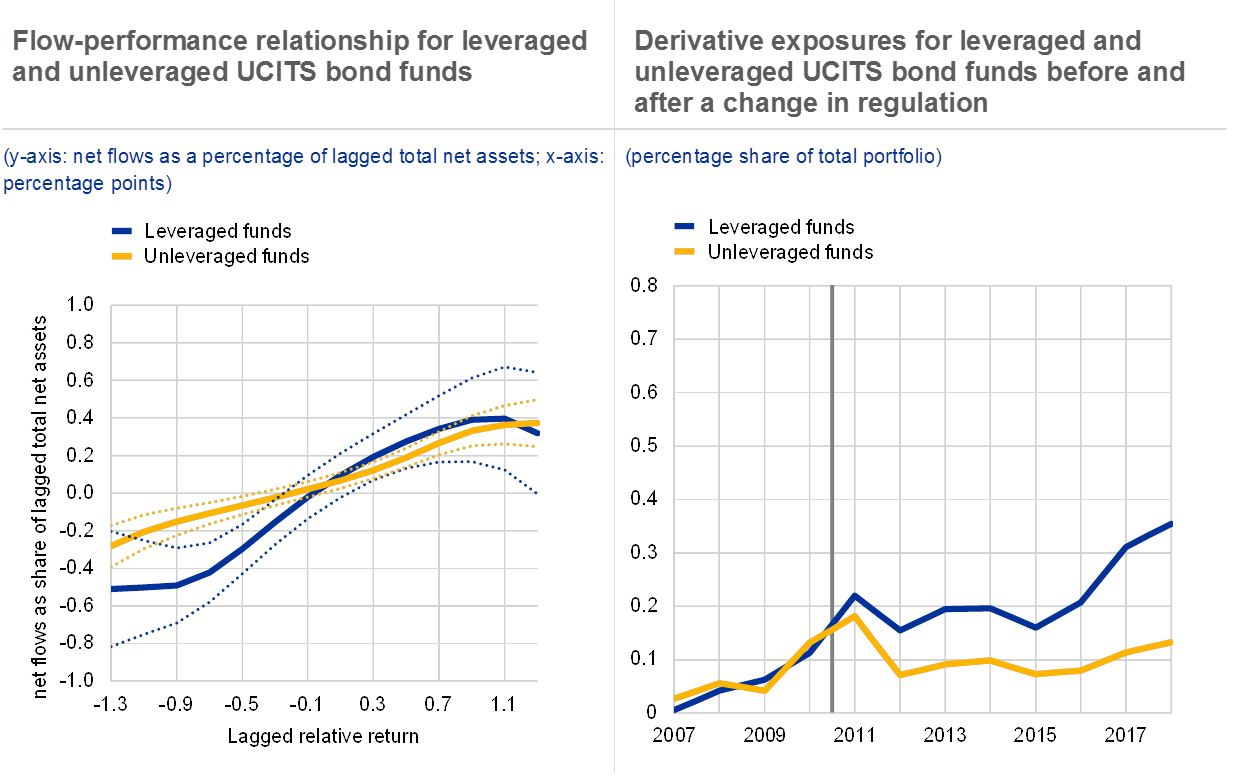

Signs of excessive leverage and risk-taking in some sectors require targeted action

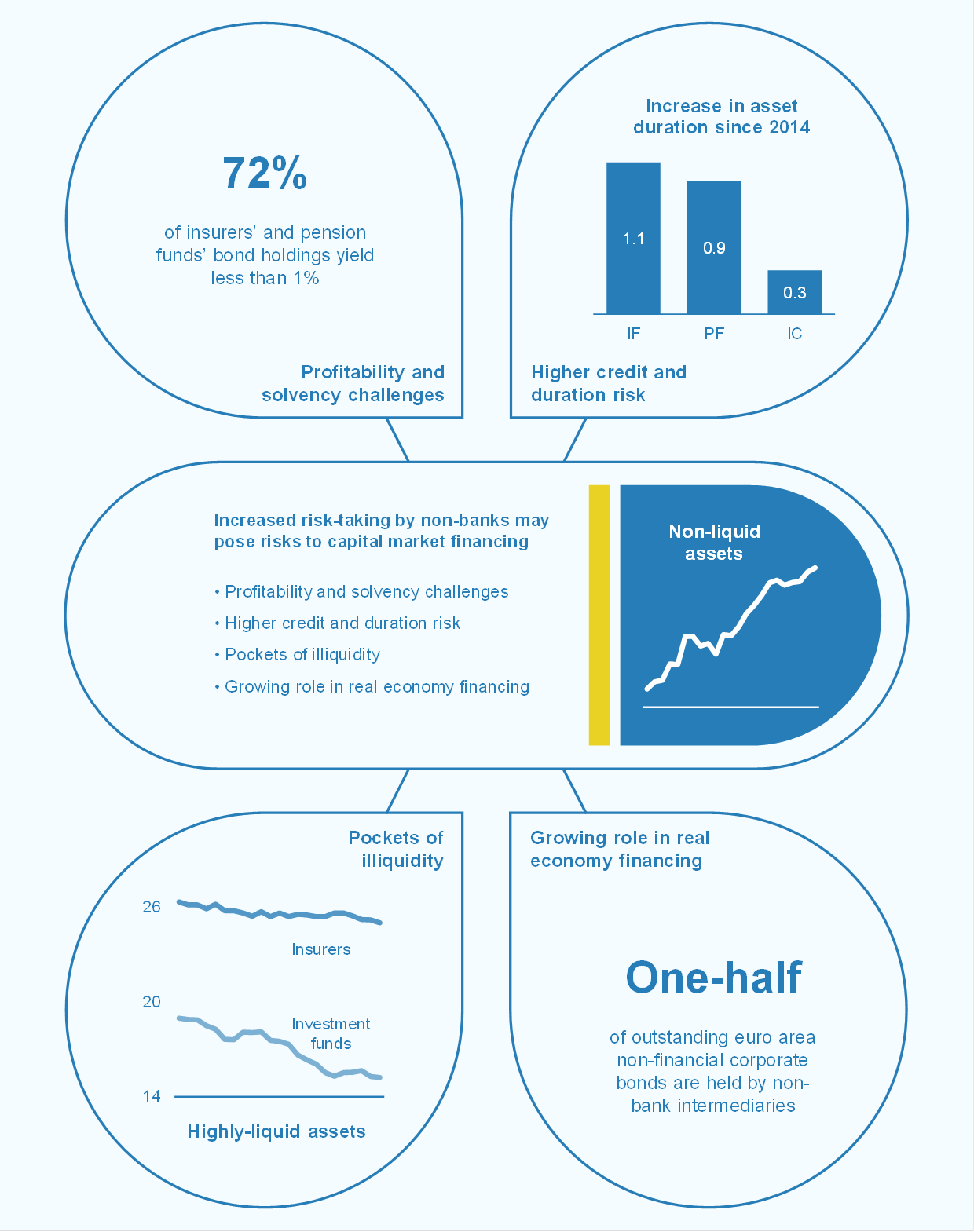

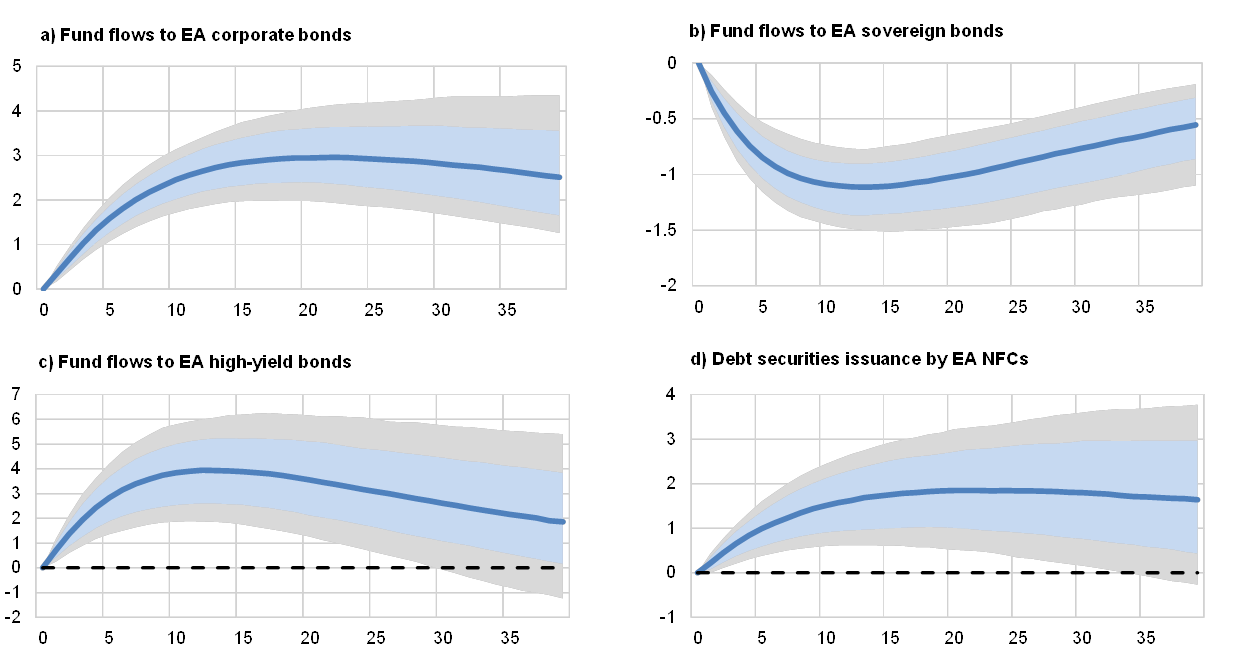

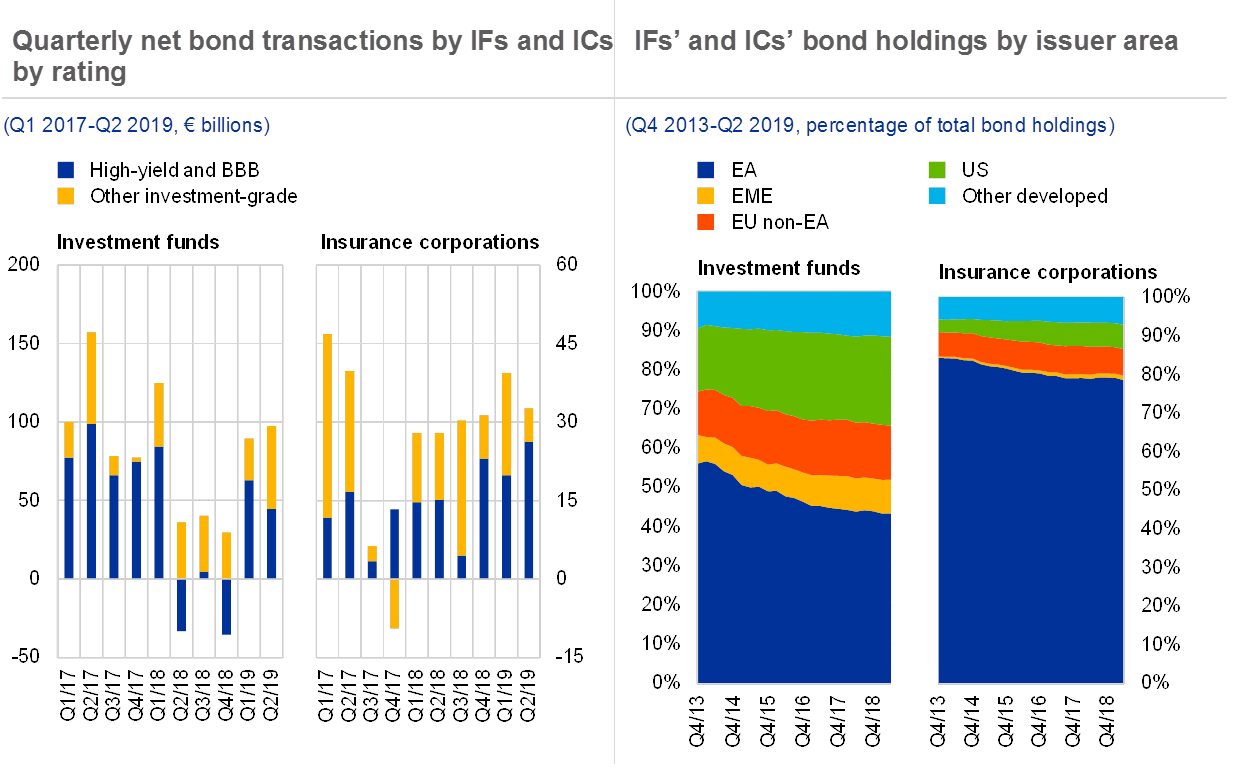

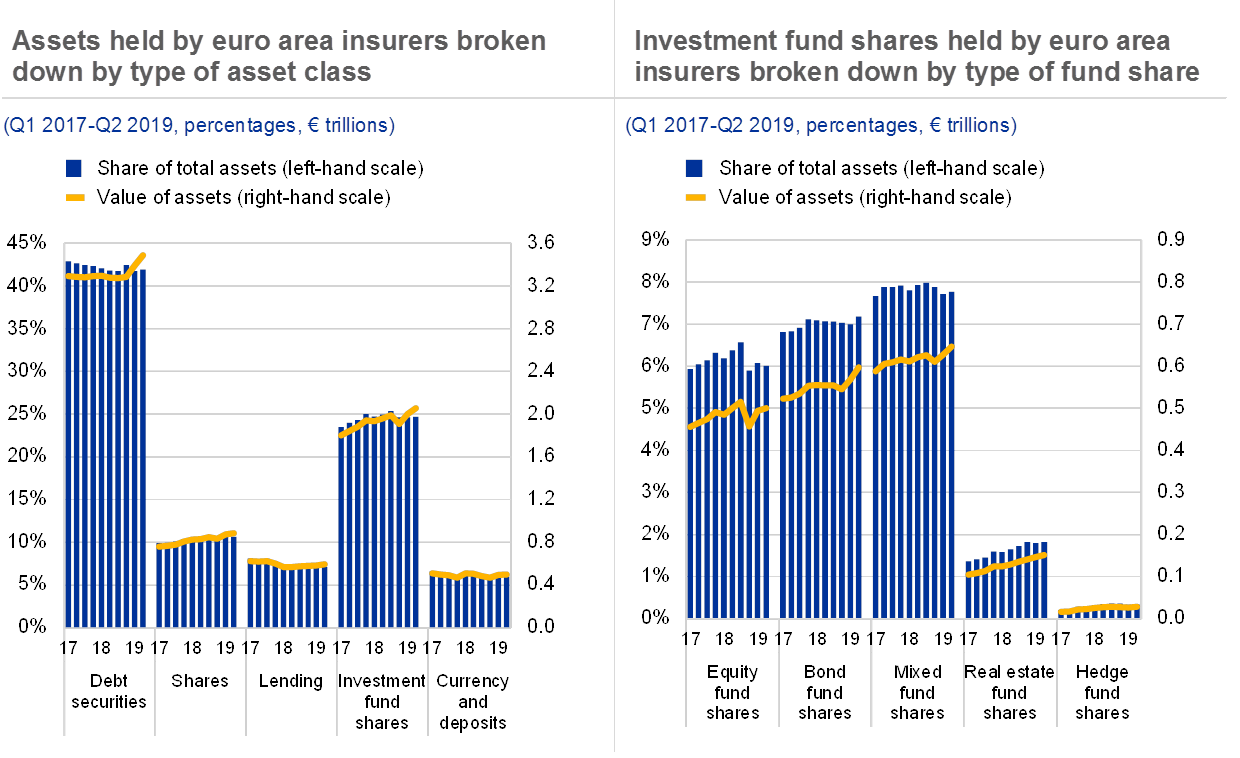

The ongoing search for yield across non-banks may exacerbate the build-up of vulnerabilities, not least by lowering financing costs for riskier borrowers. Credit and liquidity risks appear to have increased over recent years in some parts of the euro area non-bank financial sector, including investment funds (see Chart 5, right panel). Growth of non-bank financial intermediation, while improving risk-sharing and allowing firms to diversify their funding sources, has also been associated with increased risk-taking and rising interconnectedness between financial sectors which may act as a contagion channel in the event of distress.

Stress from an abrupt repricing of financial assets could be amplified by the behaviour of investment funds with high liquidity mismatches and elevated leverage. Recent stress episodes in some UCITS funds indicate that funds invested in illiquid assets can face severe difficulties in dealing with large-scale outflows. Higher leverage, for example in hedge funds, can add to procyclical investor behaviour and accelerate outflows. So, a sudden and abrupt repricing of risk coupled with large outflows could force asset sales, amplifying the original shock to asset prices. In turn, this may have implications for the ease and cost of corporate financing which could exacerbate any real economy downturn.

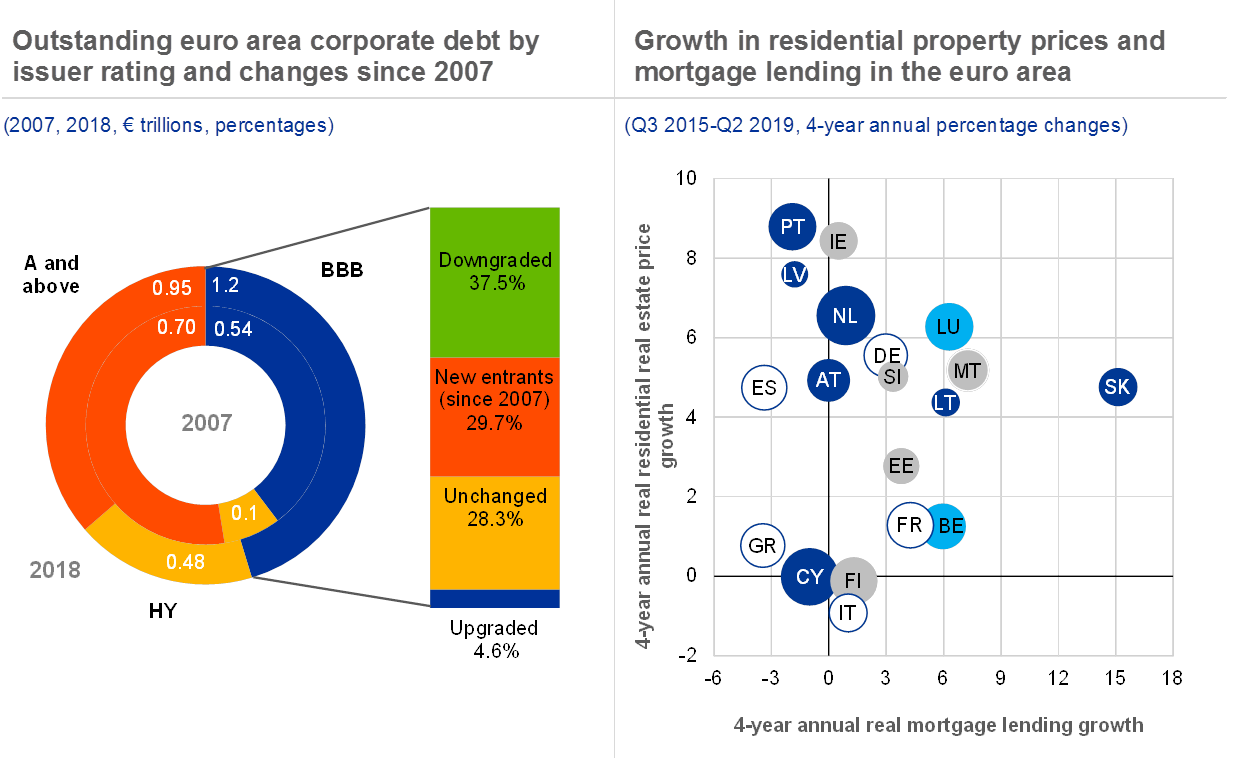

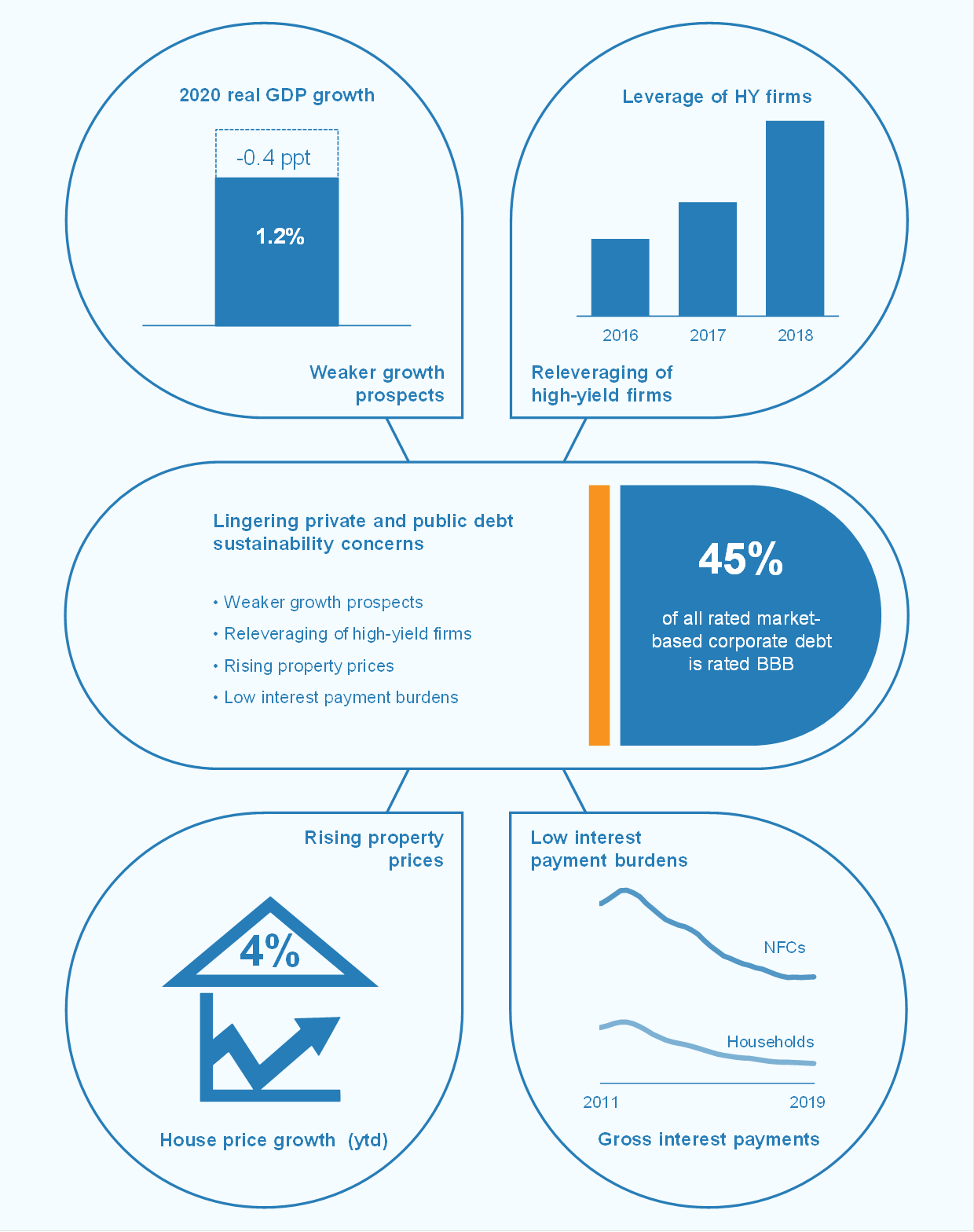

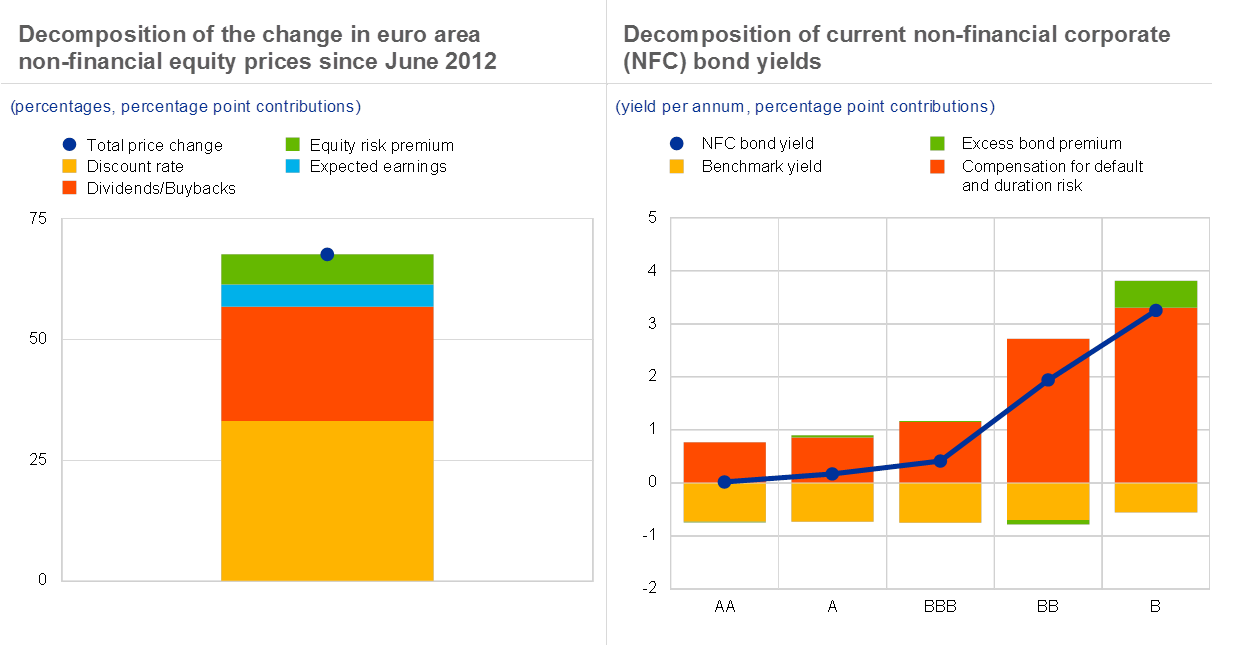

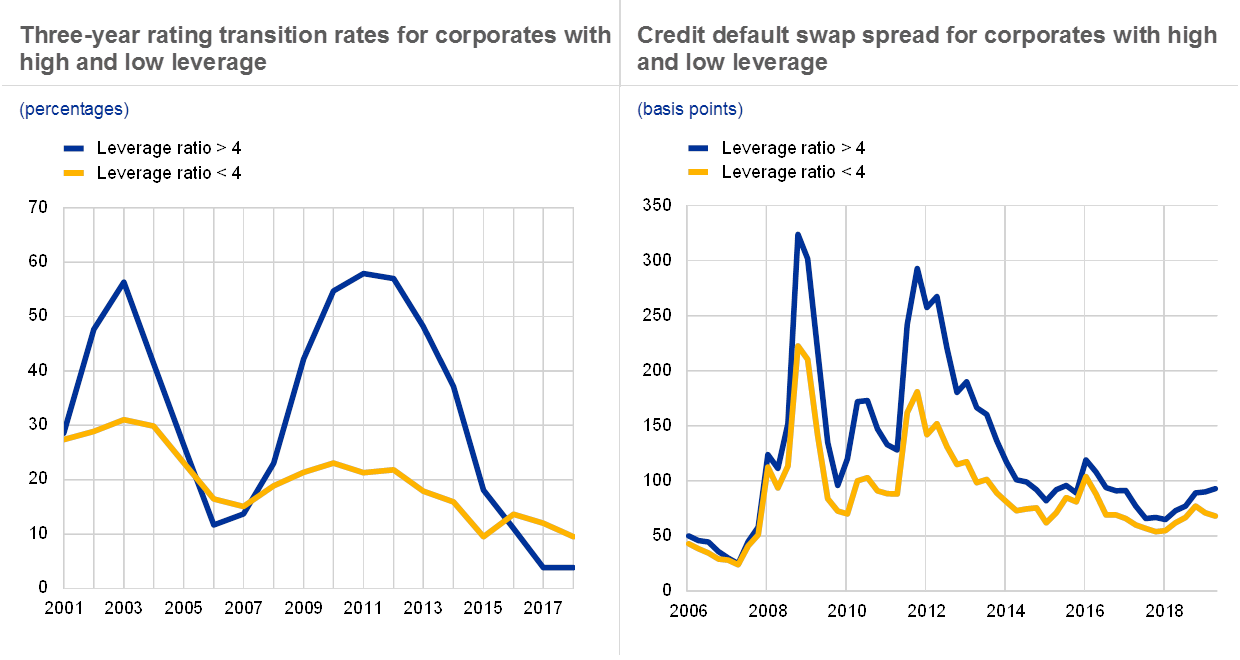

Beyond supporting economic growth, low funding costs might also lead to higher leverage among riskier firms. The lower and flatter term structure has reduced significantly market-based funding costs for corporates, facilitating higher levels of leverage. In particular, the share of high-yield and lower-rated investment-grade issuances – many involving highly leveraged firms – has risen in recent years. The tendency among firms to increase leverage and secure low financing costs is also reflected in the changing maturity and credit risk structure of corporate bond issuance (see Chapter 2). In general, highly leveraged firms are more likely to be downgraded during economic downturns than their less leveraged counterparts. Downgrade risk has increased in view of a deteriorating economic outlook, indicating higher funding costs and possible rollover risks going forward, primarily for the very large lower-rated investment-grade segment (see Chart 6, left panel), where downgrades are associated with a distinct increase in average credit spreads.

Chart 6

Pockets of vulnerability in the non-financial corporate sector as well as property markets warrant close monitoring

Sources: S&P Global Market Intelligence, ECB and ECB calculations.

Notes: Left panel: Downgraded/upgraded debt refers to corporate debt that was rated higher/lower than BBB in 2007. New entrants refer to firms that entered the market/obtained a BBB rating after 2007. Right panel: The bubble size indicates the household debt-to-GDP ratio. Dark blue bubbles indicate countries that have applied borrower-based macroprudential measures such as collateral or income-based limits. Light blue bubbles refer to countries which have applied risk weights to residential property exposures. Countries coloured grey have applied both types of measures. Measures related to the countercyclical capital, systemic risk or O-SII buffers are not captured. White bubbles indicate countries which have not applied any macroprudential residential real estate measures.

Developments in euro area property markets warrant monitoring in a prolonged low interest rate environment. Buttressed by the low interest rate environment, the euro area residential real estate sector continued its gradual expansion. The recently issued ESRB warnings and recommendations with regard to residential real estate vulnerabilities suggest that continued strong price dynamics, coupled with relatively buoyant mortgage lending growth and high household indebtedness, represent key vulnerabilities in a number of countries (see Chart 6, right panel). Alongside decreasing transaction volumes, commercial real estate price growth has shown signs of slowing, indicating that the commercial real estate cycle may be turning. Valuations also seem stretched following a strong upswing, supported by the search for yield by foreign investors, in particular US investment funds. Being more sensitive to changes in global financial conditions, foreign investors might make domestic commercial real estate markets more exposed to a sharp or disorderly adjustment (see Box 1).

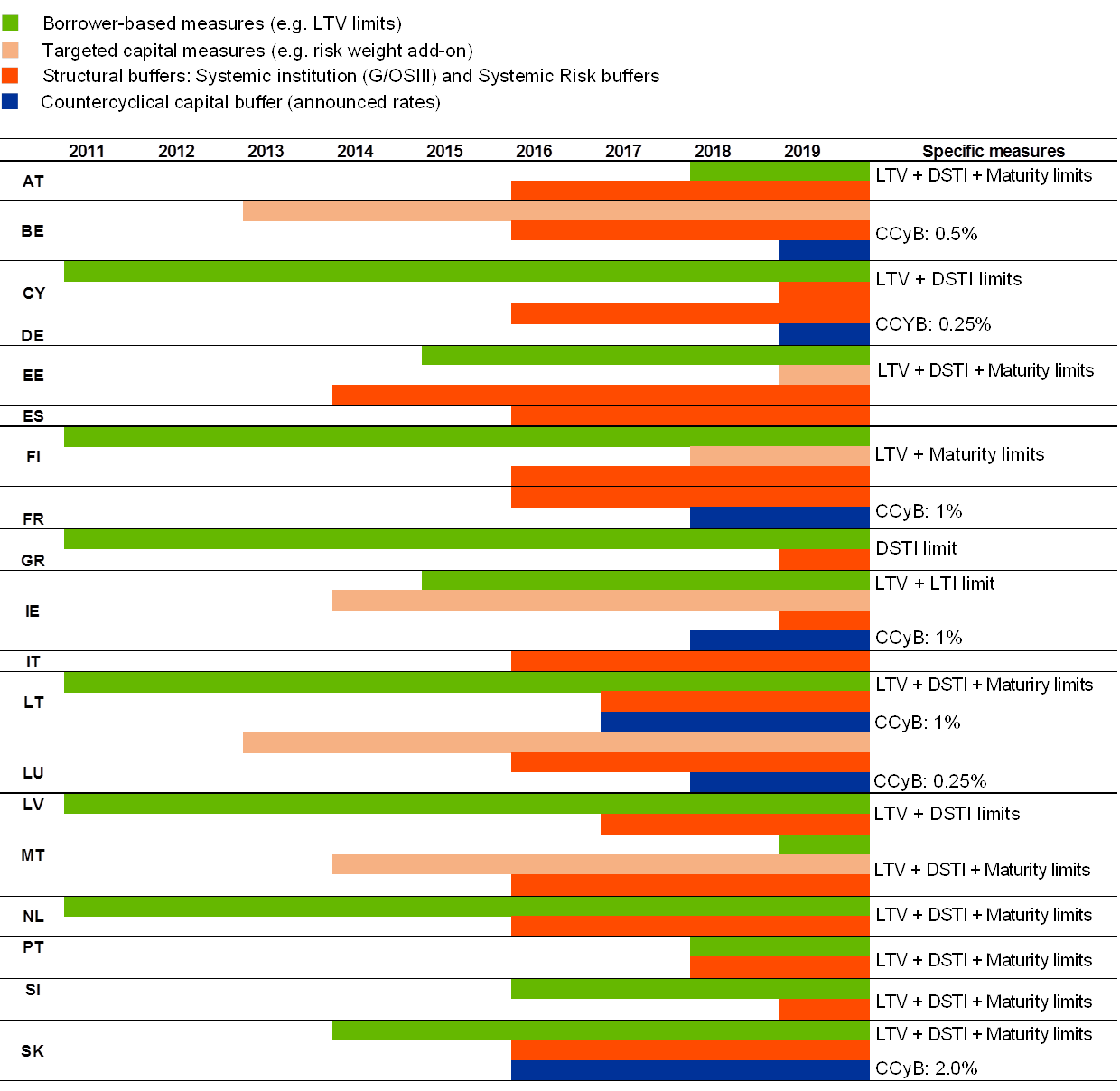

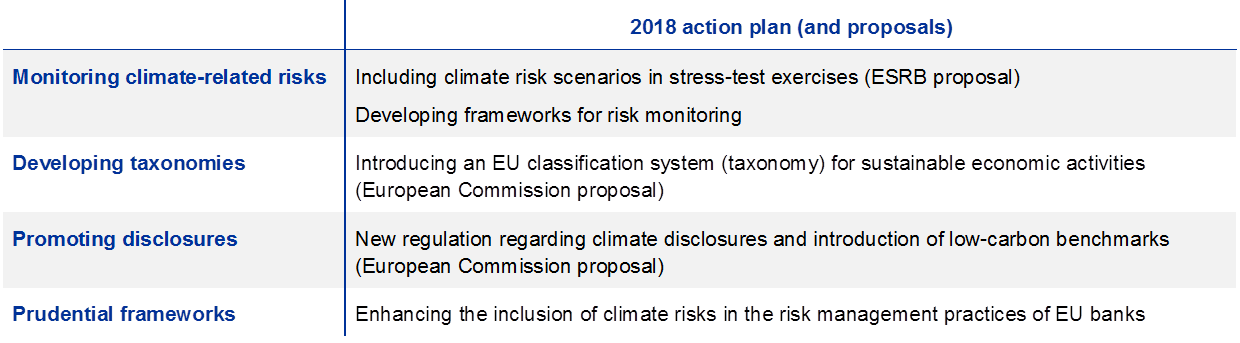

Targeted macroprudential policy measures are in place to address vulnerabilities in the banking sector and real estate markets, but the toolkit for non-banks needs to be further developed. Where available and warranted, macroprudential policy can increase the resilience of the financial sector while containing the build-up of financial imbalances. For example, various macroprudential instruments, such as capital buffer requirements for banks or controls on the terms of lending, can help mitigate risks to financial stability in property markets at the country level. Most euro area countries have already introduced such measures, but given its macroprudential mandate, the ECB is also monitoring property market developments with a view to assessing the appropriateness of capital-based national macroprudential measures in accordance with the SSM Regulation (see Chapter 5). As for non-bank financial institutions, the macroprudential toolkit is still in its infancy and needs to be further developed. Thus, pockets of vulnerability outside the traditional banking system cannot be effectively addressed by the macroprudential measures taken to date.

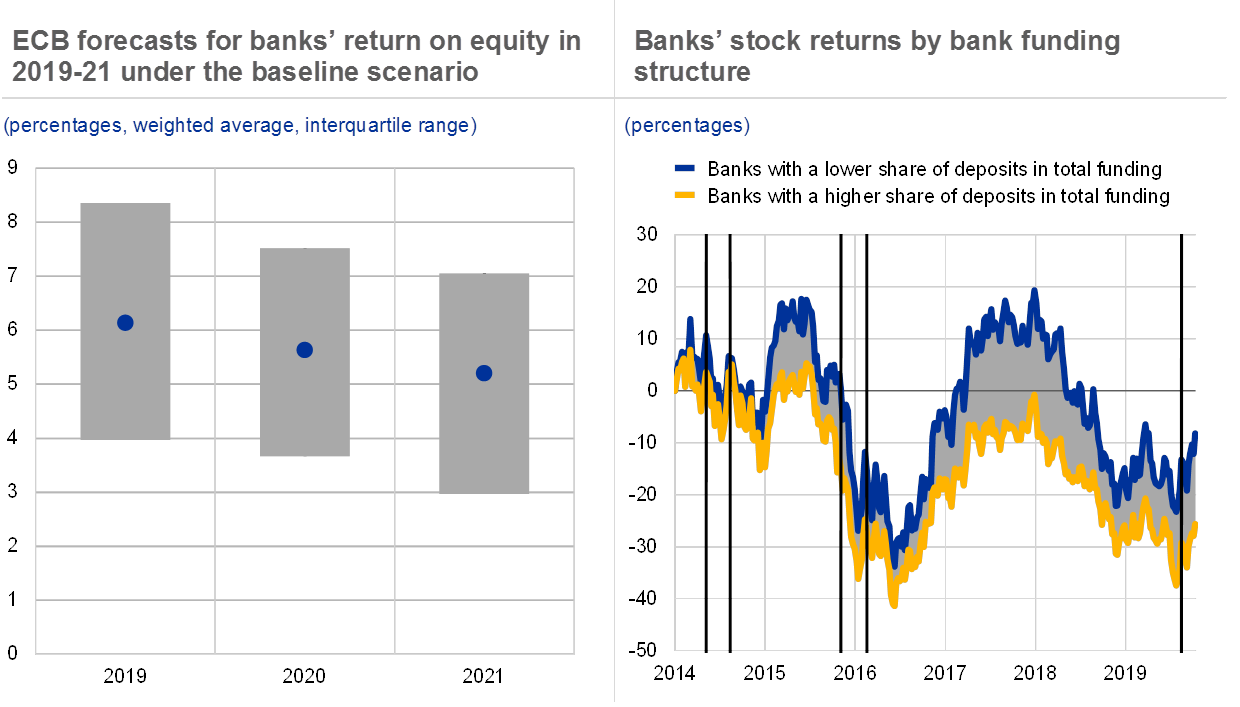

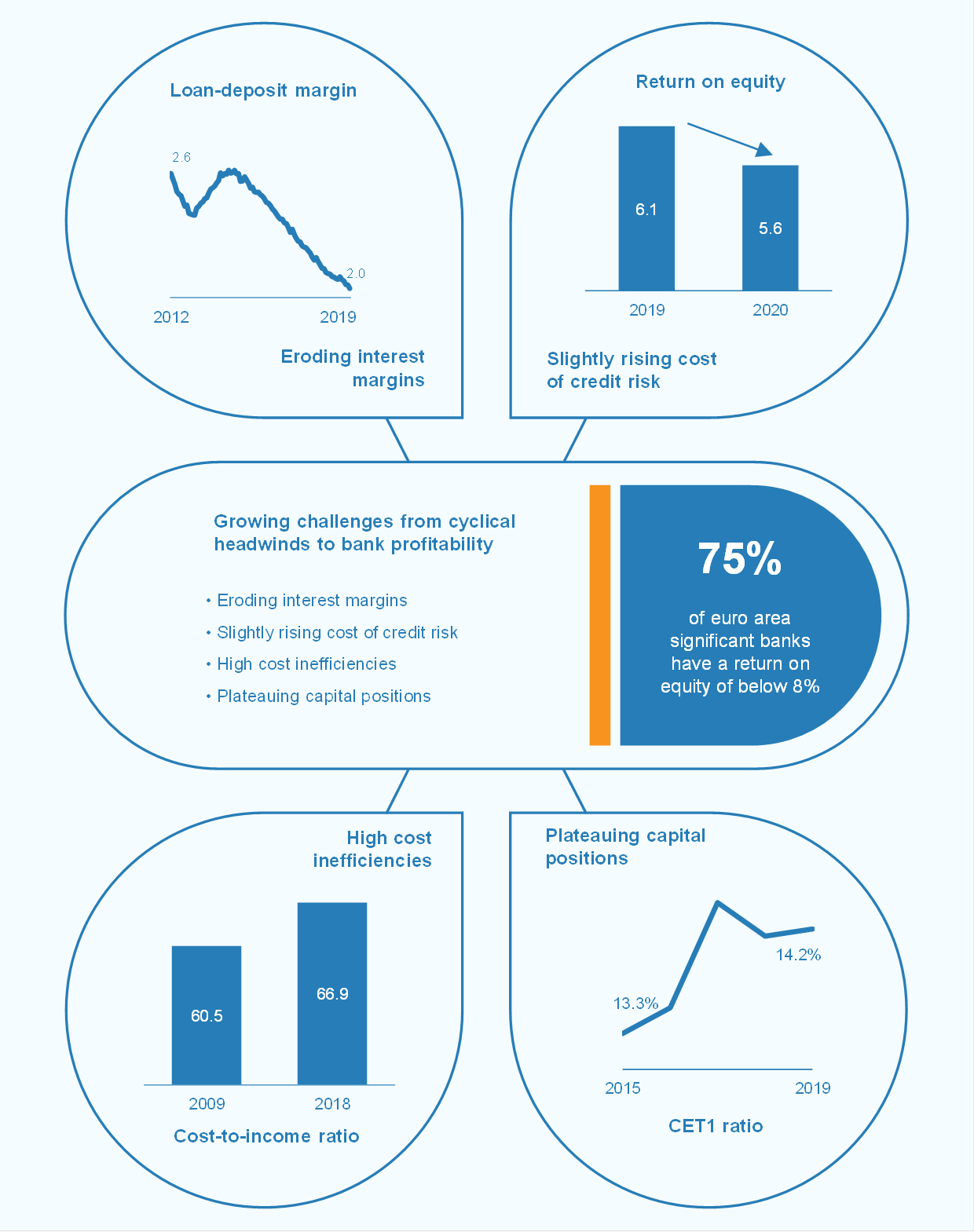

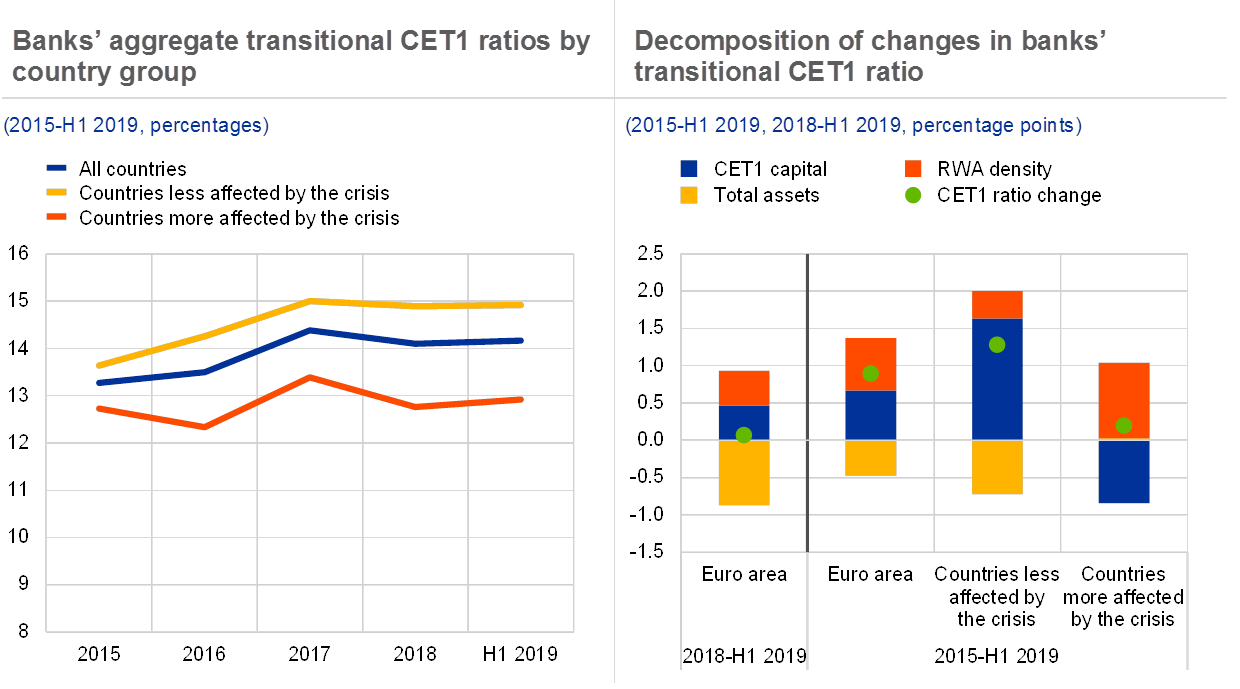

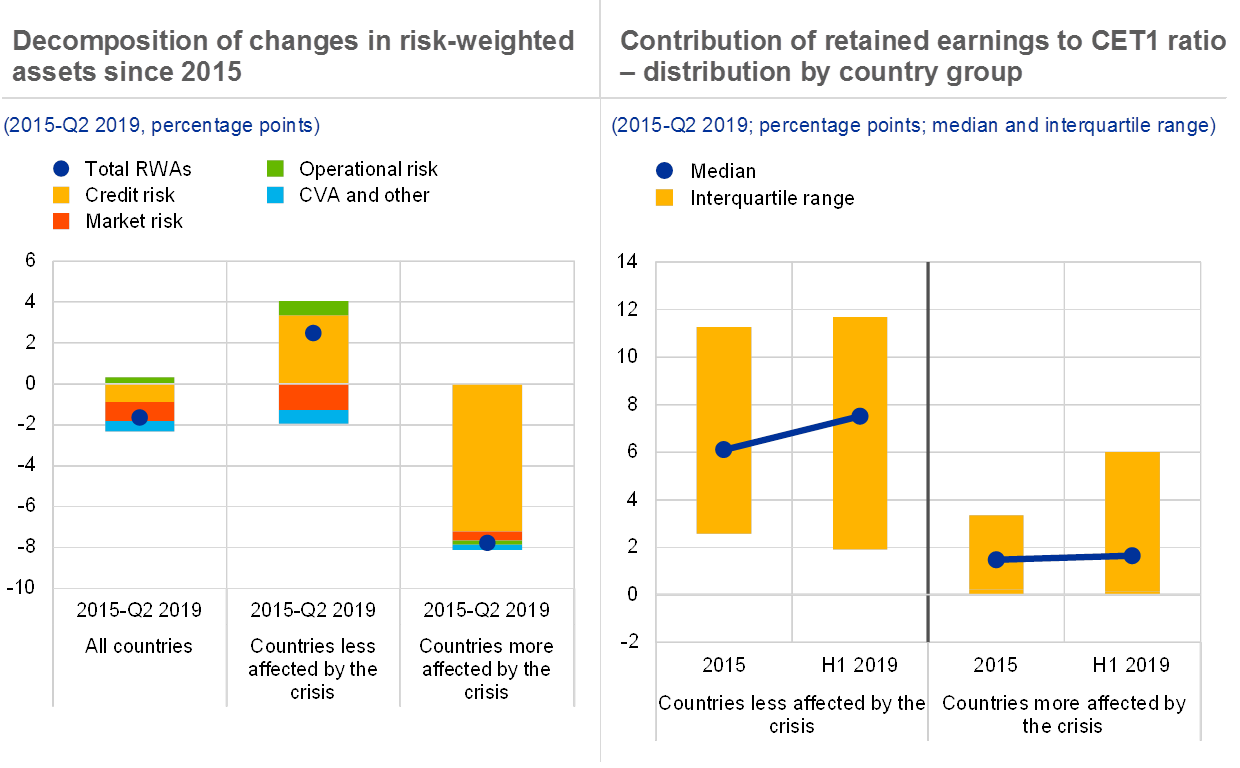

While the banking sector is resilient to near-term risks, challenges from a more subdued profitability outlook remain

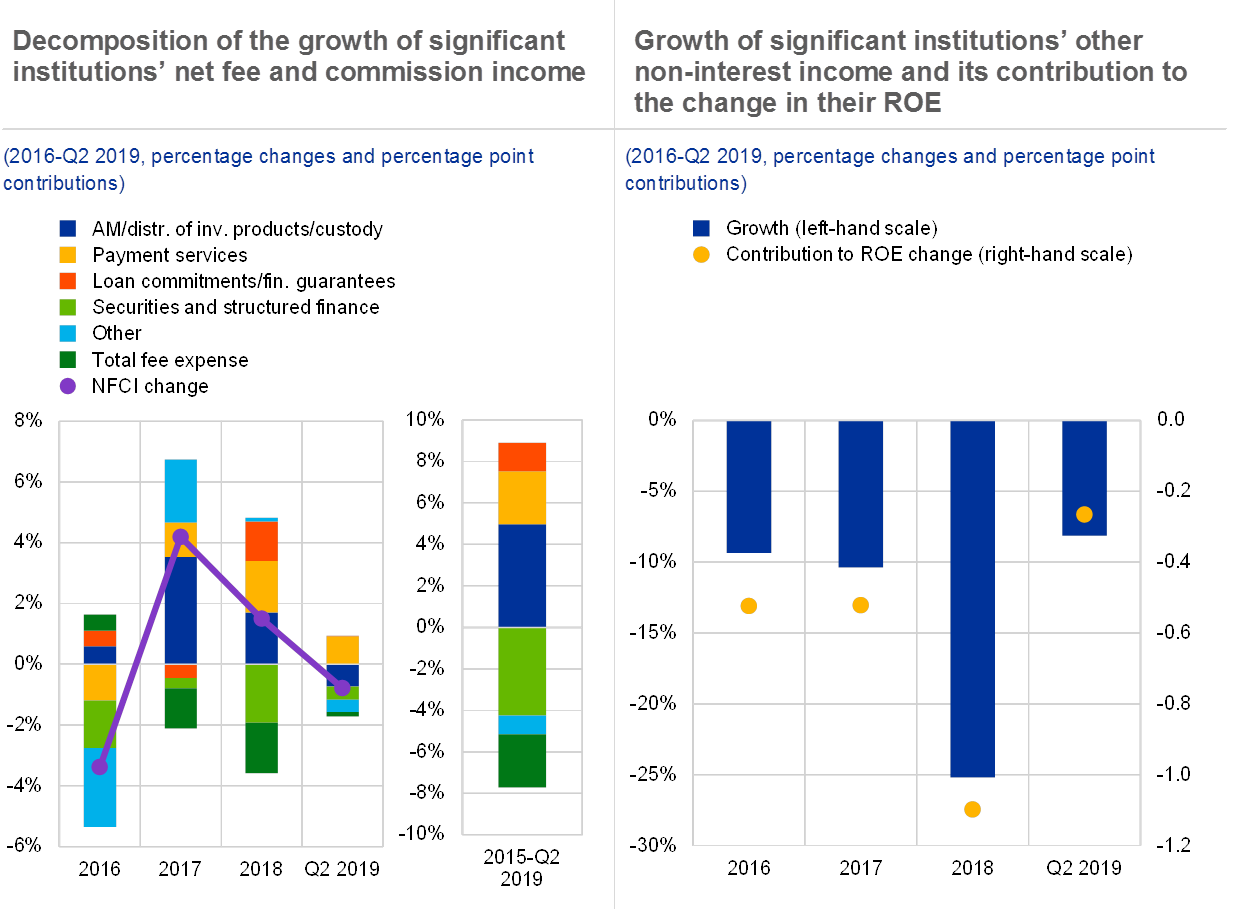

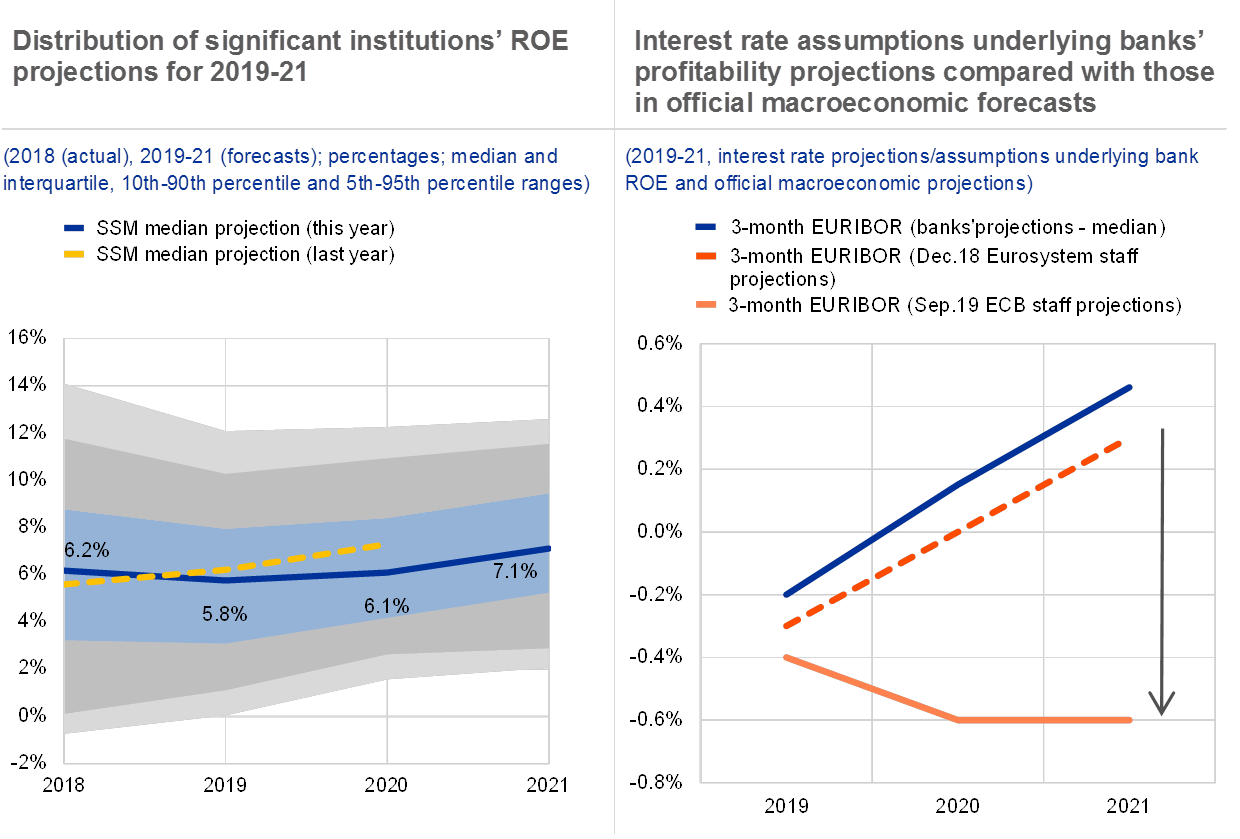

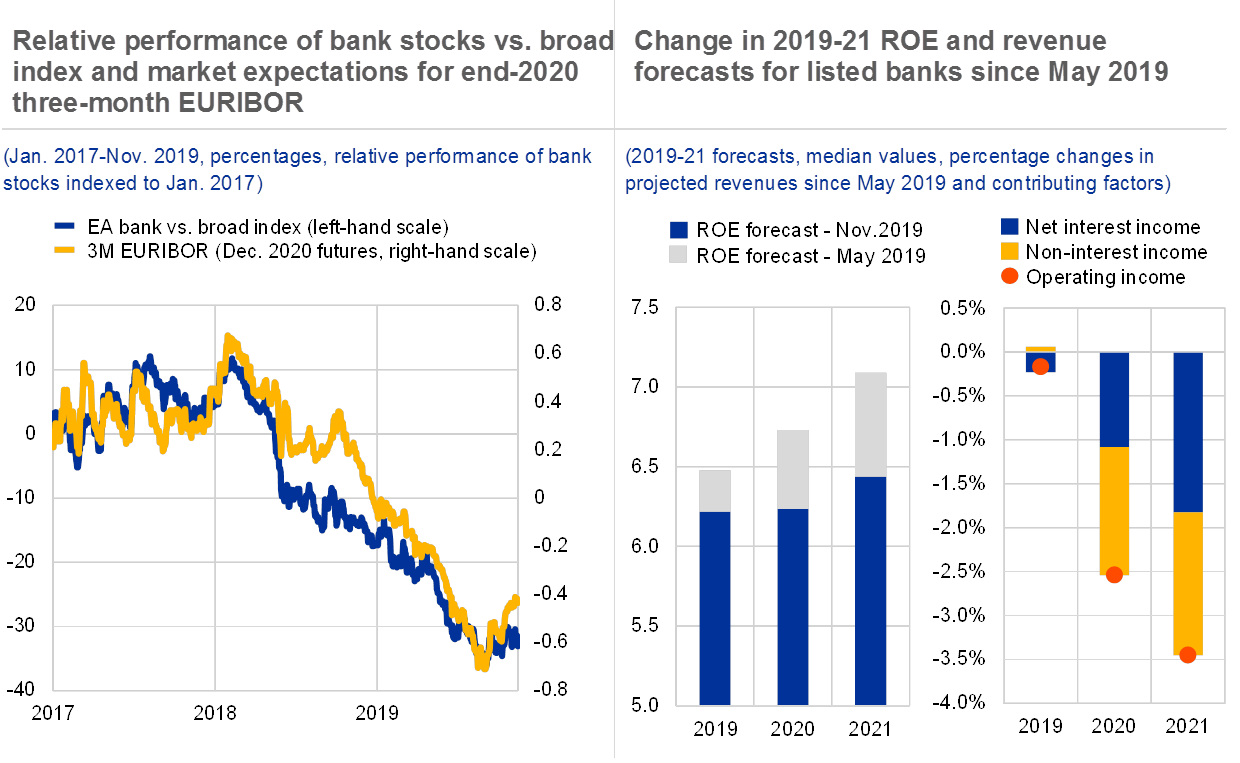

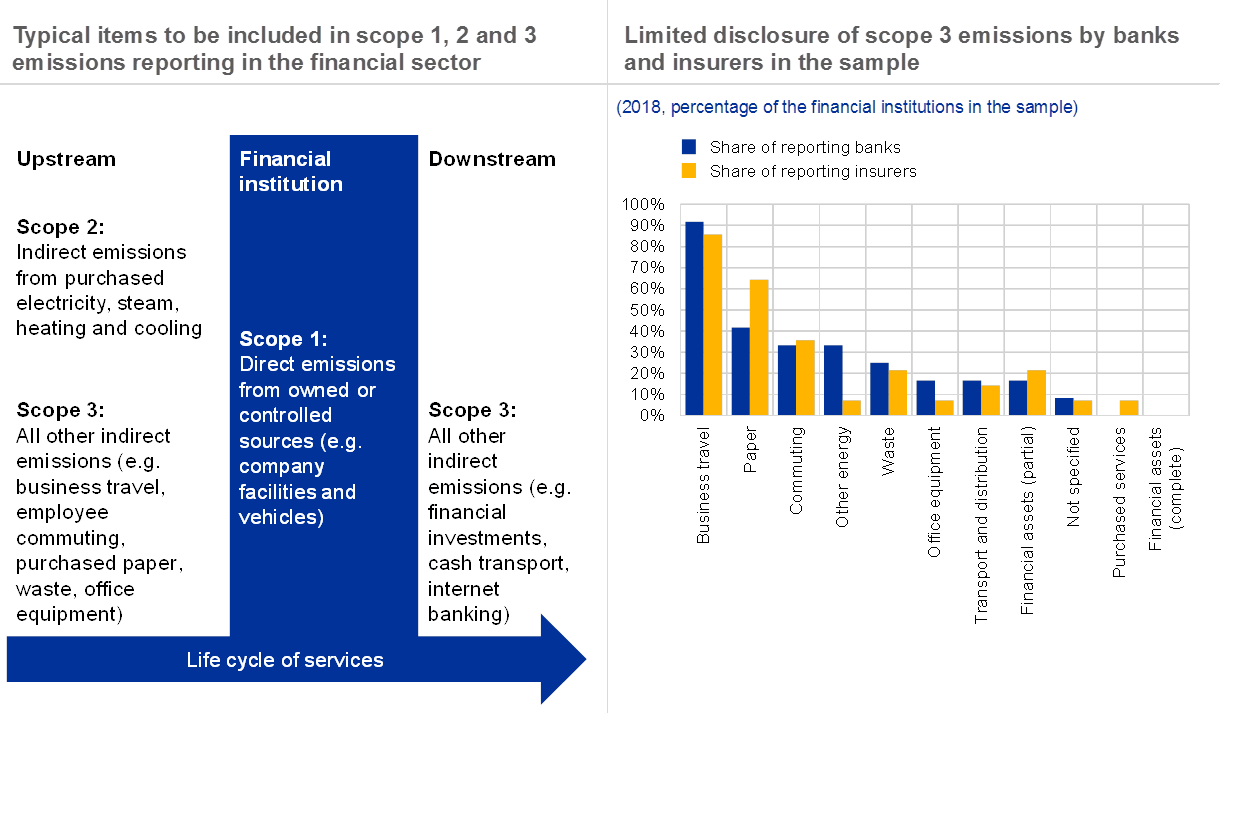

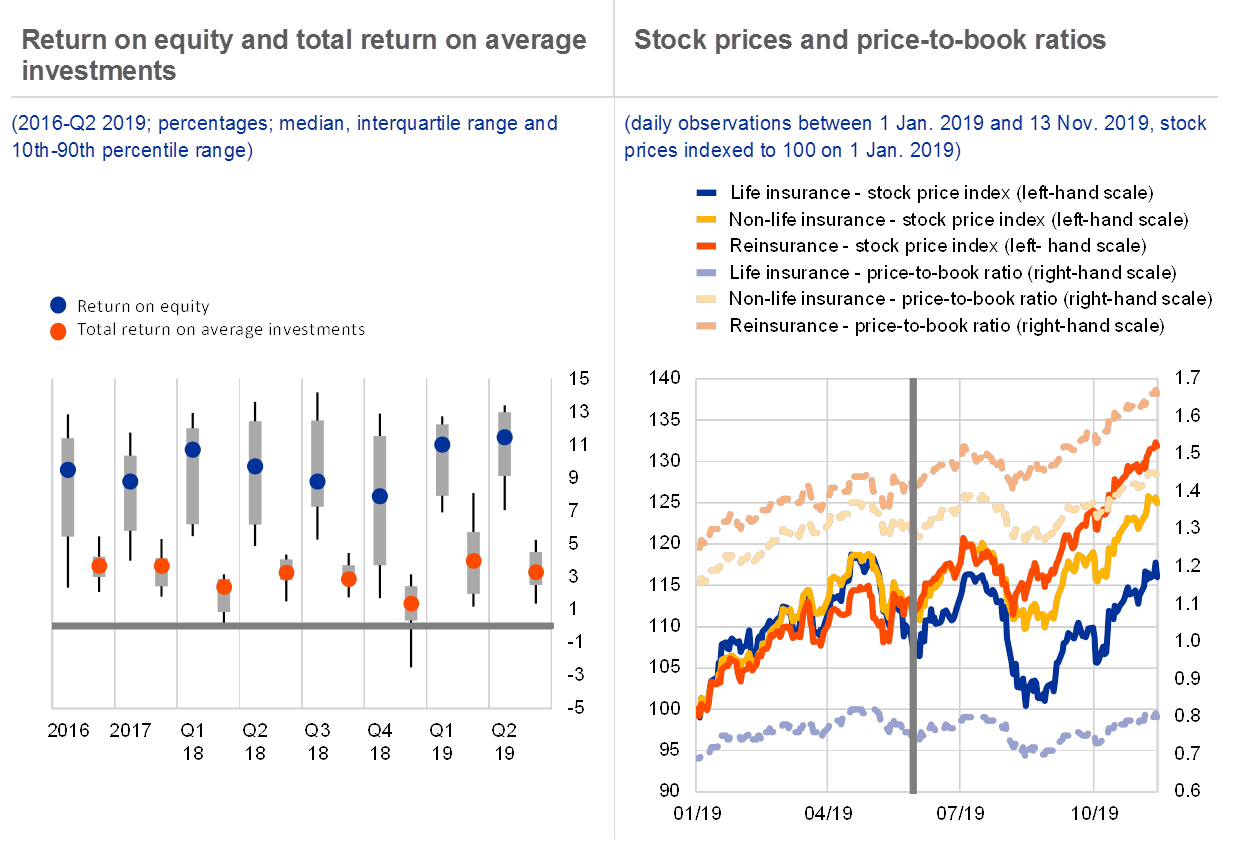

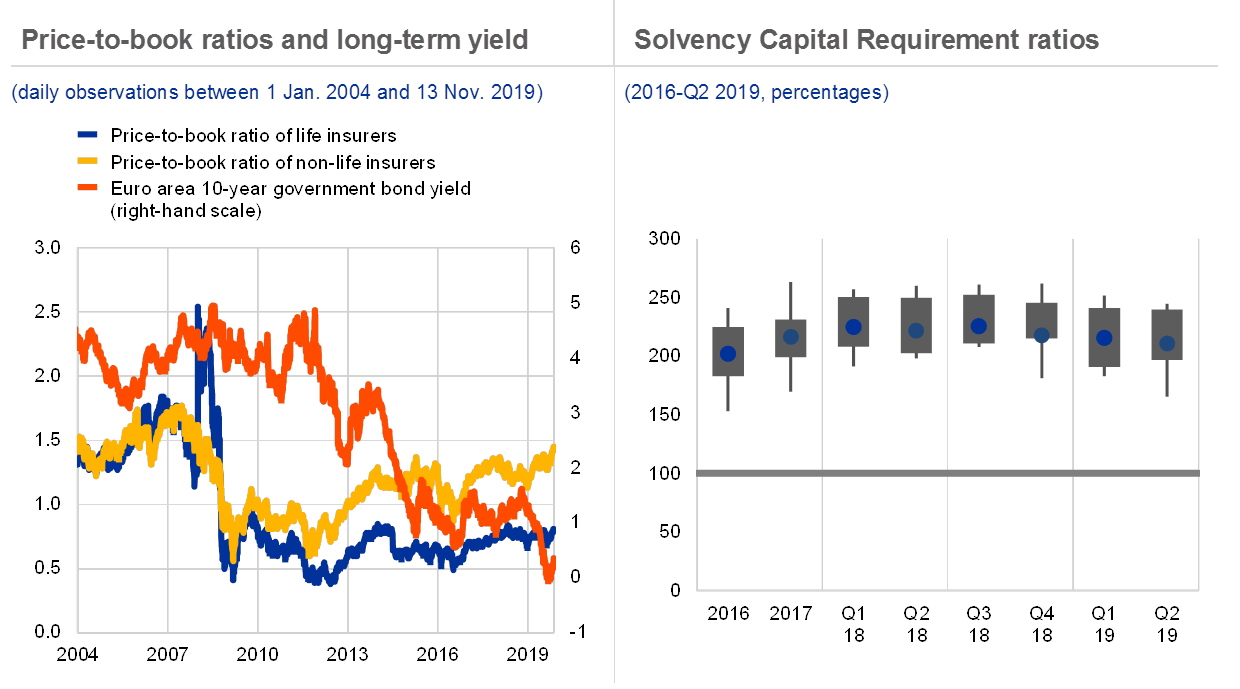

Bank profitability concerns remain prominent. Bank profitability prospects have weakened against the backdrop of the deteriorating growth outlook (see Chart 7, left panel) and the low interest rate environment, especially for banks also facing structural cost and income challenges (see Special Feature A). Reflecting these concerns, euro area banks’ market valuations remain depressed with an average price-to-book ratio of around 0.6. Alongside structural factors, such as legacy non-performing loan (NPL) problems and cost-efficiency, banks’ funding structure appears to have also played a role in shaping market perceptions of banks (see Chart 7, right panel). Moreover, misconduct costs continue to be an additional factor weighing on bank equity valuations (see Box 3), while inconsistent disclosures may be making it difficult for markets to price banks’ climate-related risks (see Box 4).

Chart 7

Low profitability prospects continue to weigh on bank valuations

Sources: Bloomberg and ECB.

Notes: Right panel: The vertical black lines indicate the Eurosystem’s interest rate decisions. The blue and yellow lines represent the total returns of portfolios built from a balanced sample of 112 traded euro area banks according to the upper and lower 50% of the deposits-to-total funding ratio, respectively. Portfolios are rebalanced monthly.

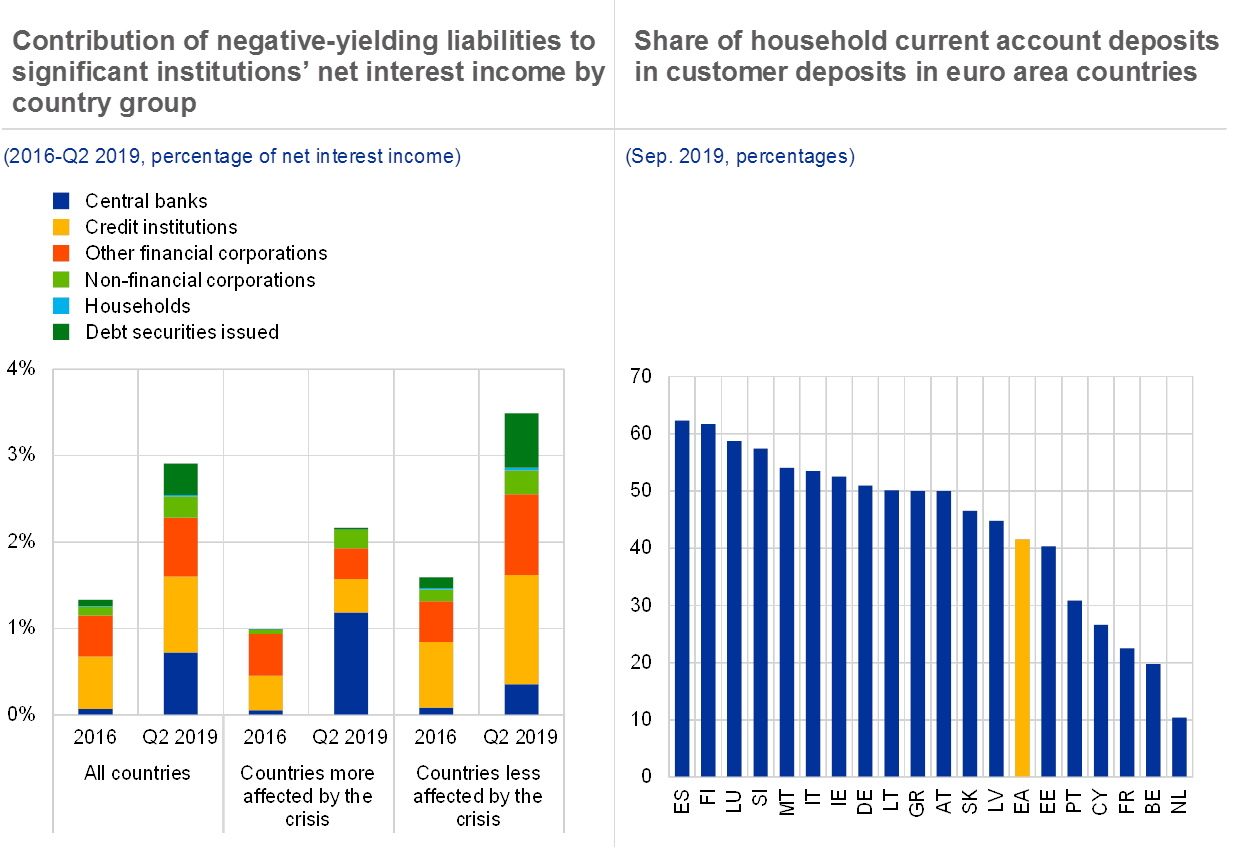

The ECB’s introduction of a two-tier system for remunerating excess reserves aims to help the pass-through of low policy rates to bank lending. Banks continue to benefit from the positive volume effects, higher asset valuations and lower credit risk of low interest rates. However, the negative interest rate policy also entails costs for banks, and these are likely to increase the longer negative rates are in place, and the larger the amount of excess liquidity. Accordingly, the ECB introduced a two-tier system for reserve remuneration that will contribute to offsetting the direct impact of negative interest rates on banks’ profitability and thereby support the pass-through of low policy rates to bank lending.

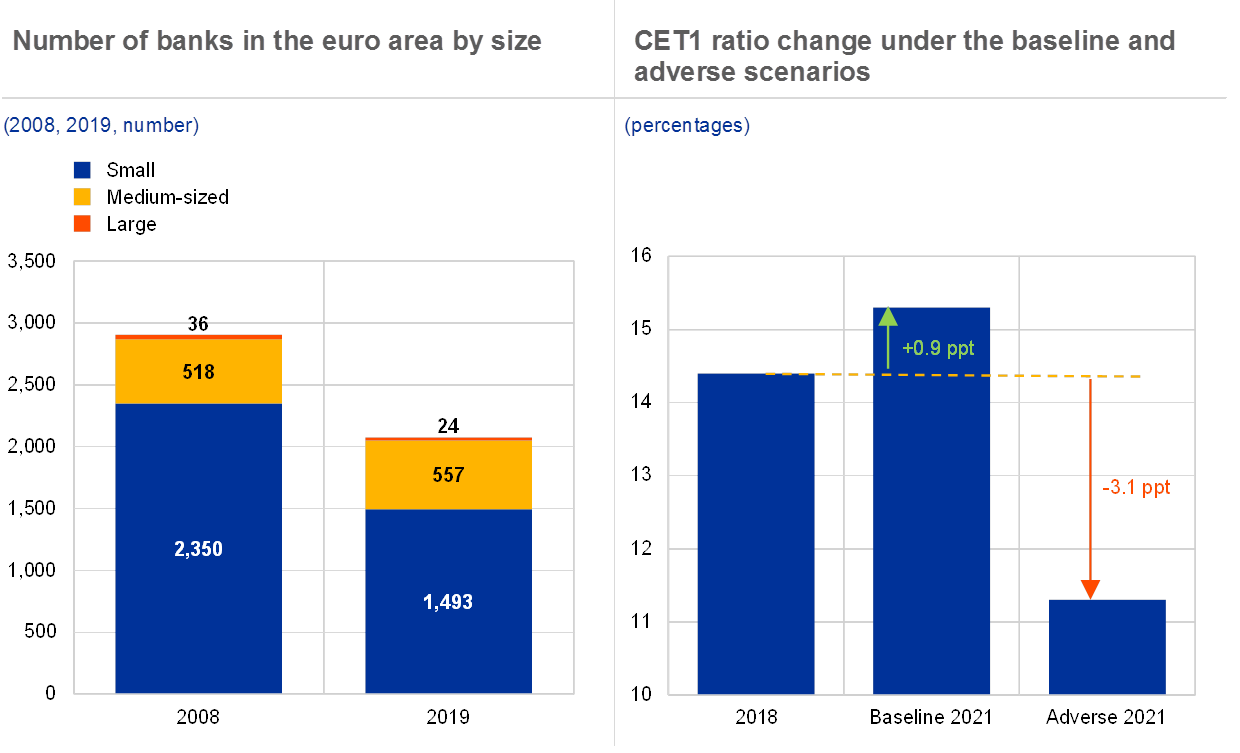

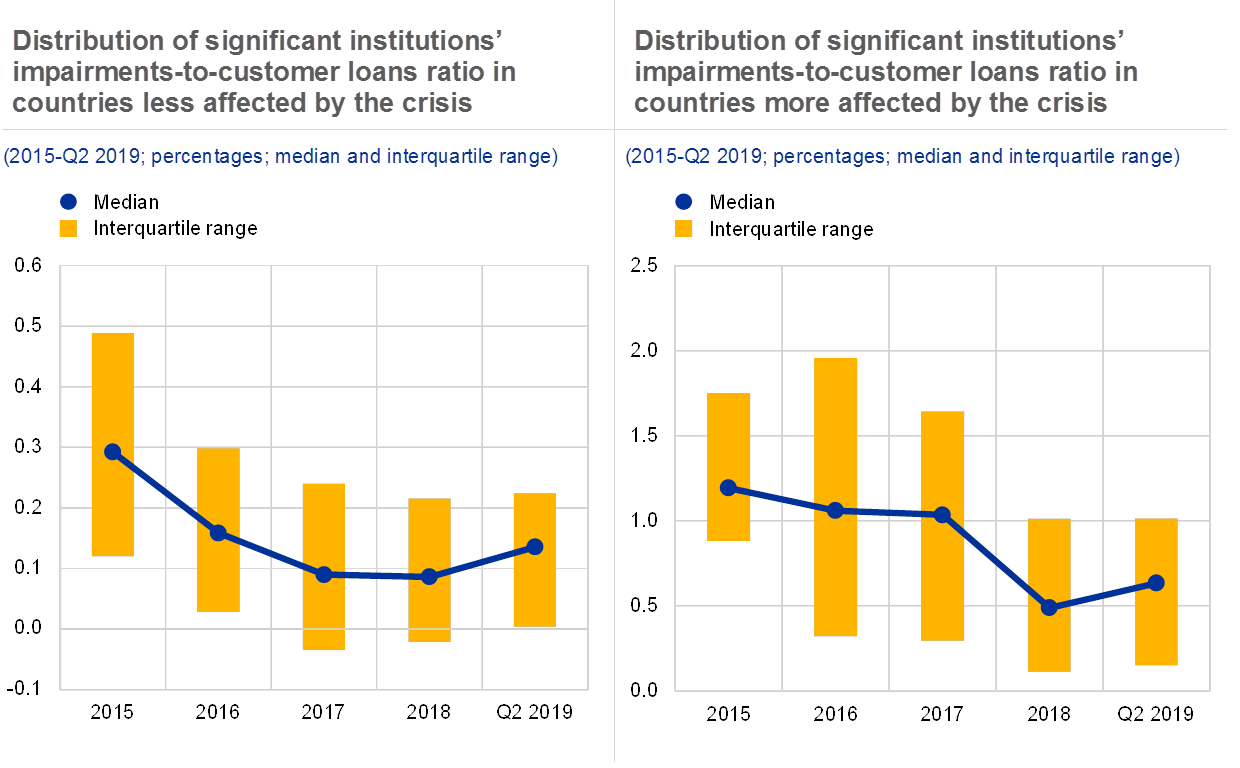

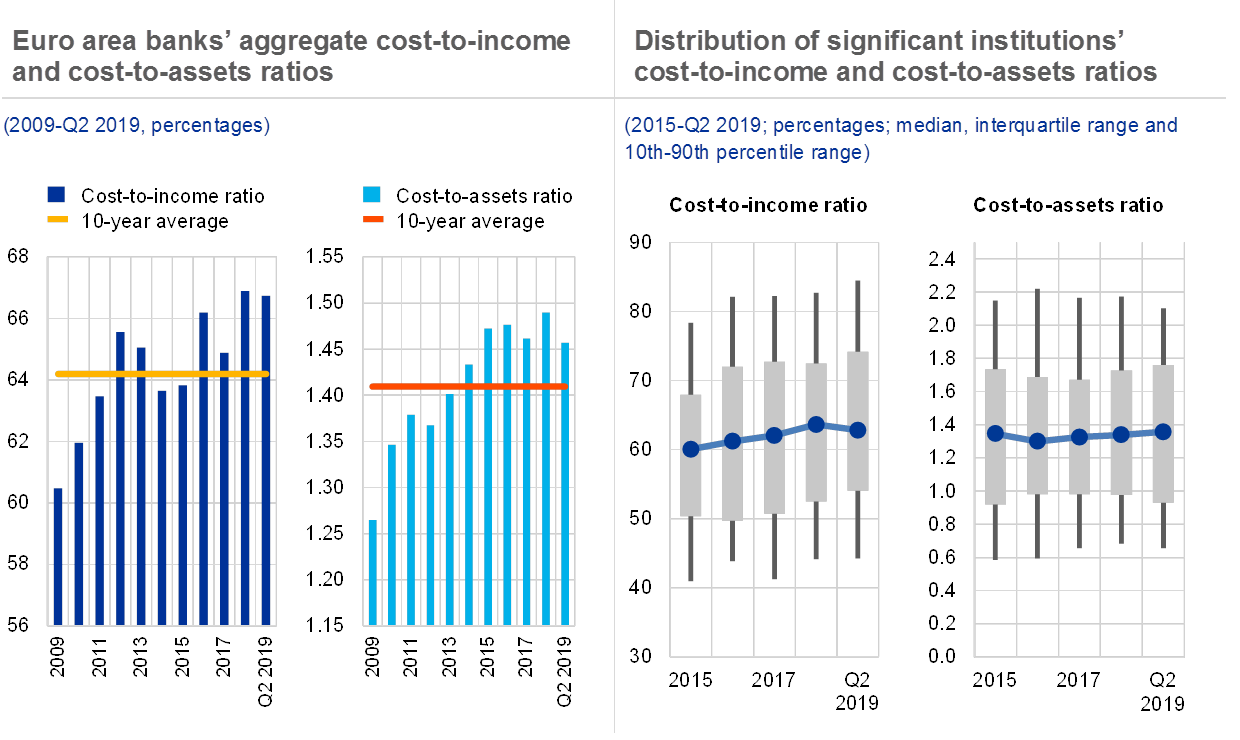

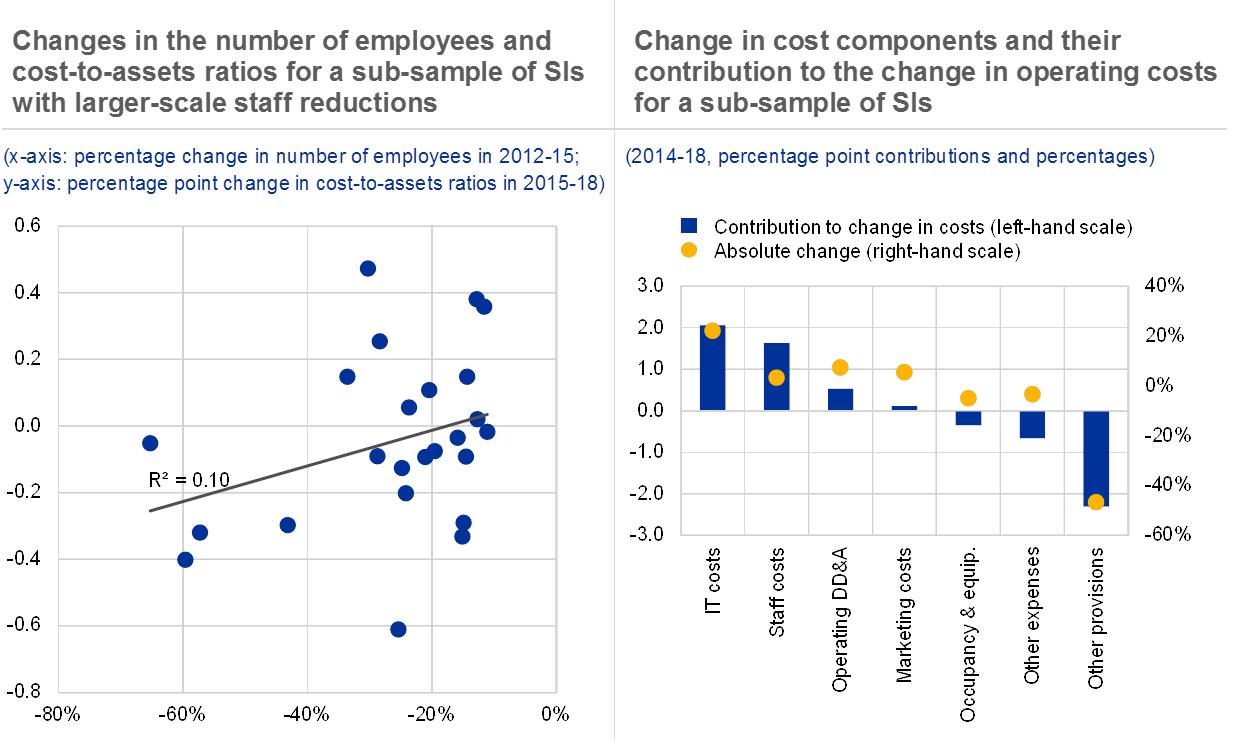

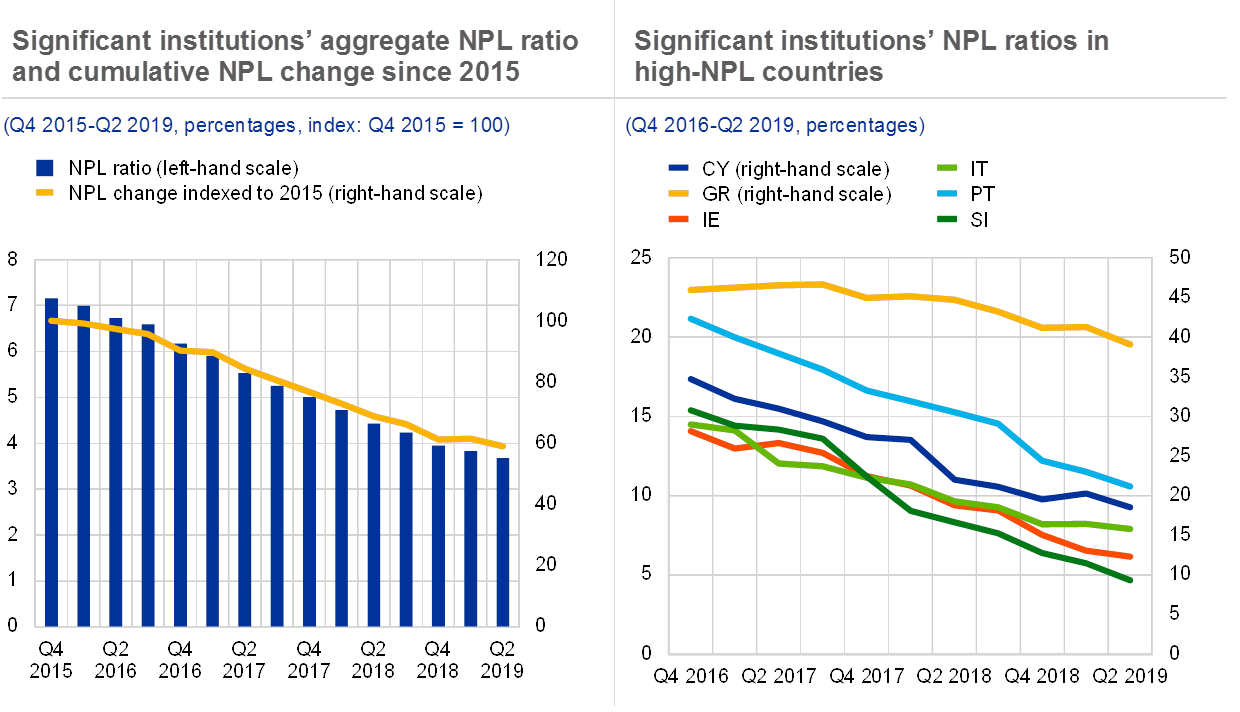

Banks have made slow progress in addressing structural challenges to profitability. Banks’ NPL ratios have improved slightly further since the previous FSR, driven by both solid loan growth and continued, albeit slowing, reductions in non-performing loans. Going forward, weaker economic activity and the related increase in new default inflows may make further reductions in NPL ratios more challenging. In addition, low cost-efficiency, limited revenue diversification and overcapacity continue to weigh on many banks’ long-term profitability prospects. There is not a single solution to these challenges for all banks. Measures would need to take into account the underlying root causes of weak bank profitability (see Special Feature A), with options ranging from restructuring and cross-border M&As for large institutions to continued domestic consolidation for smaller banks (see Chart 8, left panel).

Chart 8

The euro area banking sector is assessed to be resilient to a range of downside risks, but bank consolidation may help boost efficiency and profitability

Sources: ECB consolidated banking data and ECB calculations.

Note: Left panel: The data capture domestic banking groups and stand-alone banks. 2019 figures indicate data for the first half of 2019.

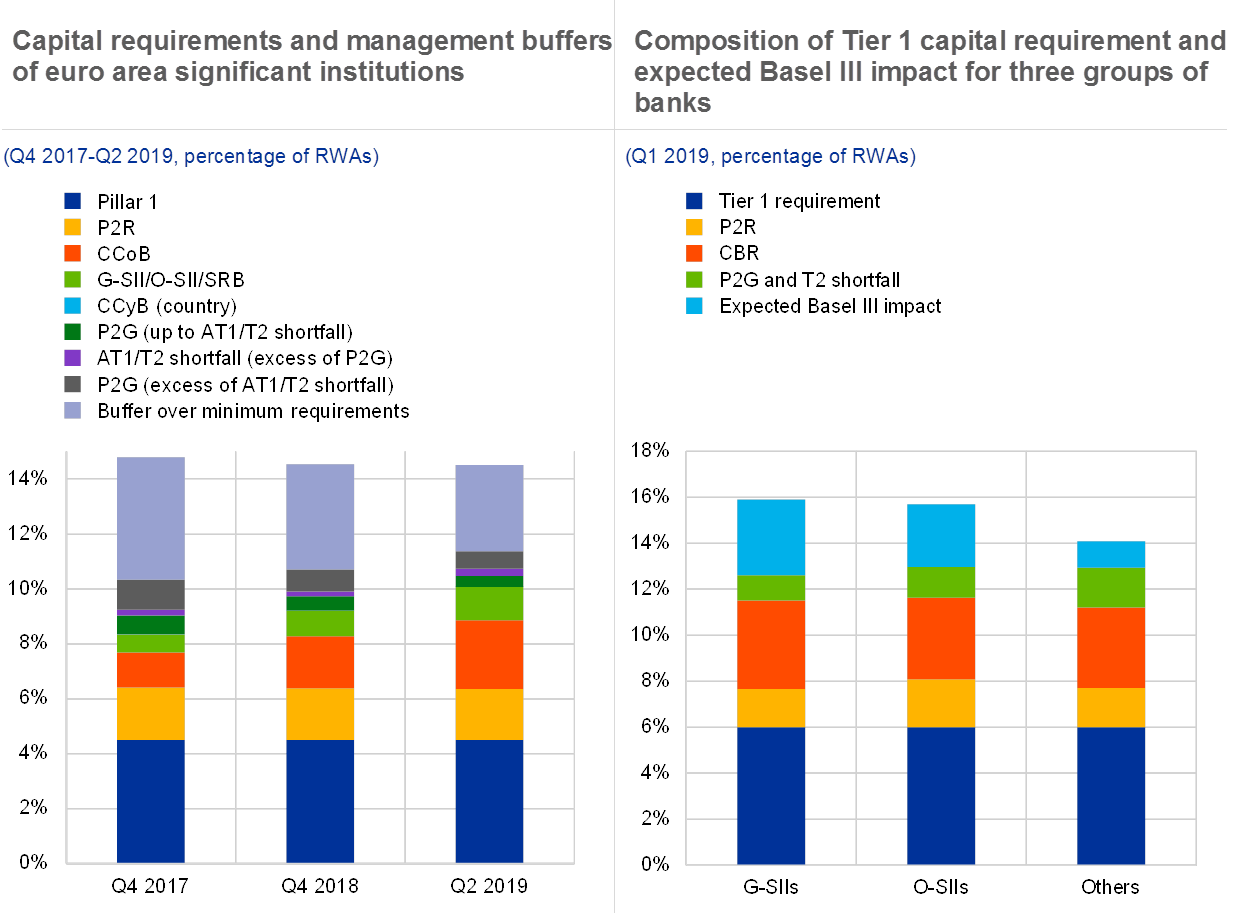

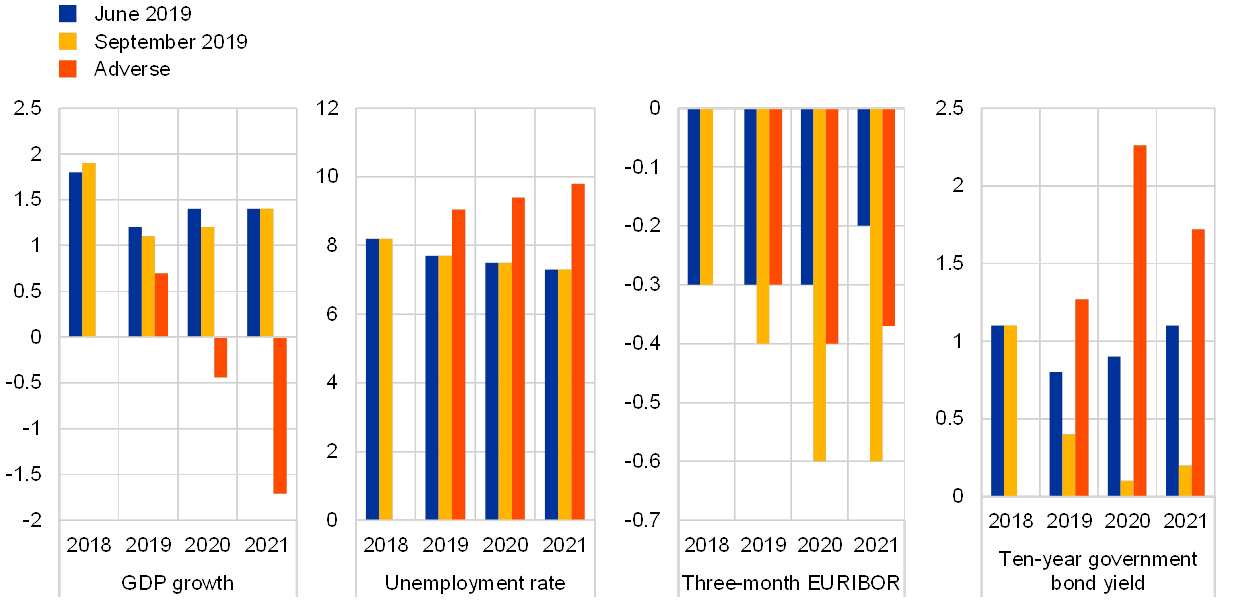

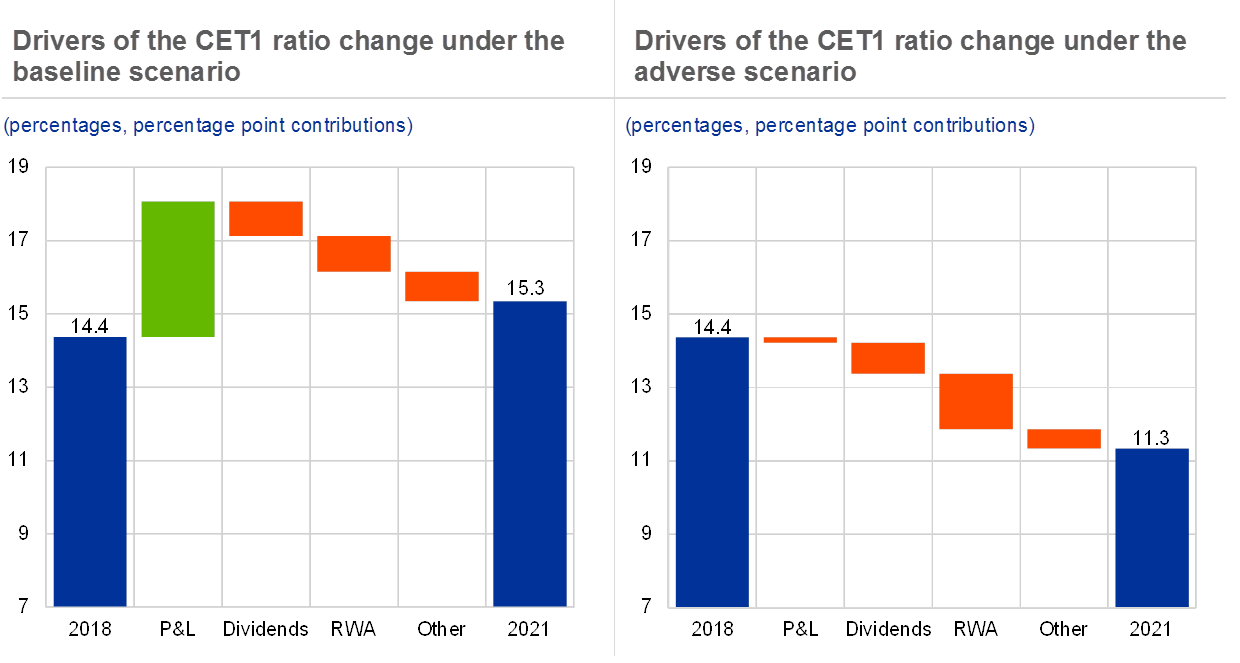

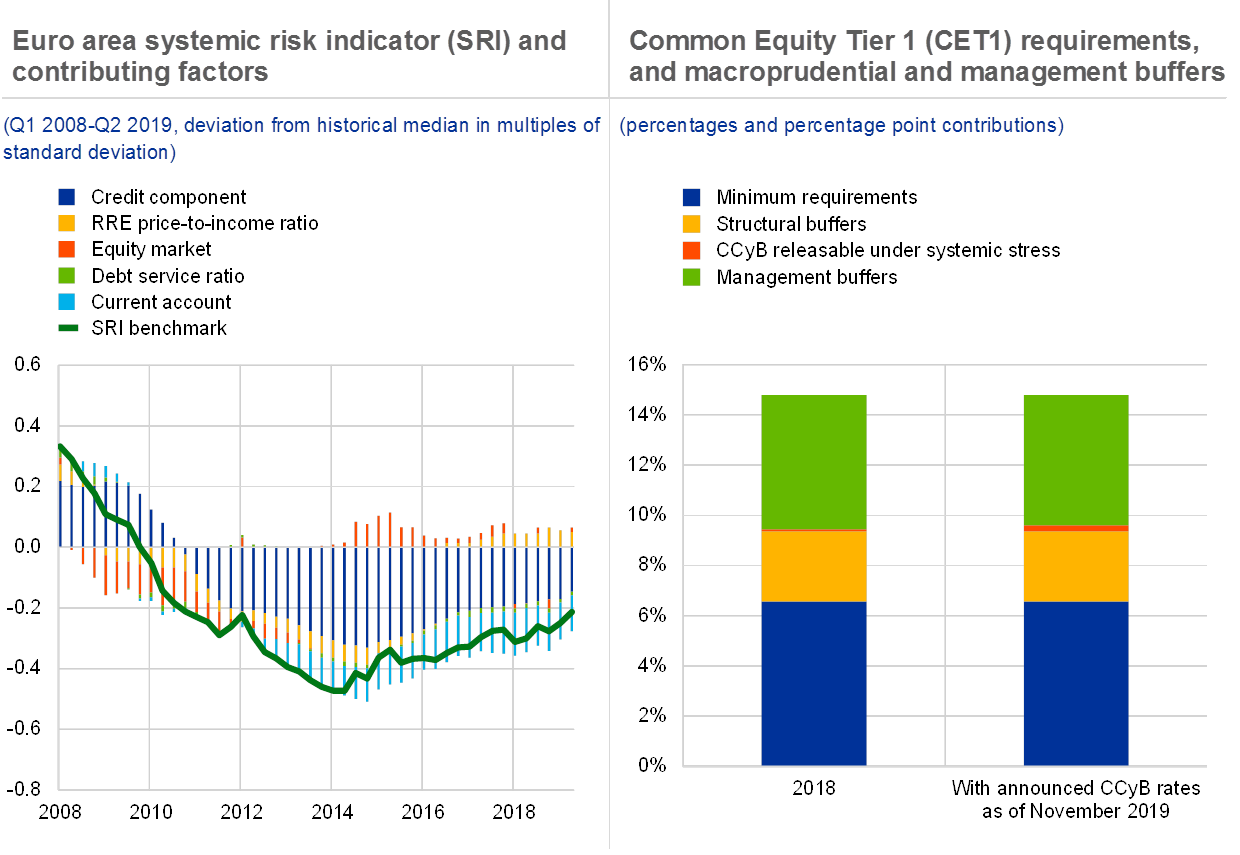

Banks’ solvency positions appear resilient to the materialisation of the main financial stability risks in an adverse scenario. The previous upward trend of bank solvency ratios has come to a halt in recent quarters. Management buffers remain sizeable on aggregate though, but a significant part of these is likely to be consumed by the Basel III finalisation package, with systemically important institutions being particularly affected. Under the baseline scenario of the ECB’s new macro-micro model (see Box 5), the solvency position of euro area significant credit institutions is projected to improve, but under the adverse scenario the euro area banking system would experience a reduction of up to 3.1 percentage points in the Common Equity Tier 1 (CET1) ratio (see Chart 8, right panel). At the individual bank level, the majority of euro area significant institutions would remain above the CET1 capital requirement (see Section 3.2).

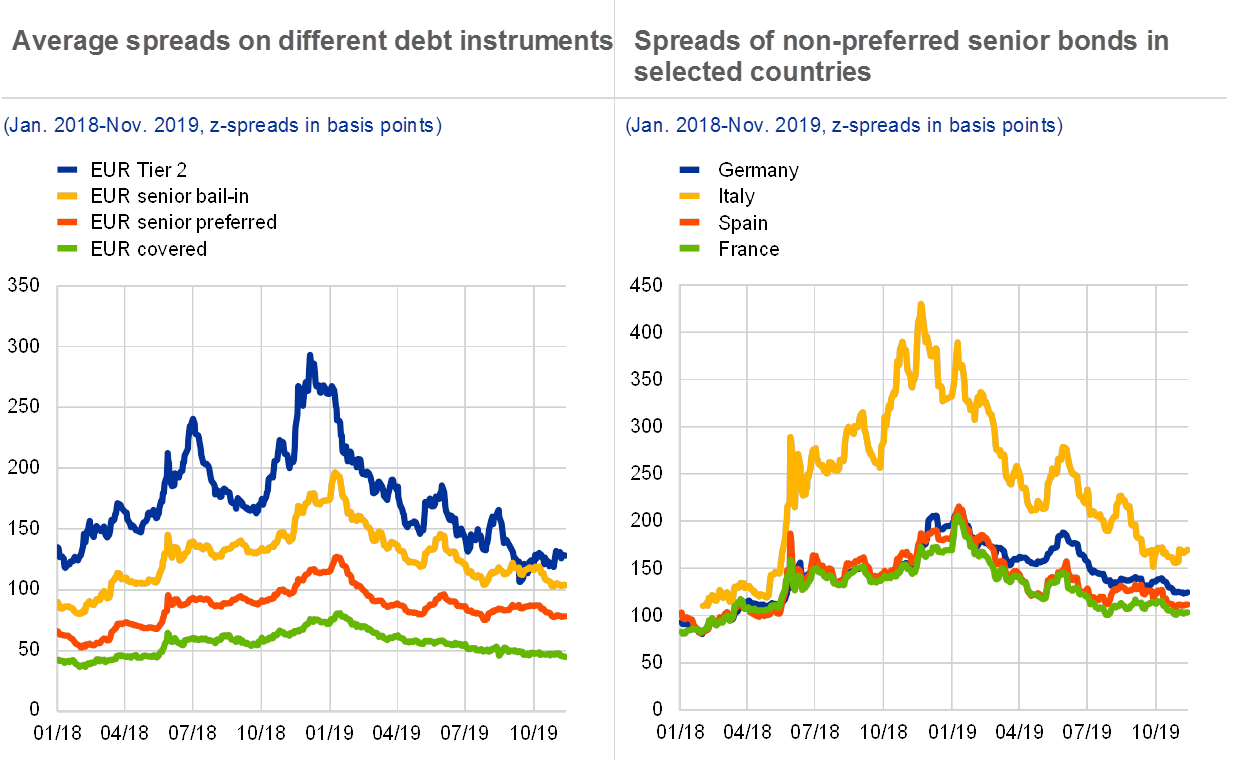

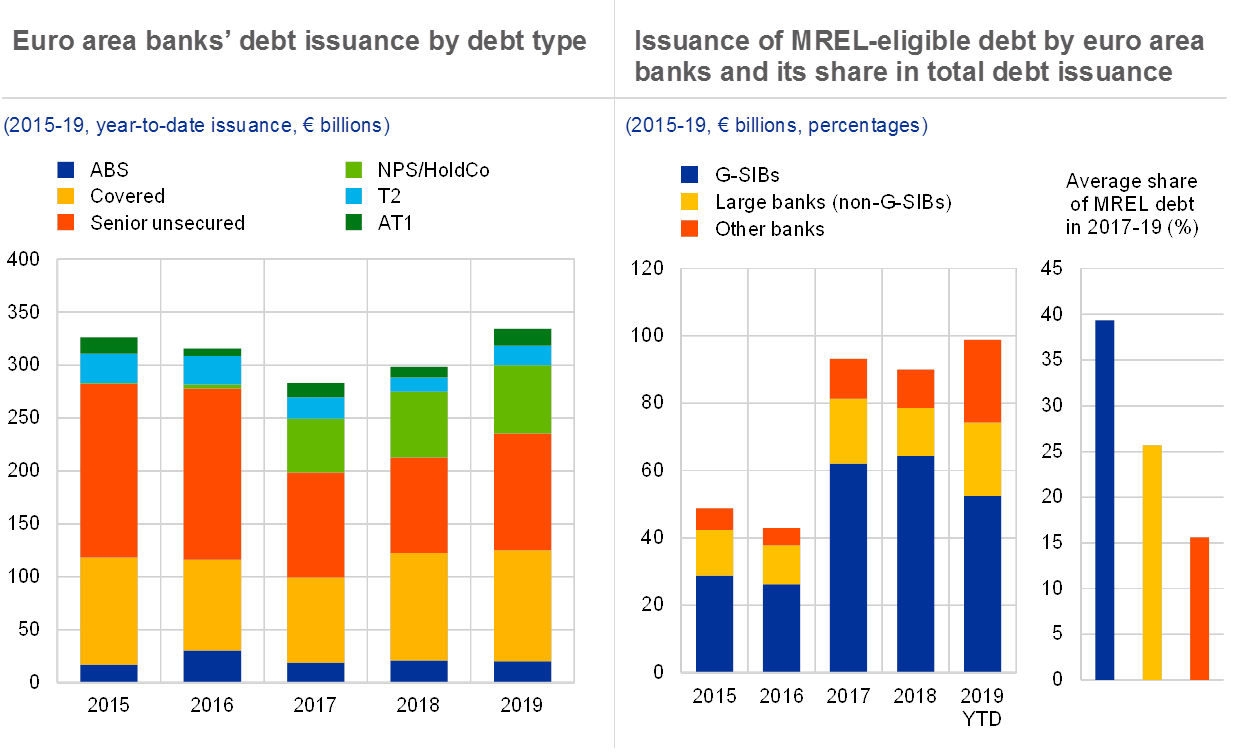

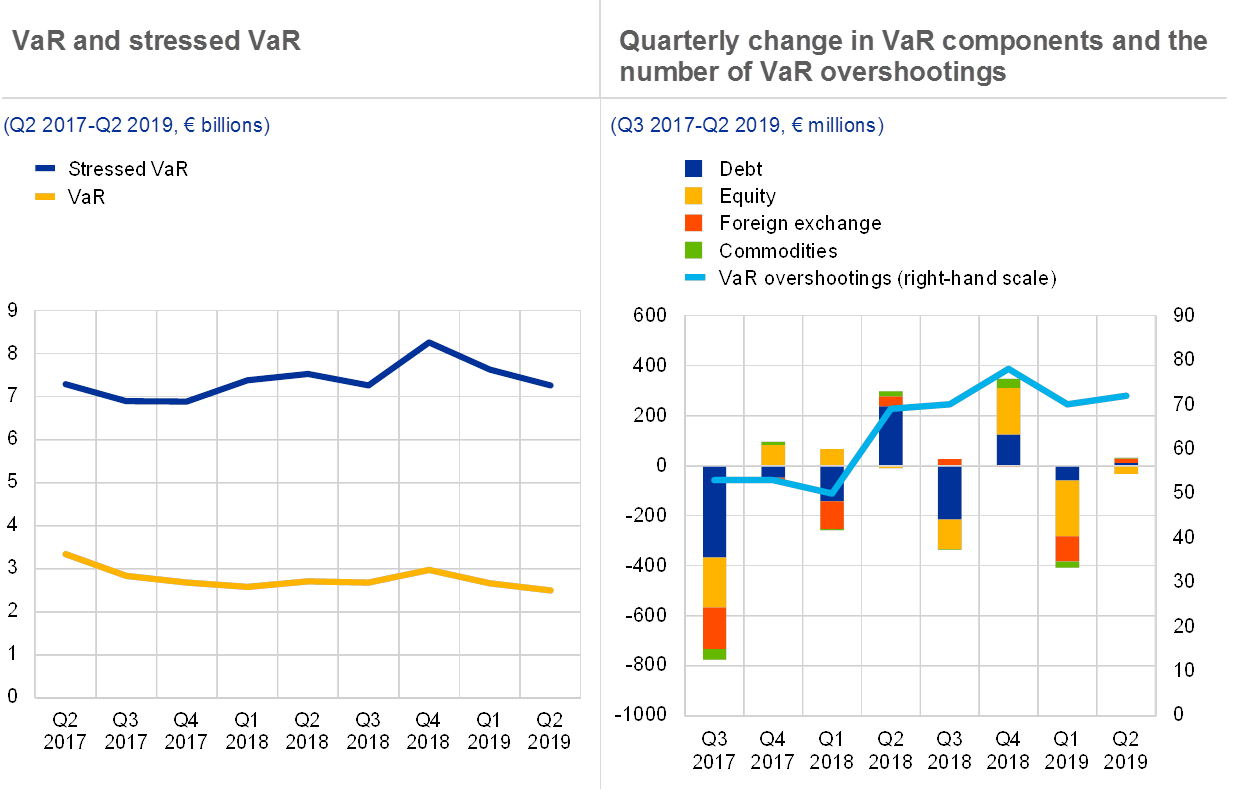

Strengthening bank resilience remains key, given a weaker macroeconomic backdrop. Despite recent strong issuance of MREL/TLAC-eligible instruments, further progress is needed in building up bail-inable buffers. Banks remain susceptible to abrupt changes in market conditions which could require them to issue MREL-eligible debt at significantly higher costs. Also, macroprudential instruments could be used to mitigate some of the increase in euro area vulnerabilities, highlighting the importance of a continuation of the efforts to strengthen resilience to adverse shocks.

The activation or further increase of releasable countercyclical capital buffers seems merited in a few countries. Seven euro area countries have announced a positive countercyclical capital buffer (CCyB) rate, with rates ranging from 0.25% to 2% (see Chapter 5). There is a case for a few other countries with solid credit growth, increasing debt levels and signs of an underpricing of risks to consider activating the CCyB. In general, a greater availability of a releasable buffer in the form of a CCyB would be useful in the euro area. Unlike structural capital requirements, the CCyB can be released in a downturn and can provide banks with room to avoid the excessive deleveraging that turns a stress episode into a crisis. This would call for a rebalancing of the current capital requirements towards a more prominent role for the CCyB.

Identified vulnerabilities could unravel in the medium-to-long run

There remain four key vulnerabilities for euro area financial stability. These are (i) mispricing of some financial assets; (ii) high public and private sector indebtedness in several countries; (iii) hampered bank intermediation capacity in view of banks’ subdued profitability outlook; and (iv) increased risk-taking in the non-bank financial sector. While bank profitability challenges appear to have increased since the previous FSR, the likelihood of the other three vulnerabilities materialising in the near term appears largely unchanged, not least as the low interest rate environment mitigates many of the possible triggers for corrections over the short-to-medium term. Beyond the near-term horizon, however, there is a risk that the identified vulnerabilities could unravel in a disorderly manner. Macroprudential policies can help contain many of these vulnerabilities and should be used more actively in some countries. But further progress is still needed to develop macroprudential tools for non-banks.

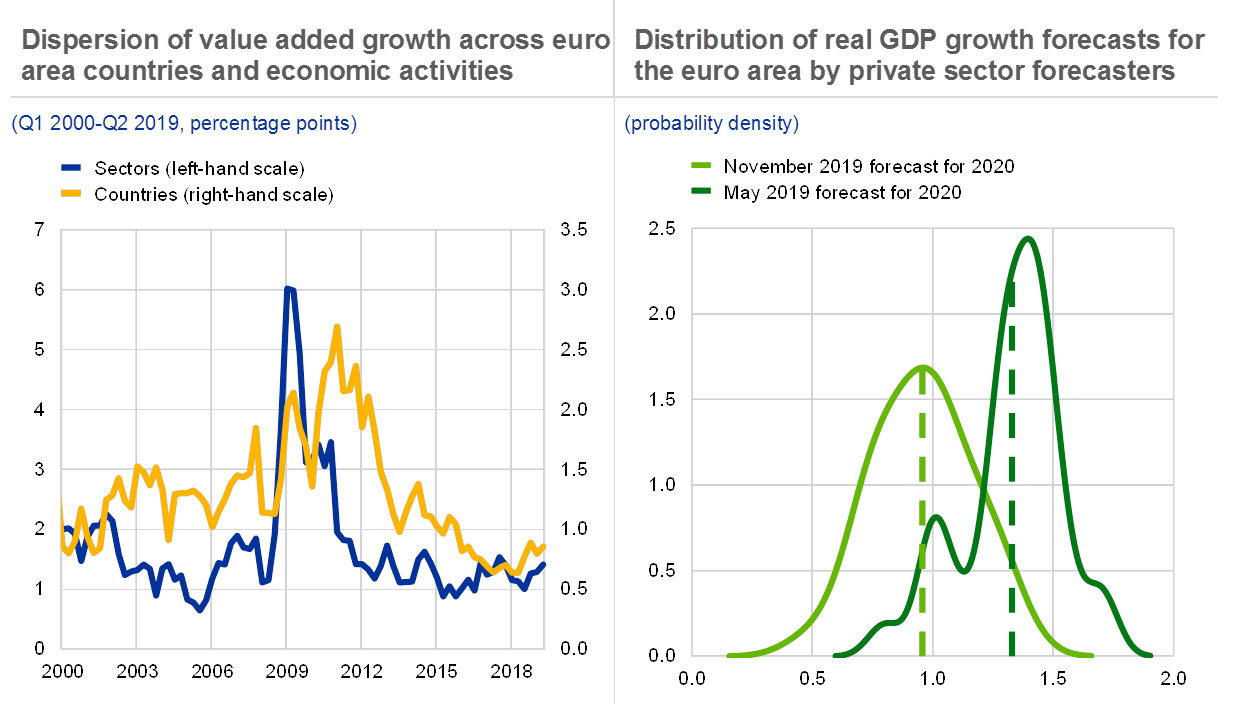

1.1 Weaker economic outlook amid elevated uncertainty

Euro area economic growth is expected to remain subdued in the near term. Real GDP growth remained moderate in the first half of 2019 and survey-based data suggest a slight deceleration in the second half of 2019. Much of the slowdown stems from the current weakness of international trade in an environment of elevated and prolonged global political and policy uncertainty, which has had a particularly adverse impact on the manufacturing sector. Since the start of the year, the weakness has spread to more countries and sectors within the euro area (see Chart 1.1, left panel), clouding the already uncertain outlook (see Chart 1.1, right panel). Reflecting these developments, the September 2019 ECB staff macroeconomic projections envisage real GDP growth of 1.1% in 2019, 1.2% in 2020 and 1.4% in 2021. Consistent with this lower growth path, projected inflation has also been revised down for the same period, pointing to modest nominal growth prospects.

Chart 1.1

Weaker economic outlook spreading to more euro area countries and sectors, with risks tilted to the downside

Sources: Consensus Economics and ECB calculations.

Notes: Left panel: The dispersion of growth across countries is measured as the weighted standard deviation of year-on-year growth in value added in the euro area (excluding Ireland and Malta). The dispersion of growth across sectors is measured as the weighted standard deviation of year-on-year growth in euro area value added in the main NACE economic activities (excluding agriculture). Right panel: The dashed lines represent the average real GDP growth forecast values. The chart presents distributions with kernel density estimates based on the point forecasts collected from 30 private sector institutions.

A gradual recovery in euro area growth is projected over the medium term, underpinned by accommodative policies. The ECB’s accommodative monetary policy stance is expected to remain in place for an extended period of time. As a result, lending to the non-financial private sector should further strengthen, buttressed by an improving macroeconomic environment, very low interest rates and favourable bank lending conditions for both households and non-financial corporations. Exports are expected to benefit from a projected recovery in foreign demand, also related to accommodative monetary policy across the globe.

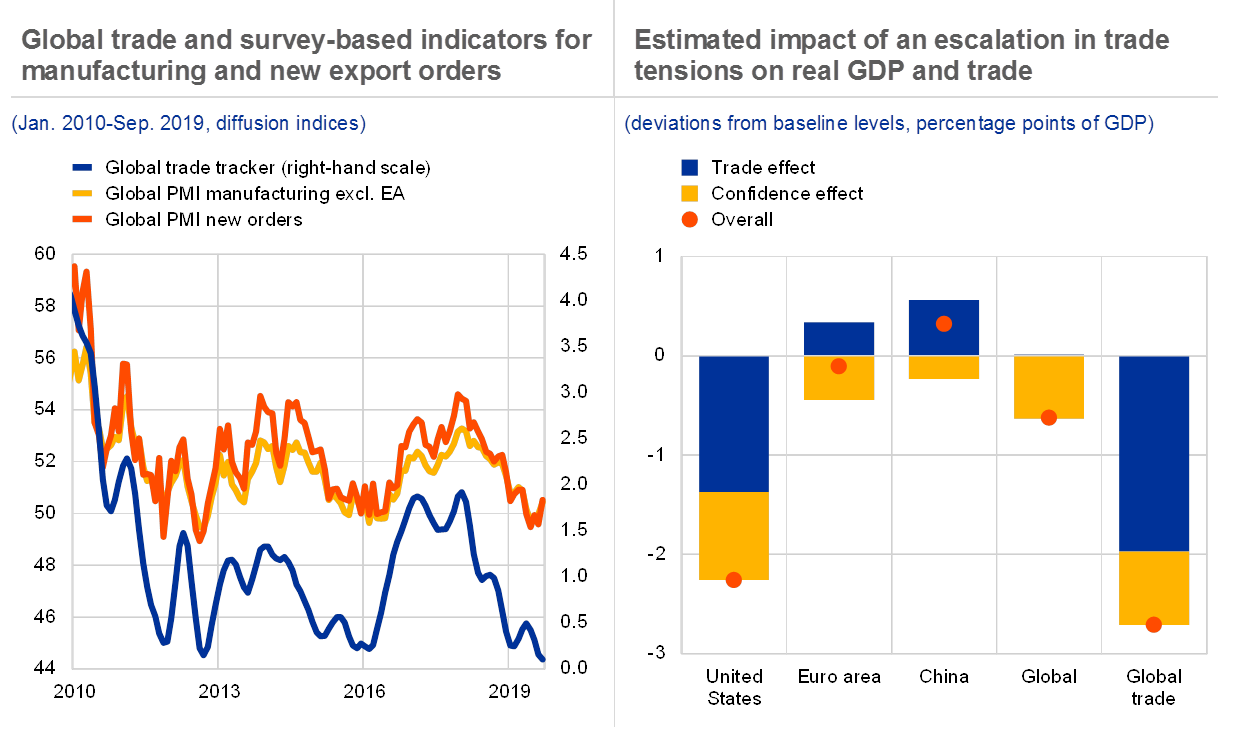

There are prominent downside risks to the growth outlook, primarily from geopolitical factors. A further rise in (geo)political and policy uncertainty across the globe may weigh on the euro area growth momentum. Global growth has already decelerated, with indications that recent tariff announcements and actions by the United States and China and the associated uncertainty are weighing on investment and trade (see Chart 1.2, left panel). An escalation of the trade conflict between the United States and China, along with the potential for this to spread to their trading partners, could have material adverse implications for global growth, which would be further amplified by confidence effects or financial market reactions (see Chart 1.2, right panel).[2]

Chart 1.2

Growth in global activity and trade has slowed since mid-2018, while an escalation of trade tensions could have a marked impact on the real economy

Sources: ECB and ECB calculations.

Notes: Left panel: The trade tracker is based on a dynamic factor model using 22 monthly trade indicators. Indicators are standardised and mean/variance-adjusted into world imports excluding the euro area. PMI: Purchasing Managers’ Index. Right panel: The analysis assumes a 10 percentage point increase in trade tariffs across countries vis-à-vis the United States and presents its first-year effects. For more details on the methodology, see the article entitled “The economic implications of rising protectionism: a euro area and global perspective”, Economic Bulletin, Issue 3, ECB, 2019.

The further extension of the United Kingdom’s membership of the European Union avoided a no-deal Brexit outcome over the FSR review period, but such a scenario cannot be excluded at a later stage. A no-deal Brexit poses manageable risks to overall euro area financial stability and authorities have prepared for this scenario. Nevertheless, there remain tail macro-financial risks whereby a no-deal Brexit interacts with other global shocks, in an environment where risks to the euro area growth outlook are tilted to the downside. If such a scenario occurs, the impact would probably be concentrated in particular countries, such as those with significant ties to the UK. A no-deal scenario would probably also entail substantial financial market volatility and an increase in risk premia. Issues related to the continuity of derivative and insurance contracts are unlikely to pose a systemic risk, given public sector measures and some progress by the private sector in taking mitigating action. But it is important that the private sector uses the additional time provided by the extension to continue to prepare for all possible contingencies and that banks progress towards their target operating models within the timelines previously agreed with their supervisors.[3]

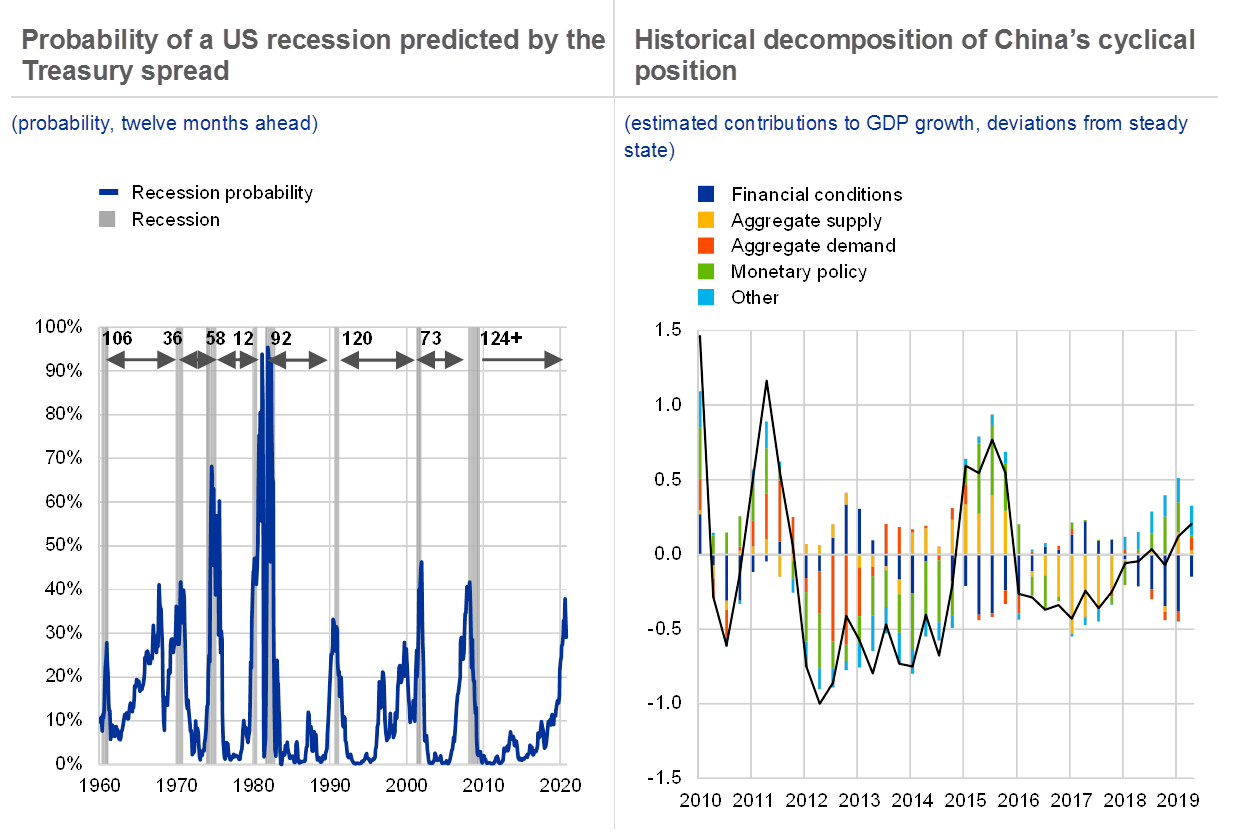

Downside risks to the US economy cloud the global economic outlook. Bolstered by a strong labour market and consumer spending, as well as supportive financial conditions, economic activity has remained robust, with the US economy currently in its longest expansion on record (124 months). The outlook under the central case appears solid, underpinned by newly agreed fiscal spending and accommodative monetary policy as well as strong consumer demand supported by a tight labour market. However, the ongoing US-China trade conflict, somewhat elevated corporate leverage and weaker global growth prospects pose downside risks to US economic growth and feed market perceptions of higher near-term recession risks in the late phase of the business cycle (see Chart 1.3, left panel).

Chart 1.3

Materialisation of large downside risks to the US and/or Chinese economies could have adverse repercussions for global growth and financial stability

Sources: Federal Reserve Bank of New York, ECB and ECB calculations.

Notes: Left panel: Recessions as defined by the National Bureau of Economic Research. The numbers in the charts indicate the length of business cycle expansions in the United States in months. Right panel: Variables are expressed as deviations from the estimated “exogenous” component, which includes the steady state and the effect of exogenous variables (world GDP and commodity prices). The chart shows the contribution of structural shocks to GDP growth less the rate of potential growth. For more details about the model set-up, see Lodge, D. and Soudan, M., “Credit, financial conditions and the business cycle in China”, Working Paper Series, No 2244, ECB, February 2019.

China’s economy has been slowing gradually, but the risk of a sharper slowdown remains. Economic activity has gradually decelerated in recent years, inter alia on account of deleveraging policy to contain financial stability risks (see Chart 1.3, right panel), the ongoing rebalancing from investment to consumption-led growth, as well as the impact of the trade conflict with the United States. Risks to growth remain tilted to the downside and include a further escalation of the trade conflict with the United States and uncertainty about available policy space in China. The escalation of trade tensions could also have negative spillovers for trade with other countries in the Asia-Pacific region, given China’s prominent role in regional and global value chains.

The materialisation of these risks to global and euro area economic growth could create challenges for financial stability. A more severe and protracted economic downturn could weaken corporate profits and household incomes, putting pressure on the ability of households and companies to service debts. Given the high level of indebtedness lingering particularly in the non-financial sector in some countries, this could further squeeze consumption and investment spending or lead to losses for lenders. Similarly, government finances, particularly for some vulnerable countries, could come under renewed stress. A severe global downturn could also be amplified by existing vulnerabilities in the financial system, if it were to prompt sharp adjustments in asset prices and a disorderly unwinding of global search-for-yield flows.

1.2 Near-term sovereign debt sustainability concerns mitigated by favourable financing conditions

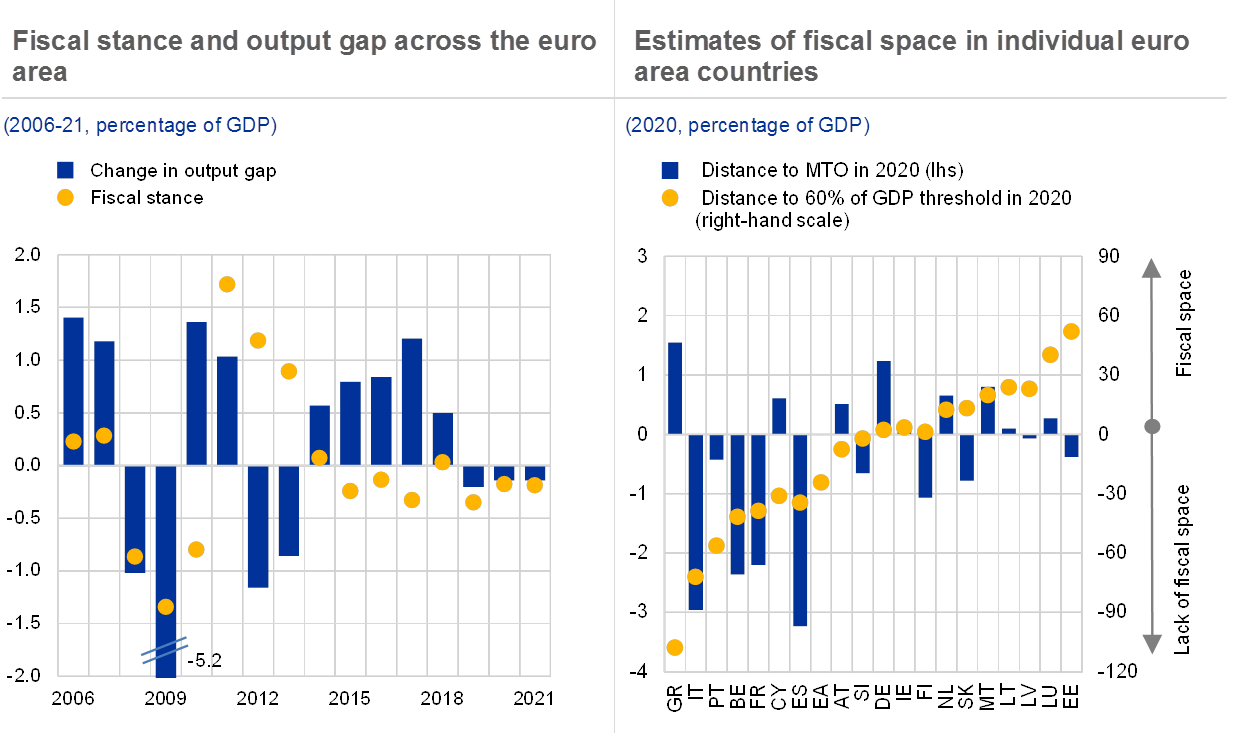

Despite a deteriorating macroeconomic environment, public debt positions appear manageable currently. In line with the slowdown of the economy, the euro area aggregate fiscal stance has become slightly expansionary over 2019 and is expected to remain so over the medium term (see Chart 1.4, left panel). Although still at an elevated level exceeding 85% of GDP, public debt is projected to remain on aggregate on a downward trajectory, reflecting in part a favourable interest rate-growth differential associated with favourable financing conditions. In view of the weakening economic outlook and the continued prominence of downside risks, governments with fiscal space should act in an adequate, effective and timely manner (see Chart 1.4, right panel). In high-debt countries, governments need to pursue prudent policies that will create the conditions for automatic stabilisers to operate freely. All countries should intensify efforts to achieve a more growth-friendly composition of public finances.

Chart 1.4

A mildly expansionary fiscal stance provides some support to economic activity, but a number of countries have more fiscal space available

Sources: European Commission, ECB and ECB calculations.

Notes: Left panel: The fiscal stance is measured by the change in the cyclically adjusted primary budget balance. Right panel: The blue bars indicate the estimated distance of structural fiscal balances from country-specific medium-term objectives in 2020. The yellow dots indicate the distance of general government debt-to-GDP ratios from the 60% of GDP threshold as defined by the Maastricht criteria.

Sovereign risk is mitigated by favourable financing conditions and accumulated liquidity buffers. Supported by the renewed Eurosystem asset purchase programme, pricing conditions for the vast majority of euro area countries have remained benign. Taking advantage of low rates, countries with higher sovereign risk have prolonged their debt maturity profile, reducing to some extent the vulnerability to abrupt changes in market sentiment. Moreover, the financial assets accumulated by euro area sovereigns, particularly liquid assets in the form of cash and debt securities, should help withstand potential temporary market stress.

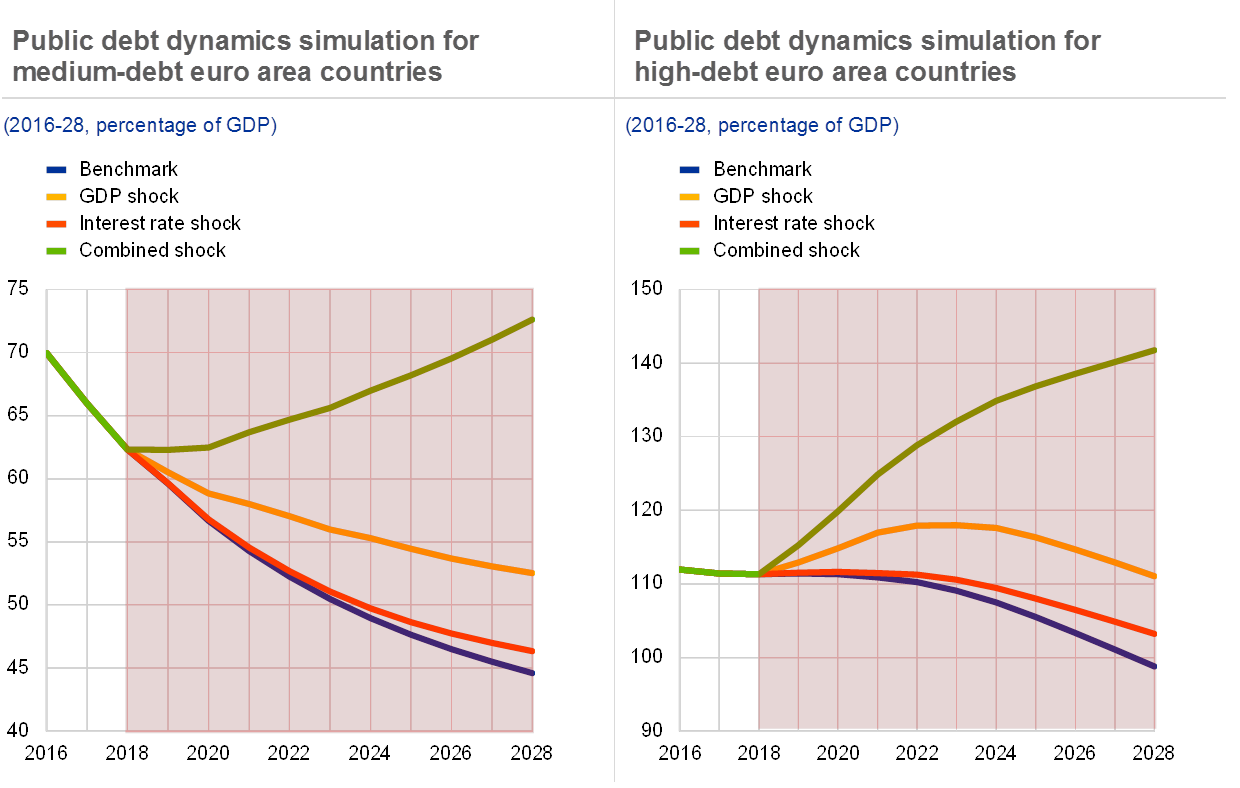

Under a more severe and protracted economic downturn scenario, risks to debt sustainability would increase, particularly in highly indebted countries. Both medium and high-debt countries’ positions are vulnerable to a more pronounced or prolonged economic slowdown (see Chart 1.5). Furthermore, if a severe economic slowdown caused risk premia to increase, this could exacerbate the economic downturn, with an adverse impact on debt dynamics. The combined effect of lower growth and higher premia, accompanied by fiscal relaxation, could potentially compromise debt sustainability for both groups, with the deterioration of their debt paths above any public debt sustainability benchmark (see Chart 1.5).

Chart 1.5

A more severe and prolonged economic downturn than expected could challenge the sustainability of public finances in highly indebted countries

Sources: European Commission and ECB calculations.

Notes: Left panel: Euro area countries with government debt-to-GDP ratios over 60% but below 90% (i.e. Austria, Finland, Germany, Ireland and Slovenia) are considered as medium-debt countries. Right panel: Euro area countries with government debt-to-GDP ratios over 90% (i.e. Belgium, Cyprus, France, Greece, Italy, Portugal and Spain) are considered as high-debt countries. In the benchmark scenario, countries with a fiscal position below/above the medium-term objective (MTO) are assumed to undertake additional consolidation/stimulus to converge to the MTO. The GDP shock scenario represents a one percentage point lower real GDP growth rate over the period 2019-21. The interest rate shock scenario considers a 100 basis points higher average market interest rate from 2019 until the end of the projection horizon (2028). The combined shock captures the simultaneous impact of three individual shocks, the two shocks described above and in addition a lower structural primary balance by one percentage point from 2019 onwards. The shock scenarios assume no fiscal policy reaction to the shocks.

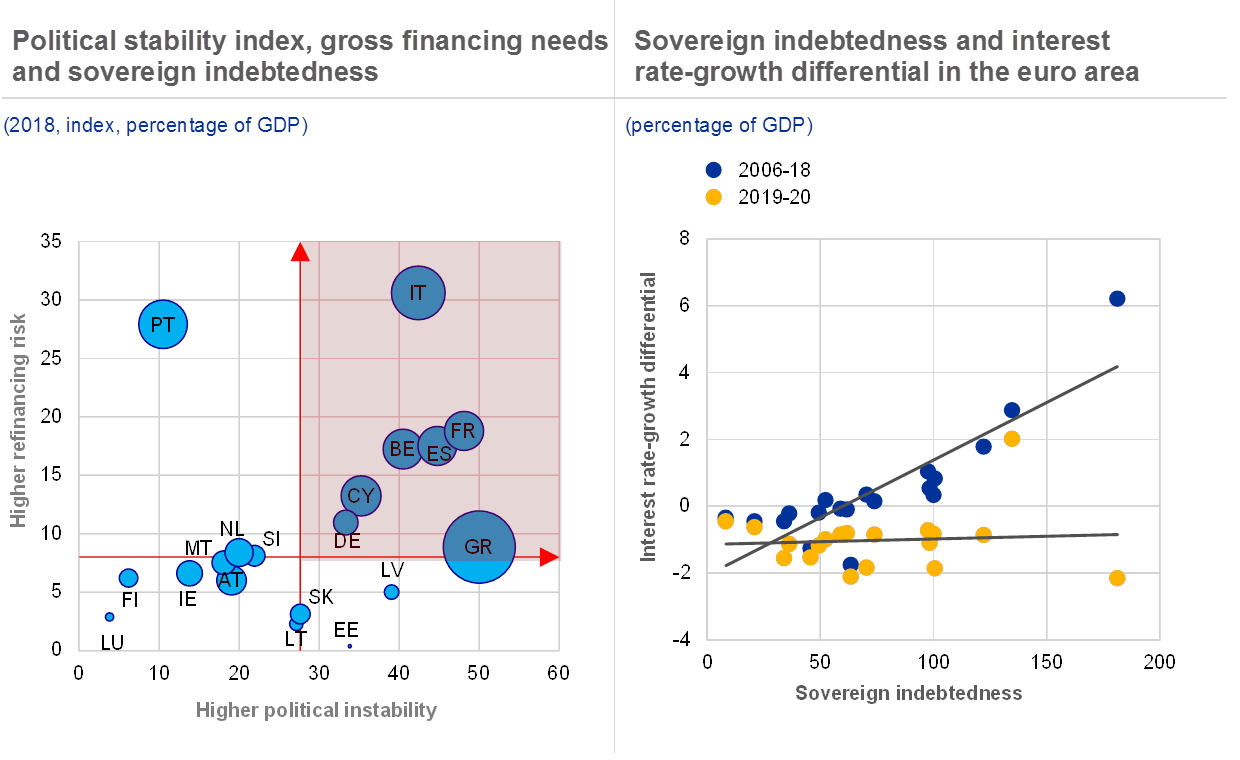

Political and policy uncertainty could challenge sovereign debt sustainability. Overall, stress in euro area sovereign debt markets has remained contained since May. But there have been temporary episodes for some countries facing heightened political uncertainty. High refinancing needs may reinforce the adverse feedback loop between political and policy uncertainty and sovereign funding costs, especially for highly indebted sovereigns (see Chart 1.6, left panel). Heightened global political and policy uncertainty in combination with weaker macroeconomic outturns may also challenge the currently favourable interest rate-growth differential for almost all euro area countries (see Chart 1.6, right panel), making the debt sustainability outlook more challenging in a number of countries.

Chart 1.6

Heightened political instability may exacerbate sovereign risk, with potentially negative repercussions on public debt sustainability

Sources: European Commission, World Bank and ECB calculations.

Notes: Left panel: The red lines represent sample averages for gross financing needs and the political stability index, while the size of the bubbles is proportionate to the level of sovereign debt as a percentage of GDP. The political stability index combines the views of a large number of enterprise, citizen and expert survey respondents and covers inter alia government stability, internal and external conflict, and demonstrations and social unrest. Gross financing needs are calculated as the sum of the headline deficit, long-maturity securities issued by the end of the latest calendar year, the stock of short-term securities outstanding at the end of the latest calendar year and repayments of official loans for post-programme countries.

Weaker than expected economic growth and renewed political and policy uncertainty could lead to an intensification of sovereign risks. Notwithstanding the continuation of the favourable financing conditions and the accumulation of fiscal buffers, a significant deterioration of the macroeconomic outlook could make public debt sustainability in the most indebted countries more challenging. A further rise in political and policy uncertainty would exacerbate sovereign risk in many indebted countries.

1.3 Euro area households’ resilience supported by low interest rates

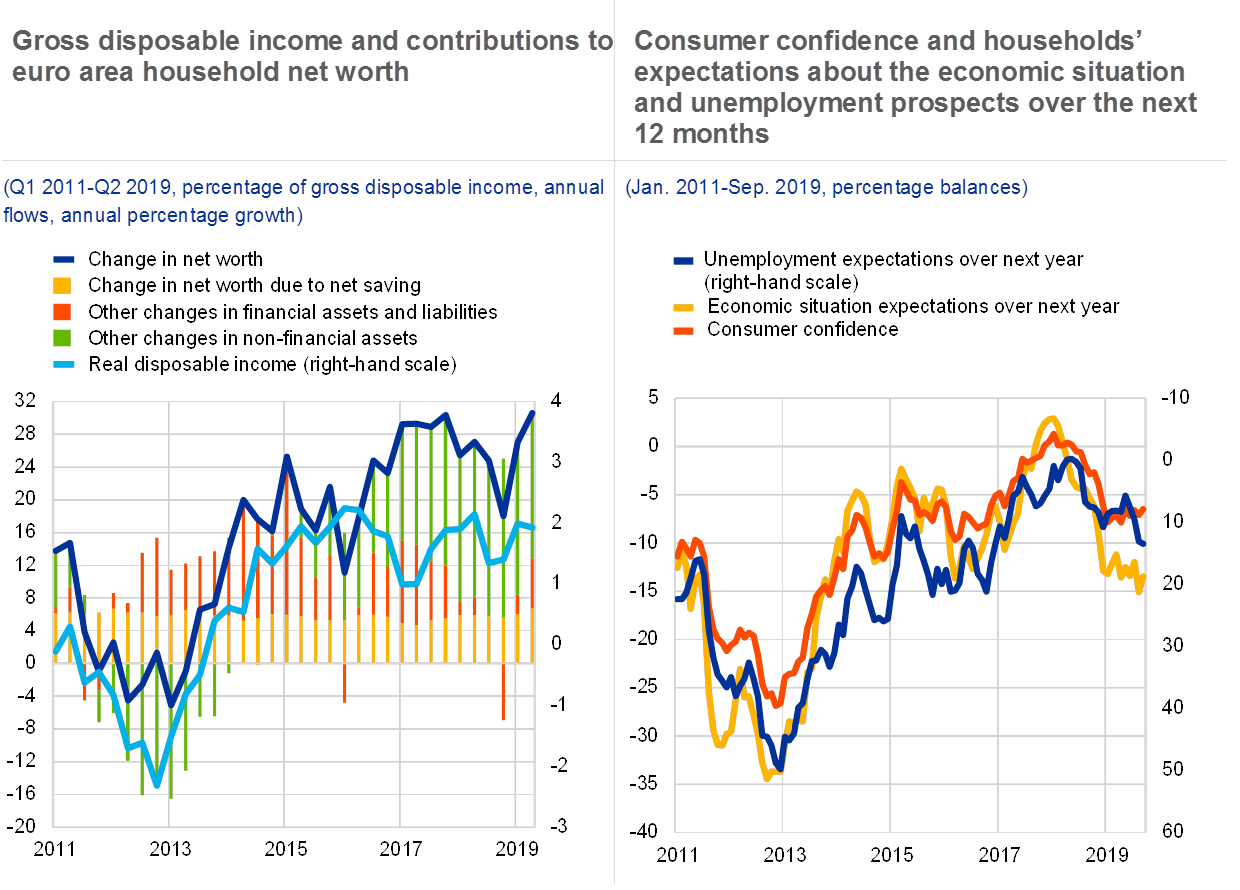

Household incomes have been largely insulated from the recent growth slowdown, but there are some signs of waning consumer confidence. Household real disposable income has continued its expansion in 2019, underpinned by employment gains and robust wage growth (see Chart 1.7, left panel). Employment growth continued to be broad-based across countries and sectors, although survey-based indicators point to some deceleration, especially in the manufacturing sector. Wage dynamics have remained solid, shaped by the still favourable labour market outlook. Furthermore, household net worth has benefited from substantial gains on financial asset and real estate holdings following the stock market recovery since December 2018 and as a result of the still favourable housing market developments (see Chart 1.7, left panel). While consumer confidence has remained broadly resilient to the slowdown, there are some signs that households have become more pessimistic about employment (see Chart 1.7, right panel).

Chart 1.7

Despite the weakening economy, solid income generation continues to mitigate risks, although with some signs of waning consumer confidence

Sources: ECB, European Commission and ECB calculations.

Notes: Left panel: Other changes in non-financial assets mainly include holding gains and losses on real estate (including land). Other changes in financial assets and liabilities mainly include holding gains and losses on shares and other equity, while the change in net worth due to net saving comprises net saving, net capital transfers received and the discrepancy between the non-financial and financial accounts. Right panel: Unemployment prospects are presented using an inverted scale, i.e. an increase (decrease) of the indicator corresponds to more (less) optimistic expectations.

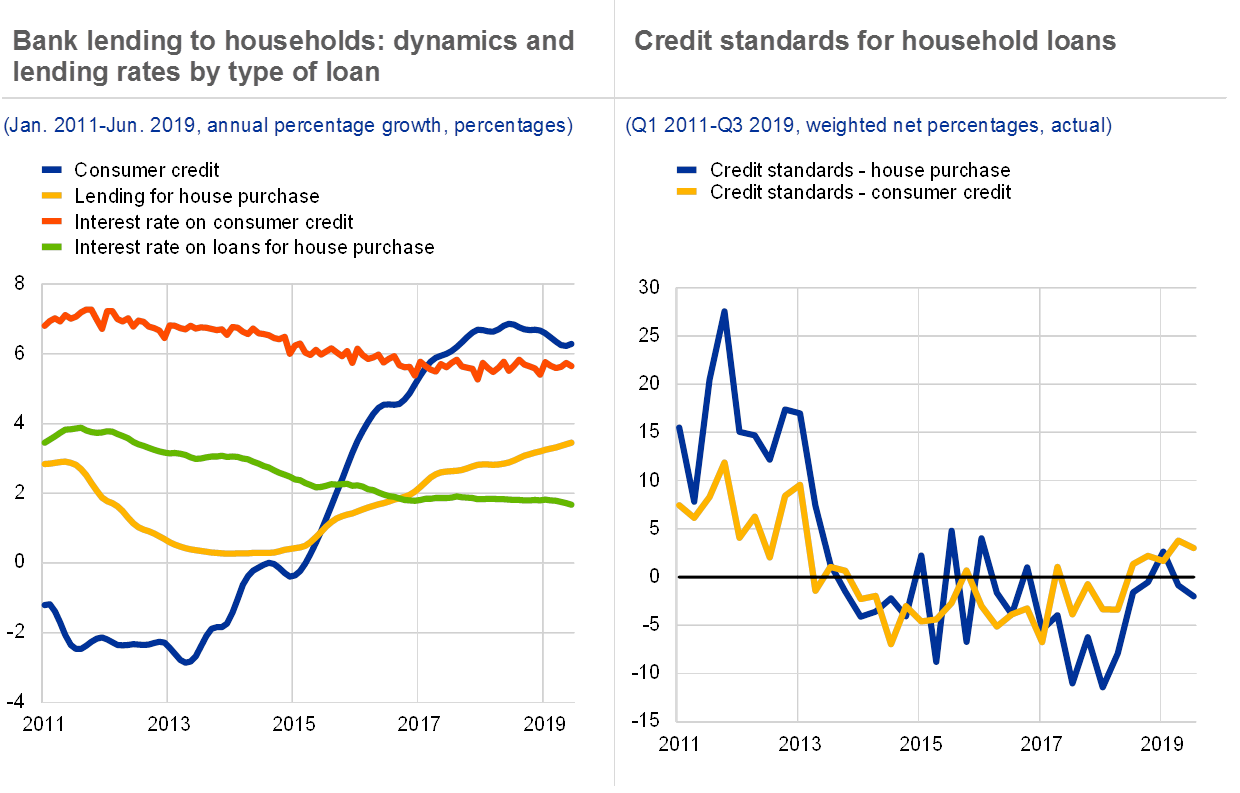

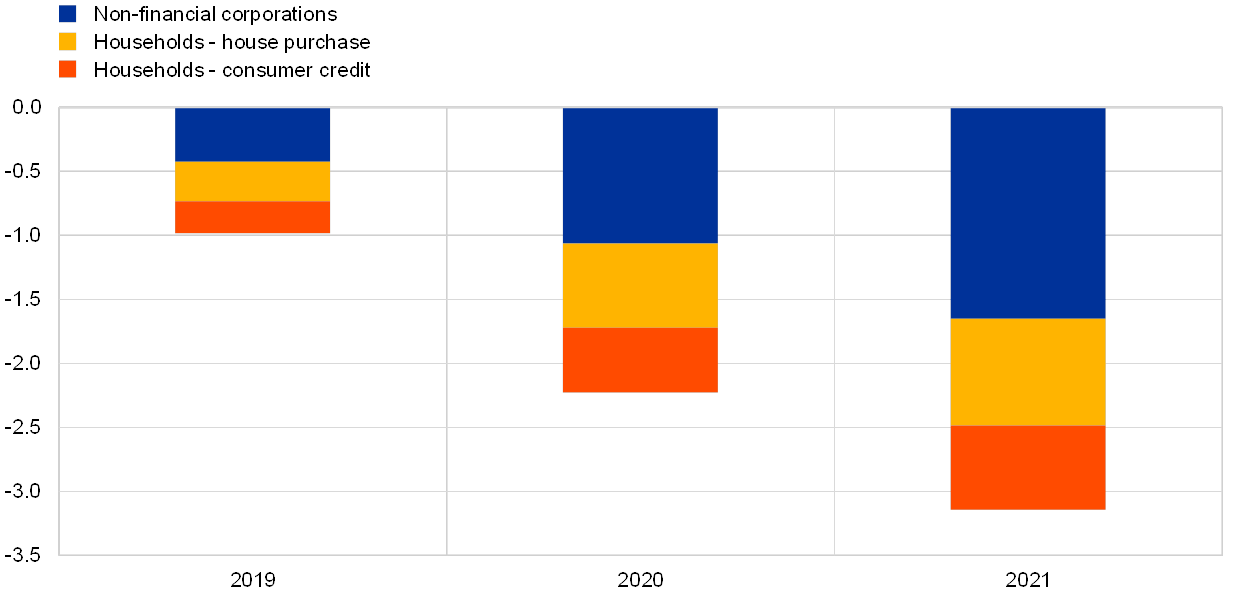

Bank lending to households has remained robust, with continued divergence across countries and types of loans. Aggregate bank loan growth has remained on its gradual upward trend, but with variation across euro area countries, reflecting different economic conditions and real estate cycles. There has also been some divergence between mortgage and consumer lending. More specifically, solid mortgage lending dynamics in the euro area continued to be supported by further improvements in labour markets, broadly resilient consumer confidence, and favourable financing conditions reflected in lower interest rates and supportive credit standards (see Chart 1.8, left panel). By contrast, growth of consumer credit has gradually decelerated, in line with the slowdown in spending on durable goods, which tends to be more sensitive to the business cycle, albeit showing signs of stabilisation in recent months (see Chart 1.8, left panel). Interest rates for consumer credit have remained stable, although banks have slightly tightened lending standards in recent quarters (see Chart 1.8, right panel).

Chart 1.8

Continued credit extension to households, although with moderation and credit standard tightening in the consumer loan segment

Sources: ECB and ECB calculations.

Notes: Left panel: Loans are adjusted for loan sales and securitisation. Right panel: Credit standards refer to the net percentage of banks contributing to a tightening of credit standards. A negative (positive) number for credit standards represents an easing (tightening).

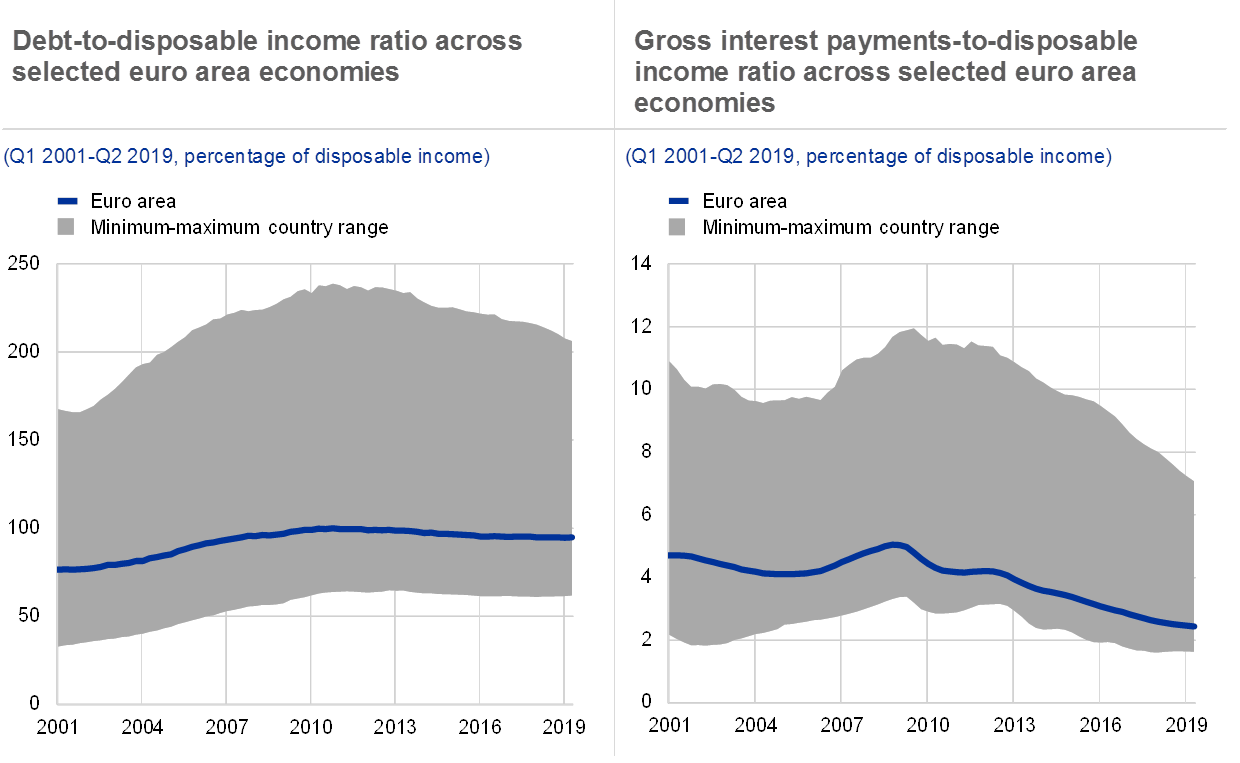

Household indebtedness has been stable at the euro area aggregate level, but this reflects deleveraging in some countries and releveraging in others. Euro area household debt has recently stabilised at around 95% of disposable income and 58% of GDP, close to pre-crisis levels. There is however considerable heterogeneity across euro area countries. While household debt is less than 40% of disposable income in Latvia and Lithuania, it stands at around 200% of disposable income in the Netherlands. Debt dynamics have also varied across euro area countries. For example, households in Spain, Portugal, the Netherlands and Ireland have deleveraged markedly over the last three years, supported inter alia by improvements in income, while France has seen continued releveraging on account of buoyant mortgage lending over the same period (see Chart 1.9, left panel).

Risks to household debt sustainability have been contained by the low level of interest rates, but would increase in the event of a severe slowdown. While the debt burden for households in some countries is still elevated, their repayment capacity has continued improving. Interest payments as a share of disposable income have fallen below 2.5%, given robust incomes and the low interest rate environment. With the expected continuation of the low interest rate environment, coupled with a shift in many countries towards longer mortgage rate fixation periods, risks to households’ repayment capacity appear benign (see Chart 1.9, right panel). If however the economic slowdown is more severe and protracted, this could weigh on household incomes or lead to a sharp correction in some countries’ property markets. This could put pressure on households’ debt repayment capacity over the longer horizon.

Chart 1.9

While some countries have high household debt levels, debt repayments across the euro area are generally low

Sources: Eurostat, ECB and ECB calculations.

Notes: Debt is defined as total loans granted to households by all institutional sectors. Gross interest payments are before FISIM allocation. The selected countries are France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal and Spain.

1.4 Emerging pockets of corporate sector vulnerabilities

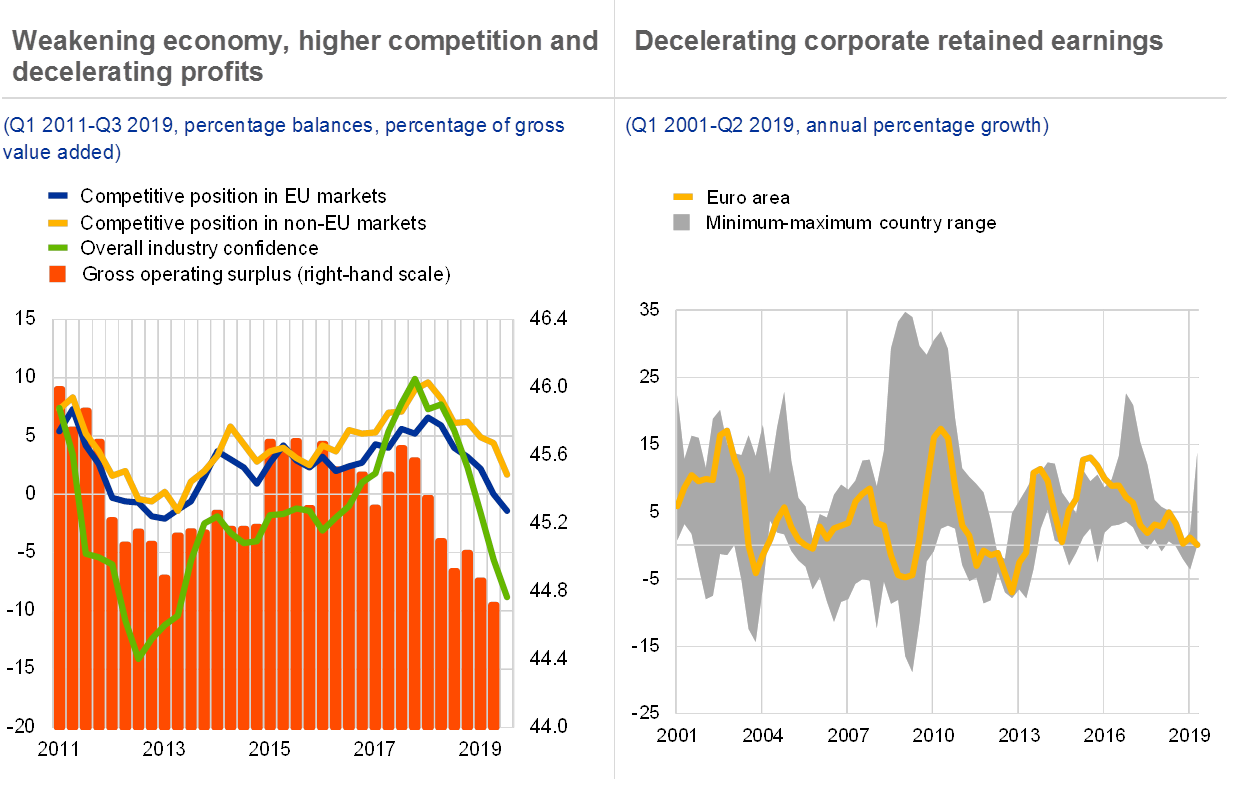

Slower economic growth has led to a continued deceleration in corporate profits. Business sentiment in the euro area has weakened sharply as the economic outlook has softened, and competition in domestic and foreign markets has increased (see Chart 1.10, left panel). Growth in corporate profits and retained earnings has moderated (see Chart 1.10, right panel). At the aggregate level, corporates finance their expansion primarily with retained earnings, so slower profit growth currently may affect future business investment and the long-term profit outlook.

Chart 1.10

Corporate profits and retained earnings have been decelerating in the euro area

Sources: ECB, Eurostat, European Commission and ECB calculations.

Notes: Left panel: Competitive position in the EU and non-EU markets is based on quarterly surveys of managers conducted by the European Commission. Gross operating surplus includes mixed income and is expressed as a share of gross value added, with the last data point for June 2019. Right panel: The country range includes France, Germany, Italy and Spain, while the euro area average covers all the euro area countries and is weighted by GDP.

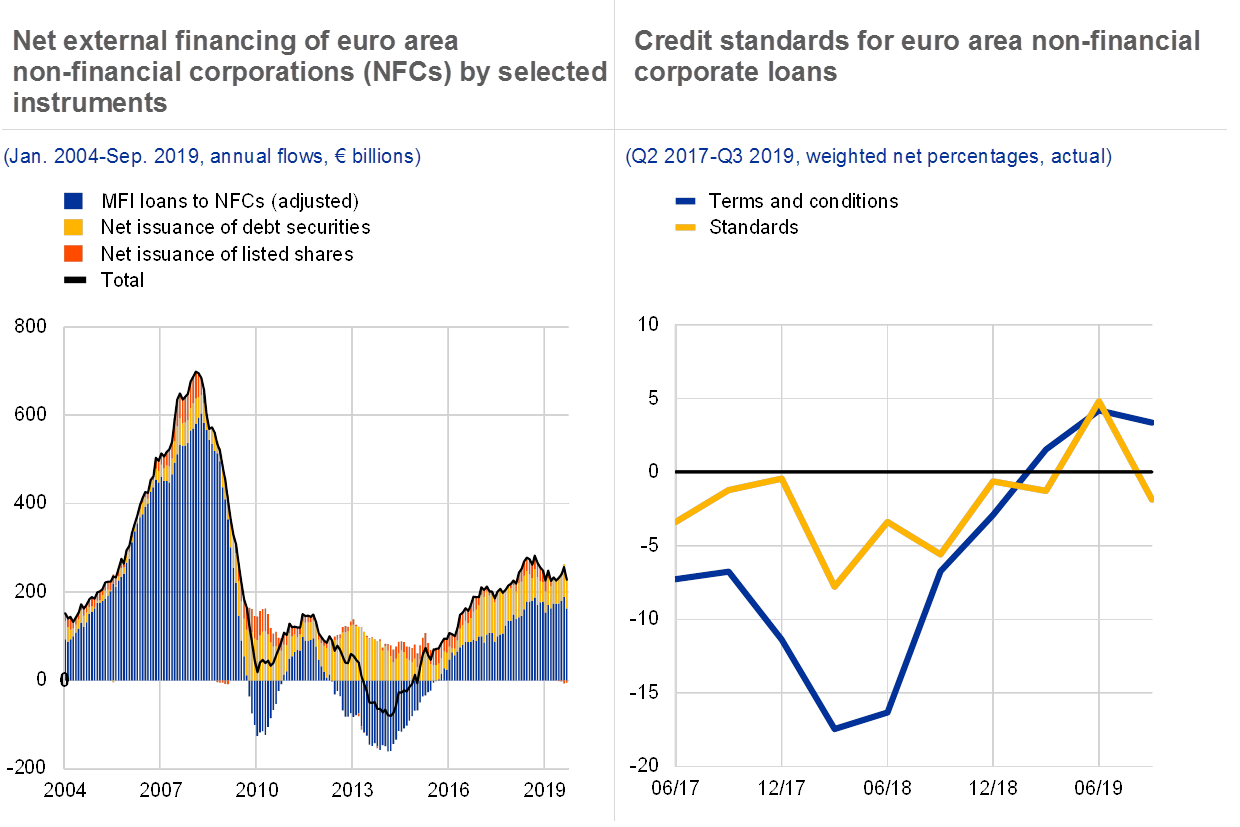

External financing to the corporate sector has increased, with credit standards remaining favourable. Despite recent growth, external financing to corporates remains below its mid-2018 level (see Chart 1.11, left panel). The lower level of external financing reflects the ongoing weakness of the economy, especially in manufacturing and trade, and the resulting lower financing needs of corporates. Bank lending to corporates in the services sector has remained robust, whereas lending to manufacturing and trade sectors has deteriorated. Credit standards to corporates remain favourable, although banks have recently tightened credit terms and conditions (see Chart 1.11, right panel), which is consistent with slower economic growth. Beyond bank lending, net issuance of debt securities has increased in the third quarter of 2019, but remains below the levels observed in 2017 (see Chart 1.11, left panel), with the issuance being concentrated in the investment-grade segment. Underpinned by accommodative monetary policy, favourable financing conditions for both bank and non-bank lending have provided an important incentive for corporates to continue their expansion.

Chart 1.11

Increasing external financing flows to corporates, with credit standards remaining favourable

Sources: ECB and ECB calculations.

Notes: Left panel: MFI (monetary financial institution) loans are adjusted for loan sales, securitisation and cash pooling. Right panel: Credit standards refer to the net percentage of banks contributing to a tightening of credit standards. A negative (positive) number for credit standards represents an easing (tightening).

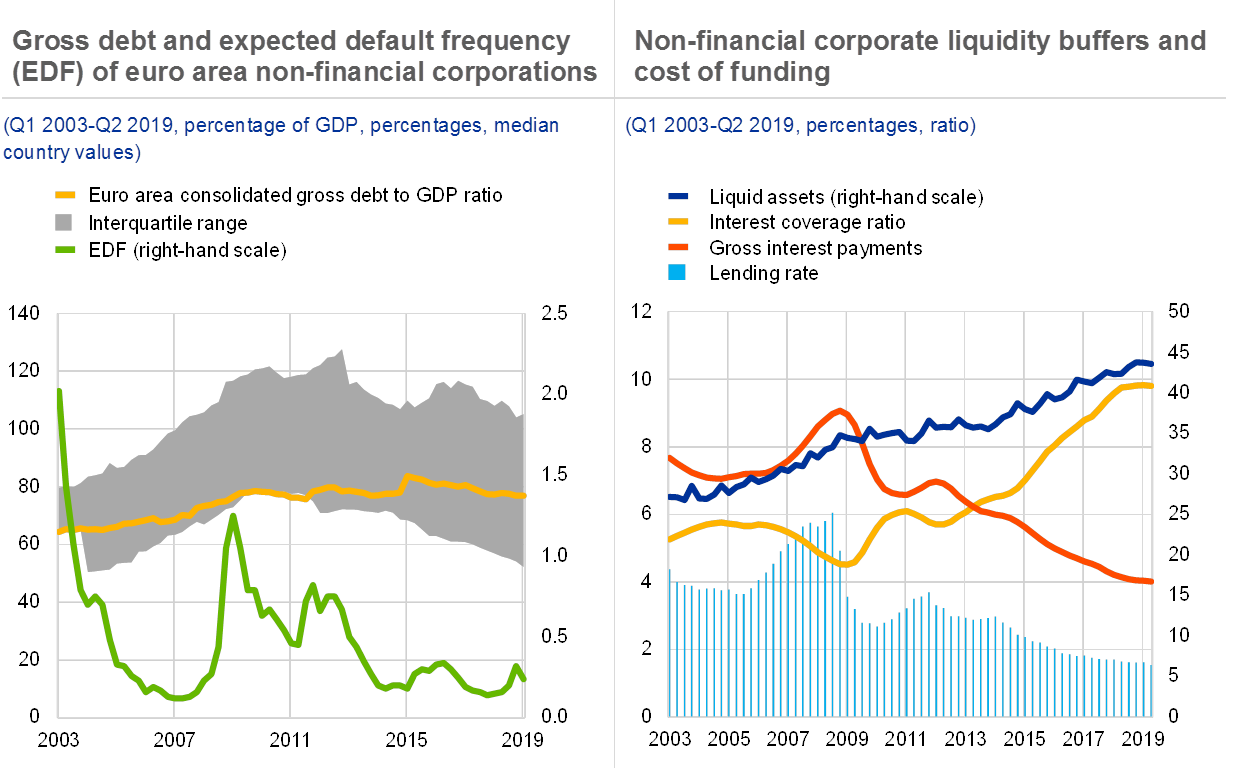

While corporate indebtedness is slightly elevated, market-based indicators point to only limited credit risk. Corporate indebtedness on a consolidated basis in the euro area has stabilised in recent quarters and is now close to pre-crisis levels (see Chart 1.12, left panel). The average masks considerable heterogeneity across countries in terms of both levels and underlying dynamics though, with some economies still exceeding the benchmark of 75% of GDP implied by the Macroeconomic Imbalance Procedure monitored by the European Commission. The market price-based credit risk assessment of the euro area non-financial corporate sector has been still quite favourable, with expected default frequencies for listed corporates remaining so far at low levels (see Chart 1.12, left panel).

Chart 1.12

Slightly elevated corporate debt levels are cushioned by favourable financing conditions and significant liquidity buffers, as reflected in expectations of low credit risk

Sources: ECB, Moody’s CreditEdge and ECB calculations.

Notes: Left panel: Consolidated non-financial corporate debt is defined as the sum of total loans granted to and debt securities issued by non-financial corporations net of inter-company loans. Expected default frequency of non-financial corporations is for one year ahead. Right panel: Liquid assets are defined as the sum of currency and deposits, short-term securities and mutual fund shares over gross value added; interest coverage ratio is defined as the ratio of gross operating surplus over gross interest payments; and gross interest payments are expressed as a share of gross value added. Gross interest payments are before FISIM allocation.

Risks to corporate debt sustainability are also mitigated by favourable financing conditions and large liquidity buffers. Debt servicing capacity is supported by record-low gross interest payments and high interest coverage ratios in most countries (see Chart 1.12, right panel). Furthermore, corporates have accumulated substantial liquidity buffers in the form of liquid assets, which together with the low debt servicing costs would allow corporates to withstand temporary funding stress without resorting to abrupt deleveraging. Moreover, the shift towards more market-based funding allows corporates to mitigate the consequences of a hypothetical stress episode originating from the banking system, although this source of funding could at the same time become subject to a reversal in investor sentiment. All of the above factors reduce in particular rollover risks, making corporate debt more resilient to shocks.

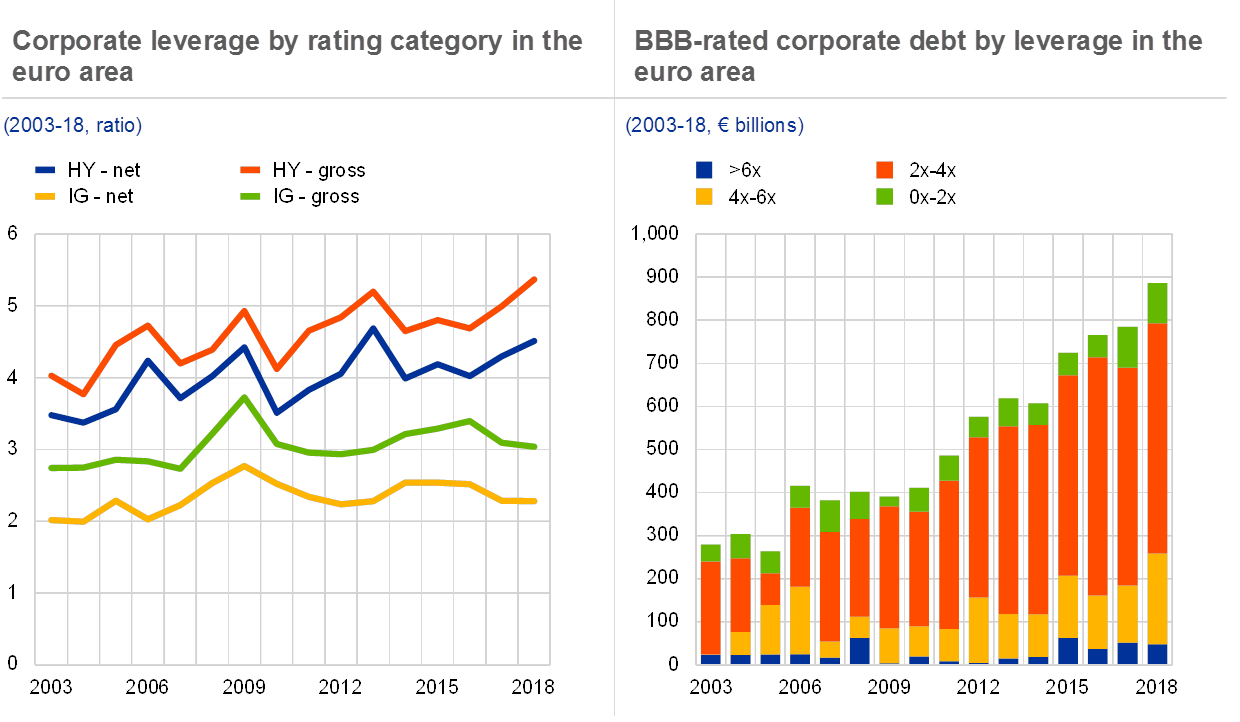

While risks remain contained generally, the vulnerability of highly leveraged corporates warrants monitoring. High-yield corporates are estimated to have increased their gross and net leverage, while investment-grade corporates have slightly deleveraged. Even so, leverage in both groups remains above pre-crisis levels (see Chart 1.13, left panel). Given that both markets and rating agencies tend to discriminate between corporates with high and low levels of leverage during economic downturns, risk premia could increase significantly under a severe growth slowdown scenario (see Chapter 2, Box 2). In addition, within the segment of investment-grade corporates in the euro area, the issuance of BBB-rated entities has significantly increased in terms of outstanding amounts over the last five years. This has been accompanied by a marked increase in issuance by highly leveraged corporates since 2016 (see Chart 1.13, right panel).[4] In the event of a severe slowdown, corporate fundamentals would weaken, prompting rating downgrades for a considerable amount of debt, market dislocations and risk premia spikes. The vulnerabilities in the corporate debt market could, under a severe stress, be transmitted to the wider corporate sector, jeopardising corporate debt repayment capacity.

Chart 1.13

Some pick-up in leverage in the high-yield segment along with a high stock of BBB-rated debt warrant monitoring

Sources: S&P Global Market Intelligence and ECB calculations.

Notes: Left panel: Corporate leverage is measured by the debt-to-EBITDA ratio. HY: high-yield; IG: investment-grade.

1.5 Diverging residential and commercial real estate cycles

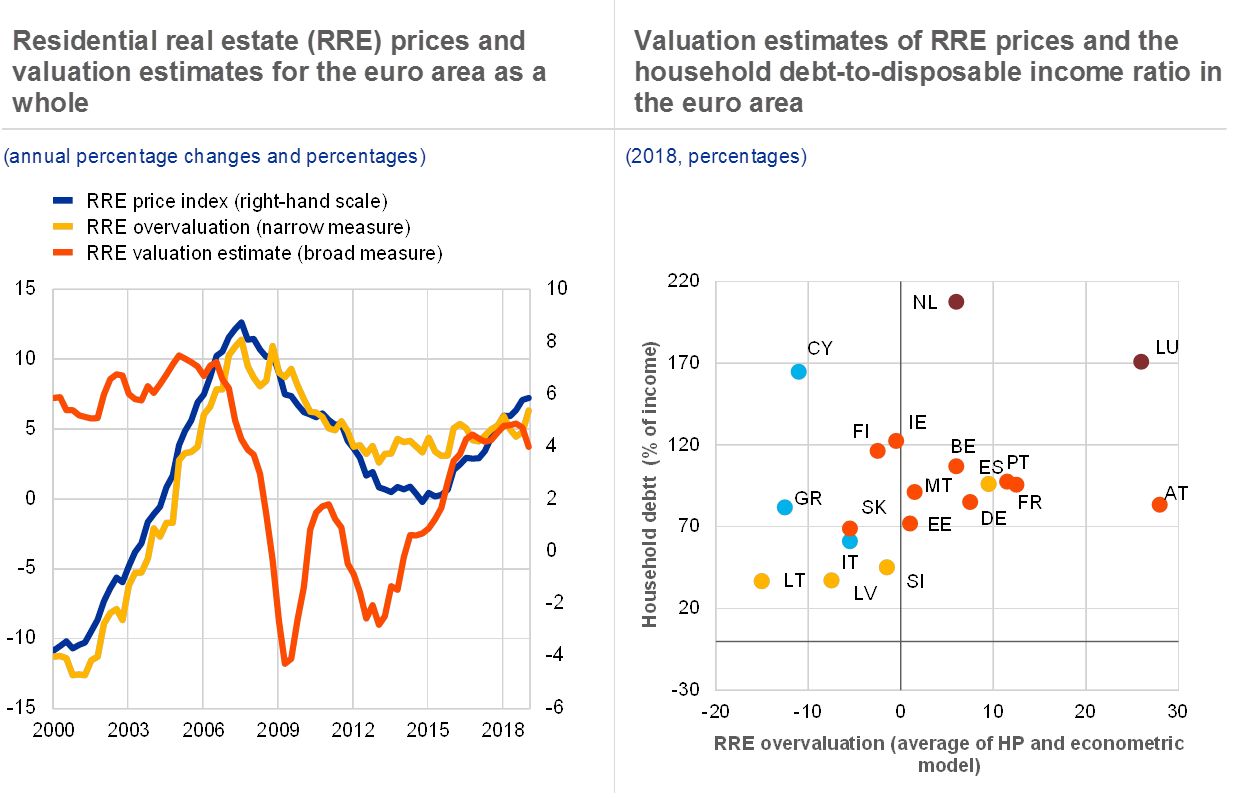

The euro area residential property market continued its robust expansion.[5] Across the euro area, nominal house prices continued to rise at a relatively high rate of 4% in the first half of 2019 (see Chart 1.14, left panel), exceeding nominal GDP growth. With favourable financing terms supporting property markets, the housing cycle has remained firmly in an expansionary phase across the majority of the euro area. While house price growth in large/capital cities has surpassed national averages in recent years, this gap has more recently narrowed in most euro area countries on account of a marked deceleration in capital cities, as property prices there have proven more sensitive to the slower economic growth.

Signs of overvaluation are accompanied by household indebtedness. Estimates of the euro area average suggest continued overvaluation, now exceeding 7% (see Chart 1.14, left panel), but with a high degree of cross-country heterogeneity. Higher valuation estimates are accompanied by a high level of household indebtedness (see Chart 1.14, right panel) and robust mortgage loan origination in some countries.[6]

Chart 1.14

Buoyant residential real estate prices amid growing vulnerabilities in some countries

Sources: ECB and ECB calculations.

Notes: Left panel: The broad average valuation estimate is based on four different valuation methods: the price-to-rent ratio, the price-to-income ratio, an asset pricing approach and an estimated Bayesian vector autoregression (BVAR) model. The narrow estimate is the simple average of the price-to-income ratio and the BVAR valuation. For details of the methodology, see Box 3 in Financial Stability Review, ECB, June 2011, and Box 3 in Financial Stability Review, ECB, November 2015. Right panel: Dark red = pronounced risk, orange = medium risk, yellow = low risk, blue = no exposures to RRE risks. For details, see Vulnerabilities in the residential real estate sectors of the EEA countries, European Systemic Risk Board, September 2019. Overall, estimates from the valuation models are subject to considerable uncertainty and should be interpreted with caution. Alternative valuation measures can point to lower/higher estimates of overvaluation.

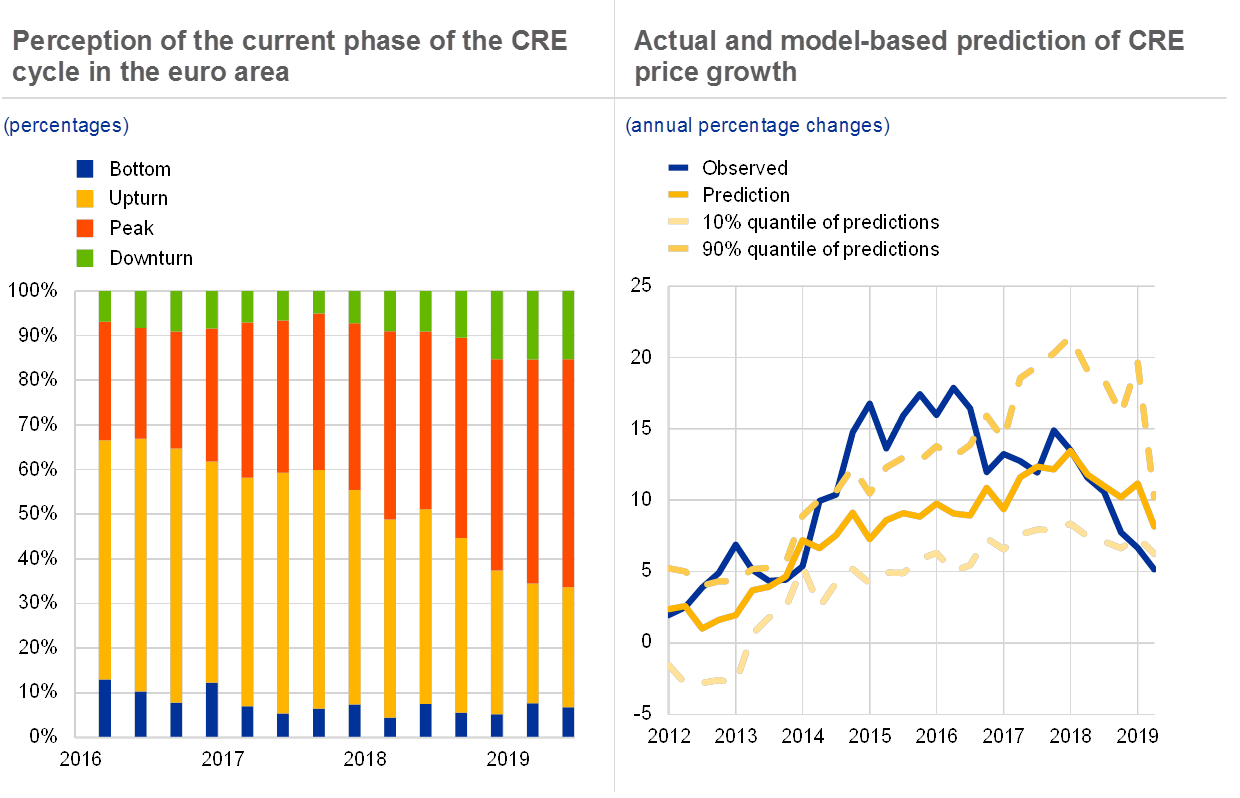

The commercial real estate cycle has continued to moderate. Survey-based data suggest that the current euro area commercial real estate (CRE) cycle is either at its peak or has already entered a downturn phase (see Chart 1.15, left panel). Countries that were less affected by the crisis (e.g. Austria, France and Germany) generally appear to be at or past the peak, while those that were more affected by the crisis (e.g. Cyprus, Greece and Spain) are still deemed to be in an upturn phase. Led by developments in the prime segment, euro area CRE price growth has still been positive, albeit clearly moderating. While prices are estimated to have grown beyond fundamentals in the past, the current dynamics seem to be below those that would be implied by fundamentals (see Chart 1.15, right panel). Transaction volumes in recent quarters have remained strong, but have decreased from peak levels in line with a maturing market cycle. The strength in transaction volumes has coincided with the increased activity of non-domestic investors, making the CRE sector vulnerable to shifts in global financial conditions (see Box 1).

Chart 1.15

CRE prices have moderated recently in a maturing CRE cycle

Sources: RICS Global Commercial Property Monitor and ECB calculations.

Notes: Left panel: The RICS Global Commercial Property Monitor is a quarterly guide to the trends in the commercial property investment and occupier markets. Respondents are asked to compare conditions over the latest three months with the previous three months, and to give their views as to the outlook. Right panel: The observed value shows CRE price growth using the median annual growth rate for a country sample covering Austria, Belgium, France, Germany, Ireland, Italy, the Netherlands, Portugal and Spain. The solid yellow line shows the growth rates using the average of the price dynamics predicted by 45 different models. The dashed lines depict the predictions using the 10% and 90% quantiles.

Risks to financial stability stemming from real estate markets have increased. With the low-rate environment expected to remain in place for an extended period of time and the outlook for the labour market being robust, mortgage lending growth could accelerate and exert further upward pressure on RRE prices. However, worse than expected macroeconomic outcomes and/or tighter financing conditions in terms of both the availability and the cost of funding could adversely affect the debt servicing capacity of households and commercial property investors, with investors from outside the euro area being particularly sensitive to changes in global financial conditions. Reflecting these risks, a number of countries have activated or strengthened policies that aim to limit the weakening of lending standards.

Box 1

Explaining cross-border transactions in euro area commercial real estate markets

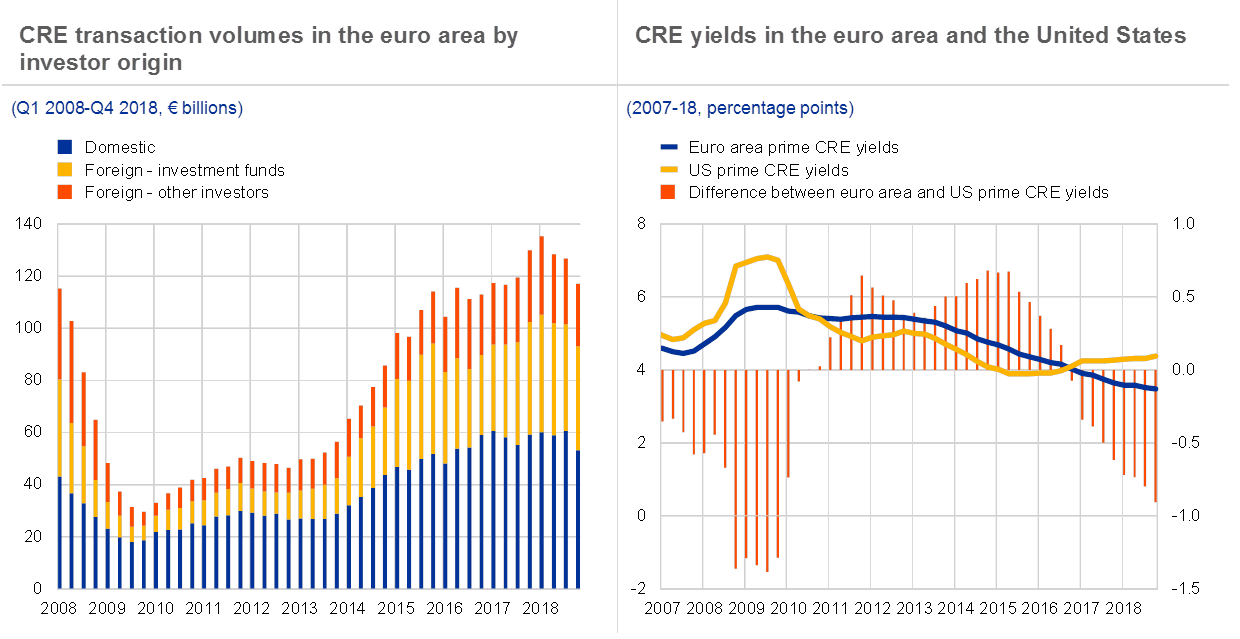

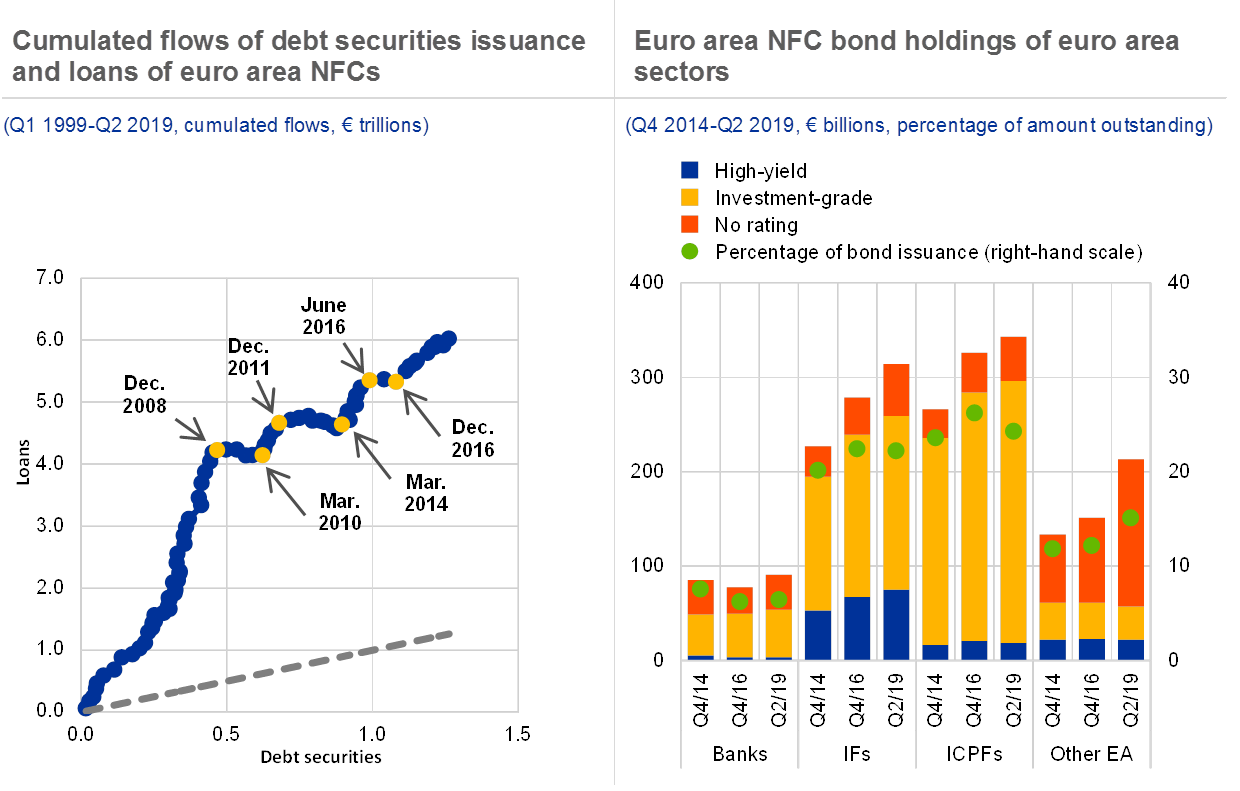

The upswing in euro area commercial real estate (CRE) markets in recent years has reflected, in part, a strong appetite from international investors, including US investment funds. Since 2013 transactions in euro area CRE markets have more than doubled, alongside a 20% increase in prices (15% in real terms) and a decline in average yields from 5.2% to 3.5%. In parallel, the share of transactions by foreign investors increased to 54% in 2018, from an average of 49% in 2013 when a particularly strong pick-up in transaction volumes started. Furthermore, the role of investment funds in foreign transactions increased to 63% in 2018 from 48% in 2013 (see Chart A, left panel), with around 40% of these on average originating from the United States.

Chart A

Foreign CRE transaction inflows into euro area countries increased substantially in the recent upswing, while CRE yields in the euro area were until recently higher than in the United States

Sources: Real Capital Analytics, Jones Lang LaSalle and ECB calculations.

Notes: Left panel: Transaction volumes are calculated as four-quarter moving sums. Foreign transactions include purchases from other euro area countries and non-euro area countries. Other investors include banks, pension funds, insurance companies, non-bank financial institutions and private investors (e.g. developers, high net worth individuals, corporate investors, cooperative investors). Right panel: US yields reflect the office market, which is the largest CRE sector and is treated as a proxy for the entire US CRE market.

The higher share of foreign investors could make domestic CRE markets more exposed to a sharp or disorderly adjustment as exuberance fades. Generally, a higher share of foreign investments implies better risk sharing across countries, but foreign investors might be more sensitive to changes in global financial conditions and could be more likely to rebalance away from euro area CRE markets if relative returns shift. This could prompt an abrupt shift in the CRE market. In particular, the volume of property purchased by investment funds tends to be relatively volatile, and funds may also be pressured into selling CRE portfolios in the event of shifts in investor sentiment resulting in increased redemptions. Given the volatility that could be generated by an abrupt flight of foreign investors away from euro area CRE markets, this box investigates what factors have supported the attractiveness of euro area CRE and might prompt a reversal, focusing on purchases by foreign investment funds. Data availability limits the analysis to investment funds domiciled in the United States, the United Kingdom and the euro area, which on average together accounted for close to 80% of annual CRE purchases by funds in the euro area over the review period. Funds domiciled in Asia, which have an almost 10% average share in funds’ euro area CRE market purchases, are not covered.

An analysis of recent trends in CRE markets suggests that search-for-yield behaviour could have been a significant driver of foreign transactions. Examining the relationship between transactions, yields and fundamentals for CRE markets for a panel of euro area countries, the United States and the United Kingdom between 2007 and 2018 shows that CRE investors invest abroad if yields are higher there than at home[7] (see Chart A, right panel). This behaviour seems to have contributed to the strength of cross-border transaction flows into euro area CRE markets. Comparing actual transaction volumes with a simulation of how transaction volumes would have evolved if yields were the same in all countries (see Chart B, left panel) suggests that since 2010 there has been an excess of transactions. This implies that search for yield was important during the recent market upswing. From 2013 to 2017, the overall aggregated excess of foreign transactions related to both the yield differentials and the additional exuberant behaviour of investment funds stood at over €26 billion (19% of transactions in this period). In particular, the part of the excess of transactions driven by yield differentials was positive in the years 2013-16, and in this period the aggregated excess of foreign transactions in euro area CRE markets by investment funds driven by this factor stood at over €10 billion, amounting to 11% of transactions (see Chart B, right panel).

Chart B

The aggregated excess of foreign transactions in euro area CRE markets by investment funds driven by yield differentials and not explained by expected drivers is substantial

Source: ECB calculations.

Notes: Computations based on a panel model focusing on the impact of the differential between prime CRE yields in country j and i on CRE cross-border transaction flows. Models control for the price dynamics over the last two years, overall macroeconomic conditions and risk-free rates in the buyer country, and include country pairs and time fixed effects. Counterfactual volumes are computed as fitted values with yield differentials at zero.

Having benefited from foreign investors in the upswing, euro area CRE markets might be vulnerable to an abrupt withdrawal of foreign investors, triggered by shifts in relative returns. Such an outflow could cause a correction of potentially stretched prices, and a downturn in CRE markets would have implications for both banks (higher potential loss given default) and firms (lower than expected credit availability). And while purchases by US investment funds, which have been particularly important to the euro area market, are still robust, since 2017 there have been net outflows as US investment funds have rebalanced away from euro area CRE. This has coincided with CRE yields in the United States starting to exceed those in the euro area. This suggests that US investment funds have already started reacting to the lower relative attractiveness of the euro area CRE market.

2.1 Rally in safer asset markets

Benchmark yield curves have moved downwards significantly since May, including further shifts into negative territory. For the first time in history, large segments of the yield curves of euro area sovereigns with high credit ratings are in negative territory (see Chart 2.1, left panel). A deteriorating economic outlook and various monetary easing measures in the United States and the euro area have helped to extend the downward trend in global bond yields that started at the beginning of 2019. The decline in euro area long-term yields can be attributed both to lower expectations about the future path of short-term rates and to lower term premia (see Chart 2.1, right panel), reflecting lower nominal growth expectations as well as the mix of conventional and unconventional measures announced by the ECB’s Governing Council following its September meeting.[8] Also the US Federal Open Market Committee lowered its target rate three times over the review period, adding to the global downward trend in benchmark bond yields. In addition, several cyclical and structural factors continued to depress term premia across the globe, including persistent policy uncertainties as well as ample global private and official demand for and an increasingly limited supply of safe assets.

Chart 2.1

Euro area yield curves largely negative as term premia and rate expectations declined

Sources: Refinitiv, ECB and Federal Reserve Bank of New York.

Notes: Left panel: “Current” refers to yield curves on 15 November 2019. The yellow lines reflect the market value-weighted average yield curve of all euro area sovereign issuers. Right panel: The chart shows the change since 29 May 2019. Latest observation: 10 November 2019. OIS: overnight index swap.

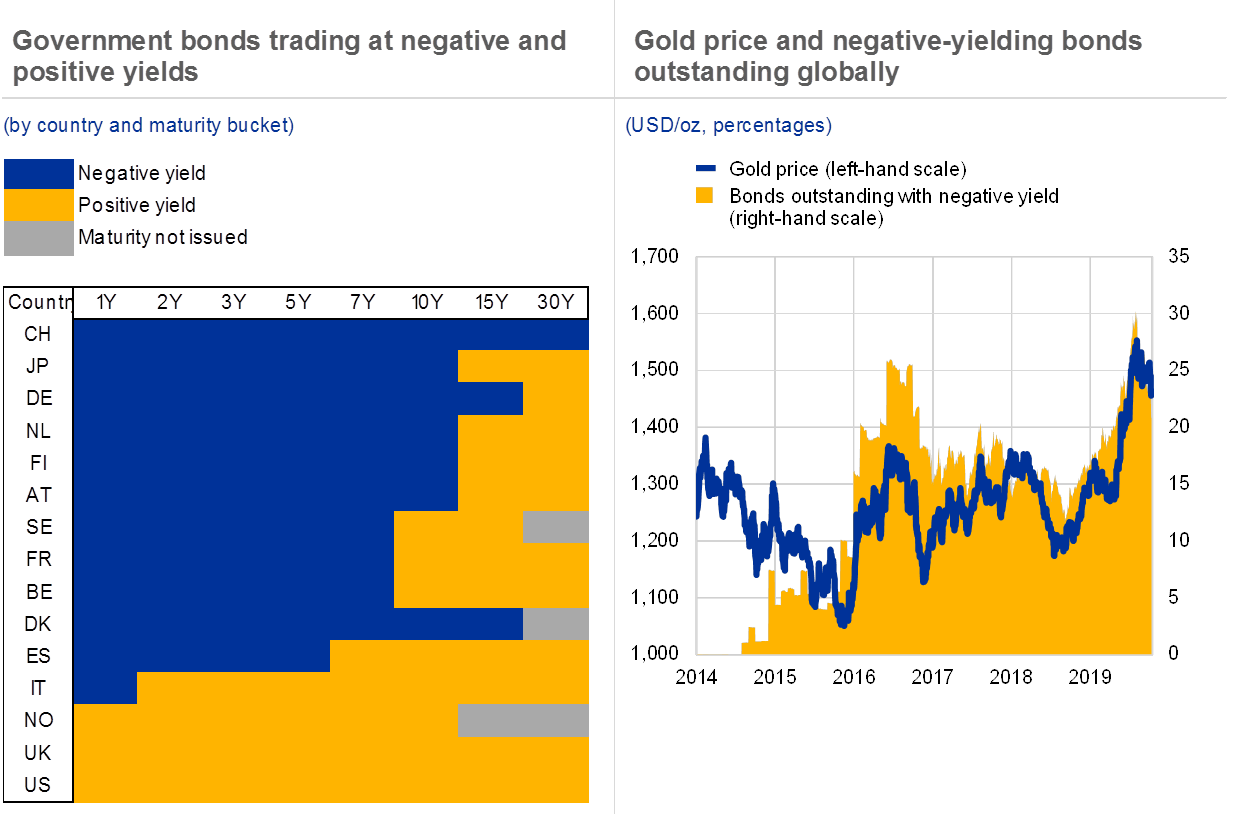

Negative-yielding bonds are mainly those bonds with higher credit ratings and shorter maturities. Sovereign issuers make up most of the approximately USD 13 trillion of negative-yielding bonds outstanding. This is unsurprising as over sovereigns are the main issuers of highly rated bonds in currency areas with negative policy rates, such as the euro area and Japan. As yield curves have flattened, the phenomenon of negative yields has extended to very long maturities for highly rated sovereign (see Chart 2.2, left panel). Moreover, as these bonds serve as benchmarks for the yields of bonds denominated in the same currency, but issued by private borrowers, negative yields have extended to significant parts of the euro area corporate bond market (see Section 2.2).

Higher demand for alternative safe stores of liquidity suggests investors are seeking substitutes for negative-yielding cash and bonds. Most prominently, the price of gold has become highly correlated with the share of negative-yielding bonds outstanding as investors seek to avoid negative yields on their investments (see Chart 2.2, right panel). Similarly, the flattening of the very long end of the Bund yield curve may partially reflect an investor flight from negative yields at shorter maturities, with the yield spread between 30-year and 10-year bonds having halved over the past two years (see Chart 2.3, right panel). An alternative interpretation of this pattern is that markets expect secularly low rates in the euro area, perhaps comparable to developments in Japan over the last years.

Chart 2.2

Negative yields – concentrated at lower maturities and higher credit ratings – appear to be supporting demand for gold

Sources: Refinitiv.

In parallel, declines in coupons have raised the average duration risk of the euro area bond market. The secular downward trend in nominal bond yields has gradually brought down the average level of coupons paid by bond issuers in the euro area (see Chart 4, left panel, in the Overview). Lower coupons make bond prices more sensitive to changes in the yield curve and thus more volatile overall (see Chart 2.3, left panel). Most strikingly, bonds with a duration above 20 years exhibit similar volatility to equity shares.[9] Recent volatility seen in very long-dated euro area sovereign bond prices illustrates the effect of low coupon rates and exceptionally long maturities on investors’ exposure to duration risk (see Chart 2.3, right panel).

Chart 2.3

Lower coupon rates and longer maturities raise bond market duration risk

Sources: IHS Markit, Bloomberg and ECB calculations.

Note: The Chart in the left panel is based on annualised volatility of daily returns of AAA-AA-rated sovereign and sub-sovereign bonds in 2019.

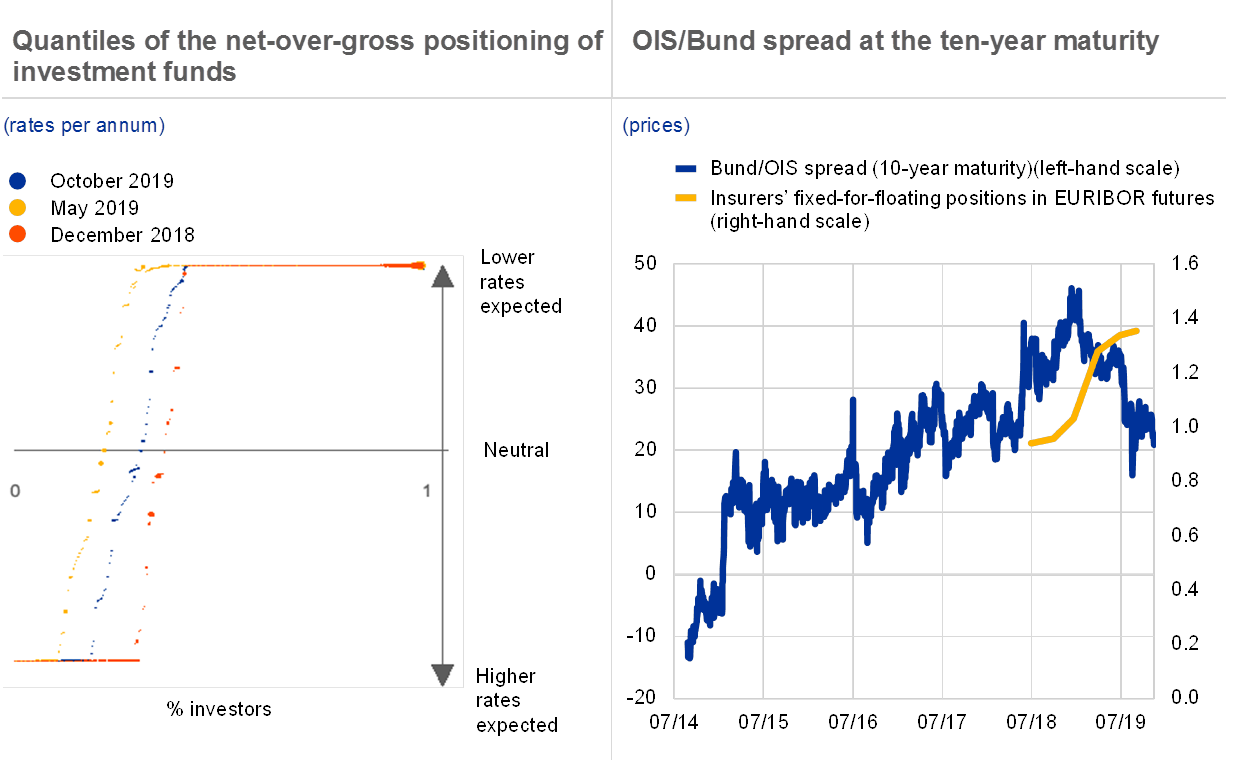

Signals from financial derivatives markets point to firming expectations of persistent low rates. Recent trends in institutional investors’ hedging behaviour reflect firming expectations of even lower future interest rates; both price and volume-based measures point to investors’ preference for protecting their portfolios against lower rather than higher rates (see Chart 2.4, right panel).[10] Moreover, investment funds remain predominantly positioned in long EURIBOR futures contracts, indicating expectations of a further decline in ECB policy rates over the coming twelve months (see Chart 2.4, left panel). These indicators suggest that markets currently assess the risk of a sudden increase in interest rates as being remote. At the same time, pricing in riskier financial market segments (e.g. equities) is increasingly based on expectations of low future benchmark rates, with a limited perceived risk of upward surprises (see Box 2).

Chart 2.4

Positioning in interest rate derivatives points to consensus on “low-for-long” interest rates

Sources: EMIR data and Haver Analytics.

Notes: The left chart shows net-over-gross positions of individual investors in the market for EURIBOR futures with a residual maturity of more than one year. The size of the bubbles is proportional to the size of individual portfolios in terms of the gross notional amount. The right chart shows on the right-hand scale the ratio of euro area insurance companies’ positions in fixed-for-floating plain-vanilla EURIBOR and OIS swaps over their positions in floating-for-fixed swaps of the same type (positions are measured by notional values). The time series start only in mid-2018, owing to quality and availability limitations of EMIR (European Market Infrastructure Regulation) data prior to this.

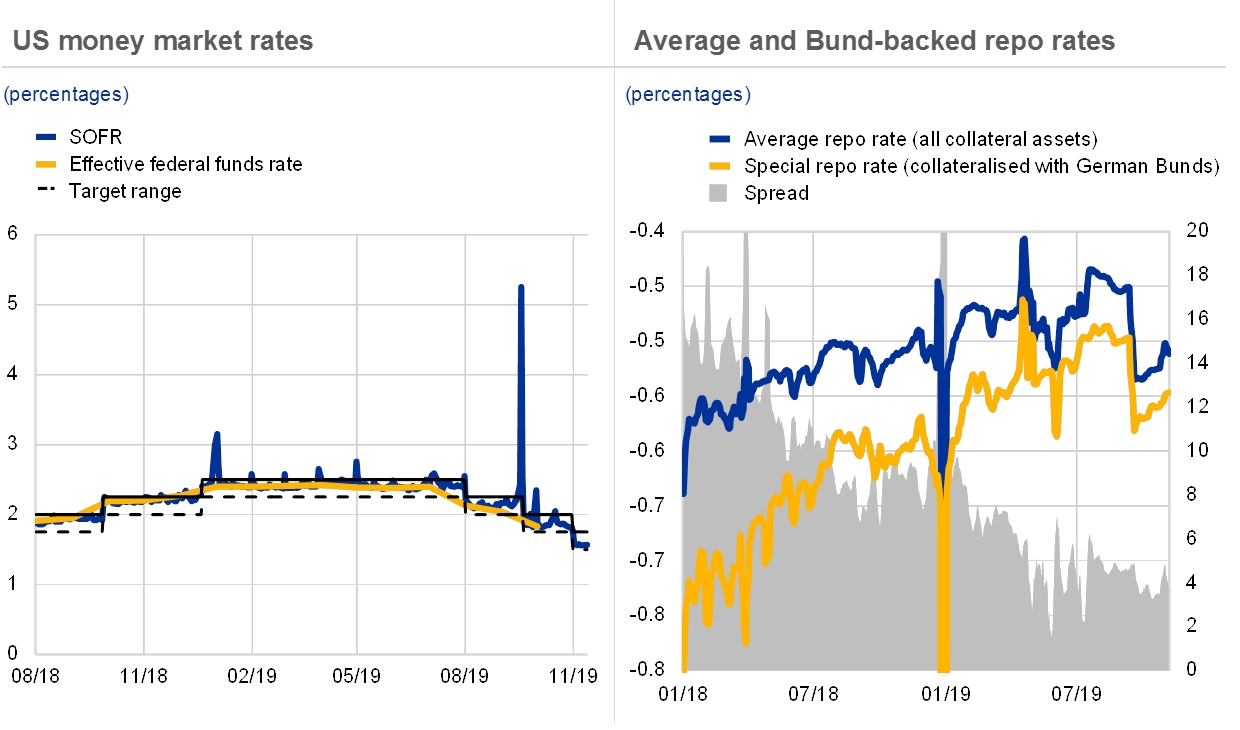

Euro money markets remained unaffected by an episode of extreme volatility in US repo rates. A spike in the US secured overnight financing rate (SOFR) made the headlines in September as high demand for liquidity coincided with a decline in deposits as US corporate tax payments fell due (see Chart 2.5, left panel). The funding strains prompted the Federal Reserve to assume a more active role in the repo market and to provide additional liquidity by means of Treasury bill purchases.

However, collateral shortages in the euro area repo market could ensue from the announced expansion of the ECB’s public sector purchase programme. Measures of collateral scarcity in the repo market have declined over recent quarters owing inter alia to a smoother functioning of, and higher participation in, the ECB’s securities lending programme, which includes the possibility to post cash as collateral. For example, the wedge between the average repo rate and those rates charged for transactions collateralised by Bunds has declined, although scarcity around quarter-ends remains evident (see Chart 2.5, right panel). These benign trends are confirmed by survey-based evidence on liquidity in euro area collateral markets.[11] That said, highly rated collateral required for some repo operations might become increasingly scarce in the context of expanding Eurosystem sovereign bond purchases further restraining the tradable amount of these assets.

Financial institutions should step up their preparations for the phasing-out of the EONIA benchmark rate to reduce operational and legal risks in euro area money markets. The €STR benchmark rate was introduced in October 2019 to replace EONIA rates which are still used to price significant amounts of outstanding derivatives and other financial instruments. The publication of EONIA will cease in January 2022. By then, market participants are required to replace the benchmark in existing derivative contracts to avoid the risk of legal disputes between counterparties over the appropriate benchmark.

Chart 2.5

US repo market stress did not spill over to other currency areas

Sources: Refinitiv and ECB money market statistical reporting (MMSR) dataset.

2.2 Riskier asset prices reliant on low rates

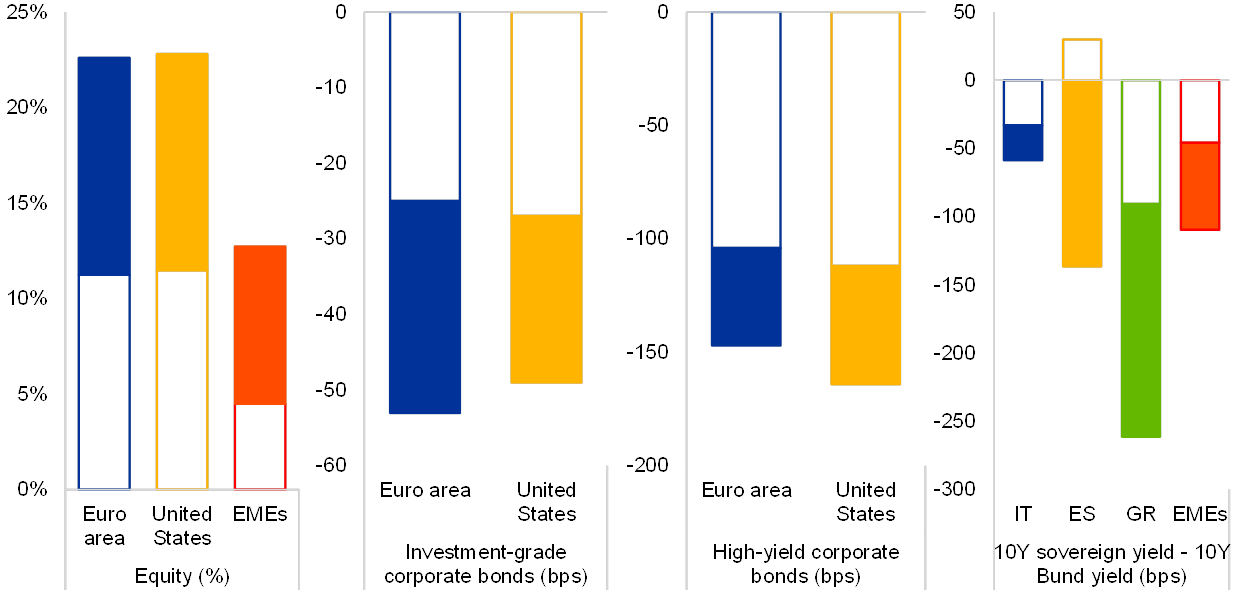

Equity and corporate bond prices continued to appreciate, despite short-lived fluctuations in response to uncertainty surrounding trade tariffs. Announcements of additional US tariffs on Chinese goods prompted a sell-off in equity and credit markets in late July. But declines were once more quickly reversed, extending the rally that had started in January (see Chart 2.6). Similarly, foreign exchange markets and UK financial markets proved sensitive to the possibility of a no-deal Brexit in October, until governments agreed to an extension of the United Kingdom’s membership in the European Union. The strong performance of equities, corporate bonds and lower-rated sovereign bonds this year has so far surpassed measures of expected earnings growth or business sentiment (see Section 1.1).

Chart 2.6

Riskier asset prices appreciate despite strong safe-haven dynamics

Developments in equity prices, corporate bond spreads and sovereign bond spreads since the beginning of the year and over the review period

(1 Jan 2019-12 Nov. 2019; left panel: percentages; middle and right panels: basis points)

Source: Refinitiv and Bloomberg.

Note: The coloured bars represent developments since the May 2019 FSR; the white bars represent year-to-date developments.

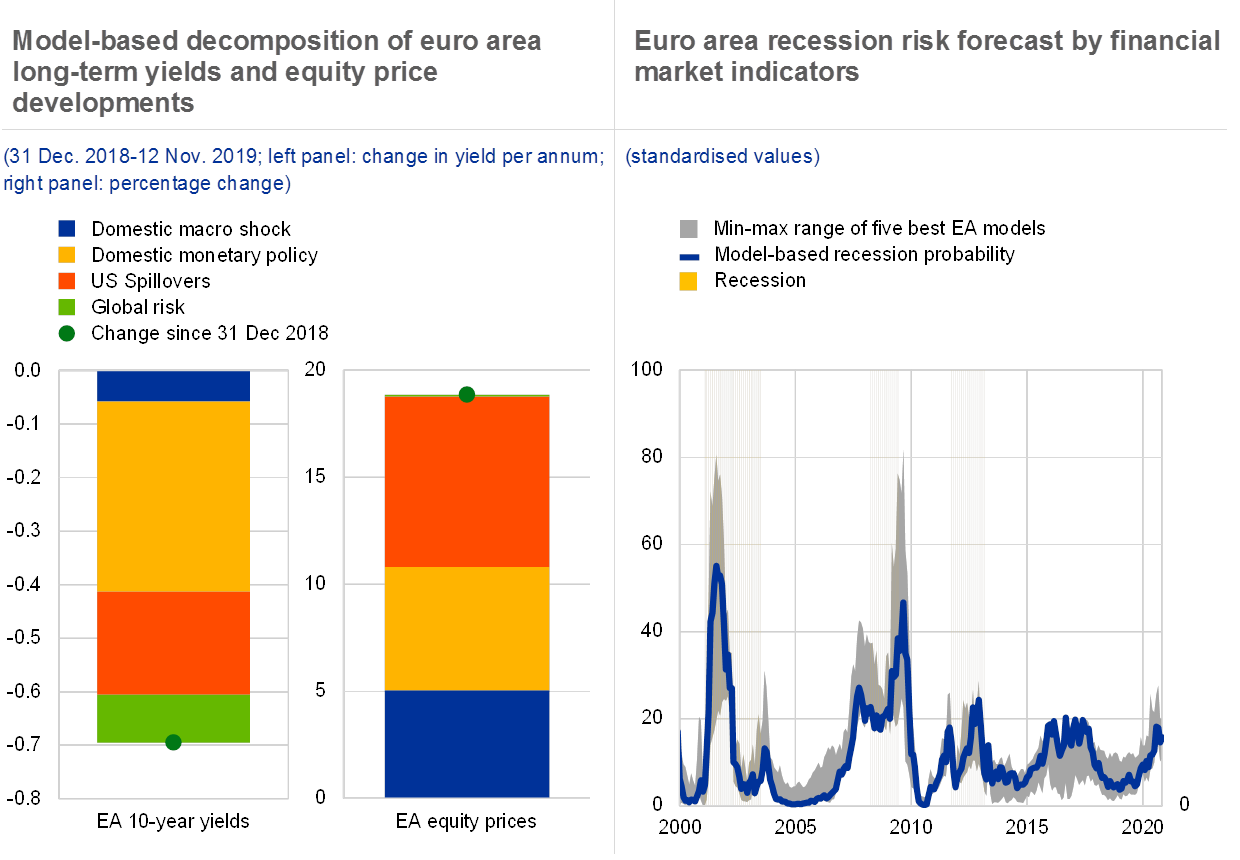

The simultaneous rally in risky and safe asset prices over the year points to the distinct role of monetary policy in recent financial market developments (see Chart 2.7, left panel). In the presence of an accommodative monetary policy shock, yields decline in expectation of lower policy rates and/or central bank asset purchases. This, in turn, raises the present value of earnings and thus also equity valuations. According to model estimates, the ECB’s policy measures and spillovers from easing measures conducted by the Federal Reserve contributed to higher bond and equity prices (see also Box 2, which quantifies the impact of declining benchmark yields on valuations in euro area equity and credit markets). In addition, persistent geopolitical and trade policy-related uncertainties induced safe-haven dynamics, further weighing on bond yields. Finally, model estimates suggest economic developments in the year to date have only had a limited impact on riskier asset prices. Indeed, the risk of an imminent recession in the euro area implied by financial market variables continued to increase over the summer (see Chart 2.7, right panel).

Chart 2.7

Financial market dynamics explained by monetary policy easing, while recession risk continued to pick up

Sources: Refinitiv, OECD, CEPR and ECB calculations.

Notes: The left chart shows the results of a two-country BVAR model including the euro area ten-year OIS rate, euro area stock prices, the USD/EUR exchange rate, the ten-year euro area OIS rate-US Treasury spread, and US stock prices. It uses sign restrictions on impact and is estimated using daily data over the period 2005-19. The right chart is based on probit regressions linking a monthly business cycle indicator for the euro area (0=expansion, 1=recession, as computed by the CEPR) to financial market variables lagged by 12 months and beyond. The models are the five top-performing models between January 1976 and September 2019 out of 36 models that combine selected financial market variables. They are chosen on the basis of their pseudo-R2, the mean absolute error for the full sample and the mean absolute error in the recession phases. The depicted OECD recession indicator does not enter the model and, in contrast to the CEPR indicator, signals the business cycle phase from peak to trough.

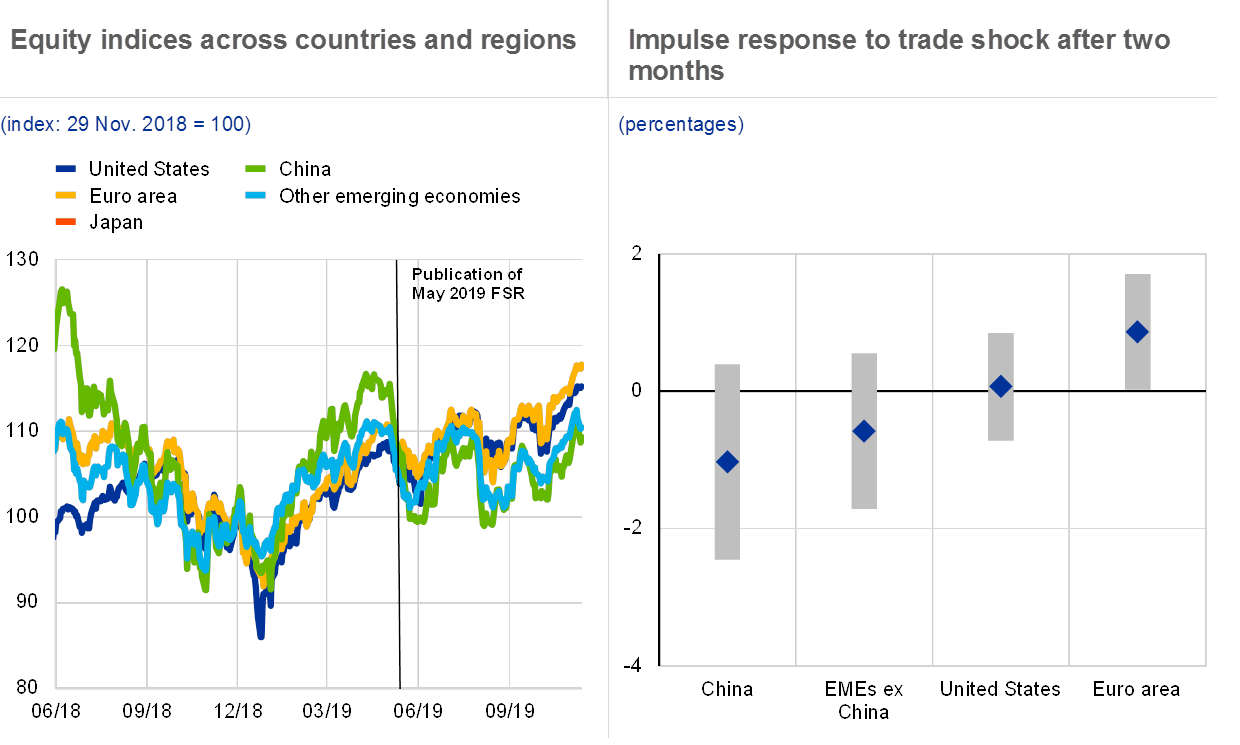

Chinese and emerging economy equity markets have so far been most affected by recent escalations of the trade conflict between China and the United States. Similarly to previous episodes, the increases in US tariffs on Chinese goods announced in July triggered a brief sell-off in global equity markets. The impact was strongest and most persistent for Chinese and other emerging economies’ equity markets (see Chart 2.8), according to model estimates, as these economies are more reliant on trade than the United States. At the same time, euro area equity markets have so far remained unaffected by (or may have even benefited from) the trade conflict (see Chart 2.8, right panel). However, this pattern could change if foreign tariffs were to be imposed on a broader set of euro area goods and services, given the high degree of trade intensity of the euro area economy.[12]

Chart 2.8

Chinese and other emerging economy equities suffer more than advanced economy equities from trade tariff news

Sources: Refinitiv and ECB calculations.

Notes: Impulse response of the MSCI China Index, the MSCI Emerging Markets ex China Index, the S&P 500 Index and the EURO STOXX 300 Index to narratively identified trade shocks derived from local projections using daily data. Shocks are weighted by the size of the immediate S&P 500 response to ensure that announcements which surprised the market have a greater impact than announcements that were largely expected. Last observation: 8 November 2019.

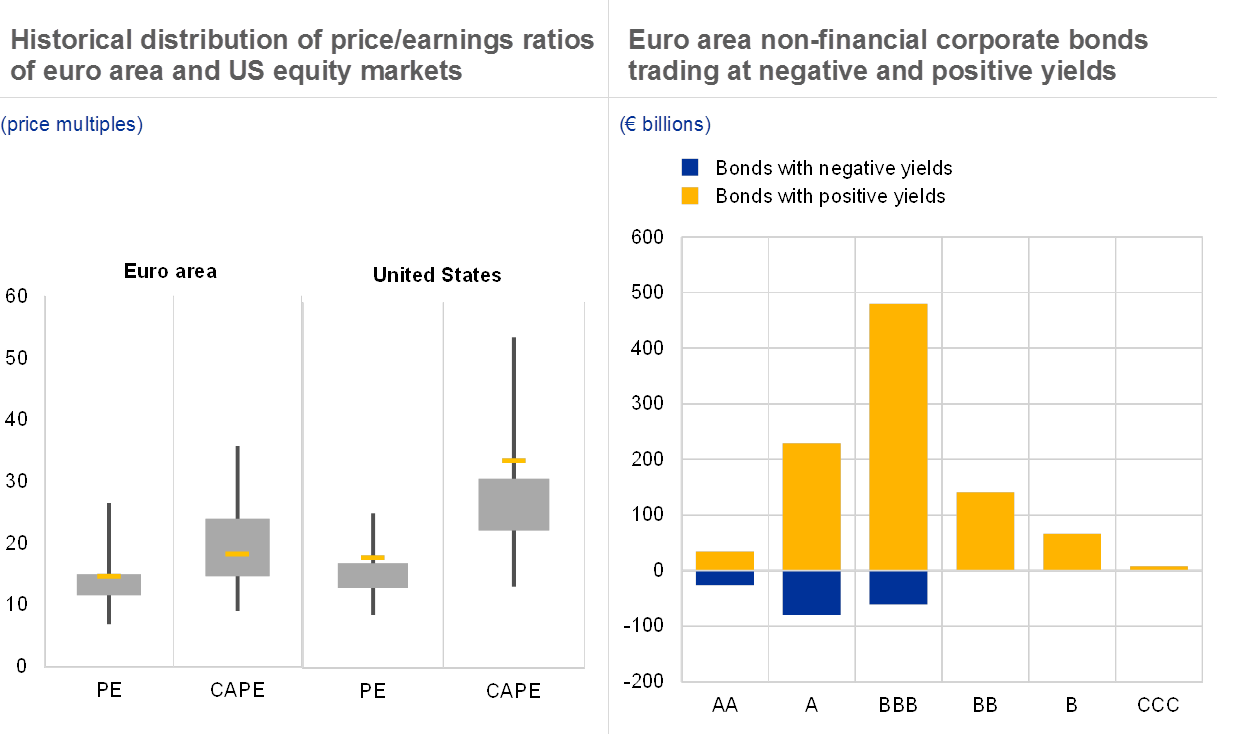

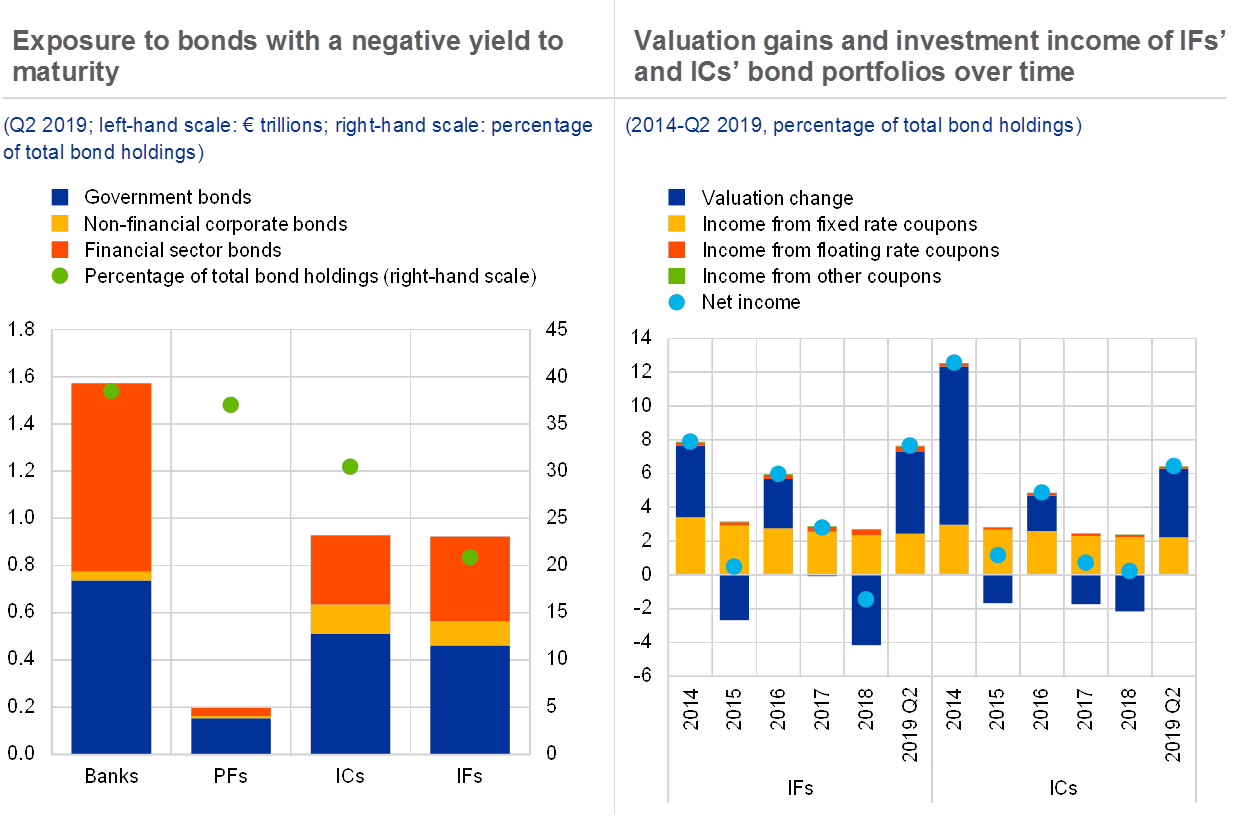

Very low benchmark bond yields have been the main driver behind increasing corporate bond and equity valuations. Low or negative interest rates are expected to lead to search-for-yield behaviour and higher riskier asset prices, as investors seek a higher return from assets with lower credit quality and longer maturities (see Chapter 4). Some of this increase in risk-taking would be an intended effect of accommodative monetary policy. But the persistence of a low yield environment can lead to some valuations becoming misaligned, and therefore being at risk of abrupt correction in the future. Following appreciation over the last decade, euro area and US equity price indices, in relation to near-term earnings expectations, stand at and above the upper end of their respective historical interquartile ranges (see Chart 2.9, left panel). In the United States, the cyclically adjusted price/earnings (CAPE) ratio stands at its second highest level ever, while euro area equity valuations appear on aggregate in line with their historical average for this metric. Box 2 presents an analysis of the relationship between developments in risk-free rates and prices of corporate bonds and equities and concludes that valuations of riskier assets are consistent with, but highly dependent on, the historically low level of the benchmark yield curve.

Low funding costs incentivise higher levels of corporate leverage, which might amplify market corrections in a severe economic downturn. The lower and flatter term structure has significantly reduced funding costs for corporates which is also an intended effect of accommodative monetary policy. As credit spreads range at moderate levels, the phenomenon of negative yields has extended to corporate bonds, with close to half of AA-rated, a quarter of A-rated and still around a tenth of BBB-rated corporate bonds trading at negative yields (see Chart 2.9, right panel). Moreover, improved interest coverage ratios have enabled companies to increase their leverage. In fact, borrowers have increased the average maturity of their debt to lock in favourable financing conditions and mitigate their rollover risk. Such balance sheet policies may be optimal for companies in the presence of strong economic growth. However, high levels of corporate leverage may prove unsustainable if the earnings outlook deteriorates in a more protracted manner. Both markets and rating agencies tend to discriminate between corporates with high and low levels of leverage during economic downturns (see Box 2), so companies with higher levels of leverage face more frequent downgrades and higher credit spreads.

Chart 2.9