Welcome to a revamped Financial Stability Review (FSR). Ever since the FSR was launched in 2004 by my late colleague Tommaso Padoa-Schioppa, the publication has continued to evolve and improve. The present issue introduces a number of new features, both in substance and in form. First, the Overview has been redesigned with the aim of offering a more thematic and comprehensive view of the key vulnerabilities for euro area financial stability, mirroring the discussion in the main chapters of the Review.

Second, the scope of the policy considerations presented in the Overview has been expanded beyond financial regulation to also include a section on Recommendations and policy considerations dedicated to issues relevant for financial stability in the euro area. Areas covered in this issue include housing markets, bank business models and non-performing loans, cybersecurity and the asset management sector.

Third, two new important systemic risk indicators are introduced which can be used as predictors of the consequences of financial instability for the real economy. The financial stability risk index (FSRI) predicts the near-term recessionary effects of financial stress, while the cyclical systemic risk indicator (CSRI) anticipates the medium-term consequences of financial instability (see Special Features A and B). The new systemic risk indicators will improve our ability to detect near to medium-term risks to financial stability in terms of “GDP-at-risk”. Other uses of these new indicators in calibrating the impact of macroprudential measures will be explored in the future, as the traditional credit-to-GDP gap has become less reliable. The methodology for assessing “GDP-at-risk” is fully in line with our definition of systemic risk. Systemic risk materialises when the ability of the financial system to provide essential financial products and services to the real economy is impaired to a point where economic growth and welfare may be materially affected.

Fourth, the scenario analysis in the chapter on Euro area financial institutions has been significantly changed. Previously, the section focused on measuring the impact on the solvency of banks and insurance companies of the various categories of identified risks in isolation. The main risks have now been mapped into two broad and internally coherent adverse scenarios to assess the resilience of the euro area banking sector. The chapter also includes the assessment of the non-bank financial sector, comprising euro area insurers and investment funds.

Fifth, a new chapter discusses developments in the Regulatory framework of the whole financial system in an all-encompassing manner. Financial regulation is the foundation of macroprudential policy because it deals with the design and calibration of instruments and the basic rules that impact the overall resilience of the financial system.

With analytical tools and recommendations, the FSR continues to fulfil its role in assessing developments relevant for financial stability, including identifying and prioritising the main sources of systemic risk and vulnerabilities for the euro area financial system – comprising intermediaries, markets and market infrastructures. It does so to promote awareness of these systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability. The FSR also plays an important role in relation to the ECB’s microprudential and macroprudential competences, including the power to top up national macroprudential measures. By providing a financial system-wide assessment of risks and vulnerabilities, the Review provides key input to the ECB’s macroprudential policy analysis. Such a euro area system-wide dimension is an important complement to microprudential banking supervision, which is more focused on the soundness of individual institutions. While the ECB’s roles in the macroprudential and microprudential realms rely primarily on banking sector instruments, the FSR focuses on the risks and vulnerabilities of the financial system at large, including – in addition to banks – shadow banking activities involving non-bank financial intermediaries, financial markets and market infrastructures.

In addition to its overview of current developments relevant for euro area financial stability, this Review includes eight boxes and three special features aimed at deepening the ECB’s financial stability analysis and broadening the basis for macroprudential policymaking.

The Review has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks.

Vítor Constâncio

Vice-President of the European Central Bank

The financial stability environment in the euro area has remained favourable over the past six months. On the one hand, the economic expansion in the euro area has continued. As a result, the debt-servicing and loss-absorption capacities of sovereigns, firms, households and financial institutions have strengthened. The improvement in economic growth has also supported a moderate, albeit not excessive, pick-up in credit origination, which will support bank profitability. On the other hand, developments in asset prices require close monitoring as risk-taking continues to gain momentum in financial markets. At this stage no broad-based asset price misalignments can be observed across euro area financial and tangible assets. Some pockets of stretched valuations are, however, building up, particularly for lower-rated bonds and in certain real estate markets.

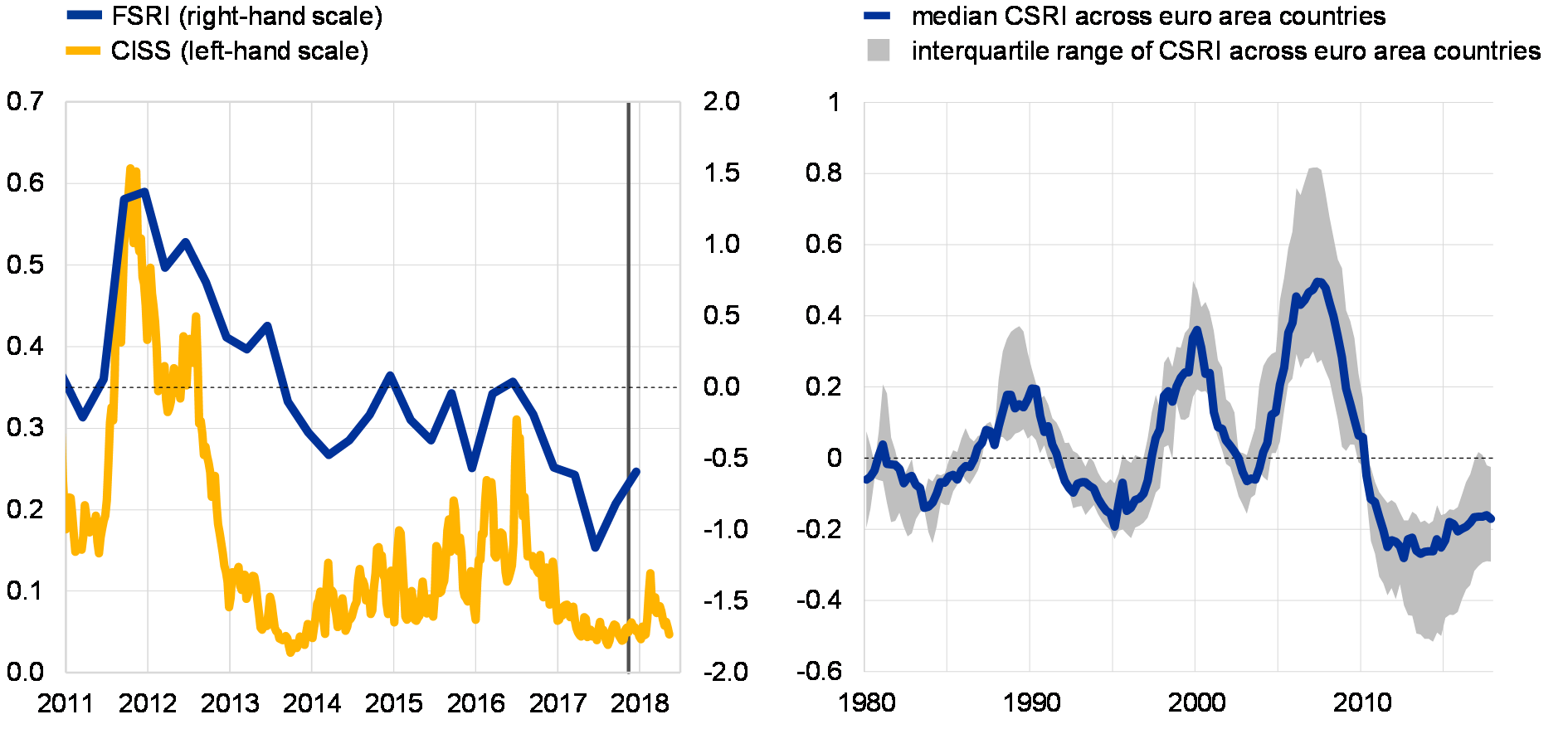

Summary indicators of systemic risk confirm a favourable financial stability environment. The composite indicator of systemic stress in financial markets (CISS) continues to signal that financial system stress is currently low, although it picked up slightly in February following the turmoil in stock markets. This issue of the FSR introduces new indicators for gauging near and medium-term risks to euro area financial stability (for details, see Special Feature A and Special Feature B). The first is a composite financial stability risk index (FSRI) aimed at predicting large adverse shocks to the real economy in the near term (see Chart 1 – left panel). The second is a composite cyclical systemic risk indicator (CSRI) designed to signal risks of a financial crisis over the medium term (see Chart 1 – right panel). Both indicators have fluctuated at low levels in recent quarters, implying a low likelihood of systemic risks to the euro area materialising in the near-to-medium term. While recent readings have increased somewhat, they come at a time of upward revisions to consensus expectations for GDP growth.

Chart 1

Economy-wide and financial market indicators of near-term and medium-term systemic risk remained contained

Financial stability risk index for the euro area economy and composite indicator of systemic stress in financial markets (left panel) and median of cyclical systemic risk indicator across euro area countries (right panel)

(left panel: Jan. 2011 – May 2018; Q1 2011 – Q4 2017; right panel: Q1 1980 – Q4 2017, median and interquartile range)

Sources: Bloomberg, ECB, Eurostat and ECB calculations.

Notes: For details on the FSRI, see Special Feature A. The scale in the left panel measures deviation from the historical mean expressed in multiples of the historical standard deviation. The CISS is normalised to lie between 0 and 1. FSRI: quarterly frequency; CISS: weekly frequency, two-week moving averages. The vertical line in the left panel represents the publication of the previous FSR on 29 November 2017. For details on the CSRI, see Special Feature B. The scale in the right panel measures deviation from the historical median expressed in multiples of the historical standard deviation.

This FSR identifies four key risks to euro area financial stability over the next two years. The first risk relates to spillovers from a disruptive repricing of term and other risk premia in global financial markets. The second risk concerns a potential hampering of banks’ intermediation capacity amid weak financial performance compounded by structural challenges. The third risk highlights public and private debt sustainability concerns amid historically high debt levels. Finally, the fourth risk relates to liquidity risks that could emerge in the non-bank financial sector, with contagion to the broader system. All four of these risks are intertwined and the materialisation of any one of them could potentially trigger the materialisation of the others.

Improved economic prospects

Since the November 2017 FSR, global economic growth prospects have further strengthened, but downside risks remain. The macroeconomic environment outside the euro area has improved overall, supported by favourable financing conditions and strengthening labour markets. Confidence indicators suggest that the global economic outlook will continue on its positive trajectory in the near term. Downside risks to the global macro outlook could, however, materialise via a number of channels. First, growth could deteriorate if uncertainties surrounding the fiscal and monetary policy mix in the United States increase. Second, a significant escalation of trade tensions risks derailing the ongoing expansion in global trade and activity. Third, abrupt changes in market sentiment and repricing in asset markets could lead to a real economic downturn via confidence and balance sheet channels.

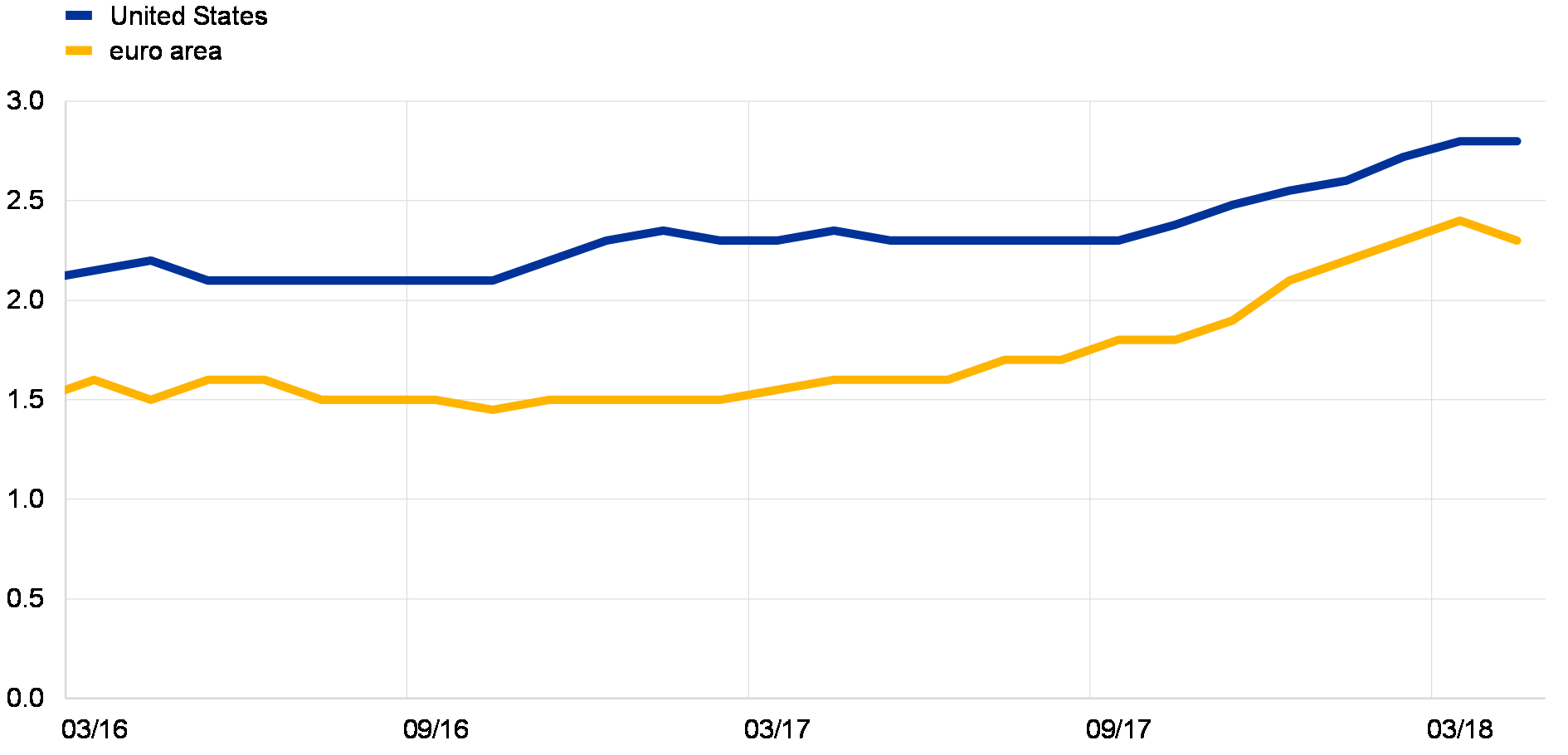

Financial stability in the euro area continues to benefit from a robust growth outlook (see Chart 2). Recent readings for the euro area confirm a solid and broad-based expansion of the euro area economy. Real GDP growth is expected to remain above potential until 2020. Downside risks to euro area real GDP growth continue to relate primarily to global factors, including developments in foreign exchange and other financial markets.

Chart 2

Improved economic growth prospects

US and euro area real GDP growth expectations for 2018

(Mar. 2016 – Apr. 2018; annual percentages)

Source: Bloomberg.

Note: Expectations of market analysts as surveyed by Bloomberg.

The resilience of the euro area economy has improved. Almost all euro area countries previously under stress in the crisis now have budget deficits below 3% of GDP. A broad-based improvement in primary balances can be observed, which has strengthened sovereigns’ shock-absorption capacity. Current account deficits have turned into surpluses owing to both structural and cyclical factors. All in all, the euro area is more resilient and better prepared to weather possible financial shocks coming from the international environment.

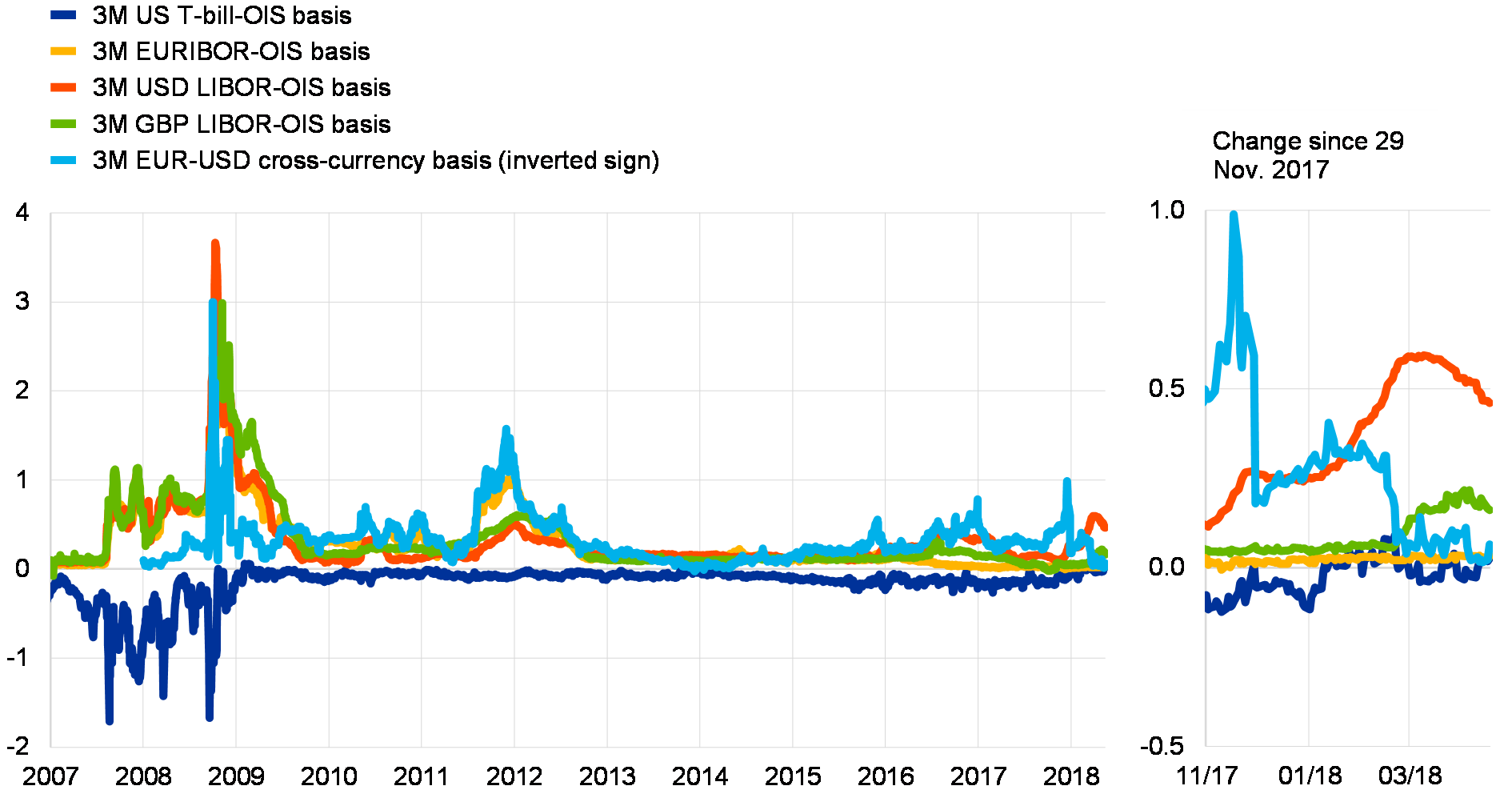

High indebtedness across sectors in a number of countries poses risks to financial stability

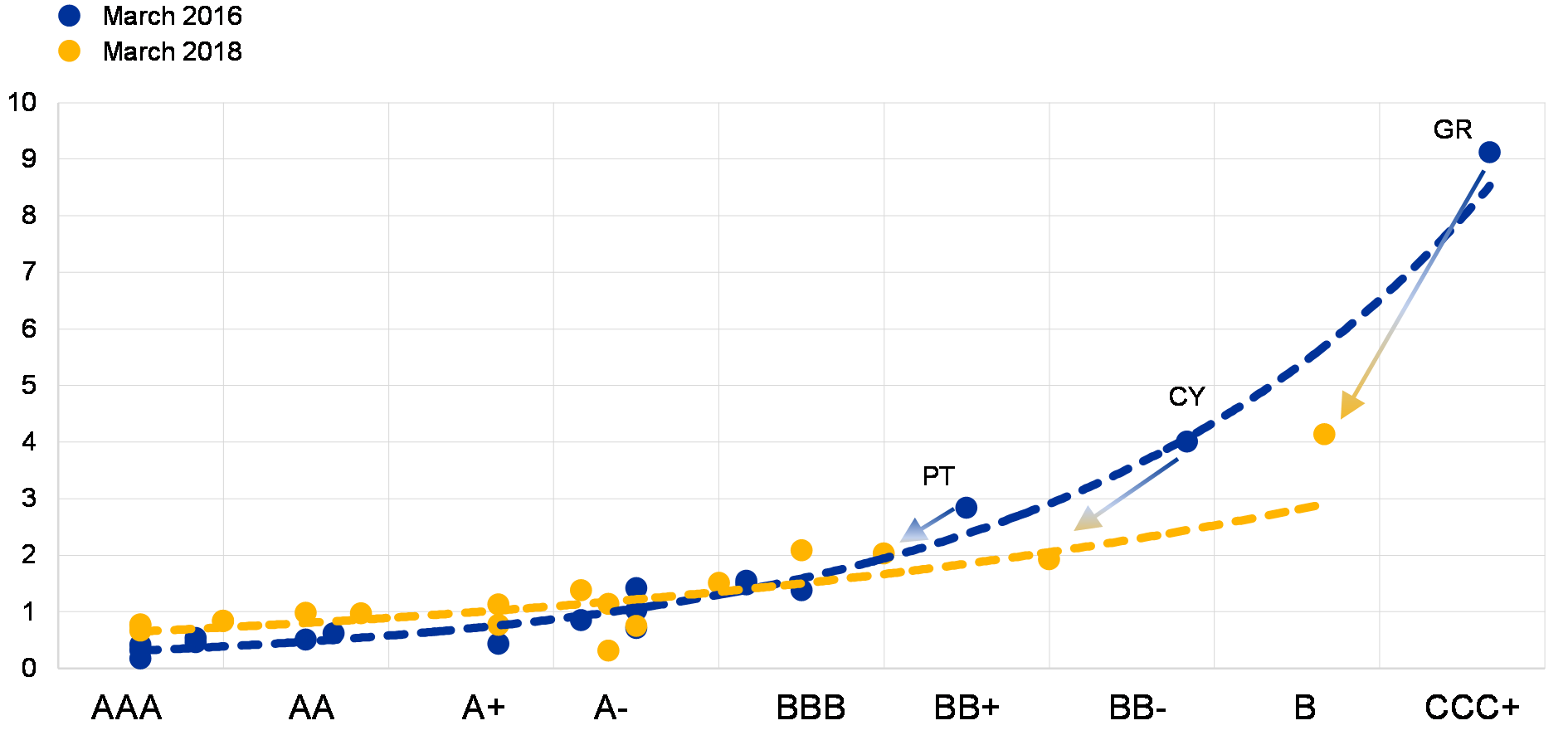

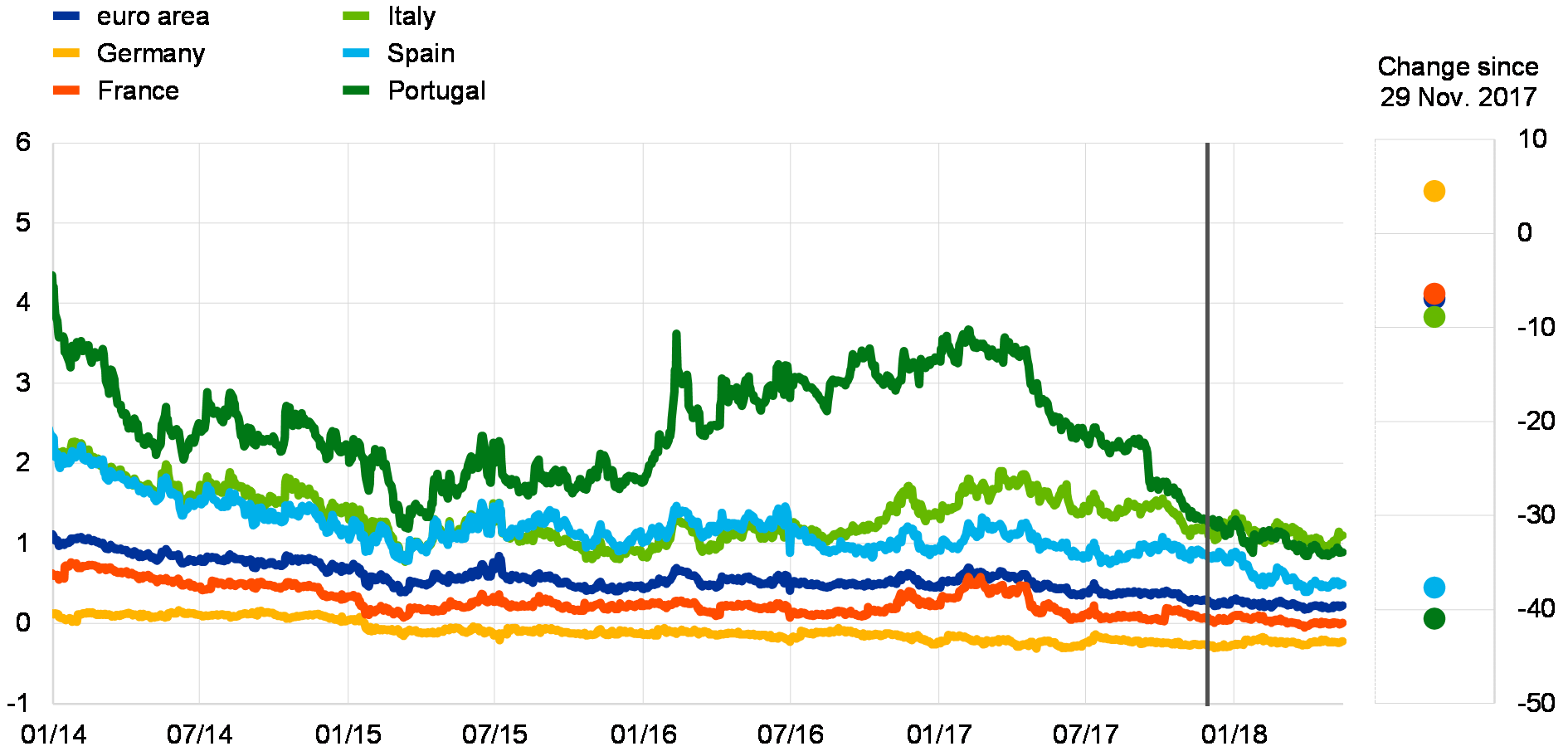

The improved macro outlook has benefited euro area sovereign financing costs. The creditworthiness of euro area sovereigns has improved, as confirmed by a number of rating upgrades. The brighter economic conditions, coupled with the overall favourable market sentiment, have contributed to lower financing costs across a number of euro area jurisdictions (see Chart 3).

Chart 3

Favourable financing costs for euro area sovereigns

Ten-year government bond yields and credit ratings of euro area sovereigns

(ratings; percentages per annum)

Sources: Standard & Poor’s, Moody’s, Fitch, ECB and ECB calculations.

Notes: The rating score represents the average rating by the three major rating agencies, Moody’s, Standard & Poor’s and Fitch. The bond yields indicate the long-term interest rate for convergence purposes (secondary market yields of government bonds with maturities of ten, or close to ten, years).

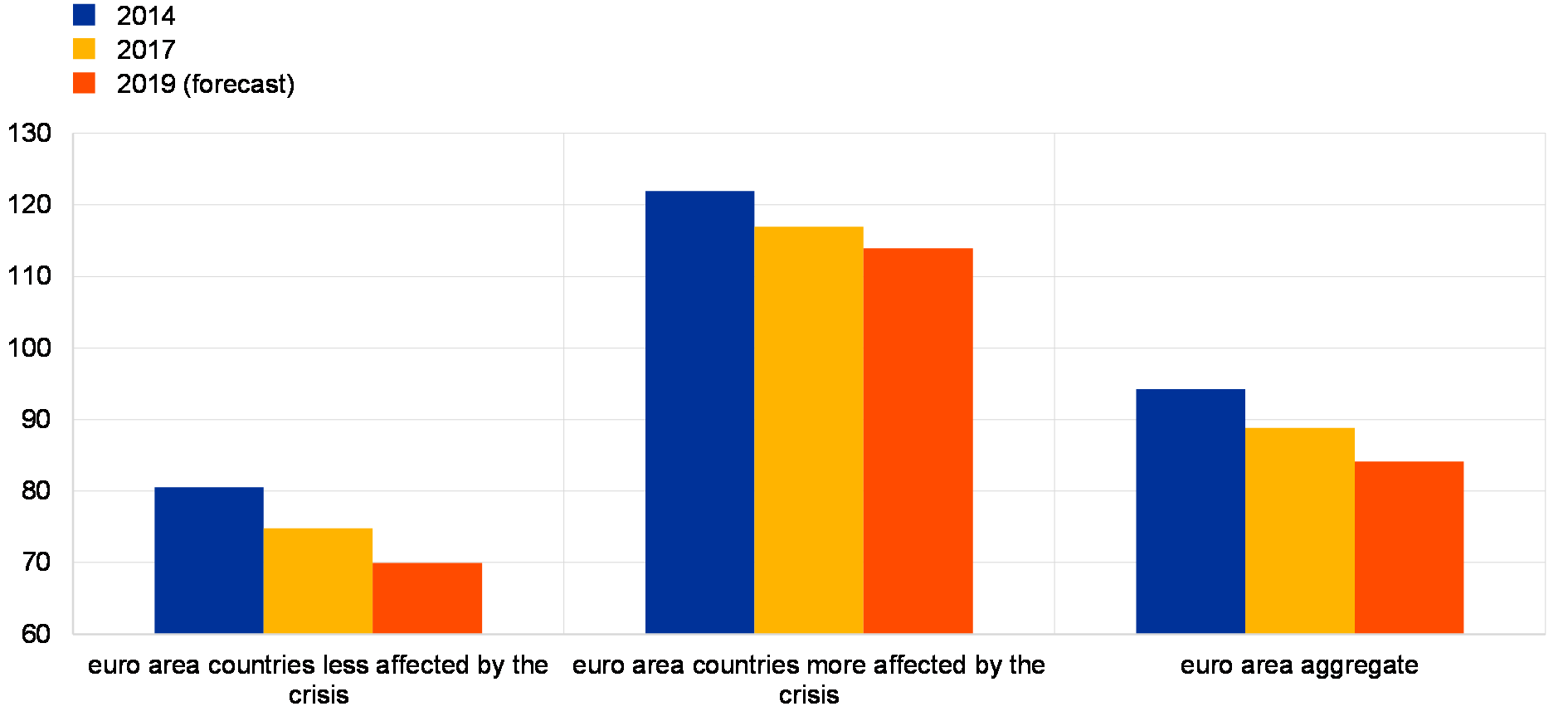

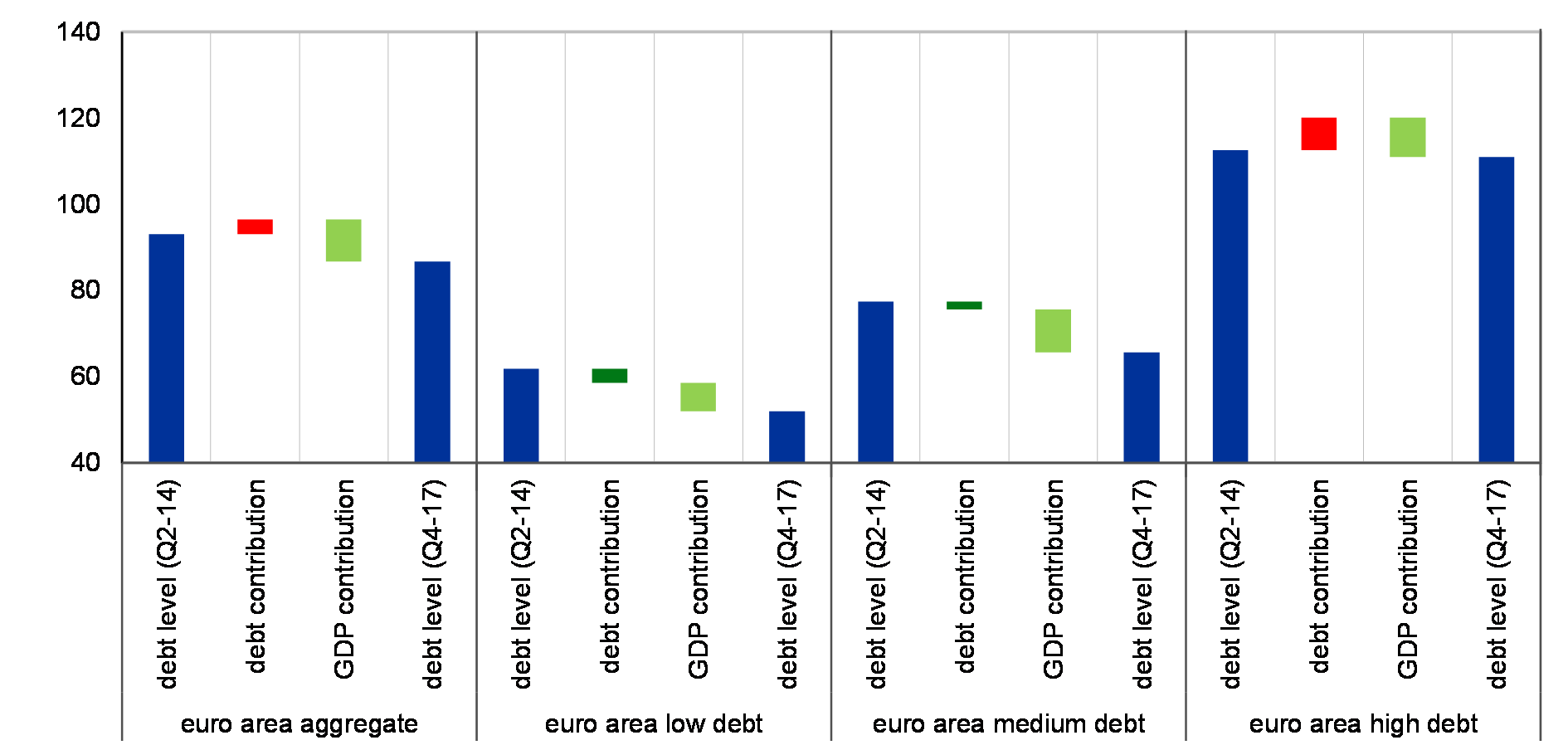

Despite the overall favourable developments in recent quarters, some euro area sovereigns remain vulnerable. Headline fiscal balances and the level of indebtedness across euro area countries are expected to improve over the coming years, strongly supported by the advantageous cyclical conditions. Some progress has been made across the euro area in reducing public debt levels, but in some countries they are still fairly elevated, highlighting the need to continue to maintain primary surpluses (see Chart 4). Going forward, risks mainly relate to a deterioration in the growth environment that could have a pronounced impact on the fiscal outlook and, by extension, on market sentiment towards some euro area sovereigns. Debt sustainability concerns may also be triggered by a possible rise in (geo)political risks. Uncertainties regarding the finalisation of the Brexit negotiations and possible adverse trade implications stemming from protectionist tendencies in advanced economies have the potential to challenge the economic outlook, which may push sovereign credit risk premia higher. These vulnerabilities and potential triggers notwithstanding, debt sustainability concerns for the euro area sovereign sector are currently assessed to be lower than they were at the time of the November 2017 FSR.

Chart 4

Sovereign debt levels have come down in recent years amid cyclical tailwinds, but sovereign indebtedness remains elevated in some euro area countries

General government debt-to-GDP ratios across the euro area

(percentages of GDP)

Sources: European Commission (AMECO Database) and ECB calculations.

Note: Euro area countries more affected by the crisis include Cyprus, Greece, Ireland, Italy, Portugal, Spain and Slovenia.

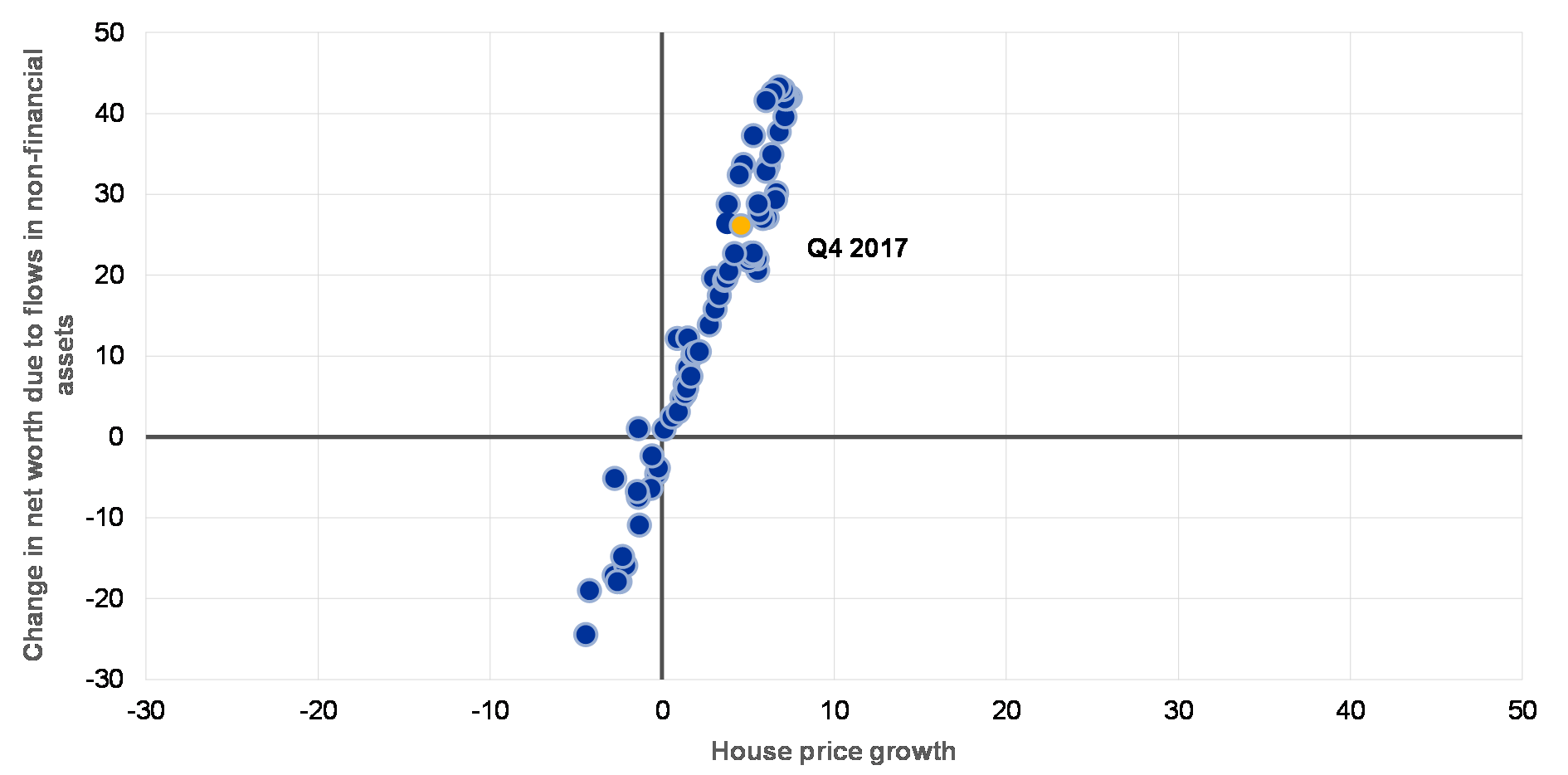

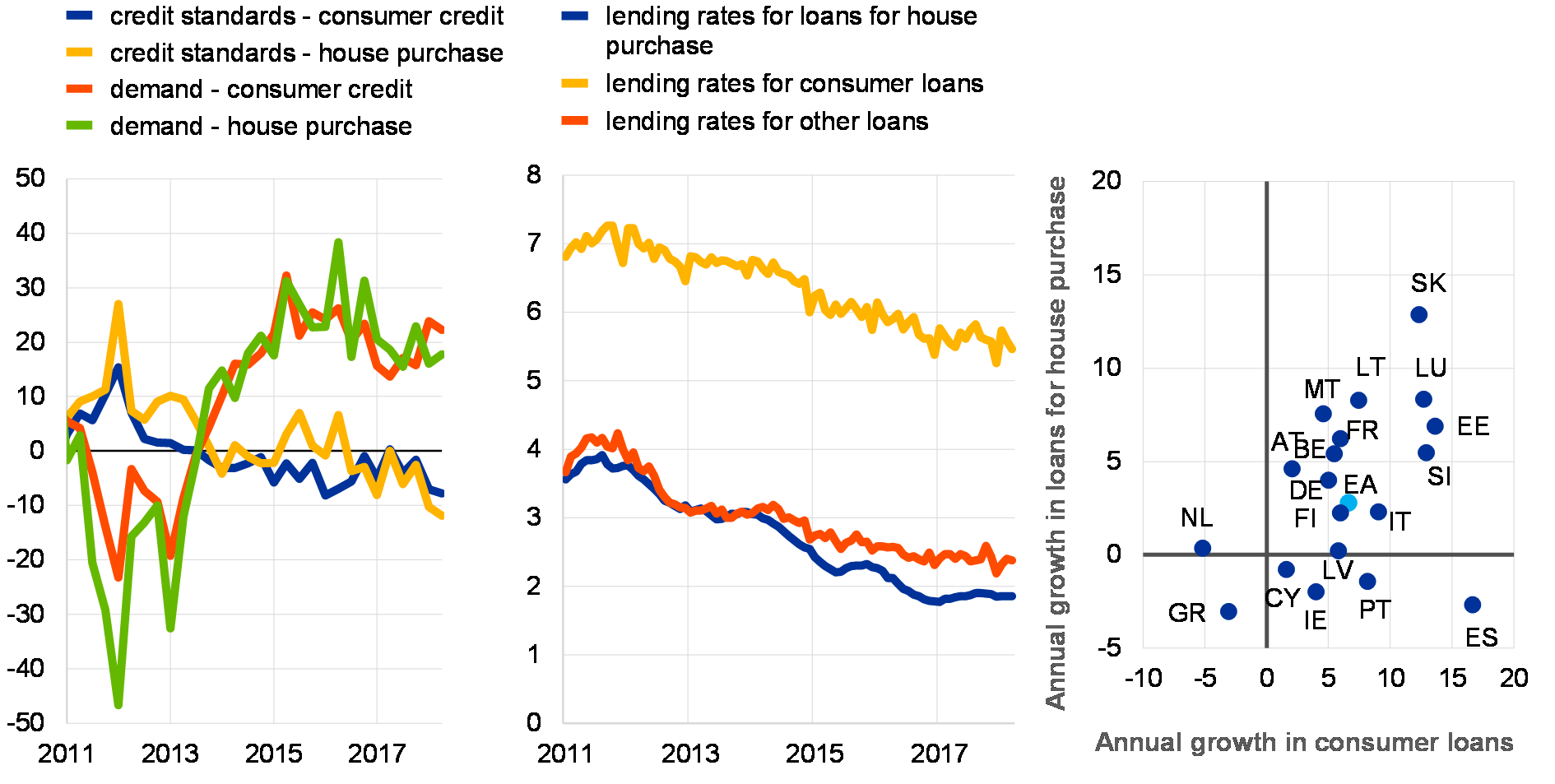

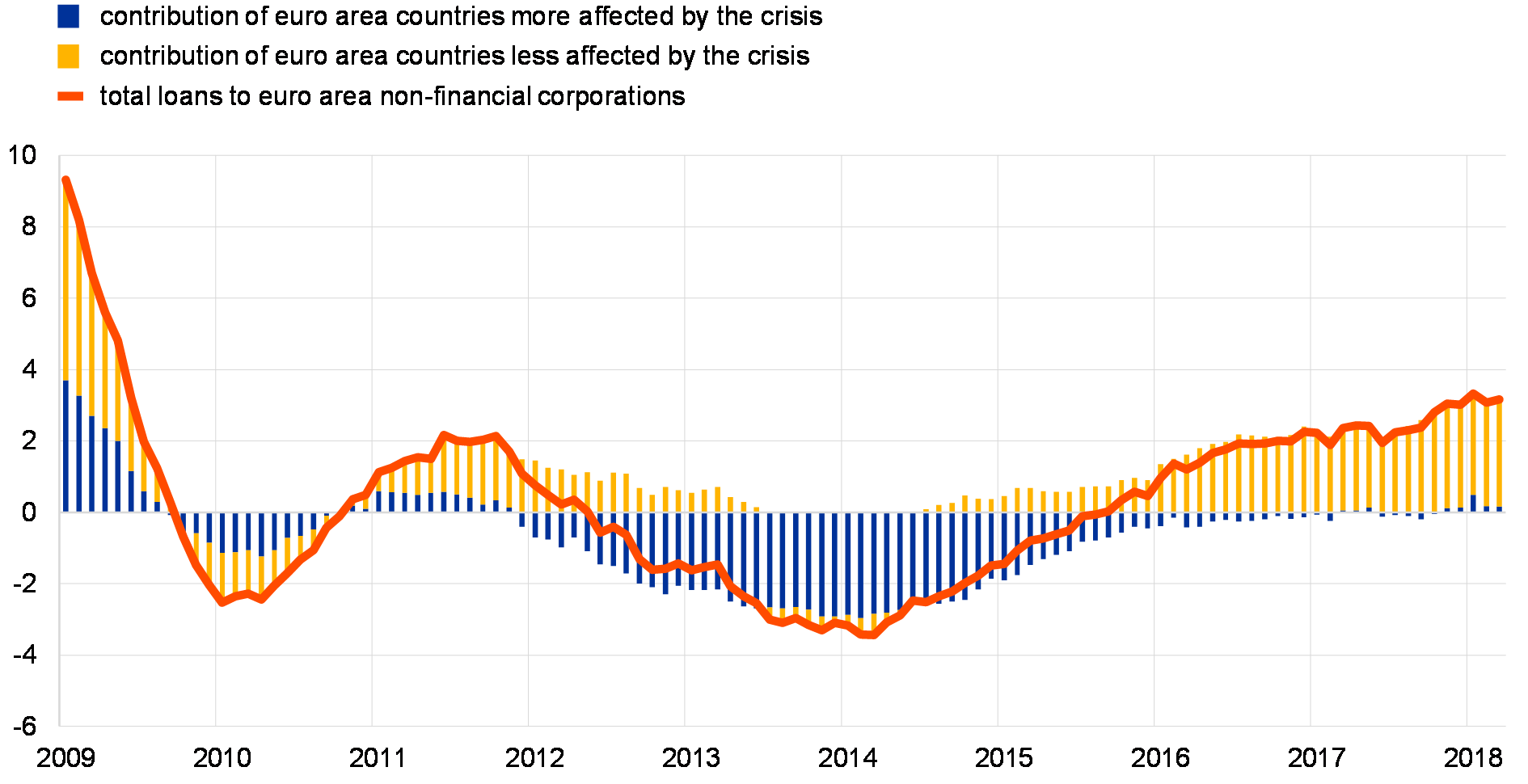

The private sector has also benefited from the favourable macroeconomic conditions, with credit flows recovering at a moderate pace. Bank lending to the corporate sector remains on a recovery path, reflecting supportive financing conditions, strong business confidence and the ongoing economic expansion. On the supply side, lending terms and conditions have continued to ease, albeit with some cross-country heterogeneity. In particular, bank lending conditions for firms continue to be tighter in most of the countries in which both firm indebtedness and non-performing loan (NPL) ratios are high. The household sector has also continued to take on more debt in an environment of favourable financing conditions, rising house prices and a further improvement in labour markets. The rate of growth in consumer credit has been particularly pronounced. In euro area mortgage markets, a rising volume of repayments of older loans – reflecting ongoing deleveraging of households in some countries – has been concealing an increasing dynamism in new loan origination over the past two years. The strength in the origination of new loans for house purchase is closely correlated with the buoyant house price dynamics observed in recent years.

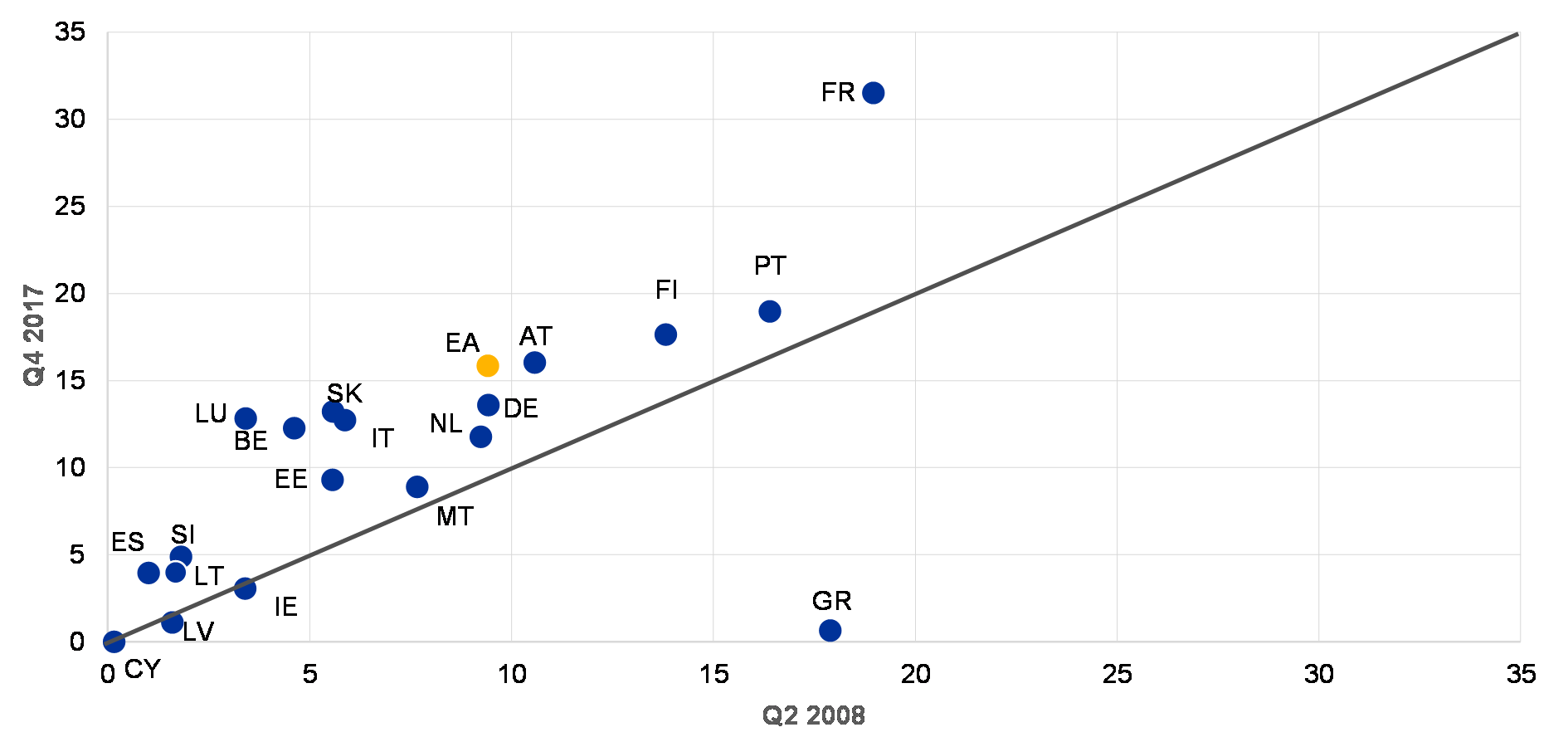

High indebtedness of households, firms and governments in a number of countries poses risks to financial stability. Deleveraging in the sovereign and non-financial private sectors has been relatively slow. As a result, debt-to-GDP ratios across sectors remain high relative to standard benchmarks in a number of countries, even in a context of contained credit growth (see Chart 5). Corporate indebtedness in particular remains high at the aggregate euro area level by both historical and international standards. The high indebtedness may lead to renewed debt sustainability concerns, especially in the event of a rapid worsening of growth prospects. Furthermore, there are risks that an intensification of vulnerabilities in one sector could spill over to other sectors, with negative repercussions for the banking system. That said, the introduction of the Bank Recovery and Resolution Directive (BRRD), which has strengthened banks’ loss-absorbing capacity, has reduced the likelihood of one possible spillover channel materialising – namely that between banks and sovereigns.

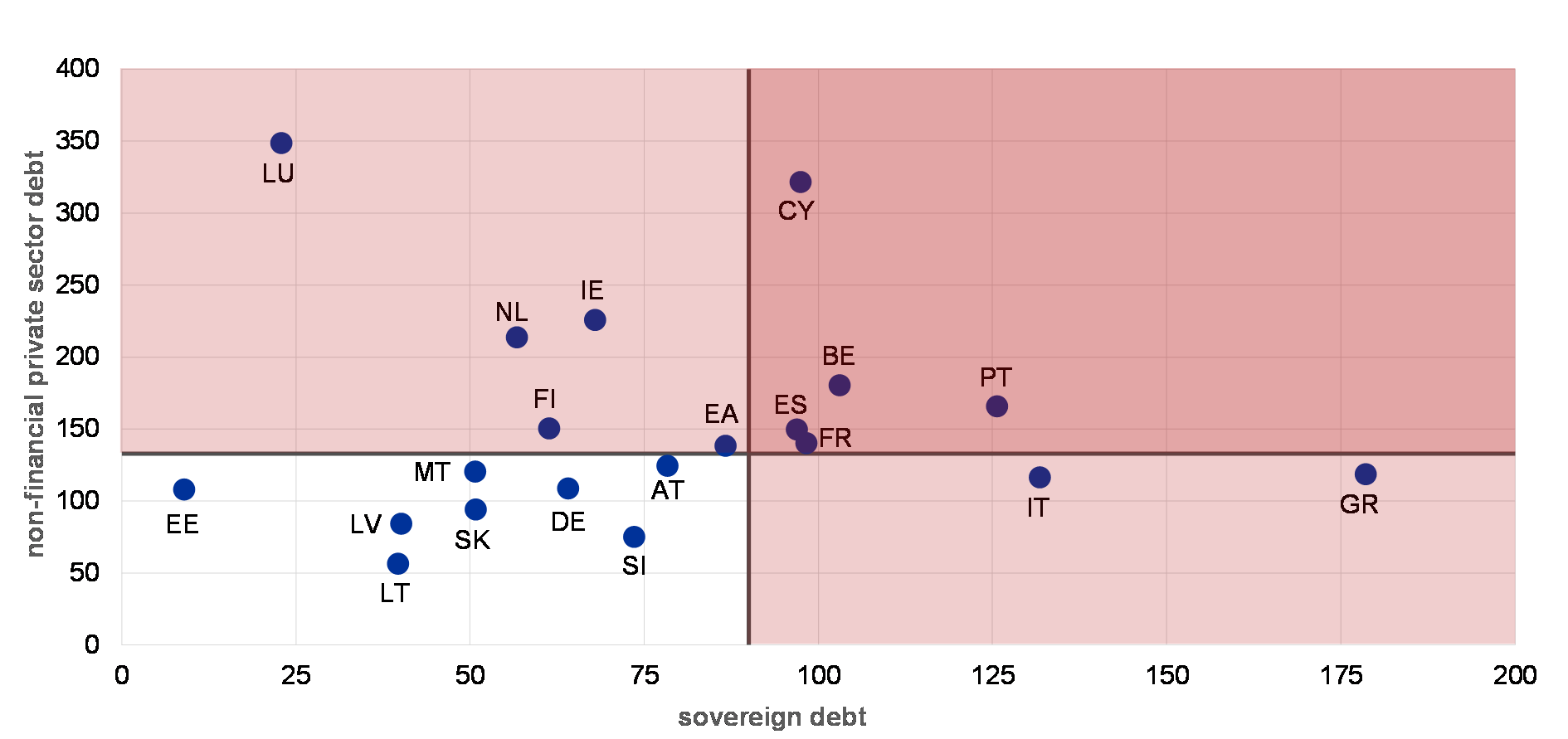

Chart 5

High indebtedness across households, non-financial firms and governments in several euro area countries

Indebtedness of the sovereign and non-financial private sectors

(Q4 2017; percentages of GDP)

Sources: ECB and ECB calculations.

Notes: The non-financial private sector comprises households and non-financial corporations, including debt relating to special-purpose entities (SPEs). Non-financial private sector debt figures are on a consolidated basis. The horizontal line represents the threshold of 133% of GDP for non-financial private sector debt based on the European Commission’s MIP Scoreboard. The vertical line represents the threshold of 90% of GDP for sovereign debt and is based on findings in the empirical literature. See, for example, Checherita, C. and Rother, P., “The impact of high and growing government debt on economic growth – an empirical investigation for the euro area”, Working Paper Series, No 1237, ECB, 2010. Consolidated non-financial corporate debt figures also include cross-border inter-company loans, which tend to account for a significant part of debt in countries where a large number of foreign entities, often multinational groups, are located (e.g. Belgium, Cyprus, Ireland, Luxembourg and the Netherlands). In the case of Ireland, GDP may not be the most representative scaling variable given the activities of foreign-owned multinational enterprises resident in the country. Alternative metrics that are more related to the domestic economy, such as the Modified Gross National Income (GNI*) or Modified Domestic Demand, would yield considerably higher levels of sovereign and non-financial private sector indebtedness.

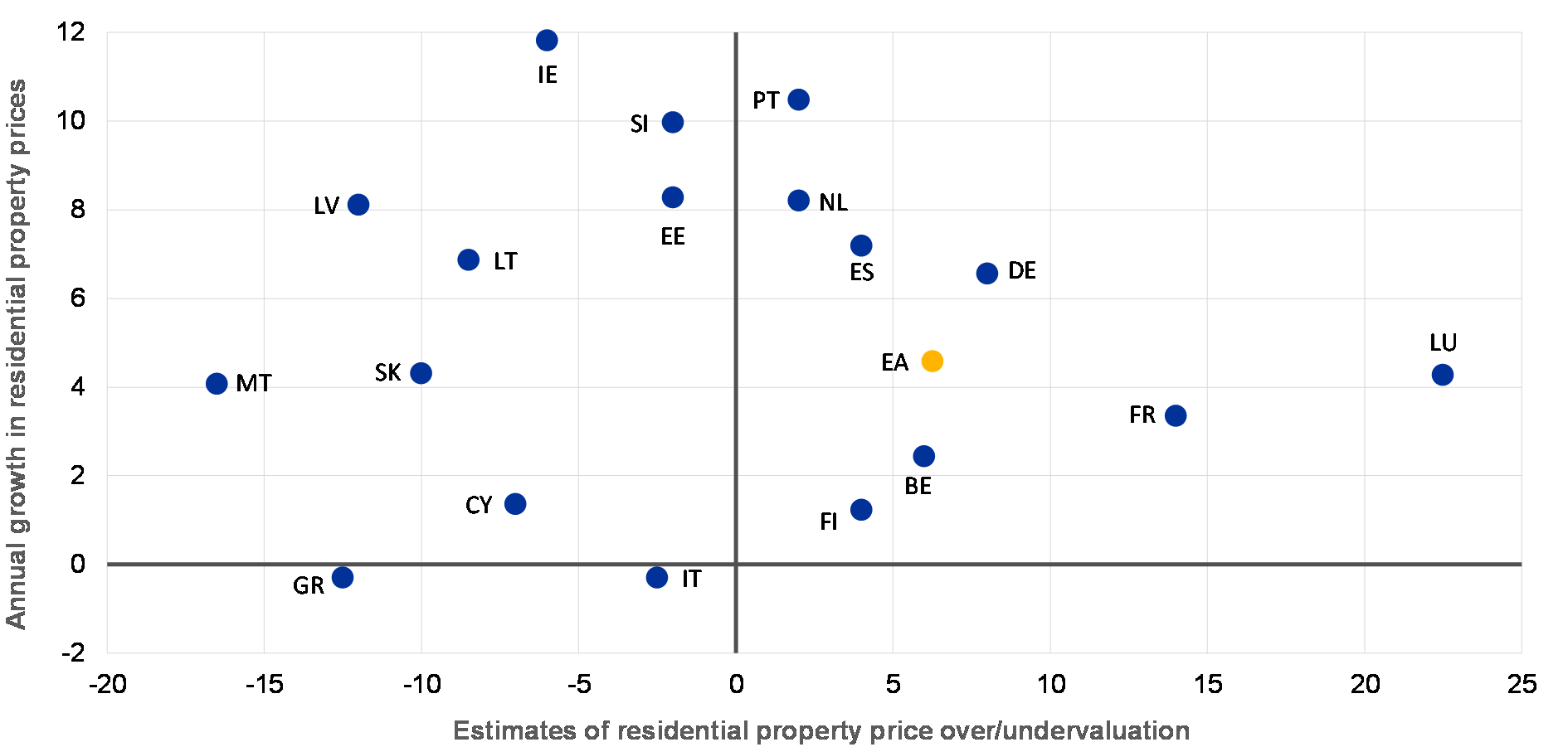

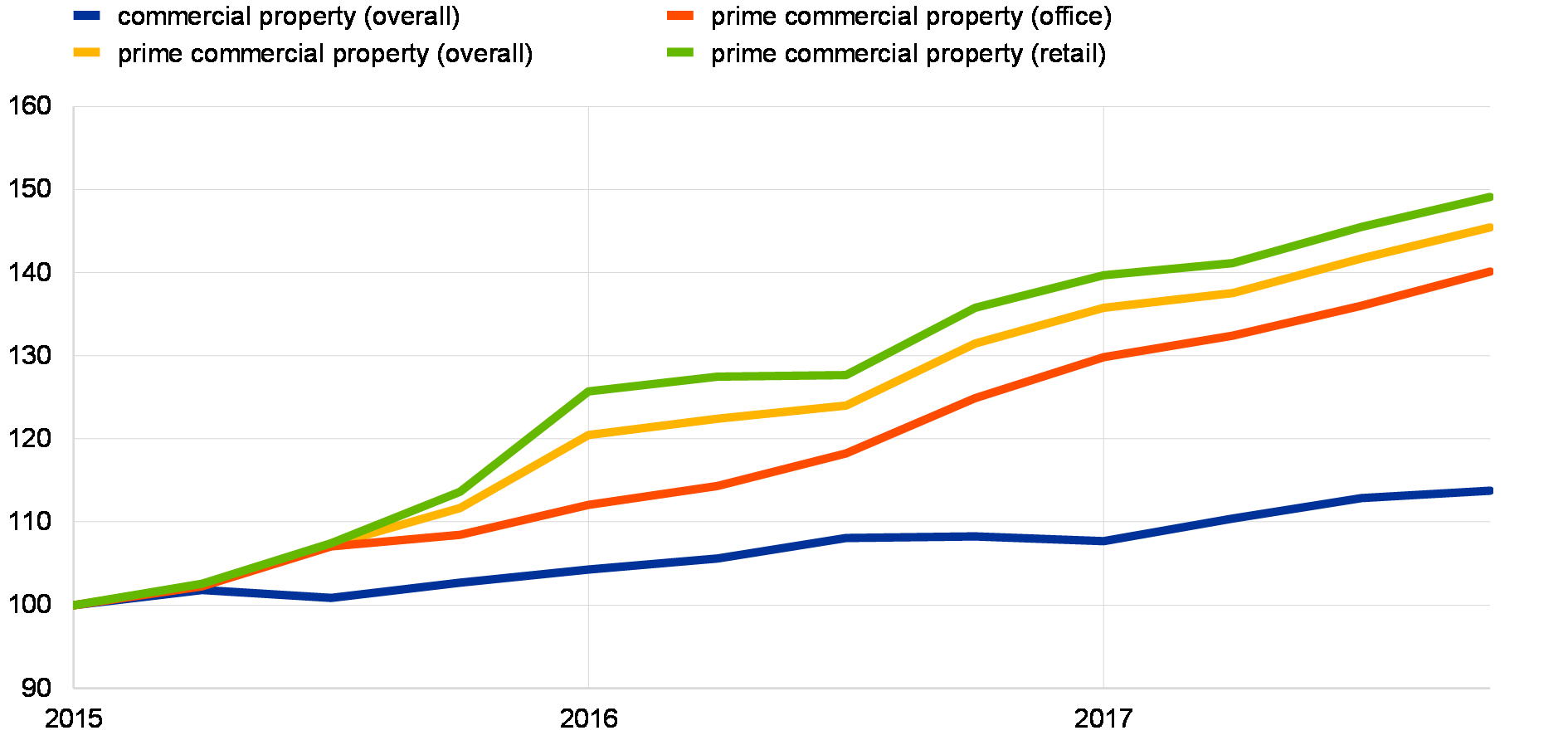

Vulnerabilities are building up in some euro area national housing markets

Some national real estate markets have experienced rapid price increases, exposing households and firms to vulnerabilities. In a number of countries and large cities, real estate prices have increased at a faster pace than household incomes. Indeed, prices in euro area residential real estate markets appear to be slightly above fundamental values (see Chart 6). Furthermore, prices in some euro area commercial real estate markets reached new highs, indicating potential misalignments vis-à-vis historical norms. Households and firms exposed to the real estate markets cannot expect past price performance to be a consistent indicator of future price developments. Thus, the build-up of vulnerabilities in the euro area real estate markets warrants careful monitoring with respect to the attendant financial stability risks in affected countries.

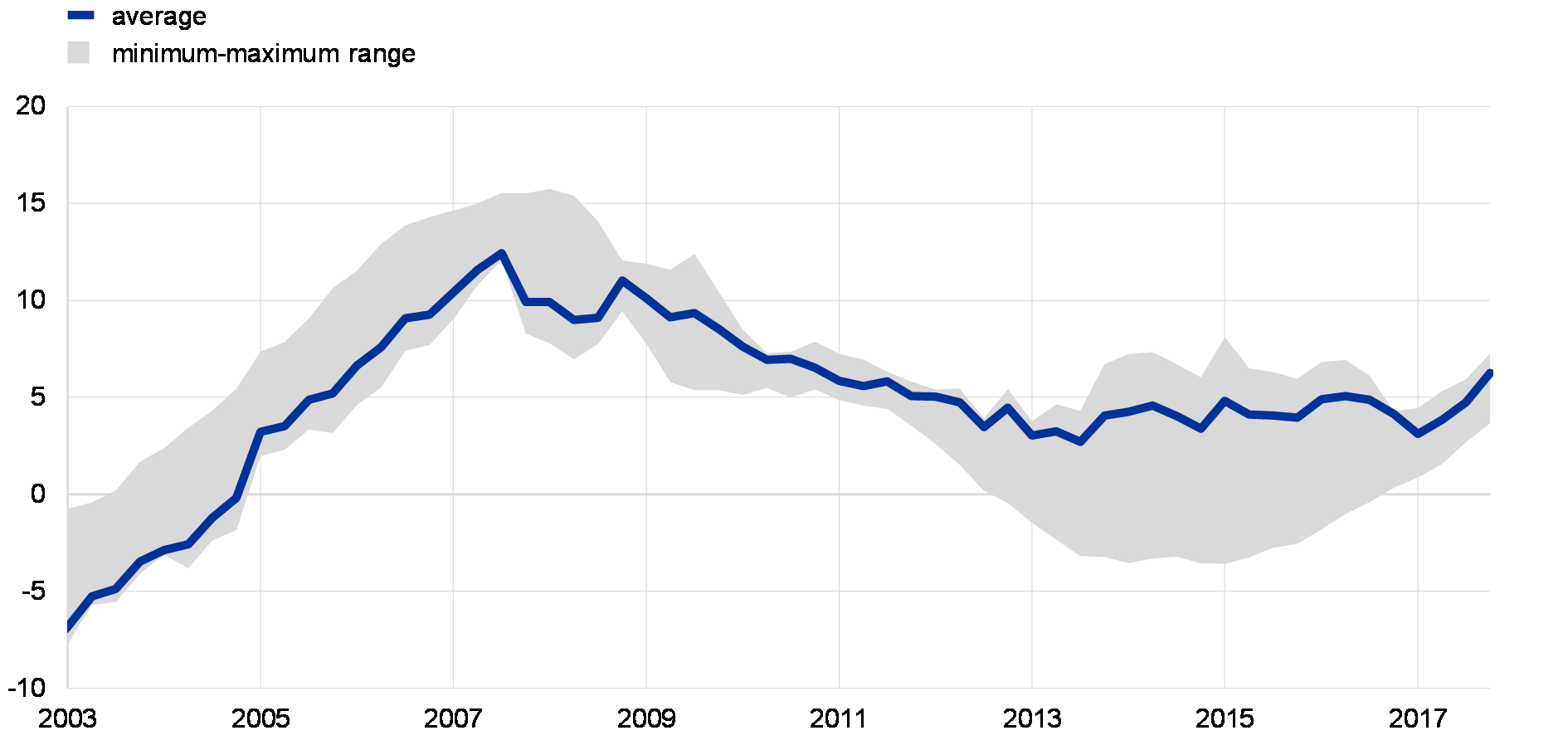

Chart 6

Euro area residential real estate prices slightly above those suggested by fair-value estimates amid measurement uncertainty

Residential property prices at the euro area level: deviations from estimated fair value

(Q1 2003 – Q4 2017; percentages, average valuations, minimum-maximum range across valuation estimates)

Sources: ECB and ECB calculations.

Notes: The fair-value estimations are based on four different methods: the price-to-rent ratio, the price-to-income ratio and two model-based methods, i.e. an asset pricing model and a new model-based estimate (Bayesian vector autoregression or BVAR). The average is based on the price-to-income ratio and the new model-based method. For details of the methodology, see Box 3 in Financial Stability Review, ECB, June 2011, and Box 3 in Financial Stability Review, ECB, November 2015.

Higher risk-taking in global financial markets

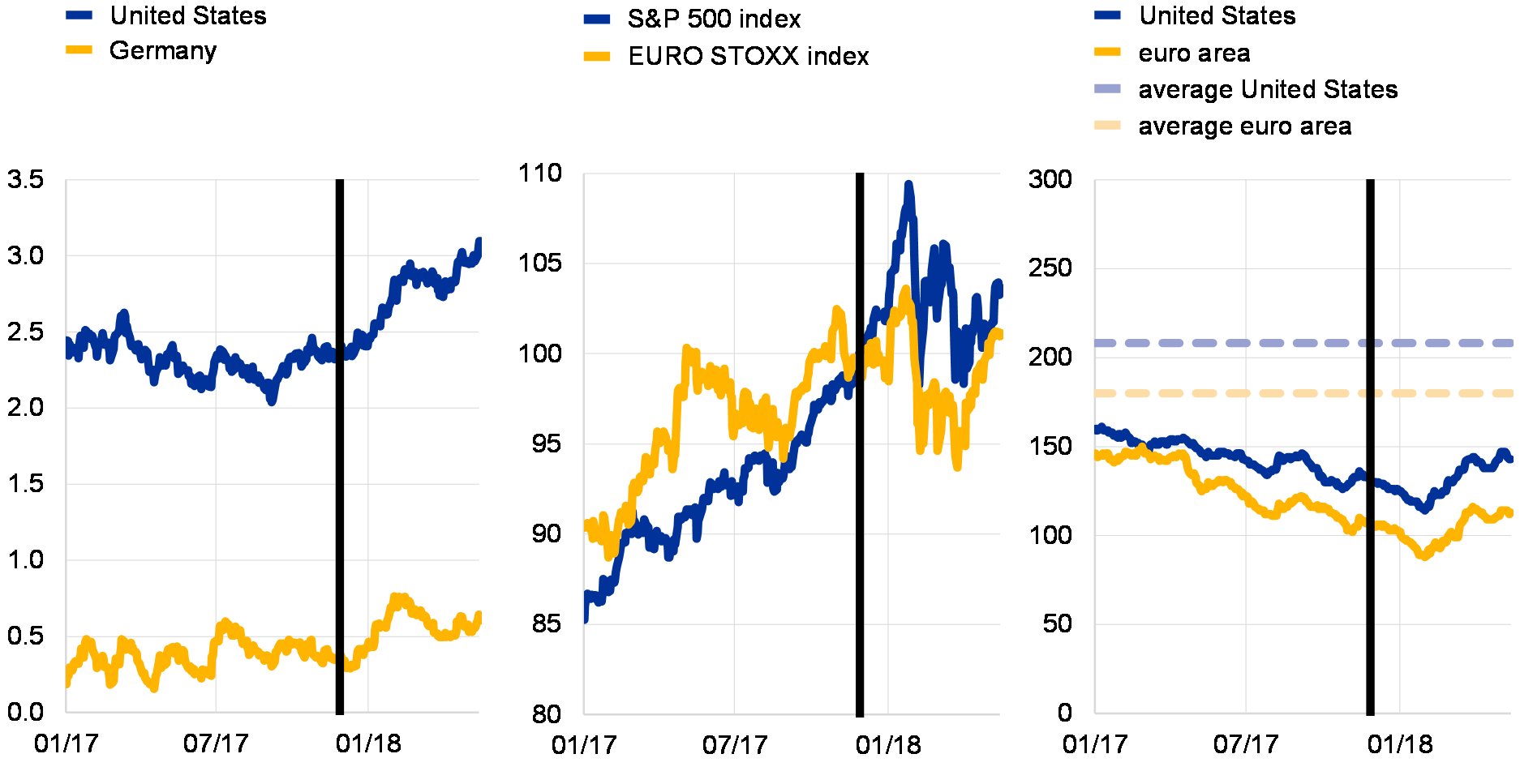

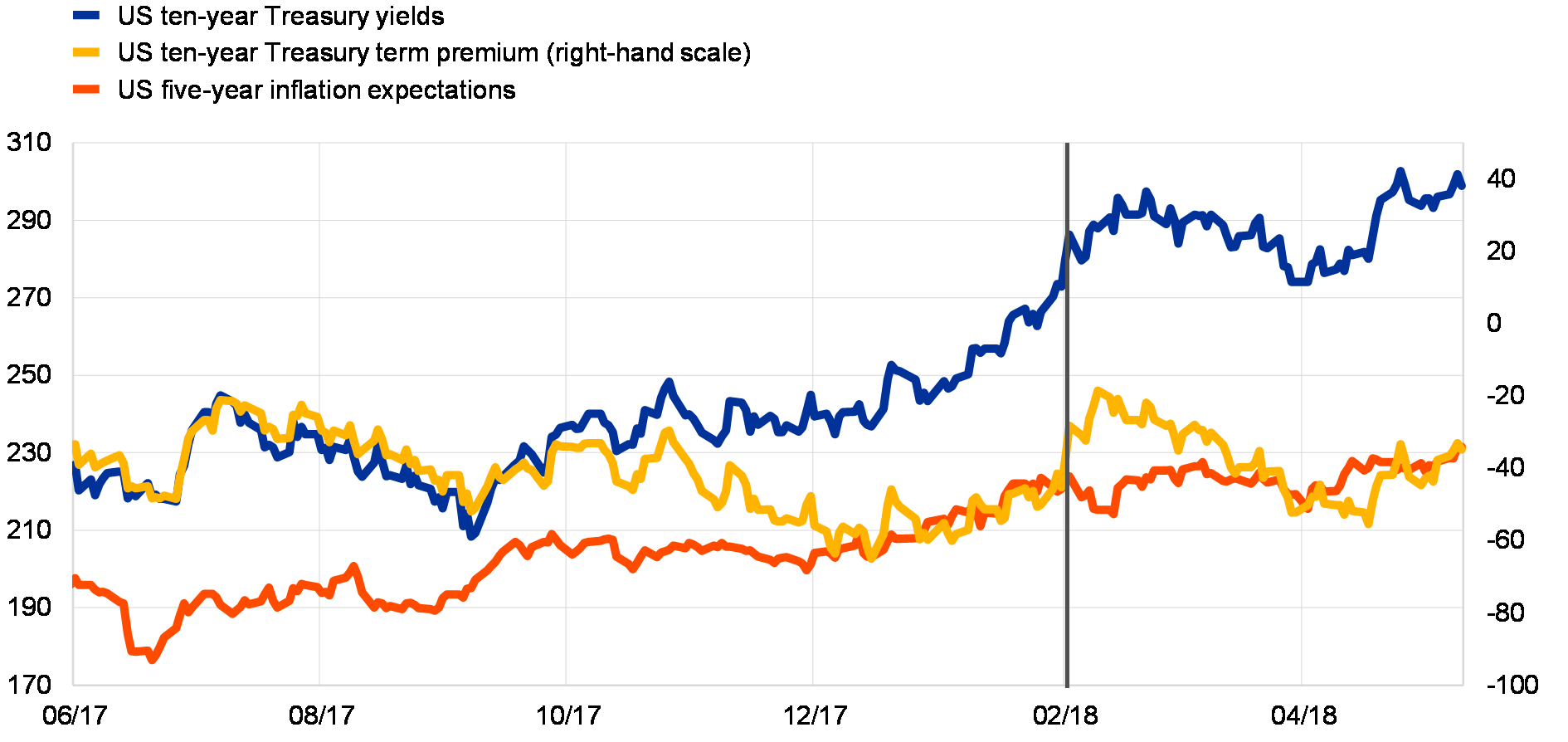

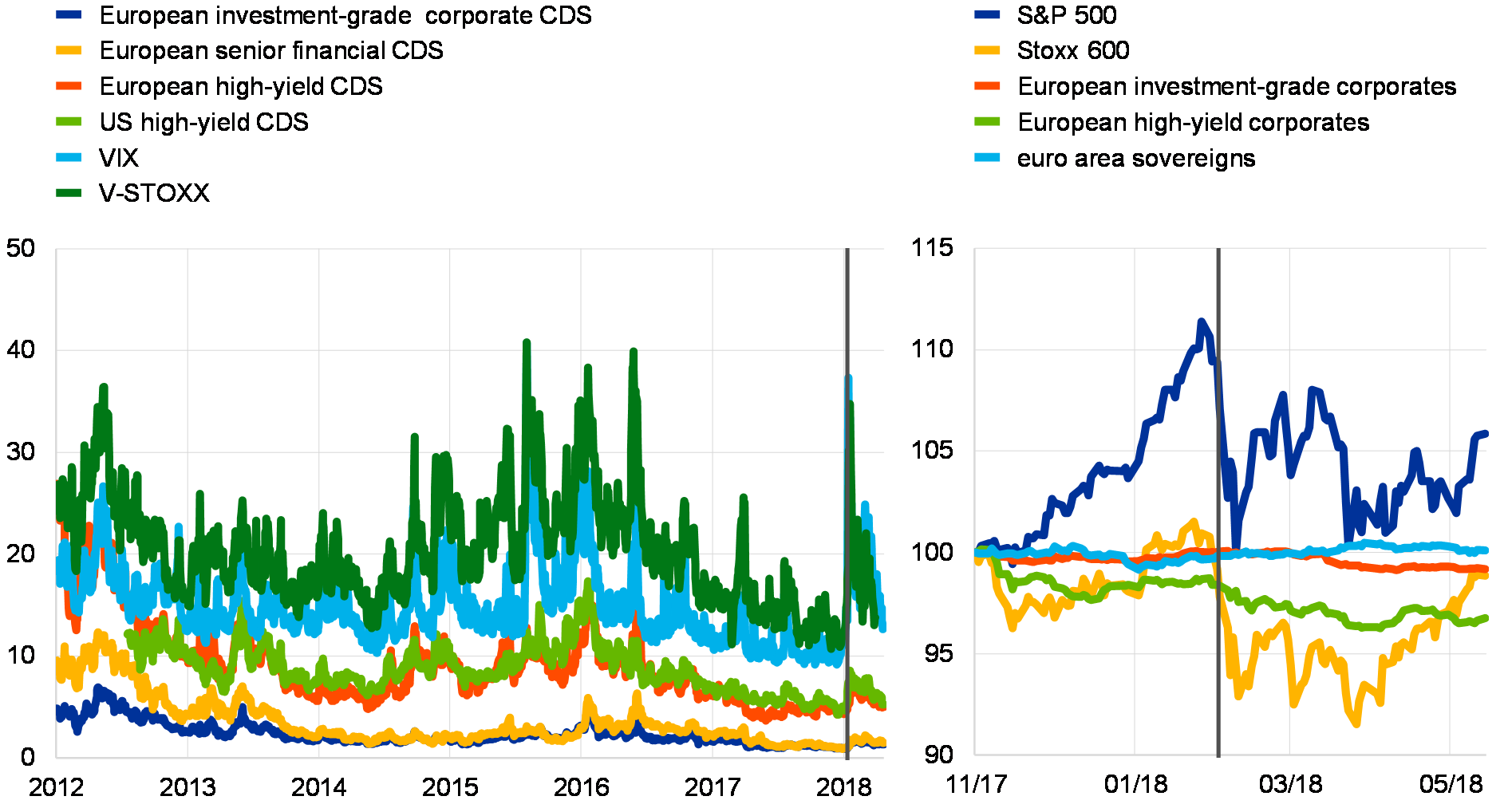

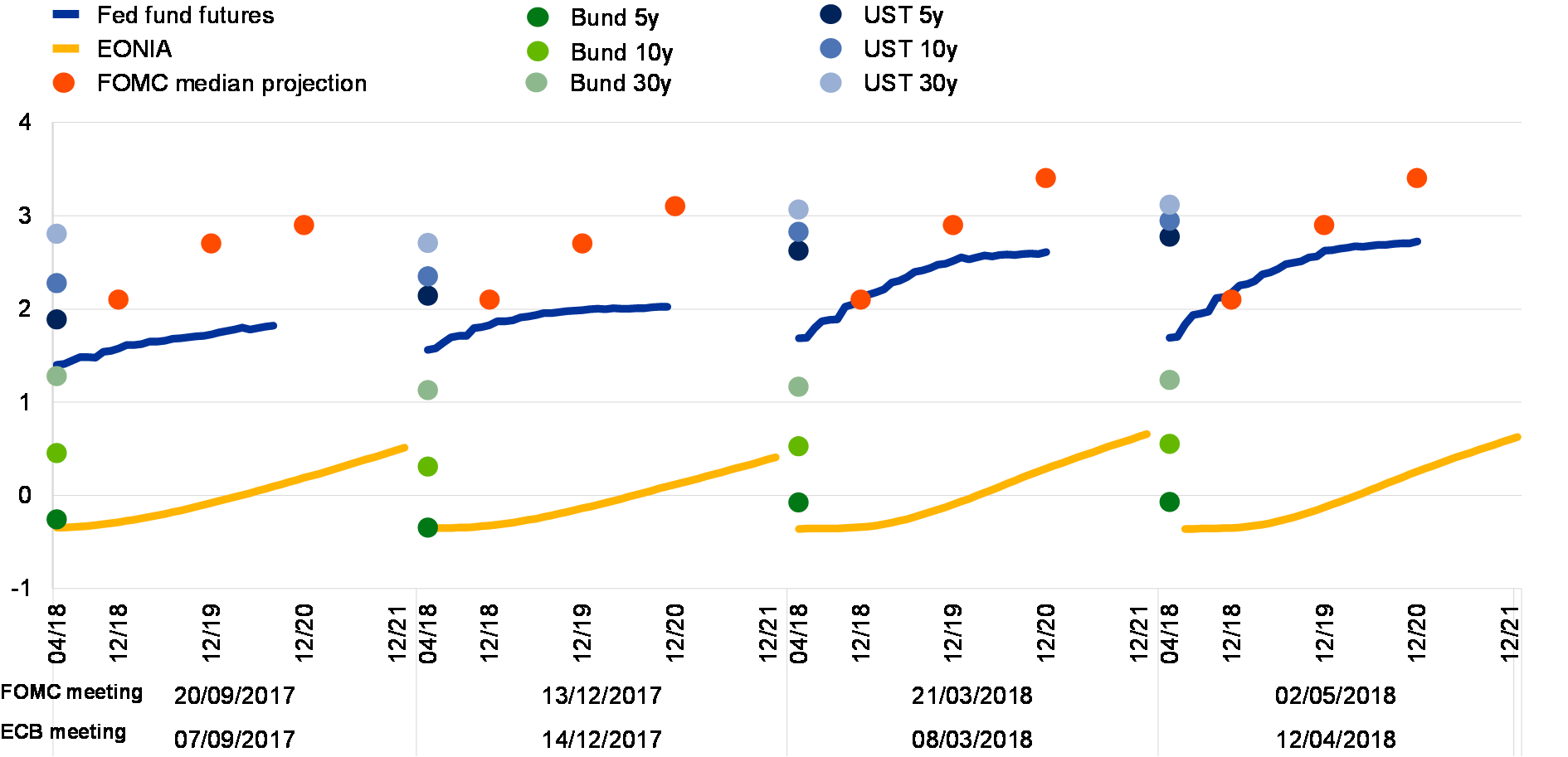

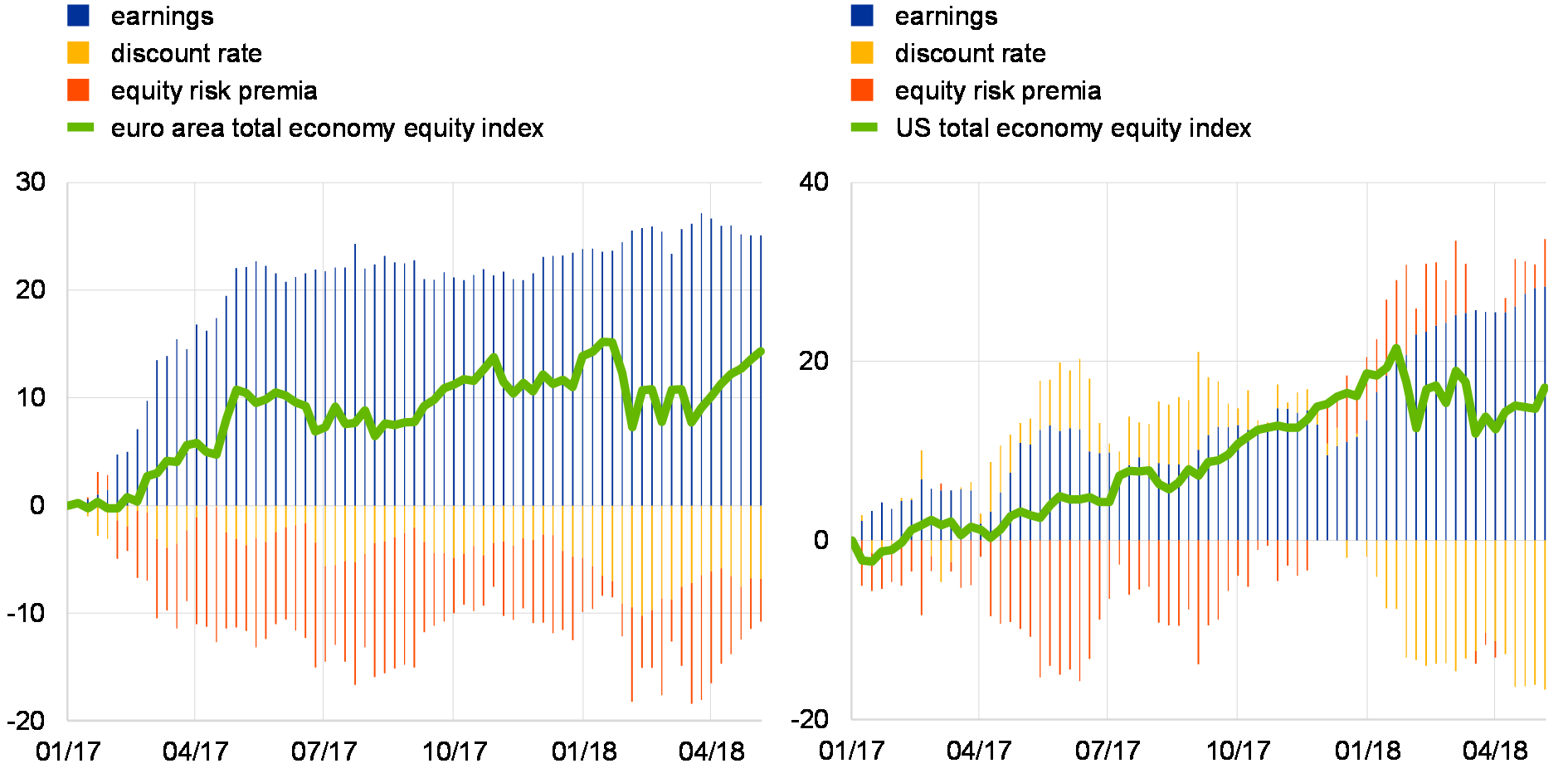

Developments in financial markets continue to signal growing optimism about the economic outlook, but vulnerabilities are building up in global markets. Long-term government bond yields in advanced economies increased in late 2017 and early 2018 on the back of solid growth prospects and news concerning the US tax reform (see Chart 7). US and euro area stock markets have experienced bouts of volatility over the past six months. Stock prices on both sides of the Atlantic benefited from overall robust earnings growth. At the same time, concerns about elevated US stock market valuations, upward revisions in monetary policy rate expectations and US trade policies contributed to slightly higher global equity risk premia. Overall, however, risk tolerance in global financial markets remains high. This is particularly noticeable in the riskier segments of the bond markets. For instance, non-investment-grade corporate bond spreads in advanced economies continue to hover at levels well below historical averages.

Chart 7

US and euro area bond yields edged up, while the upward trend in stock prices came to a halt

Ten-year sovereign bond yields, stock prices and BBB corporate bond spreads in the United States and the euro area

(Jan. 2017 – May 2018; left panel: percentages per annum; middle panel: index: 29 November 2017 = 100; right panel: basis points)

Sources: Bloomberg, Bank of America Merrill Lynch and ECB calculations.

Notes: The vertical lines refer to the publication of the previous FSR on 29 November 2017. The right panel shows averages since January 2002.

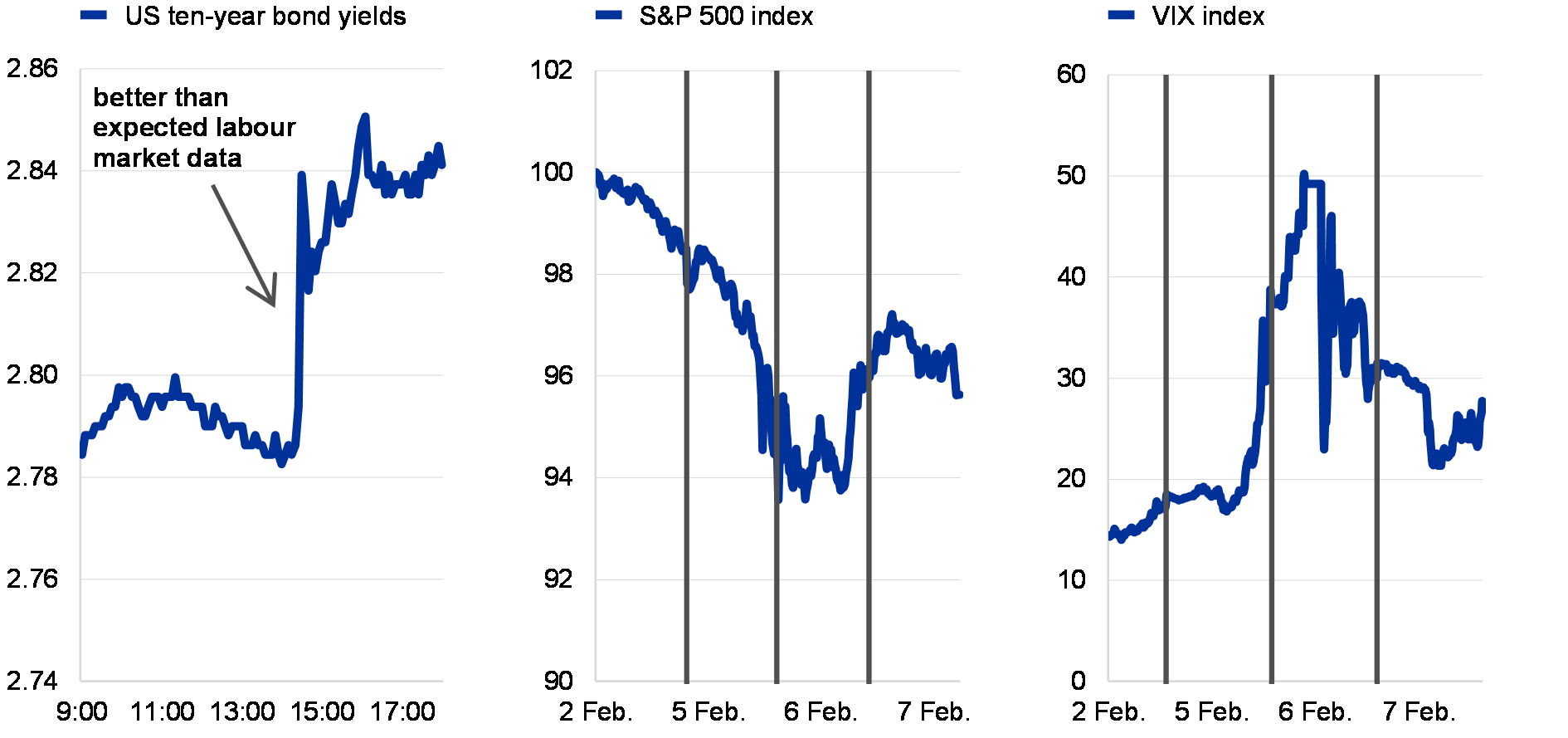

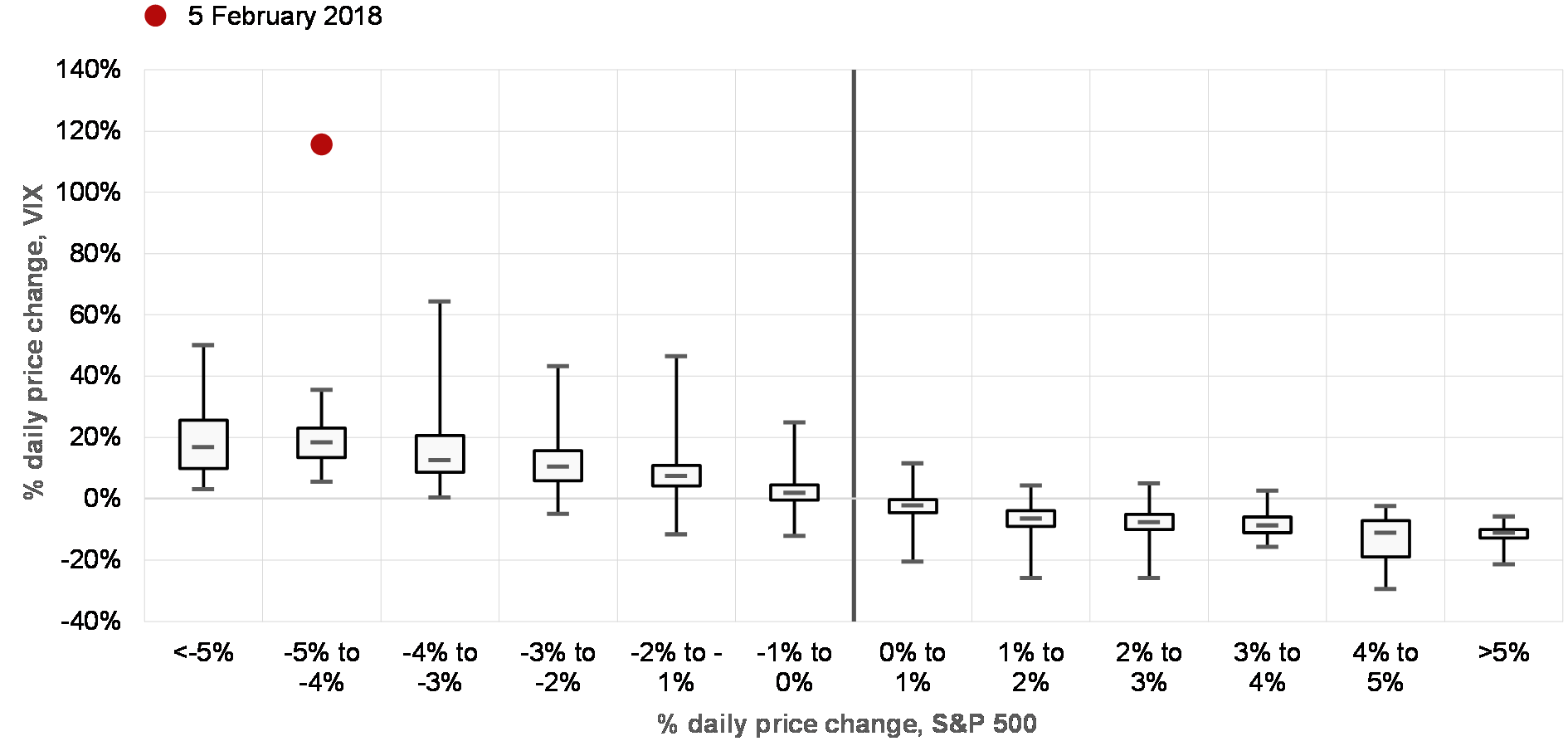

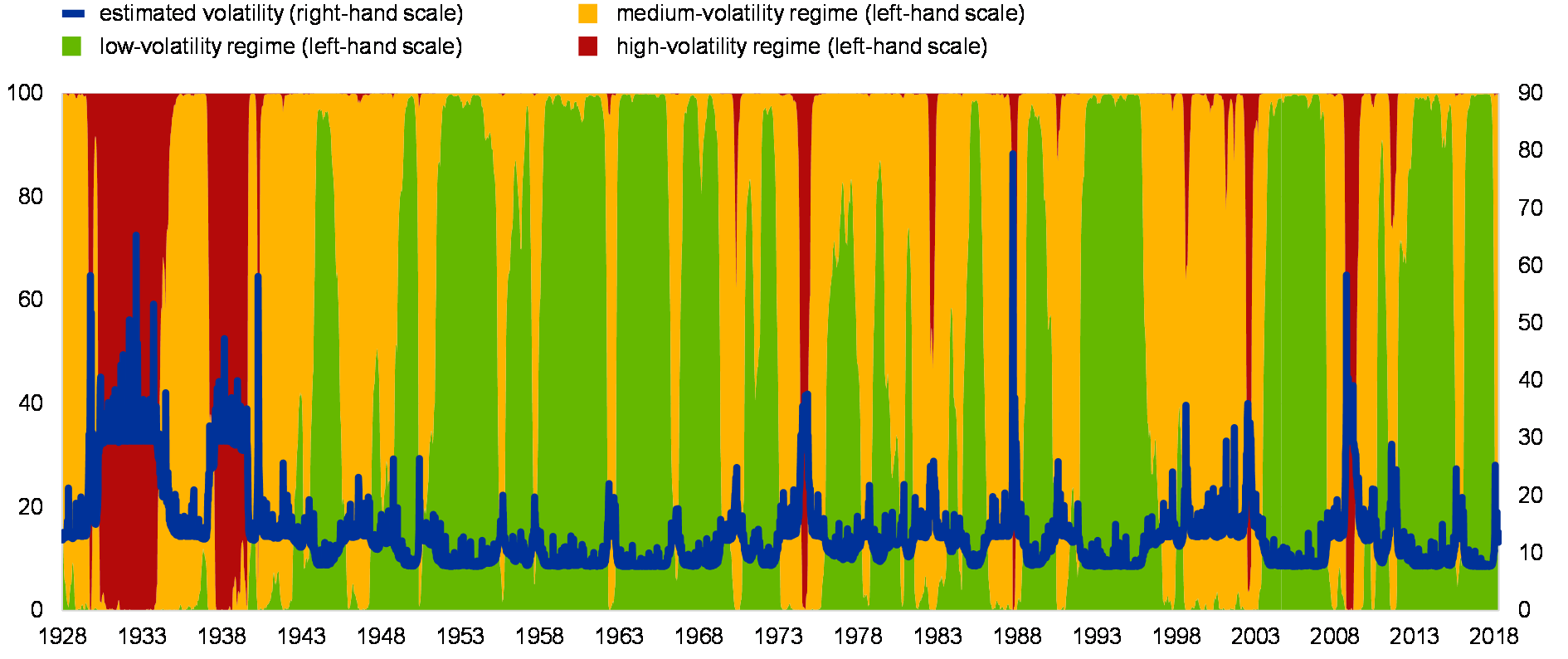

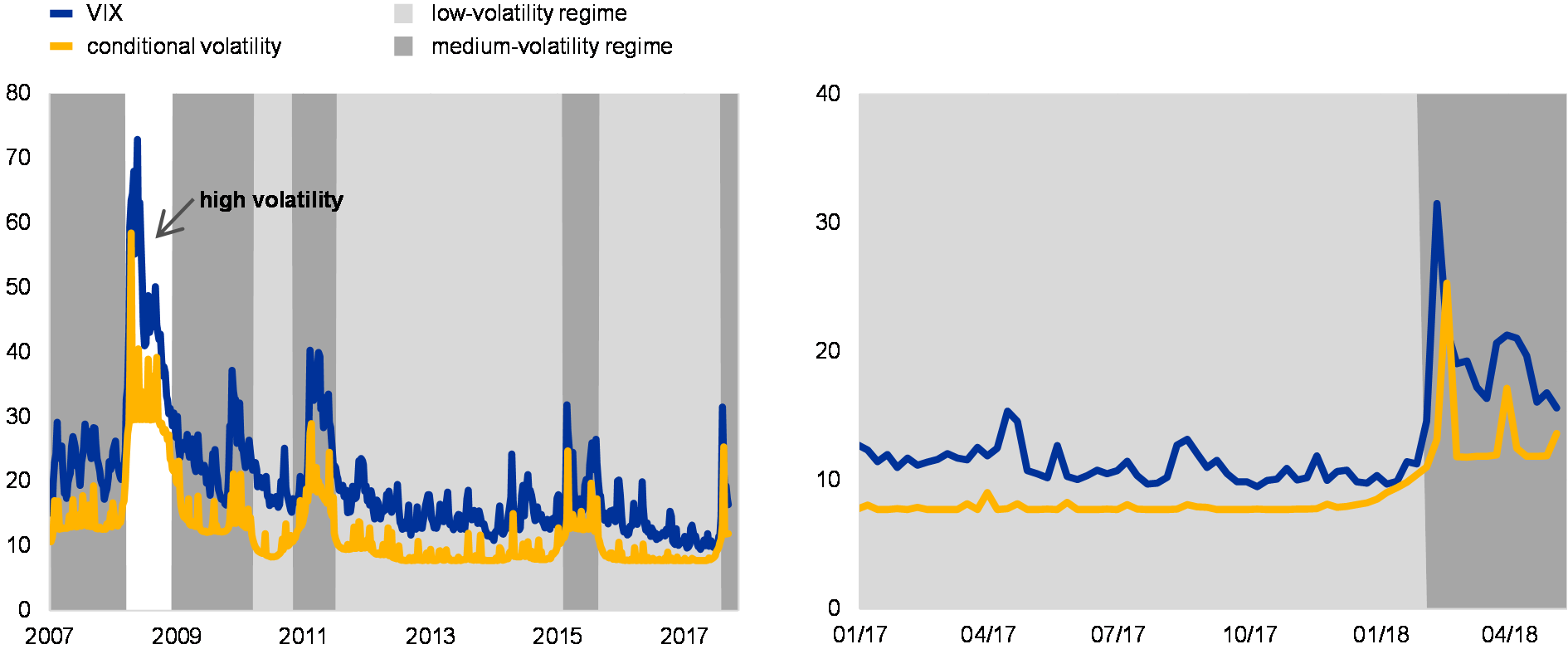

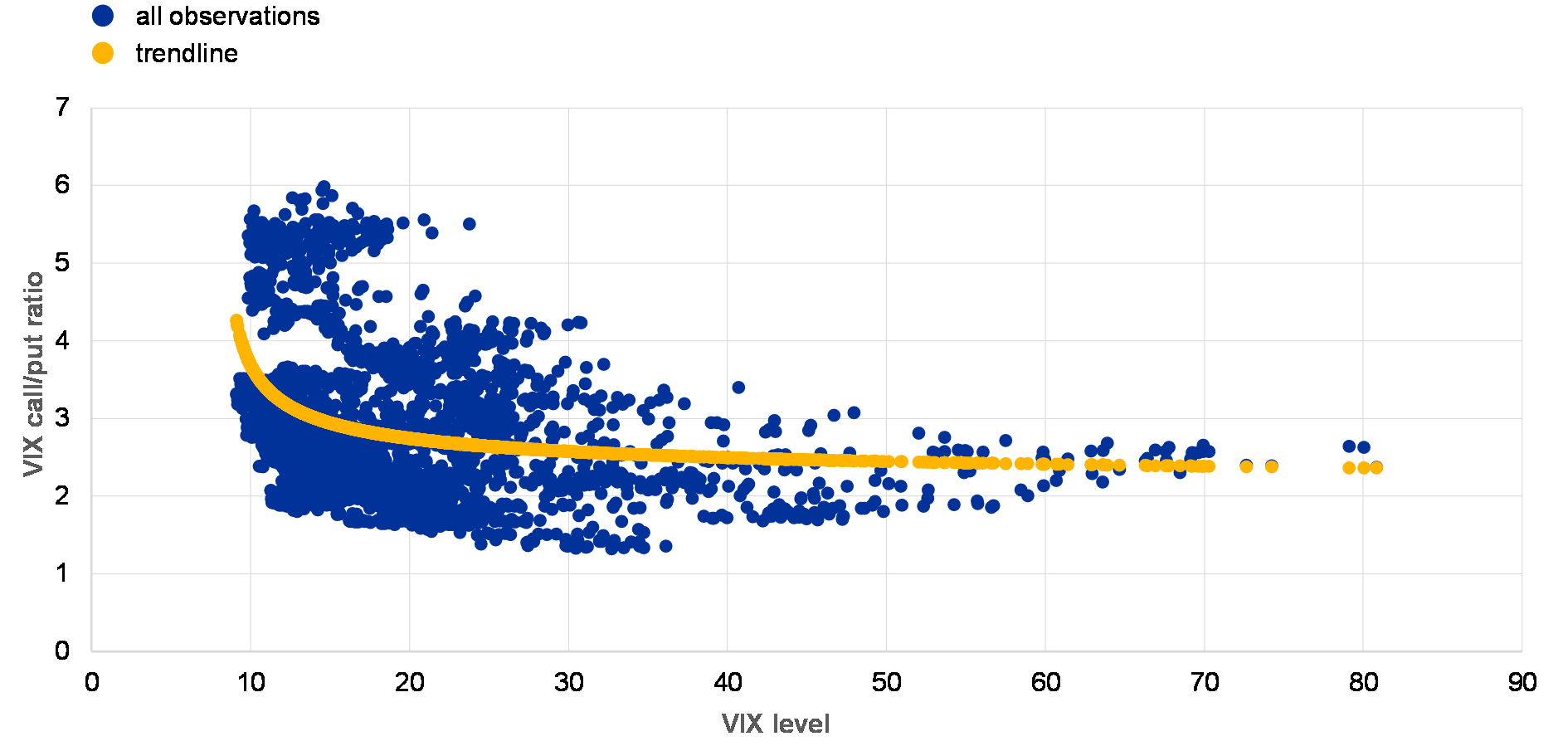

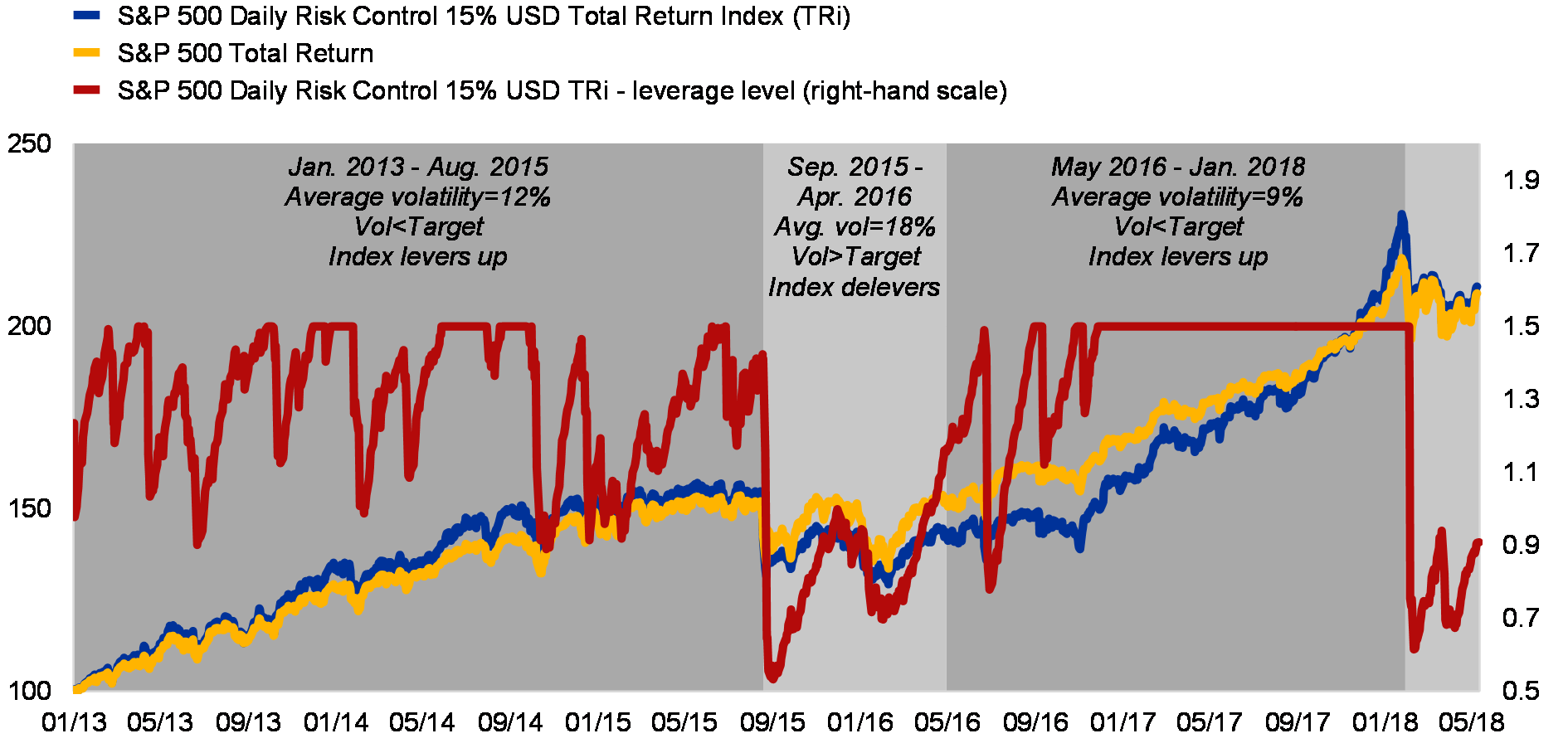

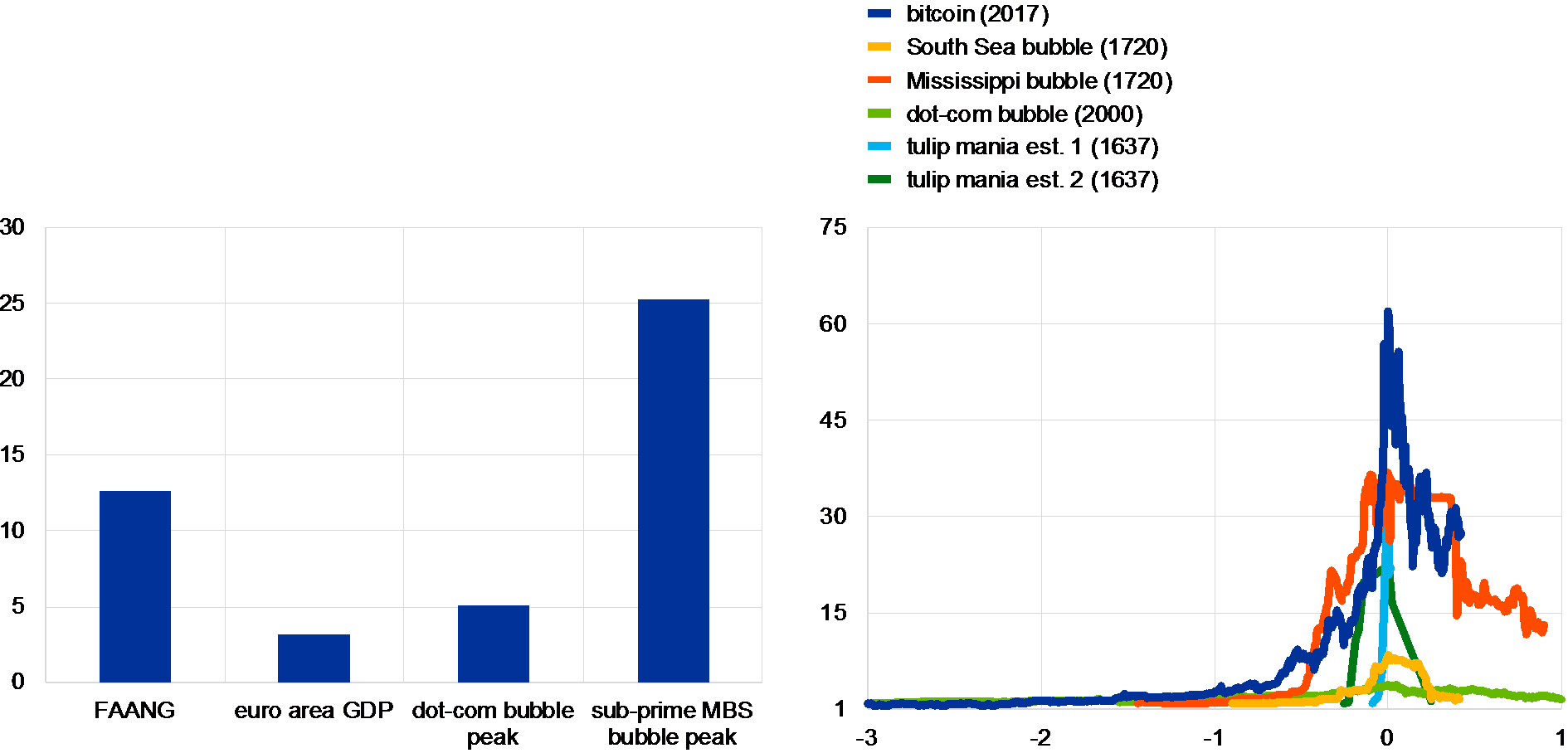

A surge in volatility in US stock markets in early February underscored the fragility of current market sentiment (see Chart 8). Following a prolonged period of rising stock prices and low volatility, US stock markets experienced a sharp sell-off in the first trading days of February. The drop in US stock prices was probably triggered by stronger than expected US labour market data which seem to have led to some pick-up in uncertainty about future inflationary pressures. Implied stock market volatility – a standard metric of future expected volatility derived from option prices – surged well above what historical patterns would suggest, given the actual drop in stock prices. The overshooting in volatility during this period was partly linked to technical factors. Hedging activities of financial products linked to the low-volatility environment (such as inverse VIX products) probably contributed to the amplified movement in implied stock market volatility. The risk that these products could amplify market fluctuations was highlighted in a special feature in the November 2017 FSR.[1] The turmoil did not have any material adverse financial stability implications. It was relatively short-lived and did not spill over to other asset classes. That said, the episode illustrated how abruptly market sentiment can change in the current environment of generally compressed risk premia. After the spikes in February, stock market volatility in the United States has hovered at slightly higher levels than in 2017 (see also Box 3, which examines the statistical pattern of US stock market volatility over the past 90 years). Further turbulence may materialise over the risk horizon of the FSR, possibly amplified by portfolio strategies linked to the level of volatility in markets.

Chart 8

Turmoil in US stock markets in early February 2018

US ten-year bond yields on 2 February 2018 (left panel), movements in US stock prices and the VIX index over the period 2-7 February 2018 (middle and right panels)

(five-minute intraday observations; left panel: percentages per annum; middle panel: index: stock prices on 2 February 2018 = 100; right panel: index points)

Sources: Bloomberg and ECB calculations.

Note: In the middle and right panels, the weekend of 3 and 4 February is omitted from the scale on the x-axis.

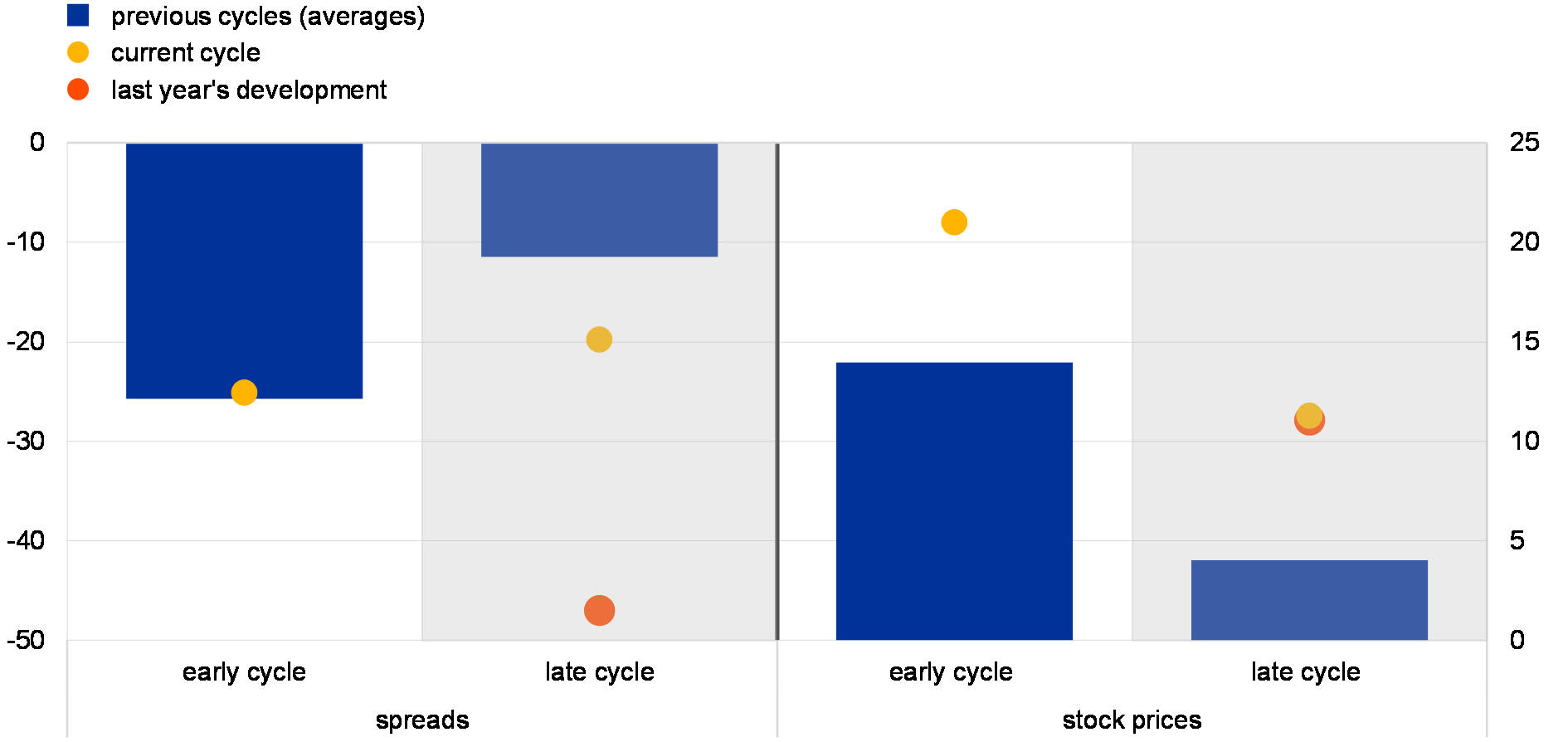

A reversal of the atypical US asset price developments for this stage of the business cycle could impact global asset prices more broadly. The United States has been in an expansionary phase since mid-2009. With the US economy running at close to full (or at full) capacity, inflationary pressures are gradually building up and policy rates are moving closer to a neutral stance. As a result, the US economy has possibly entered the latter part of the expansionary phase of the business cycle. Looking back in history, asset price performance tends to differ between the earlier and the later phases of business cycle expansions (see Chart 9). In the earlier part of expansions, stock prices have, on average, increased rapidly along with a significant narrowing of corporate bond spreads. In the late stage of the expansion, asset price increases tend to slow down, as inflationary pressures build up and monetary policy becomes less accommodative. The behaviour of US asset prices during the current “late cycle” phase differs somewhat from previous patterns. In fact, asset price gains have been stronger than what has been observed in the past. The somewhat atypical behaviour of US asset prices seems to indicate signs of “pricing for perfection”, pointing to a market perception that business cycle conditions will continue to improve for the foreseeable future and that there is a low probability of a turnaround in the business cycle. However, should a sharp reassessment of the maturity of the US business cycle occur, an abrupt reversal of US risk premia may take place, with possible spillover effects for the euro area.

Chart 9

Late cycle developments in US asset prices suggest that markets are “pricing for perfection”

Changes in US Baa corporate bond spreads and stock price returns for the S&P 500 index during the current and previous expansions

(left-hand scale: bond spreads, basis points; right-hand scale: stock prices, percentages per annum)

Sources: Bloomberg, National Bureau of Economic Research (NBER), Federal Reserve Economic Data (FRED) and ECB calculations.

Notes: Spreads are computed as the Baa corporate bond yield relative to the ten-year Treasury constant maturity rate. The cycles are defined according to the expansionary periods defined by the NBER since 1960. Early and late cycles are defined as the first and second half, respectively, of the expansionary periods. Changes in credit spreads and stock price returns are annualised. The current cycle is defined as the period from June 2009 to April 2018.

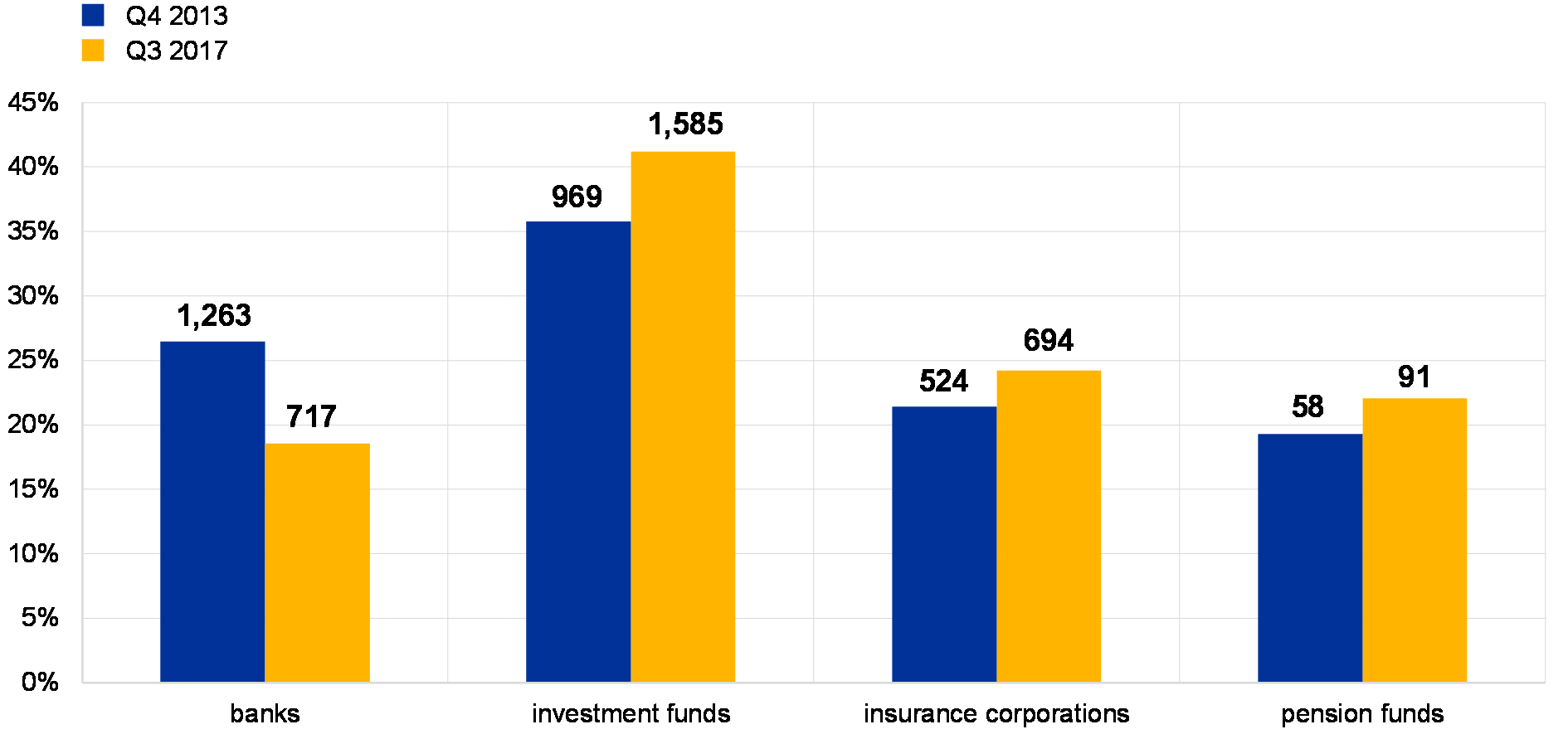

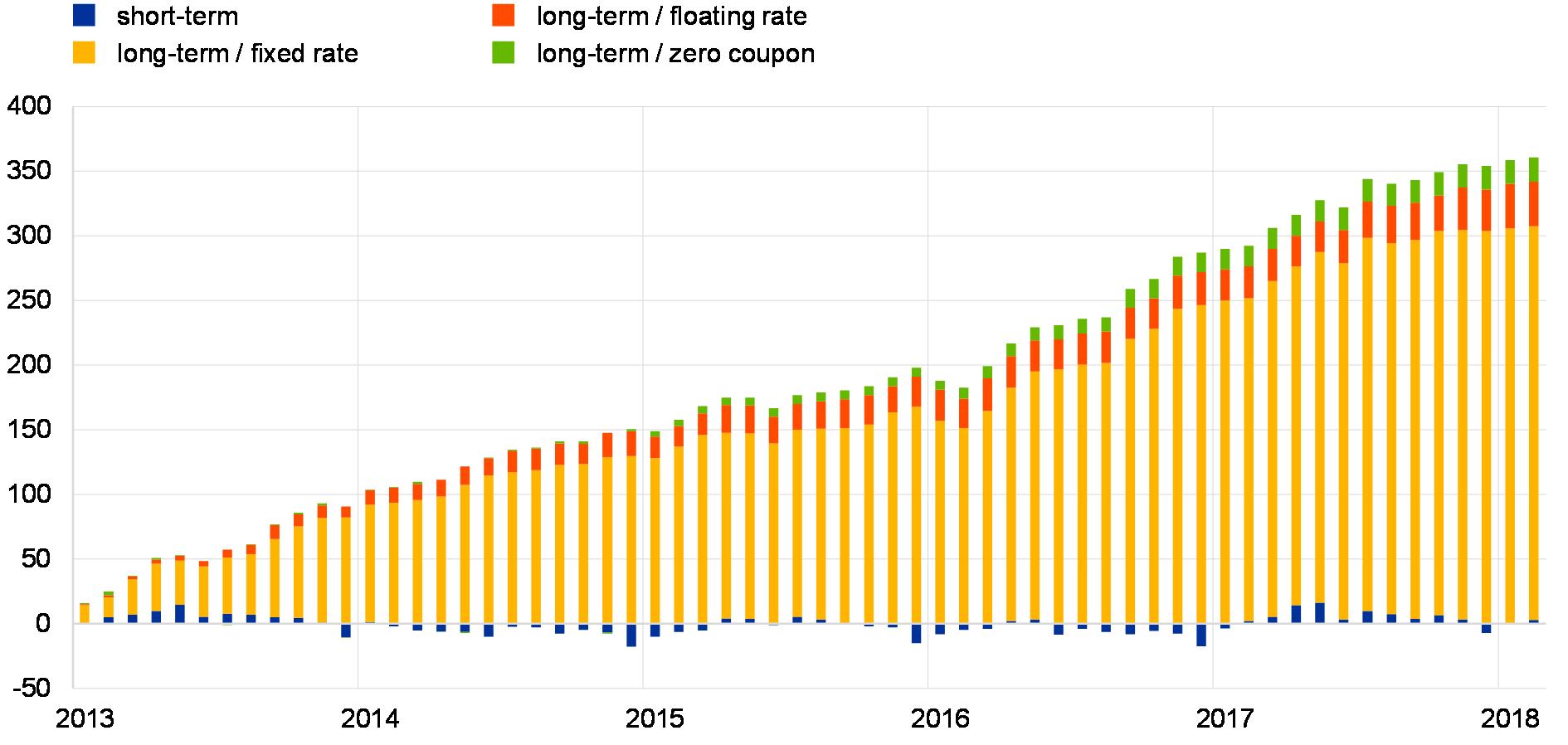

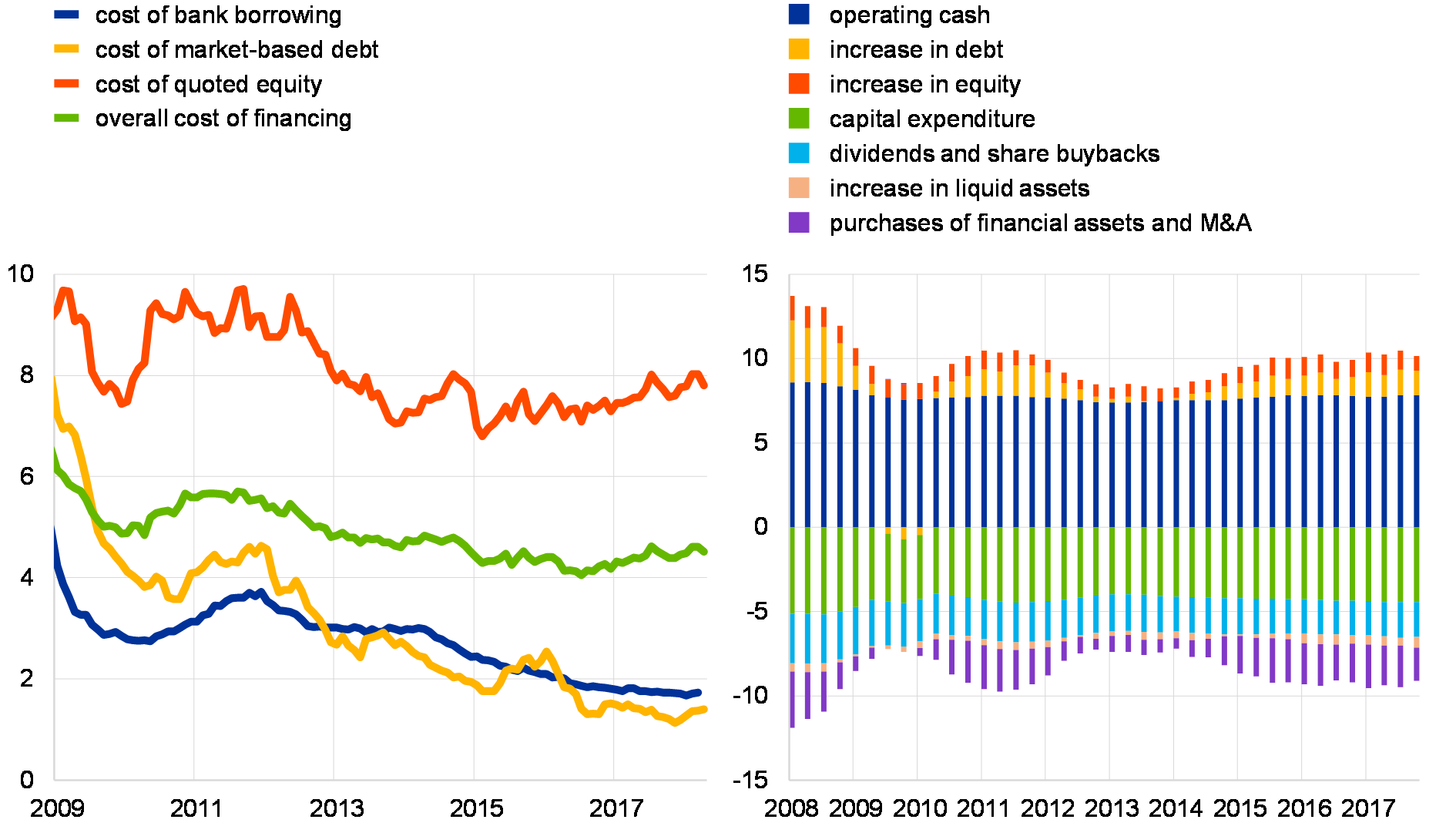

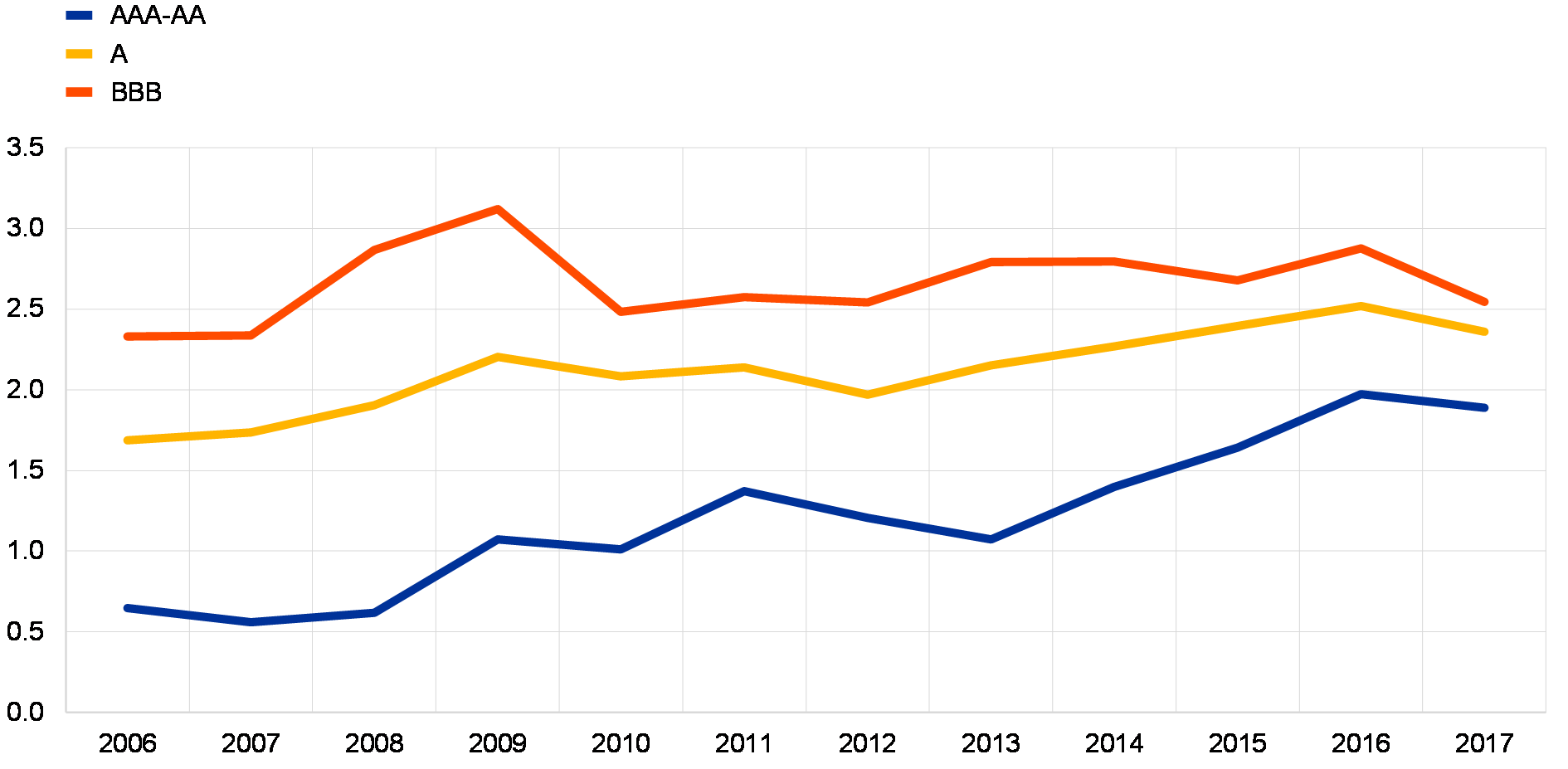

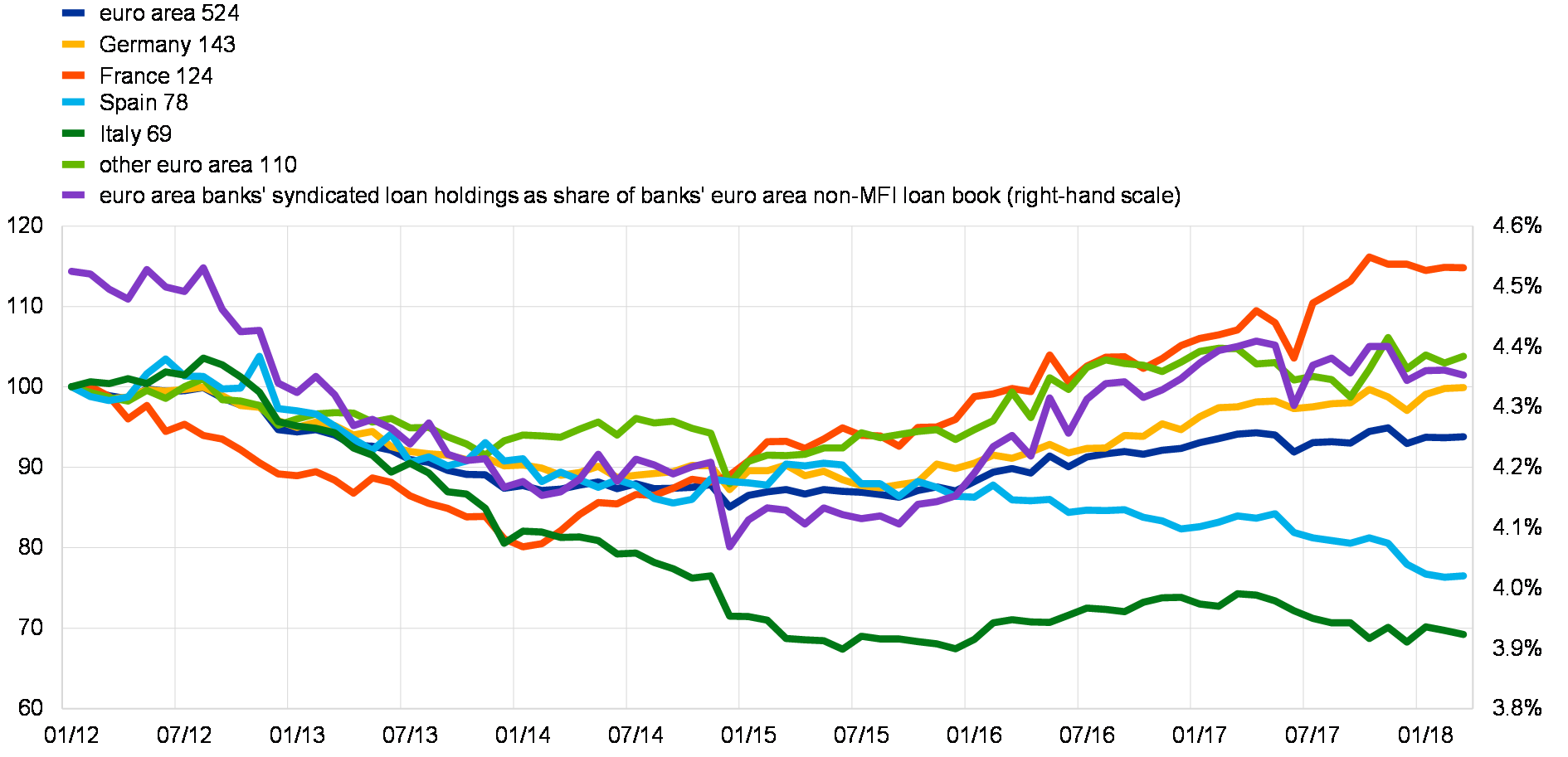

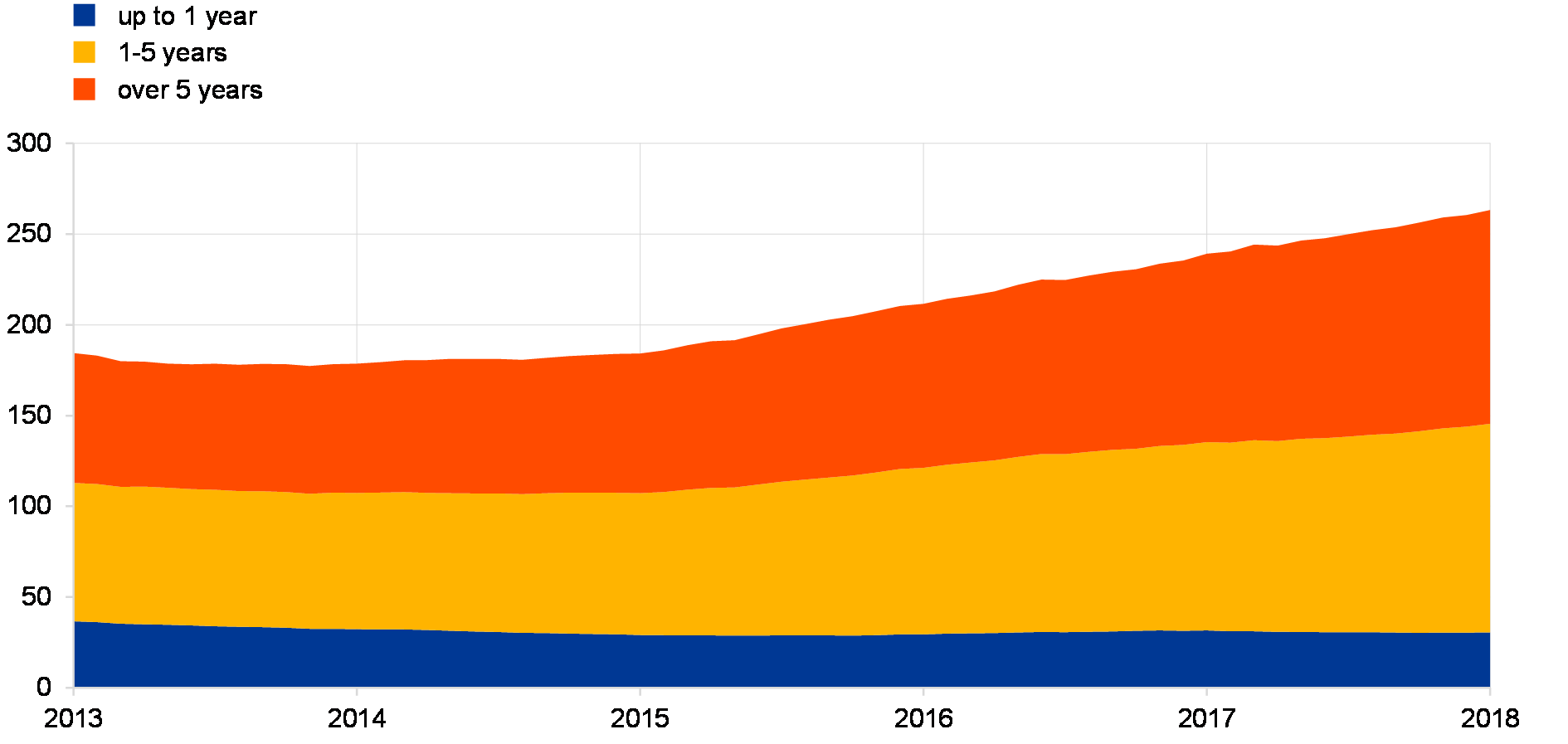

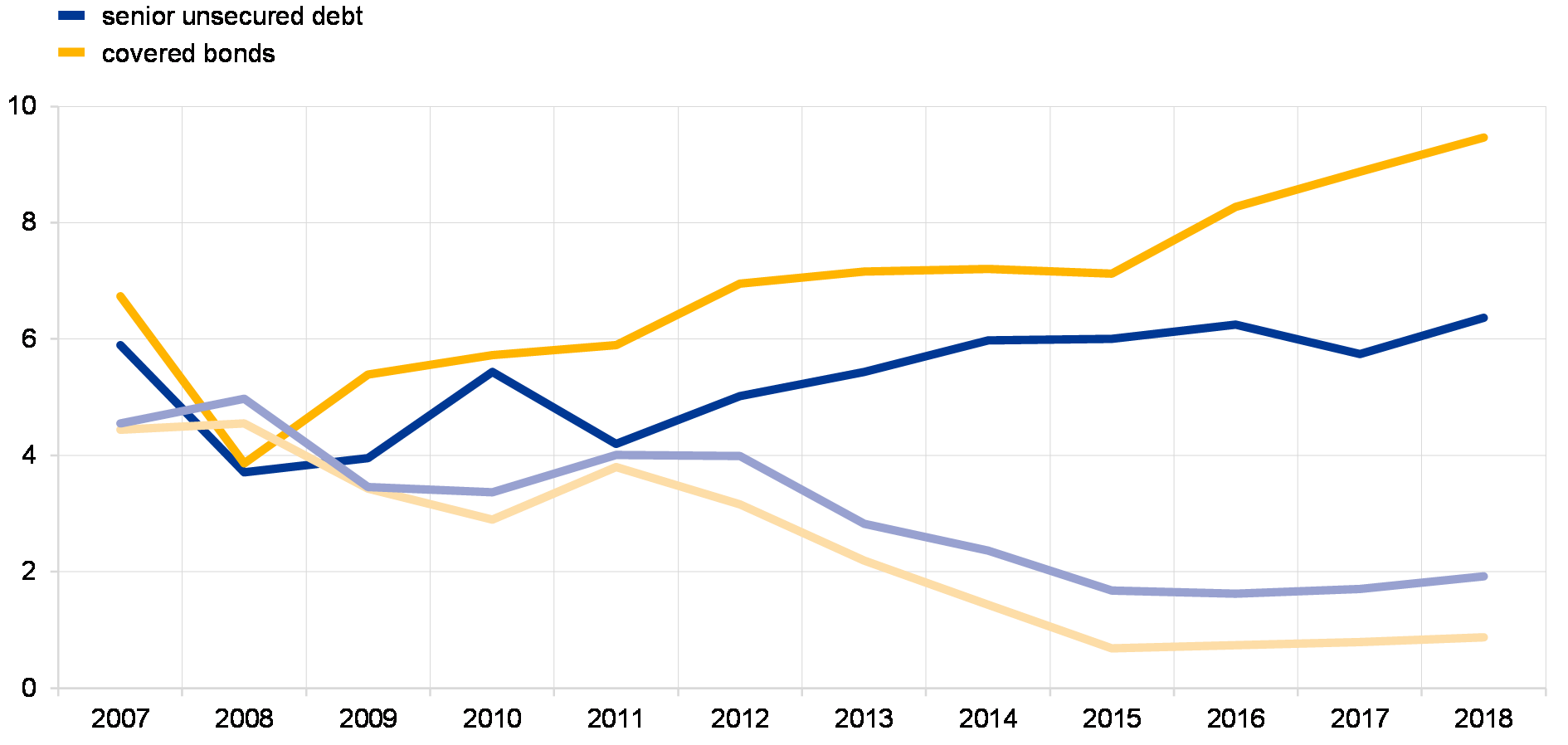

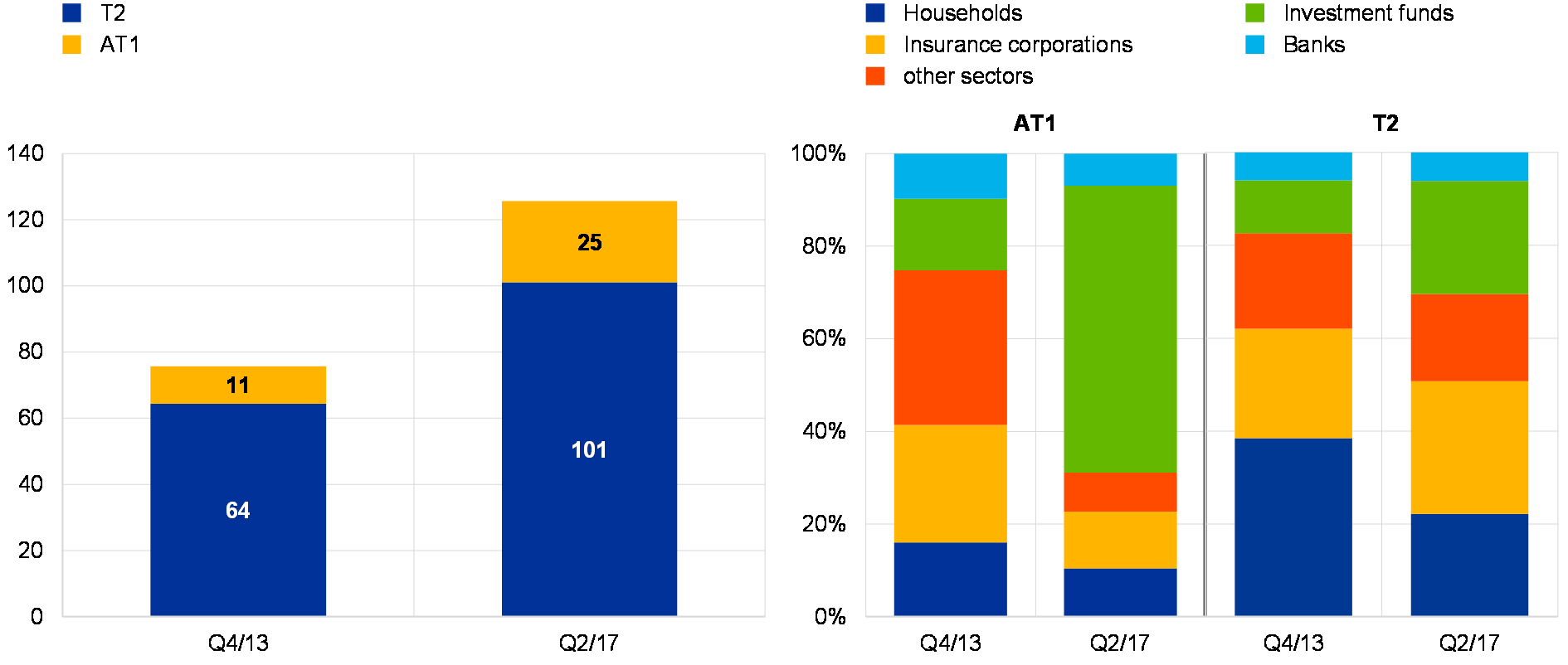

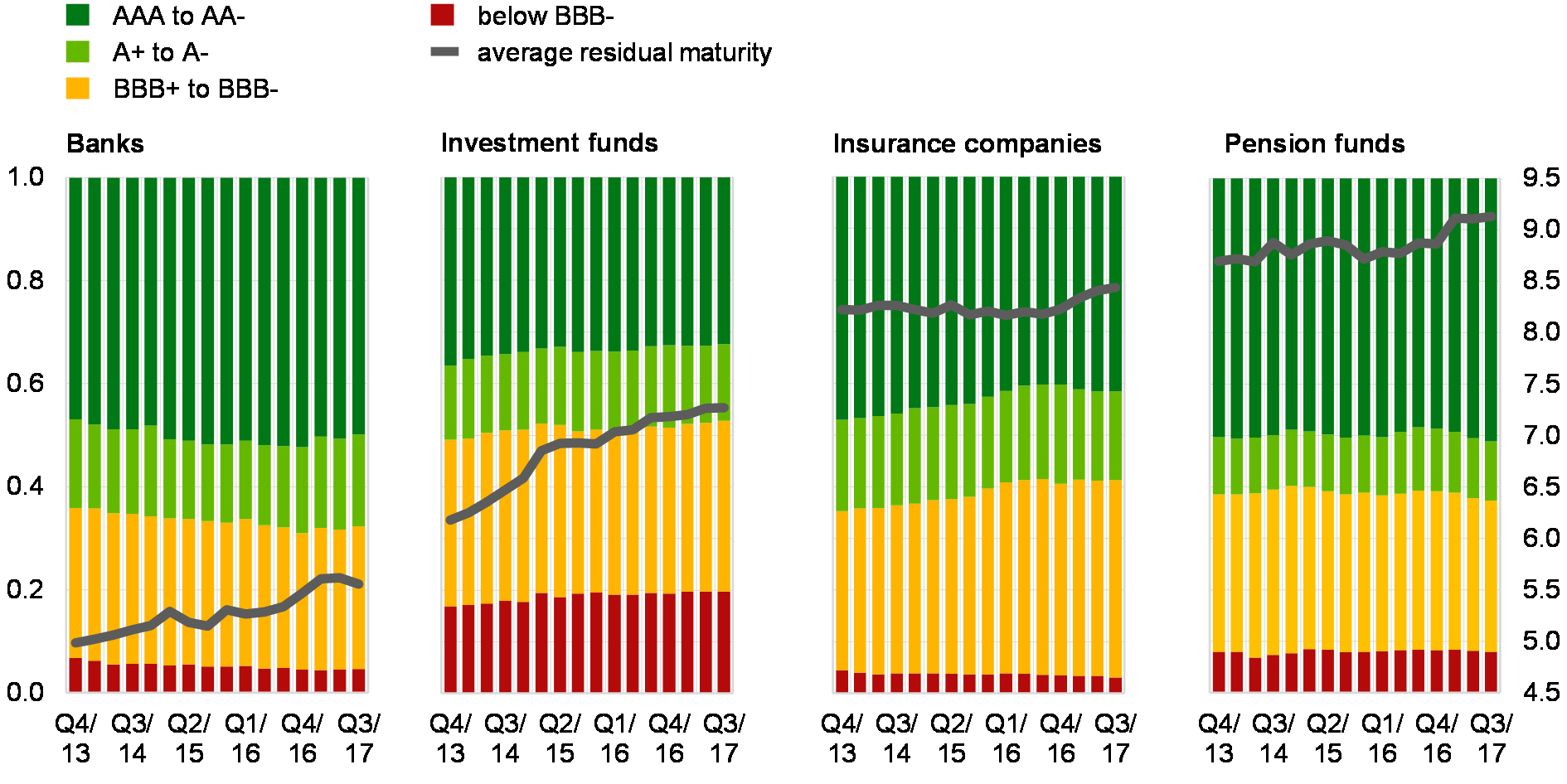

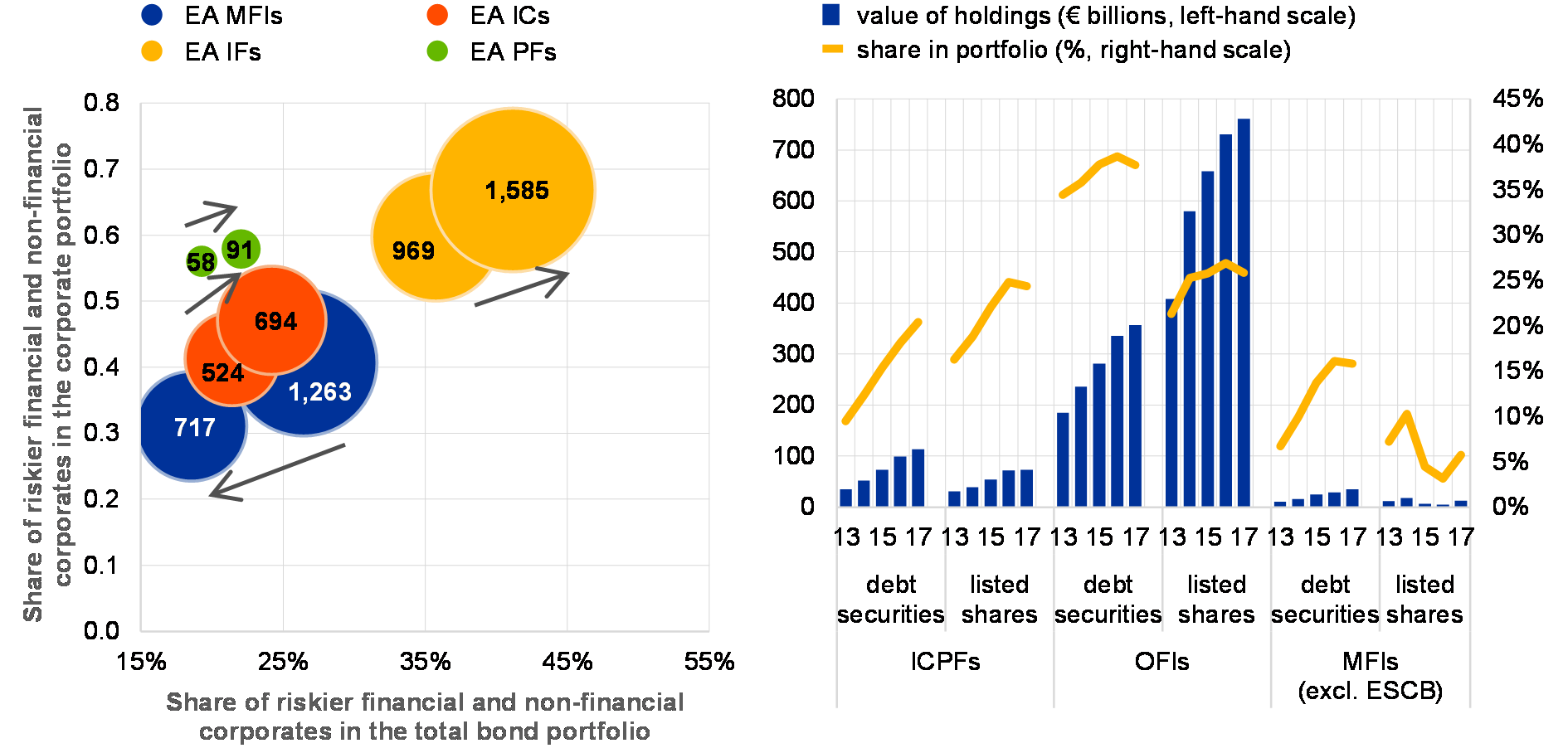

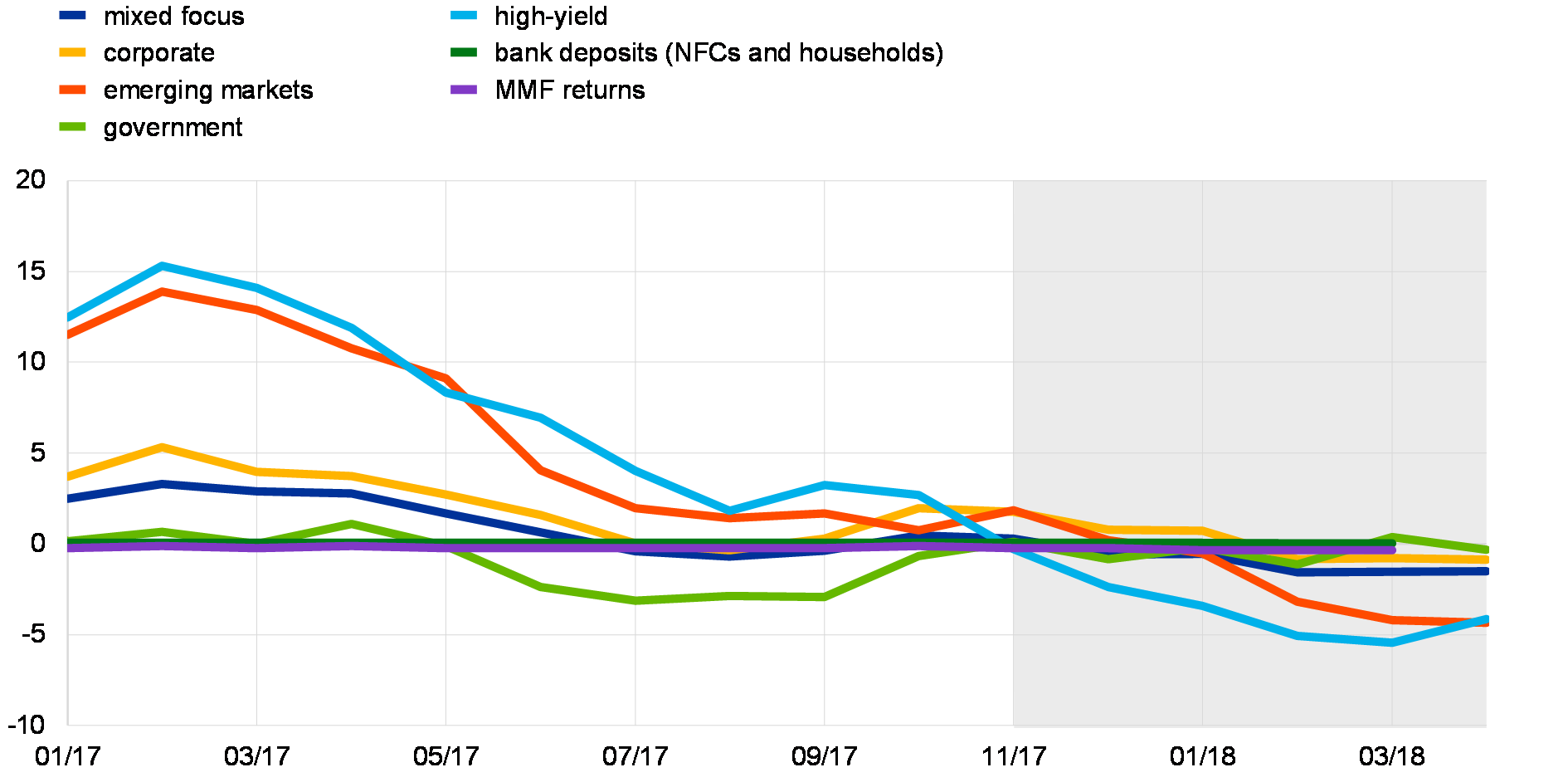

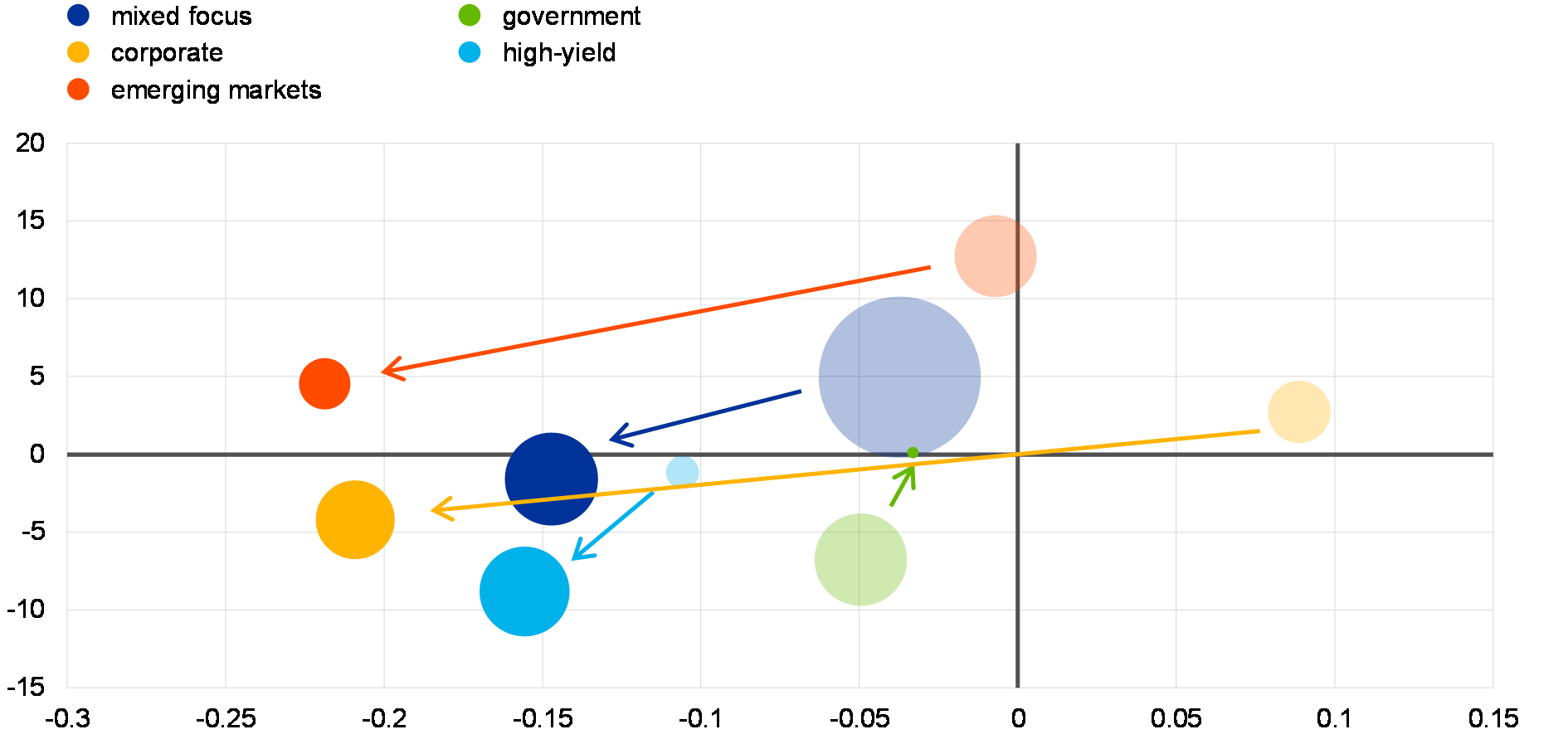

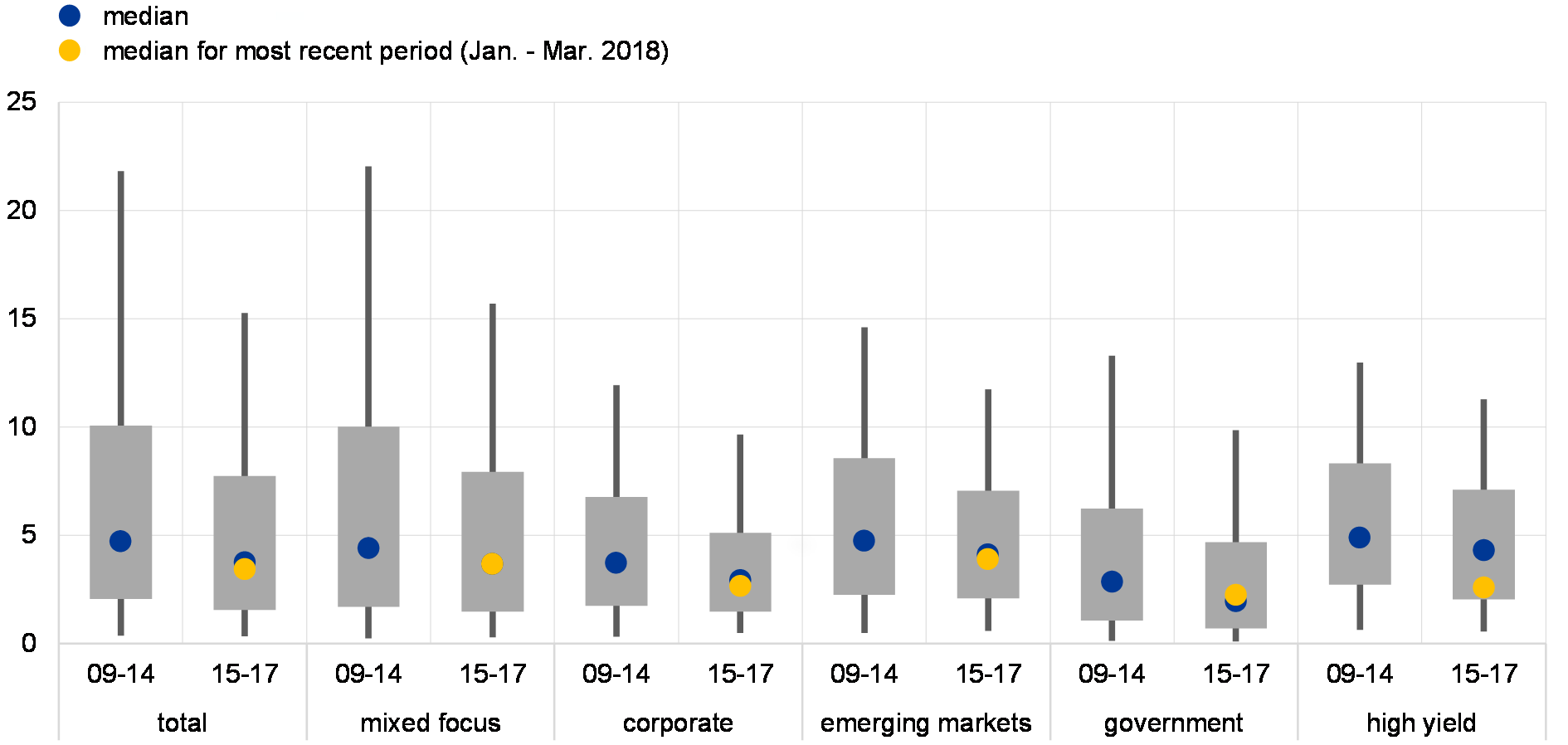

Higher risk-taking remains concentrated outside the euro area banking sector. Apart from some temporary bouts of volatility, fluctuations in global asset markets have been exceptionally muted for a prolonged period, which has incentivised one-sided risk-taking. To preserve returns, euro area financial sectors (apart from the banking sector) have increased their holdings of lower-rated fixed income instruments (see Chart 10). In addition, the same sectors have increased the duration of their fixed income instruments, exposing them to the risk of larger capital losses should a sudden and sharp repricing materialise.

Chart 10

Most euro area financial institutions have increased their exposures to lower-rated bonds

Share of lower-rated financial and non-financial corporate bonds in financial institutions’ bond portfolios

(percentages of total bond portfolio, € billions)

Sources: ECB Securities Holdings Statistics (SHS) and ECB calculations.

Notes: Corporate bonds issued globally by both financial and non-financial companies. Lower-rated bonds are BB- and below. The figures above the columns show the market value of lower-rated bond holdings.

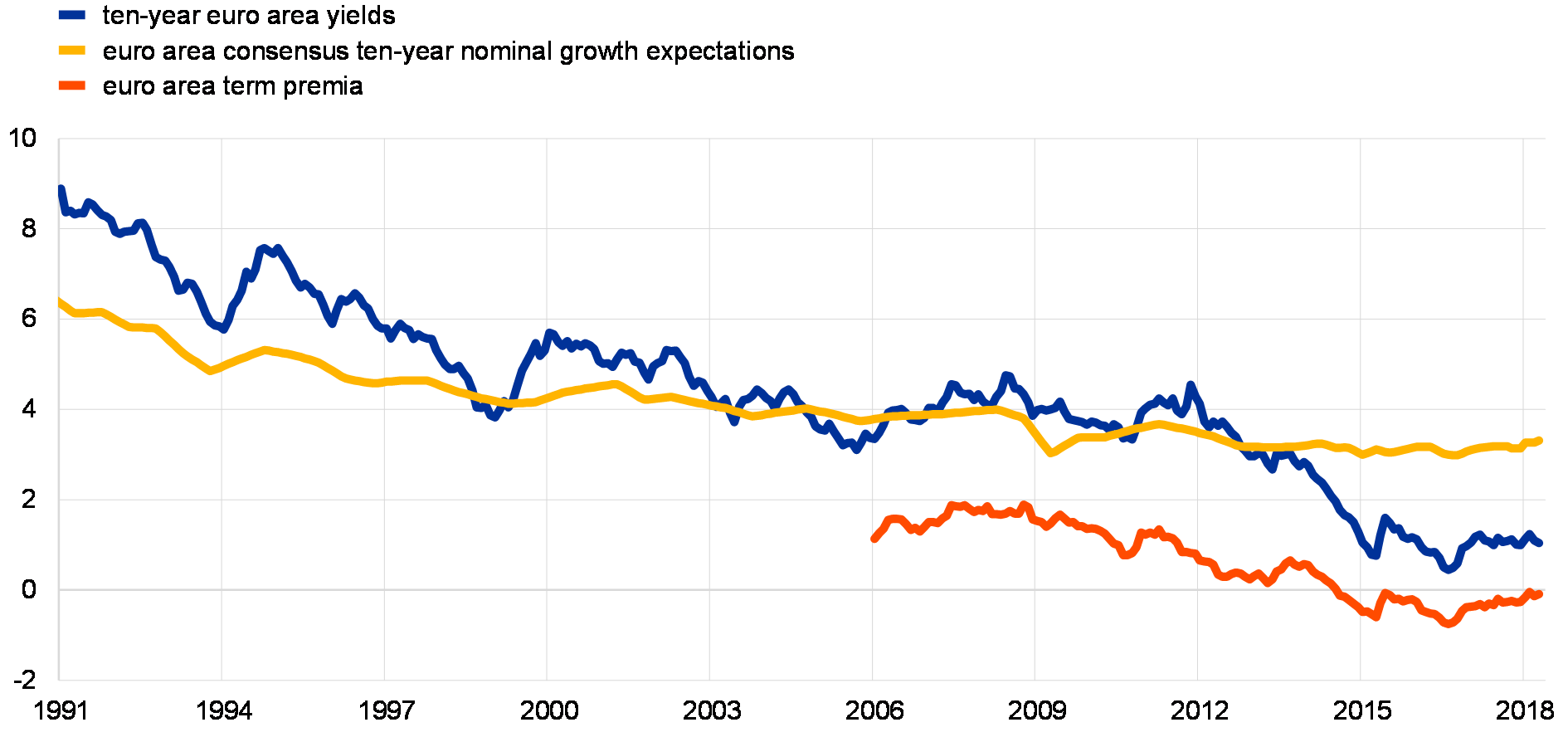

Risks of an abrupt reversal of compressed term and risk premia remain high amid stretched valuations in several asset classes and geographical regions. Estimates of term premia embedded in euro area long-term government bond yields continue to fluctuate at historically low levels and bond yields themselves are still well below nominal economic growth expectations, which are used as a yardstick for the equilibrium level of bond yields (see Chart 11). These observations point to upward risks to long-term bond yields in the coming years.

Chart 11

Upward risks to euro area long-term government bond yields

Long-term government bond yields, nominal GDP growth expectations and term premia in the euro area

(Jan. 1991 – Apr. 2018; percentages per annum, annual percentage changes)

Sources: Thomson Reuters, Consensus Economics and ECB calculations.

Notes: Before 1999, the euro area bond yields are approximated by ten-year bond yields in Germany. The euro area ten-year term premium shown in the chart is estimated on the basis of OIS rates using an affine term structure model following the methodology of Joslin, S., Singleton, K.J. and Zhu, H., “A New Perspective on Gaussian Dynamic Term Structure Models”, The Review of Financial Studies, Vol. 24(3), March 2011, pp. 926-970.

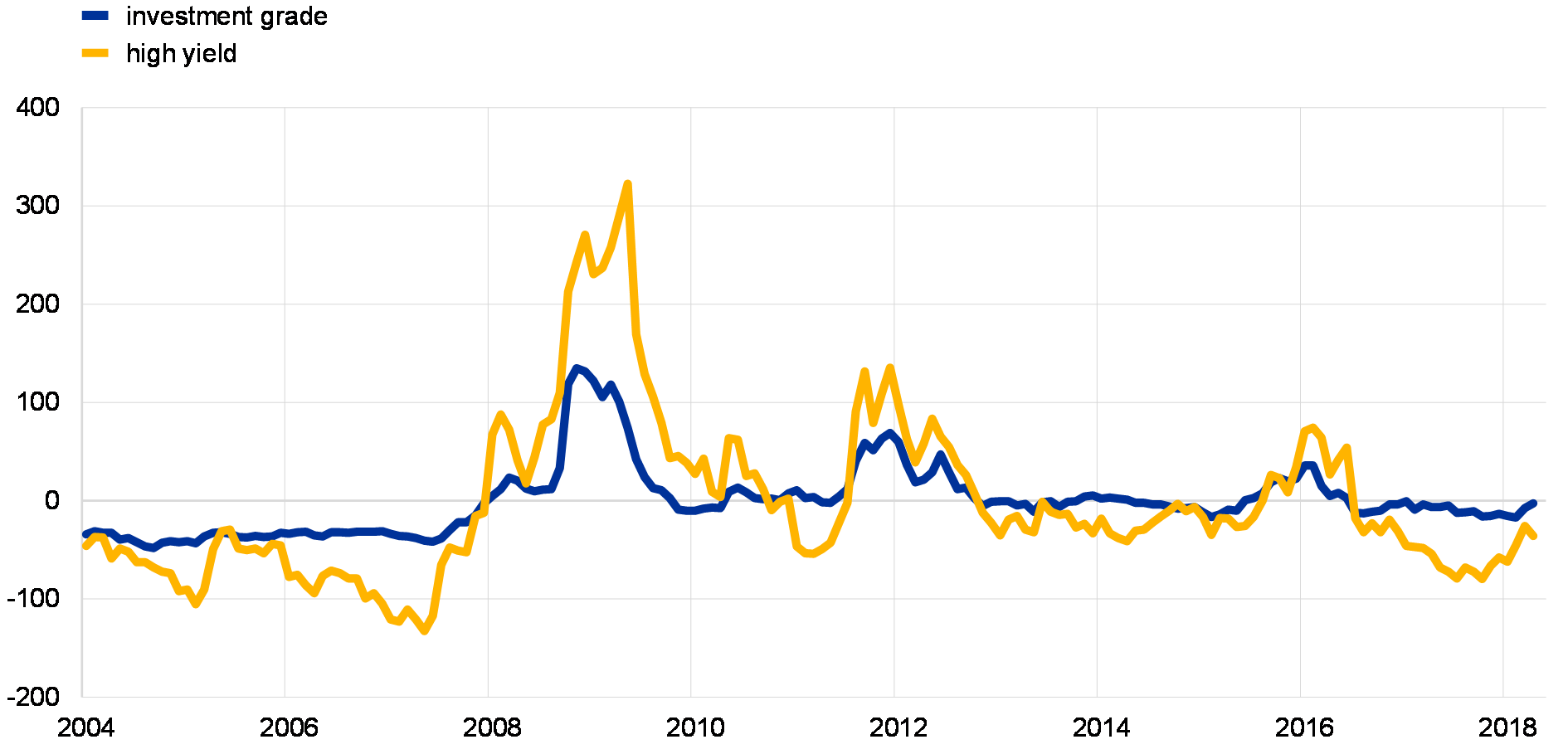

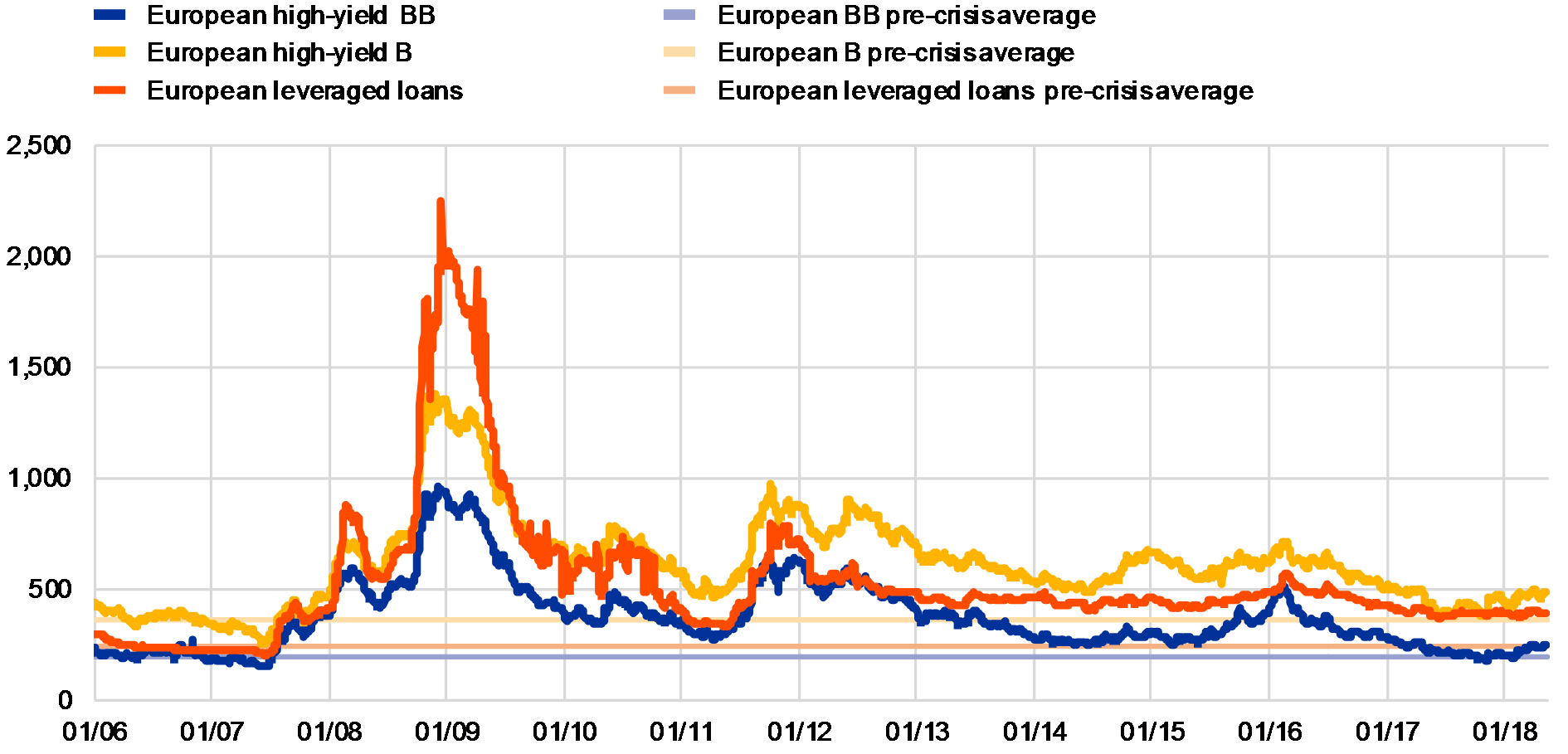

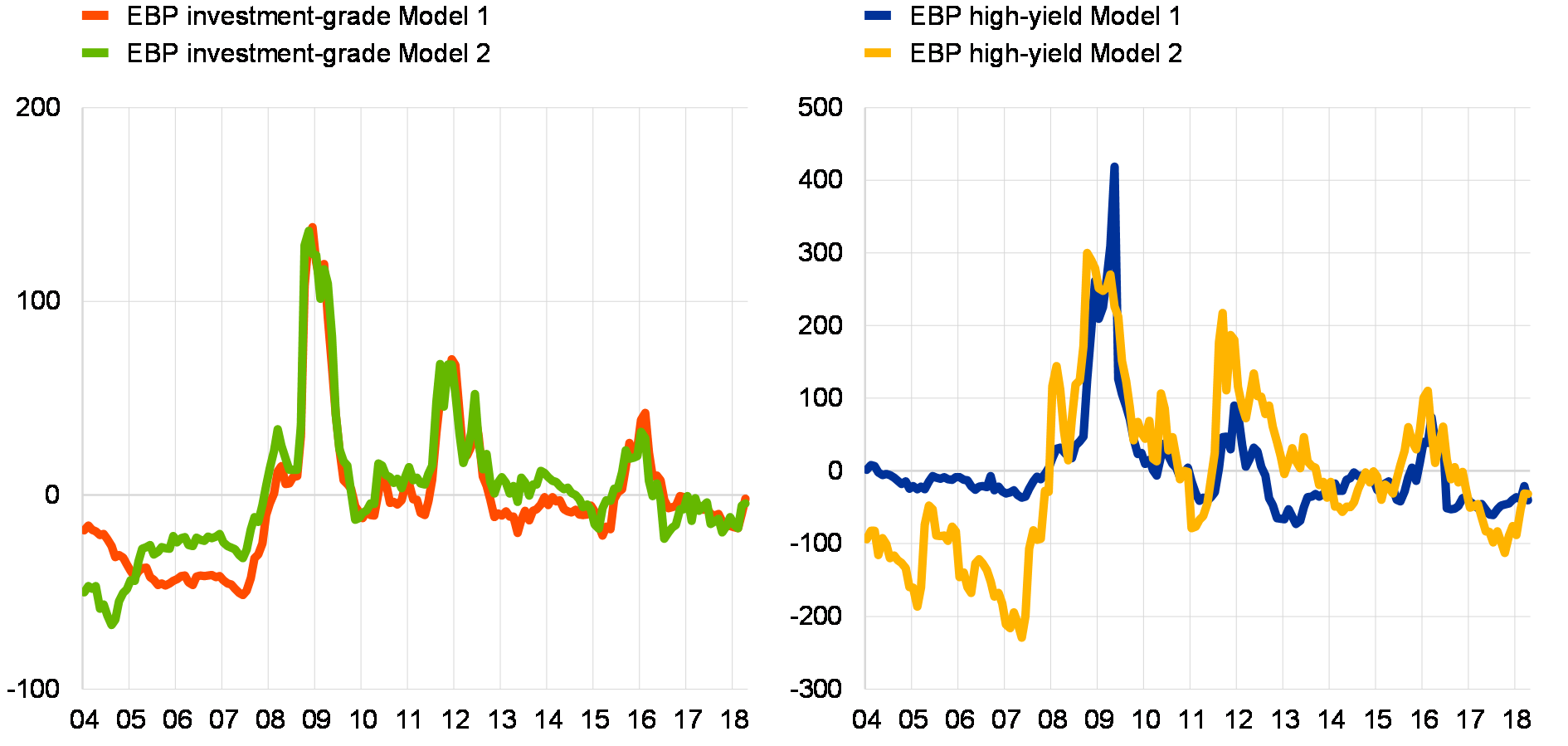

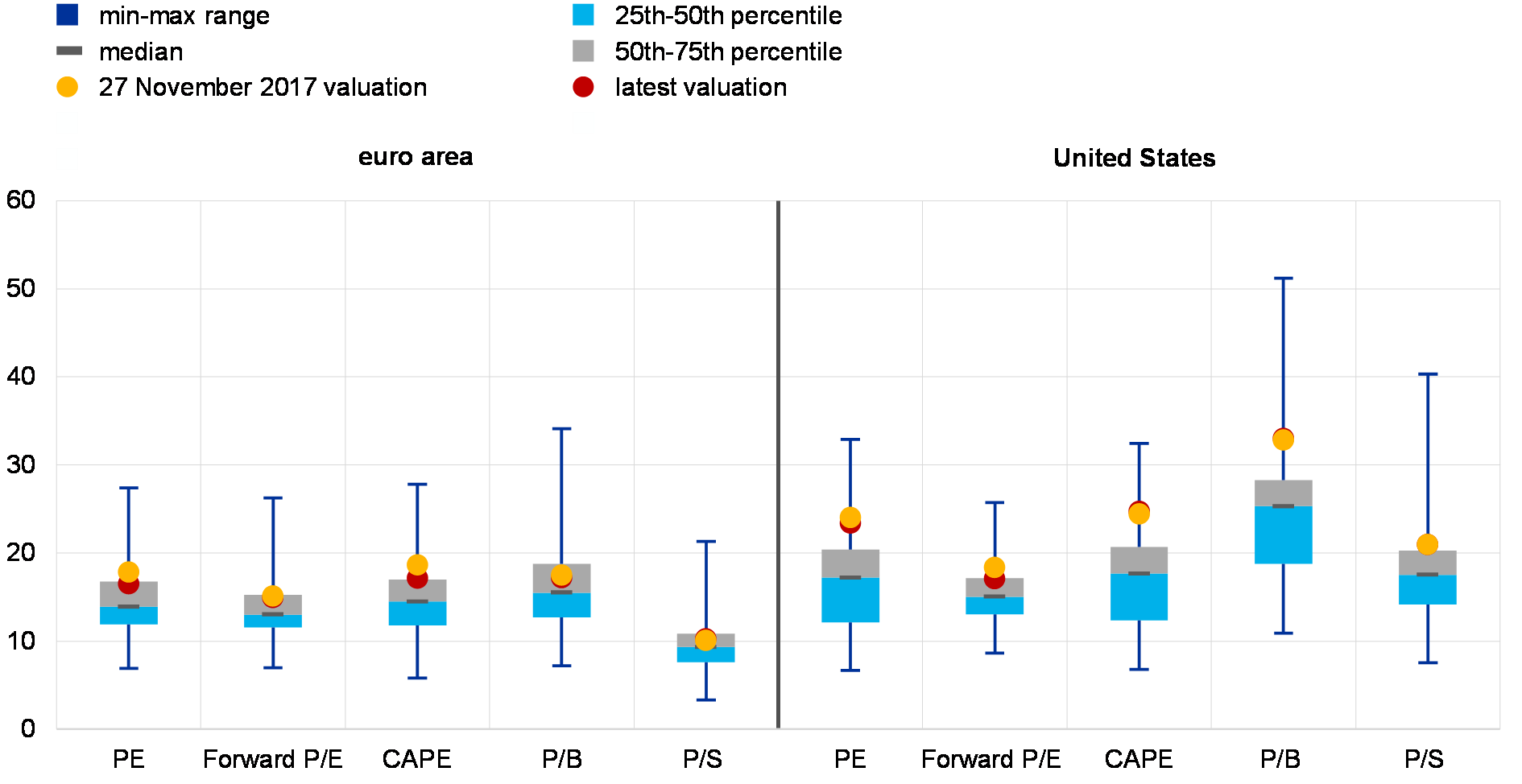

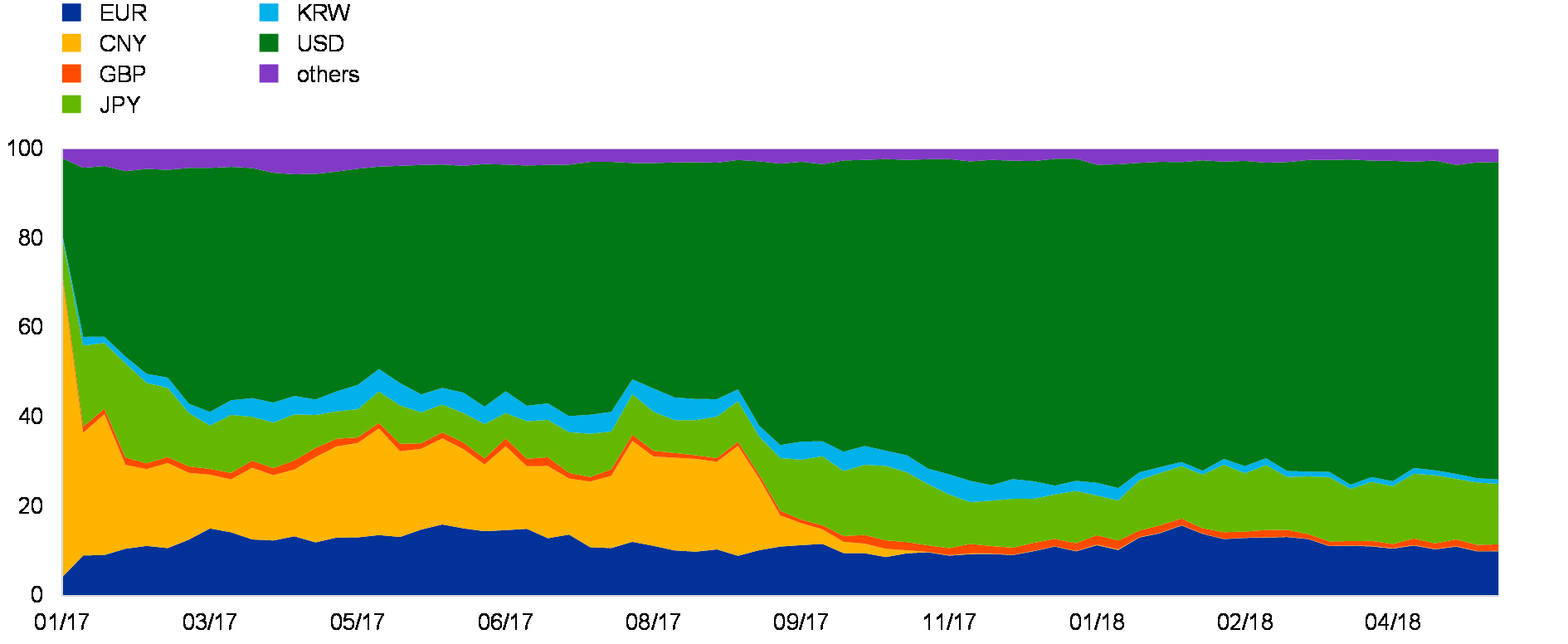

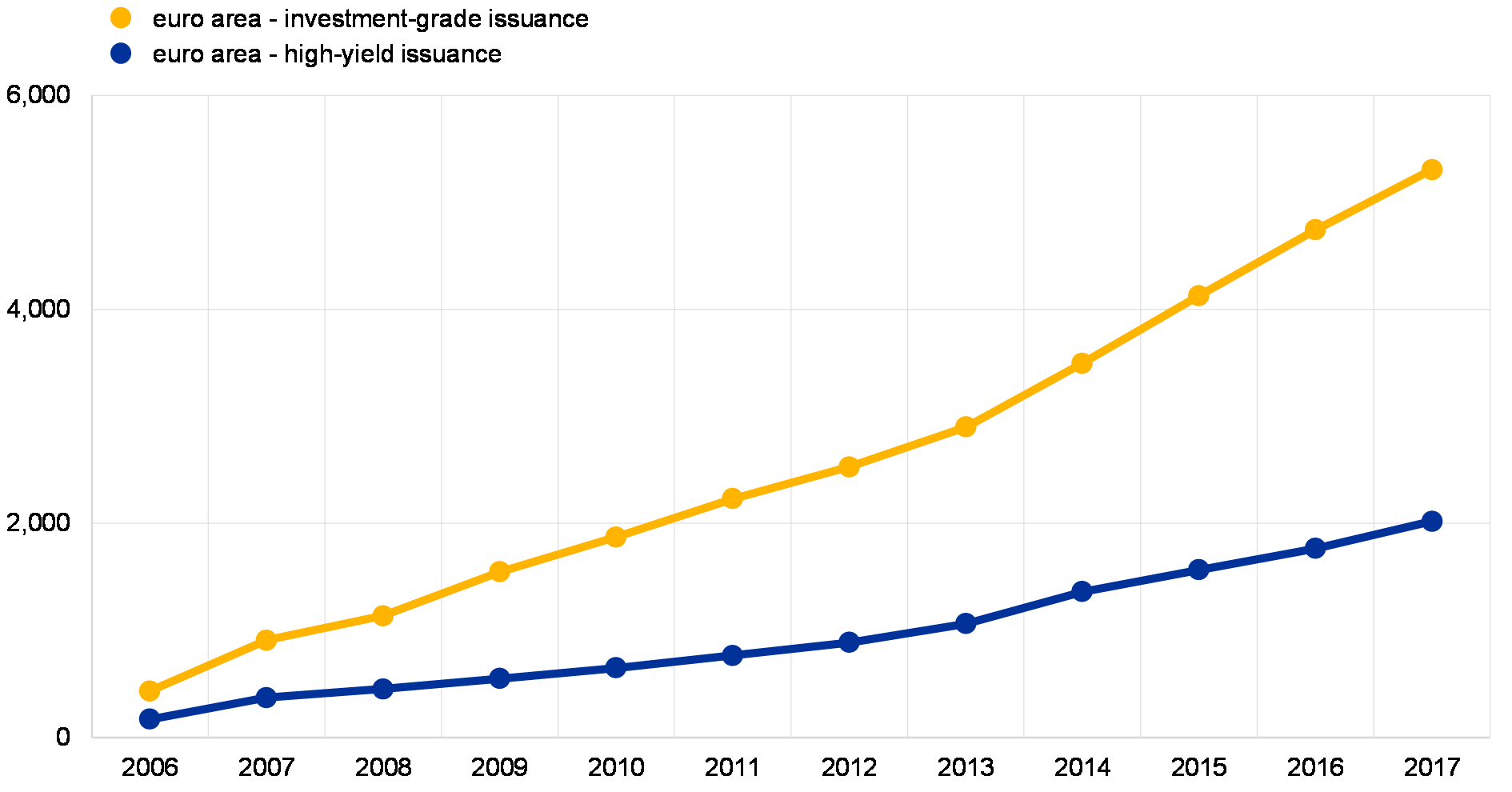

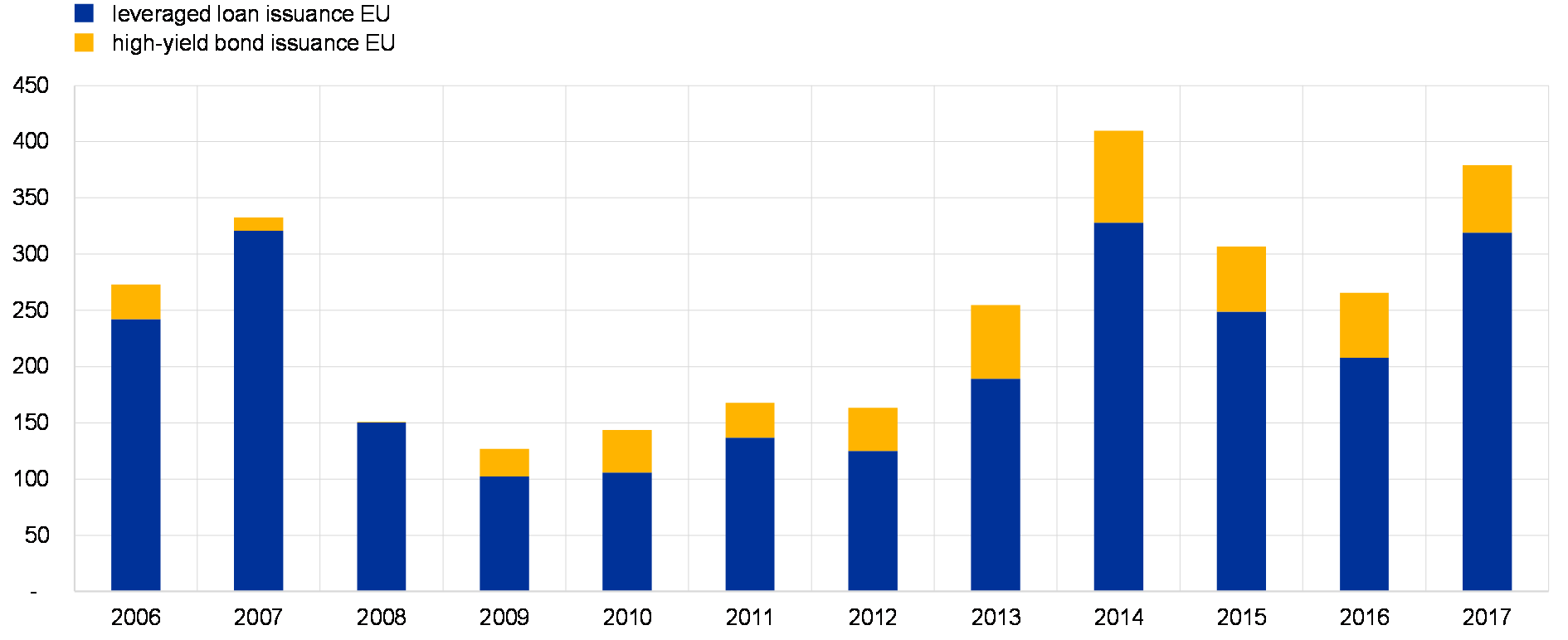

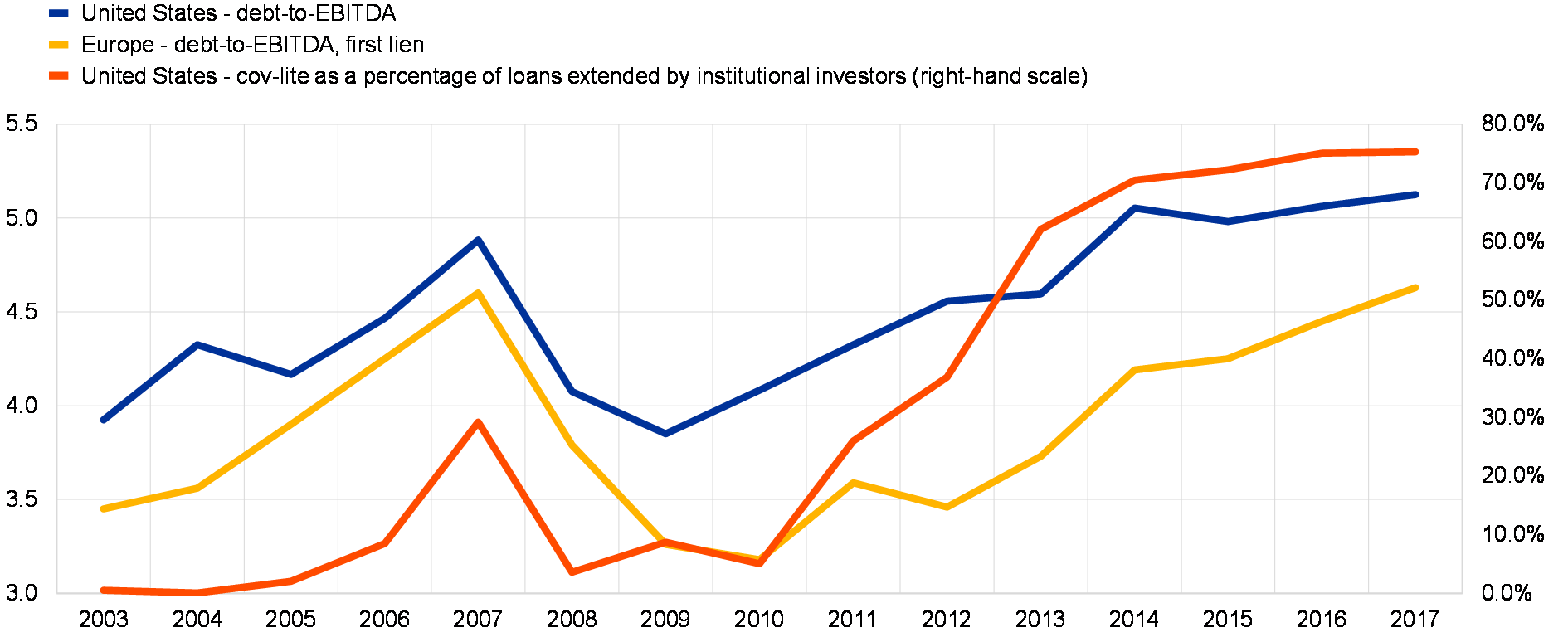

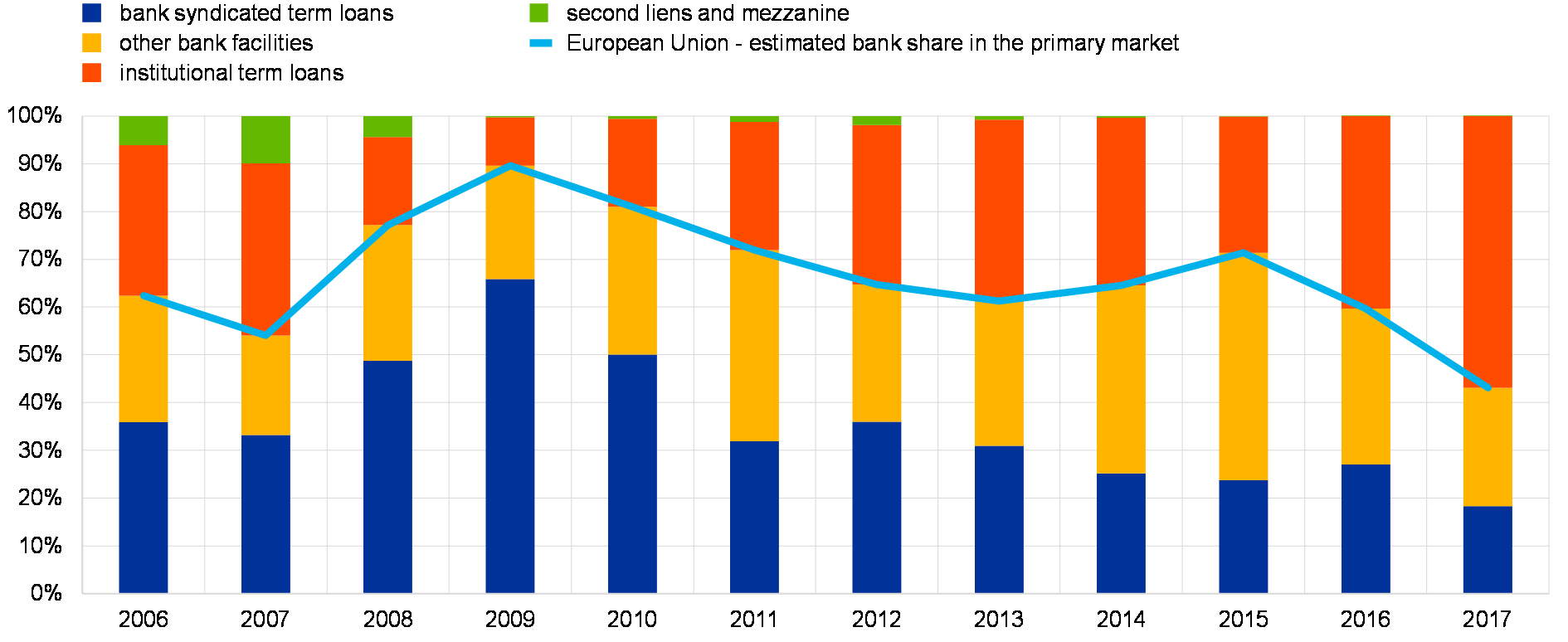

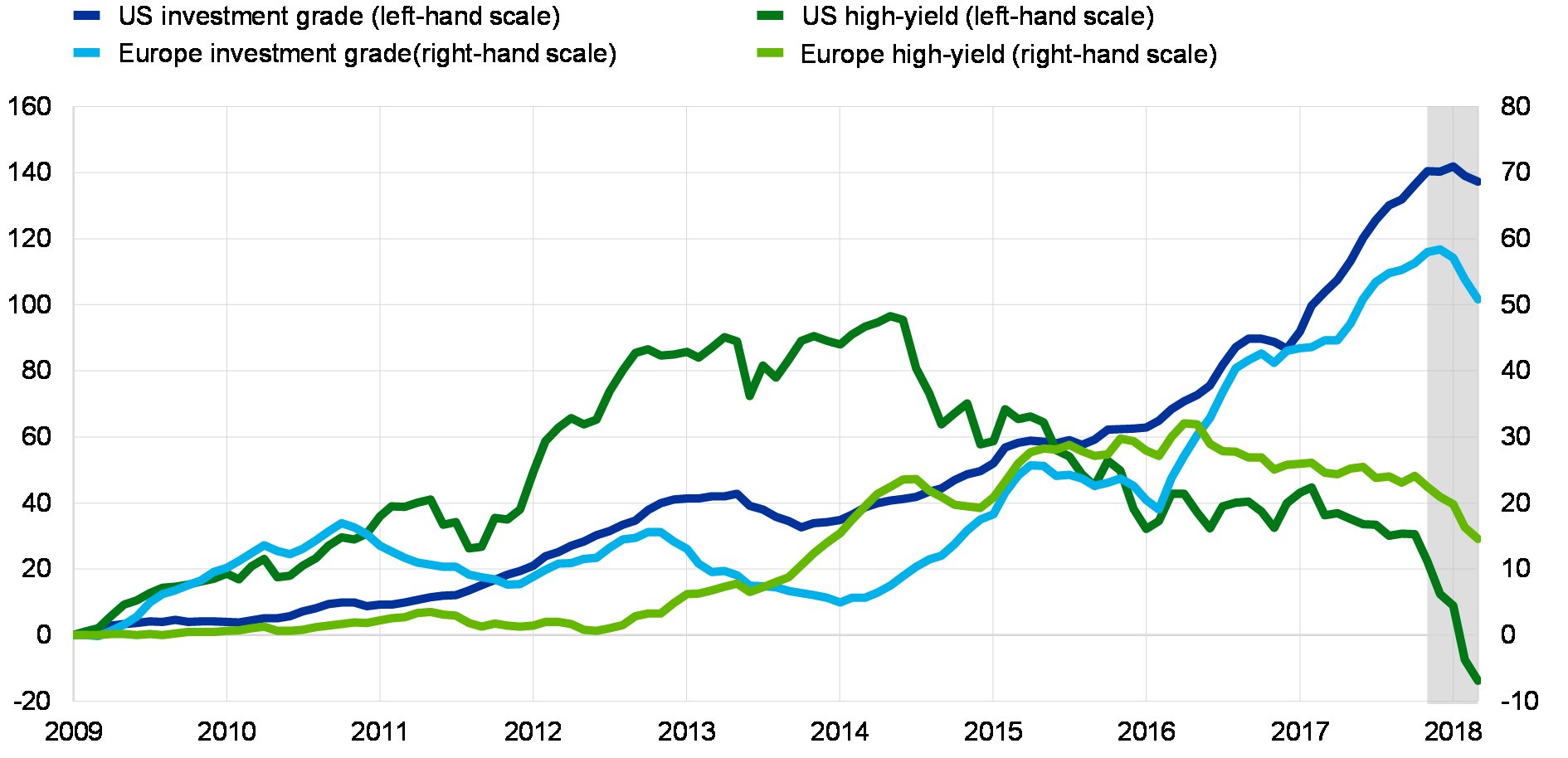

Similarly, for the high-yield corporate bond market segment, current levels of spreads are somewhat stretched vis-à-vis fundamentals (see Chart 12). Signs of potential mispricing are also evident in the larger leveraged loan market. As discussed in Box 5, a significant relaxation of underwriting standards for US and European leveraged loans has been observed in recent years. This increases the likelihood that defaults will be delayed and recovery rates will be lower should the creditworthiness of the borrowers deteriorate. At the same time, valuation models for euro area investment-grade bonds and aggregate stock price indices indicate broadly fair valuations (see Chapter 2). Nevertheless, investment-grade euro area non-financial corporates remain more levered than before the crisis, which leaves them vulnerable to a turnaround in the global economic outlook. Looking beyond the euro area, US corporate bond spreads are trading at levels below historical norms. Furthermore, as highlighted in previous issues of the FSR, US stock prices are still elevated when gauged using standard valuation metrics such as the cyclically adjusted price/earnings (CAPE) ratio.

Chart 12

Valuations somewhat stretched for euro area high-yield bonds

Excess bond risk premia on euro area investment-grade and high-yield non-financial sector bonds

(Jan. 2004 – Apr. 2018; basis points)

Sources: iBoxx and Moody’s.

Notes: The excess bond premium (EBP) is defined as the deviation of credit spreads from measures of credit risk and liquidity risk at individual bond level. The series represent averages from two ECB models. For further details, see Chart 2.7 in Chapter 2.

Higher risk premia on euro area assets could be triggered by developments from both within and outside the euro area. First, a faster than expected withdrawal of monetary policy accommodation globally has some potential to translate into higher risk premia, which could spill over to the euro area. Second, a significant reassessment of global economic growth prospects and the impact of fiscal policies or adverse implications stemming from rising protectionism all have the potential to trigger a repricing of risk. Third, a sharp, domestically driven slowdown in economic growth prospects may also drive risk premia higher in the euro area, particularly in countries and sectors where the level of indebtedness is high. Fourth, high valuations in some markets may themselves act as triggers. Once valuations reach levels that are excessively stretched compared with historical norms, a growing number of investors may start withdrawing exposures from these markets, possibly triggering abrupt normalisations.

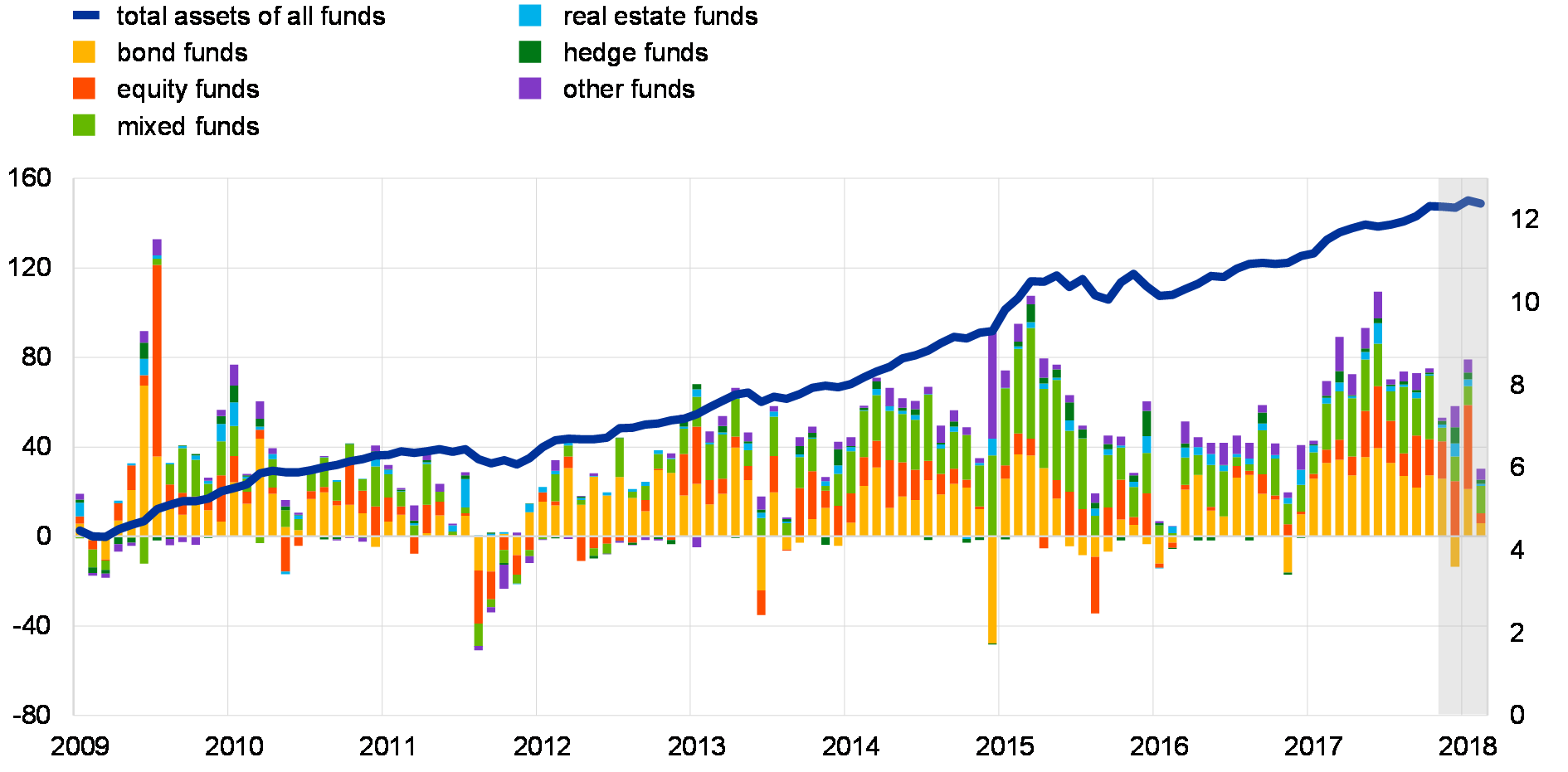

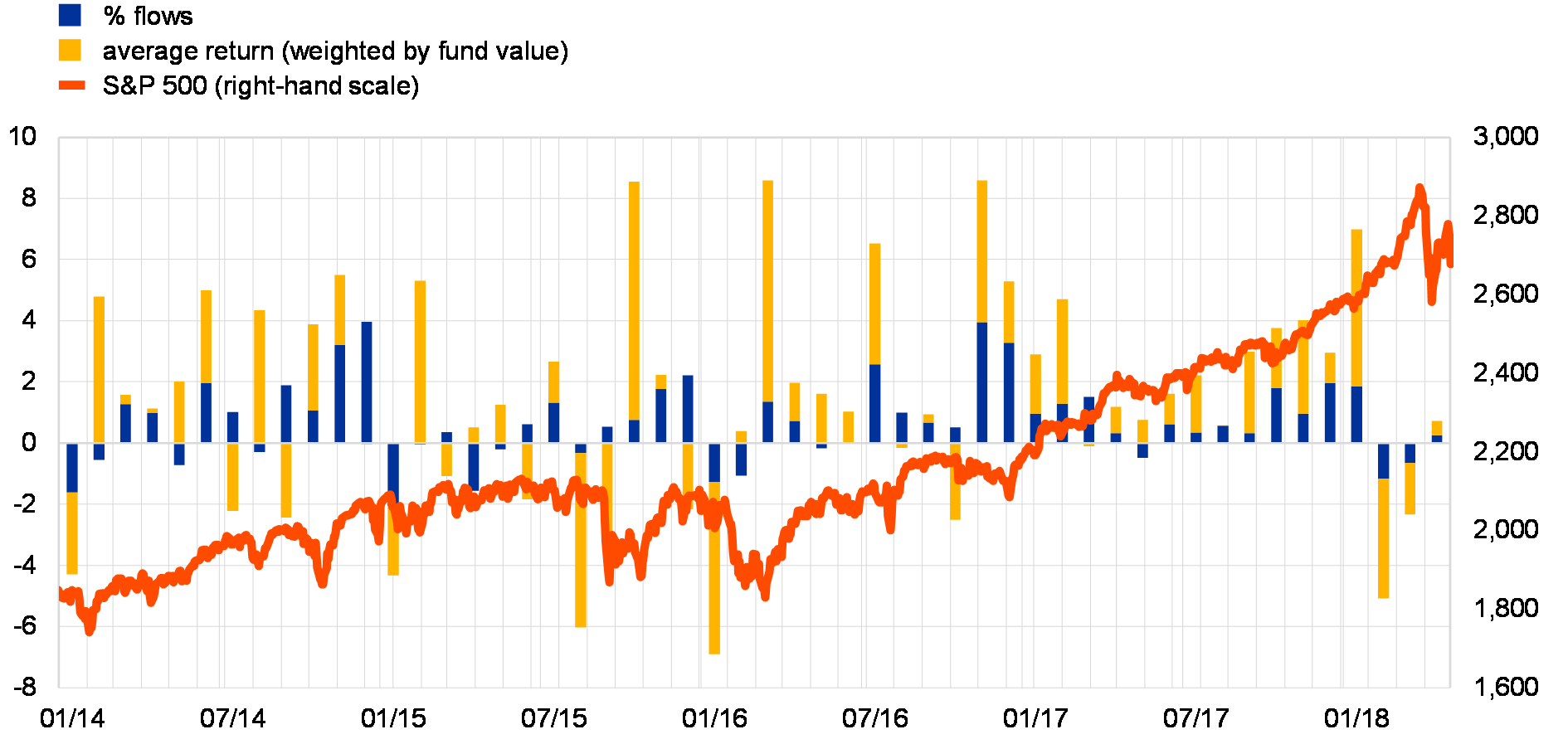

Any sustained repricing of assets could be amplified by an increasingly large investment fund sector. Both bond and equity fund flows in the euro area experienced some volatility around the turn of the year owing to rising yields and the more recent spike in equity volatility (see Section 3.2). The volatility did not adversely impact the functioning of the fund sector. That said, a prolonged period of negative returns in the future could trigger elevated investor outflows, eventually resulting in forced sales of fund portfolios. Data on liquid holdings show that bond funds domiciled in the euro area have reduced the buffers available to accommodate large outflows in recent years.

Improving cyclical outlook for euro area banks and insurers, but structural challenges remain

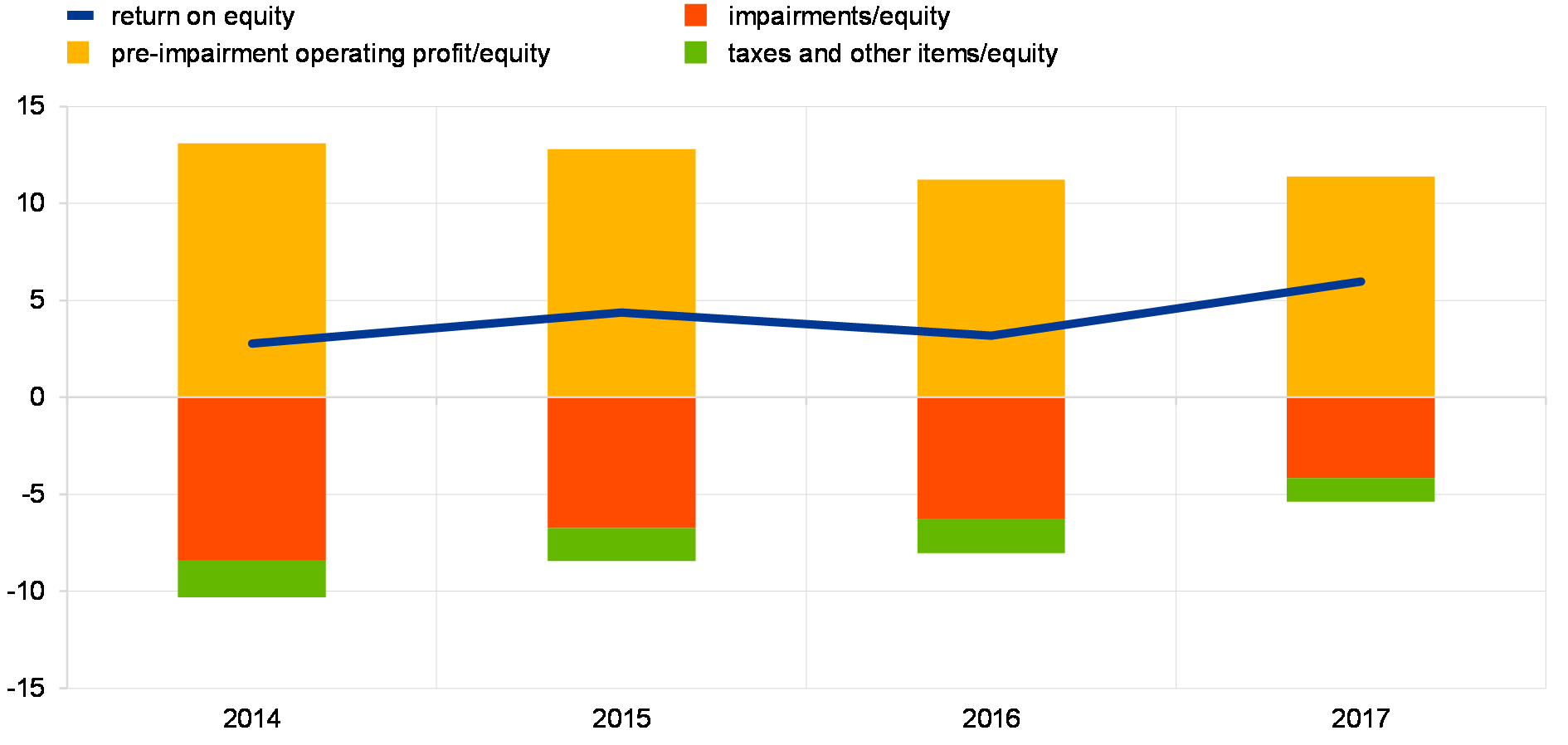

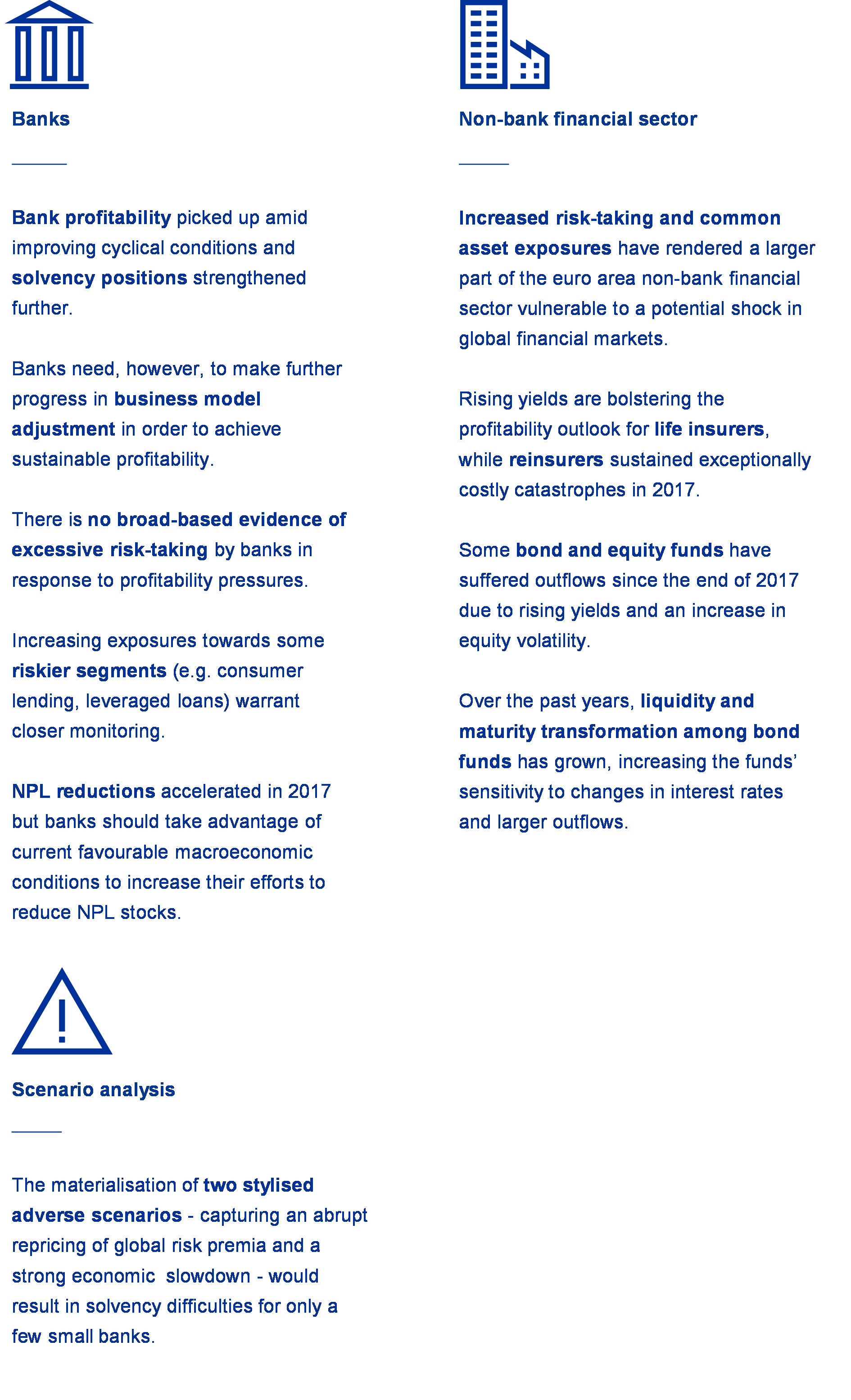

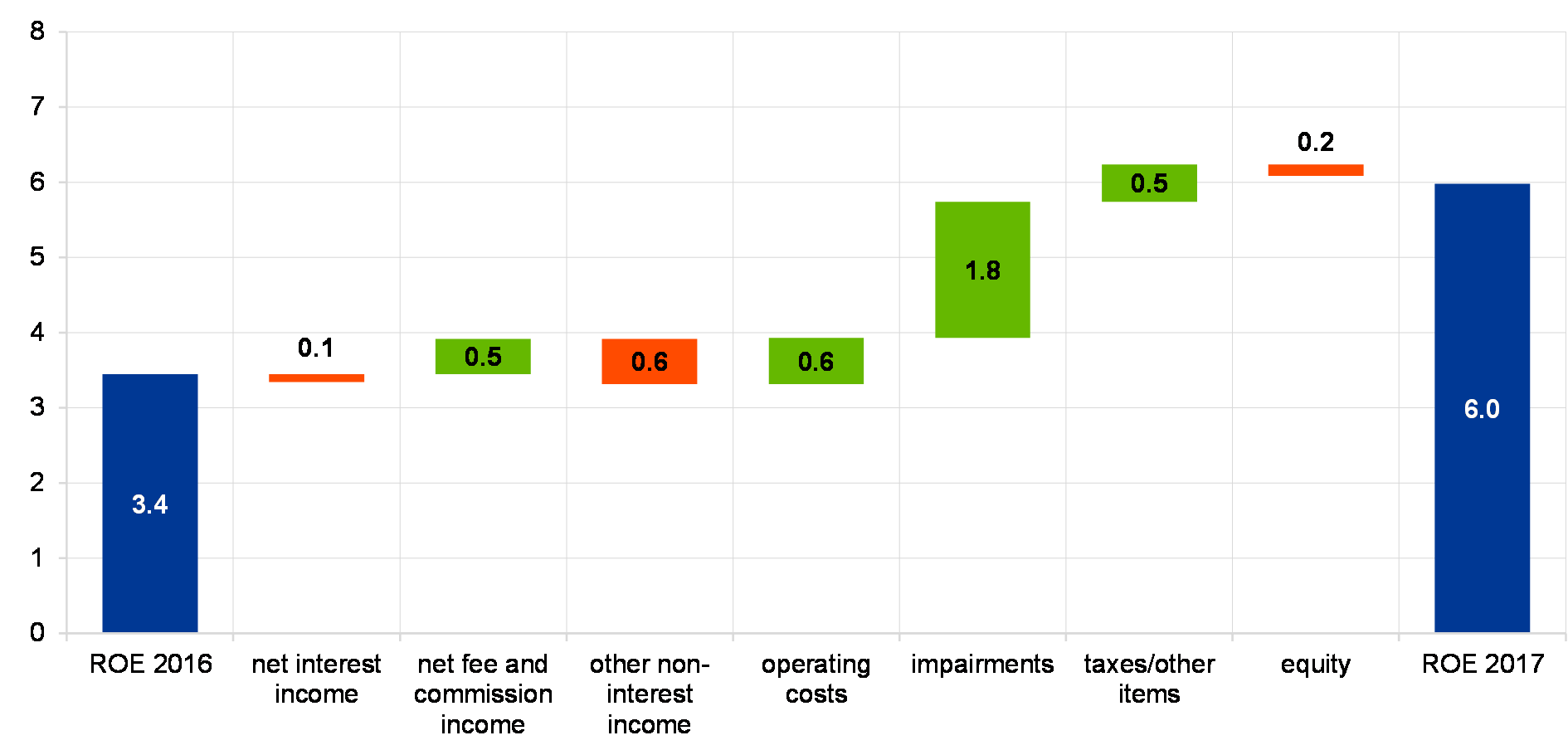

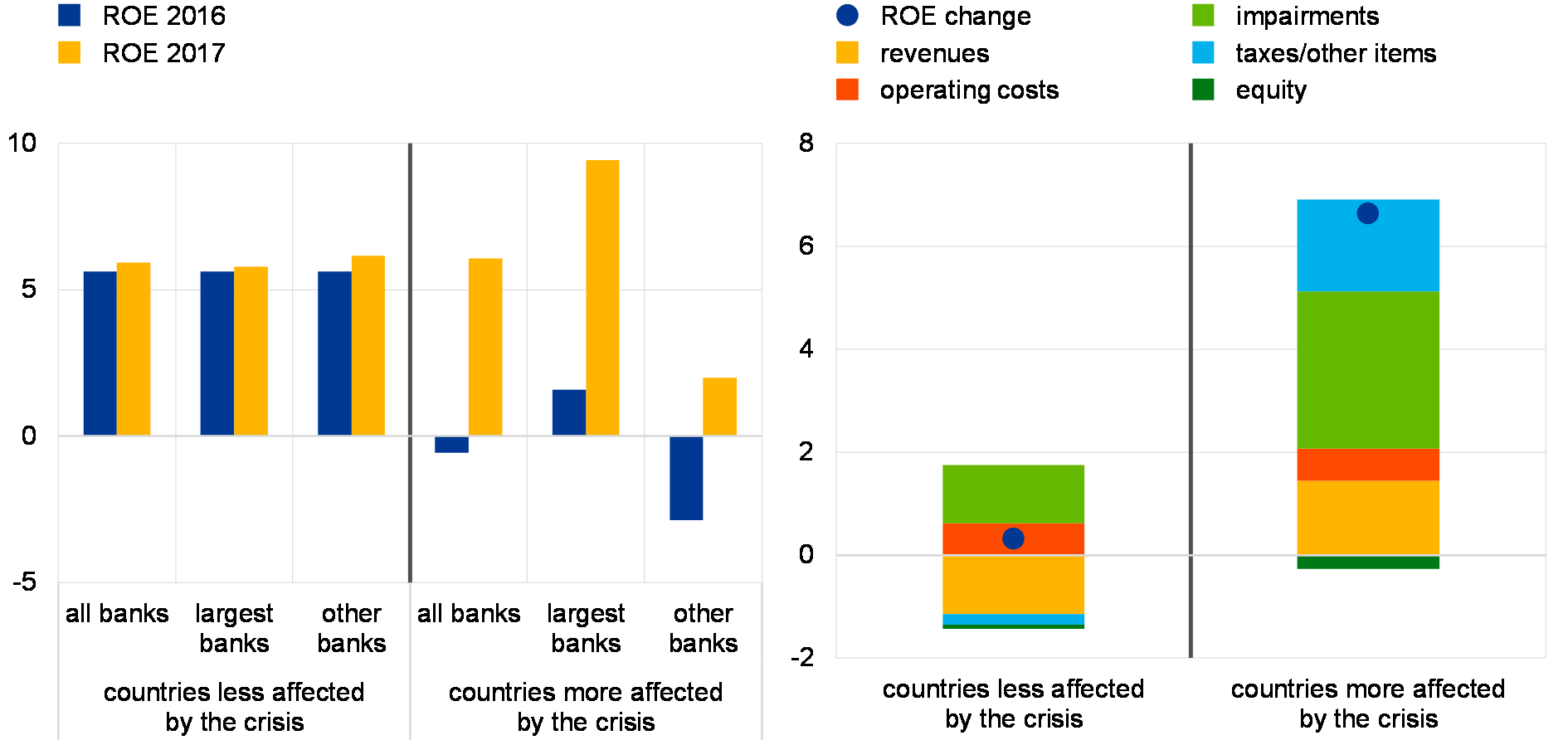

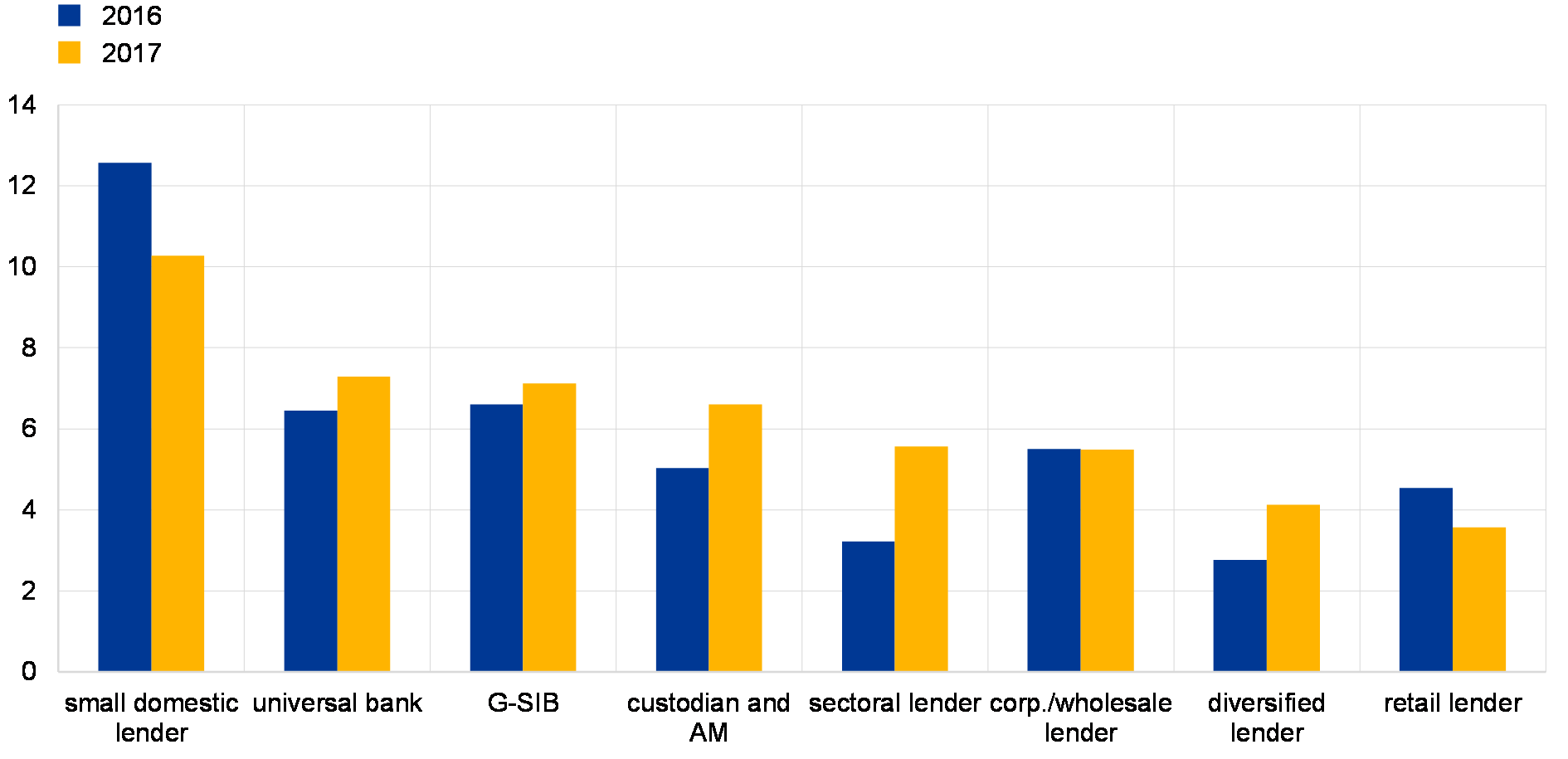

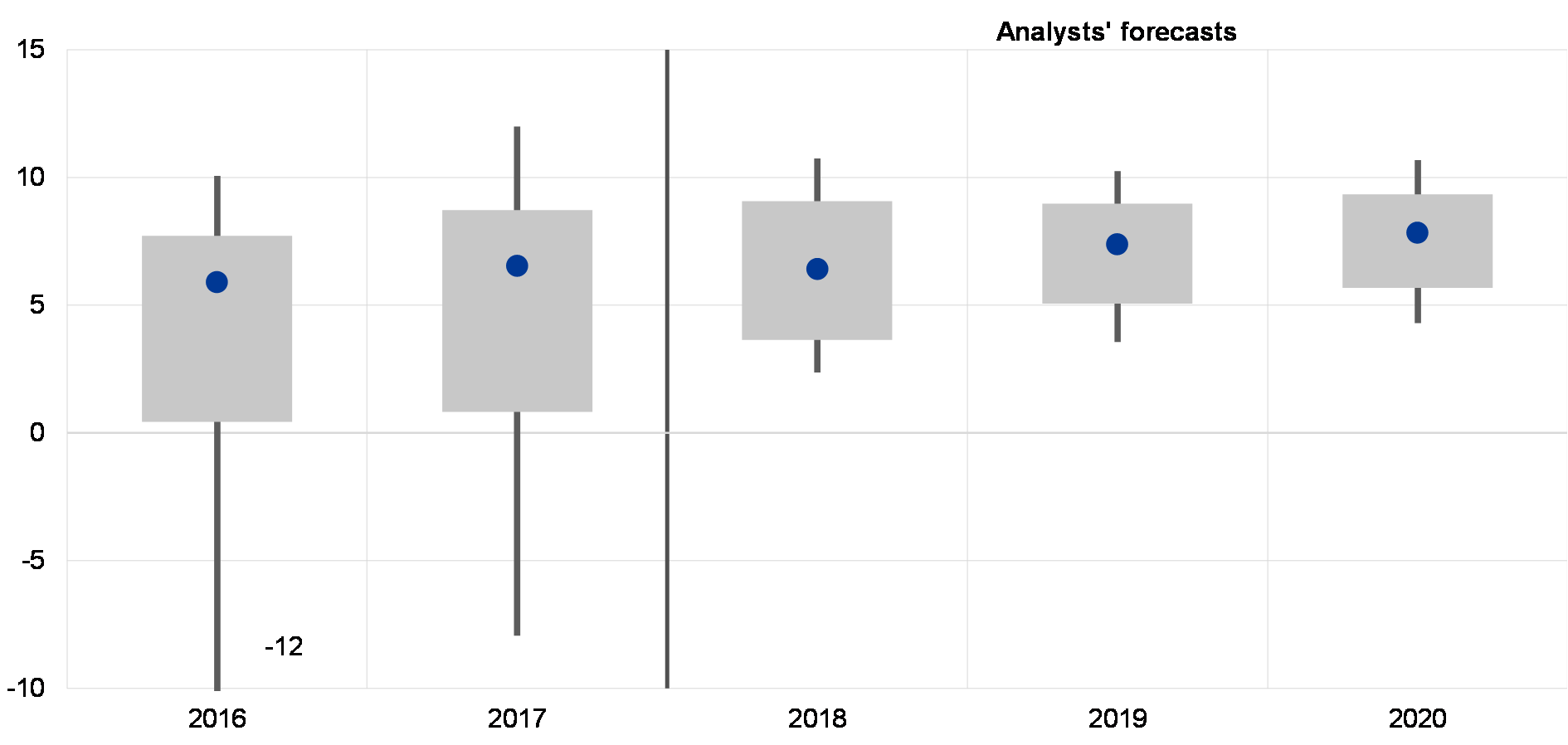

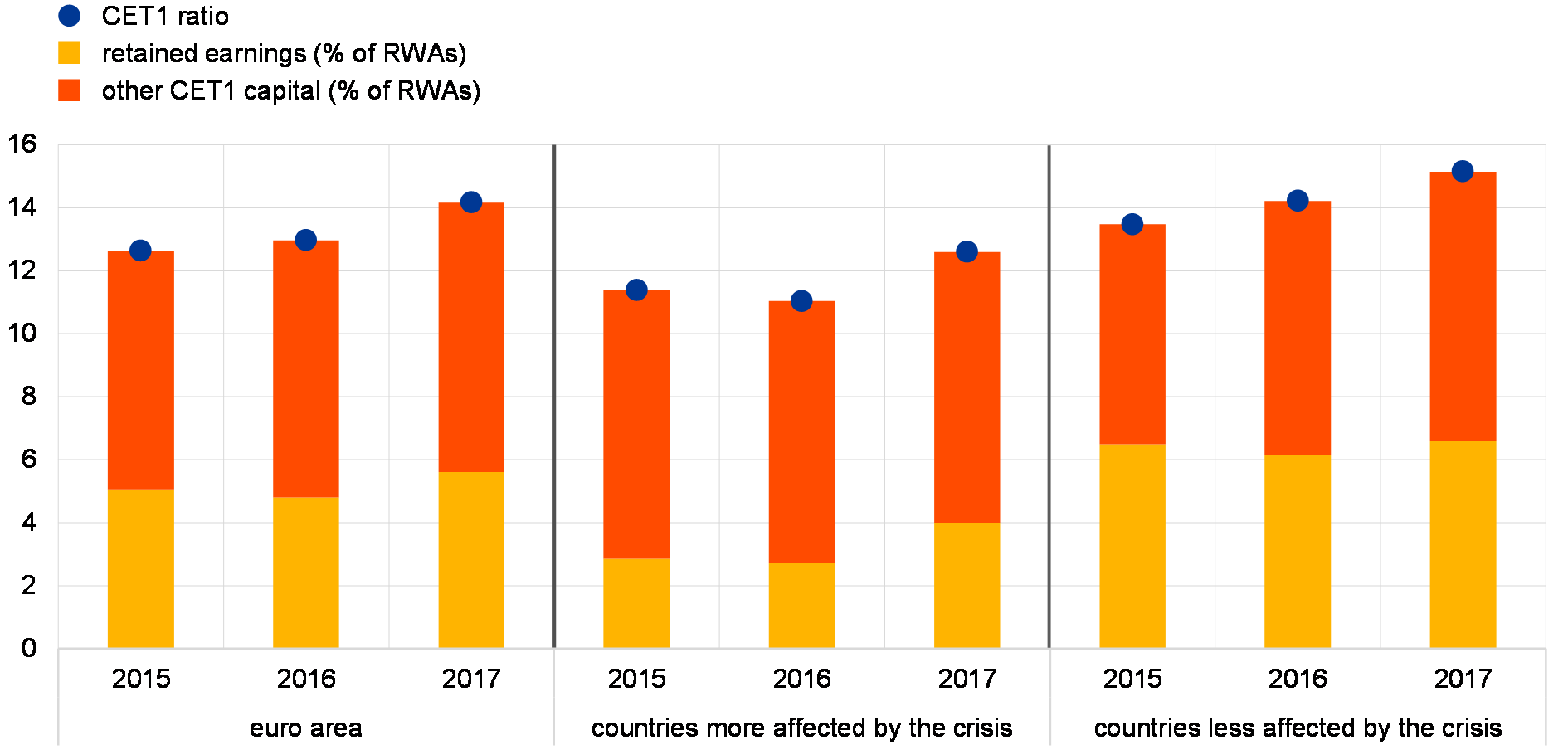

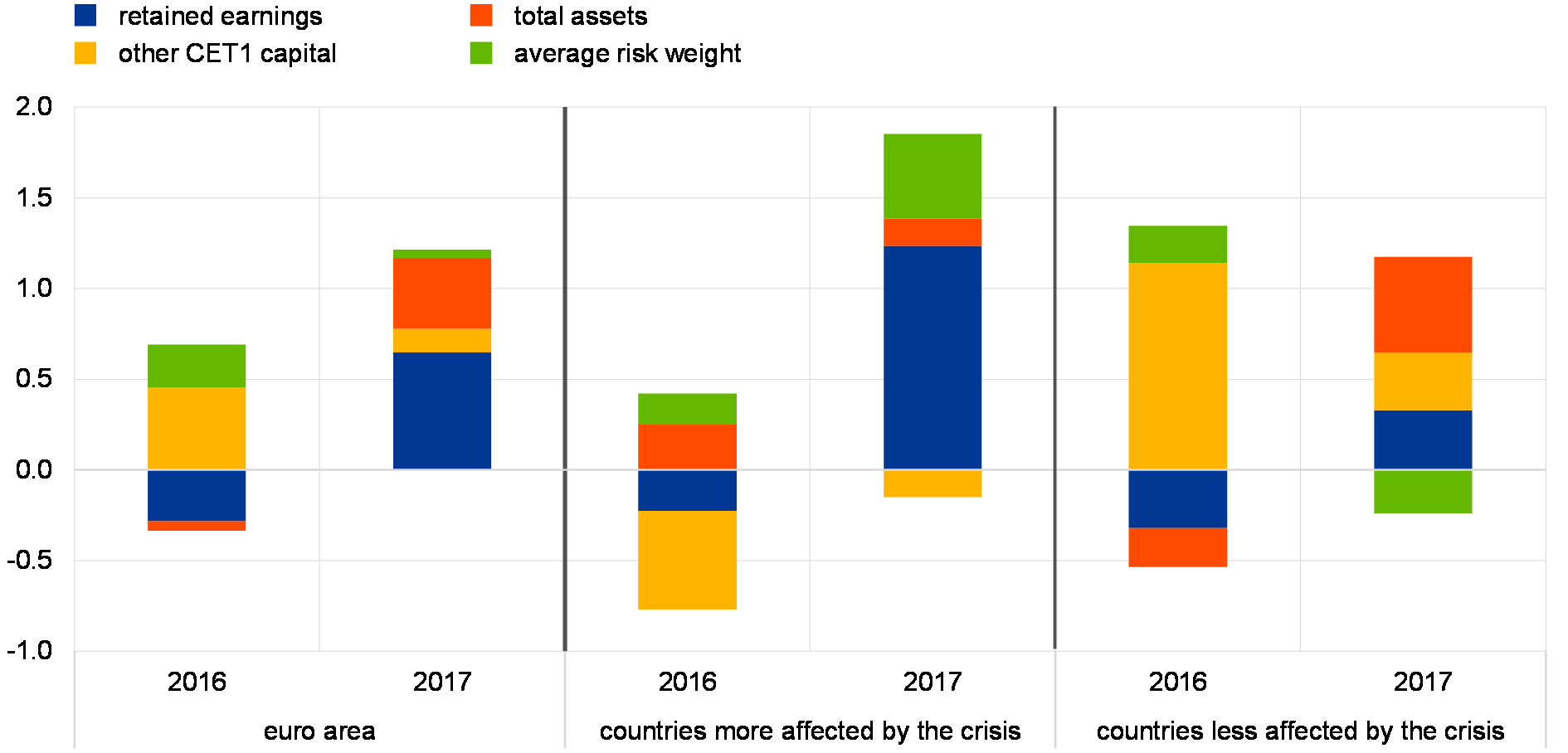

Bank profitability recovered in 2017, supported by the improvement in economic growth. After a prolonged period of low profitability, bank performance rebounded in 2017 (see Chart 13). Euro area significant institutions’ aggregate return on equity increased to around 6% in 2017, compared with 3.5% one year earlier. The main driver of higher profitability was lower impairment costs, as new NPL formation slowed. Across countries, the bulk of the euro area-wide improvement was driven by banks operating in the countries most affected by the crisis.

Chart 13

Euro area bank profitability recovered in 2017, buoyed by improving cyclical prospects

Decomposition of euro area significant banks’ aggregate return on equity

(2014-17, percentages, percentage point contributions)

Sources: ECB and ECB calculations.

Note: Based on an unbalanced sample of at least 103 euro area significant institutions.

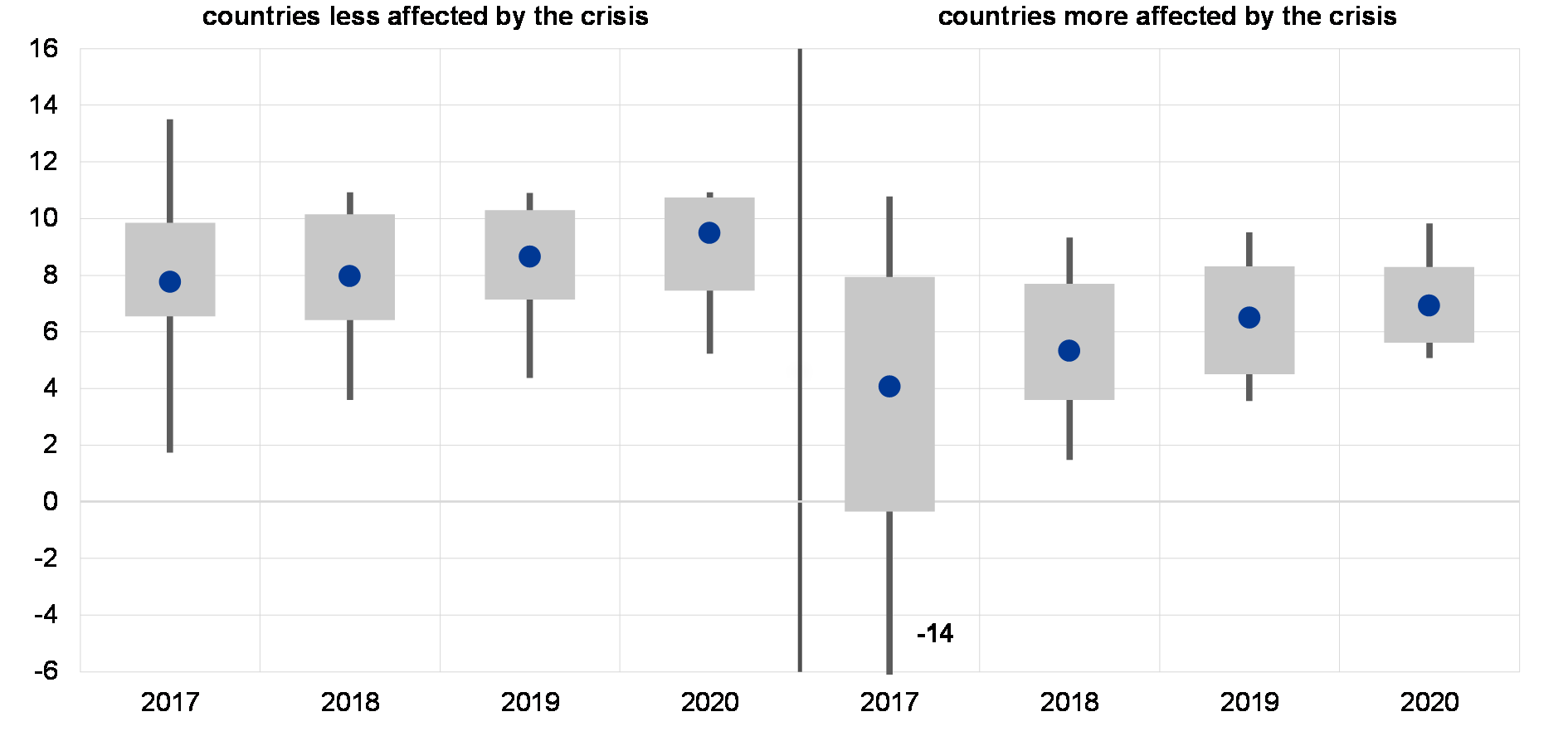

Looking ahead, bank profitability is expected to improve further over the coming years, according to market analysts (see Chart 14). This notwithstanding, for some banks, particularly in the countries most affected by the crisis, the return on equity is likely to continue to fluctuate below the corresponding cost of equity.

Chart 14

Analysts expect profitability to further improve over the next three years

Actual return on equity in 2017 and estimates for 2018-20 for euro area banks

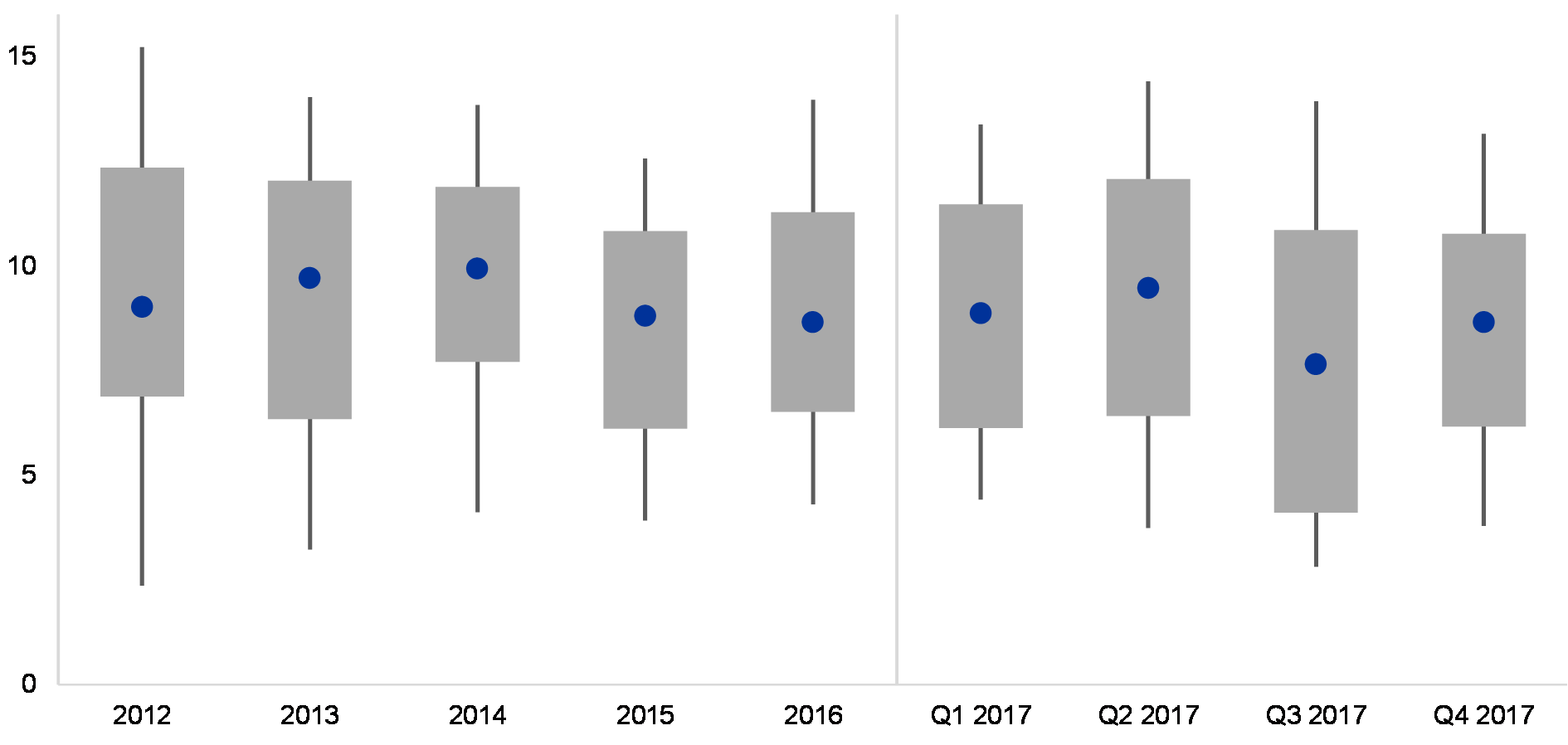

(2017-20; percentages, 10th and 90th percentiles, interquartile distribution and median)

Sources: SNL Financial and S&P Capital IQ.

Note: Based on a sample of 41 euro area listed banks. Countries more affected by the crisis include Cyprus, Greece, Ireland, Italy, Portugal, Spain and Slovenia.

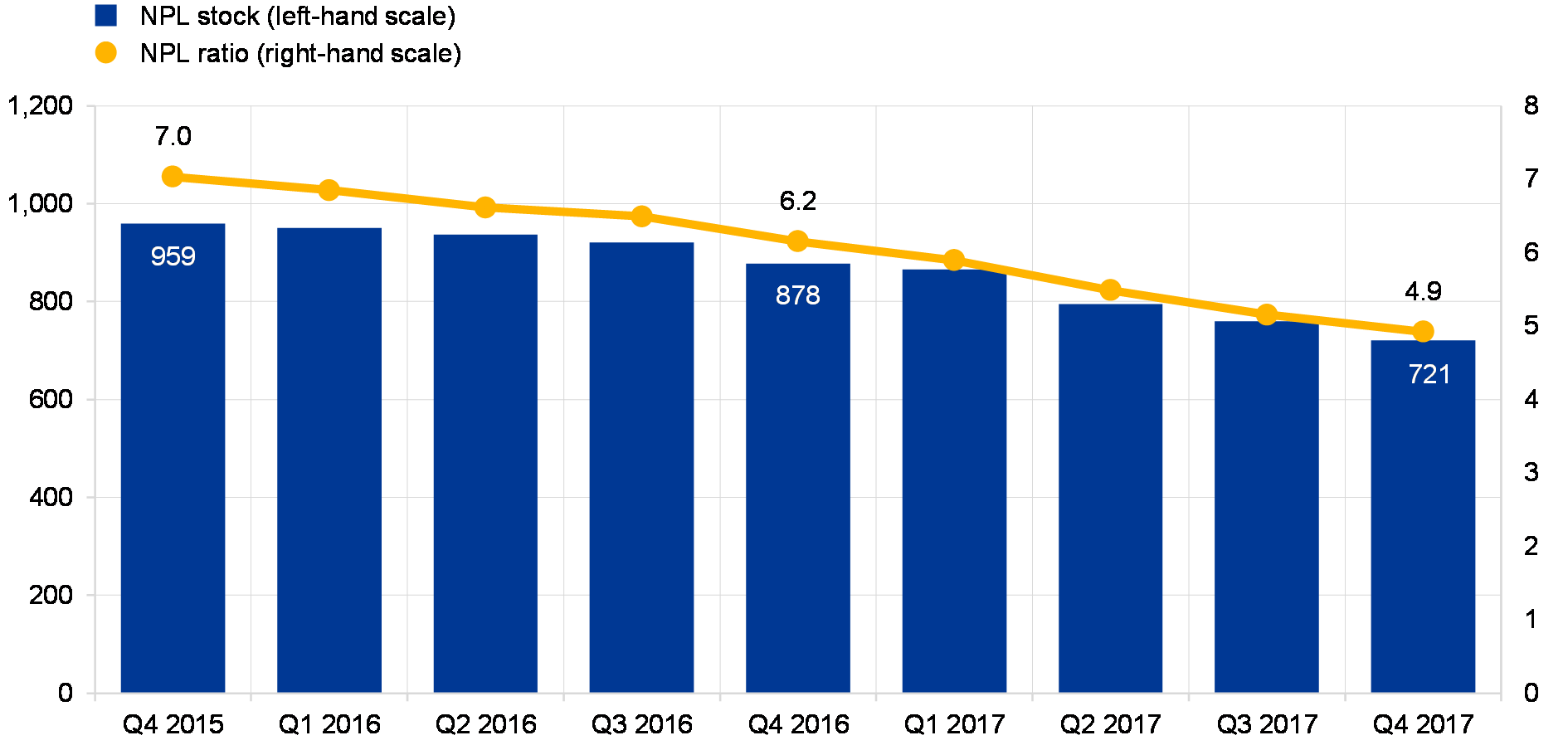

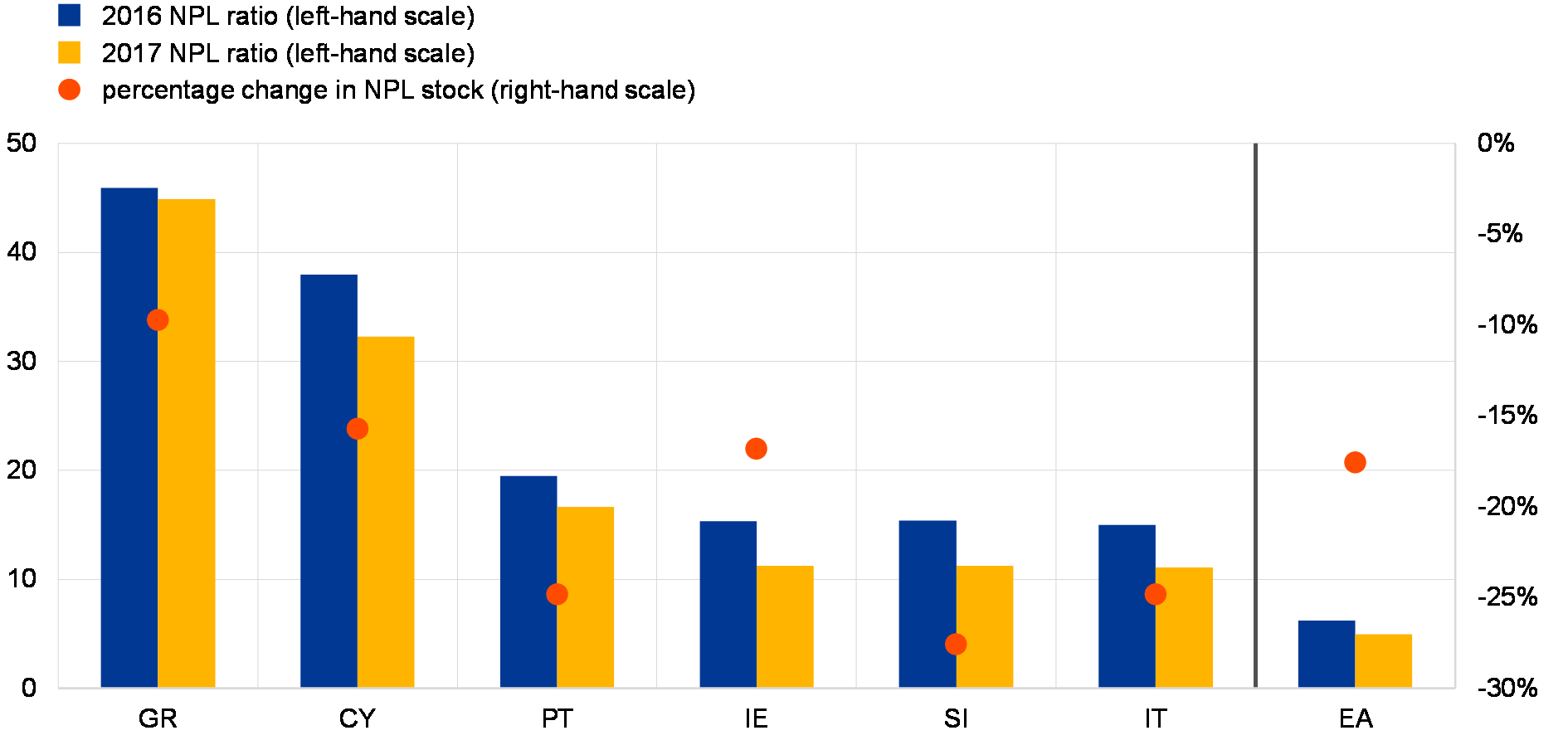

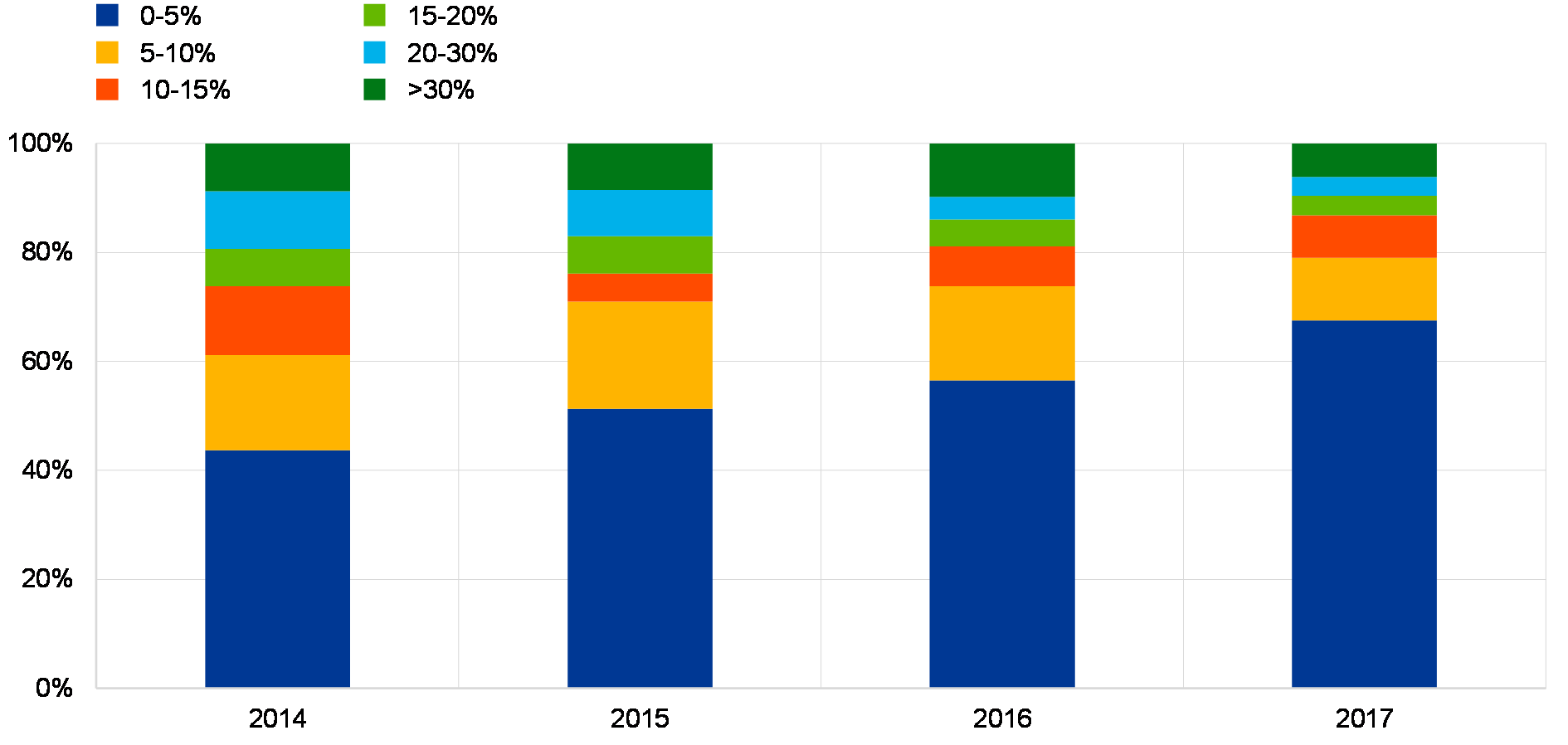

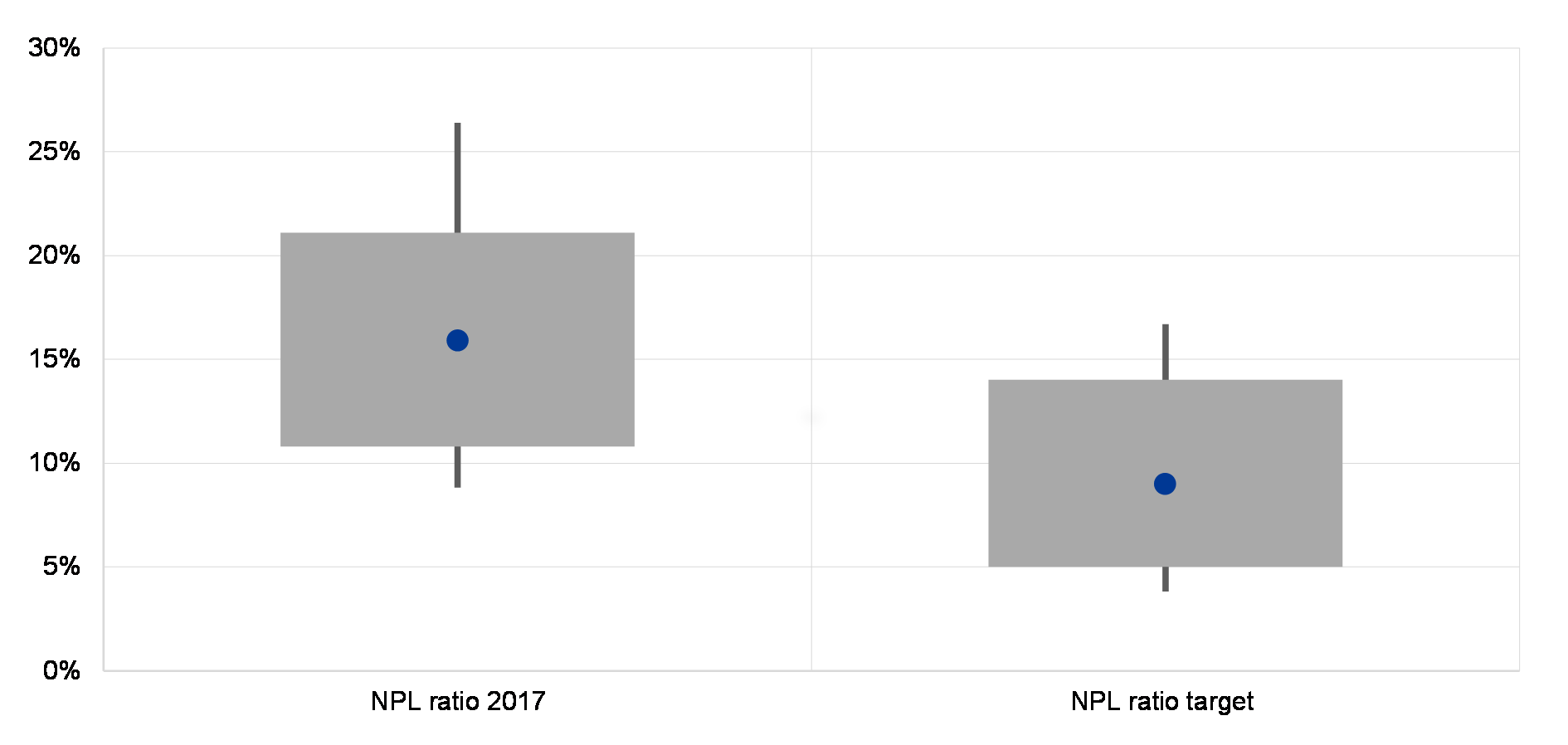

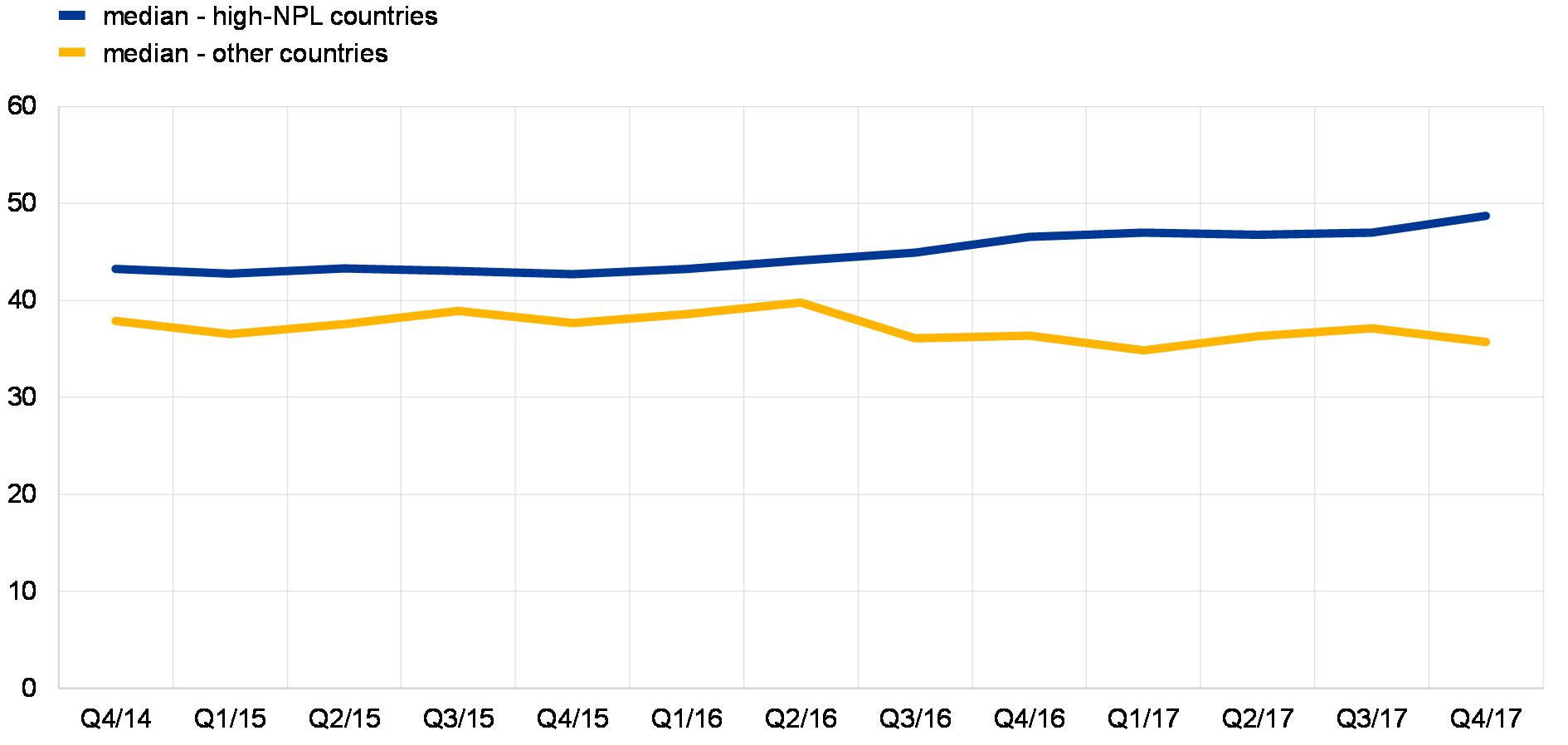

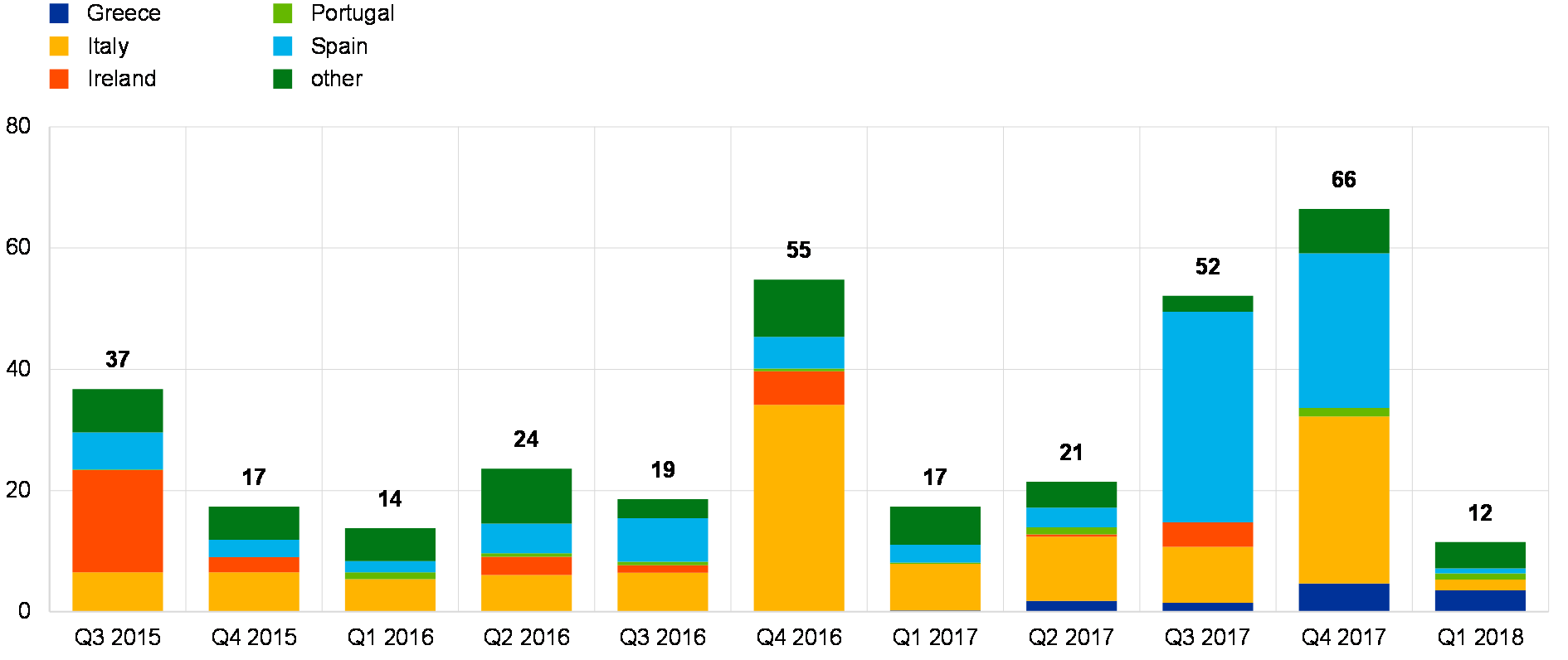

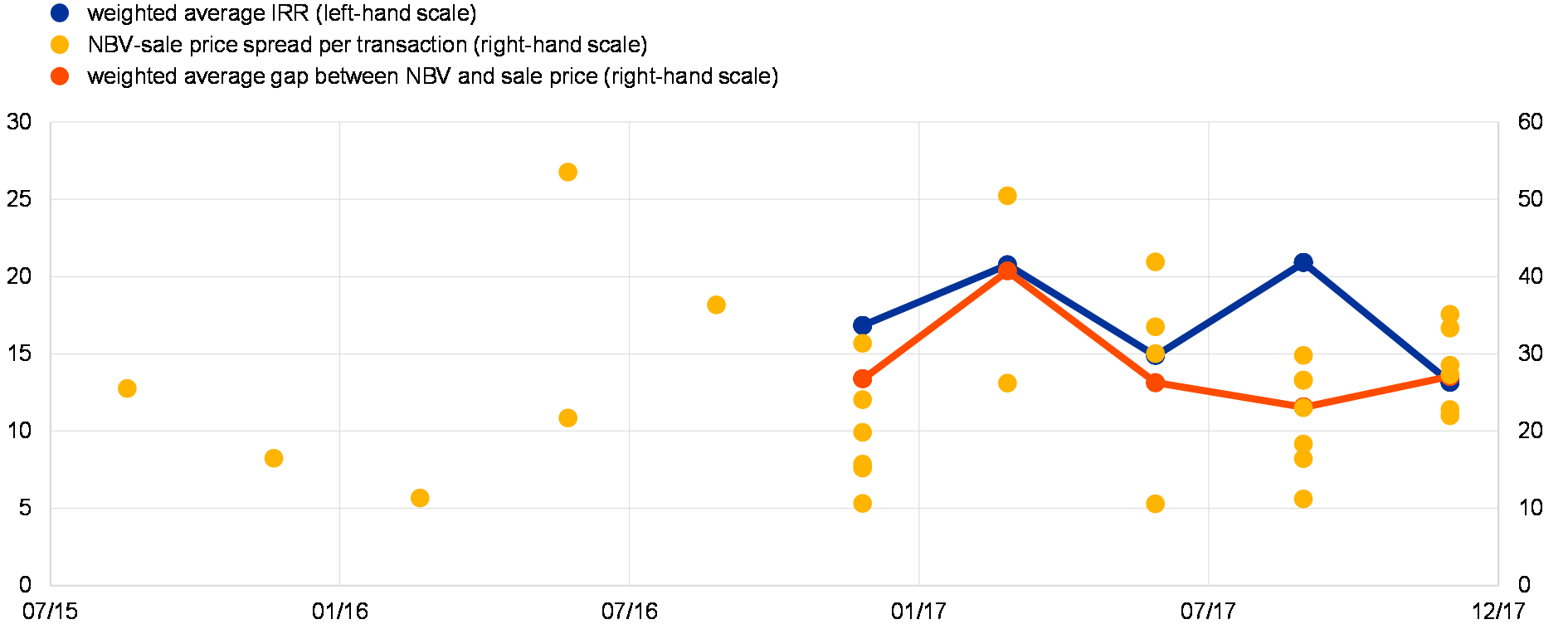

The stock of NPLs fell in 2017, but remains persistently high in some countries. Euro area significant institutions’ aggregate NPL stocks and ratios decreased in 2017 (see Chart 15). The reduction was relatively broad-based across countries. Coverage ratios also increased in 2017, which suggests an improved ability of banks to absorb losses from NPL portfolios. Despite the overall improvement in asset quality, high NPLs are still a challenge in some jurisdictions, as they weigh on financing conditions and, ultimately, economic growth prospects. Further work is needed to bring them down to sustainable levels. Improving the functioning of the secondary NPL market could make a substantial contribution in this respect. As highlighted in Box 7, liquidity in the secondary market for NPLs in Europe has improved in recent years, but continues to be afflicted by several types of market failure.

Chart 15

Progress in NPL reduction gained momentum in 2017

Euro area significant institutions’ NPL stock and aggregate NPL ratio

(Q4 2015 – Q4 2017; € billions, percentages)

Source: ECB supervisory data.

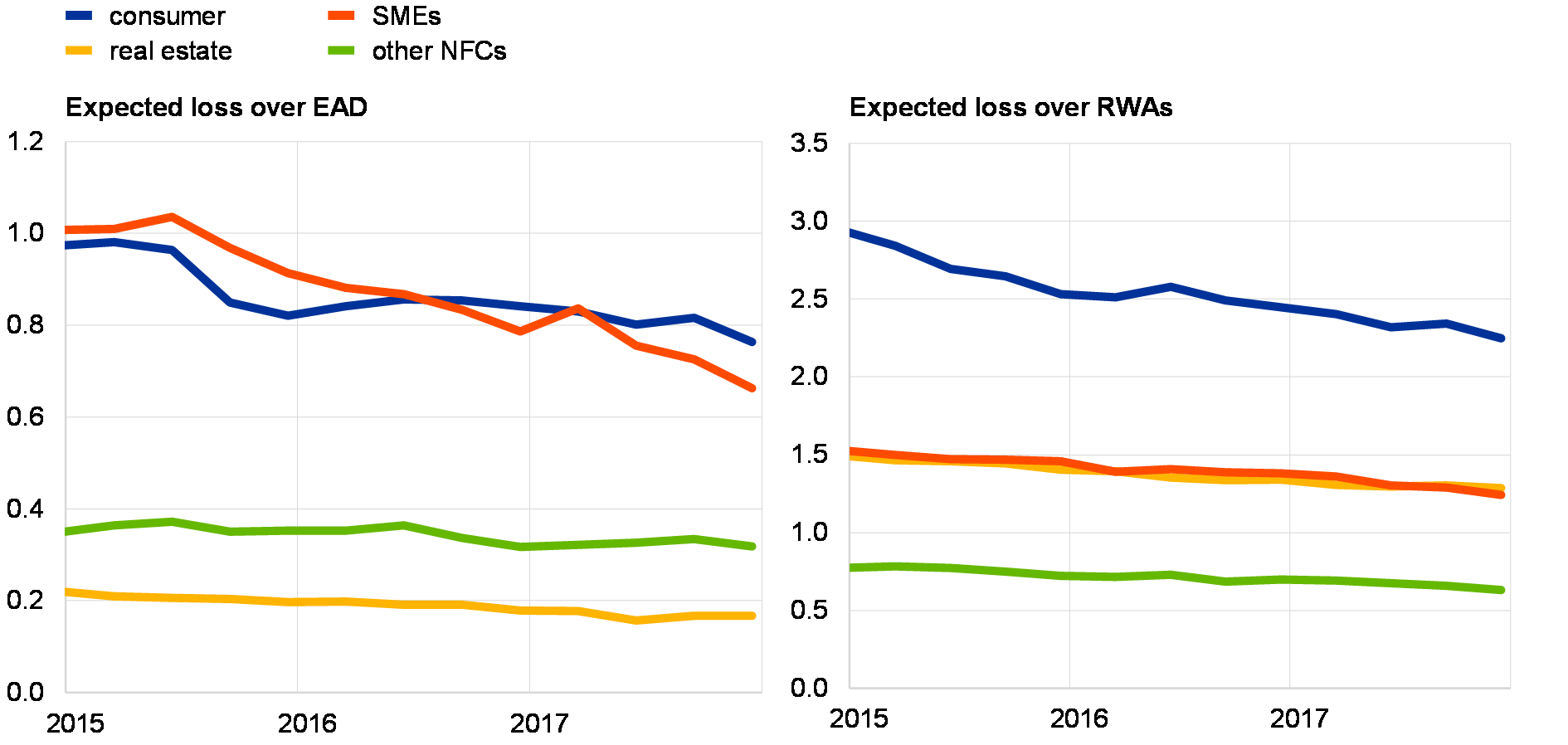

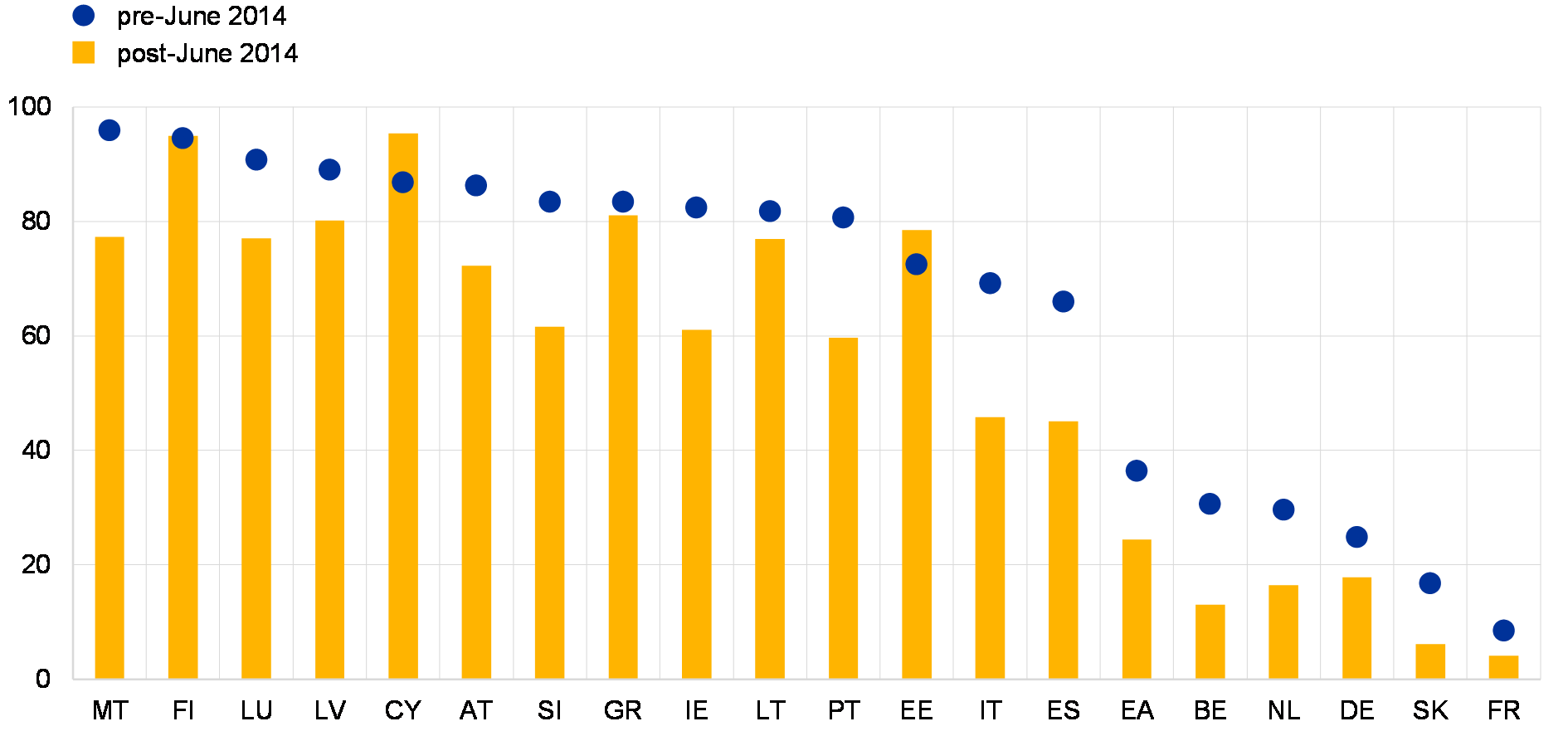

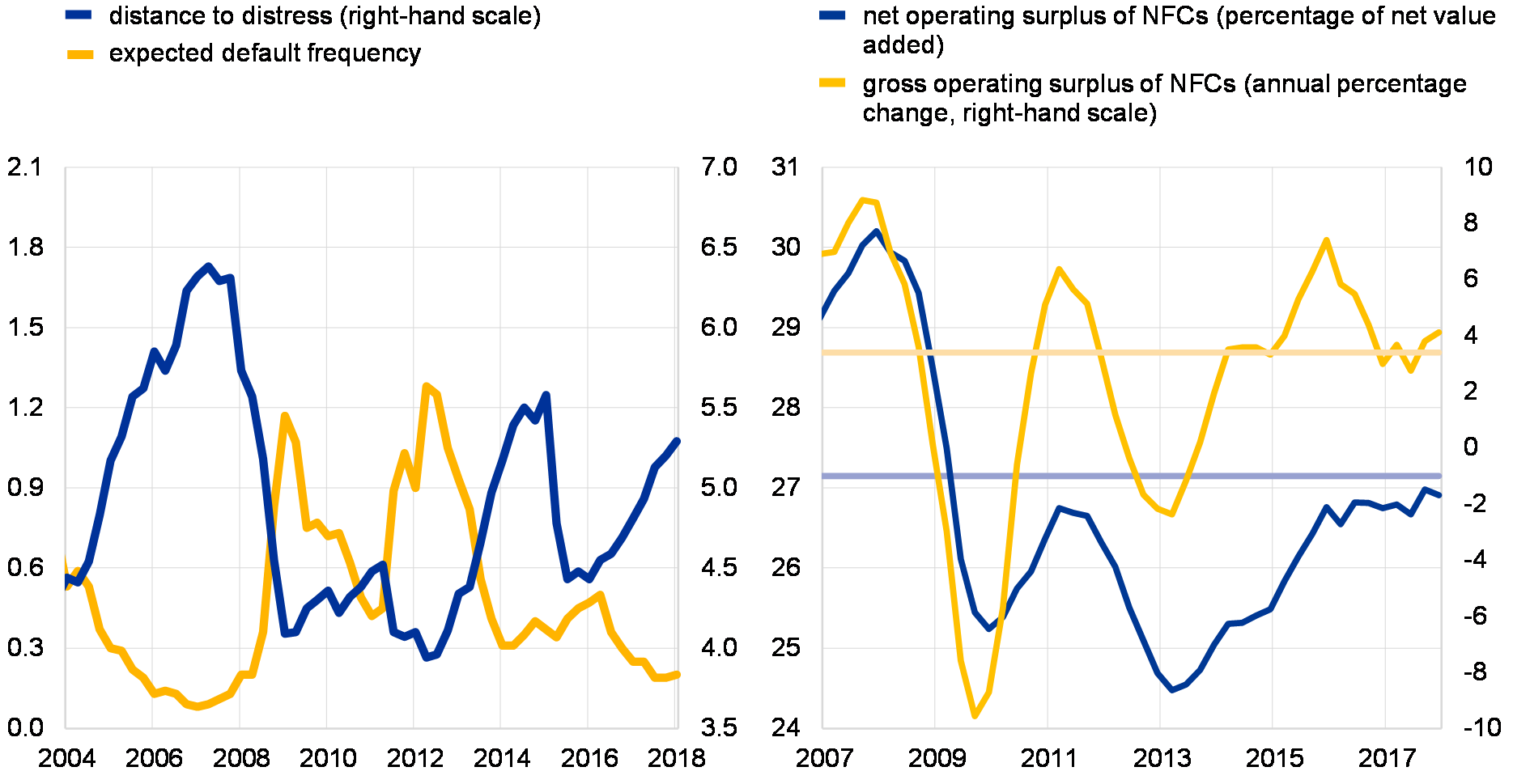

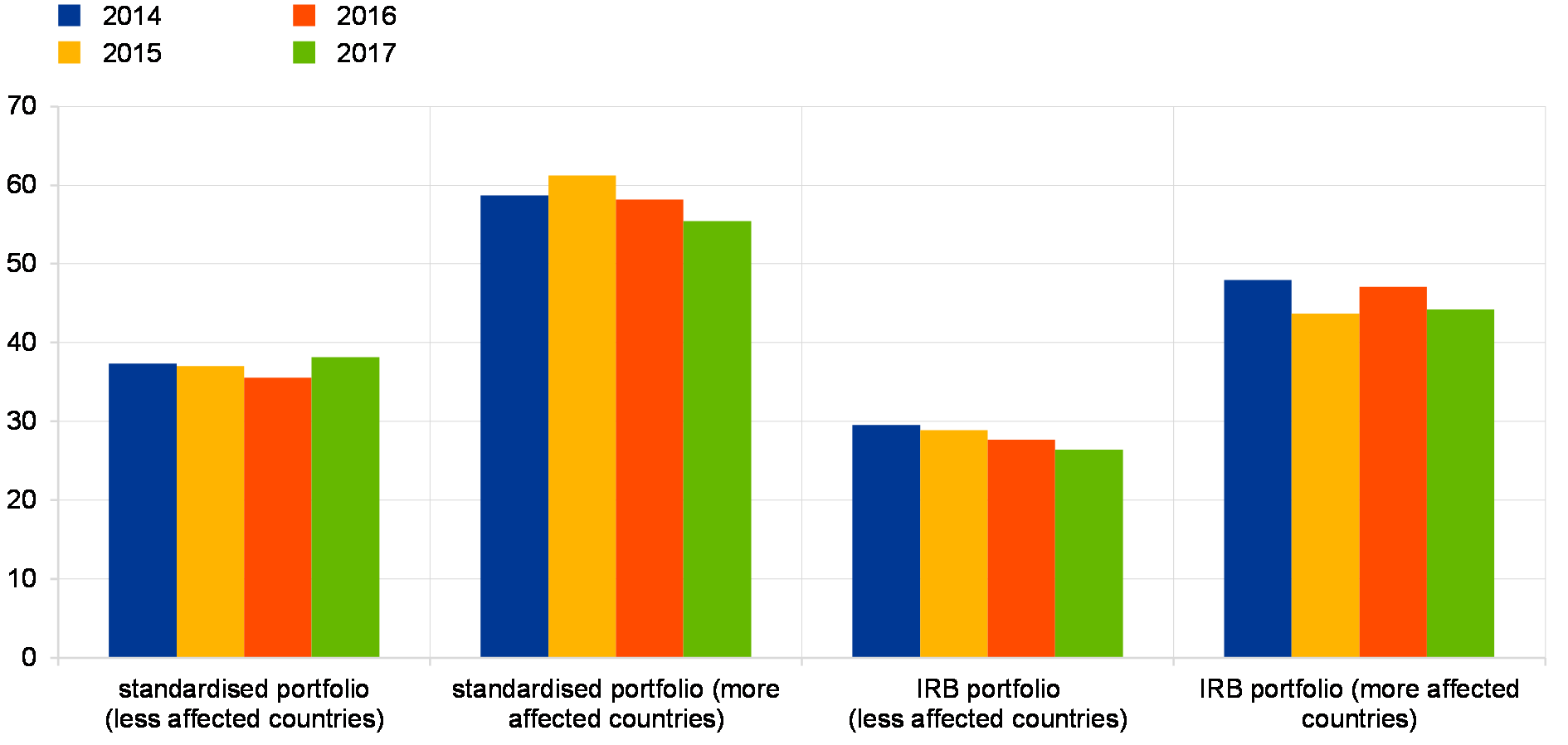

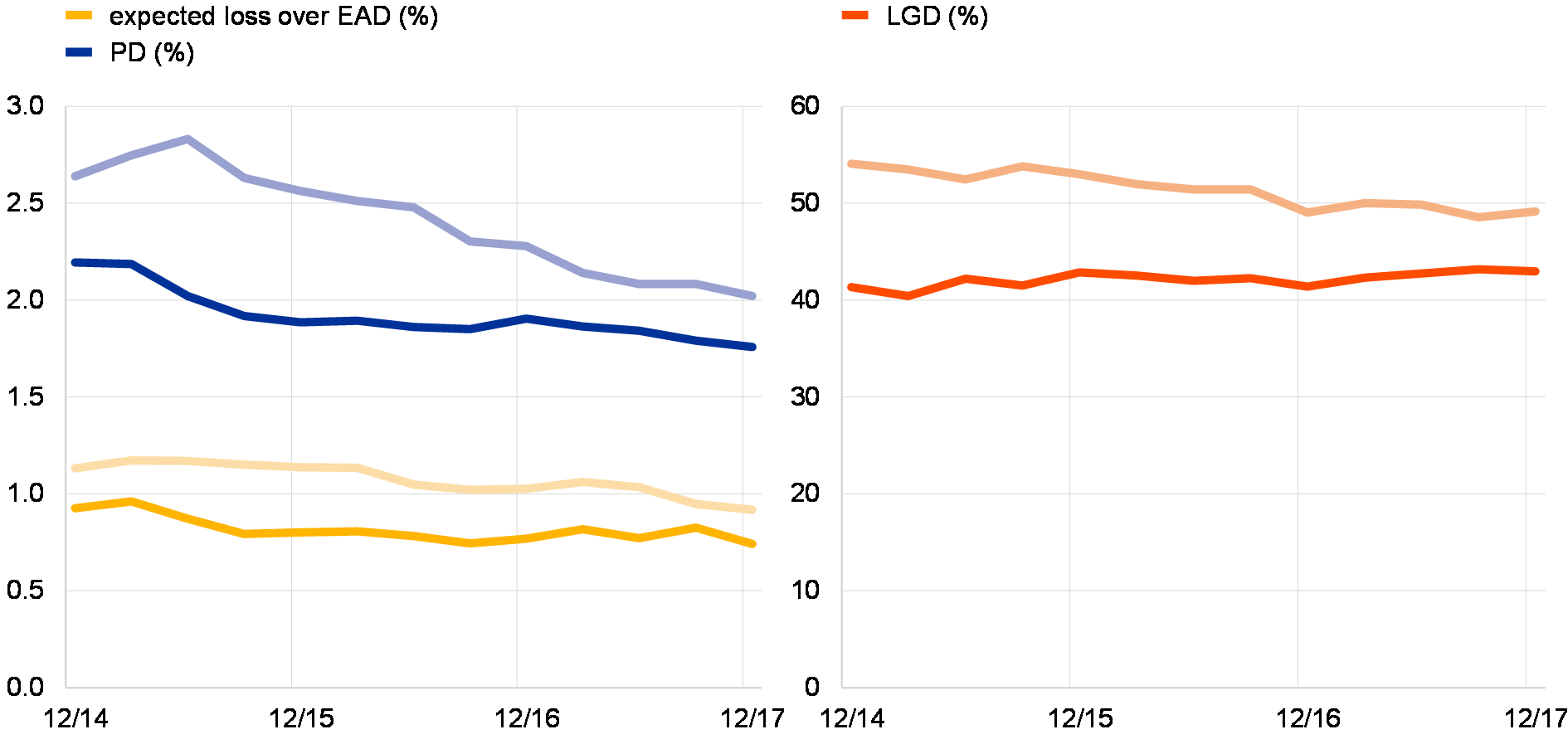

Despite still weak performance, risk-taking appears to be limited in the euro area banking sector. One avenue for banks to boost profitability in a (still) low interest rate environment is to engage in higher risk-taking. Bank credit risk measures, however, point to slightly lower reported credit risk over the past year for significant institutions (see Chart 16 and Section 3.1). This is consistent with the improved economic outlook, which supports household disposable income and companies’ earnings prospects. Some pockets of vulnerability do, however, exist. In particular, consumer lending is growing at double-digit rates in some countries. Such credit developments warrant close monitoring as risk-taking that is not properly compensated for by higher risk premia may lead to a build-up of vulnerabilities in the medium term. Euro area banks’ aggregate exposure to interest rate risk is fairly limited. Some heterogeneity across banks can, nevertheless, be observed. For instance, banks operating in countries with predominantly fixed rate mortgages will be more vulnerable to higher interest rates than banks situated in countries where floating rates dominate. As discussed in Special Feature C, there is evidence that banks are taking measures (i.e. hedging) to mitigate their exposure to interest rate risk.

Chart 16

Credit risk measures continue to drift lower

Expected loss relative to exposure at default (EAD) and risk-weighted assets (RWAs)

(Q1 2015 – Q4 2017; medians, percentages)

Sources: ECB supervisory data and ECB calculations.

Notes: Based on measures reported by banks on their internal ratings-based (IRB) portfolios. Excludes exposures in default. Cross-sectional median of a balanced sample of 52 significant institutions with IRB exposures. “Real estate” includes retail loans secured by immovable property; “consumer” includes qualified revolving loans and other non-secured retail credits.

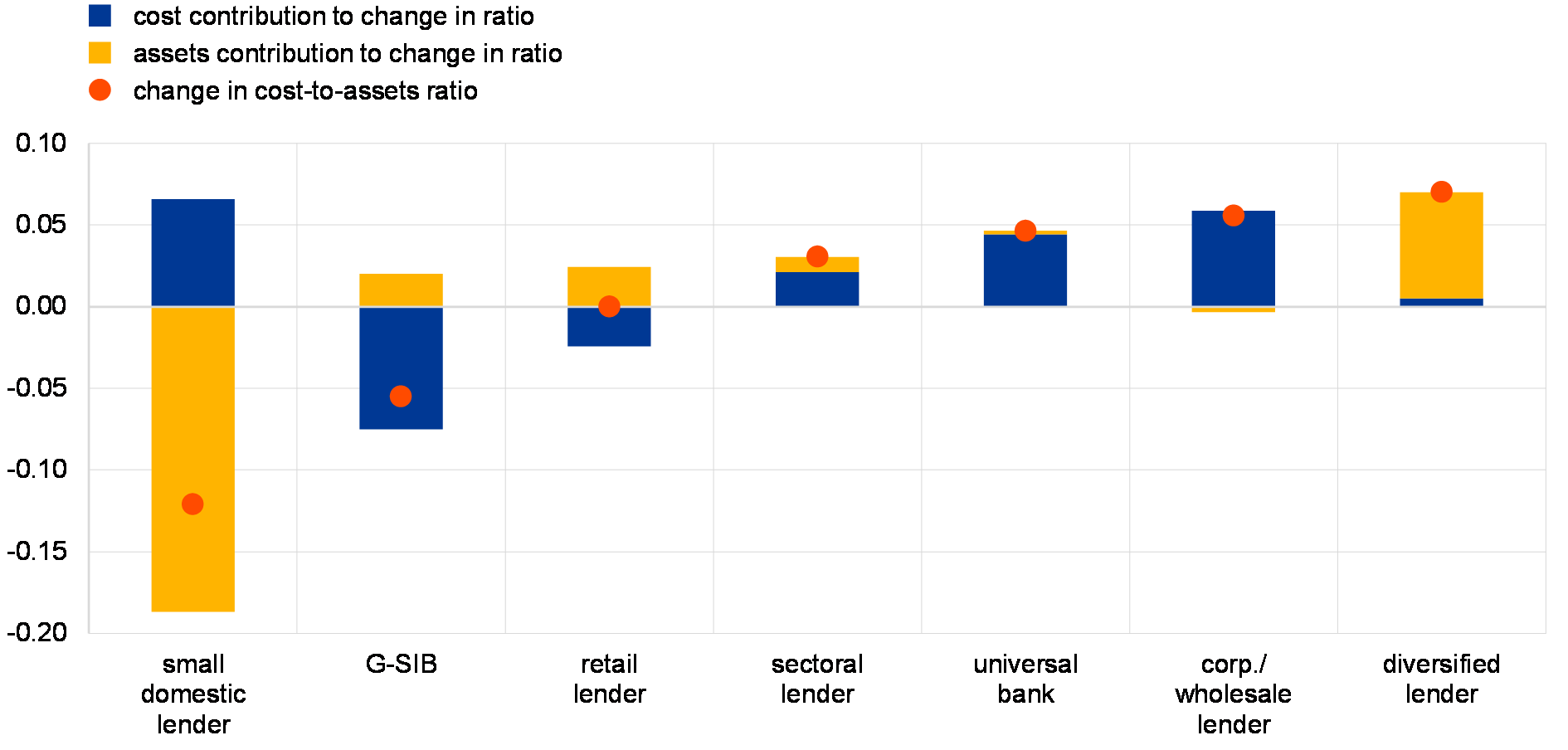

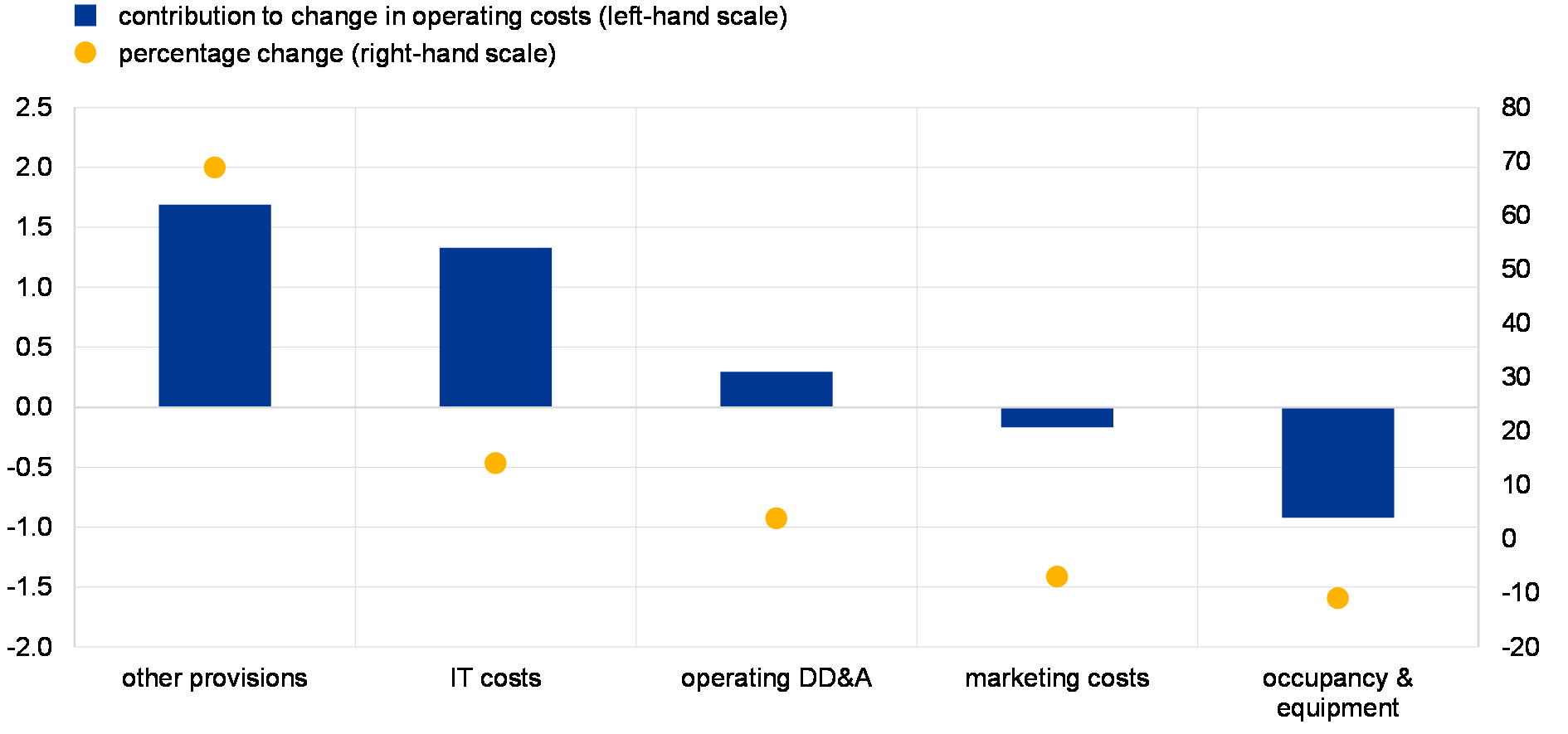

High operating costs remain a key obstacle to achieving sustainable bank profitability. Cost-efficiency across banks in the euro area remains low compared with that of their international peers. This holds true both when looking at accounting indicators (such as cost-to-income and cost-to-assets ratios) and when looking at results coming from cost function techniques that estimate banks’ relative ability to convert inputs into outputs (for a discussion about the latter, see Box 6). The largest cost component for euro area banks relates to staff (making up around half of euro area banks’ operating expenses). In recent years, however, non-staff costs have grown at a faster pace than staff-related costs. Part of the higher non-staff costs relates to higher IT costs and investment in digital technologies. It remains to be seen whether the short-term costs attached to such investment can bring long-term efficiency gains.

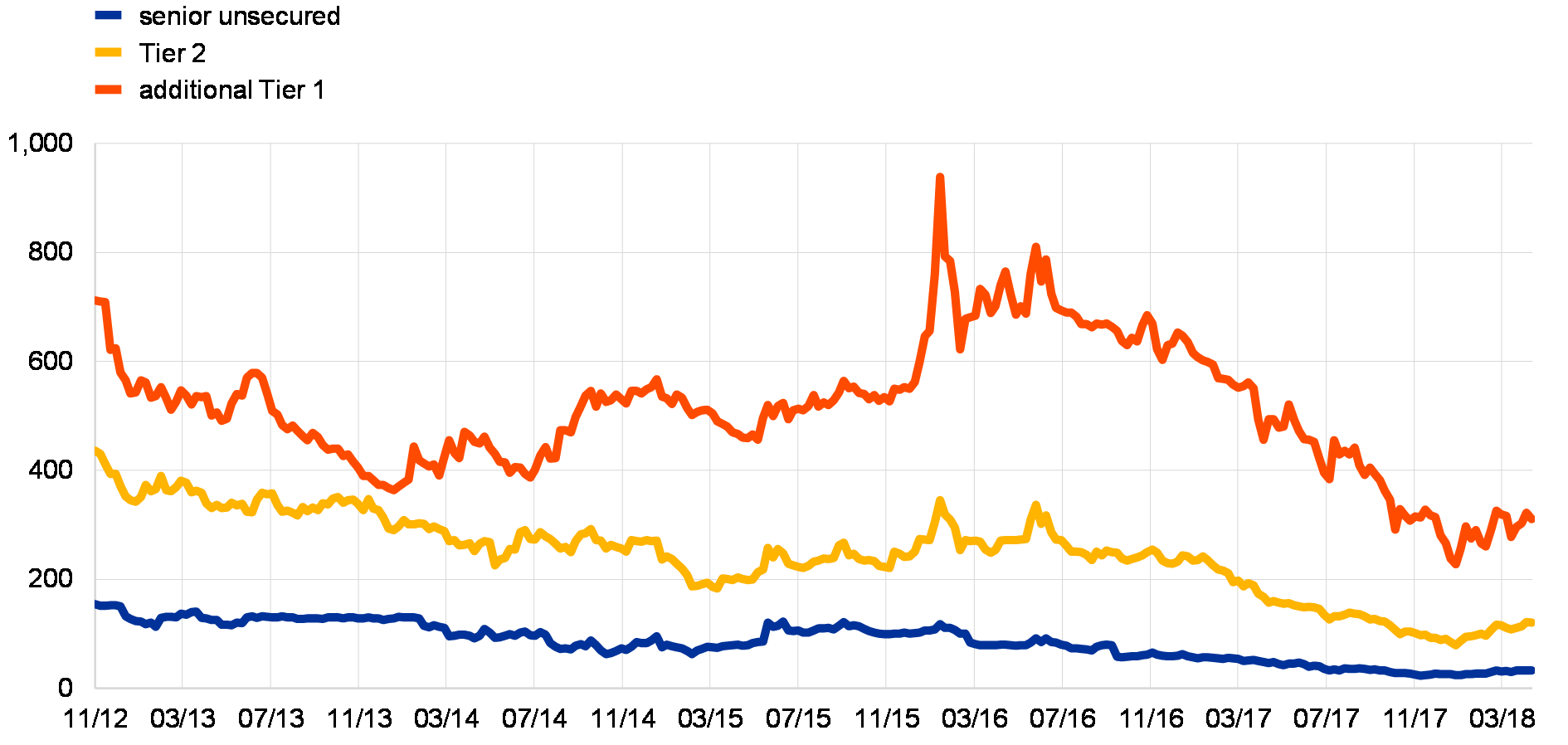

Notwithstanding an improving banking sector outlook, a sharp deterioration in economic or financial conditions could unearth stress. First, an abrupt repricing of risk premia has the potential to increase stress in the banking sector via higher funding costs and capital losses. This, in turn, could impair banks’ intermediation capacity and have an impact on the real economy. Second, substantially weaker economic developments may lead to deteriorating asset quality and earnings prospects. At the same time, the continued improvements observed in banks’ solvency positions should mitigate stress stemming from possible adverse developments.

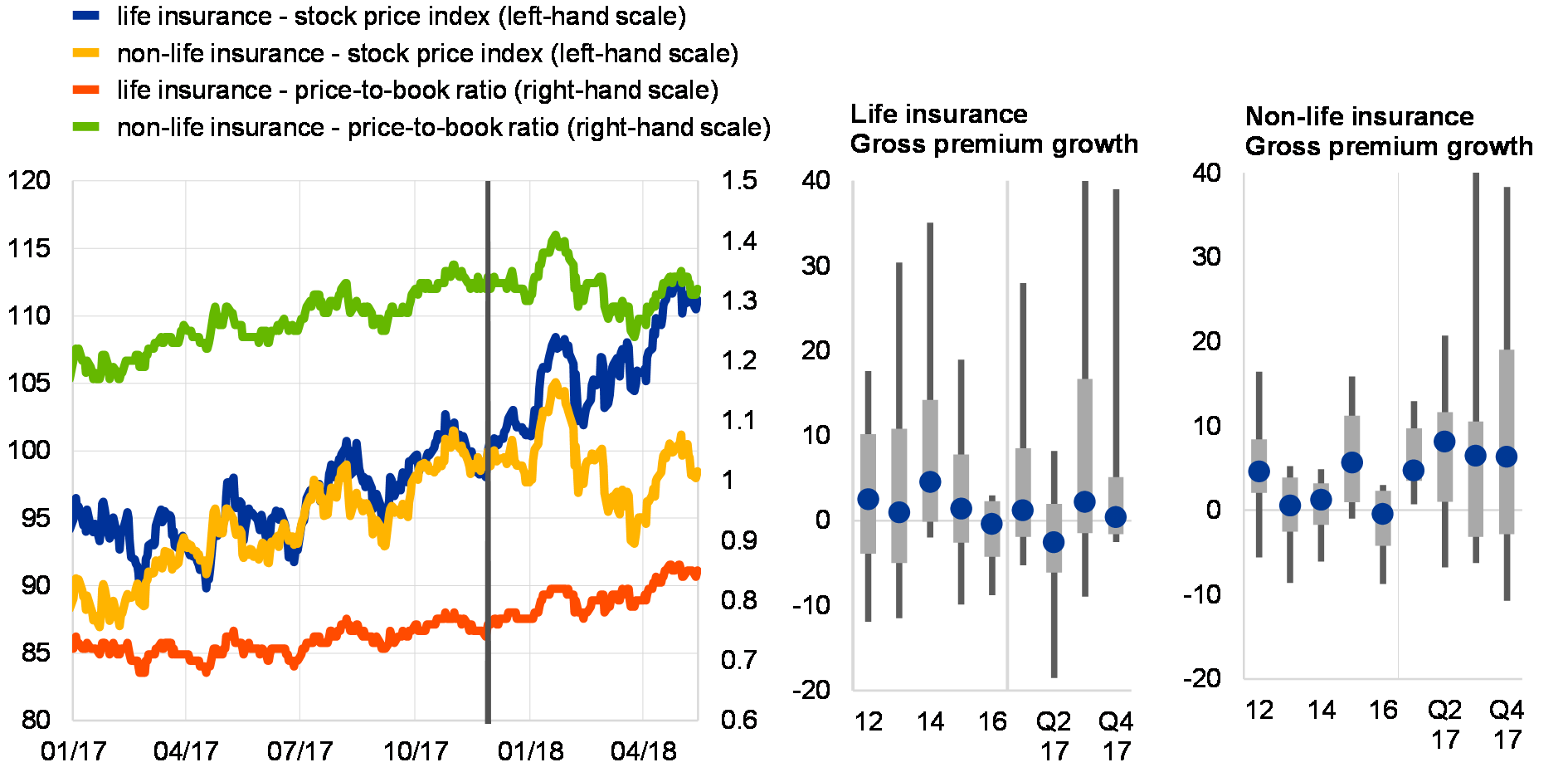

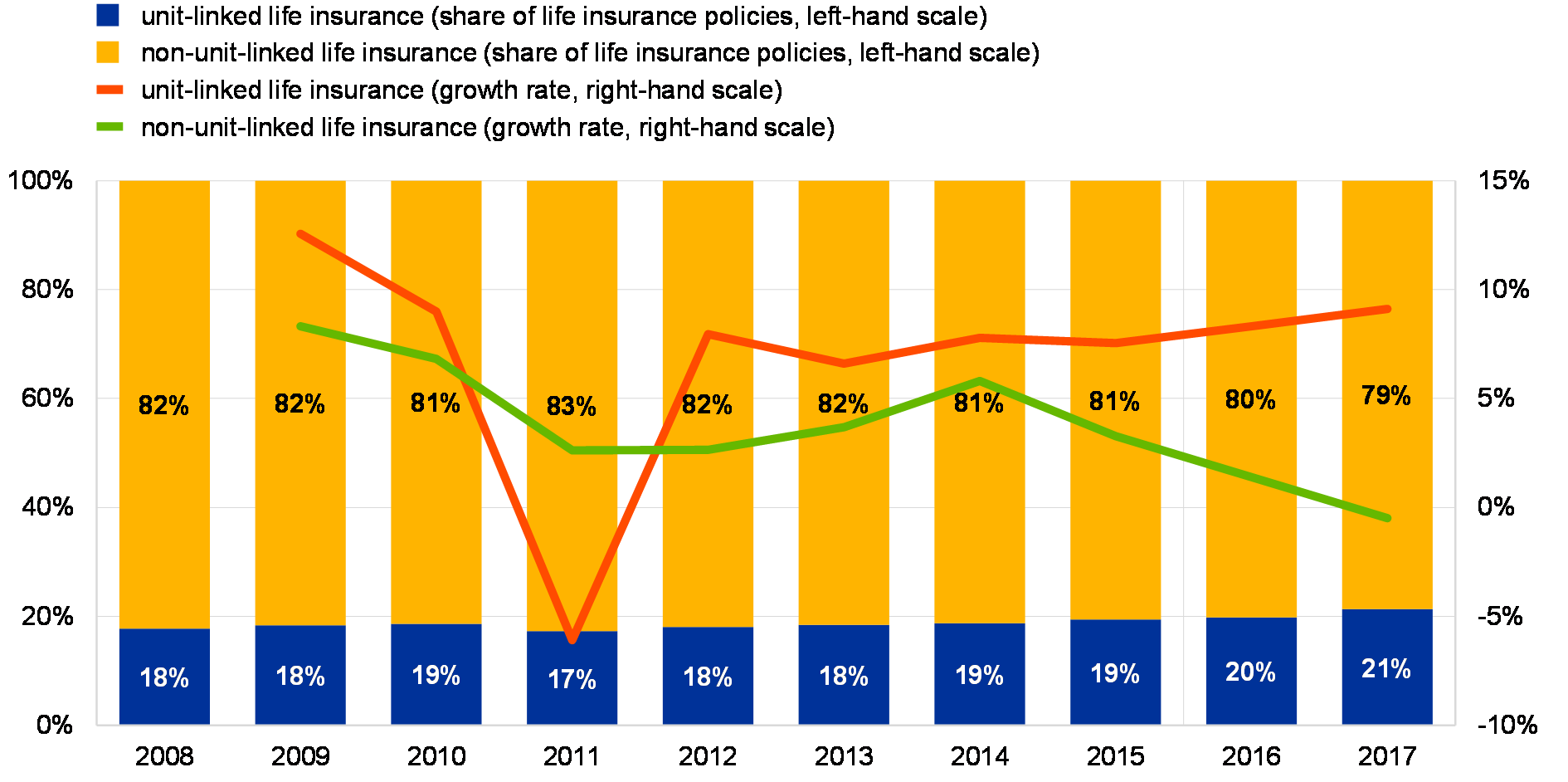

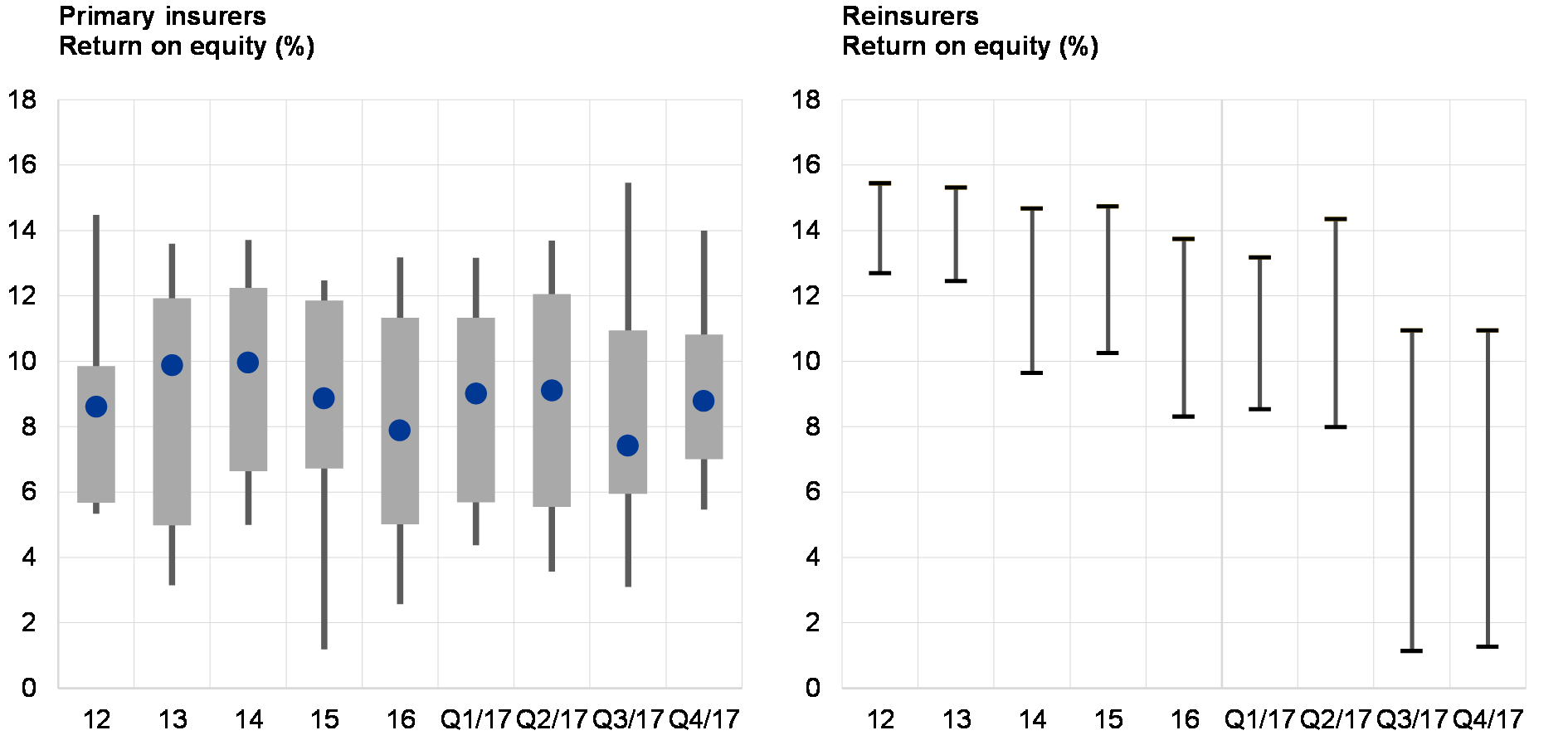

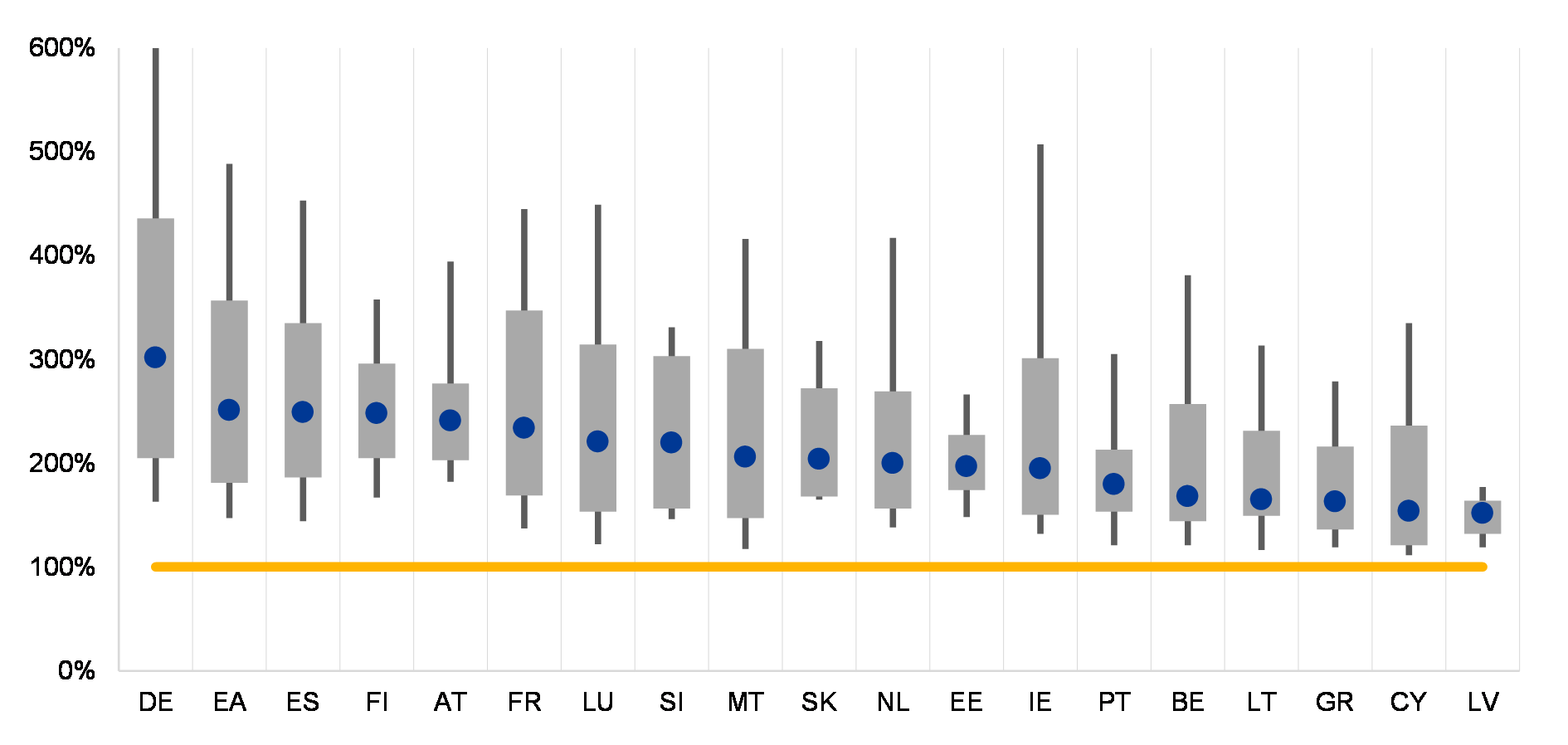

Similar to banks, the profitability and solvency positions of the insurance sector have benefited from a robust economic outlook. Insurers’ profitability continues to develop favourably, supported by the economic outlook (see Chart 17). For the life insurance sector, profitability has also benefited from increasing yields. For reinsurers, however, a number of costly natural catastrophe losses gave rise to a significant drop in profitability in the latter part of 2017. The fall in profitability is expected to be temporary and should not have any material impact on reinsurers’ long-term profitability prospects. Solvency positions remain solid and well above regulatory requirements for the majority of euro area insurers.

Chart 17

Overall solid profitability for the insurance sector

Return on equity for a sample of large euro area insurers

(2012 – Q4 2017; percentages, 10th and 90th percentiles, interquartile distribution and median)

Sources: Bloomberg, individual institutions’ financial reports and ECB calculations.

Notes: Quarterly data are annualised. Based on a sample of 27 large insurers and reinsurers with total combined assets of about €4.98 trillion in 2017, which represent around 62% of the assets of the euro area insurance sector. Quarterly data are only available for a sub-sample of these insurers.

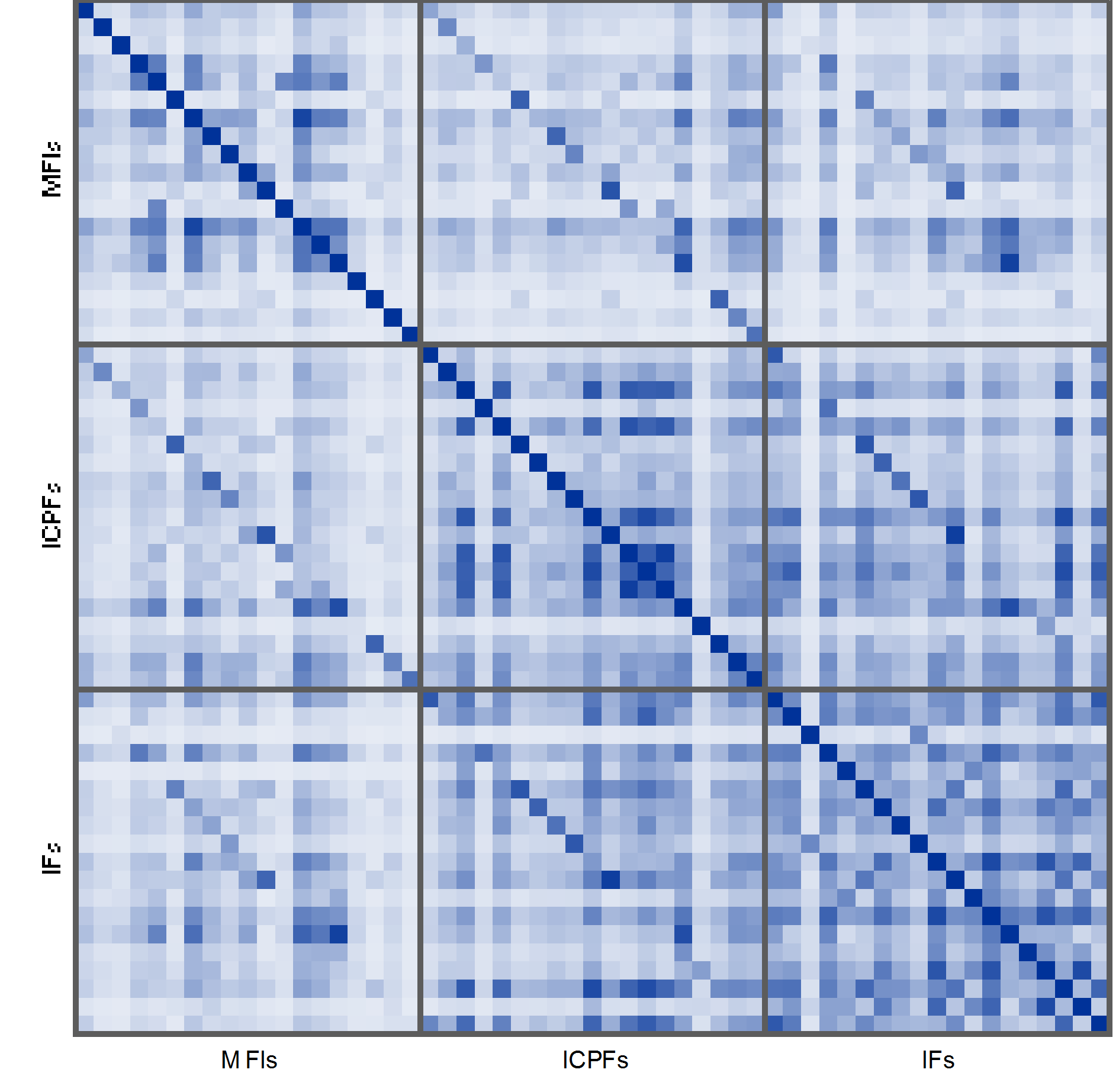

A continuing low interest rate environment and signs of increased interconnectedness are giving rise to vulnerabilities for the insurance sector. Even though the recent rise in long-term interest rates is reducing some of the cyclical challenges for insurers, long-term interest rates are in many cases still below the levels offered as guaranteed returns in the past. Some insurers have, therefore, taken on higher risk in order to boost returns. Such activities include a larger exposure to riskier debt instruments, a shift towards investments in the real estate sector and an extension of maturities in insurers’ fixed income portfolios. More broadly, the non-bank sector as a whole has become more intertwined. For instance, the securities portfolios of insurance companies and investment funds show a high degree of similarity across euro area countries – both within and between the two sectors. This makes them vulnerable to contagion should stress emerge in either of the two sectors.

ECB analysis suggests that the United Kingdom’s decision to withdraw from the European Union poses a limited overall risk to euro area financial stability.[2] Any impact on financial services is likely to differ across euro area countries, depending on the size of financial and real economy linkages with the United Kingdom, and it is more likely to be reflected in the cost of financial services and in costs for financial institutions than in a reduction in the availability of services. While the progress that has been achieved in the negotiations with the United Kingdom since the publication of the November 2017 FSR is a welcome development, the risk of an adverse outcome to the negotiations remains. Affected financial institutions should therefore continue to plan for all contingencies, including a hard Brexit scenario. Stakeholders’ timely and adequate preparations remain a key mitigant against the risks of Brexit-related cliff-edge effects.

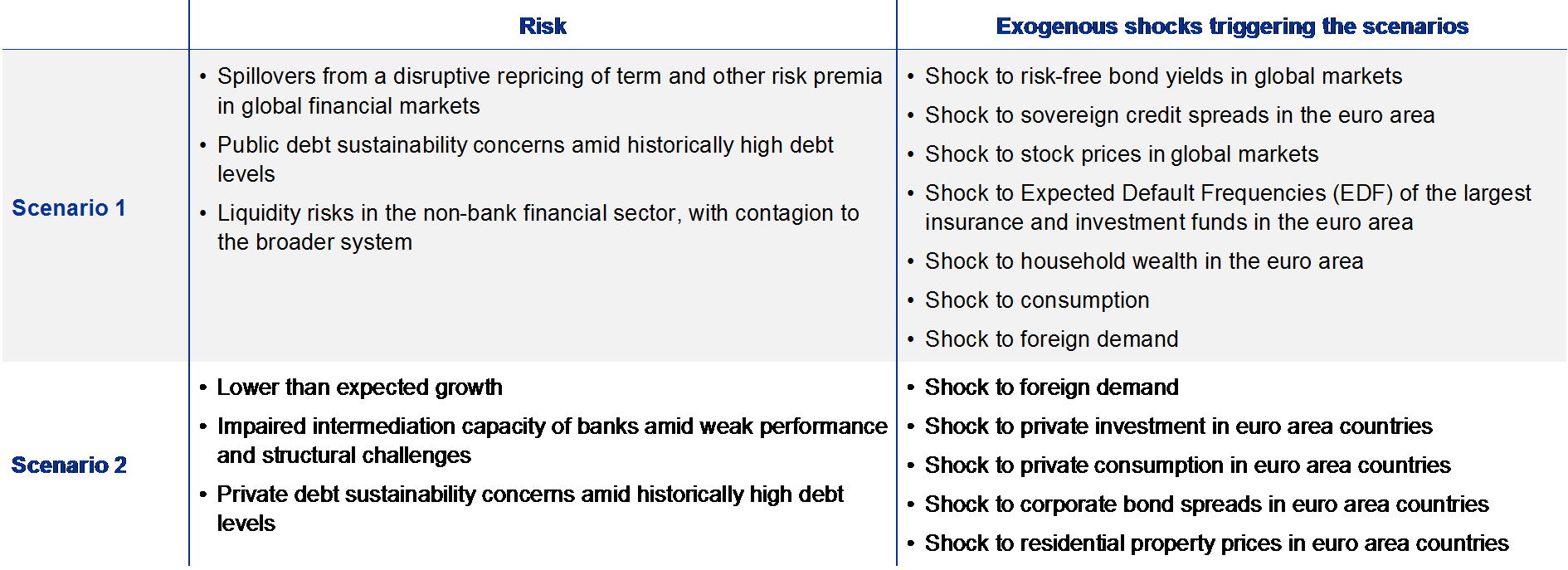

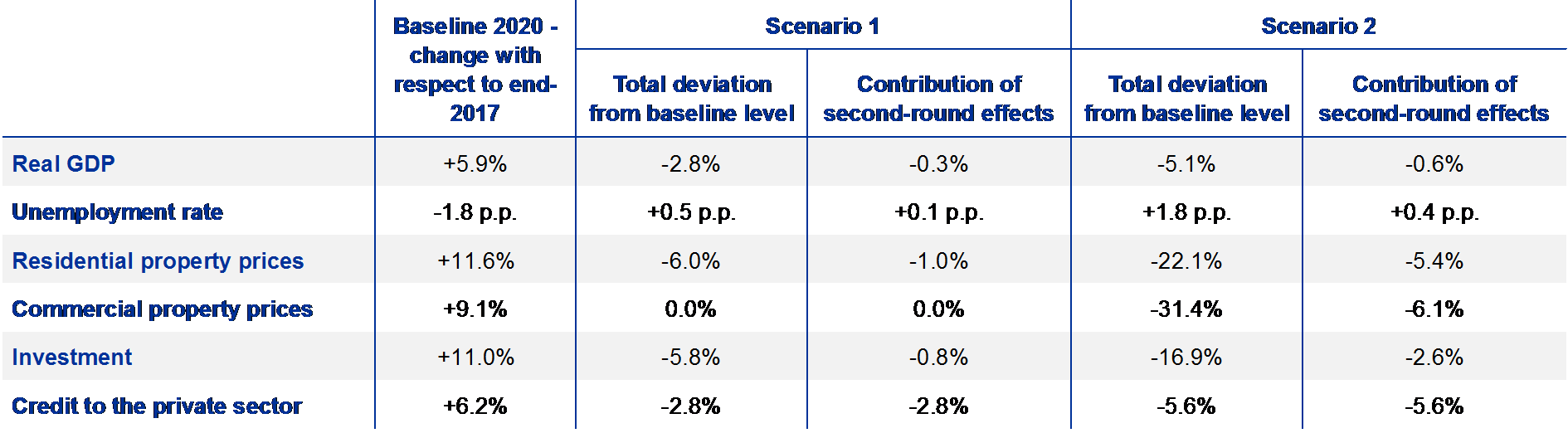

Scenario analysis

This FSR identifies two broad scenarios that could be used to test the resilience of financial institutions over a two-year horizon.[3] Two plausible, albeit unlikely, adverse scenarios are run to illustrate the quantitative implications for bank solvency positions if the risks previously outlined in this chapter were to materialise (for more details about the scenarios, see Section 3.3).

The first scenario entails an abrupt repricing of global risk premia. It envisages higher risk premia triggered by changes in market participants’ expectations regarding economic policies in major economies outside the EU. The ensuing financial market turmoil then spills over to the euro area, and the resulting higher financing costs for the sovereign sector lead to a re-emergence of public debt sustainability concerns. The financial market turmoil is amplified in this scenario by a large sell-off of financial assets by the non-bank financial sector.

The second scenario is generated by a sharp economic slowdown. The main trigger in this scenario is a slowdown in economic growth prospects in the United States and in emerging markets that spills over to euro area countries. This would be amplified by trade disruptions owing to more protectionist policies in some advanced economies. Aggregate demand falls, which leads to a sharp downturn in private consumption and investment. Households and firms face difficulties in paying back their debt, which leads to elevated debt sustainability concerns for the private sector.

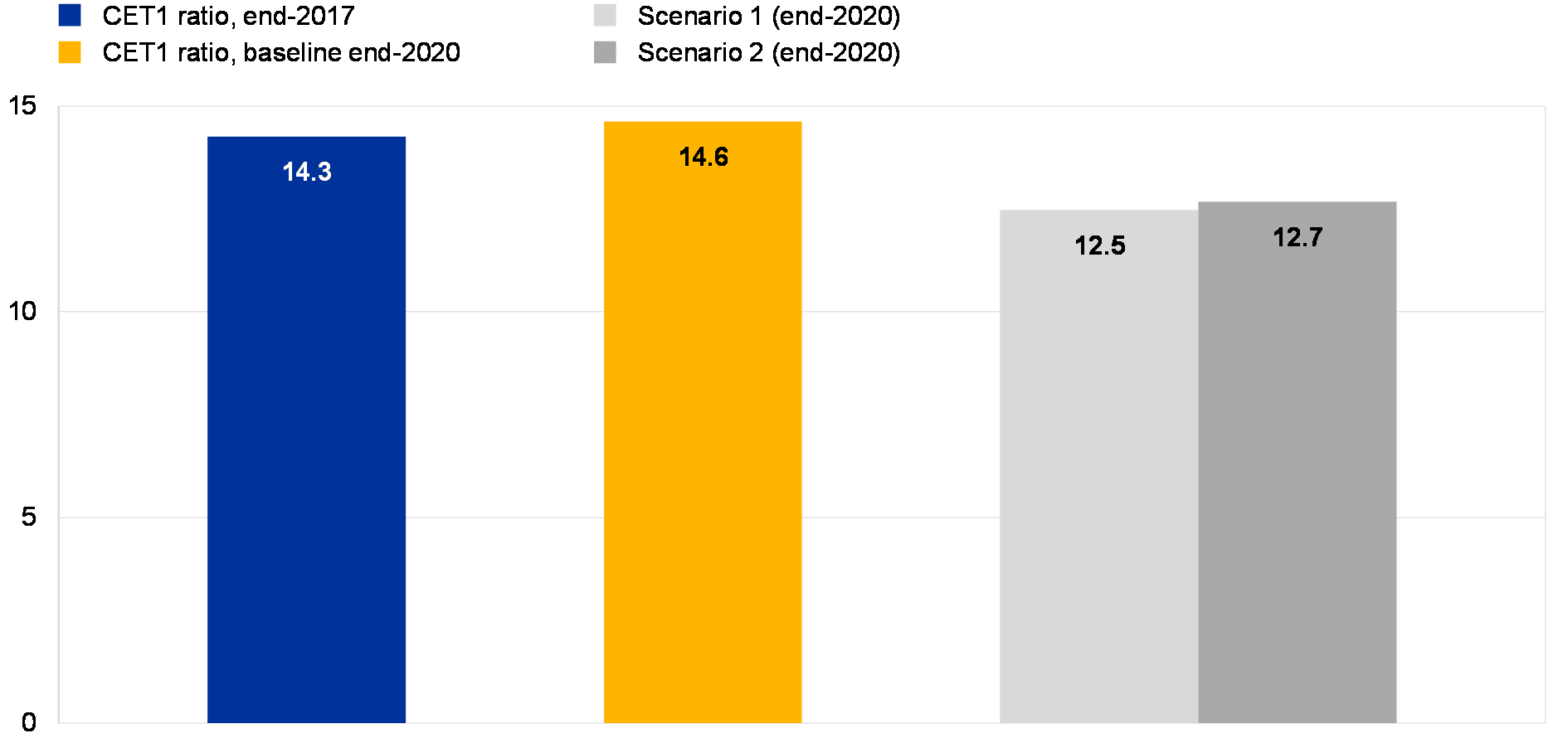

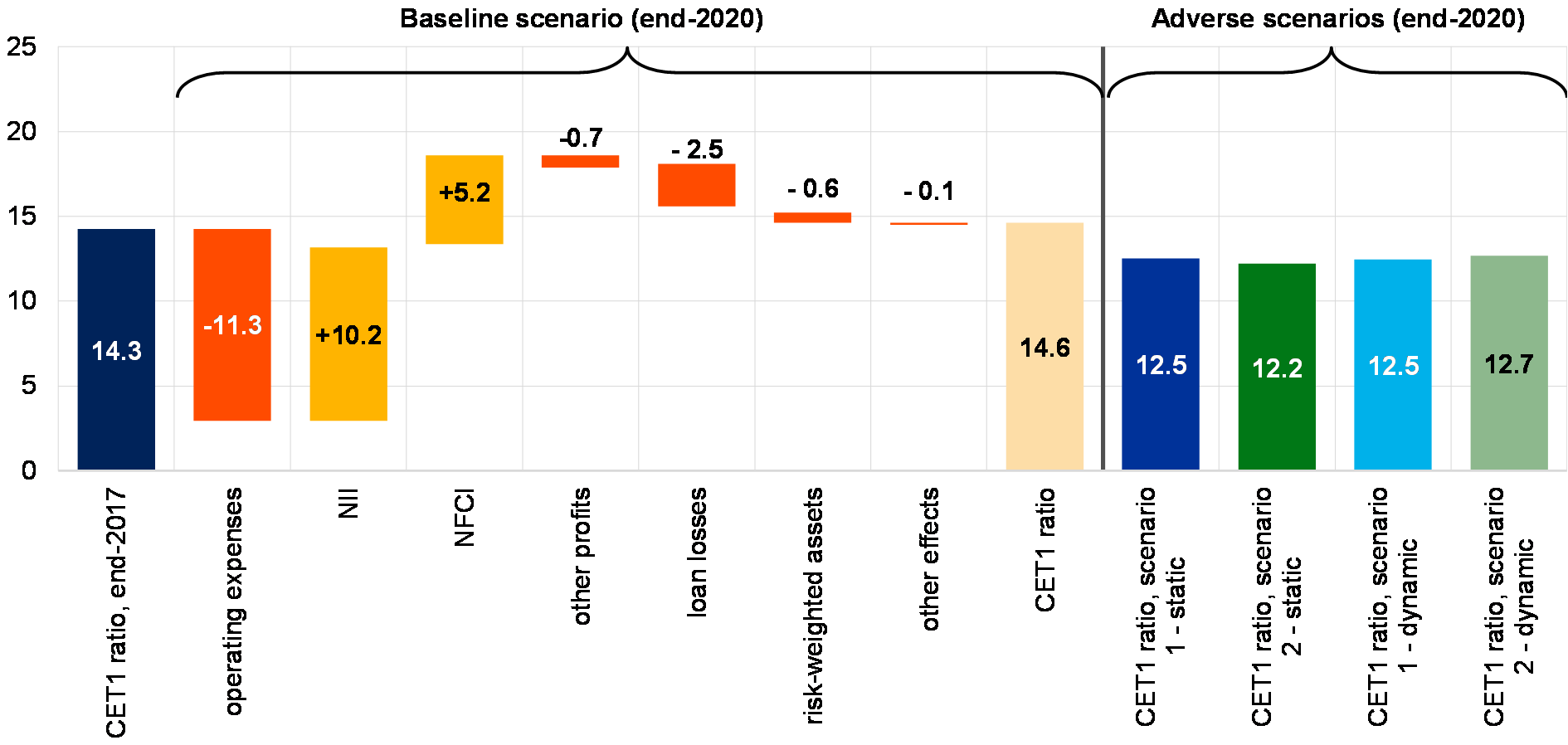

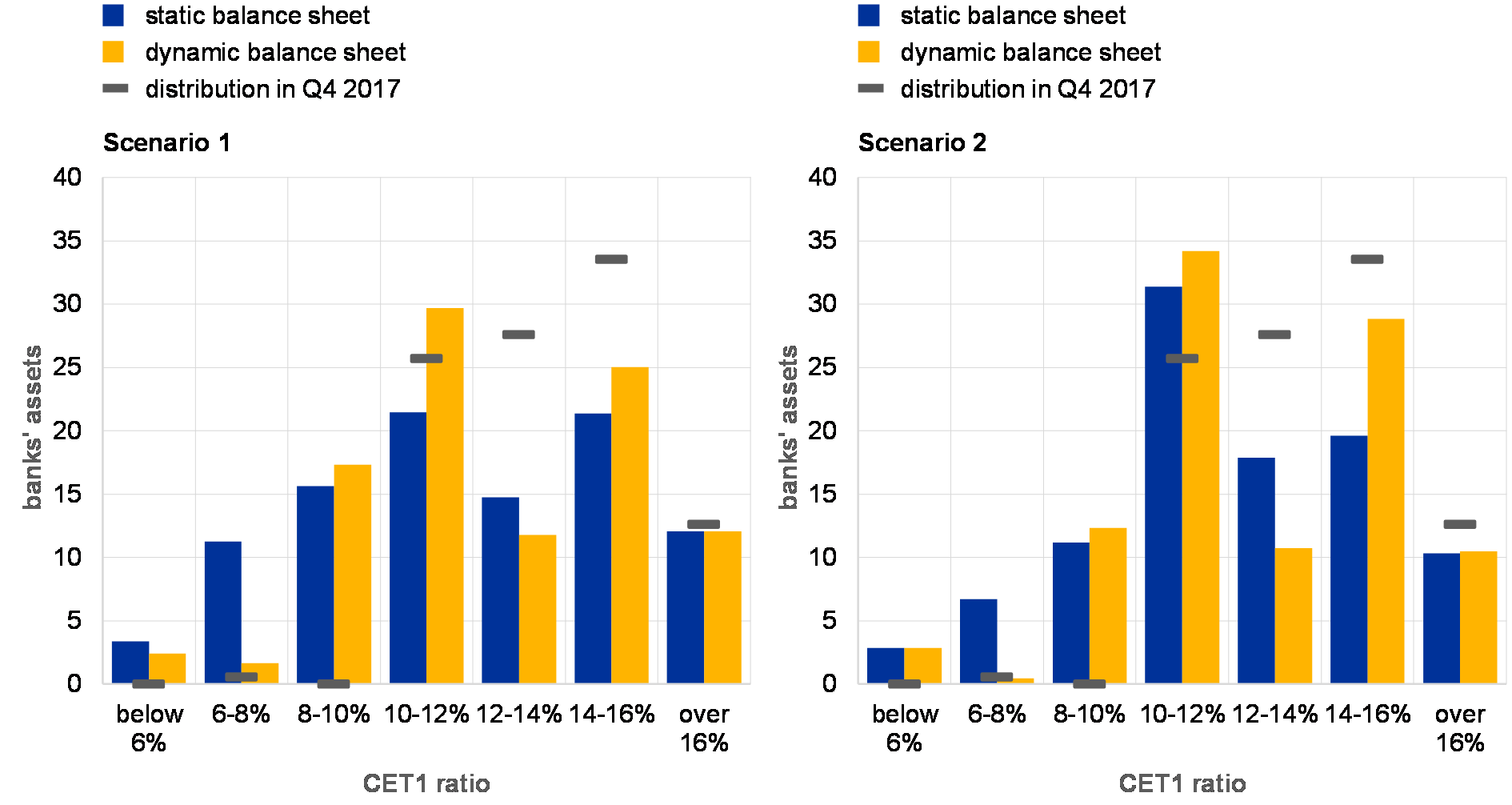

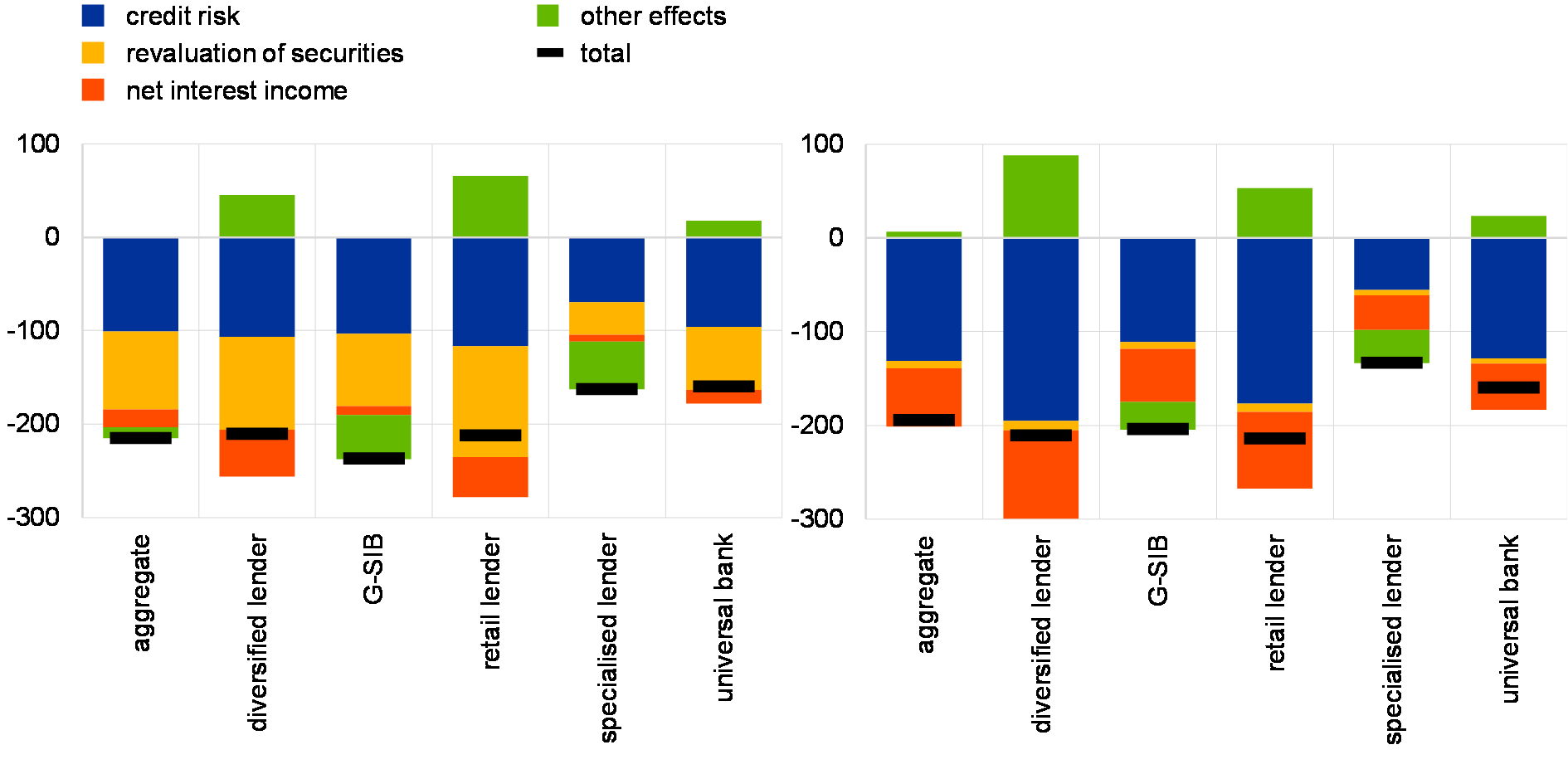

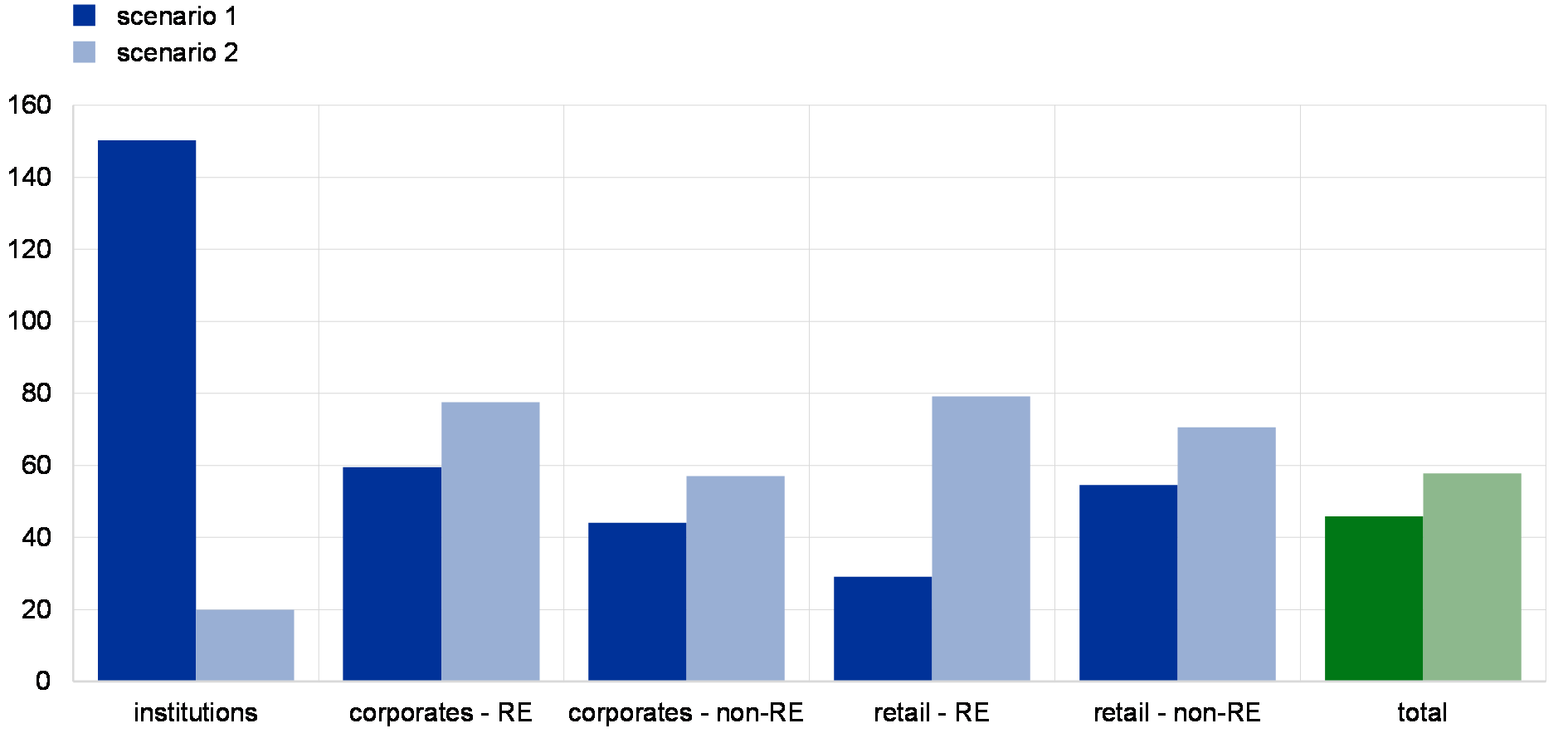

Chart 18

The materialisation of key financial stability risks could lead to sizeable losses for banks, but aggregate capital positions would remain adequate

CET1 capital ratios of euro area banking groups under the baseline and adverse scenarios

(percentages)

Sources: Individual institutions’ financial reports, EBA, ECB and ECB calculations.

Note: The scenario analysis covers about 100 large and medium-sized banking groups directly supervised by the ECB.

A materialisation of either of the two scenarios would lead to sizeable depletions of bank capital (see Chart 18). In aggregate terms, the euro area banking sector is assessed to be resilient to the materialisation of the main financial stability risks. In the first and second scenarios, the aggregate Common Equity Tier 1 (CET1) ratio would decline by 2.1 and 1.9 percentage points, respectively, compared with the baseline.[4] Some differences across banks can be observed, but the majority of euro area significant institutions would maintain their CET1 capital ratio above the average capital requirement of 10% under the adverse scenario.[5] While the implications of the materialisation of the two scenarios are broadly similar, the probability of the first scenario materialising is assessed to be higher than that of the second, given the continued higher risk-taking in financial markets and the positive macro news in recent quarters.

Recommendations and policy considerations

Although the financial stability environment is currently benign, deliberate and decisive action is needed to address nascent and existing vulnerabilities. Many of the vulnerabilities discussed in this FSR can be dealt with through action by financial regulators and legislators, macroprudential authorities as well as market participants and the financial industry. The most relevant and pressing of these recommended actions are outlined below.

Policy considerations for cyclical systemic risks

Cyclical systemic risks remain contained, but on an upward trajectory, in most euro area countries and in the area as a whole. Credit growth rates are recovering across the board. Together with additional indicators of cyclical systemic risks, especially asset prices, these developments support the assessment that risks are gradually increasing. At the same time, deviations of credit-to-GDP ratios from their long-term trend (“credit gaps”) remain negative in most countries. Overall, therefore, a broad-based increase in countercyclical capital buffers (CCyBs) across the euro area is not warranted currently. Nevertheless, CCyB rates have been announced or activated in two euro area countries. Moreover, some other macroprudential authorities should be ready to act should cyclical systemic risks increase further.

Policy considerations for property markets

Macroprudential authorities are encouraged to step up efforts to prevent the materialisation of spirals of excessive and mutually reinforcing credit and property market dynamics. Against the backdrop of the recovery in residential real estate markets gaining momentum across the euro area, macroprudential authorities should consider activating borrower-based measures in countries where household balance sheets are weakening or where lending standards are showing early signs of deterioration. In this context, countries should ensure that legal frameworks for borrower-based measures are adopted and fully operational in line with the December 2016 Governing Council statement on macroprudential policies. Moreover, in countries where the residential real estate cycle is more advanced and “stock” vulnerabilities are more visible in the form of high household indebtedness and/or price overvaluation, macroprudential authorities should consider introducing capital measures targeting real estate exposures. Regarding potential risks in commercial real estate markets, countries should close data gaps in line with the 2016 ESRB recommendation[6] in order to improve risk and policy analysis. In addition, countries should work towards sound risk assessment frameworks to support policy analysis.

Policy considerations for banks

Banks need to make further progress towards adjusting their business models in order to achieve sustainable profitability. This adjustment should encompass both a better diversification of sources of revenue (to reduce reliance on interest income) and cost-cutting, including by reaping the benefits of increased digitalisation.

In the current favourable macroeconomic environment, banks should continue to step up their efforts to reduce NPL stocks. National authorities can support banks’ efforts by implementing policies to support markets for NPLs and could facilitate the setting-up of NPL transaction platforms and consider securitisation schemes. In certain circumstances, asset management companies (AMCs) may be warranted. Banks should continue to pursue timely provisioning and write-off practices in line with supervisory expectations, also taking into account the addendum that the ECB published to its NPL guidance.[7]

Banks (and other financial institutions) need to ensure that sound cyber risk management is in place and fully integrated in their institution-wide operational risk management frameworks. As technological progress has made the financial system more complex and more deeply interconnected, banks need to reconsider their internal risk management practices in order to withstand cyber and associated IT risks. In this regard, international cooperation between institutions and authorities is essential.

Policy considerations for the asset management sector

Financial market participants need to be aware that the favourable market environment observed over the past few years may quickly change. In order to mitigate possible losses stemming from a sudden reversal in risk premia, market participants should conduct proper risk management that takes into account stressed scenarios such as abrupt changes to the correlation patterns across asset classes or a possible deterioration in liquidity conditions.

Policy considerations for highly indebted sovereigns and corporates

In view of the high debt ratios in some countries, it is important that fiscal authorities continue to ensure positive primary balances in the coming years, even under less favourable economic conditions. By the same token, as deleveraging by households and non-financial firms has scarcely materialised in the euro area, contrary to what has been seen in other major jurisdictions, it would be advisable for cash-rich private agents to reduce their current debt levels.

Regulatory issues

The finalised Basel III package should be fully implemented across all jurisdictions in a timely fashion. As further experience with this common set of standards is gained, progress should be carefully monitored through a comprehensive evidence-based evaluation. In this regard, it will be important to maintain the current high level of international cooperation, as globally agreed standards are key to financial stability.

The ongoing review of the Capital Requirements Regulation (CRR) and the Capital Requirements Directive (CRD IV) should be used to strengthen and harmonise the European regulatory architecture. Alongside increased financial integration and progress towards banking union, regulators and legislators should achieve more progress in the harmonisation of national options and discretions and consider the introduction of cross-border capital waivers, subject to additional safeguards such as those suggested by the ECB in its Opinion.[8] Moreover, regulators and legislators should consider introducing a requirement to establish an EU intermediate parent undertaking (IPU) and, to prevent regulatory arbitrage opportunities, require the inclusion of third-country branches in the regulatory EU sub-group under such an IPU. Otherwise, third-country groups could partially or fully circumvent the IPU requirement by operating in the EU primarily or entirely via branches. Finally, a full and timely implementation of internationally agreed supervisory standards is warranted.

The review of the CRR and CRD IV also provides an opportunity to revisit the design of the macroprudential framework. At present, the implementation of macroprudential policy is scattered across the CRR and CRD IV, leading to a wide range of practices regarding the use of the tools and their application by authorities. In this context, EU co-legislators should consider an ambitious set of targeted changes to the framework, with the aim of making it more coherent, consistent and operational.

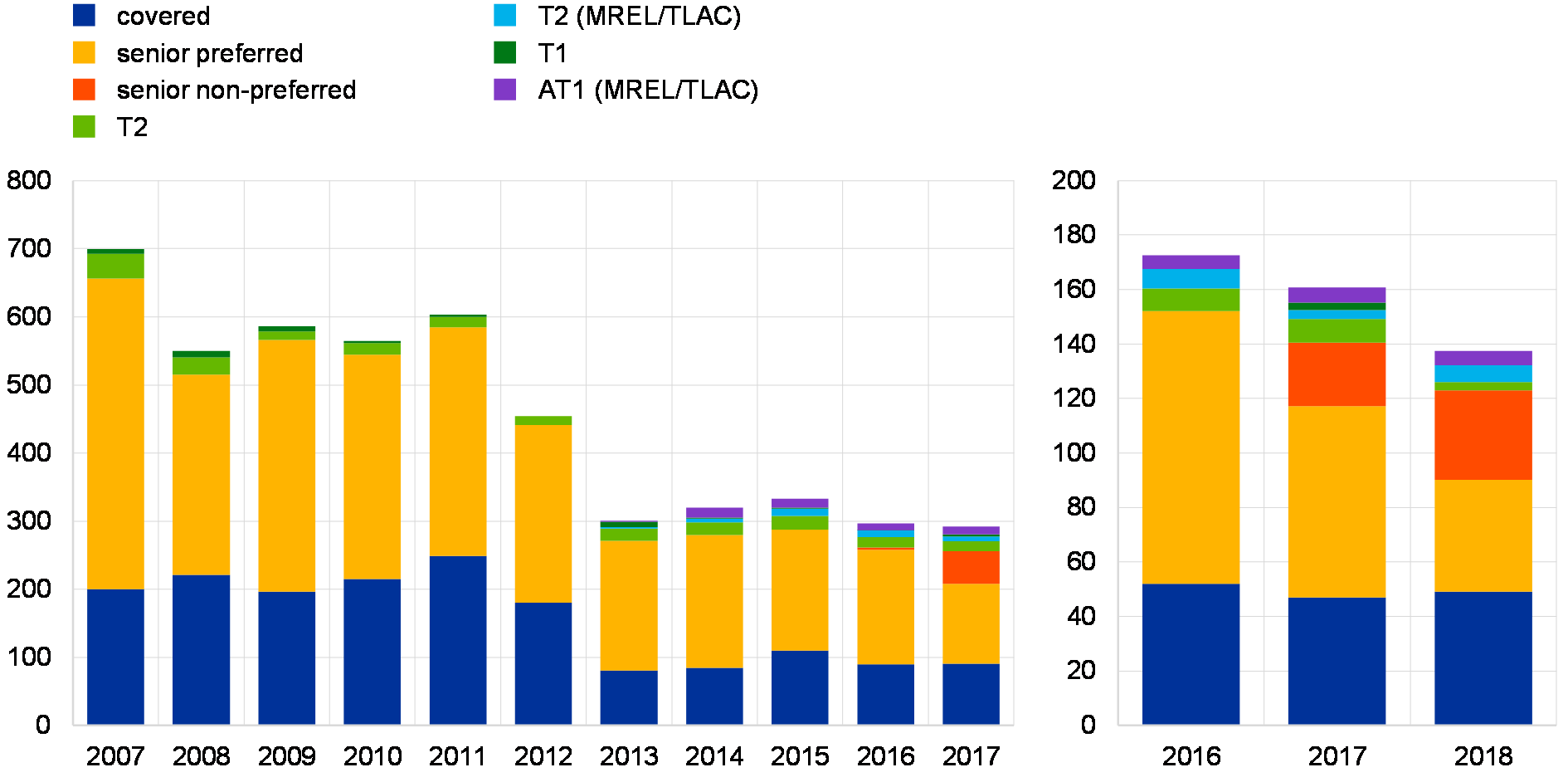

The revised framework for crisis management and resolution should be swiftly adopted so as to enable risk reduction and risk-sharing. Completing the reform requires the agreement of the co-legislators, so it is essential that the Council and the European Parliament reach a position and then agree in the trialogue meetings. In addition, the co-legislators should make progress on the European Stability Mechanism (ESM) reform, including, in particular, its establishment as a backstop to the Single Resolution Fund (SRF), and reach an agreement on the European deposit insurance scheme (EDIS) as the missing third pillar of the banking union.

The regulatory and supervisory framework for non-banks needs to be strengthened. In view of the strong growth in the role of investment funds in financial intermediation and indications that the sector is assuming more risk, authorities need to be equipped with relevant powers to be able to mitigate structural vulnerabilities from asset management activities, in particular for situations where measures available to asset managers themselves would not be sufficient to address these. EU co-legislators should introduce macroprudential tools designed to address systemic risks related to liquidity mismatches and the use of leverage in investment funds. Moreover, large and complex investment firms, and in particular those with cross-border operations and those undertaking bank-like activities, should be subject to the same regulation and supervision as credit institutions.

1.1 Robust euro area growth with a broadly balanced outlook

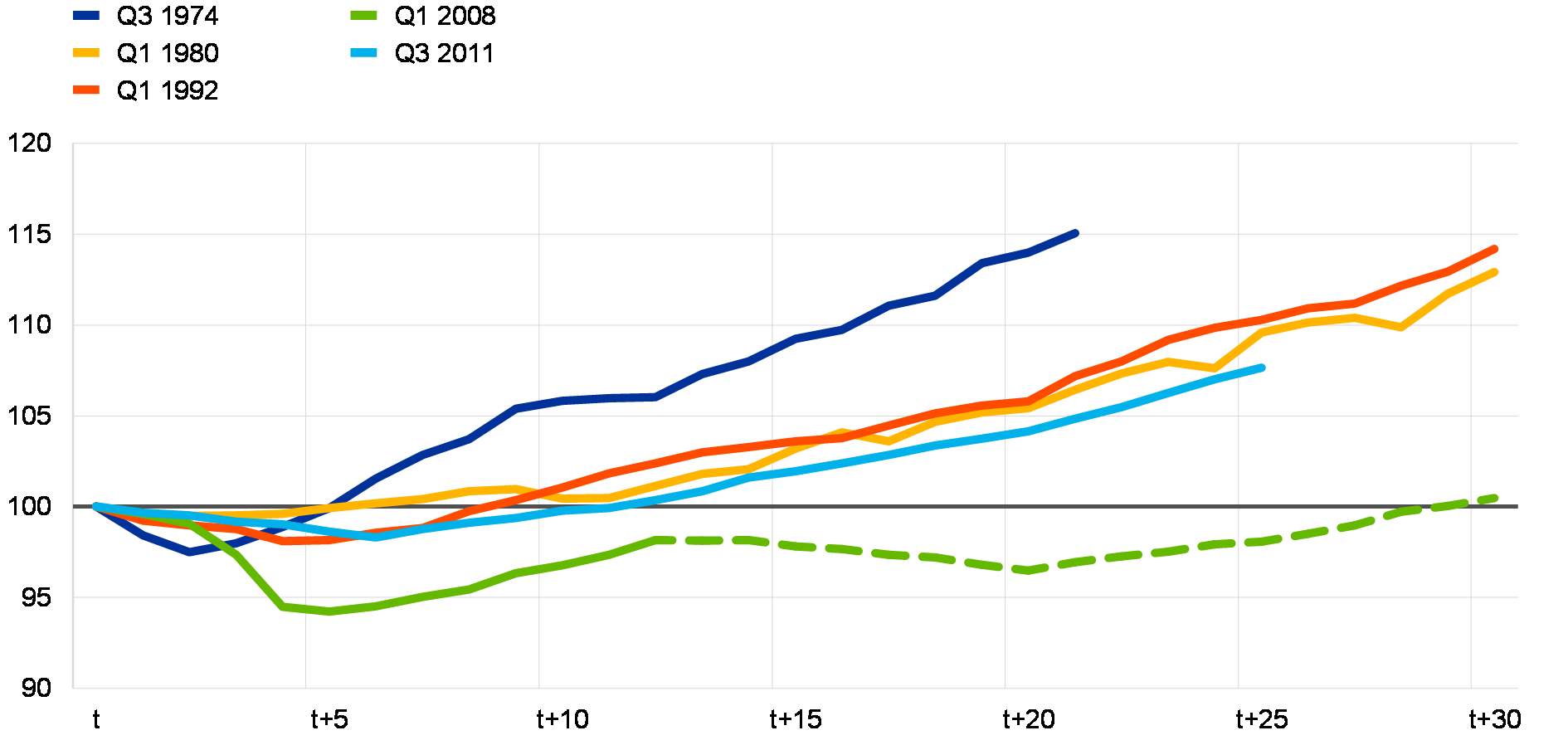

The euro area economy has continued to expand at a robust pace. Domestic demand has remained the main engine of economic growth. The ongoing recovery in labour and housing markets is bolstering private consumption via positive income and wealth effects, while very favourable financing conditions and rising corporate profitability are lending support to business investment. At the same time, a broad-based global expansion is supporting foreign demand for euro area goods and services. The cyclical euro area upturn is also being reinforced by strong (albeit more recently somewhat softening) business and consumer sentiment, as well as low macroeconomic uncertainty. After an exceptionally drawn-out recovery, the euro area economy is in an expansion phase and the output lost since the start of the downturn in 2008 has been restored (see Chart 1.1).

Chart 1.1

Relatively moderate economic recovery in the euro area since 2008 by historical standards

Real GDP patterns during various episodes of economic recovery in the euro area

(pre-recession peak = 100, number of quarters after the peak)

Source: Eurostat and ECB calculations.

Notes: The dashed line refers to the euro area sovereign debt crisis that followed the global financial crisis. This recession is also shown separately, starting in Q3 2011. Recessions are based on those identified by the CEPR Euro Area Business Cycle Dating Committee.

The broad-based nature of the economic expansion in the euro area underpins its resilience. The distribution of growth rates across both euro area countries and sectors of economic activity has continued to narrow, suggesting a broad-based and thus resilient economic expansion. Labour market conditions have also continued to improve. Employment gains have been similarly broad-based across countries and sectors and the aggregate euro area unemployment rate has dropped to the lowest level since late 2008. That said, heterogeneity across countries remains high, amid signs of increasingly binding labour supply shortages in some countries but also persistently elevated unemployment rates in others.

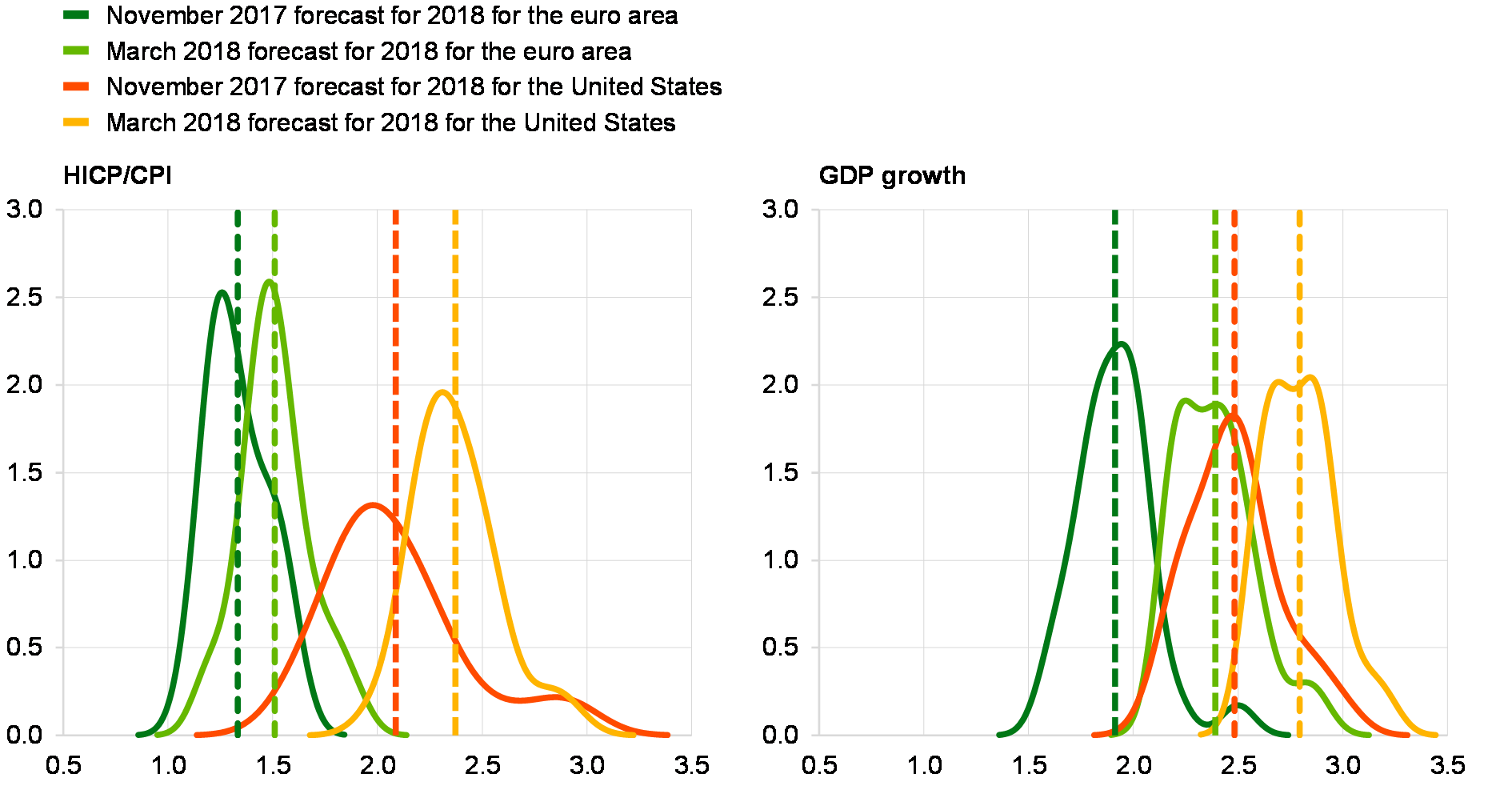

Fundamentals bode well for a continued economic expansion. Favourable financing conditions, past progress made in deleveraging and strong confidence across sectors signal robust economic growth ahead. Real GDP growth is expected to remain above potential until 2020. Nevertheless, based on the March 2018 ECB staff macroeconomic projections, real GDP growth is projected to slow from 2.4% in 2018 to 1.9% in 2019 and 1.7% in 2020, as some tailwinds gradually dissipate. Despite the strong cyclical momentum, the euro area growth environment continues to lag behind the more buoyant developments seen in the United States, particularly as regards inflation (see Chart 1.2).

Chart 1.2

Higher expected real GDP growth and inflation for both the euro area and the United States reflect improved nominal growth prospects

Distribution of the 2018 real GDP growth and HICP/CPI forecasts for the euro area and the United States

(probability density)

Sources: Consensus Economics and ECB calculations.

Note: The dashed lines represent the average real GDP growth and HICP/CPI forecast values.

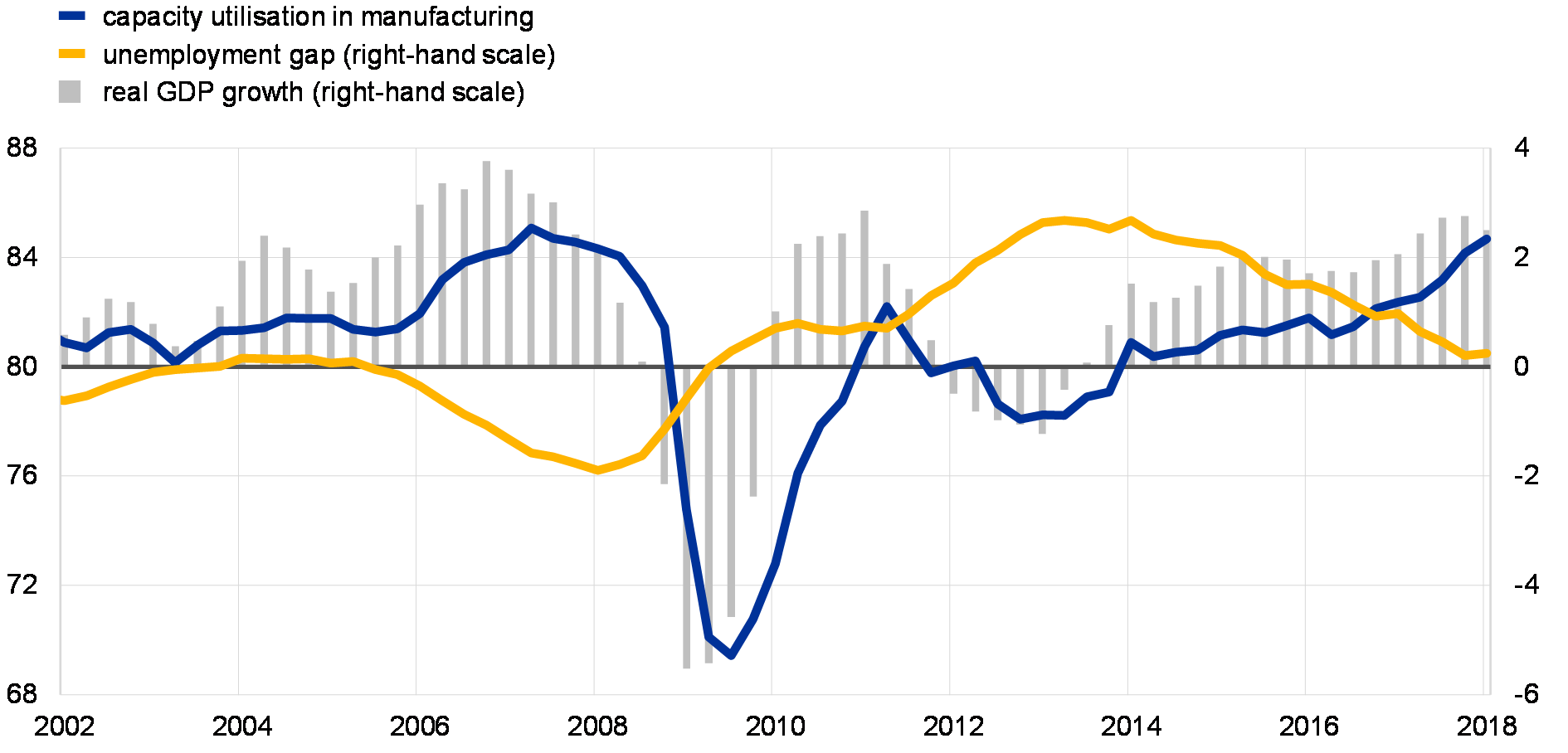

Euro area nominal growth prospects are set to improve gradually. Headline HICP inflation has been broadly stable at around 1.3% since the publication of the previous FSR. Looking ahead, on the basis of current futures prices for oil, annual rates of headline inflation are likely to hover around 1.5% for the remainder of the year. Measures of underlying inflation remain subdued but are expected to rise gradually, supported by the ECB’s monetary policy measures, the ongoing economic expansion as well as the related gradual absorption of economic slack and increase in capacity utilisation (see Chart 1.3) leading to stronger wage growth. The March 2018 ECB staff macroeconomic projections for the euro area foresee headline inflation averaging 1.4% in 2018 and 2019, before rising to 1.7% in 2020.

Chart 1.3

Nominal pressures may be building up gradually as economic activity in the euro area gathers pace

Capacity utilisation, unemployment gap and real GDP growth

(Q1 2002 – Q1 2018, percentage of capacity utilisation, percentage points, annual percentage changes)

Sources: European Commission (AMECO database), European Commission Business and Consumer Surveys and ECB calculations.

Notes: The unemployment gap is calculated as the difference between the unemployment rate and the non-accelerating wage rate of unemployment. The real GDP growth figure for the first quarter of 2018 is the flash estimate.

The global economy continued on a robust growth path. Underlying growth dynamics have become more broad-based and synchronised across the globe. Economic growth in advanced economies outside the euro area is being bolstered by supportive global financial conditions, upbeat confidence, favourable labour market conditions, an upswing in housing markets and receding headwinds from private sector deleveraging in several countries. In emerging markets, economic growth is also being supported by strong foreign demand and higher commodity prices. In fact, oil prices have reached almost USD 80 per barrel – the highest level since late 2014 – driven by both strong demand and continued supply restrictions.

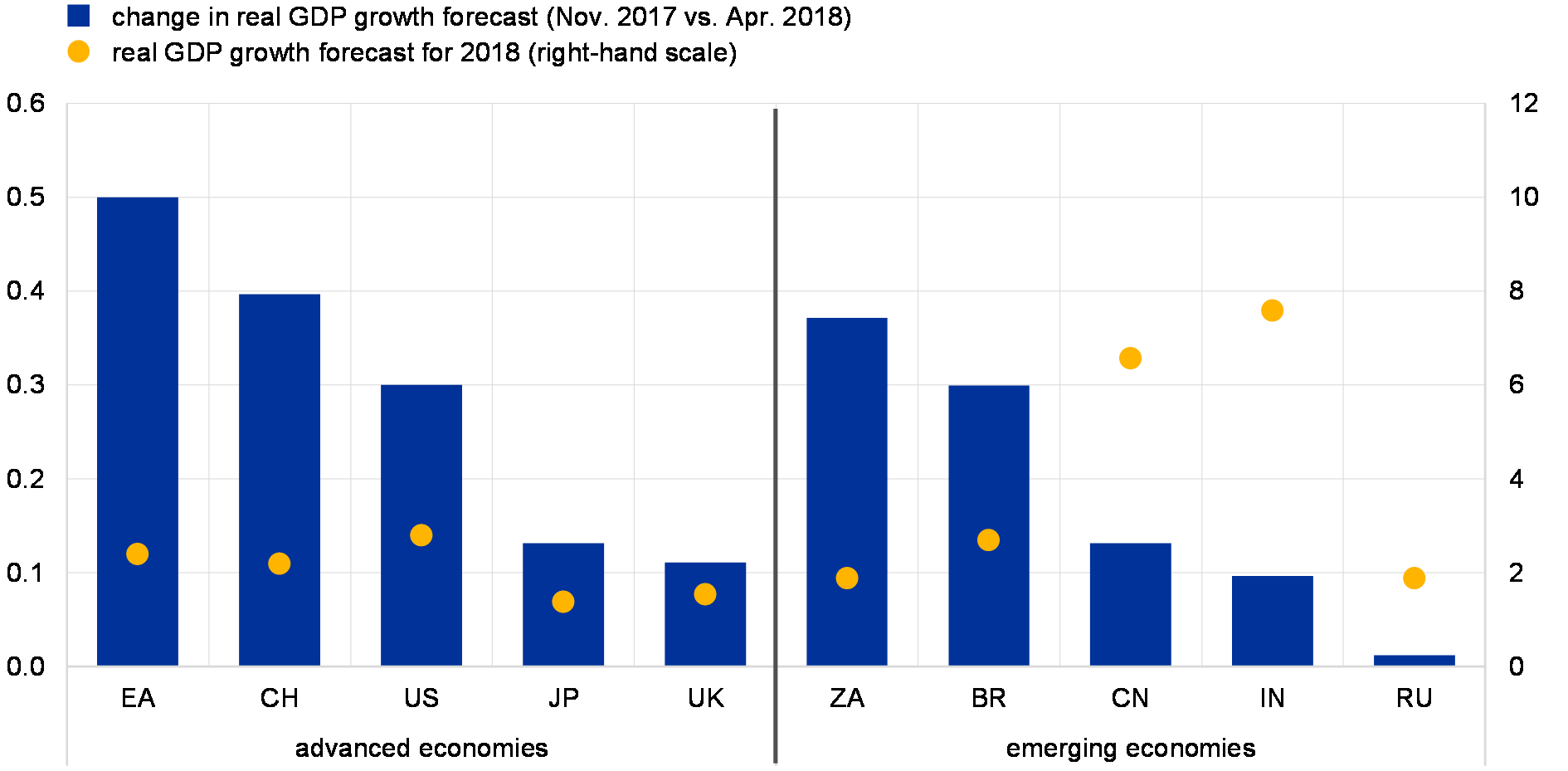

Global economic activity is expected to remain strong in the short run. Growth in the global economy is expected to accelerate in the near term (see Chart 1.4), but the pace of expansion will remain below pre-crisis rates, in line with lower potential growth estimates. Against the backdrop of overall supportive (albeit increasingly diverging) monetary policies, the outlook for advanced economies entails a robust expansion, boosted by the recent tax reform in the United States in the near term. Thereafter, output growth is projected to slow somewhat as the recovery matures. Economic activity in emerging market economies is expected to be supported by the ongoing gradual recovery from deep recessions in major commodity exporters (e.g. Brazil and Russia) and fairly resilient growth prospects in China and India.

Chart 1.4

Broad-based improvement in economic growth prospects across the globe

Change in real GDP growth forecasts for 2018 for major advanced and emerging economies

(Apr. 2018, changes vs. Nov. 2017; percentages, percentage points)

Sources: Consensus Economics and ECB calculations.

Note: EA: euro area; CH: Switzerland; US: United States; JP: Japan; UK: United Kingdom; ZA: South Africa; BR: Brazil; CN: China; IN: India; RU: Russia.

The upbeat baseline outlook for euro area growth is clouded by some risks emanating from global factors. Downside risks primarily relate to global factors, although the sluggish pace of structural reforms or further balance sheet adjustment needs in the public and/or private sectors in some euro area countries also pose risks to the growth outlook. The uncertainties surrounding the fiscal and monetary policy mix in the United States and its implications for the US and global economy, lingering debt sustainability concerns in emerging market economies and a further rise in (geo)political uncertainties across the globe, particularly as regards trade policies, may weigh on the global and euro area growth momentum. These downside risks are broadly counterbalanced in the risk assessment by the possibility of stronger than expected domestic demand momentum, a looser fiscal stance or higher than expected euro area potential output.

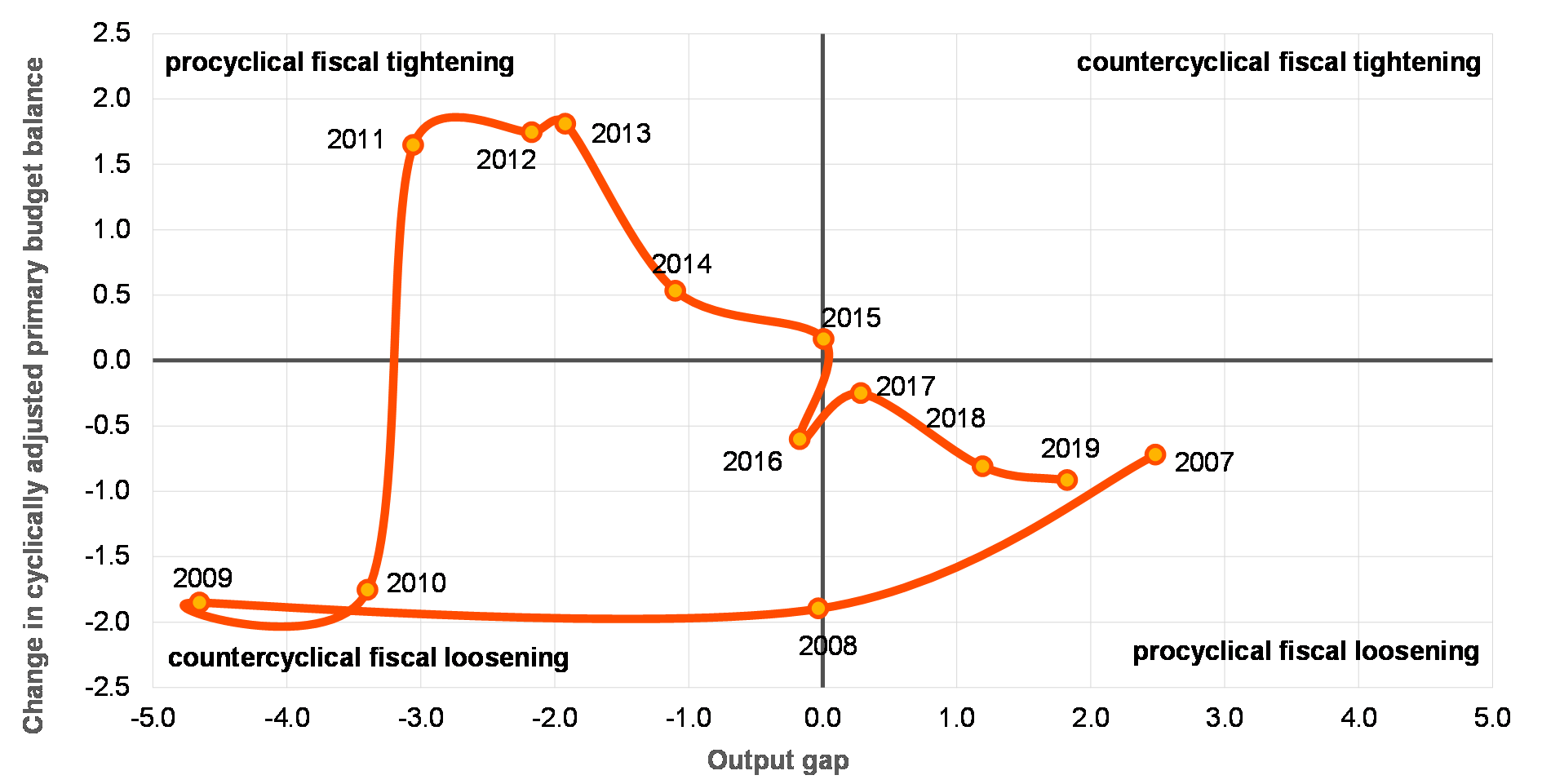

An overheating of the US economy could lead to tighter global financial conditions. The significant US fiscal stimulus enacted at the turn of the year is expected to boost economic activity in the near term. The expansionary fiscal stance in the late phase of the business cycle (see Chart 1.5) may lead to an overheating of the economy, while the ensuing higher inflationary pressures could lead to a faster than expected monetary policy tightening in the United States. Tighter financing conditions in the United States would, in turn, spill over to global financing conditions, negatively affecting the global economy. The recent fiscal stimulus may also exacerbate concerns regarding the sustainability of public finances and lead to a reassessment of US sovereign risk, potentially translating into a repricing in global bond markets.

Chart 1.5

Expansionary fiscal policies in the United States may raise public debt sustainability and overheating concerns

Output gap and changes in the cyclically adjusted primary budget balance in the United States

(2007-19, percentages, percentage points)

Sources: IMF (World Economic Outlook Database) and ECB calculations.

Note: Data for 2018 and 2019 are projections.

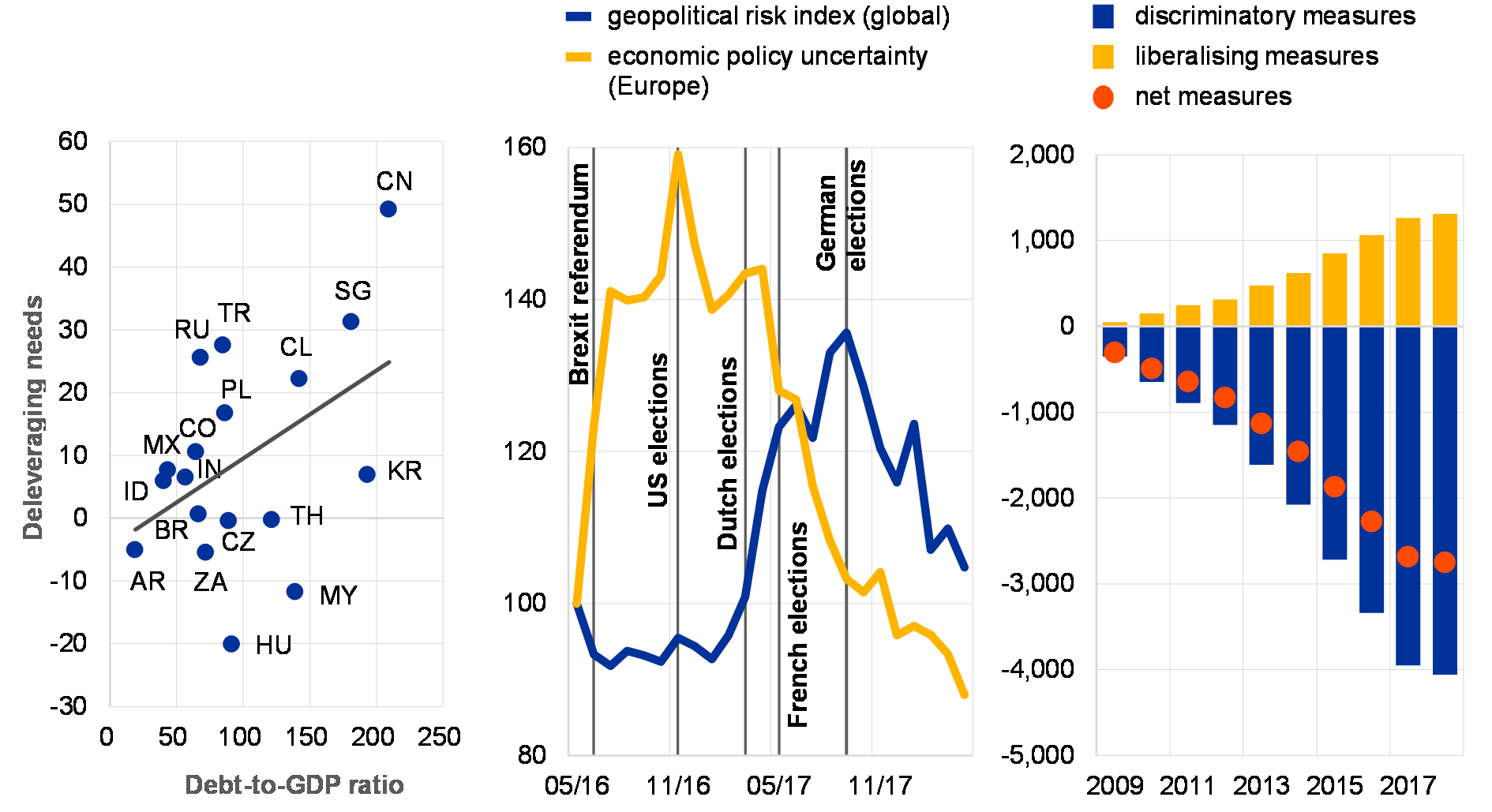

Lingering vulnerabilities in emerging market economies remain a cause for concern. In general, emerging market economies are in an increasingly robust position to withstand external financial shocks given their improved fundamentals. However, past credit excesses and the related debt accumulation over the past decade (see Chart 1.6 – left panel) may expose many emerging market economies to the risk of sudden capital flow reversals. Moreover, they render them more vulnerable to exchange rate shocks, particularly in the case of emerging market economies with notable US dollar liabilities, as reflected by the recent turmoil in Argentina and Turkey. That said, these developments have been driven by domestic factors and no wider emerging market sell-off has occurred to date in the wake of rising US long-term yields and the stronger US dollar. The prospective implications of further exchange rate turbulence could reverberate beyond emerging market economies given their growing economic and financial linkages with the rest of the world, in particular if an idiosyncratic, country-level event turns into a more broad-based increase in risk aversion vis-à-vis emerging markets (see Box 1).

Chart 1.6

Debt sustainability concerns in EMEs, a renewed flare-up of (geo)political risk and growing trade protectionism represent downside risks to global growth prospects

Non-financial private sector debt and deleveraging needs in emerging market economies, economic policy uncertainty and geopolitical risk index, and number of trade interventions

(left panel: Q4 2016, percentage of GDP, percentage points; middle panel: May 2016 – Apr. 2018, indices: May 2016 = 100, six-month moving averages; right panel: Jan. 2009 – Apr. 2018, cumulative number of measures)

Sources: policyuncertainty.com and Caldara and Iacoviello (2017), Global Trade Alert Database, ECB and ECB calculations.

Notes: Left panel: Equilibrium debt level estimates are based on a panel co-integration model. Following Consolo and Pierluigi (2016) and Arellano et al. (2009), debt developments are explained with income (GDP), the cost of debt (lending rate), a measure of uncertainty (unemployment rate), and indicators of financial market development (bank deposits, equity market capitalisation and M2 – all relative to GDP). CN: China, SG: Singapore, KR: South Korea, MY: Malaysia: TH: Thailand, CL Chile, HU: Hungary, TR: Turkey, PL: Poland, RU: Russia, CO: Colombia: MX: Mexico, IN: India, ID: Indonesia, BR: Brazil, ZA: South Africa, CZ: Czech Republic and AR: Argentina. Middle panel: Measures of economic policy uncertainty are taken from Baker, S., Bloom, N. and Davis, S., “Measuring Economic Policy Uncertainty”, Chicago Booth Research Paper No 13/02, January 2013. The geopolitical risk index of Caldara and Iacoviello is used. For more details, see Caldara, D. and Iacoviello, M., “Measuring Geopolitical Risk”, working paper, Board of Governors of the Federal Reserve System, November 2017. Right panel: Measures capture trade in goods and services. Figures for 2018 cover data for the first quarter of 2018. First available data are for 2009.

Renewed (geo)political uncertainties have the potential to weigh on growth. While economic policy uncertainty and geopolitical risk appear to have decreased in recent months (see Chart 1.6 – middle panel), a re-intensification of (geo)political risks may bear the potential to undermine confidence and sentiment with adverse repercussions for both financial markets and the real economy. In fact, policy uncertainties remain elevated in advanced economies, in particular as regards the ongoing negotiations on the future relations between the United Kingdom and the European Union. Moreover, a potential escalation of geopolitical tensions may have a severe impact on the global economy via deteriorating sentiment and a rise in risk aversion.

A significant escalation of trade tensions risks derailing the ongoing recovery in global trade and economic activity. While strong global trade continues to underpin global growth prospects, a possible further strengthening of protectionist tendencies in advanced economies (see Chart 1.6 – right panel) could adversely impact global trade and growth, especially if accompanied by retaliatory measures by target countries and adverse confidence effects. According to ECB staff simulations, in such an escalation scenario, world trade in goods could fall by up to 3% in the first year after the change in tariffs and world GDP by up to 1%.[9] That said, the precise impact on individual countries would primarily depend on their size, openness and trade intensity with the tariff-imposing country.

All in all, financial stability in the euro area could be challenged should these downside risks materialise. These factors may not only undermine the sustainability of the global and euro area recovery, but also have the potential to trigger tensions in global financial markets and prompt a disorderly unwinding of global search-for-yield flows. A weaker than expected growth environment could trigger the materialisation of any of the main risks to euro area financial stability and could reinforce global risk repricing, further challenge bank profitability or fuel debt sustainability concerns.

Box 1

The growing systemic footprint of Chinese banks

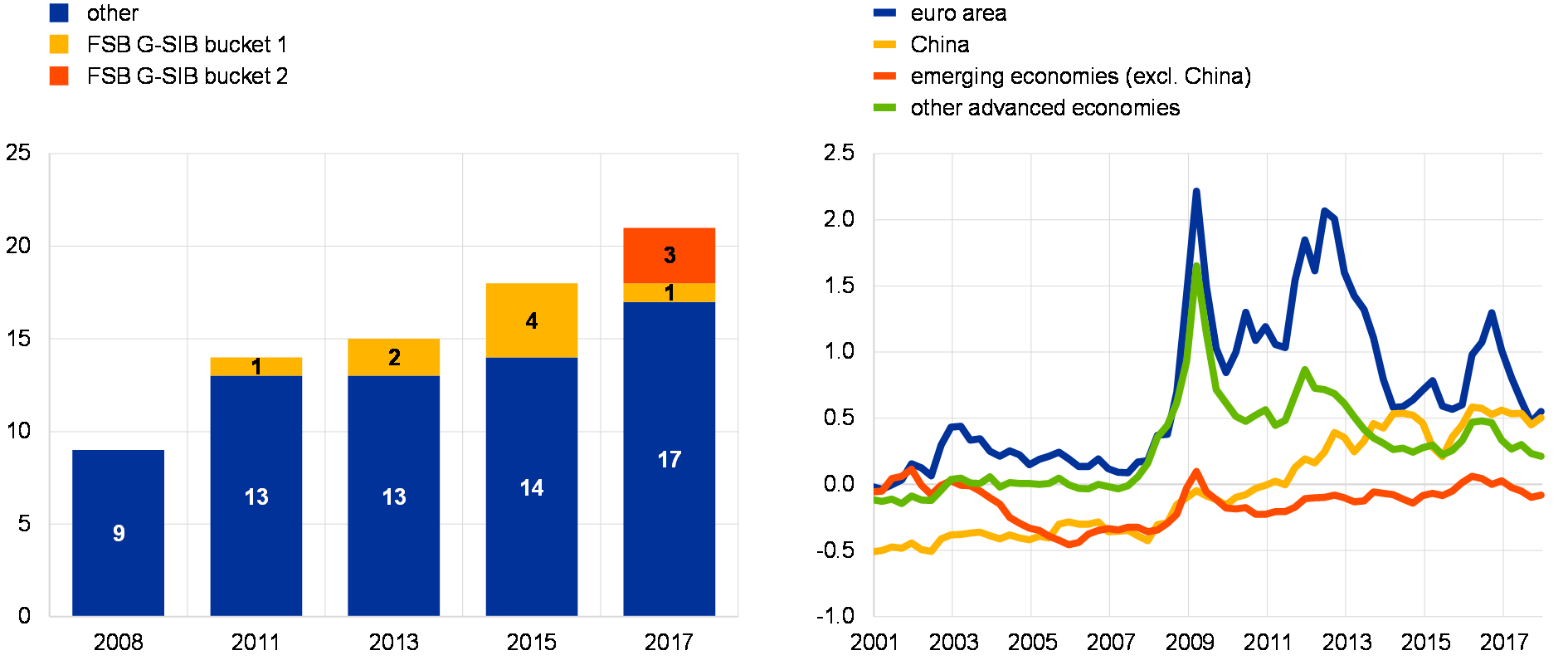

Emerging market economies have experienced accelerated financial deepening since the onset of the financial crisis. Consequently, financial stability risks emanating from emerging markets may spill over more widely to the global financial system. A key focus in this regard has been China, not least given the sheer size of its banking sector and the country’s growing role in international finance. Against this background, this box investigates the risks related to the growing size and systemic importance of Chinese banks and their possible implications for euro area financial stability.

Chinese banks have increased their weight and systemic relevance in the global financial system since 2008. The total assets of China’s banking sector have increased from 205% to 305% of Chinese GDP over the last decade, while the market capitalisation of Chinese banks relative to the global stock market capitalisation of banks rose from 13% in 2008 to 20% in 2017. At individual bank level, this is reflected in the rapidly growing number of Chinese banks among the 100 largest banks in the world and in the growing number of Chinese banks in the Financial Stability Board’s (FSB’s) G-SIB list and their respective rankings (see Chart A – left panel). Moreover, metrics of systemic risk point to a growing systemic relevance of Chinese banks. Their SRISK – a measure of individual banks’ contributions to the undercapitalisation of the global banking system in times of distress – has increased compared to the pre-crisis period and now exceeds that for banks in the euro area and other advanced economies (see Chart A – right panel), while more recently the SRISK measure has stabilised.[10]

Chart A

Increasing weight of Chinese banks in the global financial system not only in terms of their size, but also as regards their systemic importance

Number of Chinese banks among the worlds’ 100 largest banks based on total assets (left panel) as well as SRISK as a share of global stock market capitalisation (right panel)

(Left panel: 2008-17, number; right panel: Q1 2001 – Q4 2017, percentages)

Sources: FSB, SNL Financial, New York Stern V-Lab and ECB calculations.

Notes: The FSB’s G-SIB list was introduced in 2011. G-SIBs are allocated to five buckets based on their systemic footprint as measured according to BCBS methodology. SRISK quantifies the capital shortfall conditional on a severe and prolonged stock market decline. A positive (negative) value of SRISK suggests an expected capital shortfall (surplus) of the underlying banks in the case of a systemic event. For further details on the computation of SRISK, see Brownlees, C. and Engle, R., “SRISK: A Conditional Capital Shortfall Measure of Systemic Risk”, The Review of Financial Studies, Vol. 30, January 2017, pp. 48-79. Other advanced economies cover Australia, Canada, Norway, Japan, Denmark, Sweden, Switzerland, the United Kingdom and the United States.

Chinese banks have become more interconnected with the rest of the world via both direct and indirect financial and trade channels. While China’s transactions in international portfolio assets (such as equity and fixed income securities) remain subject to tight quota, bank loans, in particular Chinese banks’ outbound investments, have been far less restricted. Zooming in on the euro area, direct euro area banking exposures to China remain negligible, in spite of having risen considerably in recent years both in absolute terms and relative to total assets. Supervisory data suggest that direct exposures of significant euro area institutions to the Chinese financial sector remain limited at below 1% of their total assets, with a strong concentration in France and Germany. Interconnectedness may, however, also arise on the liability side of euro area banks’ balance sheets, where rollover risks may emerge to the extent that Chinese banks serve as providers of (wholesale/interbank) funding. Available data, while scarce, would suggest that this funding source for euro area banks is negligible at the current juncture.

Indirect exposures may be a cause for concern, as they can generate adverse repercussions for global financial markets. This was demonstrated during the 2015 Chinese equity market turmoil that spilled over to global equity markets. Although in that episode the stock market correction did not originate in China’s financial sector, a combined Chinese economic and financial crisis scenario might have a larger impact on global financial markets, including those in the euro area. Moreover, if stress in the Chinese banking sector were to reduce Chinese banks’ capacity to finance the domestic economy, this might hamper global growth through trade channels which could have an impact on euro area banks via second round effects, such as higher credit risk.

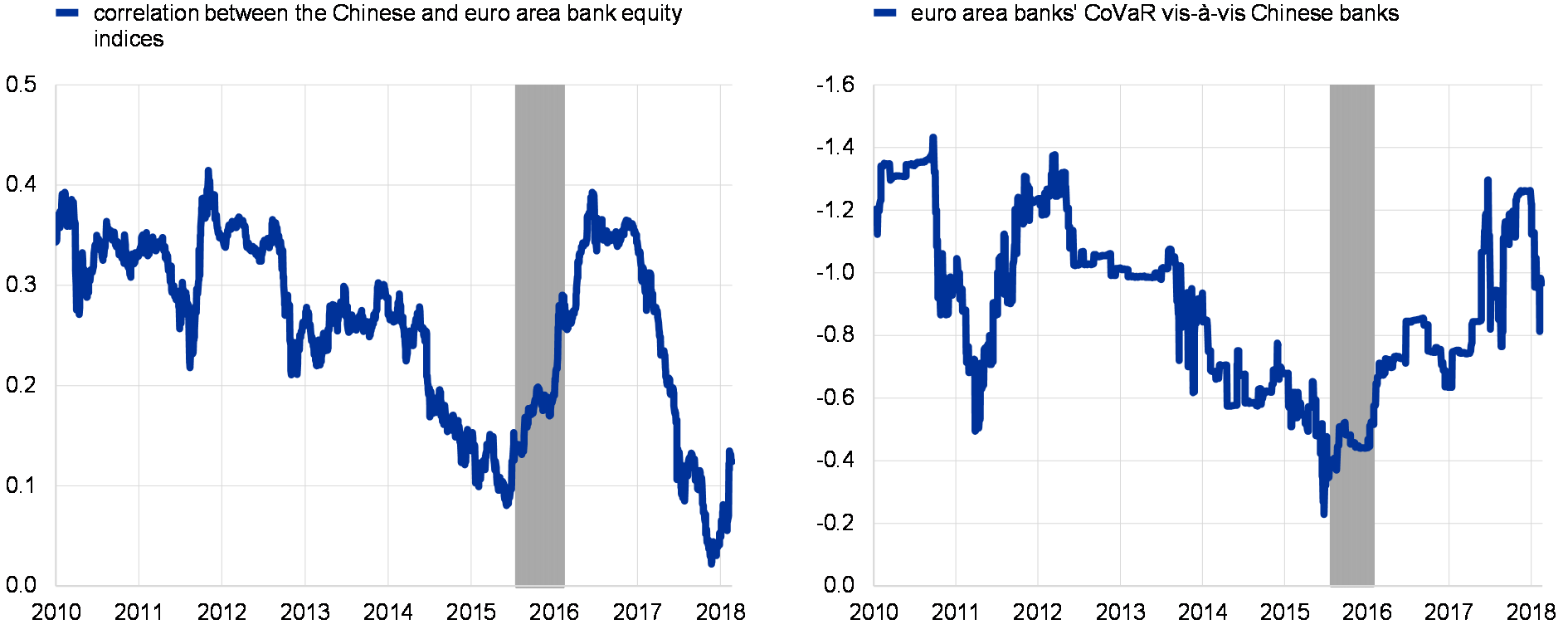

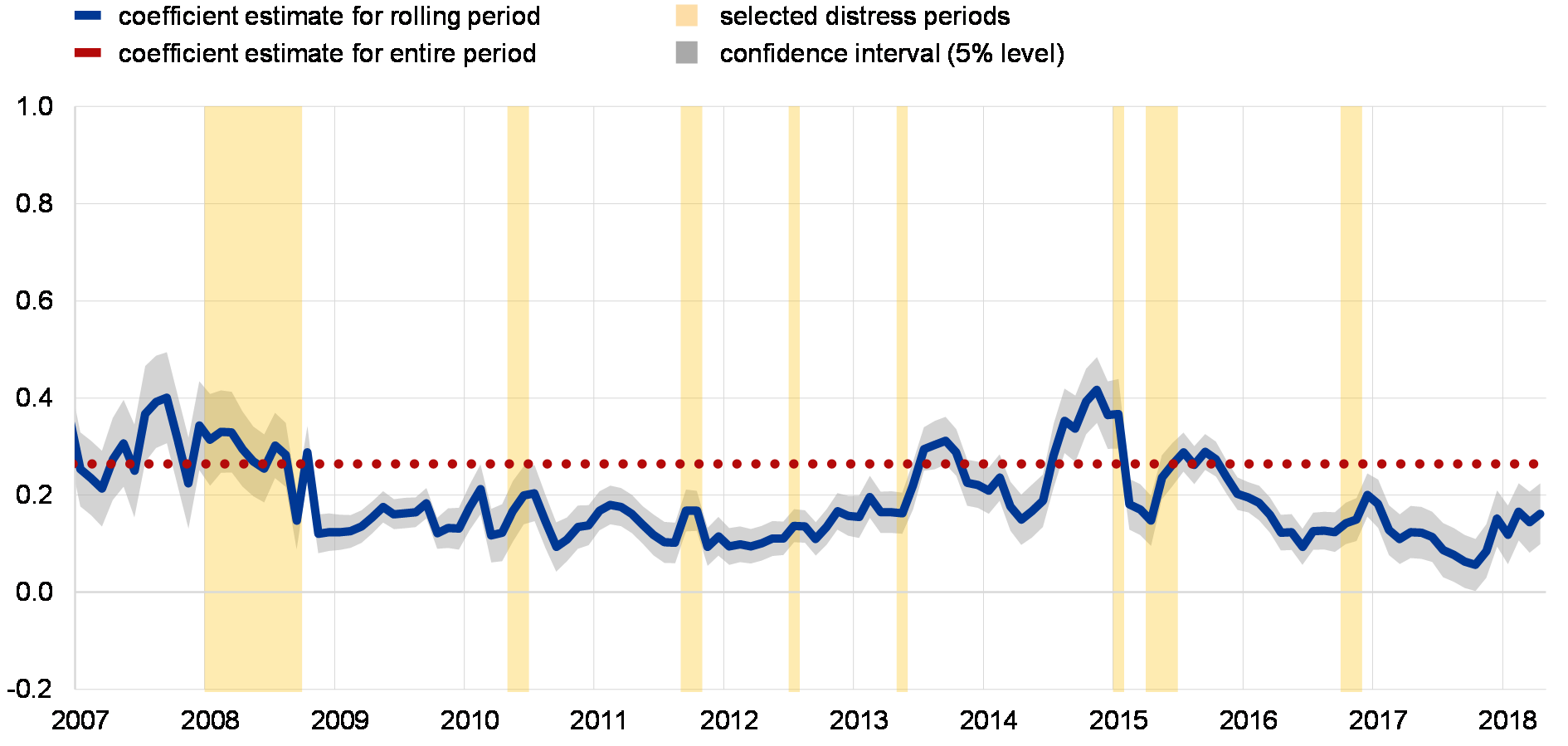

Empirical evidence points to increased spillover risks from Chinese to euro area bank stock prices. Of the various spillover channels outlined above, the indirect exposures appear to have the largest stress potential but are at the same time the most difficult to quantify. One way to proxy spillover risk is to look at the (tail) dependencies of euro area and Chinese banks’ stock prices. To abstract from the potential impact of home-grown problems in the euro area banking sector (as indicated by marked corrections in euro area bank stock prices in early 2016) on changes in the (stock price) correlation, the focus is on the period from the middle to the end of 2015, which was characterised by a pronounced stock market correction in China. In general, the correlation of bank stock prices in the two jurisdictions has declined overall in recent years (see Chart B – left panel).[11] To better capture the tail dependencies and mitigate some of the shortcomings of the simple correlation approach, the more sophisticated conditional VaR (CoVaR) measure scaled by the prevailing level of market volatility is used. The results suggest that euro area bank equities have, in spite of lower correlations, become more sensitive to tail risks in the equity price of their Chinese peers since mid-2015 (see Chart B – right panel).

Chart B

Heightened co-movement in bank stock prices during stock price turmoil in China and increased sensitivity of euro area banks to tail risks in Chinese banks

Correlation between Chinese and euro area bank stock price indices (left panel) and euro area banks’ CoVaR vis-à-vis Chinese banks (right panel)

(left panel: Jan. 2010 – Feb. 2018, correlation coefficient; right panel: Jan. 2010 – Feb. 2018; standard deviations (inverted scale))

Sources: Thomson Reuters and ECB calculations.

Notes: Left panel: The line shows the rolling correlation coefficient over a 260-day window between the euro area and the Chinese (international) bank equity indices. The shaded area represents the Chinese equity market turmoil in the second half of 2015 and early 2016. Right panel: The CoVaR corresponds to the median price change in the euro area bank equity index in response to the materialisation of the 5% lower tail of the return distributions of six large Chinese banks: Bank of China, Bank of Communications, China CITIC Bank, China Construction Bank, China Merchants Bank, and Industrial and Commercial Bank of China. The CoVaR measure is computed on a two year rolling window of daily observations and reported in terms of standard deviations of the Chinese bank index. See Adrian, T. and Brunnermeier, M.K., “CoVaR ”, American Economic Review, Vol. 106(7), July 2016, pp 1705-41.

All in all, increased spillovers from Chinese banks may have heightened financial stability implications for euro area banks. Increased spillover risks are likely to be a reflection of the growing size and systemic importance of Chinese institutions. A further increase in the systemic footprint of Chinese banks and the ever-increasing interconnectedness of the Chinese financial system with the rest of the world may generate adverse repercussions for the global financial system, including in the euro area, in the event of any future episode of financial stress.

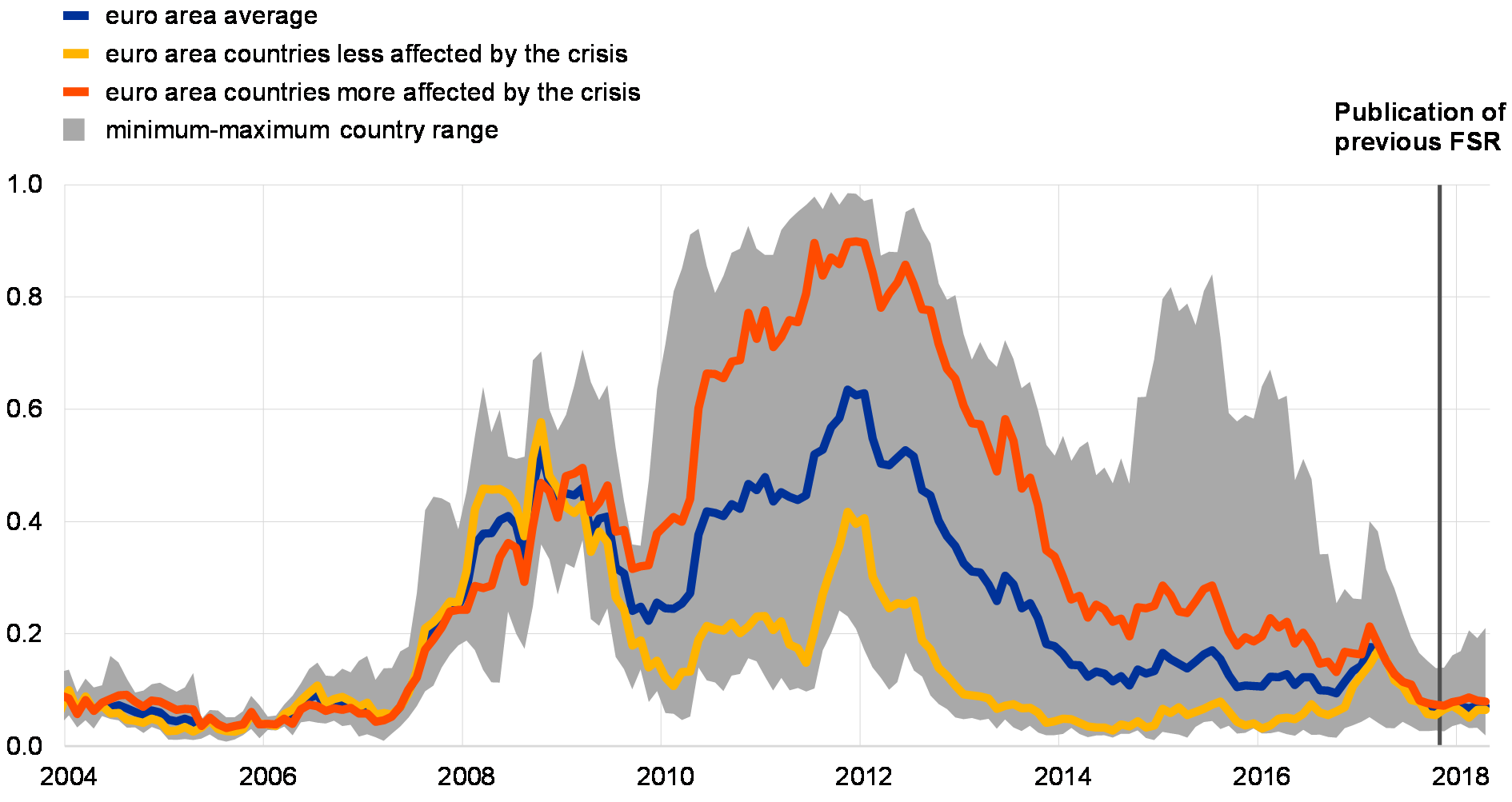

1.2 Benign macro-financial conditions conceal underlying sovereign vulnerabilities

Stress remained subdued in euro area sovereign debt markets. The composite indicator of systemic stress for euro area sovereign bond markets has continued to hover at low levels amid relatively narrow cross-country dispersion (see Chart 1.7). In terms of the underlying drivers, volatility in euro area sovereign bond markets has remained relatively low. At the same time, liquidity conditions in government bond markets (measured by bid-ask spreads) have remained favourable against the backdrop of the ECB’s public sector purchase programme, while sovereign credit risk has come down somewhat amid improving economic conditions, relatively low levels of political uncertainty and several sovereign rating upgrades (e.g. for Greece, Portugal and Spain).

Chart 1.7

Stress in euro area sovereign bond markets remained contained amid relatively low cross-country dispersion

Composite indicator of systemic stress in euro area sovereign bond markets

(Jan. 2004 – Apr. 2018)

Sources: ECB and ECB calculations.

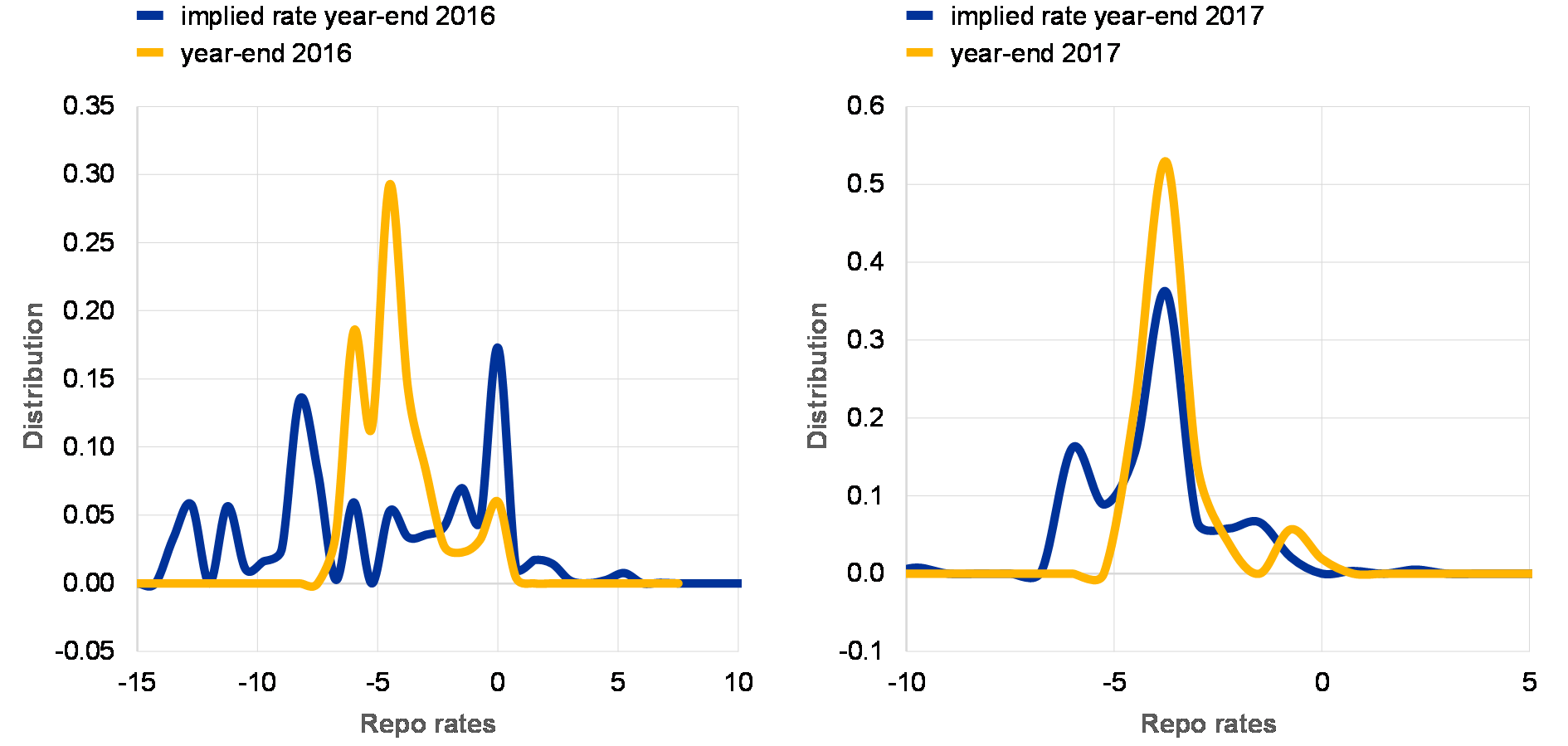

Notes: The SovCISS measures the level of stress in euro area sovereign bond markets. It is available for the euro area as a whole and for 11 euro area countries (Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal and Spain). Euro area countries more affected by the crisis comprise Greece, Ireland, Italy, Portugal and Spain, while euro area countries less affected by the crisis include Austria, Belgium, Finland, France, Germany and the Netherlands. The SovCISS combines data from the short end and the long end of the yield curve (two-year and ten-year bonds) for each country, i.e. two spreads between the sovereign yield and the euro swap interest rate (absolute spreads), two realised yield volatilities (the weekly average of absolute daily changes) and two bid-ask bond price spreads (as a percentage of the mid-price). The aggregation into country-specific and euro area aggregate SovCISS is based on time-varying cross-correlations between all homogenised individual stress indicators pertaining to each SovCISS variant following the CISS methodology developed in Hollo, D., Kremer, M. and Lo Duca, M., “CISS – a composite indicator of systemic stress in the financial system”, Working Paper Series, No 1426, ECB, March 2012.