Financial Conduct Authority must be investigated over failure to tackle de-banking, chancellor told

Jeremy Hunt has been urged to investigate the banking regulator as part of the drive to “restore integrity” after the debanking scandal.

A group of prominent Conservatives and former financial industry figures have penned a letter to the Chancellor raising their concerns that the Financial Conduct Authority (FCA) may have inadvertently encouraged the culture within banking that led to Nigel Farage losing his Coutts account.

The signatories were Iain Duncan Smith, the former Conservative Party leader, Danny Kruger, a Tory MP on the Commons Treasury Committee, Prof Daniel Hodson, the former deputy CEO of Nationwide Building Society, and Baroness Noakes, the former president of the Institute of Chartered Accountants in England and Wales and a non-executive director of the Bank of England.

The letter, a copy of which was passed to The Telegraph, raises questions about the FCA’s approach and whether it had unintended consequences.

The authors flag up the FCA’s encouragement of what is known as “environmental, social, and governance”, or “ESG”, which encourages companies to act responsibly.

They also note that an FCA source was quoted in a piece in The Guardian saying there was “a real sense of disquiet” inside the regulator at the departure of Dame Alison Rose.

Dame Alison quit as chief executive of NatWest Group after admitting to briefing a BBC journalist about the reason a client, former Ukip leader Nigel Farage, had his account closed.

Political views

Mr Farage’s account was with Coutts, which is part of NatWest. Information released after Mr Farage submitted a subject access request revealed his political views were a factor in the decision.

Part of the letter reads: “The FCA has been actively pursuing an approach which involves forcing a change in culture and diversity of thought in banks and other financial firms.

“It has also played an active role in forcing through ESG changes, where the precise scope, meaning and application of ‘environmental’, ‘social’ and ‘governance’ is arguable, to say the least.

“It appears that the FCA has been making and applying vague rules, including those known as ‘Principles’, which are open to varied interpretation.”

A line later in the letter to Mr Hunt reads: “Given the off the record briefings against you, there should be an investigation into the FCA’s culture as part of the drive to restore integrity in the banking system.”

A Treasury spokesman declined to comment on the FCA.

On wider topics, a Treasury source said: “We have acted decisively to stand up for people’s right to free speech, but recognise more work needs to be done to deal with the root causes of the issue.”

Leaders of the FCA defended their approach in a recent appearance before the Commons Treasury Committee where they were questioned on the topic.

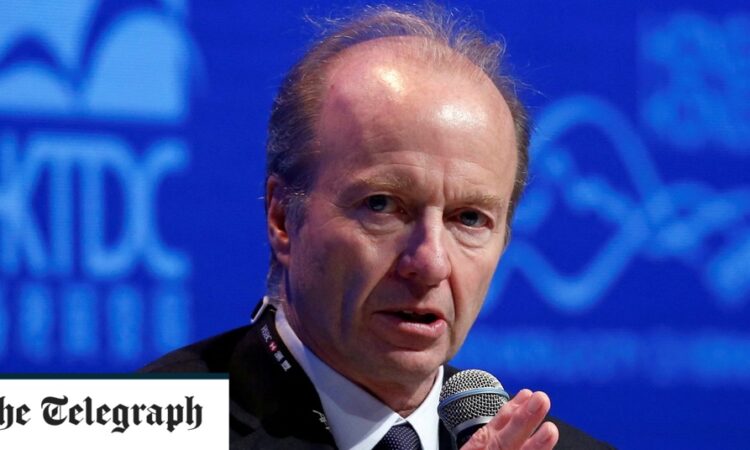

Nikhil Rathi, the FCA chief executive, told MPs that the regulator had spoken to the Coutts parent company, NatWest Group, after the Farage story broke.

Mr Rathi said: “You’re not able to discriminate on the basis of political views either.”

Degree of discretion

In the same appearance the FCA chairman, Ashley Alder, argued that lenders had a degree of discretion around who they have as customers.

Mr Alder said: “For banks as well as other commercial enterprises, it’s fundamentally up to them to choose who they do business with.”

A Financial Conduct Authority spokesman said: “The views expressed in The Guardian are not those of the FCA. We are clear that it is for any board first and foremost to make decisions about the future of a firm’s CEO.

“As boards take those decisions, it is entirely appropriate for them to take account of views of their shareholders, in particular their largest shareholders. We have made it clear that the legislation requires that no one should be having their personal bank account closed on the basis of their legally held political views.

“The Treasury has asked us to have regard to its commitments on net zero and sustainable finance. Our approach to these issues has been focused on developing international standards and increasing transparency and trust, in a market which is growing quickly due to consumer demand.”

Separately, Arron Banks, the former Ukip donor and one of the self-dubbed “bad boys of Brexit”, revealed he had his bank accounts closed. Mr Banks claimed that Andrew Bailey, the Bank of England governor, had been made aware of the issue more widely at one point.

A spokesman for Mr Bailey did not comment to the Mail on Sunday, which reported the claim.