Feedback on the input provided by the European Parliament as part of its resolution on Banking Union 2022

ECB Banking Supervision welcomes the feedback provided by the European Parliament in its “Resolution on Banking Union – Annual Report 2022”[1] (“the Resolution”) of 11 July 2023. To continue the dialogue between the European Parliament and the ECB and underline our strong commitment to accountability, ECB Banking Supervision hereby replies to the comments and suggestions provided by the European Parliament in the Resolution.

1.1 Banking sector resilience

The Resolution welcomes the joint statement of 20 March 2023 by ECB Banking Supervision, the Single Resolution Board (SRB) and the European Banking Authority (EBA) in response to measures taken with regard to Credit Suisse on 19 March 2023 by Swiss authorities.[2] The Resolution also welcomes the significant progress made since the great financial crisis through the establishment of the single rulebook, the Single Supervisory Mechanism (SSM) and the Single Resolution Mechanism (SRM), observing that European banks are in a stronger position to withstand financial shocks than before.

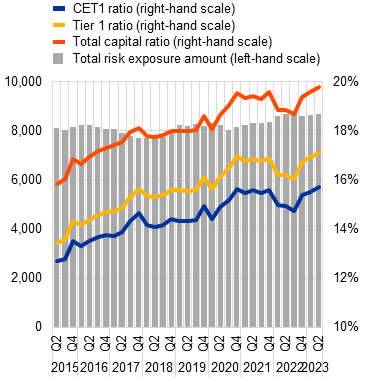

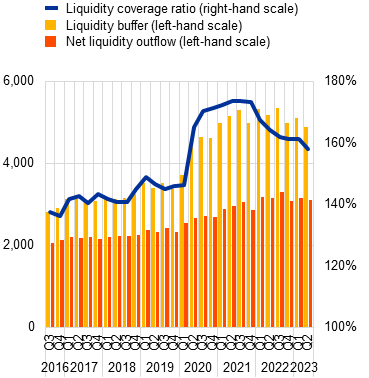

ECB Banking Supervision has delivered in terms of making the European banking sector more resilient and profitability has increased in the last years. In the second quarter of 2023 the average Common Equity Tier (CET1) ratio of the euro area banking sector’s significant institutions reached an all-time high of 15.7%, the highest level reported since ECB Banking Supervision started collecting supervisory data (Chart 1). In the second quarter of 2023 the average liquidity coverage ratio stood at 158% (Chart 1), well above both regulatory standards and pre-pandemic levels.

Chart 1

Capital and liquidity coverage ratios and their components, by reference period

|

|

Source: ECB.

In addition, annualised return on equity reached 10% in the first half of 2023, recovering from the negative values seen during the COVID-19 pandemic.

With regard to the market turmoil of March 2023, there was no direct read-across of the US or Swiss events to significant banks in the euro area. Initial market spillovers were mitigated thanks to stronger and more consistent banking regulation (for example, the application of liquidity coverage ratio and net stable funding ratio, and regulatory treatment of unrealised losses on securities held at fair value through other comprehensive income) and supervision, which had identified interest rate risk in the banking book (IRRBB) as a supervisory priority since the early signs of inflationary pressures in the second half of 2021. Market tensions were relatively short-lived, also owing to the prompt interventions by relevant authorities.

Nevertheless, there is no reason for complacency. ECB Banking Supervision follows a prudent approach and closely monitors the development of IRRBB as well as credit, liquidity and funding risks, as explained in the publication on the SSM supervisory priorities 2023-2025[3]. While increases in interest rates have had a positive impact on banks’ profitability so far, this effect may lessen over time due to increasing funding costs, higher provisions and credit losses, lower lending volumes and valuation losses in banks’ securities portfolios. Furthermore, although unrealised losses on debt securities at amortised cost are much lower compared with the situation in the US banking system, the economic value of equity of banks might be negatively impacted. The rapid shift in the interest rate environment and the pressure exercised by investors on banks perceived as weak links in times of turmoil warrant enhanced supervisory scrutiny.

1.2 NPLs

The Resolution welcomes that the stock of non-performing loans (NPLs) has continued to decrease, although to different degrees across Member States. It underlines that the share of NPLs may increase following the phasing-out of COVID-19 pandemic public support measures, emphasising that the monitoring of NPLs should remain a key priority. The Resolution further highlights the risk of asset quality deterioration due to rising interest rates and notes that stage 2 loans have increased to 9.5% of banks’ total loans in the second quarter of 2022, the highest level since 2018. The Resolution also stresses that vulnerabilities are building up in some market segments, including in the real estate sector.

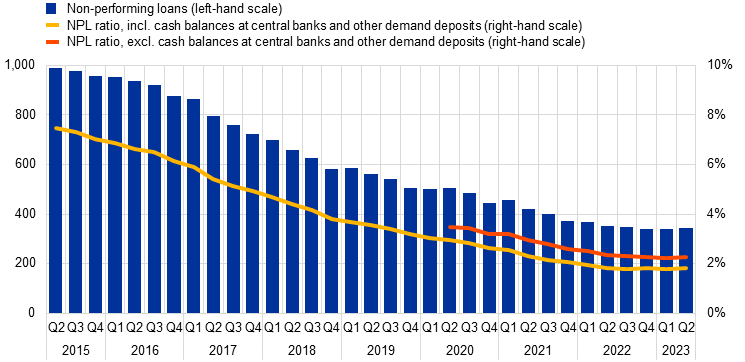

NPL reduction continues to be a priority for ECB Banking Supervision. NPLs have decreased in significant institutions, dropping from €1 trillion to €344 billion since the establishment of ECB Banking Supervision. The NPL volumes are close to historic lows (Chart 2).

Chart 2

Non-performing loans by reference period

Source: ECB.

However, due to the phasing-out of pandemic-related support measures and the more limited disposal of legacy assets which has driven the decline of NPLs over recent years, the decline in NPL ratios slowed down in 2022. Some signs of early deterioration in credit quality can be observed starting from the first half of 2023, such as the increase in NPLs in some portfolios (above all, credit for consumption and commercial real estate), and the overall increase in early arrears. On the other hand, the volume of stage 2 loans receded somewhat from the peaks reached during the COVID-19 pandemic, thanks to the reclassification into stage 1 of loans to those sectors most affected by the pandemic (for example, accommodation and aviation). There could also be further increases in NPLs in the coming quarters if inflation and high interest rates continue to negatively impact real disposable income and borrowing costs, together with the uncertain economic outlook. Therefore, it is a top priority for ECB Banking Supervision that banks ensure a proper identification and recognition of credit risk.

With regard to the real estate sector, the cycle has turned, as euro area real estate prices have started declining while accumulated vulnerabilities remain significant in several countries. Going forward, higher interest rates could result in further downward pressure on house prices, while the debt servicing capacity of households could deteriorate. This is especially the case in countries where residential property valuations are stretched, debt levels are elevated and/or household debt mostly comprises variable interest rate loans. National authorities could still increase resilience to accumulated vulnerabilities in real estate markets through targeted macroprudential policy action, while taking into account potential procyclical effects. A similar picture can be seen in the commercial real estate market, where prices in some countries have already fallen and transaction volumes have decreased substantially. This is driven by high interest rates, but also by structural changes in some sectors such as retail and offices, including lower-quality buildings facing rising retrofitting costs, which exacerbate the downward pressure on prices. Accordingly, banks need to have an early and proactive approach to assessing their commercial real estate loans by evaluating their refinancing and bullet loan repayment risk, with a focus on underlying trends in cashflows and collateral valuations.

1.3 Dividend and buyback limitations

The Resolution calls for the introduction of a risk-adjusted limitation of dividends and buybacks in times of crisis, stressing that financial institutions benefiting from direct State aid should be subject to significant limitations with regard to dividend distribution, share buybacks and variable remuneration payments.

ECB Banking Supervision closely follows banks’ distribution plans. This topic is an integral part of the regular supervisory dialogue with significant institutions to ensure that both baseline and adverse capital trajectories are sustainable. Supervisors scrutinise banks’ forward-looking capital trajectories, and for the fiscal year 2022 only a handful of banks adjusted their initial distribution plans. The ECB does not suggest adding the power to impose binding system-wide restrictions on distributions at the Union and/or national level to the Capital Requirements Regulation (CRR III) and Capital Requirements Directive (CRD VI).[4]

1.4 Banking sector consolidation, TBTF problem

The Resolution calls for the continuation of the work that EU institutions have done to contain the systemic risks resulting from interconnections and complexity in the banking sector, underpinning the so-called “too-big-to-fail” (TBTF) problem.

ECB Banking Supervision believes that cross-border consolidation, combined with prudent supervision which takes into account TBTF externalities, can help to mitigate concerns related to the increase in size of European banks, given the positive effects of risk diversification across Member States. ECB Banking Supervision fully takes on board the potential issues raised by size and addresses them in close cooperation with other authorities in charge of financial stability and resolution, resolvability also being a key part of risk mitigation.

1.5 Impact of the Russian war in Ukraine on the banking sector

The Resolution calls for the monitoring of developments related to the Russian war in Ukraine, in particular their ramifications on EU financial institutions, such as a potential deterioration in the quality of exposed assets. In relation to higher energy prices, the Resolution also points to higher counterparty credit risk exposures faced by banks due to increased margin calls, and it stresses the need to adopt appropriate supervisory measures to prevent the energy crisis from leading to a financial crisis.

Since the start of the Russian invasion of Ukraine, ECB Banking Supervision has engaged in intense monitoring and dialogue with all the supervised institutions which have subsidiaries in Russia. While most of these institutions still maintain Russian banking subsidiaries, ECB Banking Supervision observes that banks have been downsizing their activities. At the aggregate level, supervised institutions have reduced their exposures by 47% between the end of 2021 and the second quarter of 2023. Institutions have also stopped new business and are exploring different avenues of exit strategies, such as selling their activities or progressively winding down their business in Russia. As explained in the letter dated 27 June 2023 to MEPs de Lange and Juknevičienė[5] on banks’ activities in Russia, ECB Banking Supervision has stepped up its actions and asked these banks to speed up their downsizing and exit strategies efforts by adopting clear roadmaps.

ECB Banking Supervision intensified its monitoring of banks’ exposures to energy companies and energy-intensive sectors in summer and autumn 2022, in the context of significant pressure on energy prices. While the situation in energy markets has largely normalised since then, ECB Banking Supervision continues to maintain open and frequent dialogues with banks to monitor their risk profiles and stands ready to take appropriate action, should conditions in energy markets deteriorate.

2.1 Climate stress test

The Resolution welcomes the SSM climate stress test conducted in 2022 and takes note of the targets for banks set for 2024, also welcoming the follow-up actions already adopted and the publication of the reports on good practices. The Resolution recalls that ECB Banking Supervision may set Pillar 2 requirements for banks which do not comply with the recommendations.

ECB Banking Supervision welcomes the Parliament’s support on the climate actions taken and confirms that banks’ remediation of identified shortcomings will be assessed throughout 2023 and 2024. As described in the SSM supervisory priorities 2023-2025[6], the last deadlines for banks to comply with supervisory expectations regarding climate and environmental related risks are set for the end of 2024, and supervisors stand ready to closely monitor and follow up as needed. ECB Banking Supervision is determined to make full use of all supervisory tools and powers available to it, and may impose periodic penalty payments as enforcement action or impose bank-specific capital add-ons to ensure that appropriate progress is made. In addition, banks’ level of preparedness for managing climate-related and environmental risks is being assessed in the context of the ongoing deep dives into commercial real estate risk management practices. The upcoming climate stress test data collection will support the Fit-for-55 scenario analysis, namely with scenarios showing the EU’s pathway towards the target of a 55% reduction of net greenhouse gas emissions by 2030, as requested by the European Commission. This will be helpful in monitoring and assessing the progress banks are making. Supervisors will also conduct on-site inspections, engaging with institutions showing material deficiencies in their management of climate-related and environmental risks to ensure they implement sound remedial action plans and to monitor compliance with upcoming regulatory requirements.

2.2 Specific prudential requirements for activities associated with high ESG risks

The Resolution calls for the consideration of setting specific prudential requirements for activities associated with high ESG risks.

ECB Banking Supervision maintains that the prudential framework should remain risk-based and not be used to serve other purposes besides risk considerations. From a prudential perspective, changes in the capital treatment applied to certain assets presuppose that these assets demonstrate specific risk profiles.

It is for the EBA to assess whether and how regulatory capital requirements should reflect sustainability risk considerations. In this context, the ECB takes note that the EBA, in its October 2023 Report on the role of environmental and social risks in the prudential framework[7], has concluded that at this stage, the best way forward is to address drivers of environmental risk through effective use of, and targeted amendments to, the existing prudential regime rather than through dedicated supporting or penalising factors. Going forward, the ECB supports further analytical work to assess the need to adjust the minimum prudential capital treatment of ESG risks in the minimum regulatory capital requirements for credit, market and operational risk (Pillar 1), in line with the recently agreed new CRR text, which provides a new mandate to the EBA to report in iterative steps on the effective riskiness and the potential effects of an adjusted dedicated prudential treatment.

3.1 Banking union completion

The Resolution reiterates that the review of the EU crisis management and deposit insurance (CMDI) framework may help to overcome hurdles to the establishment of a European deposit insurance scheme (EDIS), but it should not be considered as a substitute for EDIS. The Resolution emphasises the importance of further risk reduction efforts and of the risk proportionality of contributions to deposit guarantee schemes (DGS) and to a future EDIS. The Resolution also calls for the due consideration of the specificities of institutional protection schemes (IPS). The Resolution expresses concerns regarding the liquidity challenge that a sizeable bank might face in resolution and calls on the EU institutions to agree on a solution that enhances predictability.

The CMDI review is an important step to make the European crisis management framework more effective in dealing with the failure of mid-sized banks, while at the same time protecting financial stability, depositors and taxpayers’ money[8]. The ECB supports a proportionate expansion of the scope of resolution, while improving resolution funding arrangements through a more efficient use of industry-funded safety nets, including by allowing DGS to contribute to resolution to unlock access to the Single Resolution Fund and introduce a single-tier depositor preference. Concerning IPS, the ECB supports the segregation of IPS and DGS funds, improving the effectiveness of the IPS. The ECB stresses the need to swiftly approve the CMDI review package, as it delivers very concrete and much-needed operational improvements to the way supervision and resolution authorities can handle bank crisis cases given the existing institutional framework. The ECB also believes that discussions on the completion of the banking union should restart as soon as possible during the next institutional cycle. In this context, the ECB supports the resumption of work to establish EDIS and does not see a need for additional pre-conditions related to risk reduction for its introduction. The ECB agrees that a European framework for liquidity in resolution should be set up and stands ready to play its part within such a framework, while fully respecting the Statute of the ESCB.

3.2 Basel III implementation

The Resolution stresses that the EU should comprehensively implement the Basel III reforms in a timely manner. The Resolution considers that EU banks’ specificities should be taken into account where there is sufficient and robust evidence that the international framework does not capture these specificities.

The timely, faithful and full implementation of Basel III in EU legislation is crucial to keeping our banks safe in an ever-changing macro-financial environment. The ECB welcomes the political agreement among co-legislators on the banking package (CRR III and CRD VI), which represents an improvement on current rules and paves the way for the entry into force of Basel III reforms in the EU on 1 January 2025. However, it will also be important to regularly review the effects and appropriateness of the deviations from the Basel standards against their stated policy objectives, to determine their impact on banks’ resilience.

3.3 AML

The Resolution stresses the link between anti-money laundering (AML) and prudential risks, urging prudential supervisors to fully take into account AML risks and to coordinate with AML authorities. The Resolution calls for the co-legislators to swiftly agree on the AML package, including the creation of a new AML Authority (AMLA).

The ECB values the cooperation between the ECB and anti-money laundering/countering the financing of terrorism (AML/CFT) authorities, and has significantly improved such cooperation. Since January 2019 the ECB has engaged in over 1,000 exchanges with national AML/CFT authorities in the European Economic Area, based on the multilateral agreement signed between the ECB and the respective AML/CFT authorities in 2019 (the AML Agreement), which now has 51 signatories. Furthermore, the ECB has signed over 60 Terms of Participation with AML/CFT lead supervisors to formalise its participation as observer in AML/CFT Colleges of the banks it supervises. The ECB has also contributed to the EBA’s database on AML/CFT material weaknesses (EuReCa) as a prudential supervisor.

The information provided by AML/CFT authorities to the ECB directly feeds into the different ECB supervisory processes, in particular in the Supervisory Review and Evaluation Process (SREP) analysis, fit and proper (FAP) assessments, and authorisation procedures. In this context, ECB Banking Supervision has, for instance, taken supervisory review measures targeting the prudential root causes of money laundering/terrorism financing concerns, imposed ancillary provisions to deal with money laundering concerns in FAP procedures and authorisation decisions, and taken negative authorisation decisions, including the withdrawal of bank licenses based on money laundering concerns. The ECB encourages the co-legislators to reach a swift political agreement on a strong AML Authority, in order to simplify the current cooperation tools between AML/CFT and prudential authorities with the creation of a central data hub to facilitate information exchange. The ECB stands ready to cooperate with AML/CFT supervisors.

The following section replies to the comments and suggestions of the Resolution which are very relevant to the work of ECB Banking Supervision, but which do not fall directly under its mandate.

4.1 Digital euro

The Resolution recalls the need to conduct a comprehensive assessment of the risks and benefits of a central bank digital currency, stressing the need for a high level of privacy, data protection, confidentiality of payment data, cyber resilience and security.

The Eurosystem is committed to designing a digital euro in such a way so as to avoid undue risks to the banking sector. Thus, effective safeguards will be embedded to avoid detrimental effects on banks’ intermediation capacity, funding costs and provision of services. Similarly, the Eurosystem is committed to facilitating privacy by default and by design. Therefore, the ECB will design the digital euro in such a way that the Eurosystem will not see users’ personal details or their payment patterns. Moreover, the Eurosystem is exploring options to allow for higher levels of privacy beyond the baseline scenario of today’s electronic payments. Offline digital euro payments could, for instance, provide cash-like levels of privacy. It will ultimately be for co-legislators to determine the framework for privacy and data protection for users of a digital euro, based on the proposal by the European Commission[9].

4.2 Disparate mortgage rates

The Resolution highlights that the interest rates offered to households and small and medium-sized enterprises (SMEs) are highly disparate across Member States, urging EU institutions to consider measures to ease the burden on households and SMEs.

The ECB carefully monitors how its monetary policy affects financial conditions, and how changes in its monetary policy stance are transmitted via the banking sector to the euro area economy. Since the ECB started raising policy rates in July 2022, bank lending conditions have tightened (as evidenced by the ECB’s bank lending survey[10]), lending rates for firms and households have notably increased and loan demand has decreased. At the same time, differences in lending rates across euro area countries remain contained by historical standards.

In addition, as part of its supervisory work, ECB Banking Supervision assesses all banks’ structural cost efficiency and actively monitors NPLs. These factors can also indirectly impact the loan interest rates of some banks.

4.3 Gender balance in financial institutions

The Resolution regrets the failure to ensure full gender balance in EU financial institutions and bodies, and the fact that women continue to be underrepresented in executive positions in the field of banking and financial services. The Resolution deeply deplores that neither the ECB Governing Council and Supervisory Board, nor the Single Resolution Board, are gender balanced.

ECB Banking Supervision is addressing the lack of gender balance on the boards of supervised entities through the SREP, as well as FAP assessments. Additionally, as announced in the SSM supervisory priorities 2023-2025[11], the ECB has further enhanced its focus on diversity. Banks lacking diversity policies and gender targets have been addressed directly and progress has been made, although at a slow pace. The ECB has also updated its methodology and revised its tools (for example, gender diversity, forming part of the assessment of the collective suitability of the board, is covered in FAP assessments), which guide banks towards ensuring a more gender-balanced composition of boards. The ECB’s power of intervention in FAP assessments, especially with regard to enforcing gender targets in FAP decisions, is constrained and depends on the applicable legal framework in each Member State. The ECB will keep actively fostering diversity in SSM banks’ boards, in collaboration with national competent authorities. Concerning the lack of gender balance in the ECB Governing Council and Supervisory Board, the ECB calls on Member States to ensure gender balance in their upcoming proposals for shortlists and appointments.

© European Central Bank, 2023

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.bankingsupervision.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the SSM glossary (available in English only).