The Banking Union: A Vision for Stability and Uniformity in EU’s Banking Sector

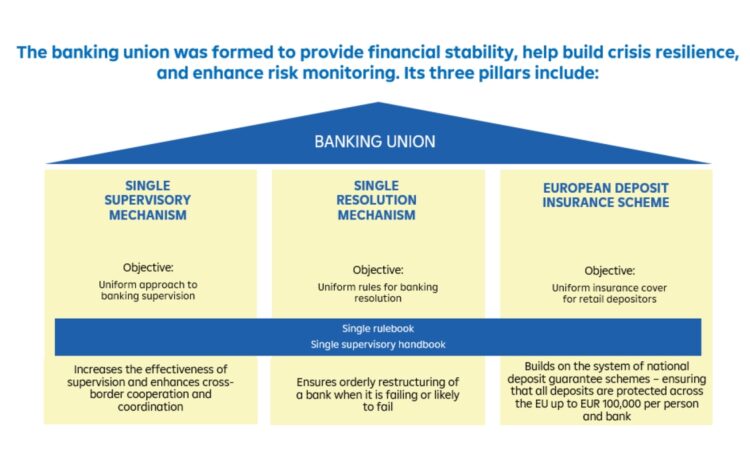

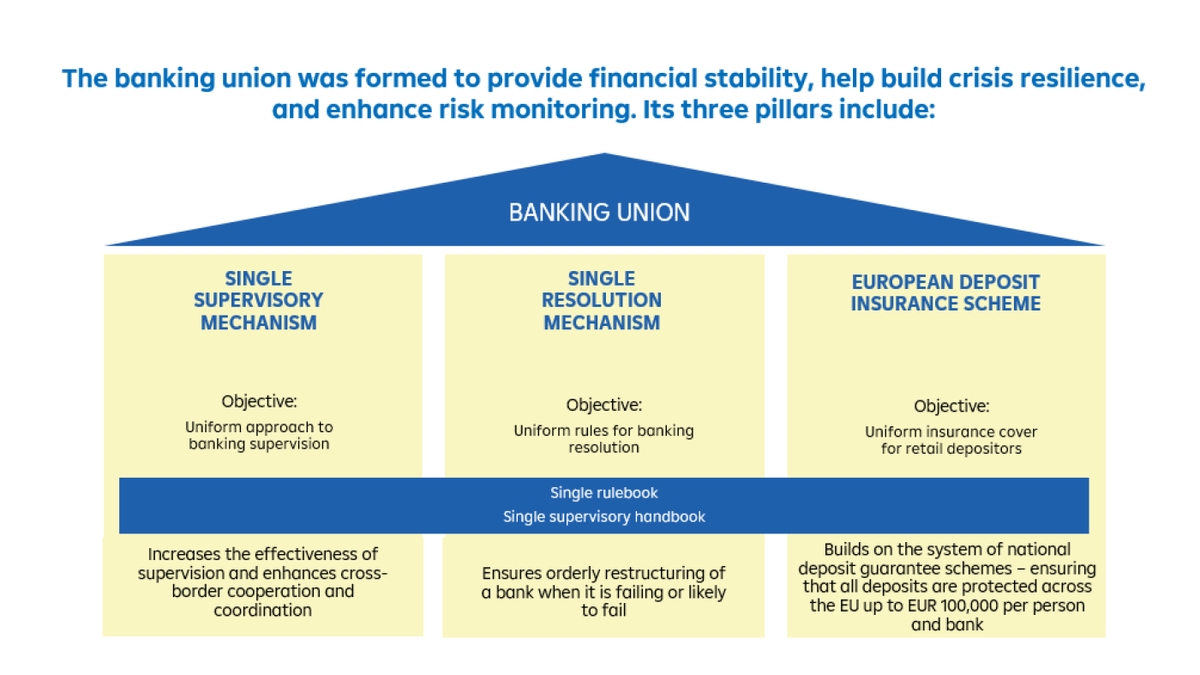

In a bid to ensure stability and uniformity within the European Union’s banking sector, the comprehensive regulatory framework known as the Banking Union was established. Born out of the ashes of the 2007-2008 financial crisis, this union aimed at breaking the ‘doom loop’ between banks and their home states, thereby preventing the destabilization of the financial system due to problems in individual banks.

The Vision of the Banking Union

The primary goal of the Banking Union is to create a level playing field for banks, irrespective of their geographical location. It aims at promoting fair competition in the EU single market and preventing economic fragmentation within the EU. To achieve this, it envisages a consistent set of rules for banks, a single supervisory authority for significant banks, and a Single Resolution Fund to address bank failures.

Progress Made and the Path Ahead

Already, two of the three main pillars of the Banking Union, the Single Supervisory Mechanism and the Single Resolution Mechanism have been put into action. However, the third pillar, the Single Depository Insurance Scheme, is still under construction. Simultaneously, the Banking Union’s rules are being refined to align with international standards, especially in areas like resolution and deposit insurance. The goal is to obviate the need for state interventions and address the absence of a single deposit insurance system.

Re-emergence of Global Imbalances

Meanwhile, at the CEPR Paris Symposium, the re-emergence of global imbalances in the post-COVID world was a topic of discussion. The symposium highlighted the increase in current account imbalances before the Global Financial Crisis and their subsequent decrease. Notably, Germany moved from a deficit to a surplus, while France transitioned from surplus to deficit. The symposium also touched upon the inversion of imbalances between goods and services trade, the surge in capital income flows, and the impact of rising interest rates on the balance of payments.

Supporting Entrepreneurship and Growth in Poland

In related news, the European Investment Bank Group has signed a revolving synthetic securitisation agreement with Europejski Fundusz Leasingowy S A EFL. This agreement, involving a portfolio of leasing receivables of PLN 2 billion, aims to support entrepreneurship, job creation, and economic growth in Poland. The agreement also aims to allocate a portion of the funding to projects aligned with climate action and environmental sustainability, reflecting the EIB Group’s commitment to equitable growth and social and territorial cohesion.