(Bloomberg) — European stocks were steady as investors were wary of making bets ahead of this week’s central bank meetings, while Brent oil’s rally to $95 triggered worries about inflation spiking again.

The Stoxx 600 Index was largely unchanged as of 8:14 a.m. in London, as a rally in autos and real estate stocks were offset by a drop in industrial goods and tech. Among single stocks, Banco Santander SA shares were slightly higher after it overhauled its corporate structure as Chief Executive Officer Hector Grisi seeks to simplify the company’s operations. Societe Generale SA, meanwhile, slipped again as BNP Paribas Exane and HSBC downgraded the bank’s rating.

This advertisement has not loaded yet, but your article continues below.

Brent surpassed $95 per barrel for the first time since November and raised risks to inflationary pressures, already key issues among central banks. Investors await a slew of central bank meetings starting with the US Federal Reserve on Wednesday.

The recent rally in oil prices plays an important role in the current equity selloff, says Mathieu Racheter, head of equity strategy at Bank Julius Baer. “It increases the pressure on leading central banks right when they are expected to be near the end of the tightening cycle.”

The main regional benchmark dipped on Monday after recording the biggest weekly advance in two months last week. Beyond the nervousness about the Fed this week, gains are also being hit by renewed fears about the health of the Chinese economy.

“Overall we still view it as a healthy short-term correction. The secular bull market is still alive,” added Racheter.

Meanwhile, the ECB will keep interest rates at 4% for as long as needed to tame inflation, Governing Council member Francois Villeroy de Galhau said — indicating he doesn’t favor future increases at this stage.

This advertisement has not loaded yet, but your article continues below.

A report that European Central Bank policymakers are considering raising the amount of reserves European lenders must park at the central bank is unwelcome news for the banking sector, Morgan Stanley analyst wrote in a note Tuesday.

SECTORS IN FOCUS:

- European energy-related stocks may be active on Tuesday as global benchmark Brent oil topped $95 a barrel for the first time since November, advancing for a fourth straight day.

For more on equity markets:

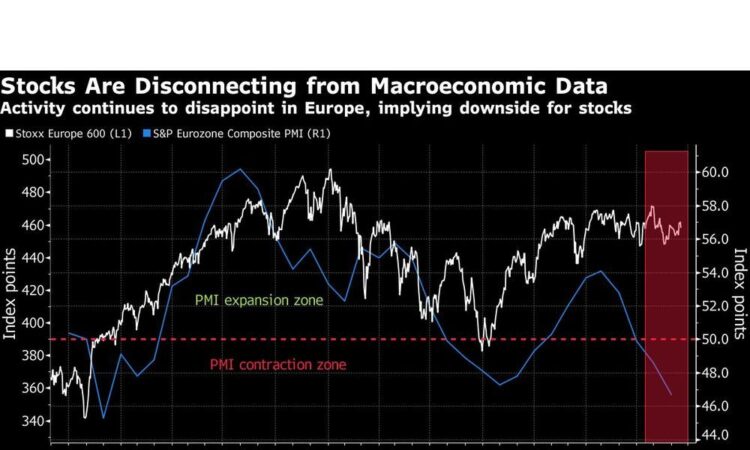

- It’s Getting Hard to Make a Bull Case for Europe: Taking Stock

- M&A Watch Europe: Edenred, Vopak, ACS, Planisware

- Sandoz Adds to Flurry of Big Pharma Spinoffs: ECM Watch

- US Stock Futures Unchanged; Dell Technologies Gains

- S4 Cuts Outlook as Recession Fears Linger: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

—With assistance from Michael Msika.