Europe’s STOXX 600 Index was subdued on Friday in thin pre-holiday trading after a turbulent week where hopes of an improving economic outlook overshadowed fears of recession and hawkish central banks.

The STOXX 600 was mostly flat by close, falling 0.04 percent to 427.45, advancing 0.64 percent for the week.

The index recouped a small part of last week’s staggering 3.3 percent loss, which was driven by heightened concerns of a recession after the US Federal Reserve and the European Central Bank signaled a prolonged rate-hike cycle.

US data on Thursday, showing a tight labor market and economic resilience, exacerbated those worries and dented expectations of a so-called “Santa rally” before the year-end.

Still, upbeat earnings from Nike and FedEx Corp and improving consumer confidence in the US and eurozone have offered some hope that the economic downturn caused by sharp interest rate hikes may not be as bad as feared.

Morale among Italian businesses and consumers rose this month, data showed on Friday, although the manufacturing sector was more downbeat.

Photo: Reuters

“Investors have been weighing up some better-than-expected corporate earnings this week against macroeconomic concerns about rising interest rates and a global slowdown,” said Victoria Scholar, head of investment at Interactive Investor.

Thin trading volumes around the holidays could also be exacerbating market moves, she added.

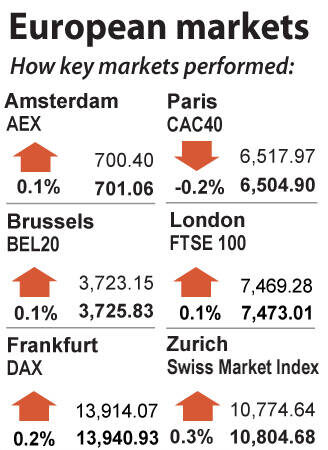

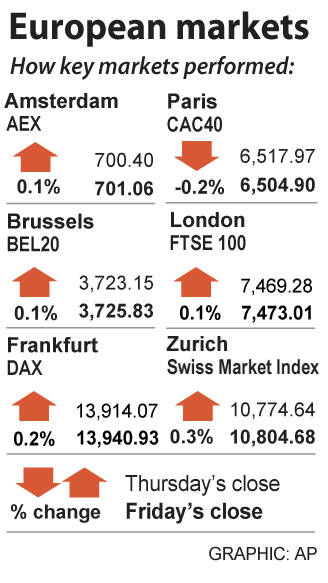

The UK’s FTSE 100 Index was also subdued, gaining 0.05 percent to 7,473.01, and rising 1.92 percent for the week.

Other European bourses were open all day, with Germany’s DAX rising 0.2 percent to 13,940.93. It rose 0.34 percent for the week.

European markets are to be closed tomorrow for the Christmas holiday.

On the economic data front, a report showed that Spain’s economy expanded 0.1 percent in the third quarter, slowing from a 2 percent growth rate in the previous three-month period.

Shares of miners rose 0.8 percent tracking firm copper prices on low inventories and hopes for economic recovery next year.

Industrials added 0.3 percent, while banks edged up after posting declines in the previous session.

The rate-sensitive tech sector fell 0.6 percent, limiting gains on the index.

Shares of French bank Credit Agricole and Italy’s Banco BPM edged up on striking a long-term bancassurance partnership on Friday.

Bavarian Nordic added 3.9 percent after the vaccine maker signed a contract with the US Department of Defense.

Comments will be moderated. Keep comments relevant to the article. Remarks containing abusive and obscene language, personal attacks of any kind or promotion will be removed and the user banned. Final decision will be at the discretion of the Taipei Times.