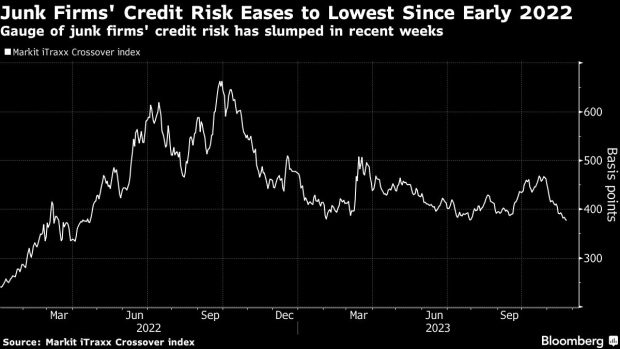

(Bloomberg) — A gauge of credit risk for Europe’s junk bonds has dropped to the lowest since early 2022 as global markets rally on bets that interest rates globally have peaked.

The Markit iTraxx Crossover Index has dropped to 374.86, its lowest since April 2022, according to data compiled by Bloomberg. A similar gauge tracking European blue-chip company default insurance costs has fallen back as well and is near its lowest in more than 18 months.

At this level, the index is well below a March high of more than 500 bps when a global banking crisis roiled markets. The gauge tracking high-grade firms’ CDS has eased to around 67 bps after topping 100 around the time of Credit Suisse’s collapse.

“Inflation optimism has helped CDS indices tighten to multi-month lows but I think we’re in thin air already,” said Marco Stoeckle, head of credit strategy at Commerzbank AG. “CDS are looking rich again.”

But he said he doesn’t expect them to break through 360 and 65 respectively. “Picking up protection becomes increasingly attractive the closer they move towards these marks,” he said.

Read more: Markets Price an End to Interest-Rate Hikes Across the World

Even as a soft US inflation print for October stokes bets that the Federal Reserve will start cutting rates sooner rather than later, there’s likely to be a lag before other regions follow. The European Central Bank is tempering speculation for a similar move, while the Bank of England is on watch for further signs of inflation persistence as it refuses to rule out another hike.

Shanawaz Bhimji, head of corporate bond research at ABN Amro Bank NV, agrees that CDS index levels are now close to fair value and said there’s more scope for outperformance from high-grade cash bonds.

“There is still a weak economy ahead of us, which will make it difficult for high-yield firms to grow out of their debt levels,” he said.

(Adds further background, quote)

©2023 Bloomberg L.P.