As of September 14, 2023, the Euro Zone Deposit Facility Rate has been set at 4%, surpassing both the estimated 3.75% and the previous rate of 3.75%. Determined by the Governing Council of the European Central Bank, this interest rate serves as the benchmark for banks to make overnight deposits with the Eurosystem. Meanwhile, the ECB Deposit Facility Rate for the Euro Area (ECBDFR) stands at 3.75%, surpassing the long-term average of 1.23%.

U Stock Performance: Fluctuations in Earnings Growth and Revenue Growth Analysis

On September 14, 2023, U stock experienced a mixed performance in the market. The stock opened at $35.70, lower than the previous close of $36.82. Throughout the day, the stock’s price fluctuated between a low of $35.28 and a high of $37.47. The trading volume for the day was 8,961,066 shares, lower than the average volume of 12,690,650 shares over the past three months. The market cap of U stood at $14.4 billion.

U, a technology services company operating in the packaged software industry, has shown significant fluctuations in its earnings growth over the past year. While the company witnessed a decline of 62.96% in earnings growth last year, it has made a remarkable recovery with a growth rate of 202.45% this year. Looking ahead, U is expected to maintain a positive trajectory with a projected earnings growth of 62.38% over the next five years.

In terms of revenue growth, U has demonstrated a positive trend, with a growth rate of 25.26% in the previous year. This indicates that the company has been successful in expanding its business and generating higher revenues. However, it is important to note that U has reported a net profit margin of -66.21%, indicating that the company has been operating at a loss.

When evaluating U’s performance, it is worth considering its valuation metrics. The company’s P/E ratio is not available (NM), suggesting that it may not be profitable or that its earnings are negative. The price-to-sales ratio of U stands at 6.38, indicating that investors are willing to pay $6.38 for every dollar of the company’s sales. Additionally, the price-to-book ratio of 4.00 suggests that the stock may be trading at a higher valuation compared to its book value.

Unfortunately, there is no available data on U’s competitors, making it difficult to assess the company’s performance relative to its industry peers. However, it is important to consider the overall market conditions and industry trends when analyzing U’s stock performance.

Investors should keep an eye on U’s upcoming reporting date on November 8, 2023, as it will provide further insights into the company’s financial performance. Analysts are forecasting an earnings per share (EPS) of $0.11 for the current quarter. In the previous fiscal year, U reported an annual revenue of $1.4 billion but incurred a net loss of -$921.1 million.

In conclusion, U stock experienced mixed performance on September 14, 2023, with the stock opening lower than the previous close and fluctuating throughout the day. The company has shown significant fluctuations in earnings growth, with a decline last year but a substantial recovery this year. Despite positive revenue growth, U has been operating at a loss, reflected in its negative net profit margin. Investors should closely monitor the company’s upcoming reporting date for further insights into its financial performance.

Unity Software Incs Stock Performance and Optimistic Forecasts: September 14, 2023

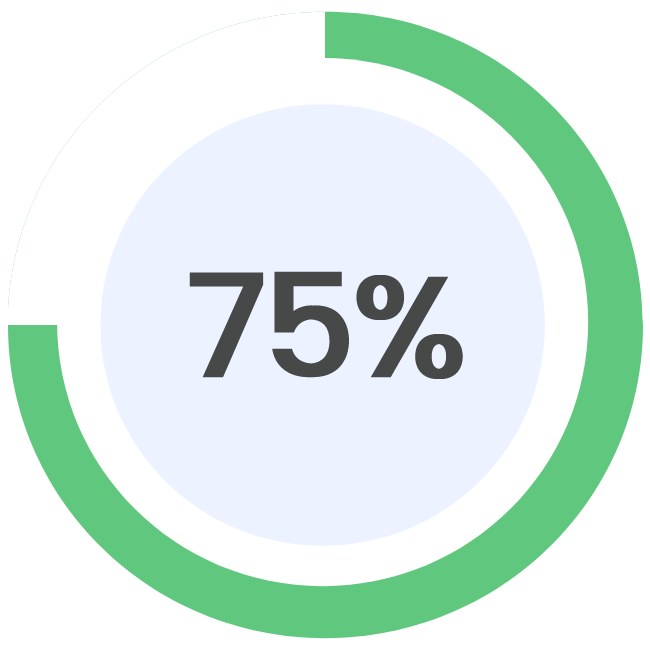

On September 14, 2023, Unity Software Inc’s stock performance was closely watched by investors and analysts. The company specializes in creating and distributing software tools for video game developers. According to data from CNN Money, 21 analysts had offered 12-month price forecasts for Unity Software Inc. The median target price was $49.00, with a high estimate of $61.00 and a low estimate of $16.00. This indicated a potential increase of 35.55% from the last recorded price of $36.15. Furthermore, a consensus among 28 polled investment analysts was to buy stock in Unity Software Inc. This rating had remained unchanged since September. These optimistic forecasts and recommendations were likely influenced by Unity Software Inc’s strong financial performance. In the current quarter, the company reported earnings per share of $0.11 and sales of $549.0 million. Investors and analysts were eagerly awaiting the company’s next earnings report, which was scheduled to be released on November 8. Overall, the stock performance of Unity Software Inc on September 14, 2023, was positive and accompanied by optimistic forecasts and recommendations from analysts. The company’s strong financial performance and its position in the video game development industry contributed to this positive sentiment. Investors would continue to closely monitor the company’s earnings reports and future developments to make informed investment decisions.