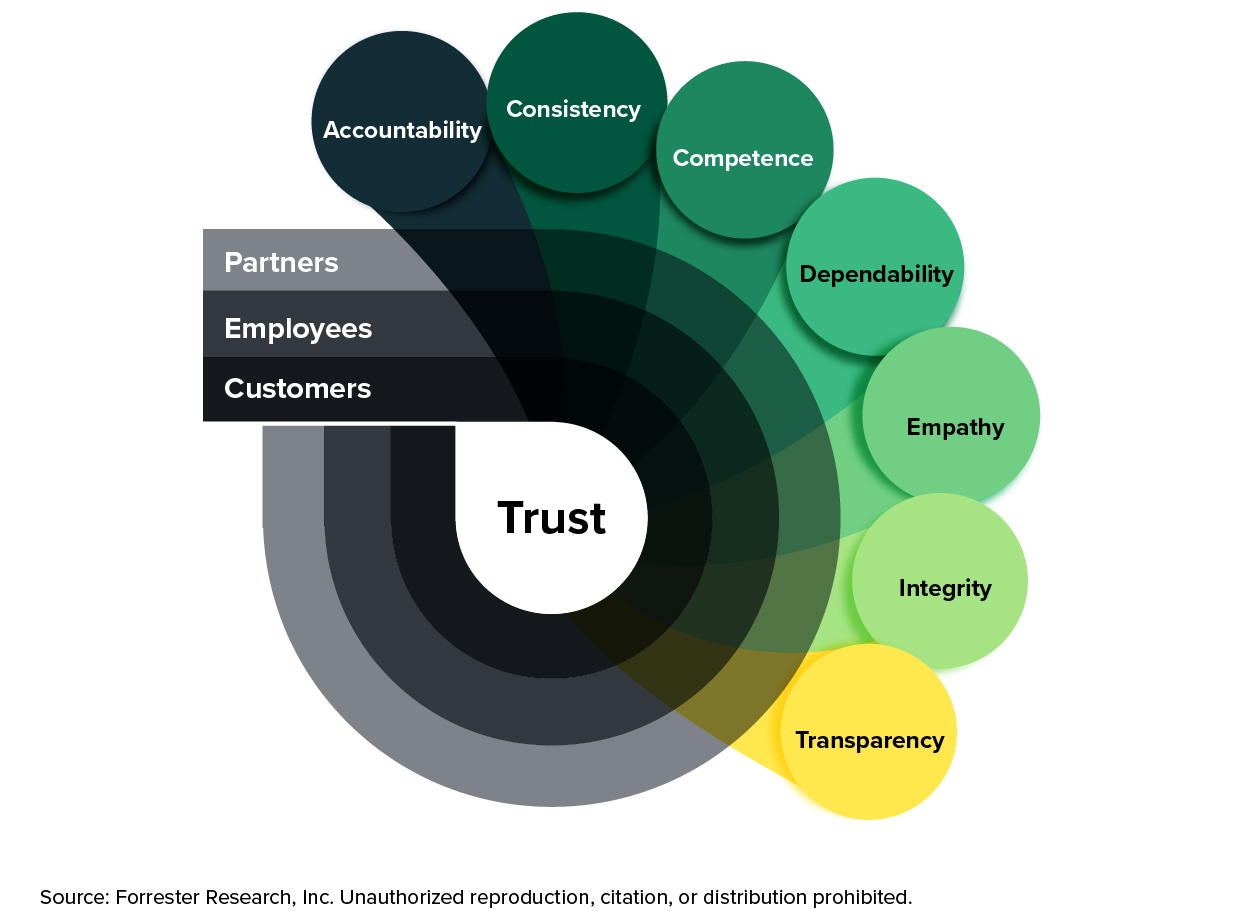

Last year, we launched the Financial Services (FS) Trust Index. This index measures and gives financial services brands the data and insights they need to assess customer trust and understand how to earn it through prioritized initiatives that drive revenue. This methodology is based on what Forrester identified as the seven levers of trust. We have now analyzed our 2023 survey data to understand if and how trust in banks has changed from last year. We didn’t have high expectations, what with three bank failures in the US and the acquisition of Credit Suisse. And indeed, most banking brands included in this year’s rankings received a “weak” customer trust score.

Highlights From The 2023 European Banking Trust Index

European banks continued to earn low levels of customer trust in 2023:

- Most countries received a weak average customer trust score — except for the UK. This year’s FS Trust Index revealed that customer trust in three of the four European countries we surveyed (France, Italy, Spain, and the UK) was “weak” on average. We saw a statistically significant decrease in customer trust in Italy compared to 2022. Only the UK received a “moderate” average trust score.

- Lack of dependability and empathy remains a problem. European customers want their bank to be dependable and empathetic. But European banks continue to fail their customers when it comes to those two most important levers of trust. Lack of empathy poses immediate concerns as consumers grapple with financial challenges stemming from persistently high levels of inflation and interest rates. Prolonged economic pressure will add to customers’ anxiety over their financial security. Financial services firms have a unique opportunity to earn customer trust by understanding these anxieties and taking proactive measures. They can provide tools to help customers become more confident with their finances despite economic uncertainties and improve their financial well-being.

- The top scorers in Europe in 2023 were the UK’s Nationwide Building Society and ING Spain. Nationwide Building Society and ING Spain secured the top spot in each of their countries’ respective rankings, scoring well above the country-level average. Both have been going the extra mile for their customers, with Nationwide renewing its Branch Promise until 2026 and ING Spain introducing functionality in its mobile app to help customers better manage their finances.

- Trust drives revenue-generating behaviors. Our research reveals that customers who have high levels of trust in their bank are more likely to open another account with that bank, recommend it to a friend or family member, and prefer that bank over its competitors. For example, 93% of French banking customers with high levels of trust in their primary bank say they would recommend it to their friends and family, versus just 34% of those with low levels of trust.

Trust Matters — But It’s Hard To Earn And Easy To Lose, So Measure It!

Why does trust matter? When customer trust is strong, financial services firms reap financial, competitive, and reputational benefits, enabling them to expand and extend customer relationships. When it’s weak, they lose those benefits and have to fight harder to win business.

Firms can earn and strengthen trust, but it’s hard because a broad range of customer perceptions and experiences accumulate over time to produce it. Every engagement with a customer is an opportunity to earn, reinforce, or destroy trust. Losing trust, however, is easy.

To earn more trust from customers, financial services firms must design and execute deliberate trust strategies. But first they must stop guessing and 1) measure trust in their brand and 2) understand what drives customer trust in it. Although data alone can’t tell business leaders what and how to improve, there are many ways they can use data to identify opportunities to earn trust and to avoid damaging it.

For a more detailed analysis of each country’s Banking Trust Index results — including every brand’s score, the top drivers of trust for each country, and relevant best practices from the top-performing banks — check out our country-specific reports:

Clients can also connect with us through a guidance session to deep dive into this research.