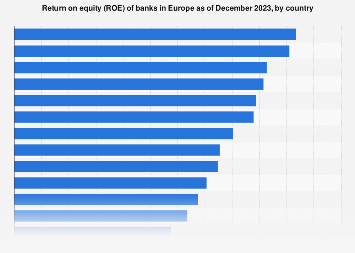

In the fourth quarter of 2023, the banking sector of Cyprus had the highest return on equity in Europe, with 25.9 percent. Cyprus was followed by Hungary and Latvia. Return on equity is an important measure of a bank’s or country’s banking sector’s profitability. ROE is calculated by taking the amount of net income returned as a percentage of the shareholders’ equity. Return on equity looks at how well a bank’s (or company’s) management is using its assets to create profits.

Return on assets

Return on assets looks at how well a company’s management is at generating earnings from their assets and is used as a key measure of a bank’s profitability. Low profitability has been highlighted several times by the ECB as a key risk to the financial stability of the Euro area. Prolonged low profitability can have a knock-on effect on an economy’s growth. On the other hand, sustained periods of higher-than-average profitability can also mean trouble, as seen in the period leading up to the financial crisis. The European Banking Authority (EBA) requires banks to report on key measures to determine and illuminate any potential risks.

Cost-to-income ratio

The cost-to-income ratio is an important financial metric in determining the profitability of banks. The measure looks at the cost of running operations as to a bank’s operating income. Lower ratios mean that a bank is running more profitably, whereas a higher cost-to-income ratio indicates that the bank’s operating expenses are too high.