European shares rose on Thursday, heading into a long Easter weekend break, as real estate and travel stocks helped outweigh concerns over a US economic slowdown that were triggered by lacklustre data.

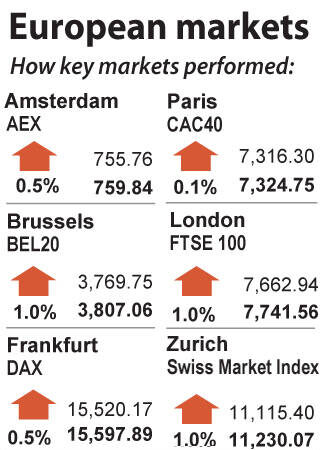

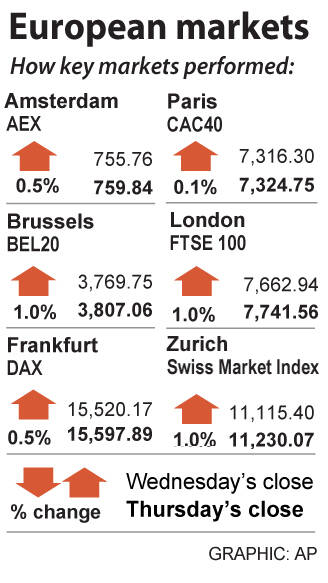

The pan-European STOXX 600 index rose 0.51 percent to 458.94, up 0.24 percent from Friday last week, with banking stocks among the biggest boosts.

After a strong start to the year, European equities remained under selling pressure from last month as the recent banking turmoil kept the risk sentiment fragile, with skittish investors fretting about mixed economic data and a looming recession.

RATE HIKES FORECAST

Markets still expect the European Central Bank (ECB) to continue its rate hikes in the next policy meeting.

“With ECB Chief Economist Philip Lane warning that food price inflation in the EU was still rising, the pressure is building for further rate hikes from the ECB in the coming weeks,” CMC Markets UK chief market analyst Michael Hewson said.

In the eurozone, German industrial production rose significantly more than expected in February, partially due to vehicle manufacturing, up 2 percent from the previous month. Real-estate shares led sectoral gains, rising 2.7 percent.

COMPANY STOCKS

Among individual stocks, Shell was up 2.3 percent as the oil and gas giant expects higher liquefied natural gas output in the first quarter after outages at its Australian plants last year.

Credit Suisse edged 0.7 percent higher after Switzerland instructed the bank to cancel or reduce all outstanding bonus payments for the top three levels of management.

UNITED KINGDOM

In London, the FTSE 100 rose 1.03 percent to 7,741.56 — its highest level in more than three weeks. The index gained 1.44 percent from Friday last week, with support from gains in oil and gas, financial and healthcare stocks.

“Markets are getting more relaxed about where interest rates might peak, and a number of sector-specific factors is helping the UK, particularly the banks recovering and the oils [stocks’ seeing profit upgrades,” Witan Investment Trust chief executive Andrew Bell said.

Comments will be moderated. Keep comments relevant to the article. Remarks containing abusive and obscene language, personal attacks of any kind or promotion will be removed and the user banned. Final decision will be at the discretion of the Taipei Times.