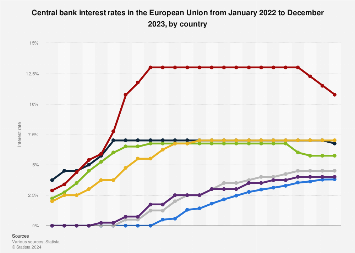

Central bank interest rates increased in every European Union (EU) member state between January 2022 and December 2023, though most countries started to lower their rates towards the end of 2023. The rise in central bank interest rates is not a unique European tendency, as policy rates increased in other advanced and emerging economies as well.

The central bank of Hungary set the key interest rate to 13 percent on the 28th of September, making it the highest central bank interest rate in the EU as of September 2023. Despite three decreases in October, November, and December 2023, Hungary’s interest rate remained the highest, at 10.75 percent as of December 2023. Bulgaria had the lowest rate at 3.8 percent, although the rate increased regularly after September 2022.

Why do central bank interest rates increase?

The central bank interest rate, or central bank policy rate, is the rate at which banks borrow from and lend to each other. It is set by central banks and used as a primary tool to maintain stability in a country’s financial system. In times of inflation, higher interest rates are a policy response to rising inflation. Higher rates make borrowing more expensive and encourage saving. When debt is more expensive, this in turn can influence consumer demand for goods and services, as well as business investments. This can help slow down inflation when demand exceeds supply. This is why interest rates tend to move in the same direction as inflation, but with a short delay.

Inflation and interest rates in the United States

The monthly inflation rate in the United States started to increase drastically after May 2020, just a few months ahead of the sharp rise in the inflation rate in the EU, and it kept rising until June 2022. Despite rising inflation, the federal funds effective rate in the United States remained relatively low until February 2022. After February 2022, the federal funds effective rate increased sharply.