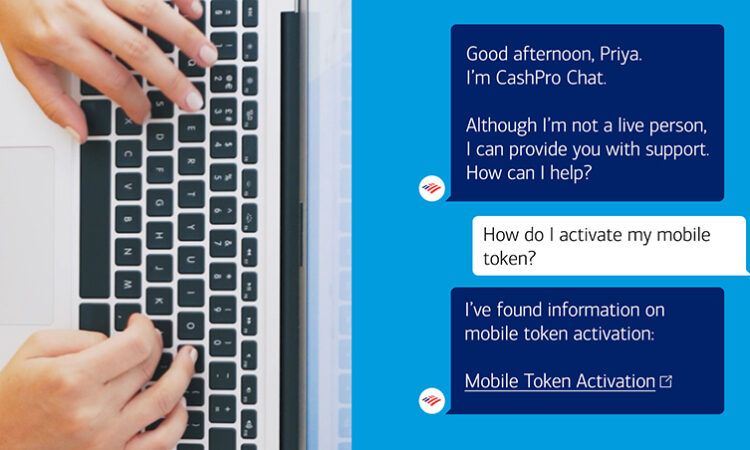

“Finance teams today need access to information quickly, at any time of day, and from any location. Whatever we can do to eliminate friction will help them respond better and faster to real-time events and demands,” said Tom Durkin, Global Product Head of CashPro in Global Transaction Services (GTS) at Bank of America. “This latest enhancement to CashPro Chat is a great demonstration of how we’re doing just that.”

CashPro Chat supplements the CashPro Search feature, launched in May, that enables clients to easily find a specific transaction from potentially hundreds of bank accounts. This time-saving function acts like an online search engine that can locate information across multiple data sets using keywords.

“CashPro Chat has become one of the most heavily used service functions on our banking platform thanks to the efficiency it creates for our clients,” said Sue Caras, head of Global Commercial Banking for GTS at Bank of America. “Through the integration of Erica, our virtual service advisor will become smarter and more sophisticated the more our clients use it.”

“Bank of America’s ability to innovate owes much to the company’s internal collaboration where best practices and cutting-edge technology can be leveraged across business lines,” said Patricia Hines, Head of Banking and Payments at Celent, a leading research and advisory firm focused on technology for financial institutions globally. “The Erica technology distinguishes the CashPro platform from its peers, giving the bank’s clients a best-in-class experience offered by a financial assistant.”

- CashPro is the banking platform that 40,000 Bank of America clients use to manage and monitor their payments, deposits, loans and trade finance transactions. CashPro offers a premium user experience that is delivered through multiple technology patents centered on digital innovation. The platform currently has 25 granted patents with more pending.

- Since launch, chat volume increased by 41% compared to the 2023 weekly average. Meanwhile, chats with a live agent decreased by 16%.

- In January 2022, Bank of America launched a cash-forecasting solution that uses machine learning technology. The solution has seen rapid adoption. From first half 2022 to first half 2023, new client enrollments have soared 141%; the number of active users has increased by 105%, and total sign-ins amongst those users have increased by 375%.

- Launch of CashPro Supply Chain Solutions, a platform that will offer participants in a supply chain the benefits of digitization with improved process efficiency and working capital optimization.

- Launch of CashPro Insights, the latest tool within the CashPro Data Intelligence product suite, will analyze information that flows through CashPro and present data-driven insights to users. The first functionality clients will see is a Security Meter that measures the robustness of a user’s security controls. Future insights will focus on transaction activity and proactive suggestions to optimize operational efficiency.

- Further enhancements to CashPro Forecasting and more robust functionality added to CashPro Search, including the ability to initiate and track investigations.

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 68 million consumer and small business clients with approximately 3,900 retail financial centers, approximately 15,000 ATMs (automated teller machines) and award-winning digital banking with approximately 57 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 4 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and more than 35 countries. Bank of America Corporation stock is listed on the New York Stock Exchange (NYSE: BAC).

Louise Hennessy, Bank of America

Phone: 1.646.858.6471

louise.hennessy@bofa.com