August 10, 2023

Frédérique Carrier

Managing Director, Head of Investment Strategy

RBC Europe Limited

Elevated bond yields have rekindled investor interest in fixed income,

given the battle against inflation is making pleasant progress in many

regions and most central banks in advanced economies are nearing the end

of their rate hiking cycles. But Japan moving away from its super-loose

monetary policy could add to an already volatile backdrop. We continue to

see opportunities in emerging market fixed income, where the rate cutting

cycle has kicked off in earnest.

Inflation progress to continue?

Inflation has pleasingly receded in most regions. In the U.S. it declined

to 3.2 percent year over year in July, while in Canada it was down to 2.8

percent in June. European inflation also slowed in June, though to a still

higher level of 5.3 percent. Even UK inflation – stubbornly high for most of

the year – retreated to 7.9 percent in June, the lowest level in 15 months.

RBC Global Asset Management Inc. Chief Economist Eric Lascelles warns,

however, that these improvements should not be taken for granted. Higher

oil and food prices and fast wage growth could slow the recent progress.

Oil prices surged over the past month, with West Texas Intermediate crude

oil shooting up to more than $84 per barrel from less than $70 per barrel

a month ago. This, in turn, is feeding upward pressure on gas prices.

Food prices could also spike. The summer’s intense global heat wave could

undermine harvests across at least three continents, while the

Russia-Ukraine war is disrupting Ukrainian grain shipments through the

Black Sea and risks further damaging supply chains.

Lascelles points out that wage-price spirals are another key upside

inflation risk. According to the Atlanta Fed’s wage growth tracker, the

actual rate of wage growth in the U.S. currently remains brisk and has

slowed only modestly, to six percent year over year from a peak of 7.1

percent last year. In the UK, wage growth exceeded seven percent year over

year in May.

For central banks, wage growth will continue to be a key factor to

monitor, though we think many will likely look past food/energy inflation.

For now, most countries are celebrating the progress they’ve made in

controlling inflation.

Japan is the exception. As it reopened its economy in late 2021 after

strict COVID-19 lockdowns, inflation crept in, reaching a high of 4.3

percent in January 2023. The Bank of Japan (BoJ) was initially very

tolerant of higher inflation as a tool to revive long-term inflation

expectations, setting its policy on a different course than that of its

developed nation peers.

Nearing the end of the hiking cycle

Central banks in the U.S., Canada, the UK, and Europe are at or nearing

the peaks of their hiking cycles.

With the Fed having raised the upper end of the fed funds rate target

range to 5.50 percent in July, markets believe Fed rate hikes are now

likely in the rearview mirror. We concur, as we expect the Consumer Price

Index and jobs report that are scheduled for release before the Fed’s next

policy decision on September 20 to show that things are moving in the

right direction. The Fed, in our view, may well be ready to end its

tightening cycle by then.

The Bank of Canada (BoC), the European Central Bank (ECB), and the Bank of

England (BoE) all raised interest rates by 25 basis points (bps) in July,

to five percent, 3.75 percent, and 5.25 percent, respectively, and adopted

a highly data-dependent approach. We think that may mean the BoC and ECB

will take no action at their next policy meetings in September and remain

on hold henceforth. The BoE remains the outlier, and markets expect two

more hikes which would bring the peak rate to 5.75 percent.

Unwinding super-accommodative policy

The BoJ stepping away from its ultraloose monetary policy is a relevant

development that investors shouldn’t overlook. As a result of this policy,

the BoJ has been injecting cash into the global financial system.

Withdrawing this liquidity could potentially amplify the volatile backdrop

in fixed income markets.

The BoJ’s so-called yield curve control policy – put in place seven years

ago to fend off deflationary risks – requires the central bank to buy

benchmark 10-year Japanese government bonds (JGBs) in an effort to hold

down their yields.

As inflation returned to Japan, the yield curve control policy was first

relaxed in December 2022 when the BoJ increased the yield ceiling to 0.5

percent from the previous 0.25 percent limit. In July, with the most

recent reading of core inflation (excluding fresh food and energy prices)

reaching 4.3 percent year over year, it extended the ceiling further to

one percent. As a result, the 10-year JGB yield surged to over 0.60

percent at one point – the highest level in nine years.

Cutting policy rates

By contrast, in emerging markets the rate cutting cycle is well underway.

Two central banks in Latin America are aggressively lowering rates – this

has caught our eye as we’ve been highlighting emerging market fixed income

as an attractive opportunity for investors.

Central banks in Brazil and Chile hiked early – in the case of Brazil, a

year before the Fed – and aggressively due to the greater sensitivity of

their economies to food prices and capital flows. Moreover, lacking the

Fed’s reputation for fighting inflation, they set out to prove their

credentials. This was particularly important to the Central Bank of

Brazil, which only became independent in 2021. With inflation declining to

just over three percent year over year, in line with its target, from a

peak of 12 percent in April 2022, Brazil cut interest rates by 50 bps in

early August. This followed in the footsteps of Chile, which cut rates by

100 bps in July.

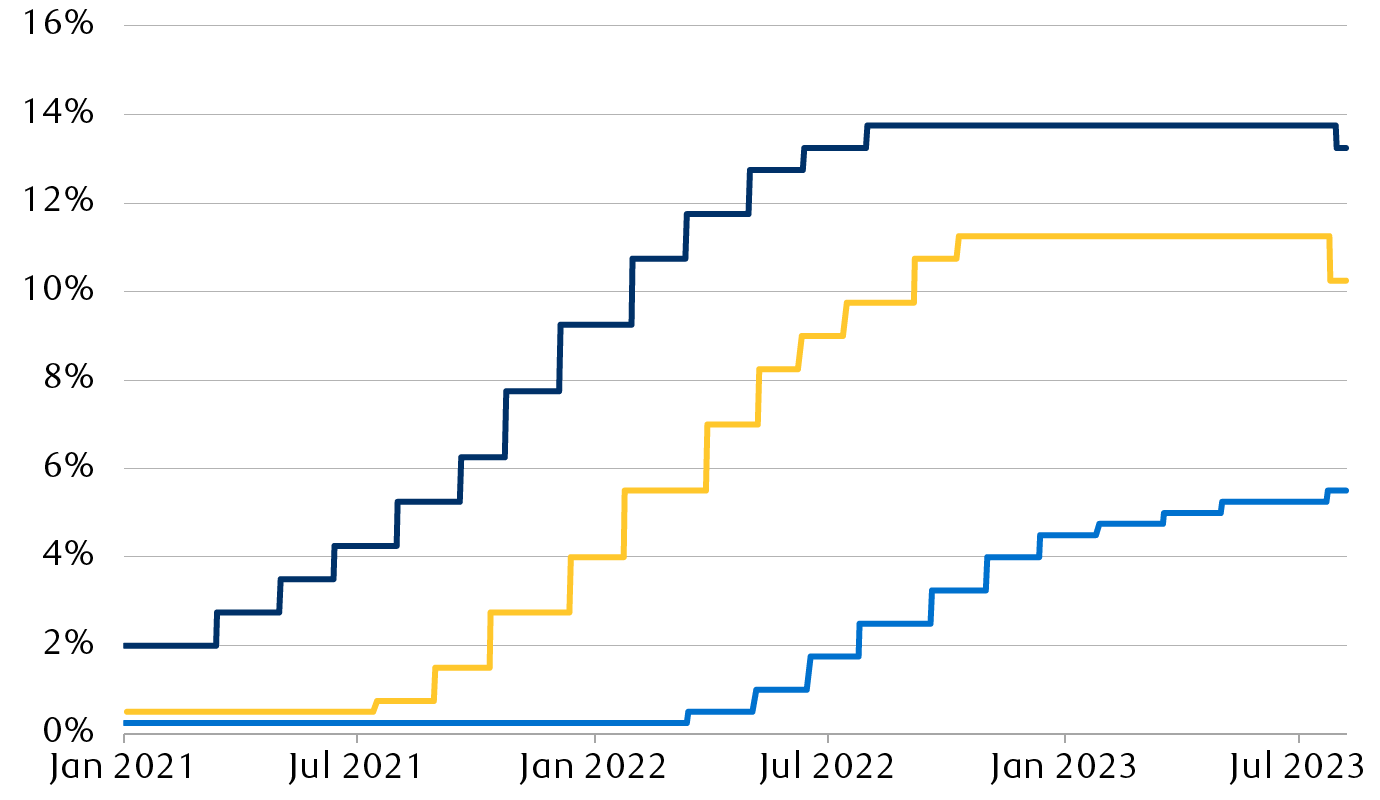

Brazil and Chile: Aggressive tightening, a long pause, then cuts

For the period of January 2021 through Aug. 9, 2022, line chart

showing that over the course of the first 16 months, Brazil increased

its Selic interest rate from two percent to 13.75 percent, well above

the levels in the U.S. and Europe. The Central Bank of Brazil

maintained that level for 11 months before cutting rates to 13.25

percent. For its part, Chile hiked rates from 0.5 percent to 11.25

percent over the span of the first 15 months, and then maintained that

level for nine months before cutting rates by 100 bps in July to 10.25

percent. Both hiking cycles preceded that of the U.S Federal Reserve

which maintained 0.25 percent for the first 15 months and then

steadily increased rates to 5.5 percent.

-

Brazil fed funds rate (Selic)

-

Chile monetary policy rate

-

U.S. fed funds rate

Source – RBC Wealth Management, Bloomberg; data through 8/9/23

We look for other emerging market central banks that also have taken

preemptive action on inflation to cut rates over the next few months.

Windows of opportunity

Bond markets have been very volatile so far in August, with the 30-year

U.S. Treasury yield experiencing one of its most rapid increases of the

past year. The rise was due to a combination of U.S. economic strength and

fading inflation that could allow the Fed to be less aggressive, paving

the way for a longer economic expansion. But we think the divergent paths

that central banks are setting out on may also contribute to a volatile

backdrop.

In our view, such volatility can provide interesting entry points for

investors who can now put money to work at yields that have eluded them

for much of the past decade. We think emerging market fixed income remains

an attractive opportunity for investors as monetary policy is gradually

being relaxed, though being selective is of prime importance.

Managing Director, Head of Investment Strategy

RBC Europe Limited