Advancements in technology, rising demand for digital solutions and increased competition have prompted European banking incumbents to undertake digital transformation journeys.

To understand the status of banks’ digitalization efforts, the European Central Bank (ECB) launched in 2022 two major initiatives aimed at gaining a deeper understanding of the digital transformation of the European banking sector. First, it engaged with stakeholders to gain insights into major market trends. Second, it conducted a survey of more than 100 large banks to assess the status of their digital transformation.

Results from the study were released last month and revealed that almost all of the banks surveyed in Europe now have a digital transformation strategy in place. These banks are aiming for improved profitability by embracing a strategy focused on either becoming more customer-centric in how products and services are offered as a lever to increase revenues, or by improving operational efficiency by automating processes and modernizing information technology (IT) infrastructures.

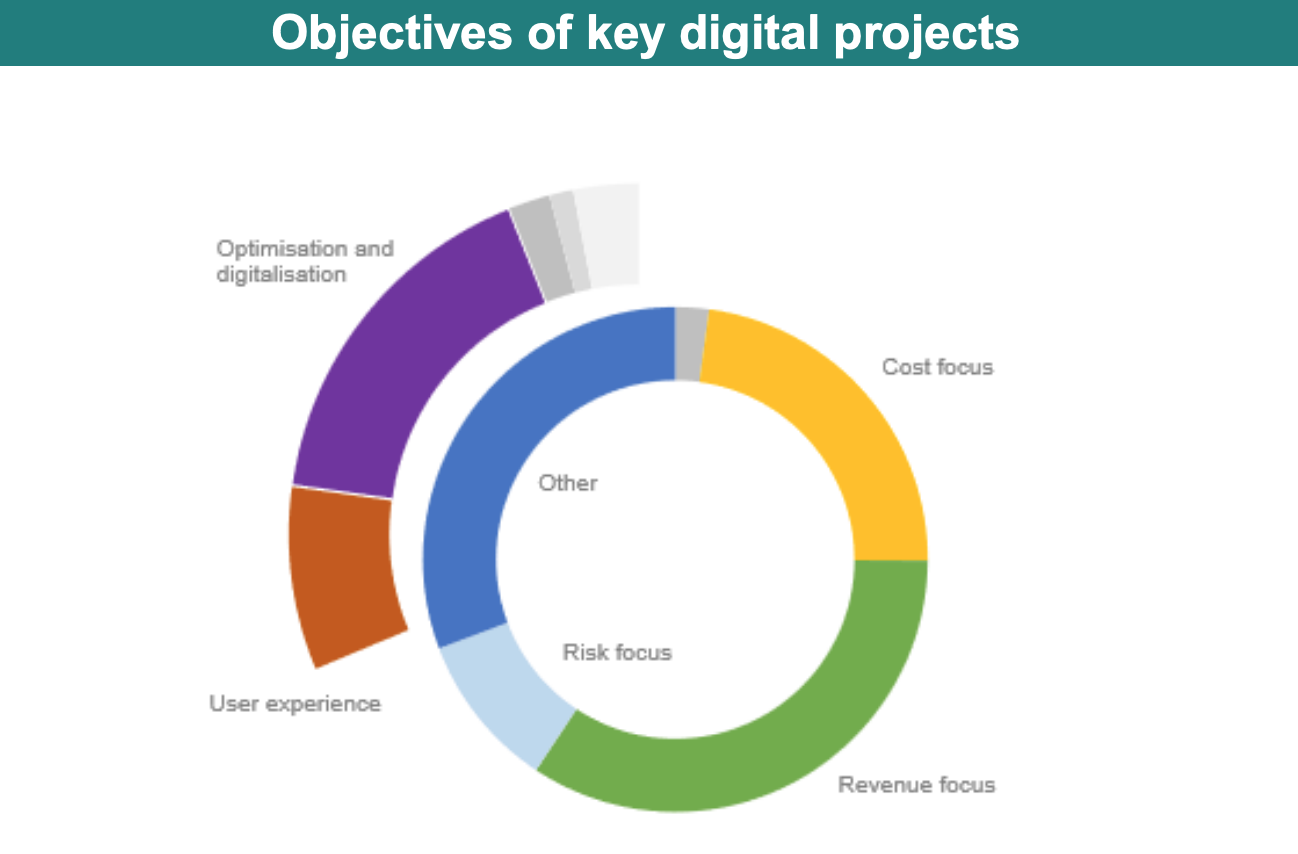

The study found that 43% of banks’ top-5 projects are aimed at revenue or customer experience enhancement, and that 83% of banks perceive process automation and IT legacy transformation as a way to reduce costs.

Objectives of key digital projects, Source: European Central Bank study 2022

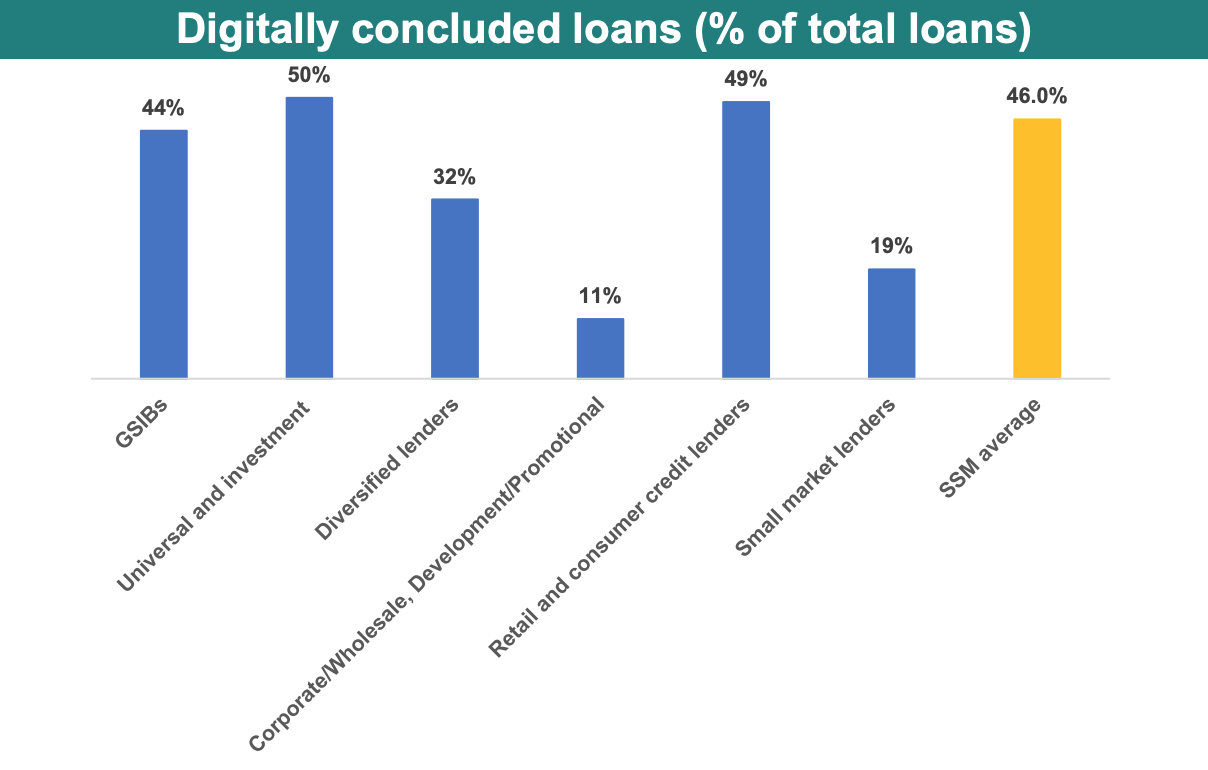

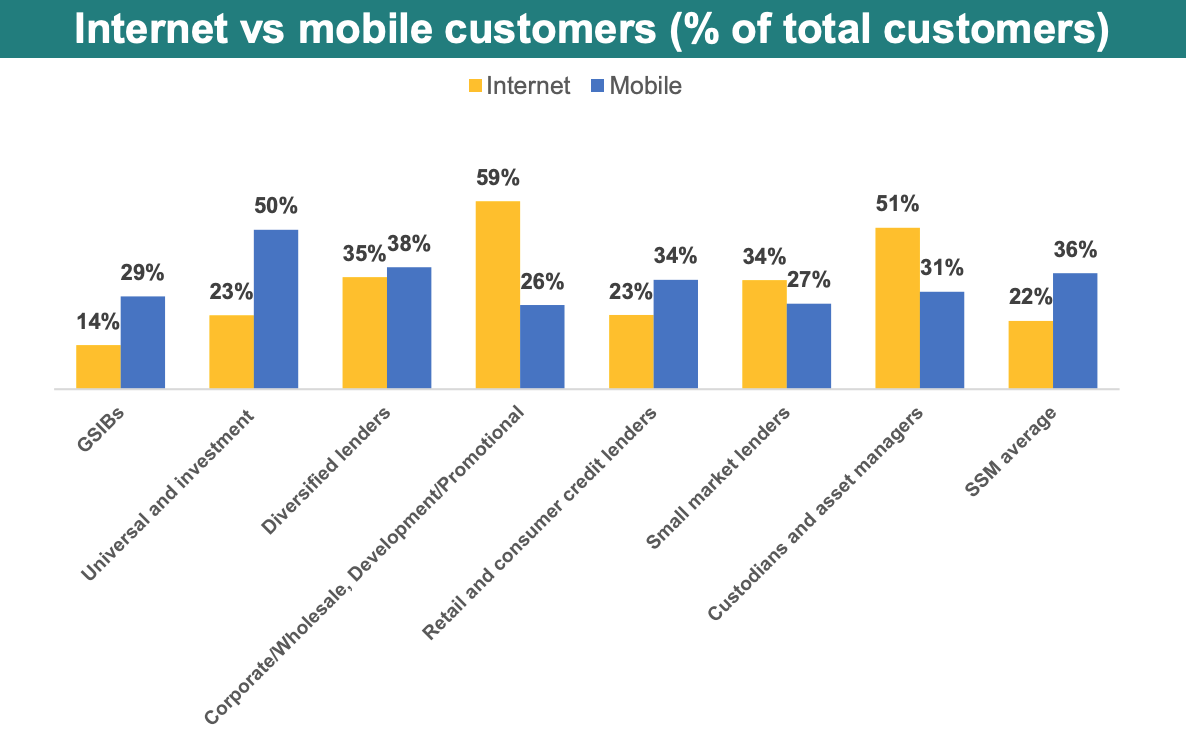

Results also revealed increased usage of digital channels by banking customers. On average, the surveyed banks indicated concluding nearly half (46%) of their loans via digital channels, with 36% of their customers using mobile banking and 21% using online banking.

Digitally concluded loans (% of total loan), Source: European Central Bank study 2022

Internet vs mobile customers (% of total customers), Source: European Central Bank study 2022

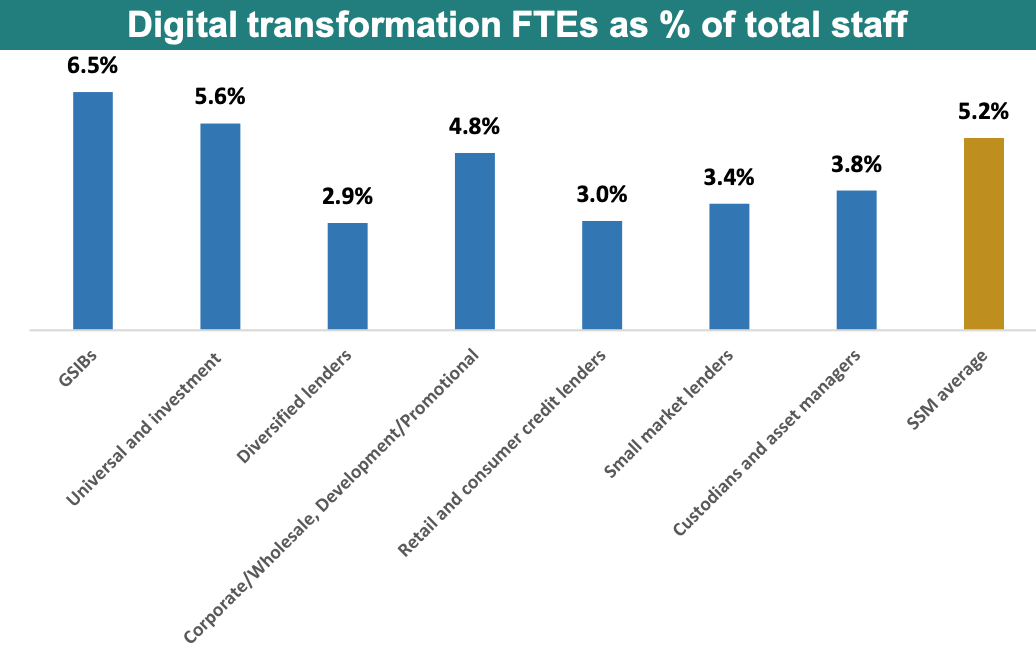

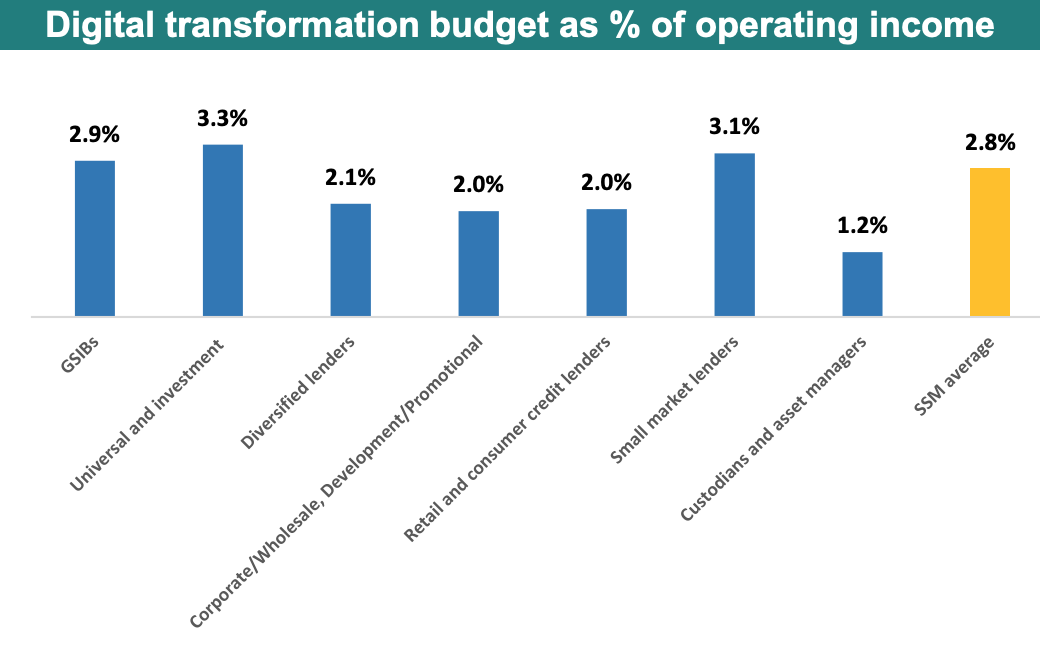

Despite the realization that digitalization has become essential, banks were found to dedicate a limited budget to their digital transformation. On average, banks indicated allocating 5.2% of their staff to digital transformation projects, and dedicating only 2.8% of their operating income to their digitalization efforts.

Digital transformation FTEs as % of total staff, Source: European Central Bank study 2022

Digital transformation budget as % of operating income, Source: European Central Bank study 2022

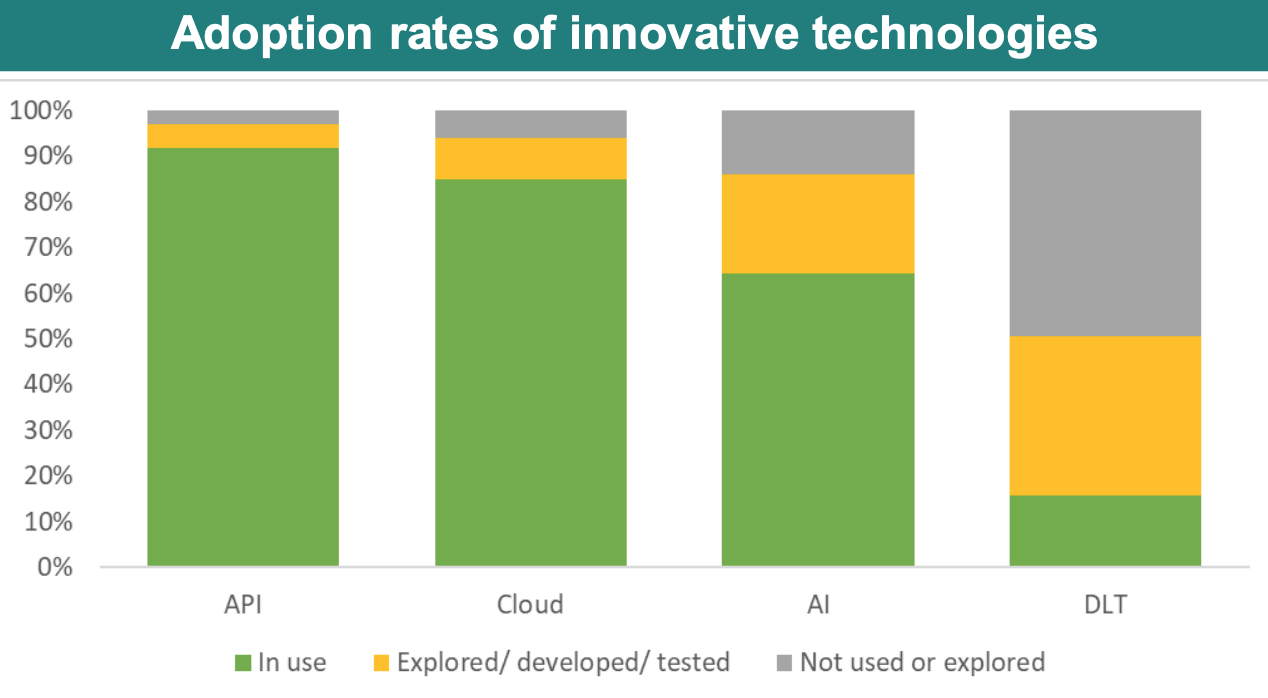

When it comes to the technologies banks use, findings show that a vast majority of European banks already utilize cloud computing (~85%) and application programming interfaces (APIs) (~90%). 60% of respondents said they use artificial intelligence (AI), but added that more use cases were in development.

Adoption of distributed ledger technologies (DLT), meanwhile, was found to be rather low among European banking incumbents, with less than 20% of the respondents indicating using DLT. When delving into crypto activities specifically, the study found that these applications remained insignificant for the surveyed banks.

Adoption rates of innovative technologies, Source: European Central Bank study 2022

Banks’ digital transformation among ECB supervisory priorities

Increased adoption of digital tools and technology among financial institutions is putting heightened risks of third-party dependency, money laundering, fraud and cybersecurity on the banking sector. These risks require further monitoring and are among the supervisory priorities of the ECB’s Banking Supervision over the next three years, the bloc’s central bank says.

During the 2023-2025 period, the ECB says it will undertake targeted reviews and on-site inspections to ensure that banks are developing and executing sound digital transformation plans through adequate arrangements. Reviews and inspections of outsourcing arrangements, cybersecurity measures and IT risk controls, will also take place to make sure that banks have robust outsourcing risk management, IT security and cyber resilience frameworks in place.

The ECB plans to publish its findings, with a particular focus on best practices, in addition to any deficiencies it may discover. These findings will be down the line integrated into the ECB’s supervisory methodology and will become part of its supervisory guidance and expectations for banks in the coming years.

In the European Union (EU), 2023 is set to be a key year in terms of digital regulation. The bloc’s landmark cryptocurrency legislation, the Markets in Crypto Assets (MiCA) regulation, is nearing completion and is slated for vote in April.

The new regulation, which is expected to go into effect in 2024, will introduce a common licensing regime for crypto wallets and exchanges to operate across the EU and will apply stricter rules than those currently in place in some European countries.

Under the legislation, crypto companies will be required to keep the public informed about their pricing process and trading volumes in real time, settle all trades the same day those trades happen, and keep separate their own funds, including crypto, and funds belonging to their clients.

2023 is also set to see the release of a legislative proposal on an open finance framework, an initiative focusing on enabling data sharing and third party access for a wider range of financial sectors and products.

In parallel, the digital euro project is still in the works and currently undergoing an investigation phase. A document published by the European Commission (EC) in January 2023 revealed that a bill underpinning the digital euro is scheduled to be released in May 2023.

Featured image credit: edited from Freepik