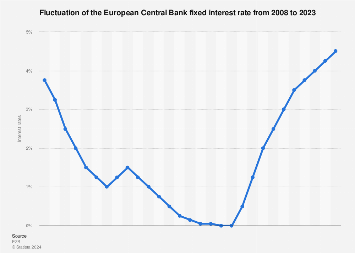

In July 2022, the European Central Bank (ECB) increased its fixed interest rate to 0.5 percent. This was the first increase since March 2016. After July 2022, the ECB increased its fixed interest rate almost monthly. As of December 2023, the rate was 4.5 percent, the highest since the global financial crisis in 2007 and 2008. The ECB’s interest rate is the rate that it offers to banks for overnight loans. Commercial banks use these loans to ensure liquidity in the short term.

How does this ensure liquidity?

Banks only hold a fraction of their capital in cash on hand. This amount, often measured by the Tier 1 capital ratio, is generally low because the banks would rather use their capital to issue revenue-generating loans. When the capital on hand gets too low, commercial banks go to the ECB for a short-term loan. In contrast, commercial banks can also deposit funds with the ECB for a lower interest rate.

Reasons for fluctuations

The ECB’s mandate is to ensure price stability. This means that, in theory, the only indicator that should matter to the ECB is the Euro area inflation rate. When the fixed interest rate in this statistic is lower, commercial banks ask for more loans from the ECB. This increases the money supply, which in turn raises inflation. When inflation is higher, the ECB will raise this rate, reversing the effect.