Justin had the UK inflation data Wednesday:

Via Deutsche Bank on the data and their GBP outlook:

- One of the market observations we have been making is that upside surprises to UK inflation have returned to being positive for the currency so far this year, as they open the door for the Bank of England to further increase rates but in a better-than-expected environment for growth.

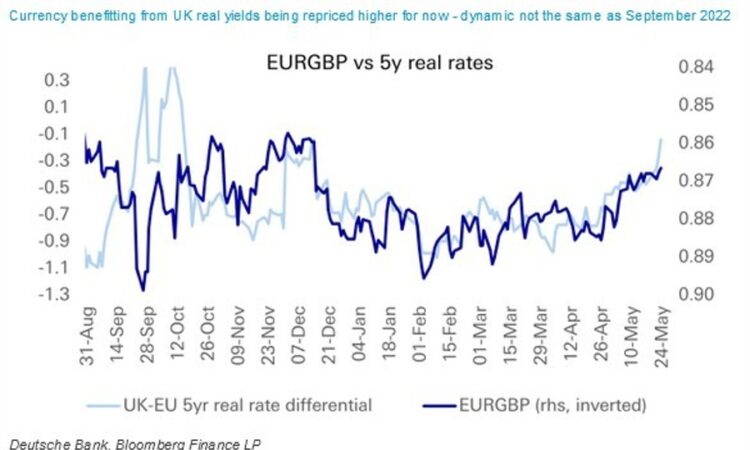

- (the) inflation print was another very strong one across the board, with headline, core, and services CPI all coming in above the BoE’s and the Street’s forecasts. The market continues to take UK yields higher relative to peers, not just in nominal terms but crucially in inflation-adjusted (real) terms too. 5y real yields have moved up in the UK relative to the EU over the past month. And as our chart shows below, the currency has strengthened in line with the relative move in rates.

- This is in contrast to the dynamic both in the run-up to and around the mini-budget last September, however. Back then, the currency weakened despite the market taking real yields higher, as the market baked in a premium across all UK assets. We don’t see such a cross-asset premium returning to UK markets, but do think it more likely than not that the currency starts to weaken from here if the nominal yield repricing fails to keep up with the reassessment of the inflation outlook, and brings down relative real yields. We like being long EURGBP.

add a comment