Deutsche Bank

Thomas Lohnes

(Note: All amounts in the article are in EUR. At the current exchange rate 1 EUR is around 1.09 USD.)

Investment thesis

Over the last quarters, Deutsche Bank (NYSE:DB) had a lot of going for it. The long-term 8% RoTE (Return on Tangible Equity) goal was reached in 2022, against a lot of doubters. In Q1 2023 the bank reported 1.9bn profit before tax, the highest quarterly profit since 2013. It seems that after many bad years and the share pricing declining by almost 90% (from the high in 2010 to the low in 2020), the bank was finally moving forward.

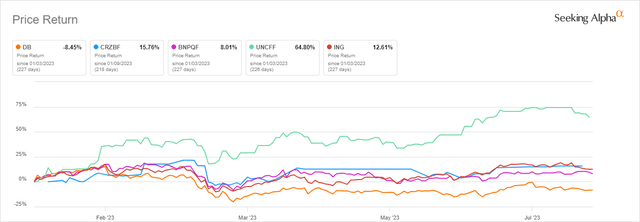

But the share price has not moved this year (at least not in a positive direction), and Deutsche Bank is trailing significantly behind its peers. I chose Commerzbank (OTCPK:CRZBF) (OTCPK:CRZBY), BNP Paribas (OTCQX:BNPQF, OTCQX:BNPQY), ING (ING), and UniCredit (OTCPK:UNCRY) (OTCPK:UNCFF) for a comparison:

Deutsche Bank share price YTD versus European peers (Source: Seeking Alpha)

That made me take a closer look at Deutsche Bank and its Q2 results because I thought there was maybe some hidden value here. However, I did find that Q2 financial results were a setback again. Profitability declined to an unacceptable 5.4% RoTE. I also found that the bank has not lost its proclivity to overmarket its numbers and include or exclude items in its reporting as one-time expenses or gains for that purpose. Just one example: while the bank included a one-time tax credit when it reported the RoTE for Q4 2022, it excluded one-time costs for restructuring and legal expenses when reporting the RoTE for Q2 2023. (Important Note – this is my personal view and other Seeking Alpha analysts have a different opinion. I encourage you to check the recent article from Cavenagh Research for example, and make your own conclusions. As always, I welcome your feedback and a discussion in the comments sections.)

After Credit Suisse collapsed in March, Deutsche Bank shares went down almost 15% within a few hours on March 28, and nobody seemed to know why. The only thing that had happened on that day was that Deutsche Bank had announced an early repayment of a Tier 2 bond, which is actually more a sign of financial strength than weakness. Comparisons with Credit Suisse came up quickly. Credit Suisse was also financially sound until it was very suddenly not anymore – and then it was gone even quicker. Some people pointed to Deutsche Bank’s large derivatives book or the exposure to commercial real estate.

My view is that Deutsche Bank is certainly not Credit Suisse, but looking at the numbers and company reporting, it seems to me it is still the same Deutsche Bank that I have avoided over the past years, and I will continue to do so.

Here is why I think the low share price is warranted and that Deutsche Bank’s transformation journey looks like it could come to an early and premature end.

A detailed look at the Q2 2023 numbers

The numbers were not good, at least in my view. Revenue was 7.4bn, up 11% YoY, but down -4% QoQ. Profit was only 0.9bn, down -22% from the last year and even -29% QoQ. This though includes 700mn nonoperating expenses, which Deutsche Bank excludes in its adjusted numbers as a one-time and non-recurring cost (which I think is wrong, but more on that later).

Positive drivers were the still rising net interest income and low risk provisions. Risk provisions should stay relatively low and within 20-30bps for the full year 2023 according to the bank’s guidance. I think this is remarkable considering that Germany’s economy is unlikely to grow in 2023 and that the problems in some sectors such as the construction industry are piling up.

The CET1 ratio was 13.8%, and the LCR (liquidity coverage) ratio was 137%. Those are good numbers (and comparable to peers) and in my view a testament that Deutsche Bank has a solid capital and liquidity situation. Both numbers also have improved YoY (the CET1 ratio was 13.6% at the end of Q1 and 13% at the end of Q2 2022; the LCR was 133% at the end of Q1 2023 and 143% at the end of Q2 2022).

Accordingly, Deutsche Bank intends to continue to distribute capital back to shareholders, through dividends and share buybacks. The target number is at least 1bn euros for 2023. While this is certainly a big number by itself, it pales in comparison to what other European banks are doing. UniCredit, for example, has bought back shares valued at 2.34bn euros since June 2022 and is in the process of completing the second part of a 3.34bn buyback volume – 6.5% of the total share capital, and that comes on top of a 3bn dividend volume (the bank has accrued 1.5bn in H1 2023). My key point here – investors should not just look at the 0.33 P/B ratio of Deutsche Bank versus the 0.73 ratio for UniCredit and conclude that Deutsche Bank is undervalued in comparison. There is a reason UniCredit is valued higher and that is its much higher profitability which results in significantly higher returns to shareholders.

Costs go in the wrong direction

A major reason for the low profitability is the high cost base. After costs decreased from FY 2021 to FY 2022, they are now increasing again. This is not a general trend among European banks. For example, its German peer Commerzbank reduced expenses in Q2 2023 compared to the previous year.

The Q3 expenses include 700mn non-operating expenses, mostly restructuring and legal costs. Deutsche Bank excludes those when reporting adjusted costs. I am not sure this is appropriate. The bank also had non-operating expenses of 900mn in 2021 and 500mn in 2022. It seems to me that this is what I call the one-time cost fallacy – a company adjusts its reported numbers by one-time items, but if you look at the reported numbers per period, the one-time cost is always there. It is just that in every period it is a different one-time cost.

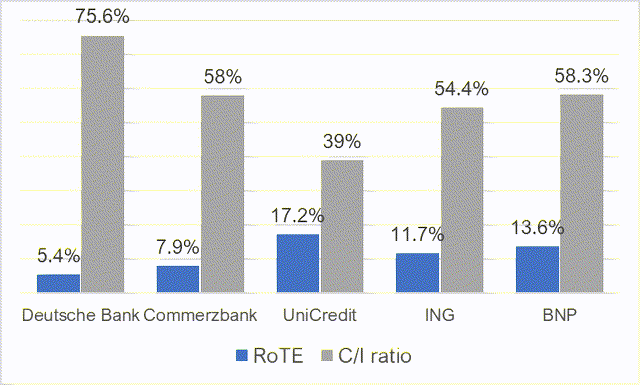

Accordingly, the Cost/Income ratio declined to 75.6%, down -2.4ppt YoY and -2.9ppt QoQ. RoTE was a dismal 5.4%, down -2.9ppt QoQ and -2.5ppt YoY. It is not easy to find the 5.4% number in Deutsche Bank’s reporting, though. If you look at the Q2 earnings presentation you will come across a variety of other RoTE numbers – 6.8%, 7%, 8.1%, and even 9%. The highest number 9%, which is above the 8% target for 2022 and close to the long-term goal of a post-tax RoTE of 10%, is for the full H1 2023 and adjusted by non-operating expenses. For me, this is a deja vu – the proclivity for Deutsche Bank to report numbers that look better than they are. The bank reached its goal of an 8% RoTE in 2022 also only because of a one-time tax credit, but at that time it decided to go the other way and included it in their profit number.

While the approach has obviously worked for Deutsche Bank CEO Christian Sewing – the German newspaper Handelsblatt recently reported that he was the best-paid CEO in Germany in 2022, investors need to look carefully at Deutsche Bank numbers and not take them at face value.

Both RoTE and C/I ratios are significantly worse than what other European banks and the German peer Commerzbank are reporting.

Cost/Income ratio and RoTE comparison Deutsche Bank and European peer banks (Source: Bellasooa Research based on company financial reporting)

Private Bank segment keeps underperforming

While none of the four segments – Corporate Bank, Investment Bank, Private Bank, and Asset Management stands out in a positive way – at least compared to peers, the RoTE in the Corporate Bank and in Asset Management was at least decent with 14.8% for the Corporate Bank and 12.5% for Asset Management. However, the Investment Bank segment had a RoTE of only 5.3%, and the largest segment by revenue, Private Bank, came to only 2.8%.

The Private Bank segment fell short of expectations in Q2 for the third time in a row now. For Q2 2023 the segment reported profit before taxes of just 171mn – where, according to analysts, it was expected to be 399mn.

In a macro environment that is almost perfect for retail banks with rising interest rates and (still) low credit losses, this is disappointing. The Private Bank has a C/I ratio of over 80% and investors need to ask what this will look like when the macro environment deteriorates.

On the positive side, a management change in the Retail segment is on the way. Even if this means further restructuring and possibly more non-operational expenses, a change for the better here is necessary for me to consider Deutsche Bank as an investment opportunity. With 576mn, most of the Q2 profit comes from the Investment Bank. The Private Bank segment only contributed 171mn (both numbers are pre-tax). However, the Investment Bank needs much more capital with risk-weighted assets of 141.38bn versus RWAs of 71.04bn for the Private Bank. So, improvements in the Retail segment will have an outsized impact on shareholder returns.

Conclusion

Deutsche Bank shares look undervalued when investors only focus on specific metrics, especially the book value per share. While Deutsche Bank has improved considerably over the past 2-3 years, the bank is still far behind its European peers regarding profitability. Deutsche Bank also still has the tendency to report optimistically, so investors need to look carefully at numbers to understand what they mean.

The Retail segment looks troubled, despite the considerable macroeconomic tailwinds that other European banks have been able to profit from. As those tailwinds will not persist forever, I would put a big question mark on further progress in the transformation.

My conclusion therefore is: if you want to invest in European banks, there are better opportunities than Deutsche Bank at the moment – at least in my view.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.