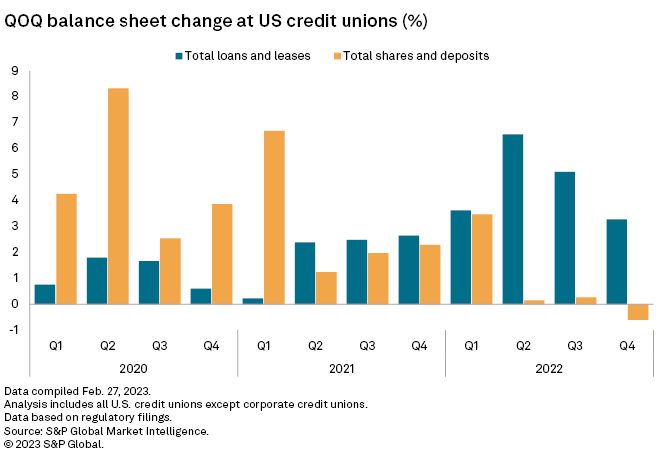

Total shares and deposits at U.S. credit unions were down on a quarterly basis for the first time in more than eight years in the fourth quarter of 2022.

Contrasting trends for deposits and loans

The industry held $1.868 trillion in total shares and deposits for the quarter ended Dec. 31, 2022, 0.6% lower relative to Sept. 30, 2022. Total shares and deposits last declined in the third quarter of 2014. Regular shares with a maturity of less than one year dipped $23.48 billion, and money market deposit accounts decreased $20.43 billion. Those declines were partially offset by a $37.59 billion increase in share certificates with a maturity of up to three years.

Total loans and leases grew by the slowest rate since the fourth quarter of 2021, rising 3.3% quarter over quarter and at $1.520 trillion as of Dec. 31, 2022. Among the growth, $12.56 billion was from first lien, one- to four-family; $7.88 billion was from junior lien, one- to four-family; $6.60 billion was from new vehicle; and $6.56 billion was from used vehicle.

Four of the five largest credit unions by total assets at year-end 2022 reported a negative quarterly change in shares and deposits. Vienna, Va.-based Navy FCU, which is more than 3x larger than any credit union peer, reported a negative 1.4% change. Bucking the trend was Tysons, Va.-based Pentagon FCU with 2.1% growth.

Three of the 20 largest credit unions reported a negative change in loans and leases: Pentagon FCU; Anchorage, Alaska-based Alaska USA FCU; and San Diego-based San Diego County CU.

* Click here for a primer on the U.S. banking industry.

* Click here to take part in S&P Global Market Intelligence’s U.S. Bank Outlook Survey – Fintech & The State of U.S. Banks.

Credit quality deterioration

Loans have grown at a rate of more than 2% for the last seven quarters, and cracks are beginning to appear in some credit quality ratios. Delinquent loans as a percentage of total loans rose to 0.61%, up 8 basis points quarter over quarter and at their highest level since March 31, 2020. Net charge-offs to average loans increased 9 basis points to 0.43%, a high-water mark during the last 10 quarters. The only top 20 companies with improving ratios in the 2022 fourth quarter of 2022 were Bethpage, N.Y.-based Bethpage FCU for delinquencies and Live Oak, Texas-based Randolph-Brooks FCU and Jacksonville, Fla.-based VyStar CU for net charge-offs.