By Stephen Johnson, Economics Reporter For Daily Mail Australia

Updated: 03:21 09 Aug 2023

- Commonwealth Bank made cash profit of $10.164billion

- This marked a six per cent increase in the year to June 30

- Record statutory profit of $10.188billion includes investments

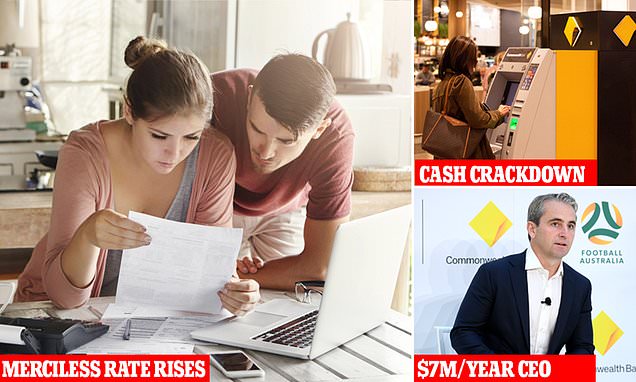

The Commonwealth Bank has made a record $10.2billion profit after scrapping cash withdrawals at some branches and hiking mortgage rates 12 times in little more than a year.

Australia’s biggest home lender saw its cash profit, based on core operations, rise by six per cent in the year to June 30, figures released on Wednesday said.

Despite an economic slowdown, the Commonwealth Bank’s $10.164billion full-year net profit has coincided with the rollout of more cashless branches that refuse to do banknote transactions over the counter.

The bank’s statutory net profit of $10.188billion was a record, increasing by five per cent from $9.673billion during the last financial year, with this figure including commercial investments.

Chief executive Matt Comyn, a key supporter of the Indigenous Voice to Parliament, saw his pay packet surge by another $3.5million to $10.426million.

Acting Greens leader Mehreen Faruqi told ABC News Breakfast the profit figure was ‘absolutely obscene’ with inflation still high at six per cent.

‘People feel the corporate profits are absolutely obscene, it’s corporate profits driving inflation, yet who is bearing the brunt of it?

‘It’s everyday people with the cost of living, and it’s at this point in time renters.’

The Commonwealth Bank told the Australian share market it had reduced occupancy and equipment expenses by three per cent ‘primarily reflecting benefits from optimising our digital, branch and ATM network and exiting commercial office space as we continue to consolidate our property footprint’.

Teller cash transactions are no longer available at several Sydney branches including Commonwealth Bank Place in Darling Harbour along with nearby South Eveleigh, Barangaroo, the University of Sydney, and outer suburban Penrith, which the bank now calls ‘specialist centres’.

The cashless approach is also being expanded to some Brisbane and Melbourne ‘specialist centre’ branches.

This occurred after the Reserve Bank of Australia raised interest rates in June by another quarter of a percentage point to an 11-year high of 4.1 per cent, marking the 12th increase in 13 months.

The Commonwealth Bank has passed on, in full, every official increase.

A borrower with an average, $600,000 mortgage has, since May 2022, seen their monthly repayments soar by 64 per cent to $3,789, up from $2,306, as variable mortgage rates have climbed to 6.49 per cent, up from 2.29 per cent.

Outside of RBA moves, the Commonwealth Bank has also hiked variable mortgages, slugging new customers.

The bank told investors it had low arrears rates, where borrowers are 30 days or more behind on their monthly repayments.

‘The bank’s portfolio quality has remained sound with arrears and impairments below long-term averages, supported by a strong labour market as well as savings and repayment buffers,’ it said.

Even before the latest earnings announcement Mr Comyn was already on a $6.968million remuneration package but this rose to $10.426 – a $3.458million or 50 per cent pay rise.

‘It has been an increasingly challenging period for our customers, dealing with rising cost of living pressures,’ he said on Wednesday.

‘Our balance sheet resilience allows us to support our customers and deliver sustainable returns for shareholders.’

Commonwealth Bank shareholders received a final dividend of $2.40 a share, fully franked, taking the total dividend for the year to $4.50 per share – a 17 per cent increase.

This was a big improvement from the previous financial year when shareholders received a final dividend of $2.10 a share, taking the full-year dividend to $3.85 a share, fully franked.

The bank has already paid company tax which means shareholders are entitled to a franking credit.

The most aggressive pace of RBA rate hikes since 1989 saw the Commonwealth Bank’s loan impairment expenses increase by $1.465billion from a surplus of $357million in 2021-22 to a deficit of $1.108billion in 2022-23.

Shareholders were told this reflected ‘the impact from ongoing cost of living pressures and rising interest rates’.

Operating expenses rose by five per cent to $11.646billion, with the Commonwealth Bank blaming higher inflation and new technology.

But operating income rose by 13 per cent to $27.237billion ‘driven by volume growth and higher net interest margin’.