Economics & Growth | Europe | FX | Monetary Policy & Inflation

Summary

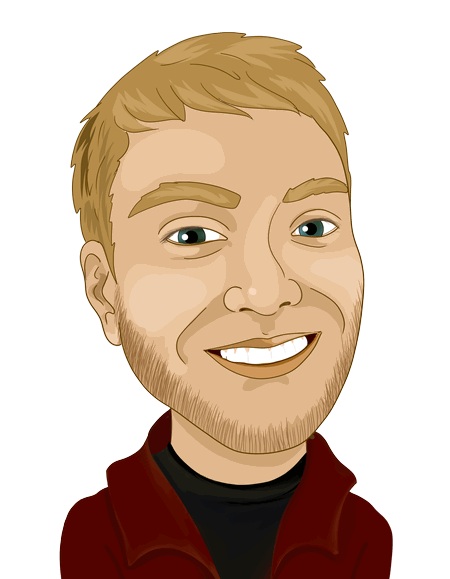

- Core inflation and wage growth remain an issue for the ECB ahead of the September meeting.

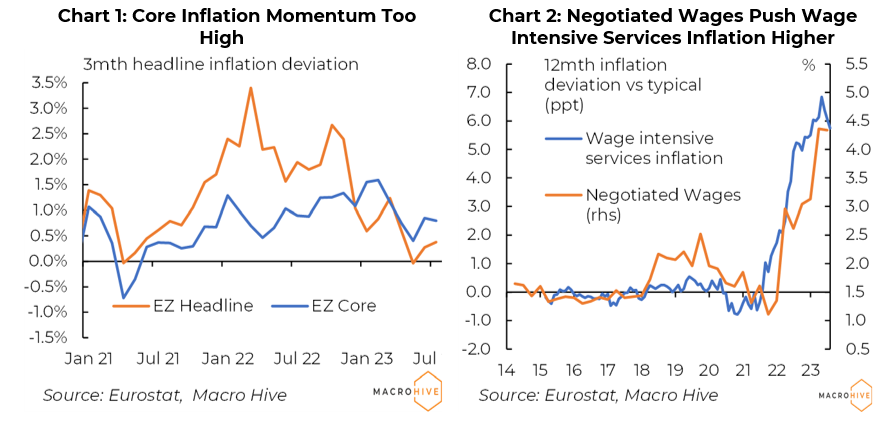

- Rapid growth acceleration in the US could explain why Powell feels less confident the Fed’s policy stance is restrictive.

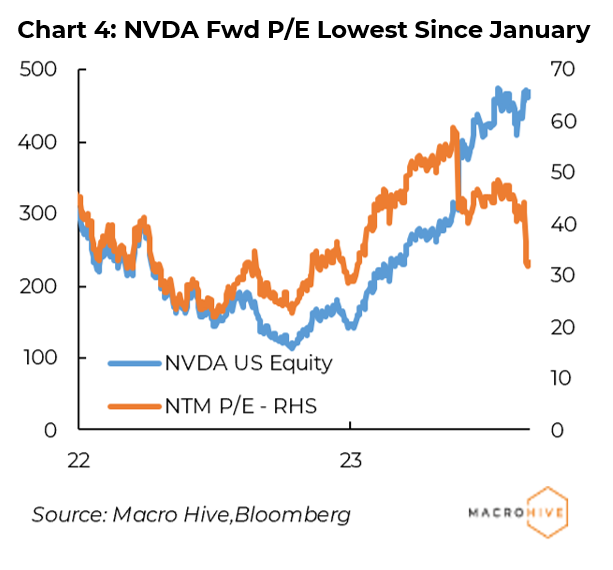

- Nvidia beat earnings expectations last week, yet its stock price suffered.

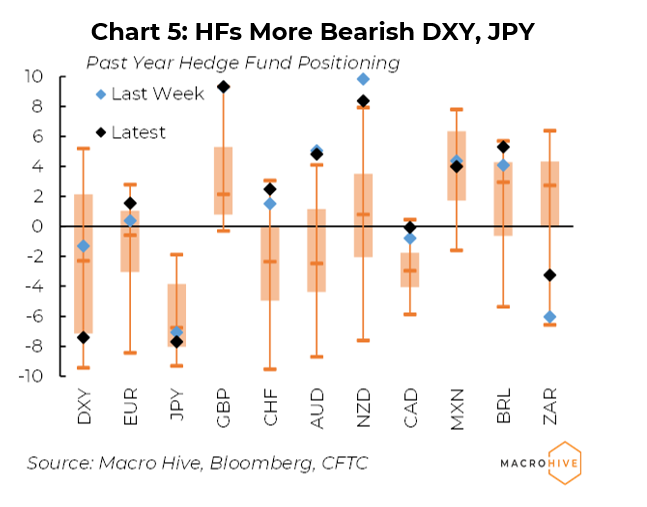

- Hedge funds have turned more bearish on the US dollar and Japanese yen.

Core Inflation, Wage Growth Worry ECB Policymakers

Core inflation and negotiated wage growth remain a problem for the ECB (Charts 1 and 2). August core inflation will prove a key input to the central bank’s September meeting. The market is expecting +5.3% YoY, but there is little consensus on that. Ultimately, the details will be key. A drop in YoY means little given base effects – we focus on the MoM momentum.

Surprising US Growth Is a Problem for the Fed

The biggest macro surprise over the past few months has been the strength of the US economy. Currently, the Atlanta Fed nowcast for Q3 is nearly 6% saar – three times the trend (Chart 2)! The biggest gains in US growth have come from the consumer (and inventories). The consumer, in turn, is supported by a strong labour market. This resilient growth has surprised FOMC members, and it could explain why Powell feels less confident the policy stance is restrictive. Friday will be an important test for the growth theme, with payrolls and ISM.

Nvidia Stock Suffers Despite Earnings Beat

Nvidia reported last Wednesday. Despite hefty expectations, the company delivered over and above: revenues grew by 88% versus a year earlier, while earnings more than doubled. Yet the stock languished. Guidance continues to improve, which means the stock is now trading at a forward P/E of 32.4x, the lowest since January (Chart 4)!

How Are Hedge Funds Positioned in FX?

HFs have extended DXY net-shorts with another 7.9k short positions added, outweighing the additional 0.5k long positions (Chart 5). JPY also saw bearish changes to net-positioning with longs decreasing and shorts increasing. And despite AUD net-positioning looking little changed over the past week, there is growing discontent with additions to both long and short positions.

Matthew Tibble is Commissioning Editor at Macro Hive. He has worked as an editorial consultant and freelance editor for companies such as RiskThinking.AI, JDI Research, and FutureScape248.

Photo Credit: depositphotos.com

(The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.)

Your comments

Spring sale – Prime Membership only £3 for 3 months! Get trade ideas and macro insights now