26 May 2023

[This press release was updated on 26 May 2023 at 14:10 to correct the reference year from 2019 to 2020 in the third paragraph.]

- Card fraud in 2021 falls to lowest level since start of data collection

- 12% decline in card-not-present fraud after introduction of strong customer authentication

- 63% of total value of card fraud involves cross-border transactions

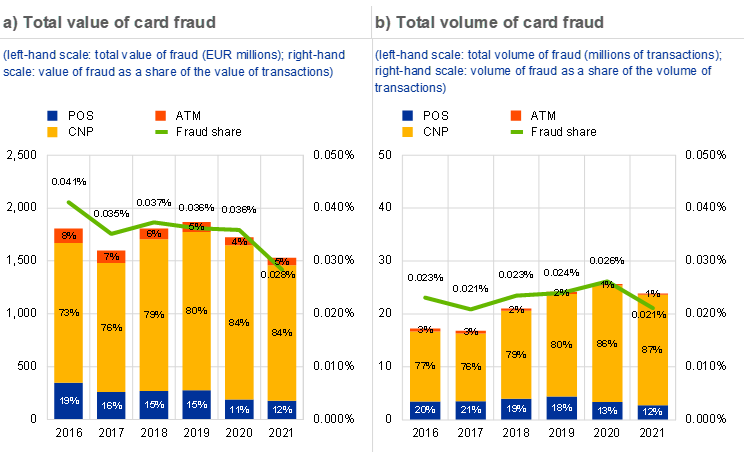

The European Central Bank (ECB) has today published its card fraud report, which is based on information provided by 20 card payment scheme operators. Card fraud in 2021 continued its downward trend, falling to its lowest level since data collection began. It constituted 0.028% of the total value of card payments made using cards issued in the Single Euro Payments Area (SEPA), amounting to €1.53 billion from a total value of €5.40 trillion. By comparison, card fraud in 2019 amounted to €1.87 billion from a total value of €5.16 trillion. The highest share of card fraud observed to date was 0.048% in 2008.

There are two distinct types of card fraud: (1) card-not-present fraud, i.e. fraud conducted remotely in online and telephone payments, using card details obtained by scams such as phishing; and (2) card-present fraud, which typically occurs at retail outlets and ATMs and involves the use of counterfeit cards.

Card-not-present fraud, which accounted for approximately 84% of the total value of card fraud in 2021, declined by 12% from 2020 following the market-wide implementation of strong customer authentication under the revised EU Payment Services Directive (PSD2). Card-present fraud fell by 6% in 2021 from its 2020 level, owing to the continued global roll-out of industry standards, which have been effective in reducing opportunities to commit magnetic stripe counterfeit fraud.

As in previous reports, most of the card fraud in both 2020 and 2021 involved cross-border transactions. Although cross-border transactions only accounted for 11% of the total value of card payment transactions, they accounted for 63% of the total value of card fraud in 2021.

Total value and volume of card fraud using cards issued within SEPA

Source: All reporting card payment scheme operators.

Note: POS stands for “point of sale”; CNP stands for “card-not-present”.

The Eurosystem is closely monitoring trends in card fraud in its capacity as overseer of card payment schemes operating in the euro area. Statistical information on the volumes and values of card transactions and corresponding fraud is collected, analysed and reported regularly. The latest report on card fraud focuses on data for both 2020 and 2021, providing a more differentiated overview of the impact on card fraud of both the recent regulatory measures and the coronavirus (COVID-19) pandemic. Fraud data for 2022 is currently being collected.

For media queries, please contact Nicos Keranis, tel.: +49 69 1344 7806.