Canada ‘likely’ headed into recession but will fare better than many other economies, says Carney

Former Bank of Canada and Bank of England governor Mark Carney says Canada likely will head into a recession next year but will fare better than many other countries and bounce back faster because of its strong economic fundamentals.

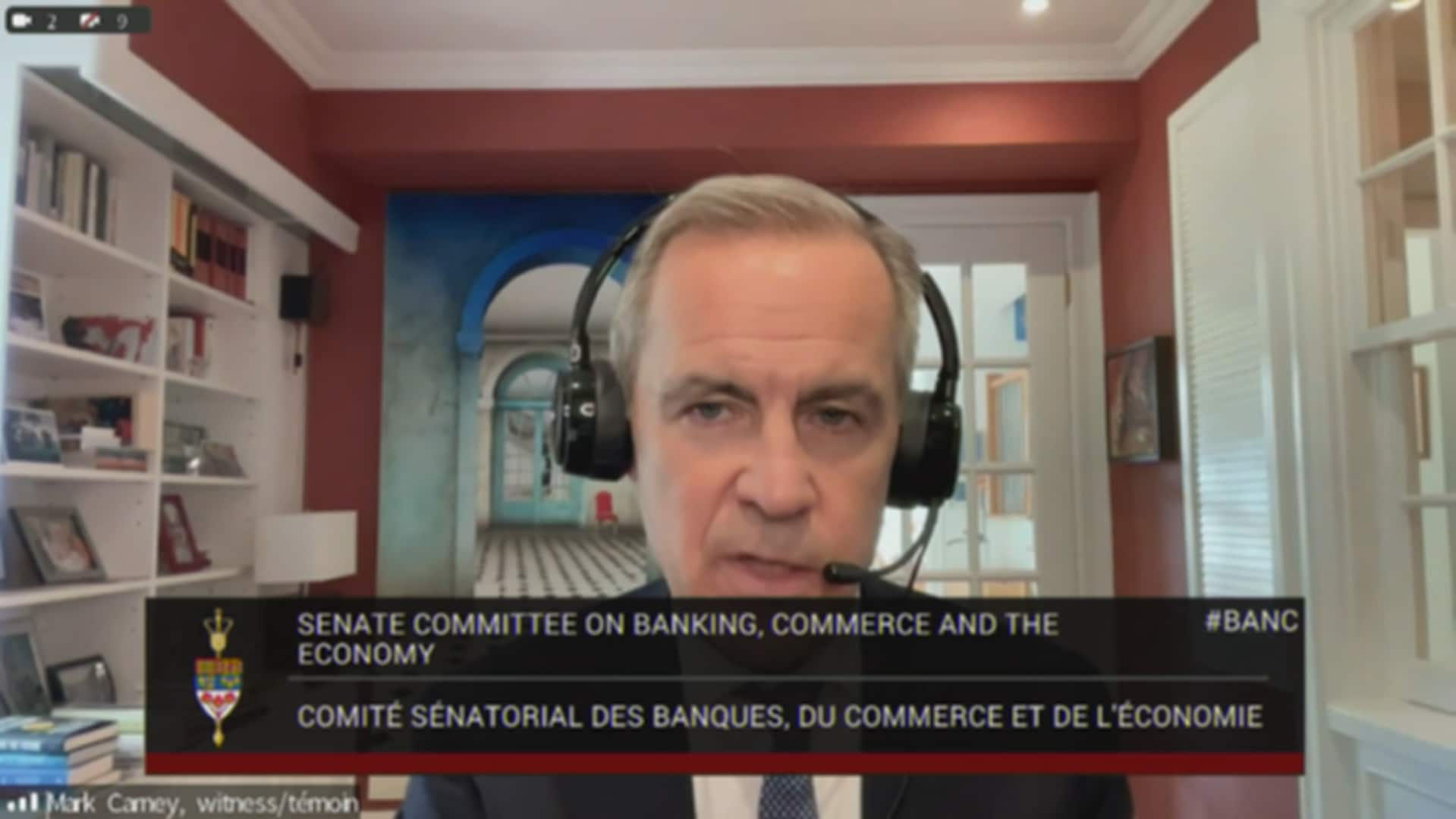

Carney made the comments before the Senate committee on banking, commerce and the economy Thursday. He also explained to parliamentarians why he thought outgoing U.K. Prime Minister Liz Truss’s mini-budget caused so much financial turmoil in her country.

“I think a recession is both likely globally and most probable in Canada,” Carney said.

“I would put it this way — I’m afraid it’s a bit like air travel these days. We know where we’re headed, we just don’t know when we are going to get there, so there’s some uncertainty about the exact time.”

Carney told senators that China is “effectively in recession” now. Europe, he said, is entering a recession and the U.K. is already in one — and while the United States’ economic momentum is propping up Canada, it will be in recession “at some point” next year.

“It will be hard for us, [given] those accumulative factors, for Canada to be a full exception from that,” he said. “The combination of all of that is likely to lead to a recession, at least a few quarters of negative growth in Canada.”

That prediction is darker than the one Pierre-Olivier Gourinchas, chief economist for the International Monetary Fund, gave to CBC’s Rosemary Barton Live in an interview airing Sunday.

“We have a slowdown that we’re projecting in Canada,” Gourinchas told Barton. “We’re seeing growth coming down to about 1.5 per cent next year, so that’s a downward revision.

“The Canadian economy has been doing well in the rebound but it’s buffeted by the same winds that are affecting the global economy.”

Gourinchas said that while unemployment in Canada and the U.S. will rise in the coming years, both labour markets are very strong and unemployment should “hopefully remain fairly modest.”

Canada to recover faster: Carney

Carney cited a strong labour market and low unemployment as reasons why Canada will do better than other countries in weathering the coming recession.

He said Canada’s job market is strong because the country’s pandemic benefits, such as the Canada Emergency Wage Subsidy, helped to keep workers attached to their jobs, which meant Canada lost fewer jobs than other countries.

Carney also said that Canada’s international trade agreements with all other G7 countries and Pacific Rim nations will help it recover sooner.

Watch: A recession is both likely globally and most probable in Canada,’ says Mark Carney:

Former Bank of Canada and Bank of England governor Mark Carney told a Senate of Canada committee that Canada likely will head into a recession next year but will fare better than many other countries and bounce back faster.

“I would see no reason that there would be any issue for our bond rating or credit rating or any sort of near term type issue,” he said.

And because the U.S. is faring better than other countries right now, Carney said, the strength of its economy should support Canada’s recovery.

“We can come out of this much stronger than others, without question, but we should be clear-eyed about what we are heading into,” he said.

“It’s a storm, not a hurricane. That’s the way I would put it.”

U.K. turmoil and basic math

Carney was also asked by senators to explain the recent financial and political turmoil in the United Kingdom.

Liz Truss announced Thursday that she was stepping down as prime minister, just over six weeks after taking the Conservative Party reins as leader. Her resignation came after Kwasi Kwarteng resigned last week as chancellor of the exchequer, the U.K.’s finance minister.

Watch: Carney weighs in on Liz Truss:

Former Bank of Canada and Bank of England governor Mark Carney says outgoing British Prime Minister Liz Truss’s failure to provide costing for her mini-budget, and her attempt to go around parliamentary institutions, undercut her credibility.

Both saw their political careers explode after Kwarteng’s so-called mini-budget on Sept. 23 sent U.K. markets into a tailspin by offering deep tax cuts without explaining how they would be funded.

“I think one of the big reasons why it failed is, it was half the story,” Carney said. “They majored on tax cuts as the solution as opposed to all the other hard work that’s necessary to build productivity over time.”

Carney said the Truss government wanted to make a “big bang” with tax cuts and funding to help British households pay for rising energy costs before delivering another budget in late November that would have filled in the holes.

Carney said that Truss was never allowed to deliver that November budget because her government’s decision to announce unfunded tax breaks made it look as if it had a “trickle down, tax-cut-only strategy.”

“Which in and of itself its not a credible strategy for a 21st century economy,” he said.

Carney said that Truss’s failure to provide costing for the cuts, and her attempt to go around parliamentary institutions such as the U.K.’s equivalent of Canada’s Parliamentary Budget Officer, undercut her credibility.

“They moved to a seven per cent of GDP deficit overnight. They already had a seven per cent current account deficit and the numbers didn’t add up. And then they acted like it didn’t matter,” he said.