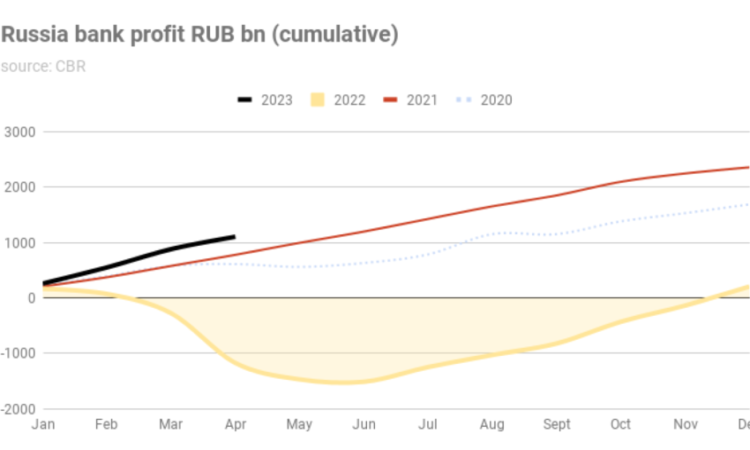

The banking sector recorded a net profit of RUB224bn in April, with an annual return on equity of 21%. While this figure represents a one-third decrease compared with the high result in March (RUB330bn), the sector has already accumulated profits of RUB1.1 trillion in the first four months of 2023. (chart) and (chart)

The sector has recovered from the initial shock of the start of the war over a year ago and is on course to have a profitable year. In May the Bank of Russia upgraded its forecast for the profit of the banking sector in 2023 from RUB1.9 trillion ($23.75bn) predicted at present, department director Alexander Danilov told reporters.

NPLs ticked up due to the shock as well, but remain at comfortably low levels well within banks’ ability to provision for them. As the economy stabilises, NPLs also fell somewhat in May.

In March, the share of NPLs slightly decreased across all major product categories: in corporate lending, from 6.5% to 6.3%; in retail, from 5.2% to 5.1%, including unsecured; consumer lending, from 8.9% to 8.7%; and in mortgages, from 0.7% to 0.6%.

Due to the uncertainties, in April, there was a significant increase in household funds (excluding escrow accounts), growing by RUB604bn, or 1.6%. This followed a moderate growth in March of 0.7%. The dynamics were partially supported by the advance social payments ahead of the May holidays and an increase in their size, including pension indexing.

The corporate loan portfolio in Russia has been experiencing steady growth for the third consecutive month, with April seeing a significant rise. Consumer lending also saw a growth of 1.2%, slightly lower than the previous month, as the CBR is being cautious and has increased the macroprudential requirements on retail loans to avoid a credit bubble.

Liquidity in the sector decreased slightly in April, but the CBR says it remains adequate to cover the needs of the sector. The total volume of liquid assets reached approximately RUB16.4 trillion, which is considered an adequate level. This amount is sufficient to cover 22% of customer funds in banks, or 48% of individual deposits. Additionally, banks have the option to attract RUB9.5 trillion in liquidity from the Central Bank against non-market assets as collateral, which would cover 13% of customer funds.

The balance sheet capital of the banking sector increased grew by RUB217bn, reaching RUB12.8 trillion, driven by the sector’s profit of RUB224bn in April.

Information regarding the dynamics of regulatory capital in April will be available after the publication of this article. However, based on the results of March 2023, the indicator of aggregate capital adequacy (N1.0) decreased by 0.18 percentage points to 12.66%, primarily due to the faster growth of risk-weighted assets (+1.8%) compared to aggregate capital (+0.3%).

In March, regulatory capital increased by RUB51bn, predominantly driven by the financial result recognised in capital.

The bond market has also returned to some sort of normality. In the early months of the war state treasury bill issues were bought up by banks as a way of supporting spending, but increasingly banks are buying up corporate bond issues as they seek to diversify their portfolio and companies seek to raise investment capital.

The debt securities portfolio rose by RUB176bn (+0.9%), mainly due to the purchase of corporate bonds. Banks acquired new issuances of federal government bonds (OFZ) totalling only RUB44bn, which is less than a quarter of the total placements.

The Russian Ministry of Finance showed a slight increase in its issuance activity in April compared to March, with OFZ placements amounting to RUB196bn. Approximately 90% of the issued bonds were fixed-coupon securities (OFZ-PD) with regular coupon payments. Ministry of Finance plans to issue a total of some RUB3.5 trillion OFZ this year to supplement income and cover an expected RUB2.9 trillion, or 2% of GDP, federal budget deficit.