Half of the cross-border banking groups active in Central, Eastern and South-Eastern Europe (CESEE) say they want to “selectively expand” in the region, according to the latest CESEE Bank Lending Survey published by the European Investment Bank (EIB).

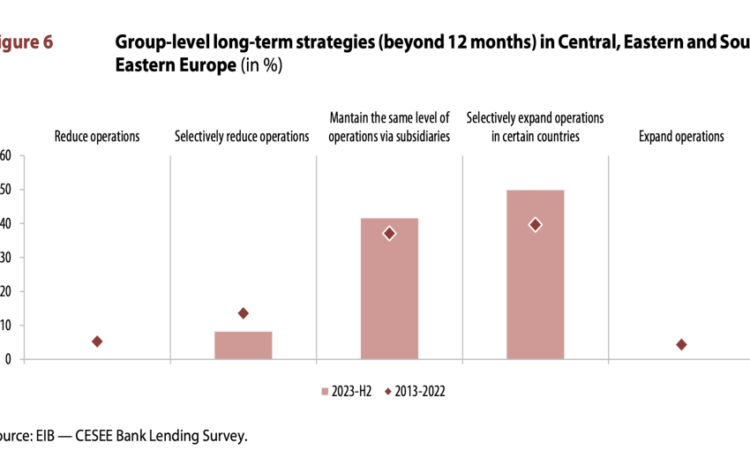

When asked about their long-term strategy, 50% of cross-border banking groups said they wanted to selectively expand, up from 45% in the previous survey and 30% in the one before that, while 40% planned to at least maintain the same level of operations in the region. Less than 10% of banking groups plan to selectively reduce activities in the region.

According to the survey, most banks see market potential in the region “medium”, though they are more optimistic about Czech Republic and Romania, and more pessimistic about Bosnia and Herzegovina. Views on the Albanian, Croatian, Serbian and Slovakian banking markets improved.

The survey follows a series of M&A deals in both Romania and Serbia in 2023. Among them, UniCredit announced plans to merge its Romanian subsidiary with the recently acquired Alpha bank in Romania, a deal valued at €300mn. This strategic move positioned UniCredit as the third-largest lender in Romania.

Earlier in 2023, Eurobank, a Greek financial institution, completed the sale of its Serbian branch to AIK Banka for €280mn. Following this transaction, AIK Banka became the second-largest banking group in Serbia.

The survey also reveals a tightening of credit supply in CESEE. Across the region, almost all countries, except Albania, anticipate weak or neutral credit supply.

Meanwhile, credit demand from bank clients has remained resilient and is expected to improve slightly, the report said.

“The survey findings indicate that the tightening of credit supply that began in 2022 because of the war in Ukraine, inflation, higher rates and economic slowdowns is still ongoing. All business segments have been affected by tight supply conditions, especially small and medium-sized enterprises [SMEs],” said EIB vice-president Kyriacos Kakouris.

Contrary to earlier pessimistic expectations, credit quality has improved in the last six months. Nevertheless, due to a weakened economic outlook and higher interest rates, banks anticipate a rise in non-performing loans (NPLs) over the next six months.

Most regional subsidiaries, particularly in Czechia, Kosovo and North Macedonia, have achieved higher profitability in terms of return on assets and return on equity compared to the overall group.

However, the outlook on profitability has deteriorated since the last survey, with over 50% of banks signalling lower profitability in various countries, including Albania, Croatia, Hungary, Poland and Romania, compared to the overall group operations.

Interviews for the survey were carried out in September 2023 among 12 international groups operating in the CESEE region and 70 local subsidiaries and independent domestic players. Survey participants collectively represent 50% of local banking assets.