(Bloomberg) — Some of the world’s biggest asset managers are buying up European corporate bonds — seeing the region as a safer bet as turmoil engulfs US regional banks.

Most Read from Bloomberg

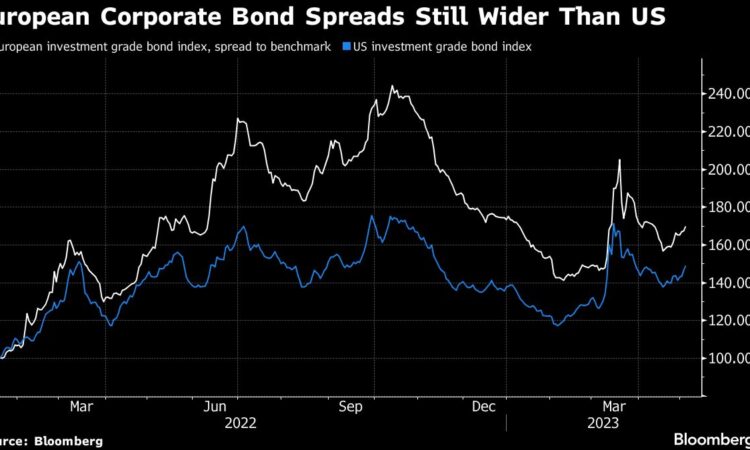

BlackRock Inc. and Legal & General Investment Management prefer high-grade European corporate bonds over similar US debt in the aftermath of the collapse of Silicon Valley Bank and rescue deal for First Republic Bank. They see a buying opportunity in Europe’s credit spreads — which are still wider than the US after last year’s rout for the asset class.

“There is currently more event risk in the US,” said Michael Krautzberger, head of EMEA fundamental fixed income at BlackRock, who also pointed to the debt ceiling as another looming issue. At the same time, “Europe is still comparatively cheap” compared to historical spreads, he said.

The preference for Europe is a big turnaround from a year ago, when markets were tumbling in the wake of an energy crisis spurred by Vladimir Putin’s invasion of Ukraine. Now, with inflation in the euro area peaking, oil prices falling and banking-sector turmoil seen as predominantly a US issue — thanks to stricter regulation in Europe — the region is becoming a sweet spot.

Fears are growing in the US that more distressed lenders could emerge — with PacWest Bancorp becoming the latest focal point — and that the regional banking crisis could have repercussions for the companies they lend to. While Europe isn’t immune to these jitters, strategists said the US may carry more risks, given that US firms tend to be more leveraged.

“The fundamentals from a hold-to-maturity perspective are good in European credit, primarily because the quality is higher,” said Fahd Malik, a portfolio manager at AllianceBernstein, who has been buying European assets selectively.

John Roe, head of multi-asset funds at Legal & General Investment Management, also favors European corporate bonds at the moment.

“I would much rather buy credit in Europe — spreads are wider but it’s not because the bonds are riskier,” he said. Roe cited high swap spreads, the gap between the euro interest-rate curve and the yield on equivalent-maturity German government bonds, as another bullish indicator.

With investors flocking to Europe, the region’s corporate bond spreads — the gap between company and benchmark government borrowing costs — have been converging with their counterparts across the Atlantic. The current spread differential of 20 basis points is down from as much as 71 basis points in October, and some expect Europe to revert to historically tighter spreads as the US bank crisis and a possible economic downturn play out.

“In six to nine months I expect Europe to trade tighter than the US,” said Guy Stear, head of fixed income research at Societe Generale SA. When growth starts to turn, and with higher leverage in the US, “things will get worse faster in the US credit market than in the European credit market.”

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.