If you or I decided to go wild with our credit cards and didn’t pay off those balances regularly, we would see what we owe expand rapidly as high interest rates make the debt increasingly hard to manage.

There’s a price to pay for unwise financial decisions. Most of us understand the economic consequences of living beyond our means.

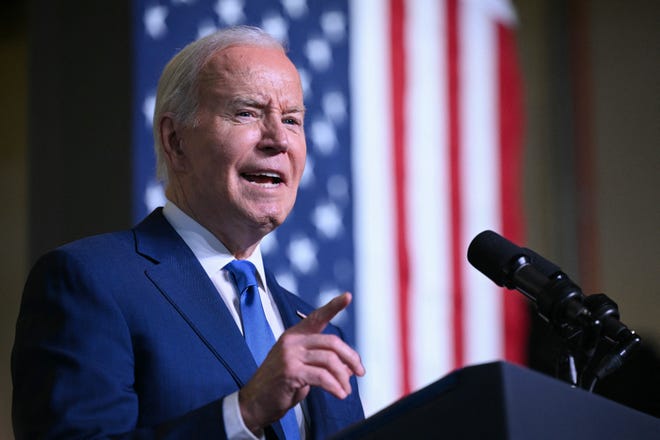

Except for President Joe Biden and the federal government, that is.

The national debt is already at $34 trillion and is quickly hurtling toward $35 trillion (it was roughly $27 trillion when Biden took office).

You may not care, but you should.

The costs of carrying such a significant debt are putting pressure on other spending priorities as interest alone takes up a higher percentage of the government’s budget. In fact, interest payments are the fastest-growing segment of the budget.

The U.S. just hit a new “milestone”: In the first seven months of the current fiscal year, payments on interest have cost taxpayers more than defense and Medicare spending. Only Social Security eats a higher percentage of the budget – for now. In less than 30 years, interest on the debt will likely become our largest expenditure.

Bad news Biden:Trump’s trial drama is salacious, but don’t overlook Biden’s blunders and bizarre stories

Do we really want to spend more on interest than anything else?

According to the Committee for a Responsible Federal Budget, interest on the debt has almost doubled to $659 billion in 2023 from $345 billion in 2020.

Debt payments are crowding out other important spending. For instance, interest costs this year are more than federal spending on education, transportation and veterans combined, CRFB reports.

Financial experts have long warned the government that it must get its long-term debt and annual deficits under control. But it’s become a glaring problem now that interest rates have continued to stay high as the Federal Reserve tries to hold down inflation.

Higher interest rates on that much debt are bad news for the budget’s bottom line. And as the debt reaches unsustainable levels, it will contribute to a negative cycle of even higher interest rates.

Inflation reached a 40-year high under Biden’s presidency, and we are still well above inflation targets. While multiple factors play into rising inflation, the amount of money Biden and Congress have pumped into the economy is certainly to blame.

Former President Donald Trump also was a big spender. Trump added about $8 trillion to the debt, yet roughly half of that was due to the federal government’s bipartisan response to the once-in-a-lifetime COVID pandemic in 2020. Until then, spending under the Trump administration was comparatively less than under Biden.

It’s fair to argue that Trump’s spending to combat COVID was over the top. Yet, rather than slow down spending when he took office in 2021, Biden continued the country’s spending spree – despite being past the worst of the pandemic.

Money trouble:I just paid my taxes. Biden’s pandering on student loans will end up costing us all more.

Biden’s costly legislative packages and illegal executive actions, including to “cancel” student debt, are racking up the country’s debt at a rate it cannot afford.

Meanwhile, Social Security is going bankrupt

The biggest drivers of the debt are costly entitlement programs like Social Security and Medicare. Yet, those are the programs that voters – especially seniors – are most likely not to want touched. And Biden and Trump alike eschew any real discussions about reforms to these expenditures.

Biden’s blunders:Biden has his own ‘fine people on both sides’ moment. He’s as wrong now as Trump was then.

But if the government doesn’t take swift action, Social Security and Medicare will see automatic cuts in coming years as they reach insolvency.

Recent reports from the Social Security and Medicare trustees highlight just how soon that could happen. If Congress fails to shore up Social Security, all retirees face a 21% automatic cut in just nine years. Similar cuts would affect Medicare within 12 years.

“Continuing to ignore these warnings puts beneficiaries at risk, creates economic uncertainty and adds to our fiscal challenges,” Michael Peterson, CEO of the Peter G. Peterson Foundation, said in a statement about the reports. “Yet the trust fund depletion dates have grown closer and closer. In fact, we haven’t been this close to the depletion of Social Security since the last bipartisan reforms done in 1983.”

With Congress more dysfunctional than ever and presidential candidates who only want to pander to earn votes, such a bipartisan solution seems like a unicorn.

If it doesn’t happen, though, we’re all going to pay.

Ingrid Jacques is a columnist at USA TODAY. Contact her at [email protected] or on X, formerly Twitter: @Ingrid_Jacques.