(Sept 29): UK banks are becoming increasingly cautious about lending for housing development in London, the latest signal that the outlook for the capital’s property market is weakening.

Lenders have cut the leverage ratios they’re willing to offer developers by as much as 10 percentage points since the start of the year, according to Nicole Lux, a senior fellow at Bayes Business School who researches real estate finance. Her data is based on a semi-annual survey of real estate lenders that she compiles.

The lack of credit is another blow to homebuilders, who are being squeezed by a combination of rising costs and slumping demand. Higher mortgage rates are also damaging London home prices, which have fallen by about 4% over the last year, according to mortgage lender Halifax.

But dig a bit deeper and even greater destruction is happening to land values. In a downturn, land usually declines by more than the properties built on it in part because developers have to beef up profit margins to protect against any further price declines during construction.

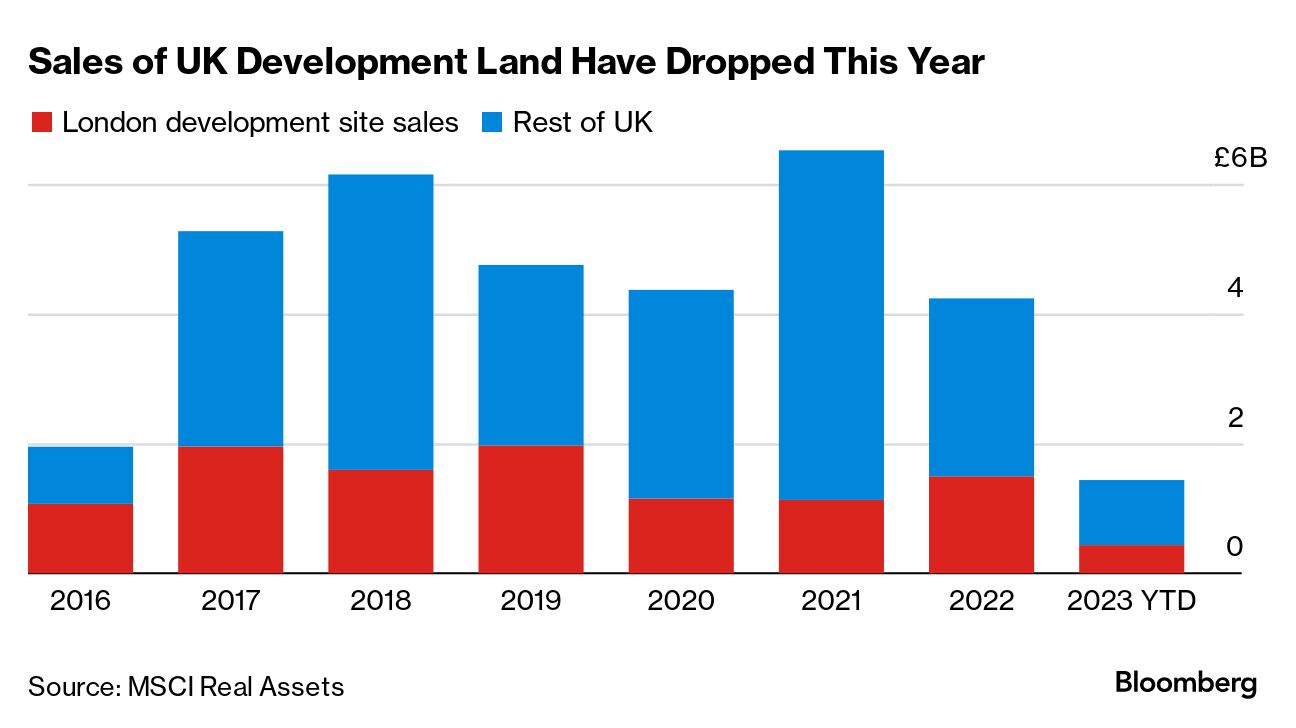

Builders also scale back purchases, and the value of development land deals has already collapsed. Less than £1.45 billion (RM8.31 billion) of sites have sold across the UK so far this year, compared with more than £6.5 billion in 2021, according to data compiled by MSCI Real Assets.

For some, the downturn is a familiar story, with land values in the city’s upmarket areas hurt by the slowdown in the luxury property market since before the Brexit vote. At the former Earls Court exhibition centre in west London, revaluation losses have risen to about £827 million (US$1 billion or RM4.74 billion) from their peak.

“The land market has felt the brunt of the recent price corrections and that’s down to a combination of fiscal, legislative and market changes,” said Antony Antoniou, managing director at broker Robert Irving Burns. “Ultimately the land market is the only part of the development process where there is still fat to be trimmed.”

The Earls Court site was bought by a venture between Dutch pension fund APG and a Delancey-managed fund in 2019 for £425 million. Plans for the area currently include 4,500 homes and a green technology research hub. The land value fell more than 15% to about £540 million last year, after a 12.6% gain in 2021, according to an April filing.

In response to queries from Bloomberg, APG said it will seek planning approval next year, describing the site as “one of the most exciting development opportunities in London”.

The plot was acquired “through an off market opportunistic approach at the significant discount to peak valuations”, it said. “We continue to forecast appropriate risk-adjusted returns from the venture.”

According to Lux’s research, banks have cut the so-called loan-to-cost (LTC) metric for housing development in London to about 55% from as much as 65% at the end of last year.

“UK banks are now becoming more careful with underwriting new loans, so it is very difficult to obtain development finance,” she said. Most of the lenders still willing to advance credit for development are specialised debt funds who can only do deals in limited volumes, she added. They’ve reduced the LTC ratio to 60% from 70%.

With sales of newly-built properties at their lowest in more than a decade, some are turning to discounted bulk sales to shift the backlog. Others plan to rent out projects once planned for sale, Lux said.

A number of developers are having to dramatically mark down land acquired when property was booming. The value of British Land Co’s Canada Water project, a mixed use development in south east London that’s even larger than Earls Court, fell 17.4% in the year through March.

That hit was surpassed by the 24.2% cut to the landlord’s warehouse portfolio in the capital, which is mostly made up of development sites.

About a mile (1.6km) away from Canada Water, on the edge of Canary Wharf, construction of what was billed as the tallest residential skyscraper in western Europe has yet to begin after a change to planning rules following the Grenfell tower fire in 2017, which claimed 72 lives.

The Chinese developer, Greenland Holdings Corp, took a £56.7 million impairment on the project in 2021, according to the latest available filing. Greenland didn’t immediately comment.

The delays are a reflection of a wider wobble in the construction industry, where firms are going insolvent at the fastest rate in a decade. A record number of housing projects in the city stalled in the second quarter, according to data compiled by Molior London.

That’s a blow to the city’s economy, which has already seen the Crossrail 2 project delayed and growing speculation that chunks of a high-speed rail link between London and Manchester will be delayed or scrapped.

This week, homebuilder Inland Homes Plc, whose assets include a residential development site near Heathrow Airport, fell into administration. That came after a subsidiary breached covenants on a loan from HSBC Holdings plc and a warning that the parent company was considering making provisions against certain assets. It’s also likely to breach covenants with other lenders, it said.

The problems with land in London are also rippling out across the country. The price of urban brownfield land in the UK fell 18% in the 12 months through June, according to broker Knight Frank LLP.

More than half of homebuilders expect values to fall this quarter and one in five have raised their margins because of the market uncertainty, the broker found.

Meanwhile, Berkeley Group Holdings, traditionally the capital’s largest homebuilder, has said that it will “only invest very selectively in new opportunities” in land. Competitor Crest Nicholson Holdings expects “future land activity to reduce significantly”.