Yet the thing about banks in particular is that though they behave as if they were free enterprise, commercial organisations and reward themselves accordingly, they are also wards of the state; they would struggle to exist at all in their modern form without the implicit backing of the taxpayer.

When things go wrong, as happened in spectacular form fifteen years ago, the public purse will always be on the hook to bail them out. If the authorities refuse, the whole economy goes down the pan. Ministers have little choice in the matter.

This inevitably makes the banking sector subject to a very high degree of political direction, regulation and interference. It is no exaggeration to say that Western economies couldn’t really exist in their current form without the public utility-like services their banking sectors provide.

Three core functions spring to mind. One is the original purpose of a bank – that of simply providing a safe deposit box for your money. Other than keeping it under the mattress, there are few alternatives.

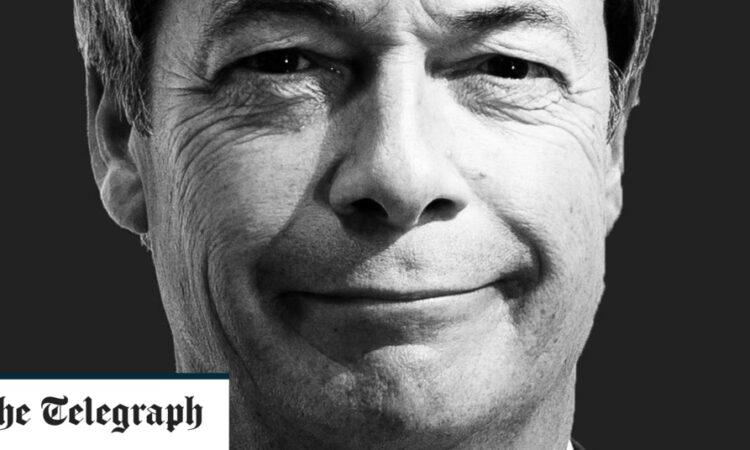

Banks also act as the nation’s payments system. As Nigel Farage has pointed out, it is pretty much impossible to function in today’s world without a bank account.

Long gone are the days when cash alone might enable you to get by. Many businesses won’t any longer even accept physical cash as payment.

And third, banks are at the heart of so-called “maturity transformation” – that is borrowing short and lending long. This, by the way, is what makes them so potentially hazardous; if the process is mismanaged, then the bank goes under and everyone loses their money. Yet if they didn’t do it, there would be no credit, and the economy would remain marooned in the pre-industrial age.

So what, to put the question succinctly, is a bank? Is it a public utility, wholly answerable to the shifting sands of political and public opinion, or is it a commercial enterprise? It is fifteen years since the financial crisis, but as the Nigel Farage affair has demonstrated anew, we still struggle to answer this question.