Banks in Greece, Portugal, Italy and Spain registered strong share price returns in the 2023 first quarter despite a sell-off in European bank shares fueled partially by the upheaval at Credit Suisse Group AG.

Greek lender Piraeus Financial Holdings SA delivered a share price return of nearly 39%, the second-highest among a sample of major European banks, S&P Global Market Intelligence data shows. National Bank of Greece SA and Eurobank Ergasias Services and Holdings SA had total shareholder returns of roughly 18% and 14%, respectively.

Banco Comercial Português SA, or Millennium BCP, recorded the third-biggest share price return, at more than 33%, followed by Italian lender UniCredit SpA with about 29.5%.

Spain-based Banco Santander SA and Banco Bilbao Vizcaya Argentaria SA and Italy’s BPER Banca SpA logged increases of between 20% and about 13.7%.

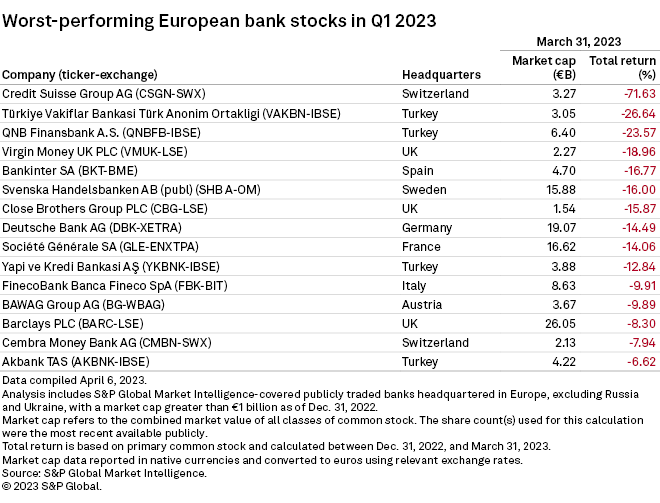

Market jitters about the stability of the global financial sector following bank collapses in the US marked the first quarter of the year. This was compounded by growing worries about Credit Suisse, culminating ultimately in its forced takeover by Swiss rival UBS Group AG in March. Credit Suisse registered a negative return of 72% over the three-month period.

Three of Turkey’s largest banks, which registered some of the highest share price returns in 2022 on the back of higher profits and a boom in local equity markets, registered negative returns in the quarter. Türkiye Vakiflar Bankasi TAO booked a negative return of 27%, while Yapi ve Kredi Bankasi AŞ and Akbank TAS recorded negative returns of 13% and 7%, respectively.

Deutsche Bank AG had a negative return of 14.5%, as its shares fell sharply days after Credit Suisse’s rescue. Spain’s Bankinter SA, France’s Société Générale SA and UK-based Barclays PLC also fared poorly.

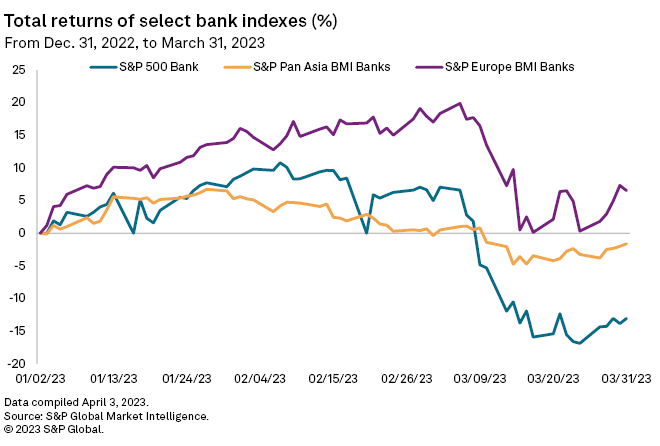

On an aggregate basis, European bank stocks have outperformed their US and Asian counterparts. The S&P Europe BMI Banks index rose 6.5%, while the S&P 500 Bank index fell 13.1% and the equivalent Asian index dipped 1.6%