Some of Europe’s biggest banks are facing steep losses after lending billions of euros to Austrian billionaire Rene Benko’s property empire.

Analysts at JP Morgan calculate that the two main companies in Mr Benko’s sprawling Signa group have borrowed a combined €7.7bn (£6.6bn) from banks on the continent, with several of his backers lending him hundreds of millions each.

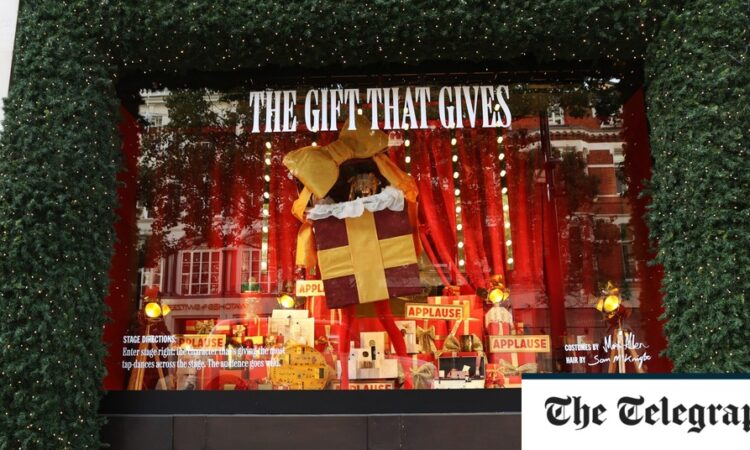

Signa swooped on Selfridges last year in a £4bn deal, teaming up with Thailand’s Central Group. Central sought to tighten its ownership of the prestigious retailer a fortnight ago as Signa’s financial troubles deepened.

It is estimated that €1.8bn of Signa’s debts alone are due to be repaid this year, though hopes of that happening are fading rapidly. Last week, a Vienna court declared the business insolvent as its search for a cash lifeline became increasingly desperate. The company faces an immediate funding requirement of €600m, according to reports.

JP Morgan estimates that the total financial liabilities of Signa Prime and Signa Development, the two largest entities in the group, stands at €13bn. In addition to €7.7bn of loans, the company owes €1.6bn to bondholders and has €1.8bn of so-called hybrid capital, usually made up of equity and debt, outstanding. A further €2bn is owed to various creditors.

Among those most exposed is the Austrian bank Raiffeisen, which is thought to have lent Signa more than €750m, and the Swiss lender Julius Baer, which is reportedly on the hook for €640m. Italy’s Unicredit, Credit Suisse, and Germany’s Commerzbank are also believed to be facing heavy losses.

Signa’s troubles could trigger the fire sale of the century as creditors seek to minimise potential losses. It has hoovered up department stores, skyscrapers, office blocks and scores of other commercial properties since being founded by Mr Benko, 46, in 2000.