The Bank of England’s top economist has suggested there are still worries about lingering price rises in the UK, even though inflation returned to its target level in May.

Huw Pill however said it is fair to say that interest rates will be cut, it is just a case of when.

The chief economist, who is also a member of the Bank’s interest rate-setting committee, spoke at Asia House in London on Wednesday.

It is the second speech to be given by a policymaker since the end of the UK’s General Election campaign period.

Mr Pill said it is “welcome news” that the headline Consumer Prices Index (CPI) inflation rate returned to the Bank’s 2% target in May.

“But the MPC’s (Monetary Policy Committee’s) remit makes clear that the inflation target holds at all times,” he said.

“It is not enough to meet the target in a transitory or fleeting way.

“Rather the MPC must achieve the inflation target on a lasting and sustainable basis.”

Mr Pill said that forecasting inflation can be difficult, particularly in the face of “shocks” to the UK economy, therefore making it harder for experts to make monetary policy decisions.

But the economist said it is “hard to dispute that inflation persistence in the UK continues to prove – well, persistent”.

“This all said, in the absence of any big new shocks, the ‘when-rather-than-if’ characterisation of prospective Bank rate cuts still seems appropriate.”

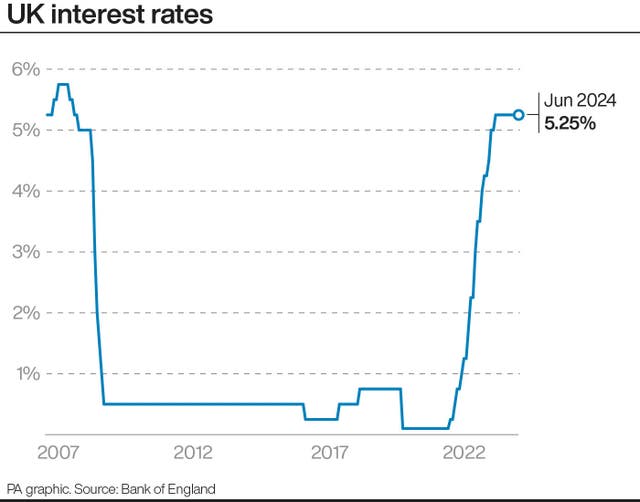

The Bank of England voted to hold interest rates at 5.25% at its latest meeting last month.

But it revealed that the vote had become increasingly “finely balanced”, particularly when it came to assessing certain factors putting more pressure on inflation.

These have been highlighted as services inflation, wage growth and tightness in the labour market – which Mr Pill said have “hinted towards some upside risk” in his assessment of inflation persistence.

Fellow rate-setter Jonathan Haskel said on Monday that interest rates should be held steady next month until the Bank can be certain that factors putting pressure on inflation have disappeared.