The Bank of England’s next decision on interest rates sits on a “knife-edge”, experts have said, as borrowers wait to see if costs will be cut for the first time since the pandemic.

The decision could impact on millions of homeowners with variable rate mortgages, or taking out new home loans, and on renters if landlords pass on any cut into lower rent.

Given the sky-high property prices and rents in London, interest rate changes can have a disproportionate impact on the capital.

Economists are split over whether the Bank’s policymakers will decide it is the right time to reduce rates on Thursday.

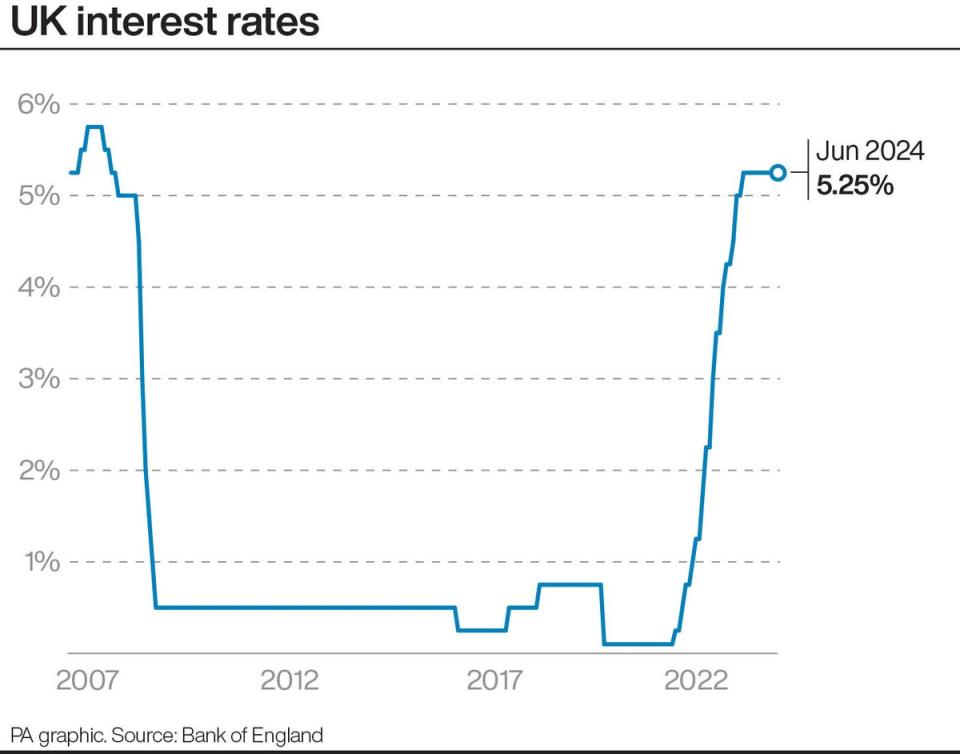

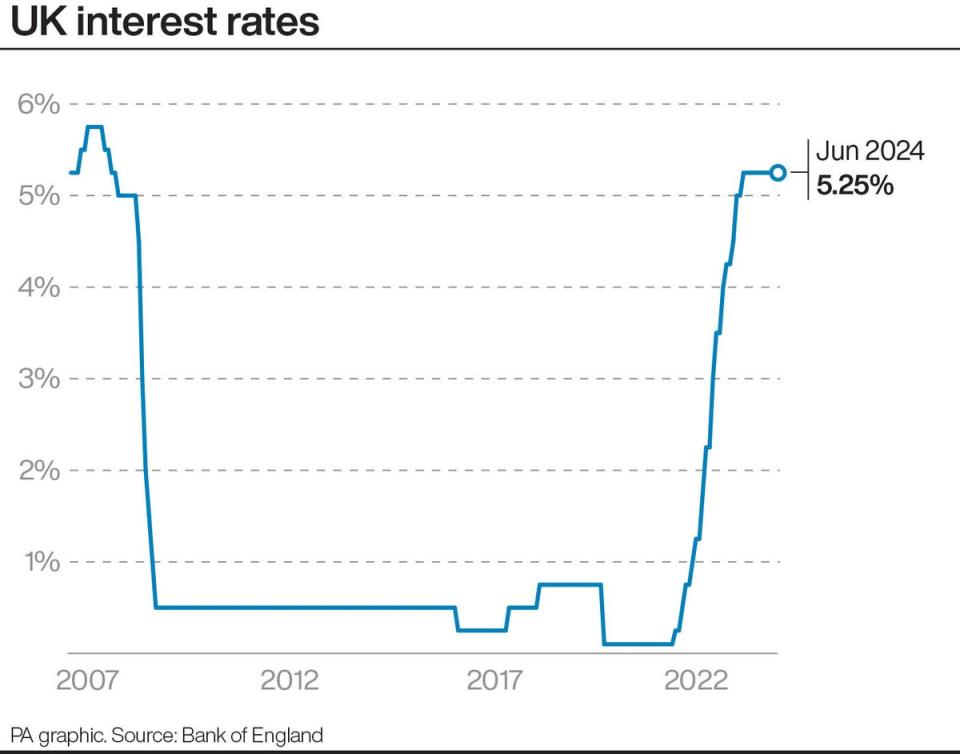

The UK’s base rate has been held at 5.25 per cent since August last year as part of the central bank’s task to put a lid on unruly inflation.

The bottom line is that there is just about enough in the recent data to give the Bank confidence to begin lowering rates

James Smith, economist for ING

But with inflation hitting the Bank’s two per cent target level for the past two months, hopes have been raised that rates can start to be reduced, easing the pressure on borrowers.

If so, it would mark the first time that UK rates have been cut since the onset of the Covid-19 pandemic in March 2020.

James Smith, developed market economist for ING, said it will be a “close call” but he expects a majority of policymakers to vote in favour of a 0.25 percentage point rate cut on Thursday.

He said services inflation – which looks only at service-related industries such as hospitality and culture – is the “guiding light for Bank of England policy right now”.

“More recently, services inflation has been propped up by a spike in hotel prices,” he said, suggesting that the Bank could be less concerned by the “highly volatile” nature of the data.

“The bottom line is that there is just about enough in the recent data to give the Bank confidence to begin lowering rates,” Mr Smith concluded.

Sanjay Raja, senior economist for Deutsche Bank, also predicted that rates will be cut to 5% but stressed it will be a “delicate balance”.

“With the bank rate held steady for the better part of a year now, risk management considerations may be shifting from having done ‘too little’ to ‘too much’,” he said.

The economist expects governor Andrew Bailey to be among the members on the Monetary Policy Committee (MPC) opting for a rate cut.

On the other hand, Andrew Goodwin, chief UK economist at Oxford Economics, said he thinks the MPC could hold rates at 5.25 per cent for another month.

The MPC hasn’t gone against the market consensus since November 2021

Andrew Goodwin, Oxford Economics

This is partly because financial markets are leaning towards a September cut, and the Bank may want to avoid “surprising” investors.

“The MPC hasn’t gone against the market consensus since November 2021,” Mr Goodwin said.

“Though not completely beholden to markets, we think the MPC would prefer to take markets with them rather than take them by surprise, particularly if there is little urgency.”

Experts at Pantheon Macroeconomics agreed that policymakers will keep rates on hold in August but “signal they expect to cut rates in the coming months”.

“The swing voters — Andrew Bailey, Clare Lombardelli and Sarah Breeden — have not spoken since the General Election, which could suggest they are not ready to take the plunge,” Pantheon’s economists said.