(Bloomberg) — The Bank of England breathed fresh life into hopes for an imminent cut in interest rates, hinting that more of its officials may be close to backing a pivot away from the highest borrowing costs in 16 years.

Most Read from Bloomberg

Investors priced in more than a 50% chance of a move in August, the first time in more than a month they’ve been so certain. The UK central bank left the key rate on hold at 5.25% on Thursday, but said the decision not to ease was “finely balanced” for some of the nine members on the Monetary Policy Committee.

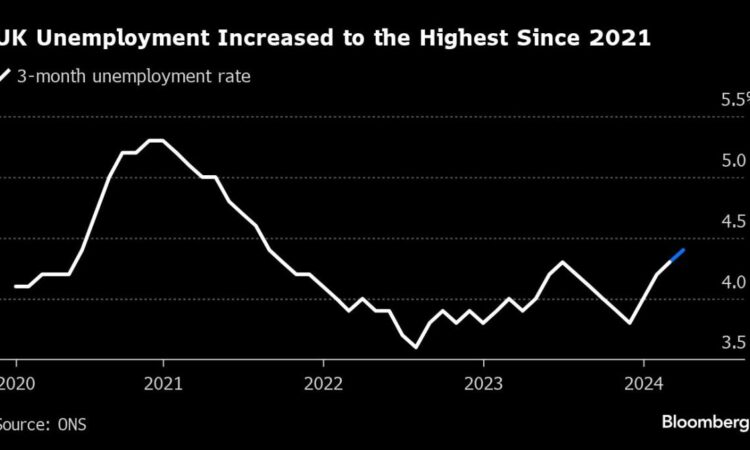

Governor Andrew Bailey said it was “good news” that inflation fell back to its 2% target for the first time in almost three years but that officials wanted to be sure that pressure on prices is subdued before acting. With price pressures cooling and unemployment rising, there’s more speculation that the bank can step back from a rates policy designed to weigh down on demand.

“This is clearly a dovish hold,” said Neil Jones, a foreign-exchange salesperson to financial institutions at TJM Europe. “The narrative from Bailey suggests for some, they are close to cutting.”

The MPC voted 7-2 in favor of no change for a second consecutive meeting, with Swati Dhingra and Deputy Governor Dave Ramsden both backing a reduction again. However, there were divisions among the majority about the importance of recent data that showed surprisingly strong services inflation, according to minutes of the meeting released by the BOE in London.

The minutes suggest that three members of the MPC, possibly including Bailey, may be close to cutting rates that have been on hold since last September. Recent comments suggest that Bailey and Deputy Governors Sarah Breeden and Ben Broadbent may be in this camp, though Broadbent leaves the committee this month.

While the formal guidance to investors was unchanged, the language from some rate-setters on the latest decision being on a knife-edge could lead to more backing a reduction in August.

What Bloomberg Economics Says…

“The Bank of England is edging closer to a rate cut. The lack of obvious alarm about recent inflation surprises suggests an August move is firmly on the table.”

—Dan Hanson and Ana Andrade, Bloomberg UK economists. Click for the REACT

Minutes of the meeting said some members believed that recent data “did not alter significantly the disinflationary trajectory that the economy was on.” That would suggest BOE officials are increasingly comfortable that they can start to reduce rates, which the MPC says is weighing heavily on the economy.

Others noted the risks from stubborn domestic price pressures in the services sector despite headline inflation falling to the BOE’s 2% target for the first time in almost three years in May.

“The fact that for some members who voted to keep rates on hold ‘the policy decision at this meeting was finely balanced’ suggests that it wouldn’t take much of a slowdown in wage growth or services inflation to convince them to vote for a rate cut in August,” said Thomas Pugh, economist at RSM UK.

Traders saw the statement as a signal that the BOE was willing to cut in coming months and moved to price more than a 50% chance of a reduction in August, from 32% before the meeting. Markets also increased the amount of easing expected for the year to almost two quarter points.

“The MPC looks to be gearing up for a late summer cut,” said Matthew Landon, global market strategist at JPMorgan Private Bank. “Whether that comes in August or September, the market will likely need to bring forward some expected easing and push yields lower.”

Bonds rallied and the pound slipped as the market adjusted its expectations. The yield on two-year gilts — among the most sensitive to changes in monetary policy — fell as much as 5 basis points to 4.13%, the lowest since the end of March. The pound traded 0.3% weaker to $1.2680.

“August meeting could remain volatile as there is still a lot of data that markets will see ahead of the next meeting,” said Pooja Kumra, the head of European rates strategy at TD.

Not everyone is convinced that a cut in August is a done deal. The market still has to wade through next month’s inflation report, wage data and PMI report — all of which could rekindle concerns over the outlook. While inflation is back at the BOE’s 2% target, both services inflation and wage growth remain too strong.

Bailey, speaking for the committee, introduced a note of caution in explaining why the panel opted for no change this month.

“We need to be sure that inflation will stay low and that’s why we’ve decided to hold rates at 5.25% for now,” Bailey said in a brief statement.

Why Aren’t UK Interest Rates Falling With Inflation?: QuickTake

It was the only comment from a BOE policymaker since Prime Minister Rishi Sunak called an election for July 4. BOE rate-setters have been silent during the campaign, meaning investors went into the June meeting with little insight from officials about how recent data surprises are affecting thinking on Threadneedle Street.

While BOE officials have sounded increasingly sanguine about inflation receeding and their ability to reduce rates, markets have swung wildly in the past few months about the timing of action.

At the start of the year, they priced in as many as six quarter-point cuts this year, but more recently investors bet on no change until November. That reflected higher-than-expected inflation prints in the US and UK over the past few months — and the absence of BOE remarks since Sunak called the election.

Bailey was seen as one of the rate-setters closer to cutting interest rates before hopes of a June reduction were dashed by stronger underlying inflation readings and the election.

While inflation fell to the BOE’s 2% target, market bets on rate cuts in 2024 have retreated in recent months after stickiness in wages and services prices — key indicators being watched by policymakers.

A move in August would put the BOE closer to the timing of the European Central Bank — which started loosening policy earlier this month. Traders expect the US Federal Reserve to wait until later in the year, while central banks in Canada and Switzerland have also started to reduce borrowing costs.

The BOE said it expects GDP growth to be much stronger in the second quarter after the sharp rebound from last year’s recession. It now forecasts growth of 0.5% in the second quarter, up from its May forecast of 0.2%, continuing the strong start to the year.

That upgrade is based on business surveys. While the UK economy bounced back from last year’s recession in the first quarter with solid growth of 0.6%, data for April showed the recovery grinding to a halt. Private sector forecasters expect a pick-up from the 0.1% growth in 2023 to a still-anemic 0.7%.

“We expect the MPC to cut rates in August, but this is not a done deal,” said Alpesh Paleja, interim deputy chief economist at the CBI. “They remain very data-driven, so the evolution of key indicators over the coming month will be key. Furthermore, the pace of any rate cuts beyond August is likely to be gradual.”

–With assistance from Alice Atkins, James Hirai, Aline Oyamada and Alice Gledhill.

(Updates with market reaction and comment from the first paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.