The Bank of England (BoE) is widely expected to hold interest rates at a 15-year high of 5.25% on Thursday with the burning question becoming: How long they will stay high?

UK headline inflation indicators such as CPI and data on wage increases are falling but BoE rate-setters have warned Threadneedle cannot afford to be complacent.

Governor Andrew Bailey has said that it was “far too early” to be thinking about rate cuts.

“We do have to get [inflation] down to 2% and that’s why I have pushed back of late against assumptions that we’re talking about cutting interest rates,” he said.

Read more: UK households expect Bank of England to hike interest rates in 2024

Sanjay Raja, a senior economist at Deutsche Bank, expects to stay the course on Thursday: “We aren’t expecting many fireworks when the Bank meets for the final time in 2023. A hold, with the base rate at 5.25% seems very likely.”

The central bank hiked interest rates in 14 consecutive meetings until they peaked at 5.25%. The Monetary Policy Committee then decided to pause the hike-cycle, leaving rates unchanged in the September and November meetings.

Martin Beck, chief economic advisor to the EY Item Club, said little has changed since the previous rate decision to bring about a different result.

“December’s MPC meeting will almost certainly prove the third in succession to deliver no change in interest rates,” he said.

“There’s been nothing in the way of significant economic surprises over the last four weeks and inflation and pay growth have slowed (the former by more than the Bank of England expected).”

But with inflation at 4.6% and falling toward the BoE’s official 2% target from its peak over 11%, analysts are expecting rates to come down in the first half of 2024.

Matthew Ryan at financial services firm Ebury said it was likely the Bank would use this week’s decision to cool growing hopes on a reduction by June.

Read more: Interest rates to remain high amid uncertain outlook for inflation, warns Bailey

“We think that the MPC will try to push back against market pricing of a full cut in the first half of 2024. The voting split among committee members will also once again be key”, he said, adding the vote breakdown “could remain unchanged this time around as the bank reinforces its stance of higher rates for longer”.

James Smith, developed markets economist at ING, also expects the Bank to reiterate its persistently tough stance on the cost of borrowing.

He said: “Markets are pricing three rate cuts in 2024 and we doubt the Bank will be too happy about that. Expect policymakers to reiterate that rates need to stay restrictive for some time.”

When will interest rates fall?

Fresh data this week showing wage growth easing from record levels fuelled speculation that policymakers at the Bank of England will need to cut interest rates before long to boost the economy.

UK economist Ashley Webb of Capital Economics said: “Overall, the labour market remains tight by historical standards, but the sharp fall in wage growth will reinforce the growing belief in markets that interest rate cuts will start sooner rather than later.”

Markets are pricing three rate cuts in 2024, according to ING, which said which is expecting a 100 basis points of cuts next year. This would bring the rate down to 4.25%.

Goldman Sachs analysts are betting on the Bank to cut interest rates from May

A poll by Reuters showed almost a third (30%) of economists are predicting the first cut to come in the second quarter of next year. Nearly 48% of economists pencilled in the first cut in the third quarter.

Read more: Bank of England not keen to cut interest rates anytime soon, Andrew Bailey suggests

Capital Economics expects Threadneedle Street to lower the interest rate to 3% by the end of 2025. Berenberg Bank predicts rates to fall to 4% by the end of next year.

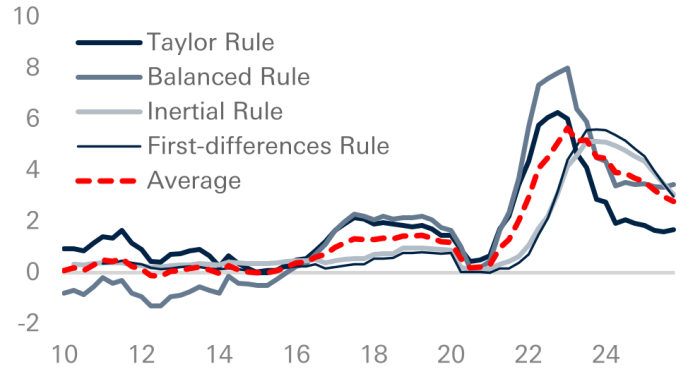

“How many rate cuts? Across our suite of policy rules, Bank Rate should theoretically come down to around 3.75% by the end of next year. By end-2025, Bank Rate is projected to drop to 2.75%. Such a speed and fall in Bank Rate wouldn’t be a big surprise to us,” Deutsche Bank analysts wrote.

CBI has broken from the market consensus by saying interest rates won’t be cut until 2026. The forecast is based on projections showing that inflation will not reach the Bank’s 2% target until the third quarter of 2025.

What about my mortgage?

The BoE’s base rate directly affects the repayments on tracker mortgages and variable rate loans and the interest charged on other financial products.

The interest rate pain is hurting mortgage holders, with the proportion of mortgage balances in arrears surging to the highest level in six years in the third quarter of this year.

Sarah Coles, Yahoo Finance UK columnist and head of personal finance at Hargreaves Lansdown, said arrears “have reared their ugly heads”.

Read more: Interest rates blamed for plunging property transactions as UK housing market cools

She added: “The pain is far from over. Given the predominance of fixed rates in the market, the squeeze on our finances caused by sharply higher rates isn’t going to come as a short, sharp shock, but as a nasty squeeze on a small section of the mortgage market each month, over a horribly prolonged period of time.

“With so many people moving from a fixed rate of less than 2% to around 6%, it’s no surprise that so many are hitting a brick wall financially.”

The Bank of England will announce its decision at noon on Thursday.

Watch: Business Lookahead: Last central bank push of 2023

Download the Yahoo Finance app, available for Apple and Android.