Barring a big surprise in February’s inflation figures, not much is expected to change when the Bank of England’s decision-makers release their latest interest rates decision on Thursday.

The Monetary Policy Committee (MPC) will meet during the week to decide if the economy is showing the signs it wants to see before starting to cut rates.

But economists say that as things look now, only one of the nine-person committee is likely to think that conditions are right for a cut.

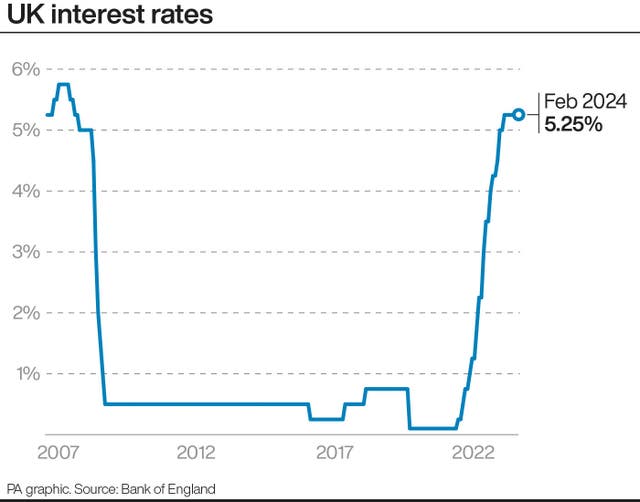

The Bank has signalled at recent meetings that cuts are likely to come in future, after rates have either been hiked or kept unchanged at every meeting for the last four years.

In February when the group met, only one of them, Swati Dhingra, voted to cut rates, two voted for a rise, but the rest said they should stay at 5.25%.

Robert Wood, chief UK economist at Pantheon Macroeconomics, said he expects the same vote this time.

“The MPC focuses on the ‘tightness of labour market conditions, wage growth and services price inflation’ to judge ‘how long Bank Rate should be maintained at its current level’,” he said.

“We think the data have not surprised enough to trigger a change in guidance at the MPC’s meeting on March 21.

“The Bank will continue signalling rate cuts, but with little new as regards timing. We expect the same 1-6-2 (cut-hold-hike) vote as last month.”

Since that last meeting, gross domestic product (GDP) data for December showed that the UK’s economy contracted 0.3%, pushing it into a recession.

That was worse than the 0.0% move that the MPC had expected.

Both unemployment and Consumer Prices Index inflation have also been lower than the MPC expected in its February forecast.

Mr Wood said: “Overall, the data since the MPC’s last meeting confirm – rather than challenge – its forecasts.

“That is all that is needed for the BoE to remain on course for summer rate cuts.

“In February, the MPC forecast inflation would fall to 1.4% at the two-year forecast horizon if it kept interest rates restrictive at 5.25%. Policymakers just need the confidence to trust those forecasts.”

On Wednesday new Consumer Prices Index inflation figures for February will be released by the Office for National Statistics.

The Bank will have these figures before making its decision.