The crisis-hit tech company behind the NHS GP at Hand app has laid off hundreds of US employees and hired Wall Street banks to run a firesale as it scrambles to save the business.

The Telegraph understands that Babylon Health has called in Bank of America and long-running advisers Citi to try to rescue the business. Deloitte is also advising the company.

Babylon laid off hundreds of US-based staff last week as it pulled the plug on its America business, sources said, which employed in excess of 300 people.

The health technology company, which works with the NHS, has suffered a share price collapse and was left fighting for survival after a merger deal to rescue the business fell apart last week.

A deal to combine Babylon and MindMaze, a Swiss mental health company, was called off. The transaction had been proposed by Albacore, a lender to which Babylon owes more than $300m (£236m).

Babylon is now facing a cash crunch. Last week, it warned it may not be able to secure enough cash “to fund the operations of the group’s business”. On Friday, it reported it had burned through a further $84m in the three months to June, compared to $113m a year earlier.

In the UK, Babylon’s GP at Hand app is used by the NHS in Fulham, serving 100,000 patients. It is hunting for a buyer for its UK business and is still trying to sell a Califorian private medical practice it owns. Its Babylon app division in the US has closed.

Last Monday, the company warned its divisions risked administration in the UK or bankruptcy in the US if they failed to secure a cash injection or find a buyer. It is understood day-to-day operations in Britain continue as normal and a source said it remained in talks with potential investors.

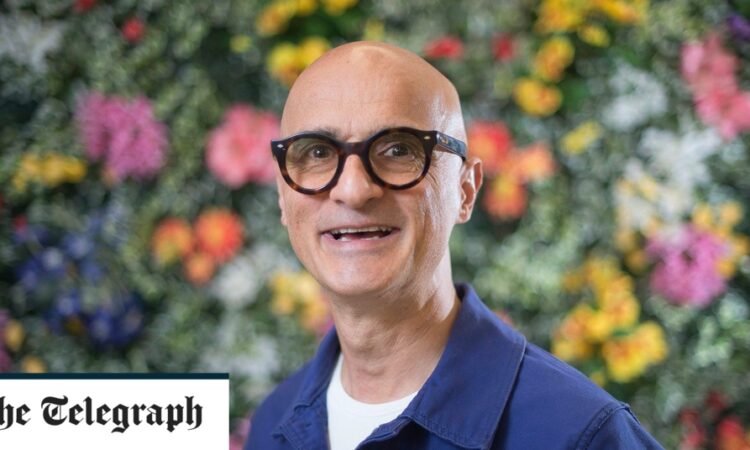

Babylon went public in a $4.2bn reverse merger in 2021 as the pandemic drove demand for telemedicine. The deal made its founder, the former Circle Health boss, Ali Parsa, a paper billionaire.

Shares have since plunged more than 99pc, however, amid heavy losses. Any rescue will almost certainly see shareholders left with nothing.

Last month Per Brilioth, managing director of VNV, a major investor in Babylon, said it had completely written off its stake. Mr Brilioth said the loss was “enormously painful” and “a bullet, a scar that will hurt for a long time”.

Bank of America, Citi and Deloitte declined to comment. Babylon and Albacore did not respond to requests for comment.