In 2023 the ECB consolidated progress in its fight against inflation in the euro area. The year began with headline inflation still close to record highs. The negative effects of earlier supply and demand shocks, while easing, were still driving up prices. But two key developments paved the way for inflation to decline sharply during the year.

First, the effects of the past shocks began to fade. Energy prices, which had spiked as a consequence of Russia’s unjustified war against Ukraine, fell steeply, and global supply bottlenecks further eased. The drop in energy prices, in particular, accounted for half of the decline in inflation in 2023. Second, the ECB continued to tighten monetary policy, which helped to lower inflation further by dampening demand. Altogether, from January to September, we raised interest rates by an additional 200 basis points.

In doing so, we continued to follow a data-dependent approach to rate decisions given the highly uncertain environment. To calibrate accurately how far rates needed to rise, we introduced three criteria: the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission. By September, we saw the inflation outlook improving and monetary policy being transmitted forcefully. But underlying inflation remained elevated and domestic price pressures were strong.

We decided on this basis that the key ECB interest rates had reached levels that, if maintained for a sufficiently long duration, would make a substantial contribution to the timely return of inflation to our target. At the same time, we committed to holding rates at these levels for as long as necessary, while continuing to follow a data-dependent approach, based on the same criteria, to determine the appropriate level and duration of restriction.

In parallel, we advanced the normalisation of the Eurosystem balance sheet to ensure it remained consistent with our overall stance. It fell by over €1 trillion in 2023, with a large part of this decline due to maturing and early repayments under our targeted longer-term refinancing operations. We also concluded reinvestments under our asset purchase programme as the year progressed. And, in December, we announced the gradual phasing-out of reinvestments under the pandemic emergency purchase programme.

While we were consolidating progress in the fight against inflation, we advanced our work on taking account of climate-related risks within our tasks. In March we published the first climate-related financial disclosures of the Eurosystem’s corporate sector holdings. The carbon intensity of our corporate asset reinvestments fell by around two-thirds in the 12 months from October 2022 when we had started tilting them towards issuers with a better climate performance.

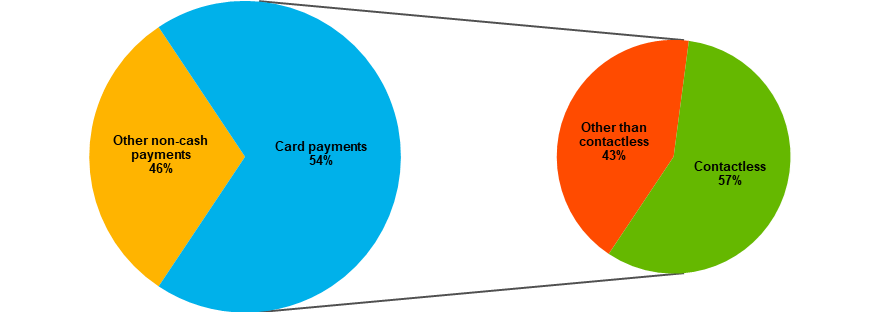

In 2023 we saw considerable progress in another area crucial for our work: payments. We launched our new T2 wholesale payment system in March. T2 contributes to the harmonisation and efficiency of Europe’s financial markets, introducing a new real-time gross settlement system – which replaces the TARGET2 system that had been in operation since 2007 – and streamlining liquidity management of central bank money.

We also launched the preparation phase of the digital euro project. This phase started in November after a fruitful two-year investigation phase, and will lay the foundations for the potential issuance of a digital euro. A digital euro would complement cash, not replace it. Cash remains the most frequently used means of payment among euro area citizens, and a clear majority consider it important to have the ability to pay in cash.

This is in part why the ECB is preparing a new series of euro banknotes – the most tangible, visible symbol of European unity. The Governing Council selected “European culture” and “Rivers and birds” as two potential themes for this new series, based on the outcome of two public surveys carried out in the summer of 2023. Looking ahead, European citizens will have the chance to express their preferences on a shortlist of possible designs, with the ECB expected to decide on the final designs in 2026.

In a year that marked the 25th anniversary of the ECB, we celebrated the arrival of Croatia in the euro area. Croatia’s adoption of the euro in January brought the number of countries in the euro area to 20 – almost double the number when the single currency was first launched. The euro area’s expansion reflects the continued attractiveness of our monetary union in an increasingly unpredictable world. In 2023 people’s support for the euro remained close to record high levels.

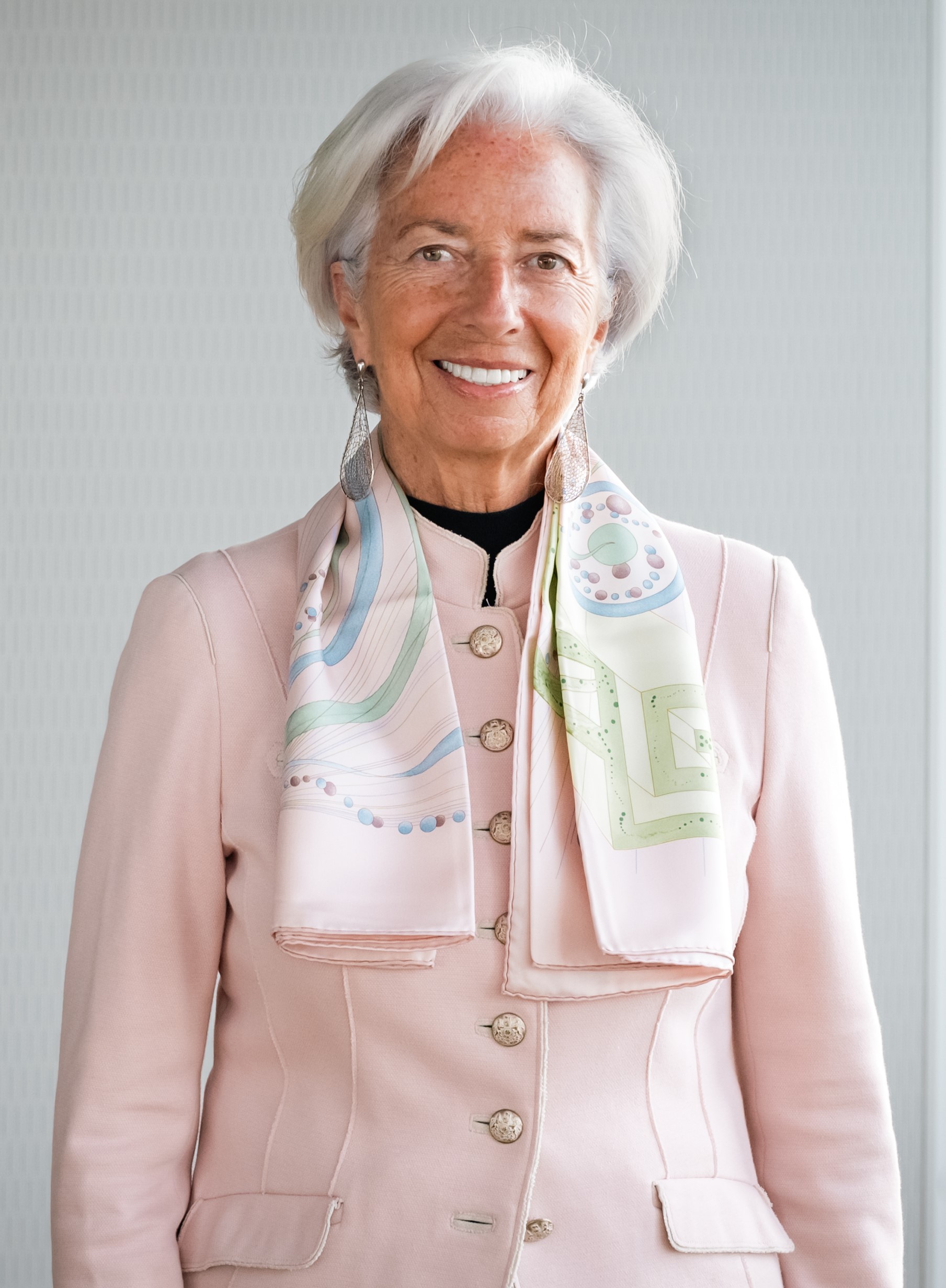

All this could not have been done without the hard work and the dedication of ECB staff to our mission: maintaining price stability for the people of the euro area. It is an honour to lead them and this institution.

Frankfurt am Main, April 2024

Christine Lagarde

President

The global economy fared better in 2023 than initially expected, continuing to expand at a moderate pace. The expansion was driven mainly by economic growth in emerging market economies and the United States, while most other advanced economies were more strongly affected by tight financing conditions and considerable geopolitical uncertainty. Global inflation declined markedly as energy commodity prices fell, while underlying price pressures remained elevated. The euro strengthened in nominal effective terms and against the US dollar.

In the euro area economic growth weakened in 2023. The industrial sector was particularly affected by tighter financing conditions, high input costs and weak global demand, whereas the services sector was initially still supported by lingering effects from the post-pandemic reopening of the economy. While the ECB’s interest rate tightening was transmitted forcefully to economic activity, the labour market remained fairly resilient. Euro area governments continued to wind down support measures adopted in response to the pandemic, energy price and inflation shocks, reversing part of the previous fiscal loosening. Headline inflation declined sharply in the euro area, helped particularly by energy inflation dropping into negative territory as the strong energy price surges of 2022 unwound. Underlying inflation also started to moderate, underpinning a general disinflationary process and reflecting the fading impact of past shocks and the increasing effects of tighter monetary policy. However, domestic price pressures replaced external pressures as the most important inflation drivers, as the labour market supported strong nominal wage developments, with workers seeking compensation for past inflation-induced losses in purchasing power.

1.1 Global economic activity expanded at a moderate pace as headline inflation declined

Global economic growth was moderate in the face of monetary policy tightening and high uncertainty

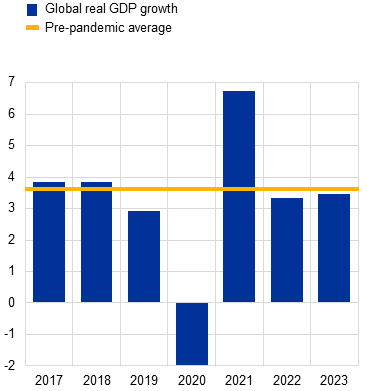

The global economy continued to expand at a moderate pace in 2023, with growth remaining broadly unchanged from 2022 at 3.5% (Chart 1.1).[1] Although subdued in a historical comparison, growth was higher than expected at the start of the year, supported by strong labour markets and buoyant demand for services despite continued monetary policy tightening.[2] The global economy was driven mainly by activity in emerging market economies and the United States, while in most other advanced economies tight financing conditions and the prolonged effects of geopolitical factors on energy prices weighed more materially on demand. In the United States, the economy was more resilient than expected, on the back of robust domestic demand and a strong labour market. Turmoil in the US financial sector at the beginning of the year did not have a significant macroeconomic impact. In China, an economic rebound at the beginning of the year, following the relaxation of highly restrictive pandemic-related measures in December 2022, was ended by a renewed slump in the housing sector as well as weak domestic and external demand. The Chinese economy nonetheless achieved the government’s stated growth target of around 5%.

Chart 1.1

Global GDP and its composition

|

a) Global real GDP growth |

b) Composition of global growth |

|---|---|

|

(annual percentage changes) |

(percentage point contributions) |

|

|

Sources: ECB, ECB staff calculations and ECB staff macroeconomic projections, March 2024

Notes: “Global GDP” excludes the euro area. The pre-pandemic average is for the period from 2012 to 2019. Values for 2023 are estimates based on available data and the March 2024 ECB staff macroeconomic projections.

Global trade momentum weakened as consumption patterns normalised after the pandemic

Global trade was weak in 2023, as import growth slowed to 1.2%, well below the previous year’s growth rate of 5.5% and the pre-pandemic average of 3.1%.[3] The slowdown reflected three major trends. First, global demand moved back from goods towards services as pandemic-related restrictions were fully phased out. Second, the share of consumption, which is generally less trade-intensive than investment, in domestic demand increased. Finally, emerging market economies, where trade responds less to changes in economic activity, made a larger contribution to global activity in 2023. Despite increasing trade barriers and business survey results suggesting possible value chain relocation, evidence of fragmentation in aggregate trade flows has so far remained limited.

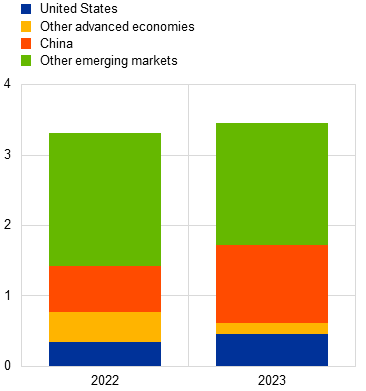

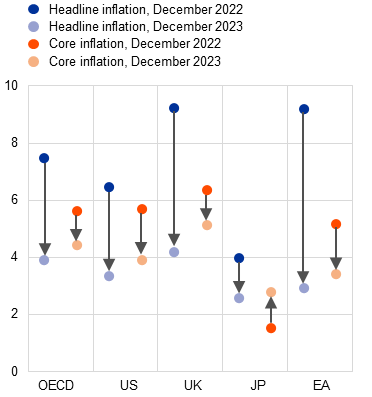

Inflation declined but underlying price pressures remained elevated

Annual headline consumer price index (CPI) inflation across OECD member countries excluding Türkiye declined from high levels during 2023, brought down by lower energy prices. It fell to 3.9% in December, and for the whole of 2023 stood at 5.3%, compared with 7.3% in 2022 (Chart 1.2, panel a). Inflation excluding energy and food also declined, but to a much lesser extent, indicating that underlying price pressures remained strong and broad-based. This was particularly evident in advanced economies, where tight labour markets contributed to high wage growth rates, making services price inflation more persistent (Chart 1.2, panel b).

Chart 1.2

OECD headline and core inflation rates

|

a) Headline inflation and its main components |

b) Inflation in major economies |

|---|---|

|

(annual percentage changes, monthly data) |

(annual percentage changes, monthly data) |

|

|

Sources: National sources via Haver Analytics, OECD and ECB staff calculations.

Notes: EA: euro area. OECD inflation excludes Türkiye and is computed on the basis of national CPIs and annual private final consumption expenditure weights expressed in purchasing power parity terms. Core inflation excludes energy and food. The latest observations are for December 2023.

Energy commodity prices declined as low demand outweighed supply constraints

Energy commodity prices declined throughout 2023 as a result of lower demand. Oil prices fell by 4%, as weak demand for oil from advanced economies outweighed the increase in demand that followed the relaxation of lockdown measures in China. Low oil demand also more than offset the effects of supply cuts by the OPEC+ group as well as the risks to supply from geopolitical factors including the sanctions on Russia and the conflict in the Middle East. The fall in European gas prices was substantially larger, as gas prices continued the decline that started towards the end of 2022 and were reduced by another 58% in the course of 2023. European gas consumption remained below historical norms as a result of lower industrial demand, reduced gas consumption among households and mild weather in the winter months. The stable supply of liquified natural gas (LNG) also allowed European countries to start the heating season with full gas storage. Despite greater stability in the European gas market compared with the previous year, supply risks, such as strikes at Australian LNG terminals, continued to cause periods of high price volatility, illustrating the sensitivity of the European gas market during the transition away from Russian gas imports.

The euro strengthened in nominal effective terms and against the US dollar

The euro strengthened in nominal effective terms (+3.9%) and against the US dollar (+3.4%) on the basis of year-end data, amid notable intra-year fluctuations. The exchange rate dynamics were primarily influenced by evolving market expectations resulting from shifts in monetary policies and volatile economic outlooks. Initially bolstered in the first half of the year by improved macroeconomic conditions in the euro area and a faster pace of monetary policy tightening, the euro started to depreciate against the US dollar in mid-July. The strengthening of the dollar, which was broad-based, was attributed to positive economic data surprises and market expectations of a tighter-for-longer monetary policy stance in the United States. A reassessment of the stance towards the end of the year amid declining inflation rates resulted in a renewed appreciation of the euro. Across major trading partners’ currencies, the euro strengthened significantly against the Turkish lira, the Russian rouble, the Japanese yen and the Norwegian krone. However, it weakened against the pound sterling, the Swiss franc and the Polish zloty.

The major risks to the outlook for global economic growth at the end of 2023 included a further escalation of geopolitical tensions, a stronger slowdown in the Chinese economy and more persistent inflationary pressures that would require tighter monetary policy than anticipated. The materialisation of such risks would reduce global economic activity. Moreover, global commodity markets remained very sensitive to supply risks, which in turn could fuel inflation and weigh on global growth in the year ahead.

1.2 Economic activity stagnates in the euro area

Euro area growth weakened as the effects of higher interest rates broadened

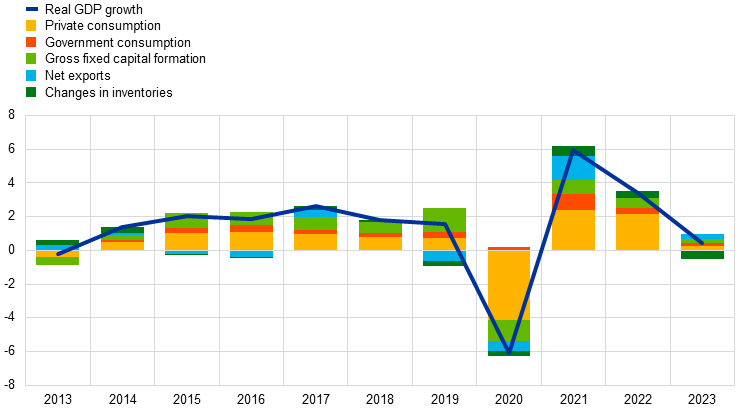

Euro area real GDP rose by 0.4% in 2023, having grown by 3.4% in 2022 (Chart 1.3). Growth reflected positive contributions from domestic demand and net trade. Changes in inventories had a dampening impact. By the end of the year output in the euro area was 3.0% above its pre-pandemic level (in the final quarter of 2019) and 1.4% above its level in the first quarter of 2022, when Russia invaded Ukraine. The slowdown in growth in 2023 was largely attributable to the economic repercussions of the war, which had varying effects across countries, reflecting their different economic structures. While the industrial sector was particularly affected by tighter monetary policy, high energy prices and weakening global demand, the services sector held up relatively well, still benefiting from post-pandemic reopening effects. However, towards the end of the year the weakness in growth dynamics broadened as the impact of higher interest rates spread across the various sectors, alongside spillover effects from the weak industrial sector to services.

Chart 1.3

(annual percentage changes; percentage point contributions)

Source: Eurostat.

Note: The latest observations are for 2023.

Consumer spending was geared more towards services than goods

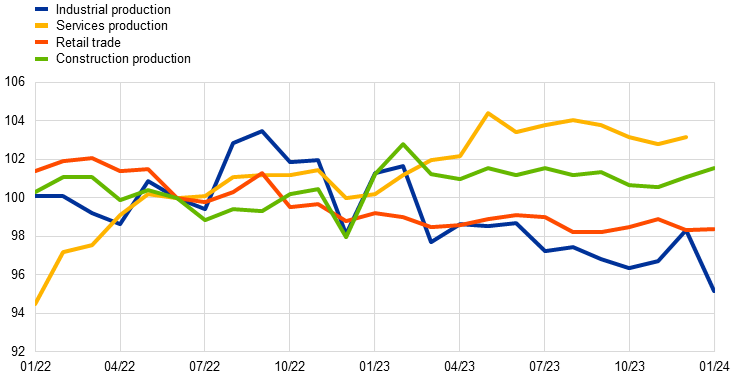

Private consumption growth weakened considerably in 2023. It stagnated in the first half of the year as the continued drop in spending on goods, as captured by retail trade volumes (Chart 1.4), offset the still positive demand for services. In the third quarter private consumption increased, driven by households’ consumption of services, which was boosted by lingering reopening effects, and the rebound in spending on durable goods. Overall spending on goods (including semi-durable and non-durable goods) continued to contract amid tighter financing conditions. Overall, household spending increased by 0.5% in 2023. Real disposable income supported household spending to some extent in 2023 as nominal wage growth increased, inflation slowed down gradually and employment growth remained resilient. Nevertheless, the transmission of tighter financing conditions to the real economy seems to have weighed on household spending, as savings remained elevated.

Chart 1.4

Euro area production and retail trade

(index: June 2022 = 100)

Sources: Eurostat and ECB calculations.

Notes: Retail trade is shown in real terms. The latest observations are for December 2023 for services production, otherwise for January 2024.

Investment was dampened by tighter financing conditions

Non-construction investment growth (a proxy for private non-housing investment) slowed throughout 2023.[4] While the first quarter of the year saw robust growth on the back of easing supply bottlenecks, the quarterly rates of increase gradually declined and investment fell in the fourth quarter, as both domestic and foreign demand weakened, backlogs dissolved, corporate profits slowed and financing conditions tightened. Uncertainty stemming from Russia’s war against Ukraine and the conflict in the Middle East among other factors likely also reduced investment incentives for firms. Nevertheless, abundant profits, ample cash reserves and a decline in indebtedness have on average strengthened corporate balance sheets over past years and contributed – along with funds from the Next Generation EU (NGEU) programme supporting digitalisation and climate-related investment – to some resilience of investment compared with other expenditure components. Overall, non-construction investment grew by 2.9% in 2023.

Construction investment broadly continued to weaken over the course of 2023. The main reason for this was the decline in residential construction investment due to high construction costs, the continued rise in mortgage interest rates and the tightening of bank lending standards, which made it more difficult for households to access finance and dampened demand for residential property. Other areas of construction, such as civil engineering, remained more resilient, supported by public infrastructure investments. At the end of 2023 construction investment was 2.1% above its pre-pandemic level, having fallen by 0.6% overall in 2023.

The euro area goods trade balance returned to surplus in 2023 amid lower prices for imported energy. Export growth remained subdued in a context of weak foreign demand. Manufacturing exports were supported by the easing of supply bottlenecks, while lingering effects from the energy supply shock and the appreciation of the euro in effective terms contributed to export weakness. The subdued export performance extended to services exports in the second half of the year, as support from pent-up demand after the reopening of the global economy was fading. As domestic demand cooled, euro area imports also declined, driven by decreasing intermediate goods imports as firms destocked and energy imports fell. Overall, the contribution from trade to euro area GDP growth was slightly positive in 2023.

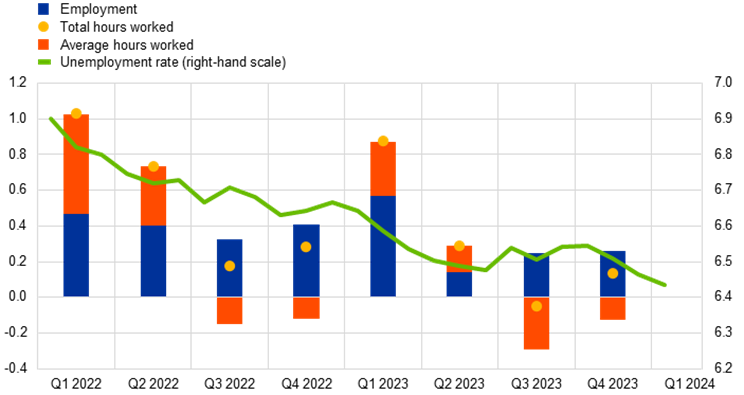

Labour market

The euro area labour market remained resilient overall in 2023, although labour market developments and survey indicators at the end of the year pointed towards a cooling down. The unemployment rate averaged 6.5% in 2023; it declined from 6.6% in January to 6.5% in March and remained broadly stable at that level for the rest of the year (Chart 1.5). Total employment and total hours worked held up well amid a stagnating economy, rising in 2023 by 1.4% and 1.6% respectively. Average hours worked increased by only 0.2% in 2023, and in the last quarter of 2023 stood 1.3% below the pre-pandemic level, likely driven by factors such as labour hoarding (i.e. companies holding on to more workers than necessary in downturns) and an increase in sick leave. The labour force participation rate in the age group 15-74 years increased to a level of 65.7% in the fourth quarter of 2023, 1.1 percentage points above its pre-pandemic level. In the second half of the year, labour demand showed some signs of softening, with the job vacancy rate still high but gradually receding from the peak reached in the second quarter of 2022. Overall, while the ECB’s interest rate increases continued to be transmitted forcefully to the economy, total employment and the euro area labour market, which is among the European Union’s objectives to which the ECB can contribute, if this is without prejudice to maintaining price stability, remained relatively resilient.

Chart 1.5

Labour market

(left-hand scale: quarter-on-quarter percentage changes; right-hand scale: percentages)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for January 2024 for the unemployment rate, and for the fourth quarter of 2023 for employment and hours worked.

1.3 Fiscal policy measures in a challenging macroeconomic environment

The euro area budget deficit ratio decreased as governments started to wind down discretionary support measures

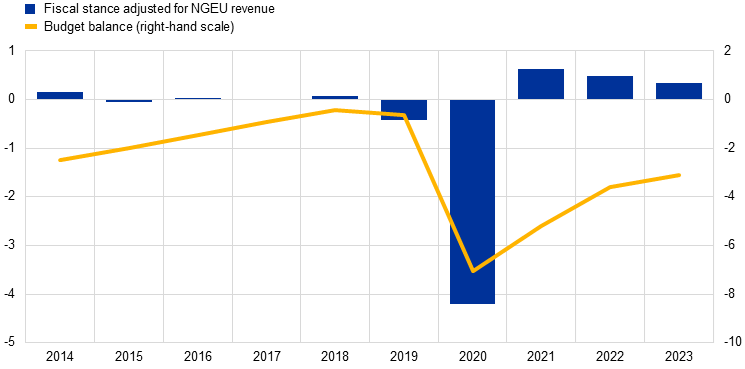

The euro area general government deficit ratio continued to decrease in 2023, following a path started at the height of the pandemic (Chart 1.6).[5] The gradual tightening of fiscal policy is also reflected in the fiscal stance, which tightened moderately in 2023 for the third year in a row.[6] However, only slightly over a third of the loosening in 2020 has so far been reversed (Chart 1.6). This means that the cyclically adjusted budget balance remains well below its pre-pandemic level, owing to lasting measures adopted in the context of the pandemic in 2020 and the energy-related support provided from 2022 onwards.

Chart 1.6

Euro area general government balance and fiscal stance

(percentages of GDP)

Sources: Eurosystem staff macroeconomic projections for the euro area, December 2023 and ECB calculations.

Note: The measure of the fiscal stance is adjusted on the revenue side from 2021 by netting out grants from the NGEU Recovery and Resilience Facility as these revenues do not have macroeconomic tightening effects.

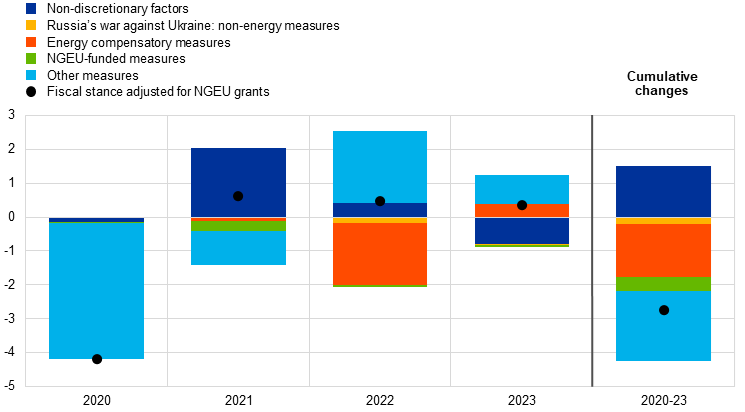

A further tightening of the fiscal stance would be appropriate

Seen from the end-2023 perspective, a challenge for fiscal authorities will be how best to reverse this cumulative expansion of the last four years (Chart 1.7) and to reduce debt ratios, particularly given that demographic developments, the green and digital transitions as well as the geopolitical environment will require fiscal room for manoeuvre in the future. The 2024 government budgets pointed towards a continuation of the fiscal tightening cycle at the euro area level. This largely reflected an unwinding of discretionary fiscal measures that had been adopted in response to the energy and inflation shocks. Such measures were estimated to have amounted to over 1% of GDP in 2023, yet only a small part of this was expected to remain in place in 2024. Notably, however, some of the expansionary measures adopted by governments during the pandemic seemed to be of a more long-lasting nature and, on the basis of the 2024 budgets, were not set to expire in the short run. This was the case for increased transfers and subsidies but to some extent also tax reductions.

Chart 1.7

Decomposition of the euro area fiscal stance and discretionary measures

(percentages of GDP)

Sources: Eurosystem staff macroeconomic projections for the euro area, December 2023 and ECB calculations.

Notes: The measure of the fiscal stance is adjusted on the revenue side from 2021 by netting out grants from the NGEU Recovery and Resilience Facility as these revenues do not have macroeconomic tightening effects. “Other measures” mainly relates to measures adopted during the pandemic and their subsequent unwinding.

A further tightening of the fiscal stance also appears appropriate from the viewpoint of monetary policy. As the energy crisis has now largely faded, governments should continue to roll back the related support measures, which is essential to avoid driving up medium-term inflationary pressures. This would otherwise call for tighter monetary policy. Besides rolling back the pandemic and energy-related measures, governments should more generally make progress towards sounder fiscal positions to ensure that public finances are on a sustainable path.

The EU needs a robust and credible framework for economic and fiscal policy coordination

A robust EU framework for economic and fiscal policy coordination and surveillance remains crucial. After extensive discussions, the Council of the European Union agreed in 2023 on a reform of the EU’s economic governance framework, which opened the way for a trilogue between the European Commission, the EU Council and the European Parliament. 2024 will be an important year to transit towards its implementation.[7]

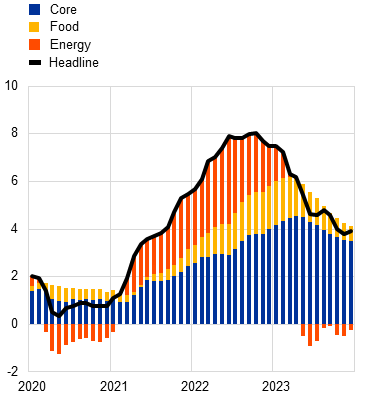

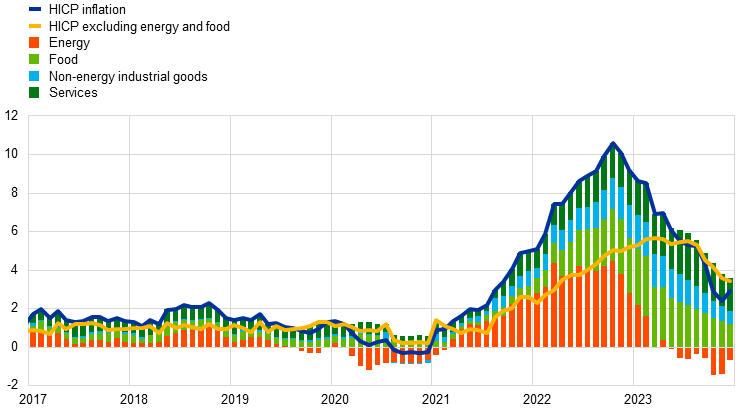

1.4 Headline inflation saw a steep decline throughout the year

Headline inflation in the euro area as measured by the Harmonised Index of Consumer Prices (HICP) was 2.9% in December 2023, a decline of 6.3 percentage points from its level in December 2022. It fell steadily throughout the year, with the disinflationary process also showing up in underlying inflation as the year progressed. In November headline inflation reached a temporary trough of 2.4%, the lowest level in more than two years (sharply down from the peak of 10.6% in October 2022) (Chart 1.8). However, inflation moved slightly higher again in December, owing to the downward effects of energy-related fiscal measures on price levels a year earlier. All major components of inflation saw declines in year-on-year inflation rates over the second half of 2023, reflecting the fading impact of previous cost shocks and weaker demand amid tighter monetary policy. However, year-on-year inflation rates (other than for energy prices) were at year-end still significantly above their longer-term averages, while annualised quarter-on-quarter rates had already moved much closer to such benchmarks. Price dynamics for goods decelerated more swiftly than those for services, as easing supply bottlenecks and input costs took considerable pressure off. Services price inflation rose until mid-year, owing to still strong post-pandemic demand, increasing labour costs, and temporary factors related to fiscal measures. With the reduction in energy and food inflation, the disparities in inflation rates across euro area countries also diminished substantially.

Chart 1.8

Headline inflation and its main components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for December 2023.

Energy inflation dropped sharply while food inflation moderated

Developments in energy prices accounted for more than half of the drop in headline inflation between December 2022 and December 2023. Energy inflation was still high in January 2023, but by year-end had declined by 25.6 percentage points into negative territory. This reflected the unwinding of the strong surges in wholesale energy prices that had taken place in 2022. However, energy inflation remained somewhat volatile, as wholesale energy markets were sensitive to events such as the conflict in the Middle East. Meanwhile, food inflation peaked at 15.5% in March 2023. It then declined substantially throughout the rest of the year, although was still over 6% towards year-end owing to the persistent impact of earlier cost shocks stemming from energy and other inputs, and to higher pressures from unit profits and labour costs.

Underlying inflation started to moderate but remained elevated at year-end

Core inflation – as measured by HICP inflation excluding the volatile components energy and food – continued to increase into the first quarter of the year, but then moderated from a peak of 5.7% to stand at 3.4% in December. This decline was initially driven by non-energy industrial goods inflation, as demand for goods weakened amid tighter financing conditions (see Section 1.2) and accumulated pressures from past supply bottlenecks and high energy costs started to dissipate. Meanwhile, services inflation hovered at high levels until August as a result of still strong demand after the reopening of the economy (for contact-intensive services sectors such as recreation and holidays) as well as rising labour costs, especially given the larger labour share in the cost structure of the services sector compared with manufacturing. Towards the end of the year, however, services inflation also fell somewhat and confirmed the general disinflationary process. Moreover the lagged dynamics in services inflation reflected the fact that many services components typically lag headline inflation (e.g. housing, postal and medical services). All other indicators of underlying inflation also moderated significantly during the year, reflecting the fading impact of past shocks and the increasing impact of tighter monetary policy, yet they continued to span a wide range and most indicators still clearly exceeded pre-pandemic levels.[8]

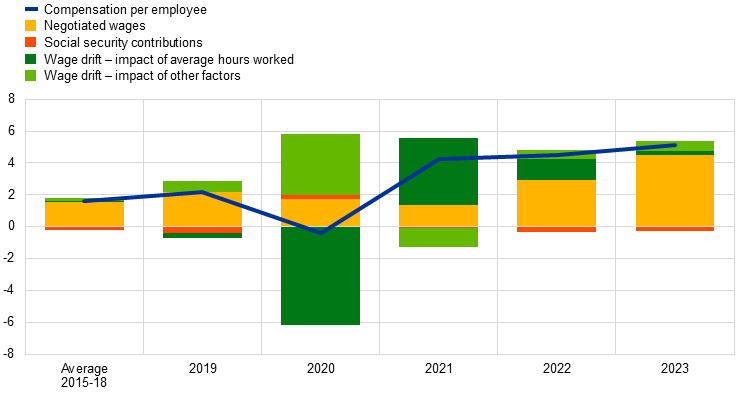

Labour costs became the most important contributor to domestic inflation later in the year

Growth in the GDP deflator (a reliable measure of domestic price pressures) was on average 6.0% in 2023. This compared with average import price inflation of -2.9%, reflecting the shift from external to domestic drivers of inflation. While profits had still played a prominent role in domestic price pressures at the turn of the year 2022/ 2023 (see Box 2), labour costs gradually became the dominant factor, given strong wage developments and a reduction in labour productivity (Chart 1.9). Annual growth in compensation per employee increased to 5.1% on average in 2023 from 4.5% in 2022, rates substantially above the pre-pandemic (2015-19) average of 1.7%, which was facilitated by still tight labour markets (see Section 1.2). The further strengthening reflected in part workers seeking compensation for past inflation-induced losses in the purchasing power of nominal wages. Growth in negotiated wages rose to 4.5% on average in 2023; the difference compared with actual wage growth implies a still sizeable wage drift component, though lower than in 2021-22.[9] Growth in both compensation per employee and negotiated wages started to edge down towards the end of the year, but their growth levels remained elevated and signalled still high nominal wage pressures going into 2024. This reflected a recovery of real wages rather than evidence of destabilising wage-price dynamics.

Chart 1.9

Euro area compensation per employee

(annual percentage changes; percentage point contributions)

Sources: Eurostat, ECB and ECB calculations.

Longer-term inflation expectations declined slightly, remaining anchored around the ECB’s 2% target

Average longer-term inflation expectations of professional forecasters, which had stood at 2.2% in late 2022, edged down to 2.1% in 2023. Other survey data, such as from the ECB Survey of Monetary Analysts and Consensus Economics, also suggested that longer-term inflation expectations were well anchored around the ECB’s 2% target. A market-based measure of longer-term inflation compensation (the five-year forward inflation-linked swap rate five years ahead) rose to a peak of 2.7% in August, but decreased to 2.3% in late December amid news of lower than anticipated headline inflation and a subdued economic growth outlook (see Section 1.2). In any case market-based measures corrected for risk premia implied “genuine” expectations very close to 2%. On the consumer side, median inflation expectations for three years ahead remained slightly above this at 2.5% in December, possibly reflecting high uncertainty, negative economic sentiment and still high price levels relative to wages.[10]

1.5 Credit and financing conditions tightened strongly as policy rates increased

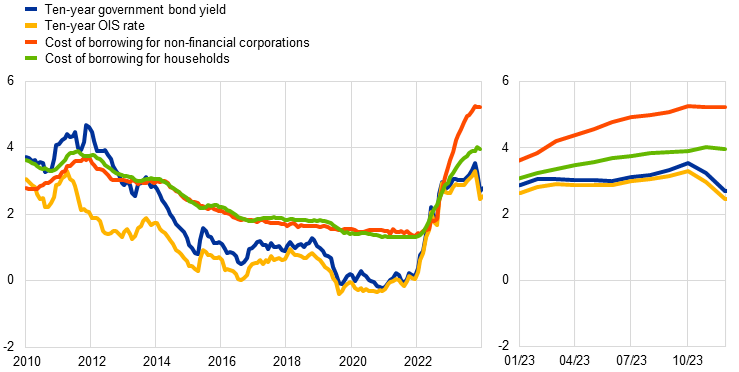

Lower bond yields despite monetary policy tightening, reflecting a change in expectations towards the end of the year

With inflationary pressures remaining elevated and persistent throughout 2023 (see Section 1.4), the ECB continued to tighten monetary policy decisively until September, and subsequently maintained the key ECB interest rates at restrictive levels, to ensure that inflation returns to the 2% target over the medium term (see Section 2.1). The – risk-free – ten-year overnight index swap (OIS) rate hovered around 3% through most of the year, reaching a peak of 3.3% in October before declining to an average 2.5% in December (Chart 1.10). The decline in the ten-year OIS rate towards the end of the year was due to a sharp drop in financial market interest rate expectations, mostly after inflation came in lower than expected. The drop in expectations was only partially compensated by an increase in the term premium. Long-term government bond yields followed developments in the OIS rate very closely. Their spreads were not significantly affected by the process of normalising the Eurosystem balance sheet (see Section 2.1) and at year-end were virtually the same as in December 2022. The euro area GDP-weighted average of ten-year nominal government bond yields averaged 2.7% in December 2023, 10 basis points below its level a year earlier.

Chart 1.10

Long-term interest rates, and the cost of borrowing for firms and for households for house purchase

(percentages per annum)

Sources: Bloomberg, LSEG and ECB calculations.

Notes: Monthly observations. The euro area ten-year government bond yield is a GDP-weighted average. The indicators for the cost of borrowing are calculated by aggregating short-term and long-term bank lending rates using a 24-month moving average of new business volumes. The latest observations are for December 2023.

Equity markets were supported by lower risk premia

Stock prices increased in 2023, in both the non-financial sector and, particularly, the banking sector. A decline in equity risk premia supported equity prices amid low and falling volatility despite heightened geopolitical tensions. The index of euro area bank stocks was boosted further by expectations of an increase in bank earnings in both the long and short term, with the March banking sector market turbulence in the United States and Switzerland having a sizeable but temporary negative impact. The broad indices of euro area non-financial corporation and bank equity prices ended 2023 around 12% and 23% above their respective end-2022 levels. Corporate bond yields declined and stood, on average, at lower levels in December 2023 than in December 2022 in both the investment grade and high-yield segments, owing to lower risk-free rates combined with a compression of corporate bond spreads.

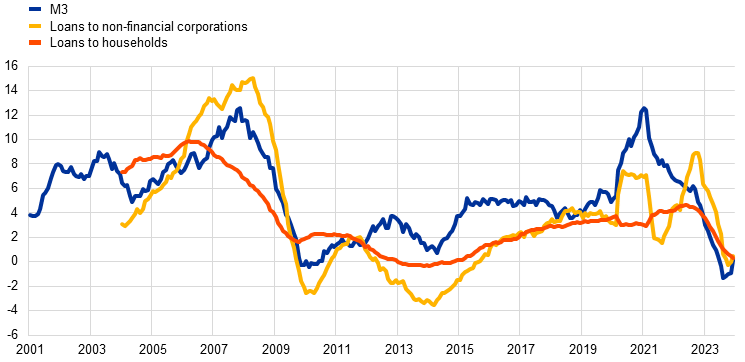

Broad money and bank intermediation reflected the tightening of monetary policy

Broad money (M3) stagnated, mainly reflecting the tightening of monetary policy. Its annual rate of change was only 0.1% in December, having declined significantly during 2023 and even temporarily reaching negative rates for the first time since the inception of Monetary Union (Chart 1.11). The decline was driven by subdued credit creation, high opportunity costs of holding liquid assets and the reduction in the Eurosystem balance sheet. While bank balance sheets remained robust overall, repayments of funds borrowed under the third series of targeted longer-term refinancing operations and a contraction in the Eurosystem asset portfolios reduced excess liquidity. Bank funding costs increased steeply, although by less than policy rates, as banks turned to more expensive market funding sources and competed more actively for customer deposits by offering higher interest on them.

Bank lending rates increased steeply for firms and households as monetary policy tightened

The transmission of the monetary policy tightening to broader financing conditions remained strong in 2023. As indicated by the euro area bank lending survey, banks tightened their credit standards (i.e. internal guidelines or loan approval criteria) for loans to households and firms substantially further. This was confirmed by the survey on the access to finance of enterprises for firms and the Consumer Expectations Survey for households. Nominal bank lending rates increased steeply again in 2023, reaching their highest levels in almost 15 years. The composite bank lending rate for loans to households for house purchase stood at 4.0% at the end of the year, up by about 100 basis points compared with the end of 2022, and the equivalent rate for non-financial corporations increased by 180 basis points to 5.2%, a rise of almost twice the increase seen for households (Chart 1.10). The increases in lending rates were more rapid and larger than in previous episodes of monetary policy tightening, mostly reflecting the faster and larger policy rate hikes since July 2022. The disparity in lending rates across countries remained contained, indicating that changes in the ECB’s monetary policy were being transmitted to lending rates smoothly across the euro area.

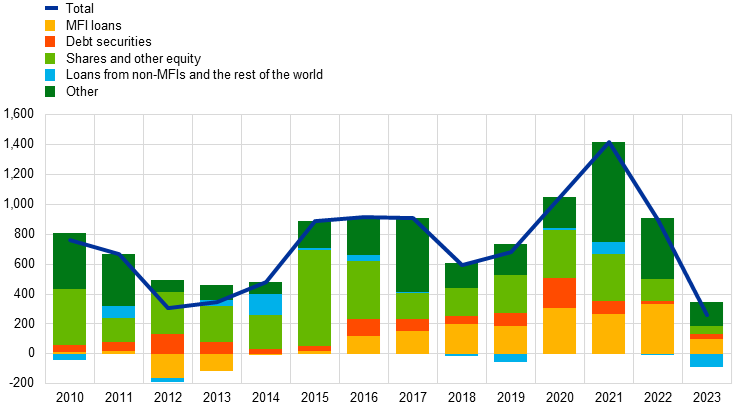

Bank lending to households and firms weakened markedly

Bank lending to households and firms weakened markedly in 2023, on the back of tighter credit conditions (Chart 1.11). Net monthly flows of loans were almost zero in the last three quarters of the year. The annual growth rate of bank loans to households declined, standing at 0.3% in December, mostly reflecting the slowdown in mortgages amid falling house prices for the first year since 2014. The annual growth rate of bank loans to firms also fell, reaching 0.4% in December, and the net flows of overall external financing to firms were at historical lows (Chart 1.12).

Chart 1.11

M3 growth and the growth of credit to firms and households

(annual percentage changes)

Source: ECB.

Notes: Firms are non-financial corporations. The latest observations are for December 2023.

Chart 1.12

Net flows of external financing to firms

(annual flows in EUR billions)

Sources: ECB and Eurostat.

Notes: Firms are non-financial corporations. MFI: monetary financial institution. In “loans from non-MFIs and the rest of the world”, non-monetary financial institutions consist of other financial intermediaries, pension funds and insurance corporations. “MFI loans” and “loans from non-MFIs and the rest of the world” are corrected for loan sales and securitisation. “Other” is the difference between the total and the instruments included in the chart and consists mostly of inter-company loans and trade credit. The latest observations are for the third quarter of 2023. The annual flow for 2023 is computed as a four-quarter sum of flows from the fourth quarter of 2022 to the third quarter of 2023.

Box 1

The macroeconomic implications of climate change

The ECB is working to better understand the macroeconomic consequences of climate change and policies to mitigate its impact, in line with commitments made following the 2020-21 monetary policy strategy review.[11] These efforts are highly relevant to the ECB’s primary mandate to maintain price stability. The complexity of climate change and the non-linear and highly uncertain nature of its effects call for enhanced macroeconomic analysis to limit forecast errors and understand the structural changes climate change is creating in the economy.

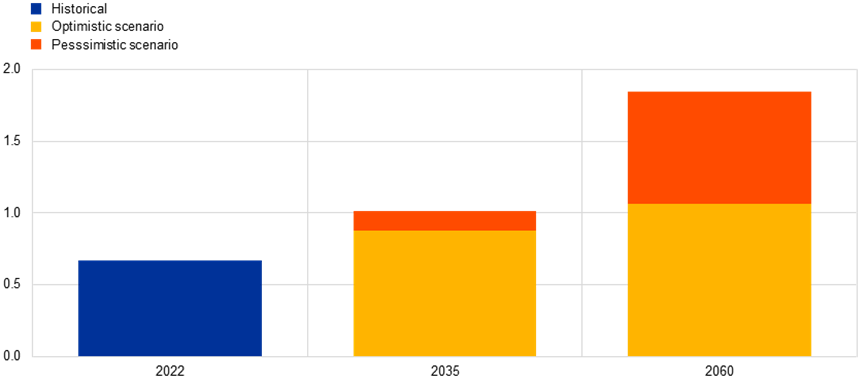

Climate change is already affecting euro area inflation. ECB research estimates that the extreme summer heat in 2022 increased food inflation in Europe by around 0.7 percentage points after one year, i.e. in 2023 (Chart A).[12] Services inflation can also be affected by hotter summers, possibly through the impact on food prices and the sensitivity of tourism-related services to temperature.[13] The impact of higher summer temperatures on inflation could be greater in a hotter climate: a heatwave similar to that of 2022 occurring in the climate of 2035 could, in a pessimistic scenario, increase average food price inflation by 1 percentage point. In an optimistic scenario, the effect of a similar heatwave would only be marginally less severe (0.8 percentage points). Increasing temperatures will have a greater impact on regions that are already hotter. This implies different effects on inflation in different euro area countries, which would make the transmission of a single monetary policy more challenging.

Chart A

Increasing impact of heatwaves on food price inflation in Europe

(year of heatwave, percentage points)

Source: Kotz et al. (see footnote 12).

Notes: Impacts estimated with a global panel regression approach, using monthly prices and high-resolution climate data. The bars show the cumulative deviation of food inflation from the baseline projection after 12 months as a result of extreme June, July and August temperatures. The chart is based on combining elasticities of a 1°C increase in temperatures with results from 21 global climate models. Temperatures are based on a summer equivalent to that in 2022 (i.e. in the upper tail of the temperature distribution on the basis of projected future climates) and are retrieved from climate model results under an optimistic emissions scenario (in which the rise in global temperatures would be below 2°C in 2100) and a pessimistic scenario (in which emissions would rise throughout the next century). Impacts could be reduced through ambitious adaptation to warmer climates.

Extreme weather events typically reduce output in the short run, but the total economic impact extends beyond the direct and immediate impacts that would arise, for example, through the destruction of houses, factories and machinery. Examples include disruption in other regions or sectors through supply-chain linkages or impaired infrastructure. Revenue losses in affected sectors and lower output will usually reduce demand for the products and services of other sectors. Another effect is higher uncertainty, which could lead households and businesses to reassess their views on disaster risk and therefore depress spending.

Over longer horizons climate change can also reduce output growth more persistently.[14] For example, reduced snowfall will threaten the viability of many skiing areas in Europe, and some Mediterranean regions may become too hot for summer tourism, although some northern regions may benefit. Yields in agriculture and forestry will likely be depressed by hotter average temperatures. While changing crops can alleviate some of the effects, less predictable temperature and rainfall patterns are also likely to weigh on agricultural output. Higher temperatures above the comfort zone of around 19-22°C – which are likely to occur more frequently in a warmer climate – reduce the productivity of workers.

Adaptation, i.e. adjustment to warmer climates, could help limit macroeconomic impacts. This includes, for example, installing air conditioning to reduce the impact of heat stress on labour productivity, or switching crops to limit agricultural productivity losses. However, such measures will likely have implications for government budgets and fiscal space.[15] Insurance provides a further tool for adaptation, but there is already a substantial climate insurance protection gap in Europe.[16]

Achieving emission reductions to meet the goals of the Paris Agreement and avert more catastrophic global warming requires a wide-ranging structural transformation of the economy. Capital and labour need to be reallocated across and within sectors, and even within individual firms (e.g. car makers will need to switch factories from making combustion engine cars to making battery-powered electric vehicles). The success of that reallocation will depend on the implementation of effective transition policies; the flexibility of markets and in particular the ability of the economy to finance and absorb the substantial capital investment required; the development of decarbonised technologies and the availability of skilled labour to implement them.

Analysis suggesting a benign economic impact of climate policy measures introduced to date is unlikely to capture the full picture.[17] Available model-based assessments of carbon price pathways find only a limited effect on output and inflation.[18] However, the measures included still fall substantially short of meeting the EU’s emission reduction target, and the broader impact of the transition – including effects from strengthened regulation and targets – can be less straightforward to quantify.

The speed of transition critically affects the ultimate economic impact: delaying the transition will require faster and more radical policy changes later on, increasing the probability of stranded assets and higher structural unemployment.[19] Moreover, different transition policies vary in their impact on productivity.[20] Market-based policies – such as carbon taxes – have less impact on the productivity of carbon-intensive firms than non-market-based policies (such as banning certain products or processes).

The competitiveness of the euro area economy is also affected by global choices regarding transition policies. These include higher carbon prices as well as industrial policies such as the recent Inflation Reduction Act in the United States. The EU Emissions Trading System (EU ETS) can trigger “carbon leakage”, i.e. the relocation of economic activity and emissions to regions with laxer emissions requirements. This can be reduced by carefully calibrating the Carbon Border Adjustment Mechanism together with existing carbon leakage prevention mechanisms.[21]

Overall, climate change and mitigation policies affect nearly all aspects of macroeconomic analysis performed by central banks. Key open questions remain, related for example to the way the transition should unfold and the resultant structural changes to the economy; to the macroeconomic impact of extreme weather and risks from accelerated climate change; and to the role of nature capital and ecosystem services.

Box 2

The role of unit profits in recent domestic price pressures

This box focuses on how unit profits contributed to the dynamics of domestic price pressures in 2023 from an accounting perspective.

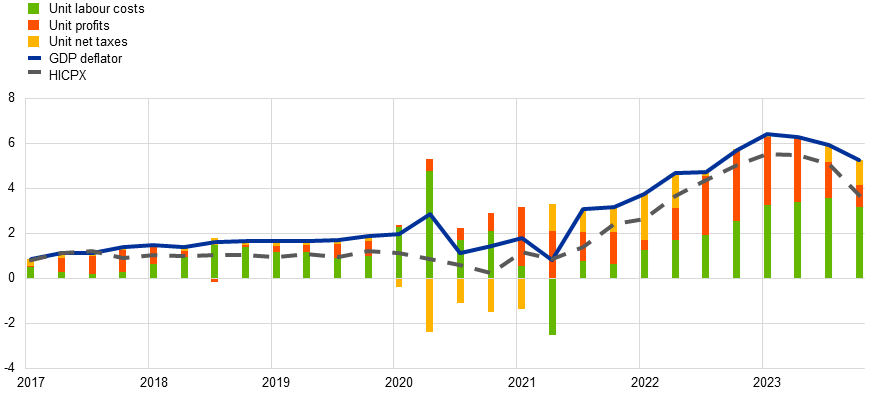

Domestic price pressures were very strong in 2023 but receded slightly in the course of the year as unit profits declined

Growth in the GDP deflator, which shows a strong co-movement with developments in HICP inflation excluding energy and food (HICPX), can be broken down into the contributions from unit labour costs, unit profits and unit taxes (minus subsidies) (Chart A).[22],[23] Annual growth in the GDP deflator rose significantly further in 2023, to an average of 6.0% from 4.7% in 2022. This contrasts with an average rate over the period from 1999 to 2021 of 1.6%. From a historical high of 6.4% in the first quarter of 2023, the growth figure started to moderate and reached 5.3% in the fourth quarter. Unit profits contributed over several quarters in 2022 and 2023 to the surge in the GDP deflator, accounting for about half or more of its elevated growth rate. This compares with an average contribution of slightly more than one-third over the period 1999 to 2019. The contribution of unit profits then declined strongly during 2023, helping to offset increases in the contribution of unit labour costs over the period.

Chart A

GDP deflator and contributions

(annual percentage changes; percentage point contributions)

Source: Eurostat and ECB calculations.

Exceptional economic developments after the pandemic explain strong unit profit growth in 2022 and early 2023

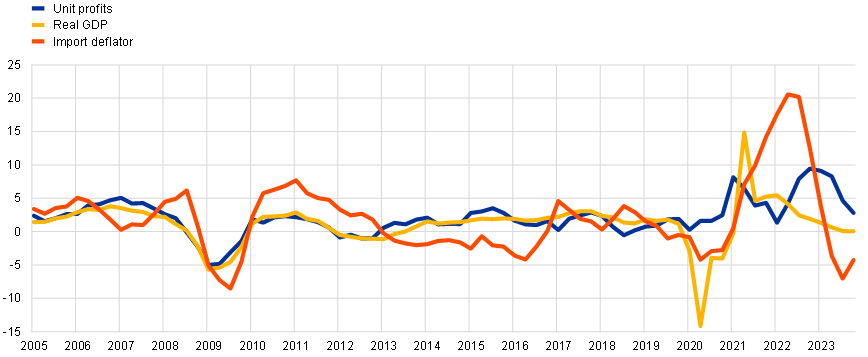

Unit profits typically move closely with developments in cyclical indicators such as real GDP. They are, moreover, typically affected by marked changes in the terms of trade, for instance owing to large fluctuations in import or oil prices. These features reflect the fact that, when demand is stronger relative to potential output, it is easier for price-setters to raise prices and unit profits without losing market share, while at times of input cost shocks e.g. from energy prices, profits are typically used at least temporarily to avoid passing the full cost increase through to selling prices. The economic weakening over 2022 and 2023, to the extent that it was driven by demand falling relative to supply, and the sharp deterioration of the terms of trade in 2022, related to the surge in import prices, would therefore have both pointed to weaker developments in unit profits than were observed (Chart B). This suggests that other mechanisms and more exceptional factors may have been at play during that period. One source of the strength of unit profits in these years was the supply-demand imbalances in many economic sectors. While supply chain disruptions during the pandemic led to widespread supply constraints, debt-financed government measures limited the impact of the growth slowdown on disposable incomes and contributed to high savings. Such savings and the related pent-up demand boosted demand in many sectors following the reopening after the lockdowns. In such an environment of strong aggregate demand relative to supply, pronounced input cost increases can lead price-setters to raise their prices without necessarily changing their mark-up pricing strategy. This implies a pass-through of input costs and a large contribution of unit profits to domestic price pressures, as recently observed.[24]

Chart B

Unit profits, real GDP and the import deflator

(annual percentage changes)

Source: Eurostat and ECB calculations.

Note: The latest observations are for the fourth quarter of 2023.

As exceptional factors unwound, unit profits realigned with the economic cycle and their typical buffer role

With the fading of supply-demand imbalances after the pandemic and the significant moderation in energy and other input cost pressures in the course of 2023, unit profit growth started to recede and return gradually to more normal levels. The unwinding of supply-demand imbalances made it harder to raise margins without losing market share and contributed to more contained increases in unit profits. The turn in the environment towards more moderate input cost pressures allowed more limited selling price dynamics. This meant that unit profit growth was set to decline even if firms maintained their approach to passing through input cost prices and setting mark-ups. The decline in input cost pressures may have, moreover, made it easier for firms to buffer labour cost pressures. The weaker unit profit developments are also consistent with the relatively weak cyclical economic environment in 2023. Overall, unit profits appear to have resumed their typical buffer role, counteracting a larger pass-through of the high unit labour cost pressures to domestic prices.

In 2023 the ECB stayed the course in raising key policy interest rates to, and keeping them at, levels sufficiently restrictive to ensure a timely return of inflation to the 2% medium-term target. In the first nine months of the year it increased rates by 200 basis points, bringing the deposit facility rate to 4%, as exceptionally high inflationary pressure stemming from high energy costs spread through the economy. High food prices were also a significant contributing factor. In addition, the effects of supply bottlenecks and of pent-up demand linked to the lifting of pandemic-related restrictions were, although easing, still driving up prices, and wage growth picked up. The ECB’s decisions reflected a data-dependent approach and were based on the assessment of the medium-term inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission. In the course of the year the available information increasingly showed that the tightening of monetary policy was being forcefully transmitted to the economy. In addition, incoming inflation data indicated that the disinflation process, as signalled especially by the decline in measures of underlying inflation, continued to make progress. Ultimately the Governing Council decided at its October and December meetings to keep the key ECB interest rates unchanged.

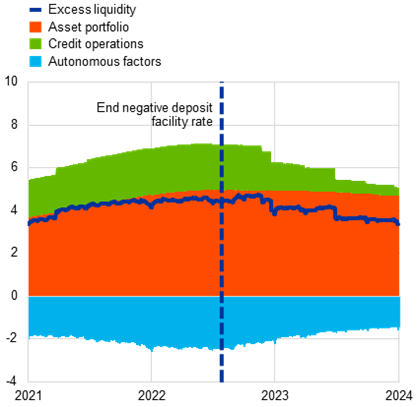

The Eurosystem balance sheet continued to contract as part of the monetary policy normalisation that began in 2022, notwithstanding the additional €45 billion contribution from Hrvatska narodna banka’s balance sheet following the adoption of the euro by Croatia on 1 January 2023. The Eurosystem balance sheet reached €6.9 trillion by year-end, a decline of more than €1 trillion in one year and of almost €2 trillion when compared with its peak in mid-2022. The reduction was mainly the result of the maturing and early repayments of long-term funds borrowed by banks under the third series of targeted longer-term refinancing operations (TLTRO III) and was supported by the end of both the full and the partial reinvestment phase in the asset purchase programme (APP), in the periods starting in March and July respectively. In December 2023 the Governing Council decided to advance the normalisation of the Eurosystem balance sheet, expressing its intention to gradually phase out reinvestments under the pandemic emergency purchase programme (PEPP) starting in July 2024. In 2023, following the announcement of December 2022, the Eurosystem worked on the review of its operational framework for steering short-term interest rates, which was concluded in March 2024.

Moreover, the ECB proceeded in 2023 with the gradual removal, initiated in 2022, of its pandemic-related collateral easing measures, and the Hellenic Republic’s credit rating was upgraded to investment grade level. Throughout 2023 the Eurosystem emphasised risk management to ensure efficient policy implementation, including by diversifying the credit assessment sources it accepts. With the key interest rates having been raised to bring down inflation, the ECB incurred losses from negative interest income, which were partly offset by previously established financial buffers. The monetary income of the ECB is expected to increase again in the future, which will support its operational effectiveness.

2.1 Pursuing a restrictive monetary policy to bring inflation back to the 2% target

Inflation was still 8.6% in January, while the economy remained resilient despite mounting challenges

In early 2023 economic growth stagnated in the euro area, after a marked deceleration since mid-2022. However, the economy showed signs of resilience in the face of significant challenges from subdued global economic activity, geopolitical uncertainties owing to Russia’s war against Ukraine and high inflation along with tighter financing conditions. Headline inflation declined in January as a result of lower energy prices but remained high at 8.6%, also in light of high food prices. This was partly due to the pervasive impact of high energy costs across the economy, which also influenced food prices, alongside ongoing – although fading – pandemic-related factors such as supply chain disruptions and pent-up demand. Wage growth was also picking up.

The Governing Council raised rates in February and expressed its intention to raise them further

In light of the medium-term inflation outlook, the Governing Council reaffirmed its intention to pursue a restrictive monetary policy and raised the three key ECB interest rates by 50 basis points at its February meeting. It also said that it intended to raise interest rates by another 50 basis points at its meeting in March, and would then evaluate the subsequent monetary policy path. The Governing Council remained steadfast in raising interest rates at a steady pace to levels sufficiently restrictive to ensure a timely return of inflation to its 2% medium-term target. Keeping interest rates at restrictive levels should gradually reduce inflation by dampening demand and pre-empting any sustained upward shift in inflation expectations.

At its February meeting, the Governing Council also established modalities for reducing Eurosystem securities holdings under the APP. This followed on from its December 2022 decision to no longer reinvest the principal payments from maturing securities in full from March onwards, so that the APP portfolio would decrease by a monthly average of €15 billion from March to June 2023, with the subsequent reduction pace to be determined later. Corporate bond reinvestments would be tilted more strongly towards issuers with a better climate performance. While maintaining a focus on the ECB’s price stability objective, this strategy was aimed at taking better account of climate-related financial risk in the Eurosystem balance sheet and gradually decarbonising corporate bond holdings in alignment with the ECB’s secondary objective of supporting the general economic policies in the EU, which include efforts to mitigate the impact of climate change (see Box 8).

US banking sector turbulence fuelled uncertainty in Europe, emphasising the need for a data-dependent approach to rate decisions

In March, amid the banking sector turbulence in the United States and Switzerland, financial market tensions soared and increased uncertainty about the outlook for euro area growth and inflation. In addition, the March ECB staff macroeconomic projections foresaw sustained high inflation levels, particularly in inflation excluding energy and food, although inflation was expected to decrease in the coming years. With inflation projected to remain too high for too long, the Governing Council decided to raise the three key ECB interest rates by 50 basis points. Moreover, the heightened uncertainty emphasised the importance of a data-dependent approach to the Governing Council’s policy rate decisions. It therefore also clarified its “reaction function”, explaining that its policy rate decisions would be guided by three criteria: the inflation outlook in light of incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council also continued to monitor market tensions closely, standing ready to respond as necessary to preserve price stability and contribute to financial stability in the euro area. In the following months, the euro area banking sector proved resilient to the tensions emanating from outside the euro area.

It became increasingly evident that restrictive monetary policy was having a significant impact on euro area financing conditions

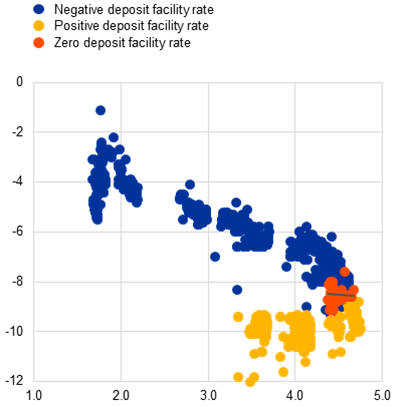

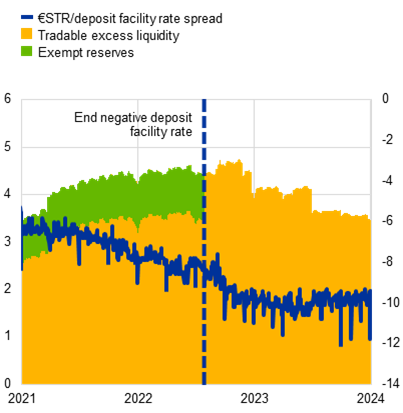

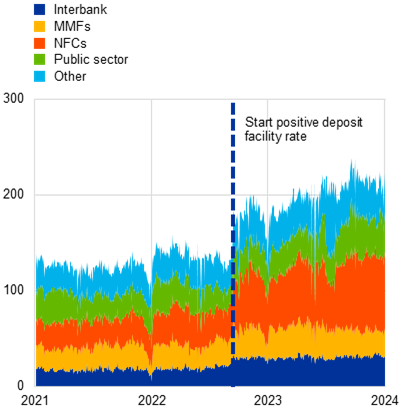

As the year advanced, it was increasingly evident that the Governing Council’s restrictive interest rate policy was having a significant impact on the economy. Past rate increases were being transmitted forcefully to euro area monetary and financing conditions – the initial stages of the transmission mechanism – and were gradually having effects across the economy, even though the lags and strength of transmission to the real economy remained uncertain. In April borrowing rates for businesses and mortgages reached their highest levels in over a decade. The resultant decline in credit demand, along with tighter credit standards, led to a progressive slowdown in loan growth. Banks also repaid the largest amount of funds borrowed under TLTRO III in June, causing a significant decline in excess liquidity. This reduction did not hinder the smooth transmission of monetary policy rate changes to risk-free rates in money markets, although an asymmetry emerged in the reaction of the spread between the euro short-term rate (€STR) and the ECB’s deposit facility rate. The spread did not narrow with the liquidity reduction, in contrast to its widening when liquidity had increased (see Box 3).

The Governing Council continued to raise policy rates as underlying price pressures remained high…

Headline inflation declined markedly. It dropped to 6.1% in May from 8.5% in February, with 6.9% in March and 7.0% in April. Nevertheless, while inflation was expected to decline further toward the target, largely driven by the concurrent tightening of financing conditions that was increasingly dampening demand, price pressures were still anticipated to remain too strong for too long. The Governing Council therefore opted for another two consecutive 25 basis point interest rate increases, in May and June respectively.

…stopped APP reinvestments as of July…

After the pace of reinvestment was reduced in March, July marked the end of APP reinvestments. Reinvestments under PEPP were still set to continue until at least the end of 2024. At the same time, developments since the Governing Council’s previous monetary policy meeting supported its expectation that inflation would drop further over the remainder of the year but stay above target for an extended period. On this basis, the Governing Council stayed on course to raise interest rates by an additional 25 basis points in July.

…and returned minimum reserve remuneration to 0%, improving policy efficiency

The Governing Council also decided in July to reduce the remuneration of minimum reserves from the deposit facility rate to 0%. This decision was aimed at maintaining the effectiveness of monetary policy by retaining control over the monetary policy stance while ensuring a full pass-through of interest rate decisions to money markets. It also enhanced policy efficiency by reducing overall interest expenses stemming from reserves while achieving the same degree of monetary restriction.

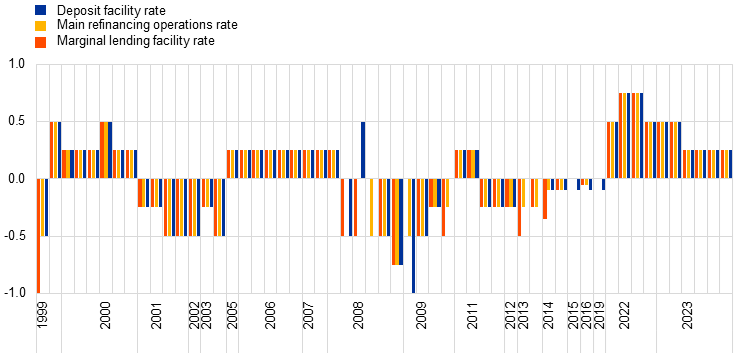

With inflation in August showing almost no progress from the 5.3% recorded in July, and the inflation outlook in the September ECB staff projections revised upwards for 2023 and 2024, mainly owing to a higher path for energy prices, the Governing Council increased the key ECB rates by another 25 basis points at its September meeting. This brought the cumulative increase over 2023 to 200 basis points and the deposit facility rate to 4% (Chart 2.1).

Chart 2.1

Changes in the key ECB policy rates

(percentage points)

Source: ECB.

…and said that maintaining current policy rate levels for a sufficiently long duration would contribute substantially to the timely return of inflation to the target

However, the economy was expected to remain subdued in the following months, after having stagnated over the first half of the year. The increasing impact of the Governing Council’s tightening measures on domestic demand, coupled with a challenging international trade environment, led ECB staff to significantly lower their economic growth projections in September 2023. Additionally, while underlying price pressures persisted at high levels, most indicators started to ease, and the projected path for inflation excluding energy and food was also revised slightly downwards. On the basis of this updated assessment, the Governing Council also considered that the key ECB interest rates had reached levels that, maintained for a sufficiently long duration, would make a substantial contribution to the timely return of inflation to its target.

October ended the longest period of consecutive rate hikes in the history of the euro

After ten consecutive rate hikes, the Governing Council decided at its October meeting to keep the key ECB interest rates unchanged. From the start of the rate increases in July 2022, the ECB had raised the deposit facility rate from -0.50% to 4% by September 2023. While inflation was still anticipated to remain persistently high owing to robust domestic price pressures, it continued to decrease significantly in September, dropping to 4.3%. This decline was accompanied by an easing in measures of underlying inflation. The increased geopolitical risks arising from October onwards from the conflict in the Middle East also further underscored the importance of the Governing Council’s data-dependent approach to determining the appropriate level and duration of restriction in its key policy rates.

Inflation dropped to 2.4% in November

As the year came to a close, inflation continued to decrease, reaching 2.4% in November. At its December meeting, however, the Governing Council assessed that it was likely to temporarily rise again in the near term, owing to base effects. Underlying inflation had eased further. The Eurosystem staff macroeconomic projections suggested that inflation would resume its gradual decline in 2024. At the same time domestic price pressures were seen as remaining elevated, primarily owing to strong growth in unit labour costs.

The Governing Council kept rates unchanged and decided to advance the Eurosystem’s balance sheet normalisation

Against this background, the Governing Council decided at its December meeting to keep its key rates unchanged.

The Governing Council also decided in December to advance the normalisation of the Eurosystem balance sheet. It expressed the intention to reinvest, in full, the principal payments from maturing PEPP securities until mid-2024, before reducing the portfolio by an average €7.5 billion per month until year-end and discontinuing reinvestments thereafter.

2.2 Eurosystem balance sheet developments as monetary policy tightens further

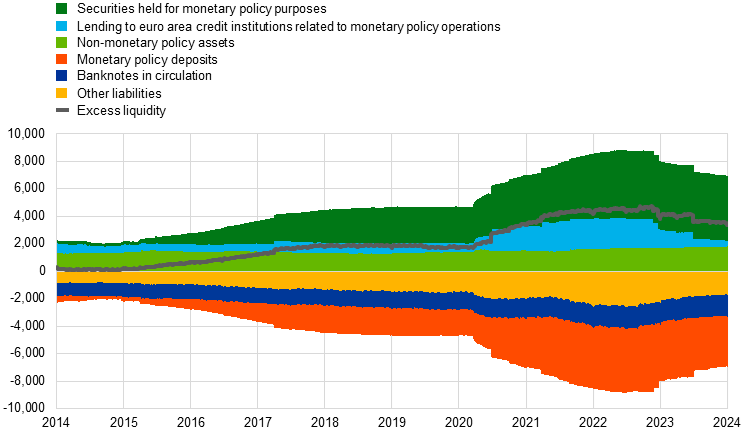

The Eurosystem balance sheet was gradually reduced, with the end of APP reinvestments and the maturing of TLTRO III operations

In 2023 the Eurosystem balance sheet continued the gradual reduction started in 2022 with the normalisation of monetary policy. It declined further as the full and partial reinvestment phases of the APP ended in February and June respectively. Under the PEPP, the Eurosystem continued full reinvestments throughout the year. By the end of 2023 the balance sheet had declined to €6.9 trillion, mainly on account of TLTRO III operations maturing as well as early repayments, and to some extent also as the APP portfolio began to be wound down.

At the end of 2023 monetary policy-related assets on the Eurosystem balance sheet amounted to €5.1 trillion, a decline of €1.2 trillion compared with the end of 2022. Loans to euro area credit institutions accounted for 6% of total assets (down from 17% at the end of 2022) and assets purchased for monetary policy purposes represented 68% of total assets (up from 62% at the end of 2022). Other financial assets on the balance sheet consisted mainly of foreign currency-denominated assets, gold and euro-denominated non-monetary policy portfolios.

On the liabilities side, the overall amount of credit institutions’ reserve holdings and recourse to the deposit facility decreased to €3.5 trillion at the end of 2023 (from €4.0 trillion at the end of 2022) and represented 51% of total liabilities (compared with 50% at the end of 2022). Banknotes in circulation were virtually unchanged at €1.6 trillion and accounted for 23% of total liabilities (up from 20%).

In 2023, following the announcement of December 2022, the Eurosystem worked on the review of its operational framework for steering short-term interest rates, which was concluded in March 2024.

Chart 2.2

Evolution of the Eurosystem’s consolidated balance sheet

(EUR billions)

Source: ECB.

Notes: Positive figures refer to assets and negative figures to liabilities. The line for excess liquidity is presented as a positive figure, although it refers to the sum of the following liability items: current account holdings in excess of reserve requirements and recourse to the deposit facility.

The adoption of the euro by Croatia on 1 January 2023 and the inclusion of Hrvatska narodna banka’s balance sheet in the consolidated balance sheet of the Eurosystem increased the latter’s total assets and liabilities by €45 billion.

APP and PEPP portfolio distribution across asset classes and jurisdictions

The run-off of the asset purchase programmes was well absorbed by the market

The APP comprises four asset purchase programmes: the third covered bond purchase programme (CBPP3), the asset-backed securities purchase programme (ABSPP), the public sector purchase programme (PSPP) and the corporate sector purchase programme (CSPP). The PEPP was introduced in 2020 in response to the pandemic. All asset categories eligible under the APP are also eligible under the PEPP; a waiver of the eligibility requirements was temporarily granted for the PEPP for securities issued by the Hellenic Republic.[25]

In December 2021 the Governing Council confirmed its intention to gradually start the normalisation of its monetary policy, by reducing the pace at which it purchased securities for the PEPP and, subsequently, the APP. It announced the end of net asset purchases under the PEPP, and in March 2022 gave an expected end date for the net purchases under the APP. The Eurosystem ended net purchases under the PEPP as of 1 April 2022 and continued to reinvest (in full) the principal payments from maturing securities purchased under the programme. It ended net purchases under the APP as of 1 July 2022 and began to only reinvest (in full) the principal payments from maturing securities. It then decided to reduce the Eurosystem holdings under the APP at a measured and predictable pace through partial reinvestment of the principal payments from maturing securities between March and June 2023, thereby ensuring that the Eurosystem maintained a continuous market presence under the APP over this period. Finally, the Governing Council confirmed on 15 June 2023 that it would discontinue reinvestments under the APP as of July 2023. For the PEPP, full reinvestments were continued till the end of 2022 and throughout 2023. On 14 December 2023 the Governing Council announced its intention to continue to reinvest, in full, the principal payments from maturing securities purchased under the PEPP during the first half of 2024 and reduce the PEPP portfolio by €7.5 billion per month on average over the second half of 2024, before discontinuing reinvestments under the PEPP at the end of that year. Reinvestment purchases continued to be conducted in a smooth manner and in line with the respective prevailing market conditions.

The size of the APP portfolio remained stable during the full reinvestment phase from July 2022 to February 2023. During the partial reinvestment phase, from March to June 2023, it declined by €60 billion, at an average pace of €15 billion per month, before the full run-off started in July 2023. Overall, APP holdings declined from €3.254 trillion (at amortised cost) at the end of 2022 to €3.026 trillion at the end of 2023. The PSPP accounted for the bulk of these holdings, with €2.403 trillion or 79% of total APP holdings at the end of the year. Under the PSPP, redemptions were in general reinvested in the jurisdiction in which principal repayments fell due. In addition, some national central banks purchased securities issued by EU supranational institutions. The weighted average maturity of the PSPP holdings stood at 7.0 years at the end of 2023, with some variation across jurisdictions. The ABSPP accounted for less than 1% (€13 billion) of total APP holdings at year-end, the CBPP3 for 9% (€286 billion) and the CSPP for 11% (€324 billion). Corporate and covered bond purchases were guided by benchmarks reflecting the market capitalisation of all eligible outstanding corporate and covered bonds respectively. The Eurosystem continued to tilt its corporate securities purchases towards issuers with a better climate performance and published its first climate-related financial disclosures for the corporate securities holdings under the CSPP and PEPP, as well as for its non-monetary policy portfolios – see Section 11.5. Securities purchases under the APP were implemented smoothly throughout the first half of 2023. The partial reinvestment phase and the discontinuation of the purchases were well absorbed by the financial markets and did not cause any major disturbance.

At the end of 2023 PEPP holdings amounted to €1.7 trillion (at amortised cost). Covered bond holdings accounted for less than 1% (€6 billion) of the total, corporate sector holdings for 3% (€46 billion) and public sector holdings for 97% (€1,614 billion).[26] The weighted average maturity of the PEPP public sector securities holdings stood at 7.3 years at the end of 2023, with some differences across jurisdictions.

Redemptions of private sector securities under the APP and PEPP amounted to €80 billion in 2023, while redemptions of public sector securities under the PSPP and PEPP amounted to €438 billion. Reinvestments under the APP and PEPP amounted to €36 billion for private sector securities and €271 billion for public sector securities. Given the large and unevenly distributed redemptions, the public sector reinvestments were smoothed across jurisdictions and across time to ensure a regular and balanced market presence, giving due regard to market price formation and market functioning considerations. This smoothing mechanism led to additional temporary deviations of the PEPP holdings from the allocation in accordance with the Eurosystem capital key, but these were largely reversed by the end of the smoothing period, which is the calendar year in which the redemptions take place.

The assets purchased under the PSPP, CSPP, CBPP3 and PEPP continued to be made available for securities lending to support bond and repo market liquidity. In 2023 repo market conditions improved significantly compared with the previous year, which was reflected in smaller lending volumes.

Developments in Eurosystem refinancing operations

At the end of 2023 the outstanding amount of Eurosystem refinancing operations was €410 billion, representing a decline of €914 billion compared with the end of 2022. This change mainly reflects voluntary early repayments (€312.5 billion) and the maturing of operations (€612.9 billion) under the TLTRO III series. The weighted average maturity of outstanding Eurosystem refinancing operations decreased from around 10.5 months at the end of 2022 to 5.2 months at the end of 2023.

Gradual phasing-out of pandemic collateral easing measures

In March 2022 the ECB announced the gradual phasing-out of pandemic-related collateral easing measures. These measures were a core element of the ECB’s monetary policy response to the pandemic, making it easier for counterparties to access Eurosystem credit operations by increasing the volume of eligible collateral. The central focus of the measures was a temporary reduction in valuation haircuts across all asset classes by a fixed factor of 20% and temporary extensions to the additional credit claim (ACC) frameworks implemented by some national central banks.

The gradual phase-out started in July 2022. In a second step, which took effect from 29 June 2023, the temporary reduction in valuation haircuts for marketable and non-marketable assets was fully phased out by implementing a new haircut schedule, thus marking the return to the ECB’s pre-pandemic risk tolerance level for credit operations.[27]

A third step in the phasing-out of the pandemic collateral easing measures will be a comprehensive review of the ACC framework. Some national central banks terminated their national ACC frameworks in full or in part in the course of 2023 or before.[28] In November 2023, the ECB announced the discontinuation of the eligibility of short-term debt instruments for use as collateral under the Guideline on temporary collateral measures[29], as well as of some specific features of the ACC frameworks. In addition, it decided to reinstate the €25,000 minimum size for domestic credit claims accepted as collateral for domestic use, as well as to extend the validity of the ACC frameworks with their remaining features, until at least the end of 2024. These decisions are to be implemented in the course of 2024.

In September 2023 the relevant credit rating of the Hellenic Republic was upgraded from credit quality step 4 to step 3 on the Eurosystem’s harmonised rating scale (from BB+ to BBB-), positioning all debt instruments issued by the central government of the Hellenic Republic at investment grade level.[30] The debt instruments issued by the central government of the Hellenic Republic, which previously benefited from a waiver included in the Guideline on temporary collateral measures, are therefore as of September 2023 subject to the eligibility criteria under the general collateral framework.

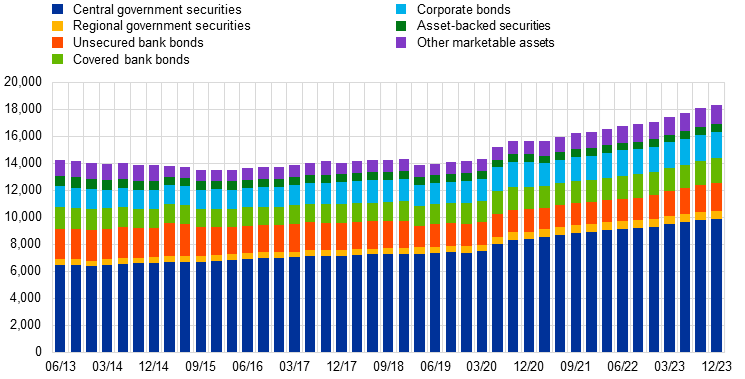

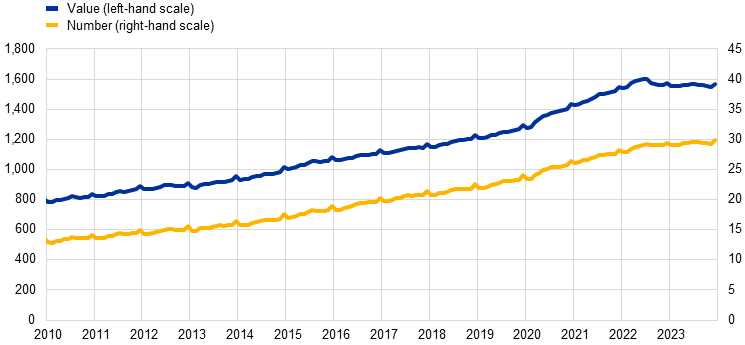

Developments in eligible marketable assets and mobilised collateral

The nominal amount of eligible marketable assets increased by €1.2 trillion in 2023, reaching a level of €18.3 trillion at the end of the year (Chart 2.3). Central government securities continued to be the largest asset class (€9.9 trillion). Other asset classes included corporate bonds (€1.9 trillion), covered bank bonds (€1.8 trillion) and unsecured bank bonds (€2 trillion). Regional government securities (€603 billion), asset-backed securities (€600 billion) and other marketable assets (€1.4 trillion) each accounted for a comparatively small fraction of the eligible assets universe.

Chart 2.3

Developments in eligible marketable assets

(EUR billions)

Source: ECB.

Notes: Asset values are nominal amounts. The chart shows averages of end-of-month data for each period.

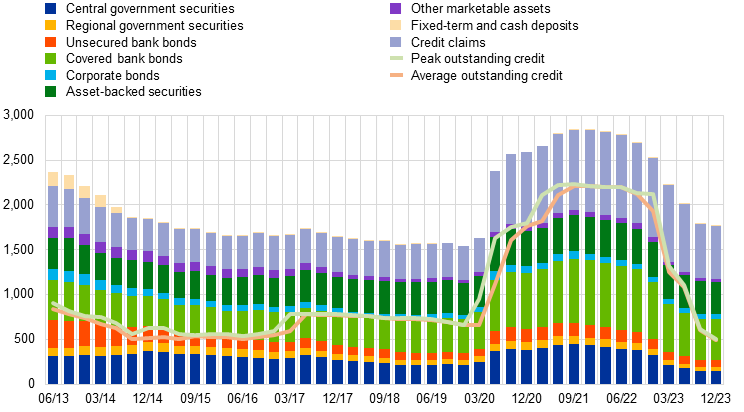

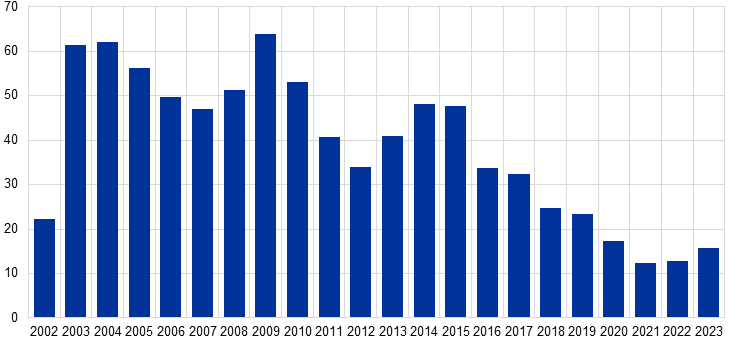

Between the adjustment of the interest rates applicable to TLTRO III in November 2022 and the end of 2023, counterparties repaid 80% of their outstanding credit, which was accompanied by a sizable reduction in mobilised collateral of more than €900 billion (Chart 2.4). Following the early repayments between November 2022 and January 2023, counterparties demobilised in particular government bonds, which have a relatively high opportunity cost and can be used in private repo funding. In addition, they demobilised more than €250 billion of covered bonds and asset-backed securities in the course of 2023. The maturity of the TLTRO III operation in June 2023 was also accompanied by a large reduction in mobilised collateral (around €300 billion), which corresponded to 60% of the net credit repaid on that day. However, two-thirds of that drop in mobilised collateral was due to the partial phasing-out of the pandemic collateral easing measures, in particular the phasing-out of certain pools of ACCs in France as well as the reversal of the remaining 10% haircut reduction.

Chart 2.4

Developments in mobilised collateral

(EUR billions)

Source: ECB.

For collateral, the averages of end-of-month data for each period are shown, and values are after valuation and haircuts. For outstanding credit, daily data are used.

2.3 Managing financial risks of monetary policy instruments

The Eurosystem continuously manages the financial risks inherent in the implementation of its monetary policy operations. Its risk management function endeavours to attain risk efficiency, i.e. to achieve monetary policy objectives with the lowest amount of risk.[31]

Losses arose because of interest rate sensitivity mismatches between assets and liabilities