2022 was a turning point for the ECB’s monetary policy. The inflation outlook changed abruptly as two types of shock hit the economy at the same time. First, the euro area underwent an unprecedented series of negative supply shocks caused by pandemic-induced supply chain disruptions, Russia’s unjustifiable invasion of Ukraine and the ensuing energy crisis. This significantly increased input costs for all sectors of the economy. Second, there was a positive demand shock triggered by the reopening of the economy after the pandemic. That allowed firms to pass their rising costs through to prices much faster and more strongly than in the past.

We had already announced, at the end of 2021, that we would gradually reduce net asset purchases under our asset purchase programme (APP) and would end them under the pandemic emergency purchase programme (PEPP) at the end of March 2022. But our overall policy stance was still highly accommodative, having been tailored to the environment of very low inflation in the past decade and the deflationary risks early in the pandemic. So we took a series of steps to normalise that stance and respond rapidly to the emerging inflation challenge.

In March we speeded up the reduction of net purchases under the APP and in April said we expected to discontinue them in the third quarter. In July we then raised the key ECB interest rates for the first time in 11 years, hiking them again in a series of large steps at the policy meetings that followed. The pace of this adjustment was an important signal to the public of our determination to bring down inflation. That helped anchor inflation expectations even as inflation accelerated.

In parallel, we acted to ensure that – as monetary policy was normalised – our policy stance would continue to be transmitted smoothly via financial markets throughout the euro area. This was achieved via two key measures. First, we decided to apply flexibility in reinvesting maturing securities in the PEPP portfolio to counter risks to the monetary policy transmission mechanism related to the pandemic. Second, we launched a new Transmission Protection Instrument.

But as the inflation outlook evolved it became clear that achieving a broadly neutral monetary policy stance would not in itself suffice. Inflation was projected to be too far above our 2% medium-term target for too long, and we saw signs that it was becoming more persistent, with price pressures broadening and underlying inflation strengthening. In this setting, we needed to bring interest rates into restrictive territory and dampen demand.

So in December, following our last policy meeting of the year, we announced that interest rates would still have to rise significantly at a steady pace to reach levels that were sufficiently restrictive to ensure a timely return of inflation to our target. At the same time, we said that, while the key ECB interest rates were our primary tool for setting the policy stance, we would begin reducing the APP securities portfolio from March 2023 at a measured and predictable pace. This also followed a decision in October to recalibrate the terms and conditions of the third series of our targeted longer-term refinancing operations, removing a deterrent to voluntary early repayment of outstanding funds. Monetary policy assets on our balance sheet declined by around €830 billion between end-June (when net asset purchases ended) and end-December, contributing to the normalisation of our balance sheet.

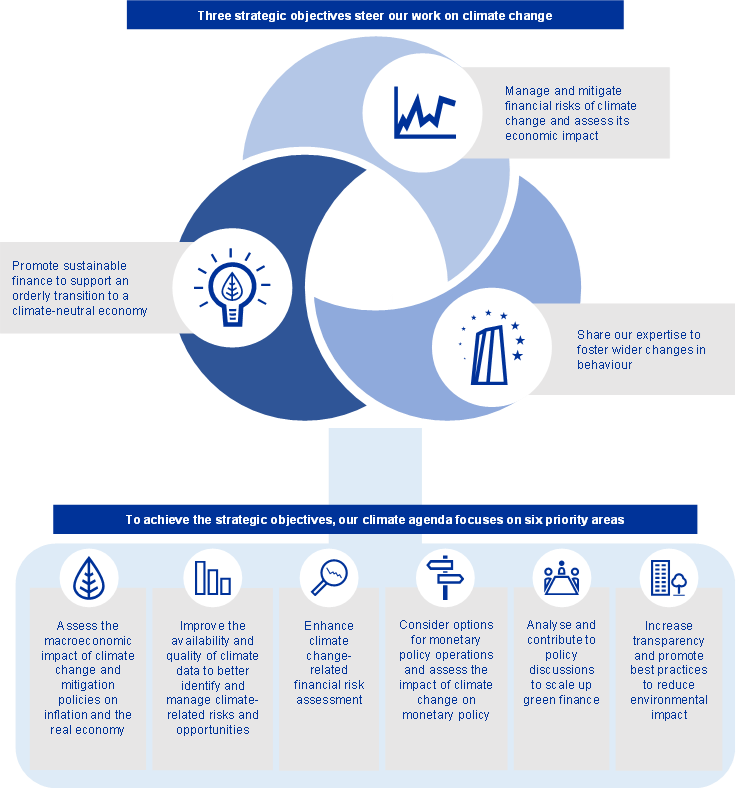

In addition to our measures to combat high inflation, we continued to examine and address wider threats to our mandate stemming from a changing climate. In 2022 we took further steps to incorporate climate change considerations into our monetary policy operations. This included conducting a first climate stress test of several of the financial exposures on our balance sheet and making progress in better capturing the impact of climate change in our macroeconomic modelling. As of October, we started to decarbonise the corporate bond holdings in our monetary policy portfolios by tilting them towards issuers with a better climate performance. We also decided to limit the share of assets issued by non-financial corporations with a high carbon footprint that counterparties can pledge as collateral when borrowing from the Eurosystem.

In 2022 we continued our efforts to remain at the forefront of technological developments in payment systems and market infrastructures. This involved preparations for the transition from TARGET2 to a new, modernised real-time gross settlement system, as well as several measures to ensure pan-European reachability of payment service providers in the TARGET Instant Payment Settlement (TIPS) system. Instant payment transactions via TIPS increased 17-fold in 2022 compared with 2021.

The year also marked the 20th anniversary of the introduction of euro banknotes and coins, a milestone in European history and a tangible symbol of European integration. To date, cash remains the most frequently used means of payment among Europeans, accounting for almost 60% of payments, and there is no doubt that it will continue to play an important role in people’s lives. But as the economy becomes increasingly digital, we need to ensure that Europeans also have access to safe, efficient and convenient digital payment methods. This is why the Eurosystem is exploring the possibility of issuing a digital euro. As part of the ongoing investigation phase, the Eurosystem agreed in 2022 on the main use cases and several key design decisions for a digital euro.

As the year came to a close, the euro area expanded again, with Croatia becoming its newest member on 1 January 2023 – demonstrating that the euro remains an attractive currency that brings stability to its members.

None of the above would have been possible without the dedicated efforts of ECB staff and their collective determination to serve the people of Europe.

Frankfurt am Main, May 2023

Christine Lagarde

President

Global growth decelerated in 2022. Russia’s invasion of Ukraine, high inflation and tighter financial conditions weighed on both advanced and emerging market economies. Global inflation pressures rose significantly, fuelled by high and volatile commodity prices, global supply bottlenecks and tight labour markets. The euro weakened against the US dollar but appreciated against many other currencies, and was thus more stable in nominal effective terms.

In the euro area inflation increased to 8.4% in 2022 from 2.6% in 2021. The rise mainly reflected a surge in energy and food prices, triggered by the war in Ukraine. Past supply bottlenecks and some pent-up demand from the coronavirus (COVID-19) pandemic, together with high input costs in production due to the rise in energy prices, increased price pressures across many sectors of the economy. After a strong first half of the year, when particularly the services sector benefited from the lifting of pandemic-related restrictions, growth slowed in the euro area, largely owing to the effects of the war in Ukraine.

1.1 Slowing economic activity across advanced and emerging market economies

Russia’s war in Ukraine weighed on global economic growth, by increasing uncertainty and inflation

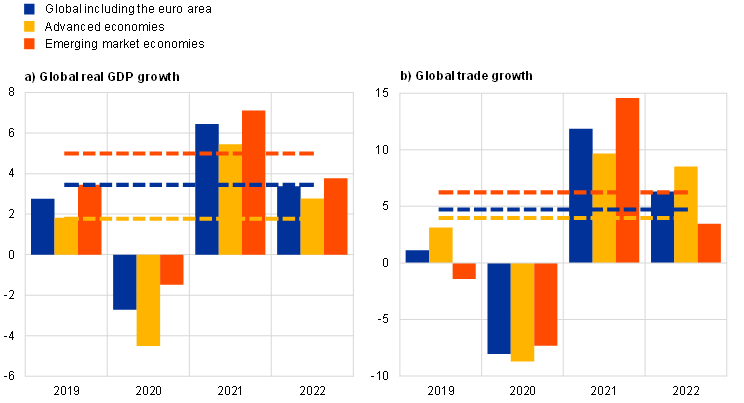

Global economic growth dropped to 3.4% in 2022 from 6.4% in 2021, as Russia’s war in Ukraine and other geopolitical factors created uncertainty, inflation rose and financial conditions tightened. The slowdown was broad-based across advanced and emerging market economies (Chart 1.1, panel a). It followed a strong recovery in 2021, mainly due to the easing of pandemic-related restrictions and a subsequent rise in global demand. In early 2022 the war in Ukraine inflicted another major shock on the world economy. It led to a surge and very high volatility in commodity prices, and undermined food security, especially for emerging market economies. Rising energy and food prices amplified inflationary pressures globally, reducing households’ real disposable incomes and leading central banks to swiftly tighten monetary policy. In an environment of rising interest rates, falling stock market valuations and heightened risk aversion, global financial conditions tightened significantly.

Chart 1.1

Global GDP and trade developments

(annual percentage changes)

Sources: Haver Analytics, national sources and ECB calculations.

Notes: Panel a): the aggregates are computed using GDP adjusted with purchasing power parity weights. The solid bars indicate data. The dashed lines indicate the long-term averages (between 1999 and 2022). The latest observations are for 2022 as updated on 18 April 2023. Panel b): global trade growth is defined as growth in global imports including the euro area. The solid bars indicate data. The dashed lines indicate the long-term averages (between 1999 and 2022). The latest observations are for 2022 as updated on 18 April 2023.

Global trade growth decelerated in 2022

Global trade growth fell in 2022, although it remained above the historical average (Chart 1.1, panel b). The drop was mainly due to weak manufacturing activity. In the first half of the year global trade was still relatively resilient since the effects of Russia’s war in Ukraine and lingering global supply bottlenecks were partially compensated by the recovery in travel and transportation services as pandemic-related restrictions were relaxed. In the second half of the year, however, trade slowed significantly, reflecting in particular lower imports from emerging market economies. While global value chain integration has stagnated since the global financial crisis, the pandemic and geopolitical developments have increased incentives for firms to return to domestic production and diversify their suppliers, which could in future lead to a fragmentation of global value chains.

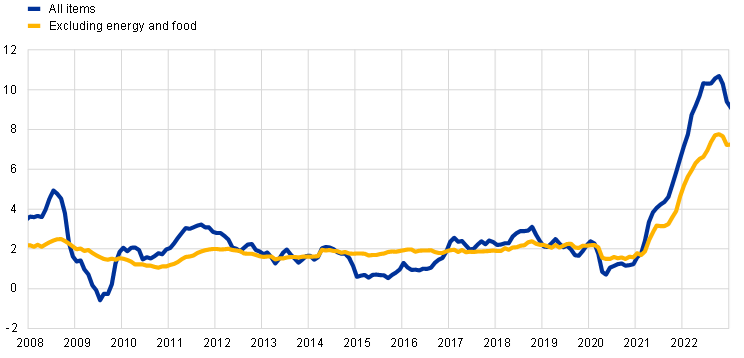

Global headline inflation and inflation excluding energy and food both rose significantly

Global inflationary pressures – as reflected both in headline inflation measures and in measures of inflation excluding energy and food – increased significantly in 2022 (Chart 1.2). Inflationary pressures were fuelled by high and volatile commodity prices, global supply bottlenecks, prolonged reopening effects from the pandemic, and tight labour markets. In the countries belonging to the Organisation for Economic Co-operation and Development (OECD), headline inflation peaked in aggregate at 10.7% in October, then started to decline. Inflation excluding energy and food peaked in the same month, at 7.8%. In most countries the surge in inflation over the first half of the year mainly reflected higher commodity prices. The increase in inflation excluding energy and food later in the year indicated that inflationary pressures had become increasingly broad-based, both in advanced and in emerging market economies. Underlying inflationary pressures were also fuelled by increasing wage pressures, as labour markets across key advanced economies remained tight despite the slowdown in global economic activity.

Chart 1.2

OECD inflation rates

(annual percentage changes, monthly data)

Source: OECD.

Note: The latest observations are for December 2022 as updated on 18 April 2023.

Energy prices rose after Russia’s invasion of Ukraine but eased to some extent as energy demand fell and LNG imports increased

Energy prices increased sharply during 2022 but eased to some extent towards the end of the year. Oil prices increased by 6%, driven by supply disruptions, mainly due to Russia’s invasion of Ukraine which caused a spike in oil prices in spring. Supply disruptions were partly counterbalanced by lower demand amid the global economic slowdown and lockdowns in China. The invasion of Ukraine and reduced gas supplies to Europe also led to unprecedented spikes in European gas prices, which increased by more than 240% in the immediate aftermath of the Russian invasion relative to the beginning of the year. The surge in gas prices left a significant mark on European energy prices in general as it also led to an increase in wholesale electricity prices. Gas prices moderated in the last quarter, as increased imports of liquified natural gas (LNG) and measures to save gas meant the EU had high gas storage levels at the start of the heating season, leaving gas prices largely similar to pre-invasion levels at the end of 2022 but still 14% higher than at the beginning of the year.

The euro fell against the US dollar but was more stable in nominal effective terms

The euro depreciated by 6% against the US dollar in 2022 but was more stable in nominal effective terms (+0.8%), albeit with considerable within-year variation. The dollar strengthened against most other currencies, as the US Federal Reserve System tightened monetary policy and global risk sentiment was subdued. The euro also came under pressure from high energy prices and the deteriorating economic outlook for the euro area. However, it appreciated against other major currencies, such as the pound sterling, the Japanese yen and Chinese renminbi.

The major risks to the outlook for global economic growth at the end of 2022, amid high uncertainty, included greater repercussions from the war in Ukraine, spillovers from a more significant slowdown of the Chinese economy and tighter financial conditions due to a swifter withdrawal of monetary policy stimulus in key advanced economies. The latter was seen as potentially triggering more significant capital outflows from emerging market economies and disrupting financial markets. In addition, global commodity markets remained sensitive to supply risks. Higher commodity prices and a stronger transmission to consumer price inflation would erode purchasing power more significantly and could weigh on global demand. Renewed pressures in global supply chains and an increasing fragmentation of the global trading system could also hamper growth and fuel inflation.

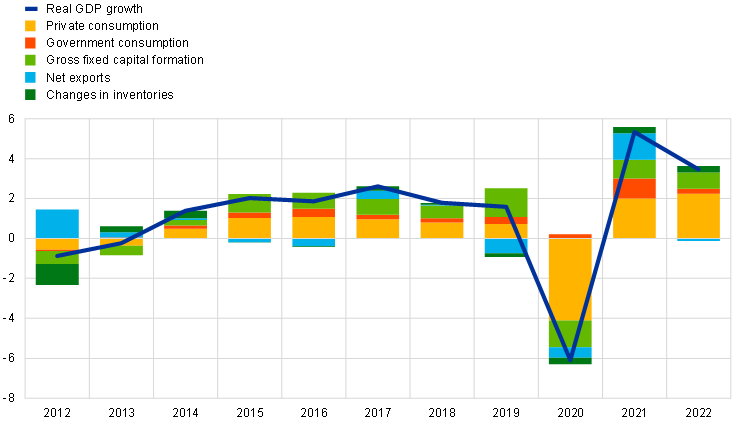

1.2 Growth in the euro area weakened substantially in the course of 2022

Euro area real GDP grew by 3.5% in 2022, after growing 5.3% in 2021 as the economy recovered from the pandemic-related recession (Chart 1.3). Growth in 2022 mainly reflected a robust contribution from domestic demand. By the end of the year output in the euro area was 2.4% above its pre-pandemic level, i.e. compared with the final quarter of 2019. However, the growth performance varied markedly across countries, reflecting the different economic structures and the extent to which individual countries benefited from the reopening of the services sector and were affected by Russia’s invasion of Ukraine. As the strong rebound in demand for contact-intensive services in the first half of the year lost steam, soaring energy prices started to dampen spending and production throughout the economy. The euro area also felt the impact of the weakening in global demand and tighter monetary policy in many major economies amid high economic uncertainty and falling confidence for businesses as well as households.

Chart 1.3

Euro area real GDP

(annual percentage changes; percentage point contributions)

Source: Eurostat.

Note: The latest observations are for 2022.

Monetary policy support was withdrawn while fiscal policy offered protection against energy price rises

In 2022 monetary policy support was withdrawn while fiscal policies focused on protection against energy price rises. While the normalisation of the monetary policy stance started in December 2021, monetary policy remained accommodative overall, particularly in the first half of the year. In the second half of the year, however, monetary policy support was rapidly withdrawn in unprecedentedly large steps (see Section 2.1). Euro area governments introduced fiscal policy measures to attenuate the impact of high energy prices. The measures were largely non-targeted, rather than primarily aimed at protecting the most vulnerable households and firms. About half of the measures had an impact on the marginal cost of energy consumption rather than being tailored to preserving incentives to consume less energy. At the same time, structural policies continued to be pursued to increase the euro area’s growth potential. The ongoing implementation of countries’ investment and structural reform plans under the Next Generation EU (NGEU) programme made an important contribution to these objectives.

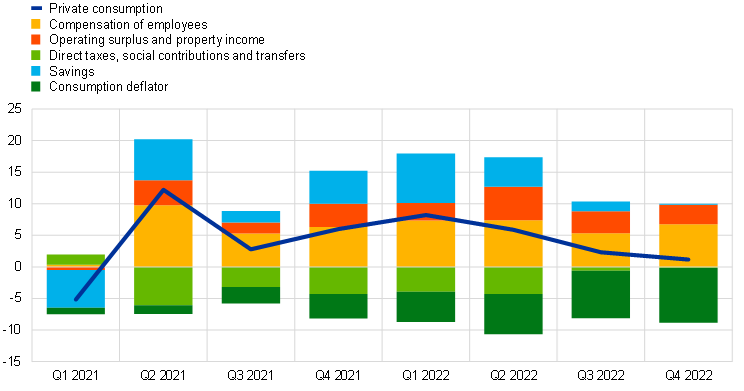

Private consumption was affected by several shocks but was resilient overall

Private consumption growth was resilient in 2022 as labour income remained firm and savings supported pent-up demand (Chart 1.4). The positive dynamics were underpinned mainly by consumption of services, which rose sharply as the pandemic-related restrictions were lifted. Nevertheless, private consumption growth slowed down in the course of the year, owing to weak spending on non-durable goods amid declining real disposable income growth and lingering uncertainty. Overall, household spending increased by 4.3% in 2022. With strong growth in employment and the gradual acceleration in wages, labour income, which is typically used for consumption more than other sources of income, was the main contributor to disposable income growth in 2022. However, rising inflation increasingly dampened real disposable income towards the end of the year, outweighing the favourable effects of the resilient labour market and fiscal support.

Chart 1.4

Euro area real private consumption

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the fourth quarter of 2022.

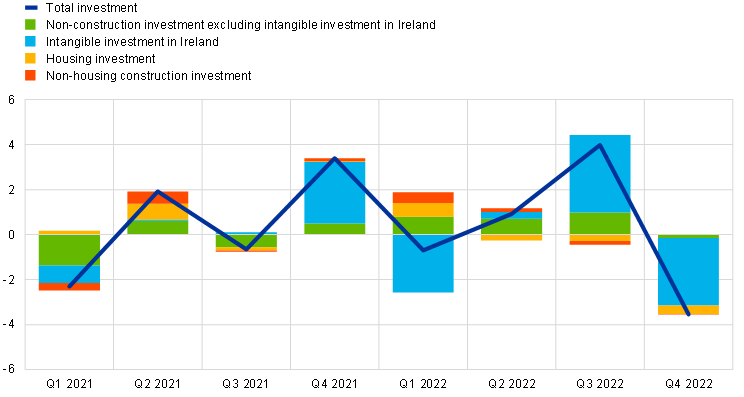

Investment faced rising energy and financing costs amid high uncertainty

Non-construction investment growth – a proxy for private non-housing investment – fluctuated strongly in 2022 (Chart 1.5).[1] Excluding the particularly volatile Irish intangible investment component,[2] non-construction investment growth slowed throughout the year. It started the year on a strong note, spurred by high demand, robust corporate profits and favourable financing conditions, as pandemic-related restrictions were lifted. However, Russia’s war in Ukraine and the ensuing energy crisis, together with the reduction of monetary policy stimulus, meant rising energy and financing costs for firms. Alongside slowing domestic and global demand in an environment of high uncertainty, this reduced their incentives to invest. In level terms, non-construction investment was by the end of 2022 well below its level in the fourth quarter of 2019, which had been boosted by a considerable rise in intangible investment. Excluding Irish intangibles, it had already recovered by the end of 2020. Overall, non-construction investment grew by 5.2% in 2022.

Chart 1.5

Euro area real investment

(quarterly percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the fourth quarter of 2022.

Housing investment grew at a strong pace in the first quarter of 2022, as housing demand was sustained by favourable financing conditions, the accumulation of a large stock of savings and income support measures. It recoiled in the following quarters, however, as demand weakened on the back of rising mortgage rates and uncertainty related to the war in Ukraine, while supply suffered from soaring costs stemming from shortages of materials and labour. At the end of 2022 housing investment was around 3% above its pre-pandemic level, having grown by 1.1% in 2022 as a whole.

Trade was affected by higher energy costs, supply chain bottlenecks and weakening global demand

The euro area goods trade balance shifted into deficit in 2022, largely owing to the higher cost of energy imports and a subdued export performance. On the imports side, robust growth driven by energy stockpiling and increasing intermediate goods imports was accompanied by strongly rising prices, especially for energy imports. Goods exports were hampered by a re-intensification of supply chain bottlenecks in the first half of 2022. They subsequently remained subdued as global demand weakened while supply chain issues improved only gradually. In contrast, services exports, particularly tourism services, benefited from the easing and gradual elimination of pandemic-related restrictions. Overall, the contribution from trade to euro area GDP growth was broadly neutral in 2022.

Labour markets

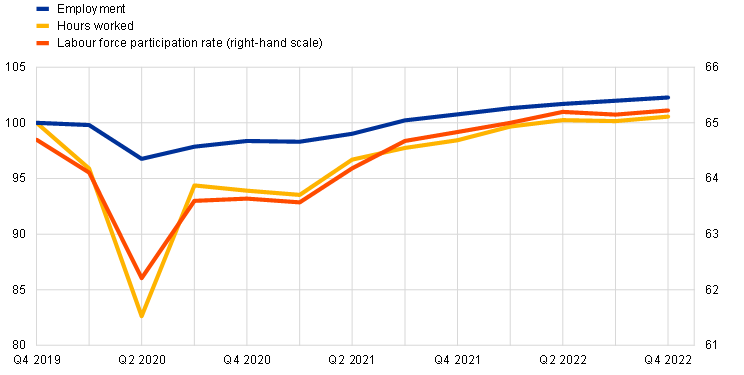

The labour market remained resilient overall in 2022

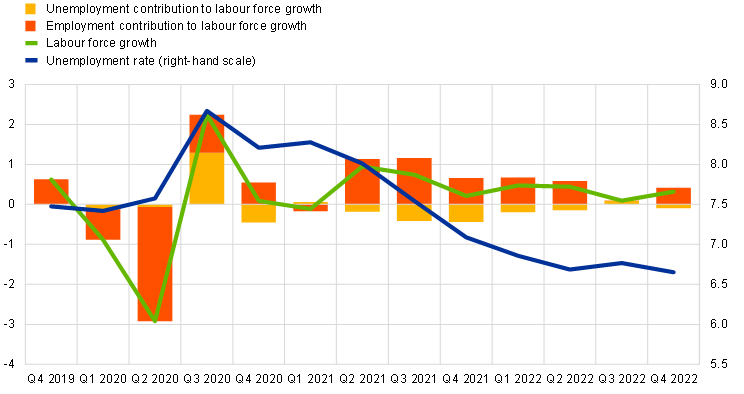

The labour market continued its marked recovery from the pandemic alongside the rebound in euro area economic activity. By the fourth quarter of 2022 total employment and total hours worked had surpassed their levels in the fourth quarter of 2019 by 2.3% and 0.6% respectively (Chart 1.6). The labour force participation rate in the age group 15-74 years increased to a level of 65.2% in the fourth quarter of 2022, 0.5 percentage points above its level in the fourth quarter of 2019. In line with employment growth, the unemployment rate declined further, from an already historically low level of 6.9% in January 2022 to 6.7% at the end of 2022 (Chart 1.7). There was a drop in recourse to job retention schemes, which had limited job lay-offs during the crisis, and workers under such schemes largely resumed their normal hours.

Chart 1.6

Employment, hours worked and the labour force participation rate

(left-hand scale: index, Q4 2019 = 100; right-hand scale: percentages of the working-age population)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the fourth quarter of 2022.

Chart 1.7

Unemployment and the labour force

(left-hand scale: quarter-on-quarter percentage changes, percentage point contributions; right-hand scale: percentages of the labour force)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the fourth quarter of 2022.

The euro area labour market remained resilient overall in 2022 despite Russia’s war in Ukraine, as also indicated by continued high levels of job vacancies towards the end of the year. Still, labour market developments and survey indicators of labour demand moderated in the second half of the year. Box 1 compares the labour market developments in the United States and the euro area with a view to better understanding the differences and similarities in the drivers of the recovery from the pandemic and prospects for developments in employment and wages.

1.3 Fiscal policy measures to address a cost-of-living crisis

The euro area general government deficit ratio decreased in 2022 as pandemic-related measures expired and were only partly offset by new support measures

In 2022 euro area governments were confronted, for the third year in a row, with new challenges that required reactive fiscal policies. The euro area’s general government deficit ratio decreased to 3.5% of GDP in 2022 from 5.1% in 2021 (Chart 1.8) as support measures related to the pandemic expired and were only partly offset by new support measures. The latter were aimed at countering rising energy prices and their consequences, namely an increased cost of living for households and higher costs for companies. To a smaller extent, they also financed spending related to Russia’s war in Ukraine. The same developments are reflected in the fiscal stance, which tightened moderately in 2022 for the second year in a row.[3] As can be seen in the chart below, however, only slightly over a third of the loosening in 2020 has so far been reversed.

But measures related to inflation and Russia’s war in Ukraine were sizeable and broad in scope

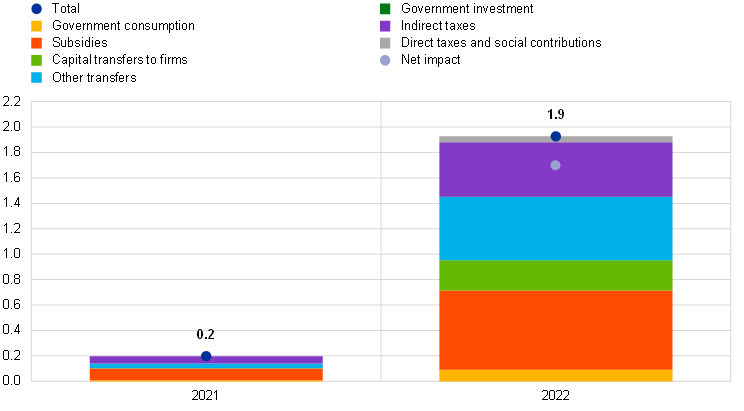

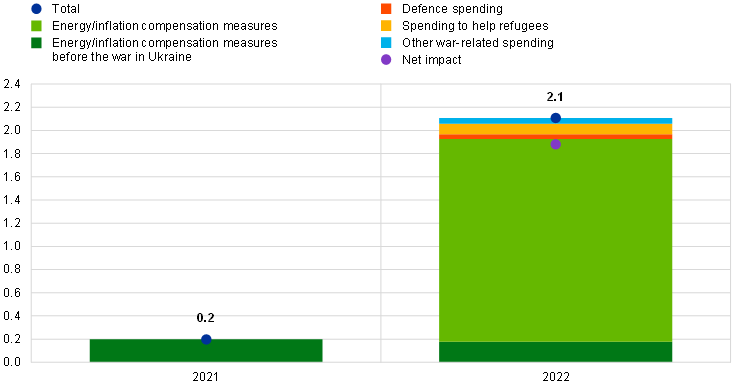

When energy prices started to increase more strongly at the end of 2021, euro area governments put in place support measures amounting to around 0.2% of GDP. These comprised subsidies, indirect tax cuts and transfers to households and companies. In 2022, with Russia’s invasion of Ukraine, governments swiftly expanded such measures to around 1.9% of GDP (Chart 1.9), which also included capital transfers to energy-producing firms. In addition they increased government support by 0.2% of GDP owing to, inter alia, refugee-related and military spending. The energy and inflation support measures were compensated only to a small extent by new financing measures such as higher direct taxation of energy producers making large windfall profits. This implied that their net budgetary effect remained sizeable, at around 1.7% of GDP. In sum, the gross discretionary support (energy and inflation support plus refugee-related and military spending) was thus 2.1% of euro area GDP and, net of new financing, 1.9% of GDP (Chart 1.10).

Chart 1.9

Euro area budget support related to high energy prices and inflation

(percentages of GDP, levels per year)

Sources: Eurosystem staff macroeconomic projections for the euro area, December 2022 and ECB calculations.

Notes: Positive numbers denote fiscal support. The bars and totals denote gross fiscal support. The net impact shows the gross support less the discretionary financing measures for the purposes indicated, as identified by Eurosystem staff.

Chart 1.10

Euro area budget support related to high energy prices, inflation and Russia’s war in Ukraine

(percentages of 2022 GDP, levels per year)

Sources: Eurosystem staff macroeconomic projections for the euro area, December 2022 and ECB calculations.

Notes: Positive numbers denote fiscal support. The bars and totals denote gross fiscal support. The net impact shows the gross support less the discretionary financing measures for the purposes indicated, as identified by Eurosystem staff.

Targeting of government support measures was limited

Support measures should be temporary, targeted to the most vulnerable households and companies, as well as tailored to preserving incentives to consume less energy. Fiscal measures falling short of these principles are likely to exacerbate inflationary pressures, which would necessitate a stronger monetary policy response, and to weigh on public finances. Given that only a small share of these measures was targeted (12% according to the December 2022 Eurosystem staff projections[4]), it is important that governments adjust these measures accordingly.

Consecutive shocks to public finances increase the need for prudent fiscal policies over the medium term

The pandemic, Russia’s war in Ukraine and fiscal expenditures to compensate for high inflation rates represent consecutive major shocks to public finances. These occurred against a background of already elevated government debt-to-GDP ratios. While the pandemic led to high costs for public finances and the war in Ukraine has intensified risks to economic growth prospects, the net impact of the inflationary shock on debt levels is less clear-cut. While higher tax receipts will have some downward effect on the debt ratio, high inflation has prompted a normalisation of monetary policy and thus rising financing costs. Moreover, government expenditures tend to eventually catch up with receipts, while inflation negatively affects output growth.

Pressures on public finances are likely to increase

Pressures on public finances are likely to increase. These will arise from, among other factors, the need to step up the energy transition and to increase investment in a greener and more digital economy, on top of rising fiscal costs due to an ageing population. It is therefore important that the increased vulnerability of euro area public finances is addressed through both growth-enhancing reforms and a gradual reduction in high debt ratios. This will require a swift implementation of the investment and structural reform plans under the Next Generation EU programme and prudent fiscal policies for years to come.

1.4 A sharp increase in euro area inflation

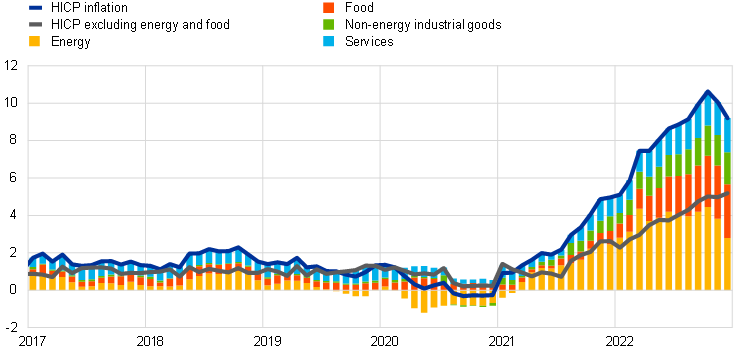

Headline inflation in the euro area as measured by the Harmonised Index of Consumer Prices (HICP) was 8.4% on average in 2022, sharply up from an average of 2.6% in 2021. Inflation surged throughout the year and led to high rates of around 10% year-on-year in the later months. Energy prices were the most important component behind the increase in headline inflation, and food prices also rose increasingly strongly, particularly after Russia’s invasion of Ukraine in February. In addition, persistent supply bottlenecks for industrial goods, recovering demand following the easing of pandemic-related restrictions, especially in the services sector, and the depreciation of the euro added to inflationary pressures (Chart 1.11). Overall, price pressures spread across an increasing number of sectors, in part owing to the indirect impact of high energy costs across the whole economy. The divergence of inflation rates across euro area countries also increased significantly, reflecting primarily different degrees of exposure to the commodity and energy price shocks. Most measures of underlying inflation recorded a sizeable rise over the year. At the end of 2022, the factors behind the inflation surge were expected to unwind and inflation was expected to ease over the course of 2023.

Chart 1.11

Headline inflation and its main components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for December 2022.

Energy and food prices drove inflation

Developments in the energy prices component accounted directly for almost half of the increase in headline inflation over the course of 2022. Energy inflation was already high at the start of the year, then rose sharply further after Russia’s invasion of Ukraine owing to concerns that the supply of energy could be disrupted. In October, energy inflation stood at 41.5%, with large contributions from gas and electricity prices, for which the underlying wholesale prices had decoupled from oil prices. Governments adopted sizeable fiscal measures that helped to dampen the short-term impact of rising energy prices somewhat (see Section 1.3). The varying intensity of these measures contributed to the differences in energy inflation among euro area countries, with the Baltic States recording the highest numbers. The surge in energy costs also placed substantial upward pressure on food prices, affecting them with various lags. The war in Ukraine had also a more direct impact on food prices, as both Russia and Ukraine are important exporters of grain and the minerals used in the production of fertilisers.[5] The contribution of total food inflation to headline HICP inflation reached 2.9 percentage points in December 2022, substantially above the level in 2021, reflecting a rise in both the unprocessed and processed components.

Underlying inflation rose strongly, with some signs of levelling off at the end of the year

Indicators of underlying inflation picked up substantially over the course of 2022, although with some signs of flattening towards the end of the year. HICP inflation excluding energy and food was, at 2.3%, already above the ECB’s inflation target at the beginning of the year and increased to 5.2% in December. On average, non-energy industrial goods inflation rose to 4.6% in 2022, while services inflation reached 3.5%. Price pressure resulted largely from the same factors: very strong input cost rises, related in part to the increase in energy commodity prices, and pandemic-related factors such as global supply bottlenecks and reopening effects. The depreciation of the euro over most of the year also contributed to inflationary pressures. As supply chain disruptions gradually eased over the second half of 2022 and commodity prices came down, pressures at the early stages of the pricing chain moderated after the summer. Yet lagged pass-through effects kept inflation high. Pent-up demand after the lifting of pandemic-related restrictions contributed to a favourable pricing environment for firms, in particular for contact-intensive services. Overall, price pressures became increasingly persistent and broad-based. This led all indicators of underlying inflation to increase.

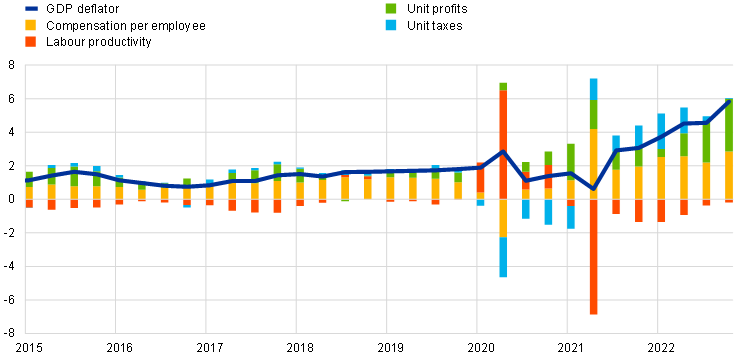

Wage pressures rose towards year-end, amid strong labour markets and some compensation for high inflation

Domestic cost pressures in the euro area, as measured by the growth in the GDP deflator, increased on average by 4.7% in 2022, continuing the path started in 2021 (Chart 1.12). Pressures from wage developments remained moderate in the first half of the year but became more pronounced towards the year-end. Annual growth in compensation per employee rose in 2022, reaching 4.5% on average after 3.9% in 2021 and an average of 1.7% in the pre-pandemic period (between 2015 and 2019). The rise compared with the previous year was partly due to an increase in average hours worked as the impact of job retention schemes faded. Negotiated wages, which were affected to a lesser extent by the impact of government measures, rose by an average annual rate of 2.8% in 2022, slightly below actual wage growth, reflecting the intensification of wage pressures towards the end of the year. Inflation compensation became an increasingly important aspect in wage negotiations during 2022, especially since labour markets remained strong. Increased labour costs were to some extent offset by an increase in labour productivity. Unit profits across sectors contributed positively to the GDP deflator over the year, indicating that firms were able to pass input cost increases through to selling prices.

Chart 1.12

Breakdown of the GDP deflator

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for December 2022.

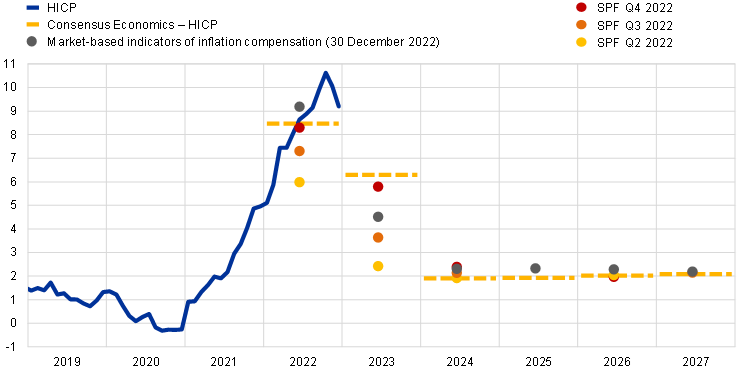

Longer-term inflation expectations rose further but remained broadly anchored at the ECB’s target

Longer-term inflation expectations of professional forecasters, which had stood at 1.9% in late 2021, edged up during the year, reaching 2.2% in the fourth quarter of 2022 (Chart 1.13). Other survey data, such as from the ECB Survey of Monetary Analysts and from Consensus Economics, also suggested longer-term inflation expectations were anchored at or just above 2%, despite higher expectations for the shorter term. Market-based measures of longer-term inflation compensation, particularly the five-year inflation-linked swap rate five years ahead, declined at the beginning of the year in anticipation of a tightening of monetary policy but, following the outbreak of Russia’s war in Ukraine, gradually picked up, standing at 2.38% in late December. Importantly, however, market-based measures of inflation compensation are not a straightforward measure of market participants’ actual inflation expectations, since they incorporate risk premia to compensate for inflation uncertainty.

Chart 1.13

Survey and market-based indicators of inflation expectations

(annual percentage changes)

Sources: Eurostat, Refinitiv, Consensus Economics, ECB Survey of Professional Forecasters (SPF) and ECB calculations.

Notes: The market-based indicators of inflation compensation series is based on the one-year spot inflation-linked swap rate, the one-year forward rate one year ahead, the one-year forward rate two years ahead, the one-year forward rate three years ahead and the one-year forward rate four years ahead. The latest observation for market-based indicators of inflation compensation are for 30 December 2022. The SPF for the fourth quarter of 2022 was conducted between 30 September and 6 October 2022. The cut-off date for the Consensus Economics long-term forecasts was October 2022, while the SPF cut-off date for 2022 and 2023 was December 2022. The latest observation for the HICP is for December 2022.

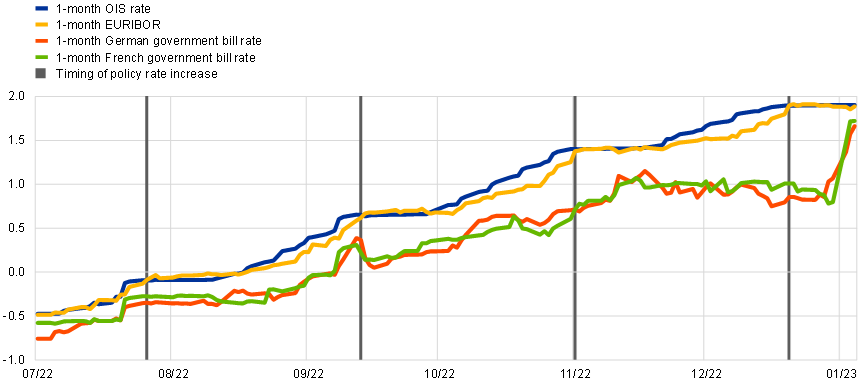

1.5 Tighter credit and financing conditions as monetary policy normalises

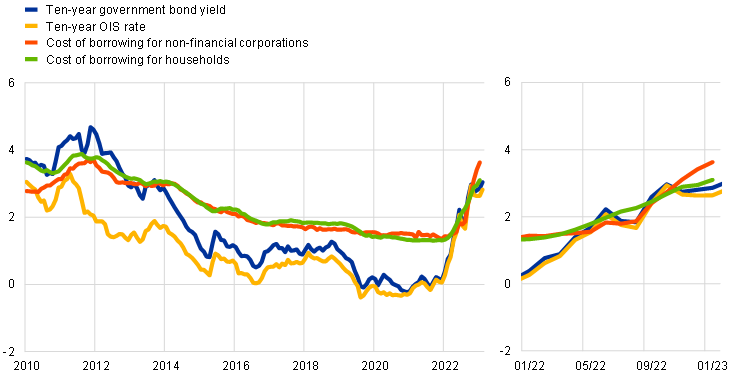

Monetary policy normalisation led to higher bond yields, amid considerable volatility

With inflationary pressures rising throughout the economy (see Section 1.4), the ECB took decisive action in 2022 to normalise monetary policy and prevent longer-term inflation expectations from becoming unanchored above its 2% target (see Section 2.1). Risk-free long-term interest rates were more volatile than in 2021, partly because of very high uncertainty about inflation and the reaction of monetary authorities around the world, including the euro area. Long-term yields increased overall. The euro area ten-year GDP-weighted average of government bond yields closely followed developments in the risk-free rate (Chart 1.14). At the country level, despite some differences, movements in sovereign spreads were contained overall, in part owing to the Governing Council’s announcement in June that it would apply flexibility in reinvesting redemptions coming due in the pandemic emergency purchase programme portfolio and the approval in July of the Transmission Protection Instrument (see Section 2.1). The euro area GDP-weighted average of ten-year nominal government bond yields stood at 3.26% on 31 December 2022, almost 300 basis points higher than at the end of 2021.

Chart 1.14

Long-term interest rates, and the cost of borrowing for firms and for households for house purchase

(percentages per annum)

Sources: Bloomberg, Refinitiv and ECB calculations.

Notes: The data refer to the GDP-weighted average of ten-year government bond yields (daily), the ten-year overnight index swap (OIS) rate (daily), the cost of borrowing for non-financial corporations (monthly) and the cost of borrowing for households for house purchase (monthly).The indicators for the cost of borrowing are calculated by aggregating short-term and long-term bank lending rates using a 24-month moving average of new business volumes. The latest observations are for 31 December 2022 for daily data and for December 2022 for monthly data.

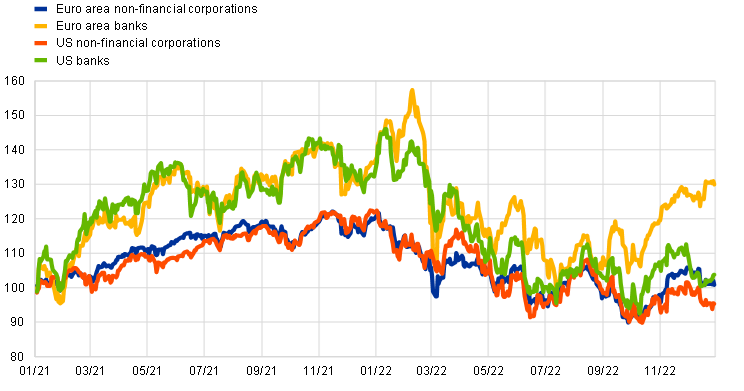

Financing conditions tightened in bond and equity markets

Expectations of higher interest rates and of lower long-term earnings growth put downward pressure on stock prices. Overall, euro area equity prices were very volatile and declined in 2022. The broad indices of euro area non-financial corporation and bank equity prices (Chart 1.15) stood at around 16% and 4.4% below their respective end-2021 levels on 31 December 2022. Since corporate bond yields also increased sizeably, in both the investment grade and high-yield categories, euro area financing conditions tightened considerably.

Chart 1.15

Equity market indices in the euro area and the United States

(index: 1 January 2021 = 100)

Sources: Bloomberg, Refinitiv and ECB calculations.

Notes: The Refinitiv market index for non-financial corporations and the EURO STOXX banks index are shown for the euro area; the Refinitiv market index for non-financial corporations and the S&P banks index are shown for the United States. The latest observations are for 31 December 2022.

Against the background of monetary policy normalisation and general market developments, bank funding costs and bank lending rates increased steeply in 2022. The overall upward trend in bank bond yields, the gradual increase in the remuneration of customer deposits, and a change in the terms and conditions of the third series of targeted longer-term refinancing operations (TLTRO III) towards the end of the year all contributed to an increase in bank funding costs. As a result, nominal bank lending rates increased during 2022 to levels last seen in 2014. The euro area bank lending survey also indicated that banks’ credit standards (i.e. internal guidelines or loan approval criteria) for loans to households and firms tightened substantially. The composite bank lending rate for loans to households for house purchase stood at 2.94% at the end of 2022, up by a cumulative 163 basis points since the end of 2021, and the equivalent rate for non-financial corporations stood at 3.41%, up 205 basis points (Chart 1.14). Viewed in relation to the changes in the key ECB interest rates, such developments were broadly in line with past periods of monetary policy tightening, and the differences in lending rates across countries remained contained. This suggested that changes in the ECB’s monetary policy were transmitting smoothly across the euro area.

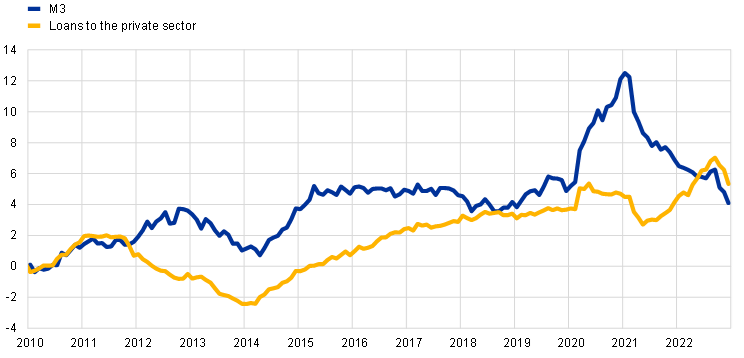

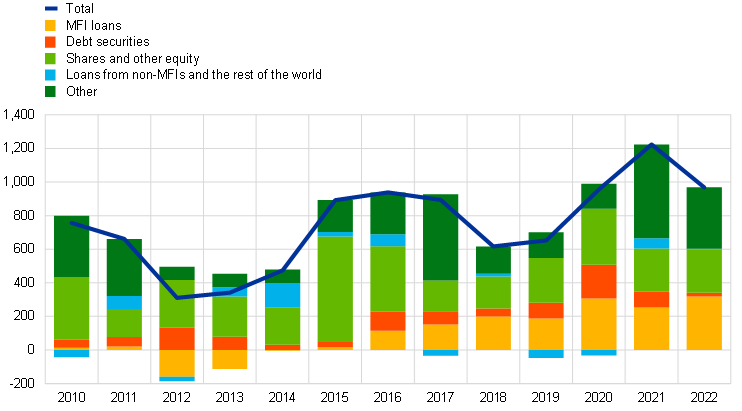

Credit growth increased in the first half of 2022, but then moderated for both households and firms

Credit growth increased in the first half of 2022, but new lending moderated after the summer on the back of tighter credit conditions (Chart 1.16). The annual growth rate of bank loans to households weakened to 3.8% for the year, reflecting rising interest rates, tighter credit standards and lower consumer confidence. The annual growth rate of bank loans to firms still increased in 2022, to 6.3%, although this concealed differing developments in the course of the year. Nominal growth was robust for most of the year, reflecting firms’ need to finance working capital and inventories in view of continued supply bottlenecks and elevated costs. In the last months of the year, however, bank lending to firms declined sharply, reflecting the impact of tighter financing conditions on supply and demand factors. Net issuance of debt securities, which had become more expensive for firms, also decreased during the year. In total, the net flows of external financing to non-financial corporations declined in 2022, mainly on account of a reduction in inter-company loans as a form of financing (Chart 1.17). The survey on the access to finance of enterprises indicated, moreover, that firms were increasingly pessimistic about the future availability of most sources of external financing.

Chart 1.16

M3 growth and the growth of credit to non-financial corporations and households

(annual percentage changes)

Source: ECB.

Notes: The second line depicts growth of credit to the private sector. Defined as non-monetary financial institutions excluding the general government sector, the private sector comprises essentially non-financial corporations and households. The latest observations are for December 2022.

Chart 1.17

Net flows of external financing to non-financial corporations

(annual flows in EUR billions)

Sources: ECB and Eurostat.

Notes: MFI: monetary financial institution. In “loans from non-MFIs and the rest of the world”, non-monetary financial institutions consist of other financial intermediaries, pension funds and insurance corporations. “MFI loans” and “loans from non-MFIs and the rest of the world” are corrected for loan sales and securitisation. “Other” is the difference between the total and the instruments included in the chart and consists mostly of inter-company loans and trade credit. The annual flow for a year is computed as a four-quarter sum of flows. The latest observations are for the fourth quarter of 2022.

Broad money growth moderated as Eurosystem net asset purchases ended and credit creation declined

The pace of deposit accumulation moderated from the high levels recorded during the pandemic, owing primarily to increased expenditure on the back of rising prices and to higher returns on alternative forms of saving in line with the normalisation of monetary policy. The annual growth of broad money (M3) moderated further to 4.1% in 2022 (Chart 1.16), reflecting the end of net asset purchases by the Eurosystem in July, lower credit creation in the last quarter of 2022, and net monetary outflows to the rest of the world linked to the euro area’s higher energy bill.

Box 1

Labour market developments in the euro area and the United States in 2022

In a context of high uncertainty in 2022, labour market analyses were an essential element in assessing the state of the economy and its degree of slack. This box examines the similarities and differences between the euro area and the US labour market as regards their recovery from the pandemic.

Developments in total hours worked

In 2022 total hours worked recovered to pre-pandemic levels in both the euro area and the United States, but the recovery reflected different paths of the labour supply and demand components. While unemployment rates were in 2022 back to levels seen before the crisis in the United States and even lower than that in the euro area, the degree of labour market tightness, measured by the ratio of vacancies to unemployment, appeared to be stronger in the United States.[6] These developments can be attributed both to diverging policy responses to the pandemic and to structural differences in labour supply and demand between the two economies.

Developments in labour demand

In 2022 the two economies were at different stages of the business cycle. Cyclical demand for labour was stronger in the United States and therefore partly responsible for the greater labour market tightness. In the euro area economic activity recovered later from its trough during the pandemic than in the United States. Real GDP in the euro area returned to its pre-crisis level in the last quarter of 2021, while in the United States the pre-crisis level had been reached in the first quarter of 2021. To some extent, this reflected more restrictive and widespread lockdown measures in many euro area countries in the second wave of the pandemic than in the United States as well as differences in the speed of vaccination. However, a more important factor was the differing magnitude and focus of the fiscal measures. The fiscal support in the euro area was concentrated on cushioning employment losses by supporting firms, and letting automatic stabilisers operate. The US fiscal support was larger and focused more directly on supporting household income and thus consumption, via pay cheques and enhanced unemployment benefits. Accordingly, private consumption in the euro area returned even later to its pre-crisis level than overall economic activity, i.e. only in the second quarter of 2022.

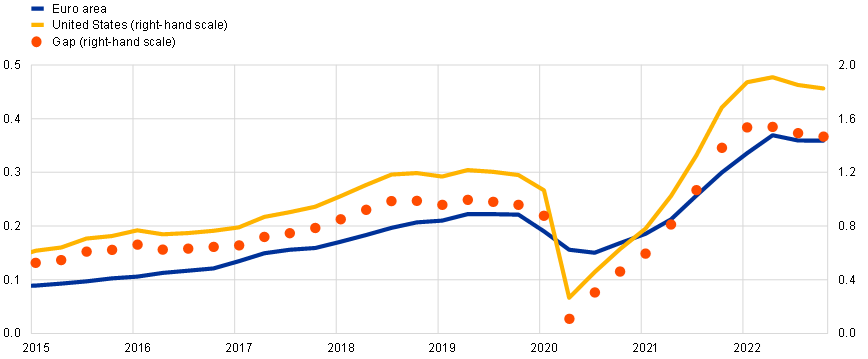

In addition, from a more structural perspective, the US labour market tends to react to the business cycle more strongly than the euro area labour market. Measures of “churning” show that the US labour market is structurally more dynamic. The term “labour churn” refers to the rate at which employees leave and are replaced within a company or organisation within a certain period of time. A crude measure of churning indicates that on average since the early 2000s around 4% of all US workers changed jobs per month. Indicators of churning are not available for the euro area, and the most comparable statistics refer to recent job leavers and job starters (although these also cover people moving from inactivity/unemployment into employment and vice versa). These point to an increase in the number of job starters in 2022 particularly, but a less pronounced rise than that seen in the United States. These dynamics are also visible in the level of vacancies in the two economic regions: this was higher in 2022 in the United States than it was in the euro area (with considerable variation across euro area countries[7]), where the focus had mainly been on bringing retained staff back to normal working time (Chart A).

In sum, stronger structural dynamism of the US labour market added pressure to already more robust labour demand.

Chart A

Labour market tightness in the euro area and the United States

(ratio of vacancies to unemployment)

Sources: Eurostat, Haver Analytics, US Bureau of Labor Statistics and ECB calculations.

Notes: The gap refers to the figure for the United States minus the figure for the euro area. In France, vacancies are reported only for firms with ten or more employees. Employment losses during the pandemic crisis were cushioned in the euro area by extensive usage of job retention schemes, which had declined to very low levels by mid-2022. The latest observations are for the fourth quarter of 2022.

Developments in labour supply

Wage developments

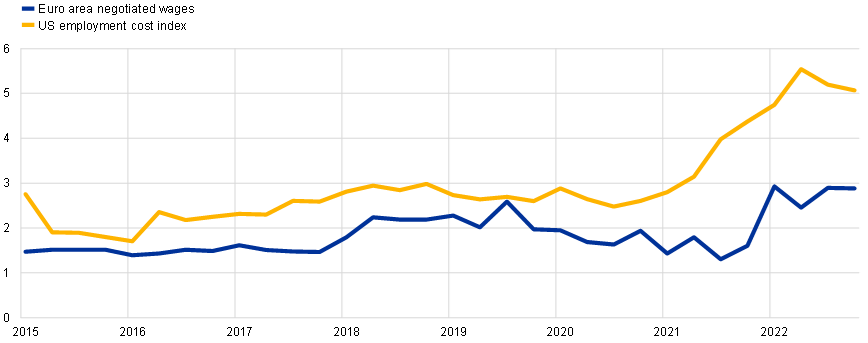

The gap in wage growth between the United States and the euro area has increased in recent years, and this was particularly visible in 2022. To a large extent this can be explained by the different developments in labour supply and demand as explained above. From the second quarter of 2020, US nominal wage growth increased substantially, to 5.5% in the second quarter of 2022, as measured by the employment cost index (private industry). It has moderated since then, but remained high. The rise in euro area wage growth in this period was more gradual and limited, with negotiated wage growth (which is much less affected by job retention schemes than compensation per employee or hour) standing at 2.9% in the fourth quarter of 2022 (Chart B). The structurally more dynamic labour market in the United States may also strengthen the reaction of wages to labour market tightness, as reflected in the higher wage growth of those switching jobs.

Chart B

Measures of wage growth in the euro area and the United States

(annual percentage changes)

Sources: Eurostat, Haver Analytics and ECB staff calculations.

Note: The latest observations are for the fourth quarter of 2022 for both euro area negotiated wages and the US employment cost index (private industry).

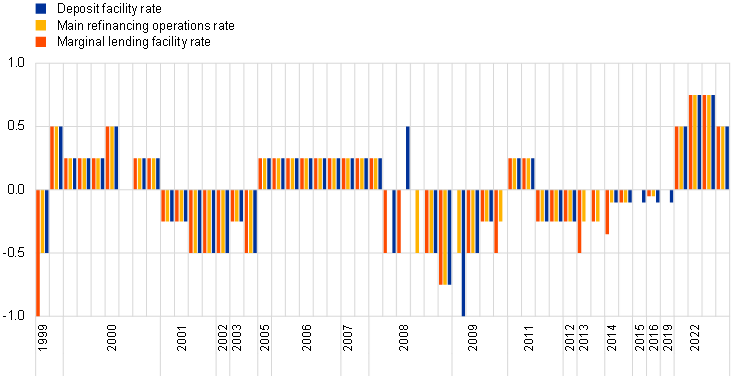

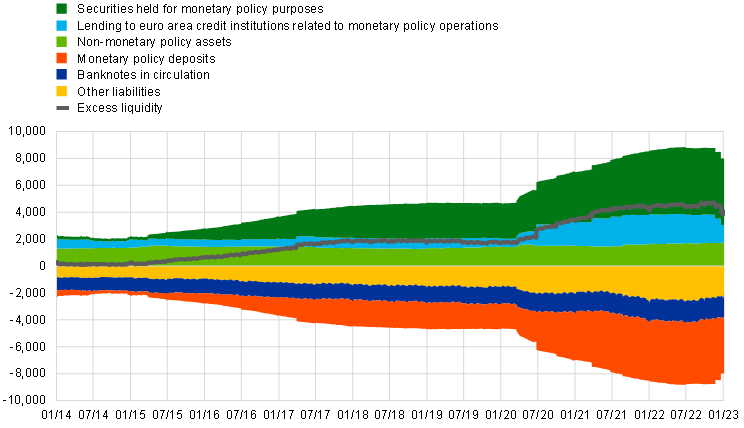

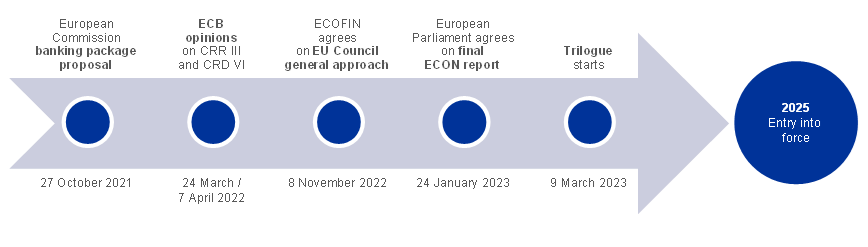

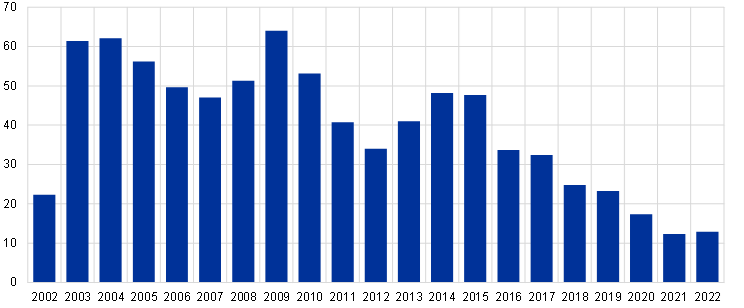

The ECB continued to normalise its monetary policy in 2022 to combat exceptionally high inflation, amid Russia’s invasion of Ukraine and lasting effects from the pandemic. In the first phase of normalisation the Governing Council ended net asset purchases under the pandemic emergency purchase programme (PEPP) at the end of March and under the asset purchase programme (APP) at the beginning of July. In the second phase the key ECB rates were raised for the first time in more than a decade, and the deposit facility rate left negative territory for the first time since 2014. Policy rates increased by a cumulative 250 basis points over the last four meetings of the year, which included the largest individual rate hikes on record (Chart 2.1). The Governing Council also approved the Transmission Protection Instrument to ensure an orderly transmission of monetary policy across the euro area. In addition, the flexibility available for reinvestments under the PEPP served as a first line of defence to counter pandemic-related risks to transmission. In December, the Governing Council decided to decrease the monetary policy securities portfolio acquired by the Eurosystem under the APP, at a measured and predictable pace, from March 2023 onwards. The Eurosystem’s balance sheet reached a historical high in June 2022 at €8.8 trillion, before declining to €8.0 trillion by the year’s end. The reduction stemmed mainly from maturing operations and early repayments under the third series of targeted longer-term refinancing operations (TLTRO III). Early repayments were supported by the Governing Council’s decision in October to change the terms and conditions for TLTRO III operations. In line with the normalisation of monetary policy, the ECB also began phasing out collateral easing measures introduced in response to the pandemic, thus gradually restoring pre-pandemic risk tolerance levels in the Eurosystem’s credit operations.

2.1 Withdrawing monetary policy accommodation

A first phase of policy normalisation: a slower pace of asset purchases and the preconditions for rate hikes

In early 2022 the pandemic was still hampering economic growth, and inflation was higher than projected

In early 2022 the euro area economy continued to recover from the pandemic and the labour market improved further, not least as a result of the support provided by public policies. However, the near-term outlook for economic growth remained subdued amid surging new coronavirus infections due to the spread of the Omicron variant. Shortages of materials, equipment and labour continued to hold back output in some industries, and high energy costs were already hurting real incomes. Inflation in the Harmonised Index of Consumer Prices (HICP) had risen sharply in the preceding months and was again higher than projected in January. This was primarily driven by higher energy costs, which were pushing up prices across many sectors, as well as by higher food prices. On the basis of data at the beginning of the year, the Governing Council assessed in February that inflation was likely to remain elevated for longer than previously expected but to decline over the course of the year.

In February the Governing Council continued the normalisation of monetary policy which had started in December 2021

The Governing Council therefore confirmed the decision taken at its monetary policy meeting in December 2021 to continue reducing the pace of asset purchases step by step over the following quarters. It had decided to discontinue net asset purchases under the PEPP at the end of March 2022, and to reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2024. The Governing Council emphasised that, in the event of renewed market fragmentation related to the pandemic, PEPP reinvestments could be adjusted flexibly across time, asset classes and jurisdictions whenever threats to monetary policy transmission jeopardised the attainment of price stability. This could include purchasing bonds issued by the Hellenic Republic over and above rollovers of redemptions in order to avoid an interruption of purchases in that jurisdiction, which could impair the transmission of monetary policy to the Greek economy while it was still recovering from the fallout of the pandemic.

The invasion of Ukraine dramatically increased economic uncertainty and price pressures

Russia’s invasion of Ukraine in February was a watershed for Europe. The unjustified war had a material impact on economic activity and inflation in 2022, including in the euro area, through higher energy and commodity prices, the disruption of international trade and weaker confidence. In March the Governing Council assessed that the extent of these effects would depend on how the war evolved, on the impact of sanctions and on possible further measures. In recognition of the highly uncertain environment, the Governing Council considered a range of scenarios in addition to the usual ECB staff macroeconomic projections for the euro area. The impact of the war was assessed in the context of incoming data that indicated still solid underlying conditions for the euro area economy, helped by considerable policy support. The ongoing recovery of the economy was boosted by the fading impact of the Omicron coronavirus variant. Supply bottlenecks were showing some signs of easing and the labour market was improving further. Still, in the baseline of the March staff projections, which incorporated a first assessment of the implications of the war, GDP growth was revised downwards for the near term. Prior to the Governing Council’s March monetary policy meeting, inflation had continued to be higher than projected mainly because of unexpectedly high energy costs. Price rises had also become more broad-based across sectors. Compared with the December 2021 Eurosystem staff projections, the baseline for HICP inflation in the March projections was revised significantly upwards, while longer-term inflation expectations across a range of measures were in line with the ECB’s 2% medium-term inflation target.

The Governing Council revised the APP purchase schedule in March

On the basis of this updated assessment and taking into account the uncertain environment, the Governing Council revised the purchase schedule for the APP at its March monetary policy meeting, with monthly net purchases to be €40 billion in April, €30 billion in May and €20 billion in June. The calibration of net purchases for the third quarter was to depend on incoming data. The Governing Council also confirmed its prior decision that any adjustments to the key ECB interest rates would take place some time after the end of net purchases under the APP. The path for the key ECB interest rates was still determined by the Governing Council’s forward guidance, reflecting its strategic commitment to stabilise inflation at 2% over the medium term.

The June staff projections made another upward revision to the inflation path

Inflation again rose significantly in May, mainly due to the impact of the war and a continued surge in energy and food prices. At the same time, inflation pressures had broadened and intensified, with prices for many goods and services increasing strongly. Against this backdrop and the June baseline Eurosystem staff projections, which saw inflation above the 2% target at the end of the projection horizon, the Governing Council decided on 9 June to take further steps in normalising monetary policy, guided by the principles of optionality, data-dependence, gradualism and flexibility.

The Governing Council said it would end APP net asset purchases and start raising rates…

First, the Governing Council decided to end net asset purchases under the APP as of 1 July 2022. It said that it intended to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it started raising the key ECB interest rates and, in any case, for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance.

Second, the Governing Council concluded in June that the conditions under its forward guidance for starting to raise the key ECB interest rates had been satisfied. Accordingly, and in line with the previously signalled policy sequencing, it said that it intended to raise the key ECB interest rates by 25 basis points at the July monetary policy meeting, with another increase expected in September.

Third, based on the assessment in June, the Governing Council anticipated that, beyond September, a gradual but sustained path of further increases in interest rates would be appropriate, depending on the incoming data and the assessment of inflation developments over the medium term.

…and addressed concerns about the transmission of monetary policy

The decisions taken on 9 June reflected significant steps towards a normalisation of the monetary policy stance. At an ad hoc meeting on 15 June, the Governing Council assessed the financial market situation and potential fragmentation risks, and underscored its determination to preserve an orderly transmission of the monetary policy stance throughout the euro area. In particular, the Governing Council assessed that the pandemic had left lasting vulnerabilities in the euro area economy, which were contributing to an uneven transmission of the normalisation of the ECB’s monetary policy across jurisdictions.

On the basis of this assessment, the Governing Council decided to apply flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to preserving the functioning of the monetary policy transmission mechanism. In addition, it mandated the relevant Eurosystem committees together with the ECB services to accelerate the completion of the design of a new anti-fragmentation instrument.

A second phase of policy normalisation: the Transmission Protection Instrument and policy rate hikes

In July the Governing Council approved the Transmission Protection Instrument…

The new Transmission Protection Instrument (TPI) was approved by the Governing Council at its meeting on 21 July. The Governing Council considered the establishment of the new instrument necessary to support the effective transmission of monetary policy, in particular over the course of policy normalisation. The TPI would ensure that the monetary policy stance is transmitted smoothly across all euro area countries. The TPI constitutes an addition to the ECB’s toolkit and can be activated to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across the euro area. Subject to established criteria being met, the Eurosystem can make secondary market purchases of securities issued in jurisdictions experiencing a deterioration in financing conditions not warranted by country-specific fundamentals, to counter risks to the transmission mechanism to the extent necessary. The scale of TPI purchases, if activated, would depend on the severity of the risks facing monetary policy transmission; purchases would not be restricted ex ante. The Governing Council further emphasised in July that, in any event, the flexibility in reinvestments of redemptions coming due in the PEPP portfolio remained the first line of defence to counter risks to the transmission mechanism related to the pandemic. The Governing Council also highlighted in July that it retained discretion to conduct Outright Monetary Transactions for countries that fulfilled the requisite criteria. While the TPI’s objective is to safeguard the smooth transmission of monetary policy across all euro area countries, Outright Monetary Transactions can be activated in the event of severe distortions in government bond markets which originate from, in particular, unfounded fears on the part of investors of the reversibility of the euro.

The Governing Council also decided in July on the first policy rate hike since 2011, raising the three key ECB interest rates by 50 basis points. It judged that it was appropriate to take a larger first step on its policy rate normalisation path than had been signalled at its previous meeting. This decision was based on the Governing Council’s updated assessment of inflation risks and the reinforced support provided by the TPI for the effective transmission of monetary policy. The Governing Council also signalled that further normalisation of interest rates would be appropriate in the following months.

…and ended its forward guidance on policy rates

The frontloading of the exit from negative interest rates in July allowed the Governing Council to make a transition from forward guidance on interest rates to a meeting-by-meeting approach to its interest rate decisions. This transition appeared warranted in view of the exceptional uncertainty surrounding the outlook for inflation and the economy.

With inflation over 9% in August and expected to be above target in the medium run, the Governing Council raised rates by another 75 basis points in September

In September the Governing Council decided to raise the key ECB interest rates by another 75 basis points, the largest single increase in these rates on record up to then. It took this decision because inflation remained far too high and incoming data indicated that it would stay above target for an extended period. Soaring energy and food prices, demand pressures in some sectors owing to the reopening of the economy, and supply bottlenecks were still driving up inflation, which had risen to 9.1% in August. As in previous months, price pressures were continuing to strengthen and broaden across the economy. ECB staff had significantly revised up their inflation projections in September in comparison with the June projections, with HICP inflation declining over the projection horizon but still above the 2% target in the final year. Furthermore, incoming data pointed to a substantial slowdown in euro area economic growth, and the economy was expected to stagnate later in the year and in the first quarter of 2023. Very high energy prices continued to reduce the purchasing power of people’s incomes and supply bottlenecks were still constraining economic activity. In addition, the geopolitical situation, especially Russia’s war in Ukraine, weighed on the confidence of businesses and consumers. Against this backdrop, the September staff projections for economic growth were revised down markedly for the remainder of 2022 and throughout 2023.

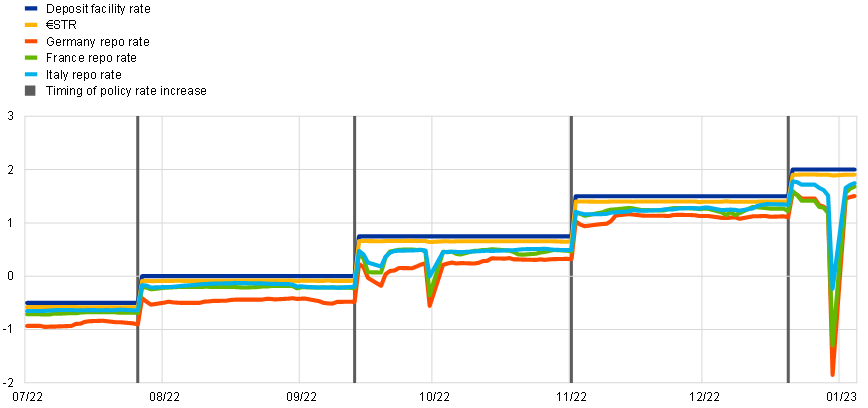

Positive policy rates made the two-tier system for excess reserve remuneration obsolete

The increase in the key ECB interest rates by 75 basis points in September frontloaded the transition from a highly accommodative level of policy rates towards levels that would ensure the timely return of inflation to the ECB’s 2% medium-term target. The Governing Council said that, based on its assessment, it expected to raise interest rates further over the coming meetings to dampen demand and guard against the risk of a persistent upward shift in inflation expectations. Furthermore, since the deposit facility rate had been raised to above zero, the two-tier system for the remuneration of excess reserves was no longer necessary. The Governing Council therefore decided to suspend the two-tier system by setting the multiplier to zero. In addition, to preserve the effectiveness of monetary policy transmission and safeguard orderly market functioning, the Governing Council decided to temporarily remove the 0% interest rate ceiling for the remuneration of government deposits. The ceiling was temporarily set at the lower of either the deposit facility rate or the euro short-term rate (€STR), including under a positive deposit facility rate. The measure was intended to remain in effect until 30 April 2023 and was designed to prevent an abrupt outflow of deposits into the market, at a time when some segments of the euro area repo markets were showing signs of collateral scarcity, and to allow an in-depth assessment of how money markets were adjusting to the return to positive interest rates.

A third phase of policy normalisation: further rate hikes and balance sheet reduction

With inflation likely to stay high for an extended period, the Governing Council raised rates again by 75 basis points in October…

Inflation rose to 9.9% in September and 10.6% in October, the highest reading in the history of the single currency. Soaring energy and food prices, supply bottlenecks and the post-pandemic recovery in demand had led to a further broadening of price pressures and an increase in inflation over summer. Against this background, the Governing Council decided in October to raise the three key ECB interest rates again by 75 basis points, emphasising that with this third major policy rate increase in a row substantial progress had been made in withdrawing monetary policy accommodation.

…and aligned the TLTRO III terms and conditions with the broader policy normalisation

The Governing Council also decided in October to change the terms and conditions of TLTRO III. It adjusted the interest rates on the operations from 23 November, by indexing the interest rate paid to the average applicable key ECB interest rates, and offered banks three additional voluntary early repayment dates. During the acute phase of the pandemic, this instrument played a key role in countering downside risks to price stability. In view of the unexpected and extraordinary rise in inflation, however, it needed to be recalibrated to ensure consistency with the broader monetary policy normalisation process and to reinforce the transmission of policy rate increases to bank lending conditions. The Governing Council expected the recalibration of the TLTRO III terms and conditions to contribute to the normalisation of bank funding costs. The ensuing normalisation of financing conditions would, in turn, exert downward pressure on inflation, helping to restore price stability over the medium term. The recalibration also removed deterrents to voluntary early repayment of outstanding TLTRO III funds. Voluntary early repayments would reduce the Eurosystem balance sheet and thus contribute to the overall monetary policy normalisation. The recalibration of TLTRO III and the subsequent repayments led to a substantial decline in excess liquidity.

Finally, in order to align the remuneration of minimum reserves held by credit institutions with the Eurosystem more closely with money market conditions, the Governing Council decided to set the remuneration of minimum reserves at the deposit facility rate.

December saw the fourth rate hike in a row amid double-digit inflation and increasing recession risks

In December the Governing Council raised interest rates for the fourth time in a row, this time by 50 basis points, because inflation remained far too high and was projected to stay above the ECB’s target for too long. The Governing Council also said that interest rates would still have to rise significantly at a steady pace to reach levels that were sufficiently restrictive to ensure a timely return of inflation to the target. Keeping interest rates at restrictive levels would over time reduce inflation by dampening demand and also guard against the risk of a persistent upward shift in inflation expectations. Inflation was 10.1% in November, slightly lower than the 10.6% recorded in October. The decline resulted mainly from lower energy price inflation. Food price inflation and underlying price pressures across the economy had strengthened and were expected to persist for some time. Amid exceptional uncertainty, Eurosystem staff had significantly revised up their inflation projections in December, and saw average inflation reaching 8.4% in 2022 before decreasing to 6.3% in 2023, with inflation projected to decline markedly over the course of that year. Inflation was then seen falling further to an average of 3.4% in 2024 and 2.3% in 2025. The projections indicated that the euro area economy might contract around the turn of 2022/2023, owing to the energy crisis, high uncertainty, weakening global economic activity and tighter financing conditions. However, they saw a possible recession as likely to be relatively short-lived and shallow, while the growth outlook for 2023 had still been revised down significantly compared with the previous projections.

The Governing Council laid out the principles for normalising the balance sheet

In December the Governing Council also discussed principles for reducing the APP securities holdings. It decided that from the beginning of March 2023 onwards the APP portfolio would decline at a measured and predictable pace, as the Eurosystem would not reinvest all of the principal payments from maturing securities. The decline would amount to €15 billion per month on average until the end of the second quarter of 2023 and its subsequent pace would be determined over time. The Governing Council also highlighted that by the end of 2023 the ECB would review its operational framework for steering short-term interest rates, which would provide information regarding the endpoint of the balance sheet normalisation process.

Chart 2.1

Changes in the key ECB policy rates

(percentage points)

Source: ECB.

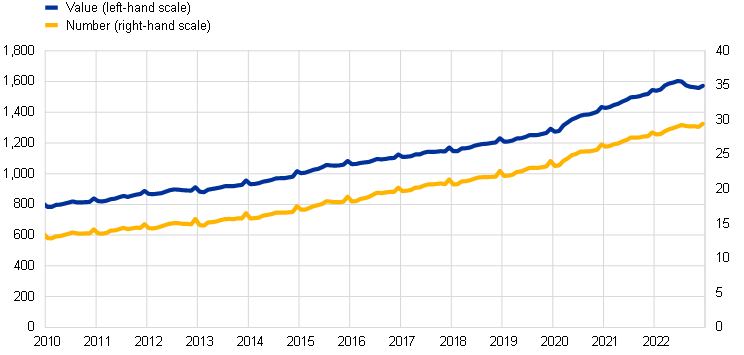

2.2 Eurosystem balance sheet developments as monetary policy normalises

In the first half of 2022 the growth of the Eurosystem balance sheet slowed as net purchases under the APP and the PEPP were phased out. In the second half the ongoing normalisation of monetary policy contributed to a gradual reduction of the balance sheet. The balance sheet reached its historical high in June at €8.8 trillion before net asset purchases under the APP were concluded as of 1 July (Chart 2.2). By the end of the year it had declined to €8.0 trillion, mainly on account of TLTRO III operations maturing as well as sizeable early repayments, especially after the TLTRO III terms and conditions were changed to align them with the broader monetary policy normalisation process.

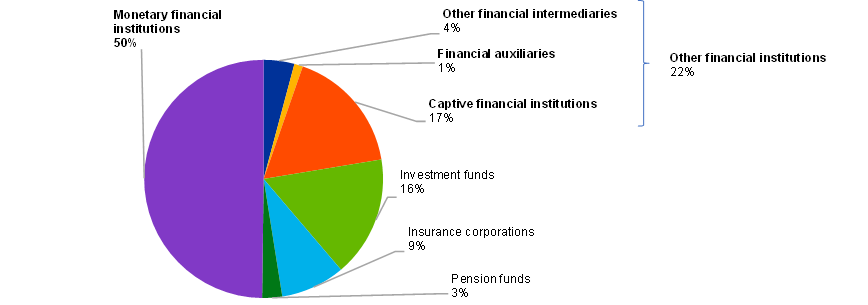

At the end of 2022 monetary policy-related assets on the Eurosystem balance sheet amounted to €6.3 trillion, a decline of €0.7 trillion compared with the end of 2021. Loans to euro area credit institutions accounted for 17% of total assets (down from 26% at the end of 2021) and assets purchased for monetary policy purposes represented 62% of total assets (up from 55% at the end of 2021). Other financial assets on the balance sheet consisted mainly of foreign currency and gold held by the Eurosystem and euro-denominated non-monetary policy portfolios.

On the liabilities side, the overall amount of credit institutions’ reserve holdings and recourse to the deposit facility decreased to €4.0 trillion at the end of 2022 (from €4.3 trillion at the end of 2021) and represented 50% of total liabilities (in line with the percentage at the end of 2021). Banknotes in circulation grew to €1.6 trillion (from €1.5 trillion at the end of 2021) and accounted for 20% of total liabilities (up from 18%).

Chart 2.2

Evolution of the Eurosystem’s consolidated balance sheet

(EUR billions)

Source: ECB.

Notes: Positive figures refer to assets and negative figures to liabilities. The line for excess liquidity is presented as a positive figure, although it refers to the sum of the following liability items: current account holdings in excess of reserve requirements and recourse to the deposit facility.

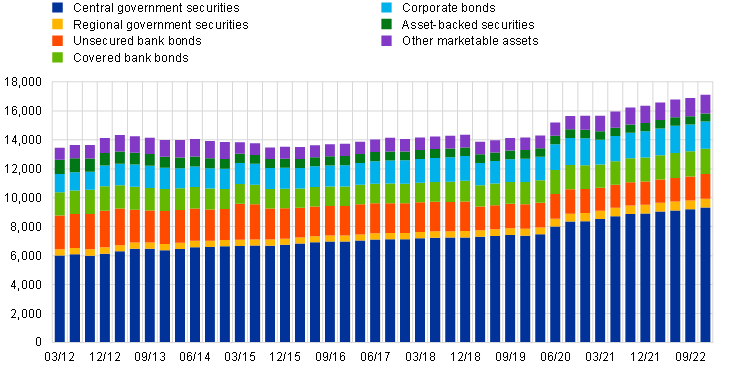

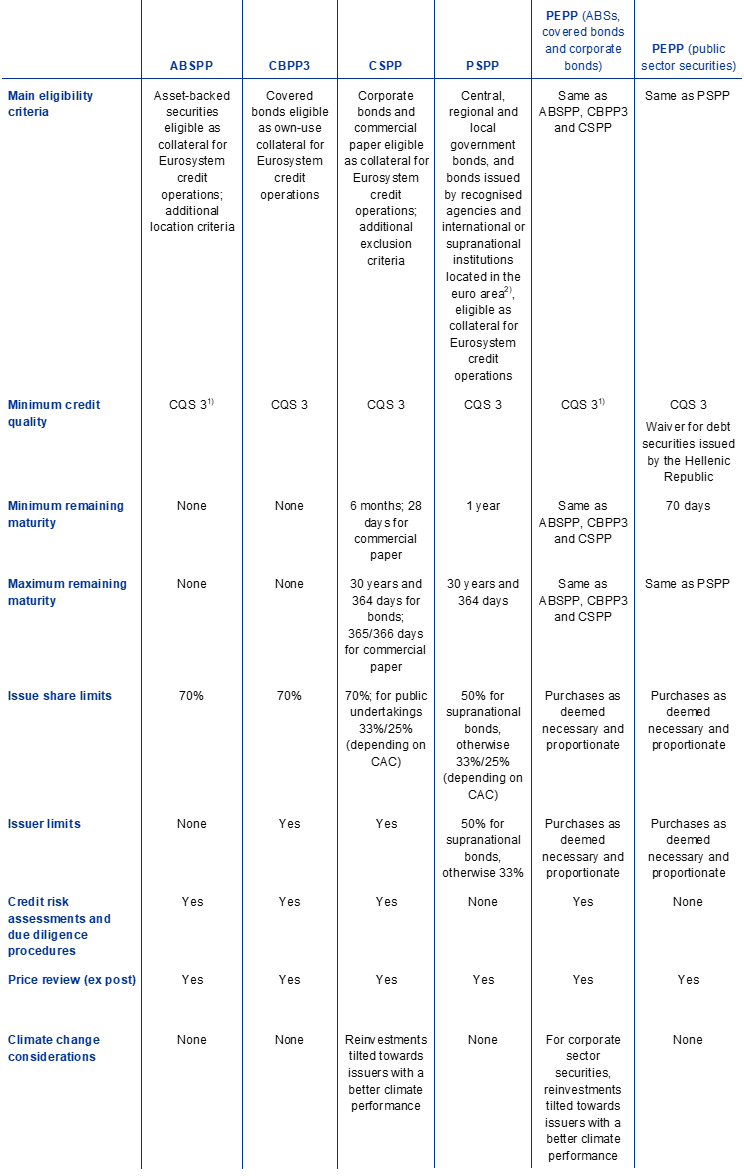

APP and PEPP portfolio distribution across asset classes and jurisdictions

The APP comprises four asset purchase programmes: the third covered bond purchase programme (CBPP3), the asset-backed securities purchase programme (ABSPP), the public sector purchase programme (PSPP) and the corporate sector purchase programme (CSPP). The PEPP was introduced in 2020 in response to the pandemic. All asset categories that are eligible under the APP are also eligible under the PEPP; a waiver of the eligibility requirements has been granted for securities issued by the Hellenic Republic. The Eurosystem completed net purchases under the PEPP at the end of March 2022 and under the APP as of 1 July 2022, while it continued reinvesting the principal payments from maturing securities under both programmes in full. Purchases continued to be conducted in a smooth manner and in line with the respective prevailing market conditions.

APP holdings were €3.3 trillion at the end of 2022

At the end of 2022 APP holdings amounted to €3.3 trillion (at amortised cost). The PSPP accounted for the bulk of these holdings, with €2.6 trillion or 79% of total APP holdings at the end of the year. Under the PSPP, the allocation of purchases to euro area jurisdictions was guided by the ECB’s capital key on a stock basis. In addition, some national central banks purchased securities issued by EU supranational institutions. The weighted average maturity of the PSPP holdings stood at 7.2 years at the end of 2022, with some variation across jurisdictions. The ABSPP accounted for less than 1% (€23 billion) of total APP holdings at year-end, the CBPP3 for 9% (€302 billion) and the CSPP for 11% (€344 billion). Of the private sector purchase programmes, the CSPP contributed the most to the growth in APP holdings in 2022, with €34 billion of net purchases. Corporate and covered bond purchases are guided by benchmarks which reflect the market capitalisation of all eligible outstanding corporate and covered bonds respectively. As of October 2022 climate change considerations were incorporated into the corporate sector benchmark – more details can be found in Section 11.5.[8]

PEPP holdings were €1.7 trillion at the end of 2022

At the end of 2022 PEPP holdings amounted to €1.7 trillion (at amortised cost). Covered bond holdings accounted for less than 1% (€6 billion) of the total, corporate sector holdings for 3% (€46 billion) and public sector holdings for 97% (€1,629 billion).

For the purchases of public sector securities under the PEPP, the benchmark allocation across jurisdictions is the ECB’s capital key on a stock basis. At the same time, purchases were conducted in a flexible manner, which led to fluctuations in the distribution of purchase flows over time, across asset classes and among jurisdictions. The weighted average maturity of the PEPP public sector securities holdings stood at 7.6 years at the end of 2022, with some differences across jurisdictions.

The Eurosystem reinvested the principal payments from maturing securities held in the APP and PEPP portfolios. Redemptions of private sector securities amounted to €77 billion in 2022, while redemptions of public sector securities under the PSPP and PEPP amounted to €446 billion. The assets purchased under the PSPP, CSPP, CBPP3 and PEPP continued to be made available for securities lending to support bond and repo market liquidity. Owing to the increase in demand for securities amid collateral scarcity in repo markets, the Governing Council decided in November 2022 to increase the Eurosystem limit for securities lending against cash collateral to €250 billion.

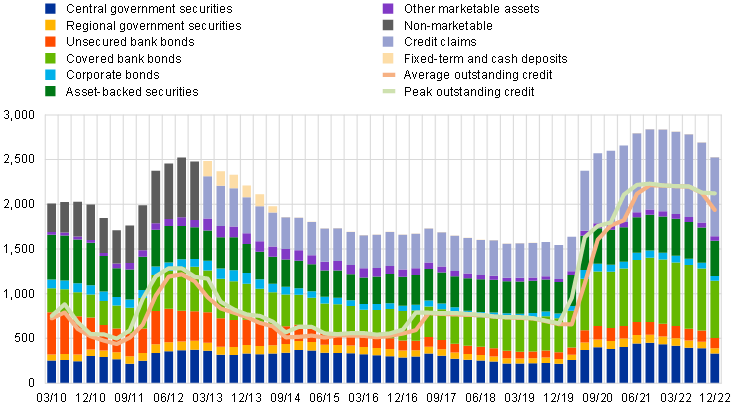

Developments in Eurosystem refinancing operations

At the end of 2022 the outstanding amount of Eurosystem refinancing operations was €1.3 trillion, representing a decline of €878 billion compared with the end of 2021. This change mainly reflects voluntary early repayments (€826 billion) and the maturing of operations (€54 billion) under the TLTRO III series. Of the early repayments, €744 billion occurred following the change in the TLTRO III terms and conditions which took effect on 23 November 2022. Additionally, the pandemic emergency longer-term refinancing operations (PELTROs) had mostly matured by the end of 2022, with only €1 billion outstanding, compared with €3.4 billion at the end of 2021. The weighted average maturity of outstanding Eurosystem refinancing operations decreased from around 1.7 years at the end of 2021 to 0.9 years at the end of 2022.

Gradual phasing-out of pandemic collateral easing measures

In March 2022 the ECB announced the gradual phasing-out of pandemic-related collateral easing measures. These measures were a core element of the ECB’s monetary policy response to the pandemic, making it easier for banks to access Eurosystem credit operations and increasing the volume of eligible collateral. According to ECB staff estimates, roughly 10% of the total collateral mobilised at the end of February 2022 was attributable to the easing measures.[9] This contribution was predominantly driven by the temporary reduction in valuation haircuts across all asset classes by a fixed factor of 20% and the extensions to the additional credit claim (ACC) frameworks of some national central banks.

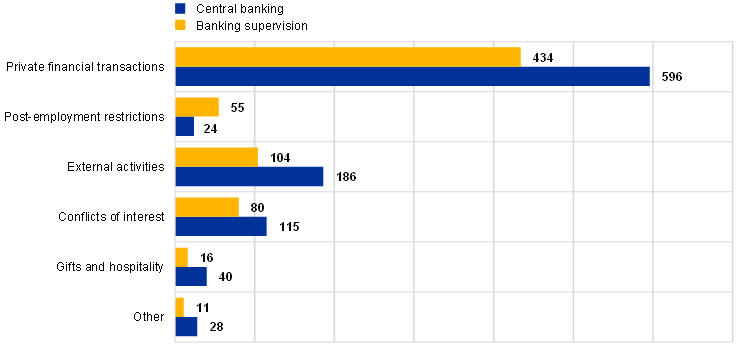

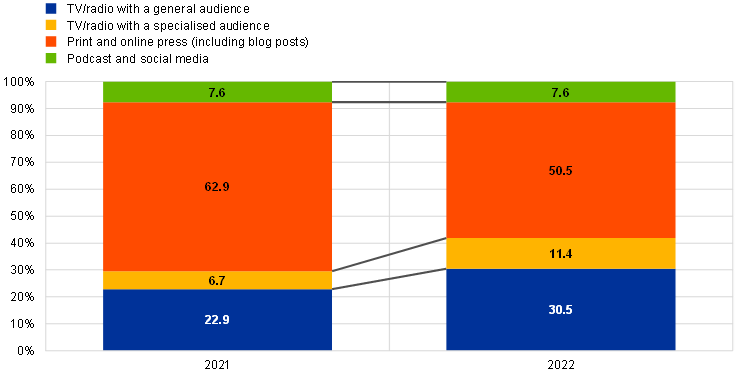

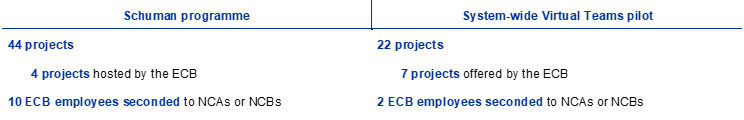

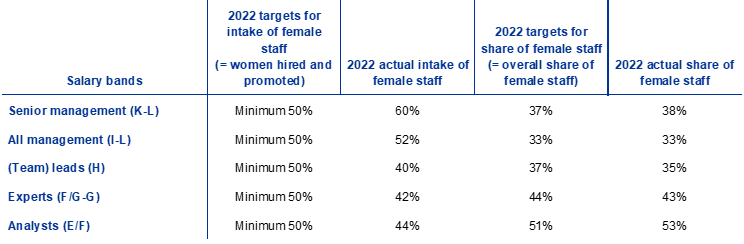

In the first step of the gradual phase-out, which started in July 2022, the temporary reduction in valuation haircuts was decreased from 20% to 10%. In addition, several measures with a more limited impact and scope were phased out. This included no longer maintaining the eligibility of certain downgraded marketable assets and issuers of these assets that had met the credit quality requirements on 7 April 2020 and restoring the 2.5% limit on unsecured debt instruments, in a credit institution’s collateral pool, issued by any single other banking group.