Foreword by the Chairperson

JOSÉ MANUEL CAMPA

Dear readers,

2021 marked our 10-year anniversary and we celebrated this special and momentous milestone by reflecting on all the key milestones of the past decade, the progress achieved so far as well as by setting the tone for the challenges that lie in front of us.

Timely and effective responses to the different crises hitting our economies and societies. We were established in 2011 in response to the great financial crisis of 2007-2009 that had brought the global economy and investors to its knees and affected the levels of trust that citizens had in the system and its institutions. Since then, a number of shocks, of different origin and nature, have hit our economies and societies. I am thinking of the sovereign debt crisis of 2009-2011, the Brexit crisis starting in 2016 after the UK voted to leave the European Union, the Covid-19 health crisis that broke out in early 2020 and whose threat has not fully receded, and the Russian-Ukrainian crisis that is still unfolding as we write. Despite the best forecasts and analyses, crises are inevitable and many of them quite unpredictable. What is sure is that the EBA has contributed to the policy response to each of these crises and emergencies with extensive regulatory reforms, increased transparency, enhanced cooperation, always serving the needs of the economy and its citizens.

Stronger and more proportionate rules. Since 2011, we have developed a harmonised and consistent set of rules on prudential and resolution aspects with more than 230 technical standards, which helped establish a level playing field for financial institutions across the EU. We provided additional guidance with more than 120 Guidelines and answers to over 2000 Q&As on its supervisory implementation. One of the key principles governing our regulatory effort is proportionality, to ensure that rules are not “one size fits all” but that every single measure in the EU’s Rulebook is fit for purpose, effective, proportionate, operational, and as simple as possible. We will further embed proportionality in the revised regulatory frameworks to ensure rules are more accessible and digestible to less complex and less risky banks, to reduce unnecessary regulatory burden and compliance costs, and to make effective use of scarce supervisory resources.

Preserving a global level playing field and avoiding regulatory fragmentation with the Basel III framework. The EBA played an important role in the finalisation of the internationally agreed Basel III framework: another important milestone in the post financial crisis regulatory reforms. Basel III indeed creates a clear and solid regulatory framework, allowing common rules to be applied by all the banks around the world, and ensuring global level-playing field. Its full and compliant implementation is the final piece of this important structural reform, which has clear macro-economic benefits, and will restore trust.

Enhanced transparency to ensure better monitoring of risk build-up and increased market discipline. The EBA has from its inception taken a leading role in promoting and enhancing transparency, which is key to achieving market discipline and ultimately financial stability. Through the stress test exercises performed on a biannual basis and the transparency exercises conducted every year, we have been able to provide reliable and comparable information, thus enhancing the credibility and use of the outcome of these exercises. In addition, our regular releases of bank data and information are valued as essential to improve market transparency. We continue working on our data strategy to become a data hub, with the aim of gathering and processing prudential data from institutions and to allow internal and external stakeholders, including competent authorities and EU legislators, and the public at large, to access more timely and comprehensive evidence-based analyses and information.

Timely response to the Covid-19 health crisis. I think that the pandemic reminded us of the importance of a high-quality regulatory framework for a robust EU banking sector and that the bulk of the measures implemented post the great financial crisis, of which Basel III is the most visible, have proven useful in getting us through this crisis. This time, banks were even part of the solution to this major health crisis by supporting the economy. We, as EBA, played an important role in strengthening banks’ lending capacity by balancing operational and supervisory relief measures, developing new guidelines on the application of moratoria, adjusting the regulatory framework, as well as monitoring banks’ key metrics so as to provide transparency on their balance sheets.

Closely monitoring the new challenge emanating from the war in Ukraine. Unfortunately, the future poses us additional challenges. The Covid 19 pandemic effects have been overshadowed by the geopolitical developments emanating from the Russian invasion of Ukraine. The current high level of uncertainty and the potentially large impact on the wider EU and global economy are a key concern. We are closely monitoring and assessing the direct implications, the impact of sanctions for all actors involved, including financial inclusion of refugees, increase in cyber risks or in financial crime and the longer-term impact on supply chains in the global economy. As we write, based on our initial assessment, the first-round risks to the EU banking system are expected to be manageable, and do not seem to pose a fundamental threat to financial stability but we still need to remain vigilant and we will make every effort to assess, monitor and adjust as the situation evolves.

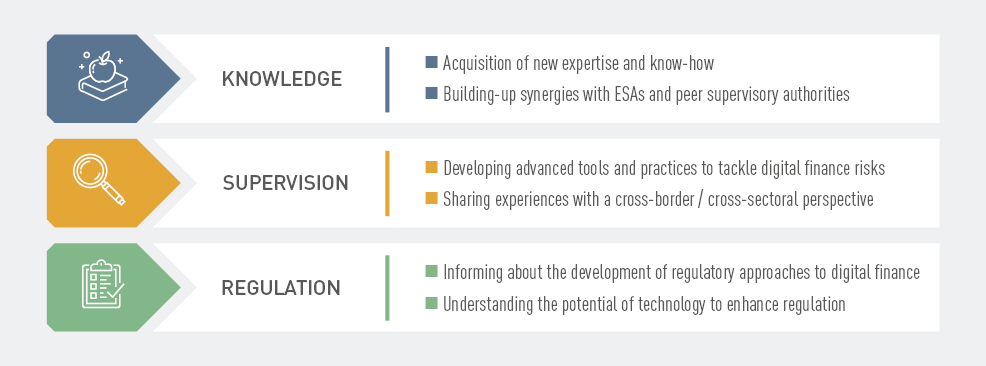

Digital finance is increasingly on our radar. Digital finance is another important challenge and priority for the EBA going forward. Our work in this area has particularly focused on consumers as end-users of technology. In that respect, we have made great progress in removing obstacles to the application of innovative technologies in the banking and payments sectors, namely by working to achieve technological neutrality in our regulatory and supervisory approaches. Going forward, the EBA, together with the other European Supervisory Authorities, will have an enhanced role in the digital finance area. At the beginning of this year, we jointly responded to a Commission’s call for advice on digital finance and related issues and provided a series of recommendations covering cross-sectoral and sector-specific market developments in this area, and highlighted the risks and opportunities posed by digitalisation in finance.

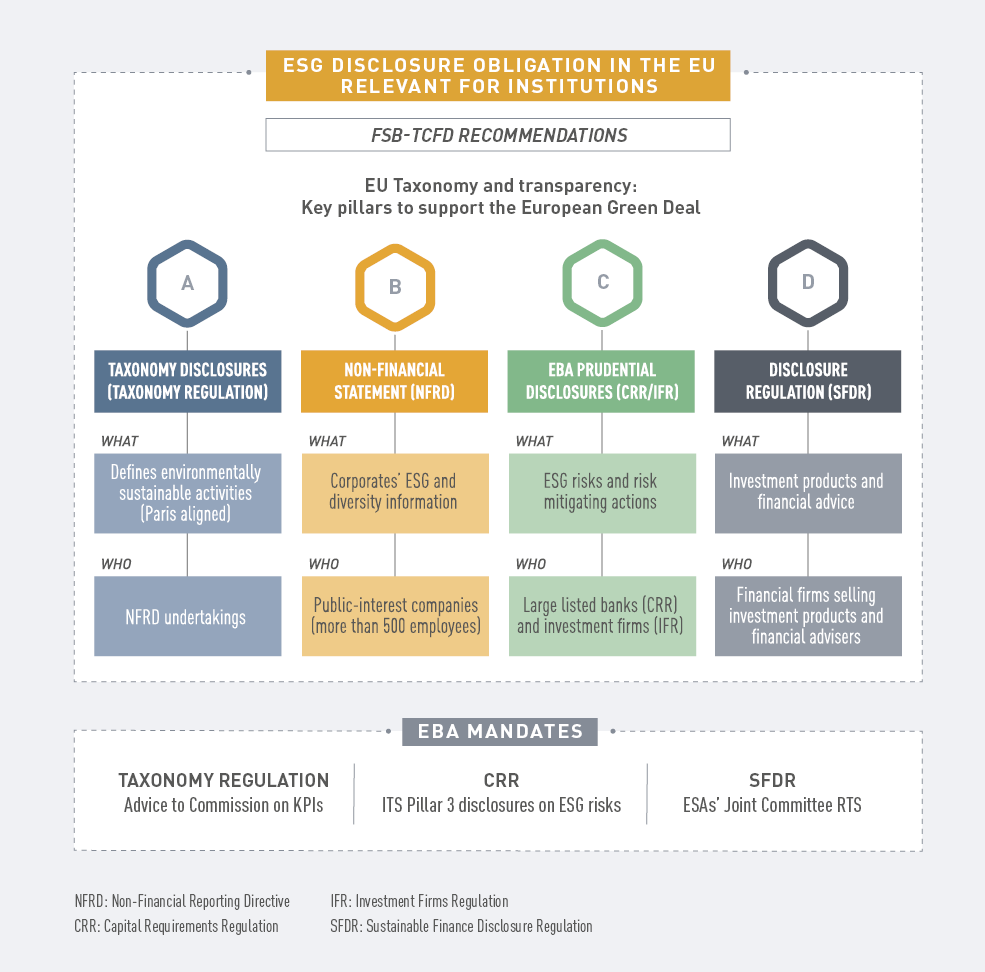

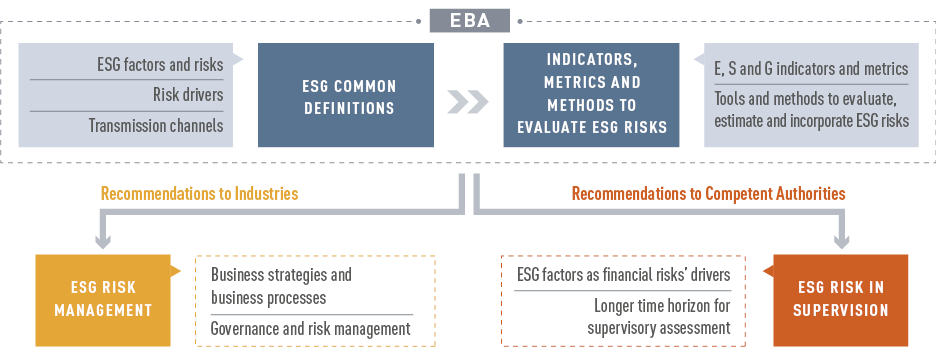

Another important priority is to properly integrate ESG into regulation. Climate change and its implications are another important global challenge for the banking sector and another key priority for the EBA. There is a growing consensus among policymakers and supervisors that climate change poses real financial risks. We are working on many fronts to integrate ESG considerations into regulation. These include enhancing disclosure, advancing the risk management standards for banks, updating core elements of the prudential framework as well as stress testing methodologies. On the latter, we are currently defining our strategy on climate risk stress test in line with the European Commission’s renewed strategy on sustainable finance, which will require the EBA to initiate and coordinate regular climate risk stress tests, including a system-wide exercise in cooperation with the other European Supervisory Authorities.

Global challenges require enhanced cooperation with all our stakeholders. In conclusion, I would like to underscore that all the challenges and priorities that I mentioned throughout my remarks have a global dimension and are pretty much interconnected. Let’s just think of how the COVID-19 pandemic has accelerated the digital transformation of almost all industries. As a result, the need for accessible and affordable digital financial products is even more apparent in the pursuit of a global economic recovery and growth. If I turn to sustainability considerations, it is clear that the COVID-19 crisis has highlighted the interconnected and interdependent nature of the world’s social and economic systems. The ongoing Ukrainian war is also prompting investor rethink of environmental, social and governance considerations. This interconnectedness calls for enhanced cooperation and synergies not just at EU level but globally. And on this final note, I would like to thank all our Board Members, the EBA staff, the EU institutions, and all our stakeholders for the great cooperation and collaboration throughout these years. I am looking forward to enhanced cooperation to address our future challenges together.

Interview with the Executive Director

Can you tell us about 2021, which marked the EBA’s 10th anniversary but was also another challenging year with COVID-19 still affecting our daily lives? And what were your priorities when adjusting the EBA’s organisation?

Indeed 2021 has been a very important and challenging year for the EBA and a year of significant organisational changes. It marked our ten years as an organisation and we took the time to celebrate and reflect, despite the challenging working conditions due to the pandemic. In particular, we have invited a number of inspiring speakers throughout the year, and we organised a large conference which gathered more than 1000 participants to take a step back, look at the previous decade and the amazing achievements of the EBA with its stakeholders, but also prepare for the new challenges.

While COVID-19 continued to be a challenge for our societies as for our own organisation, it also offered a real opportunity to explore new ways of working. Our teams have continued to demonstrate their full commitment and their flexibility. We have made our best efforts to provide all necessary material and psychological support. We have also continued recruiting new talents and onboarded an important number of new staff members who have very easily adjusted to their new roles. Our key takeaway is that combining presence in the office and telework also brings a lot of benefits, both to an organisation and to its staff, professionally and personally. We will be building on this to implement the new hybrid working model European institutions and agencies are now moving into.

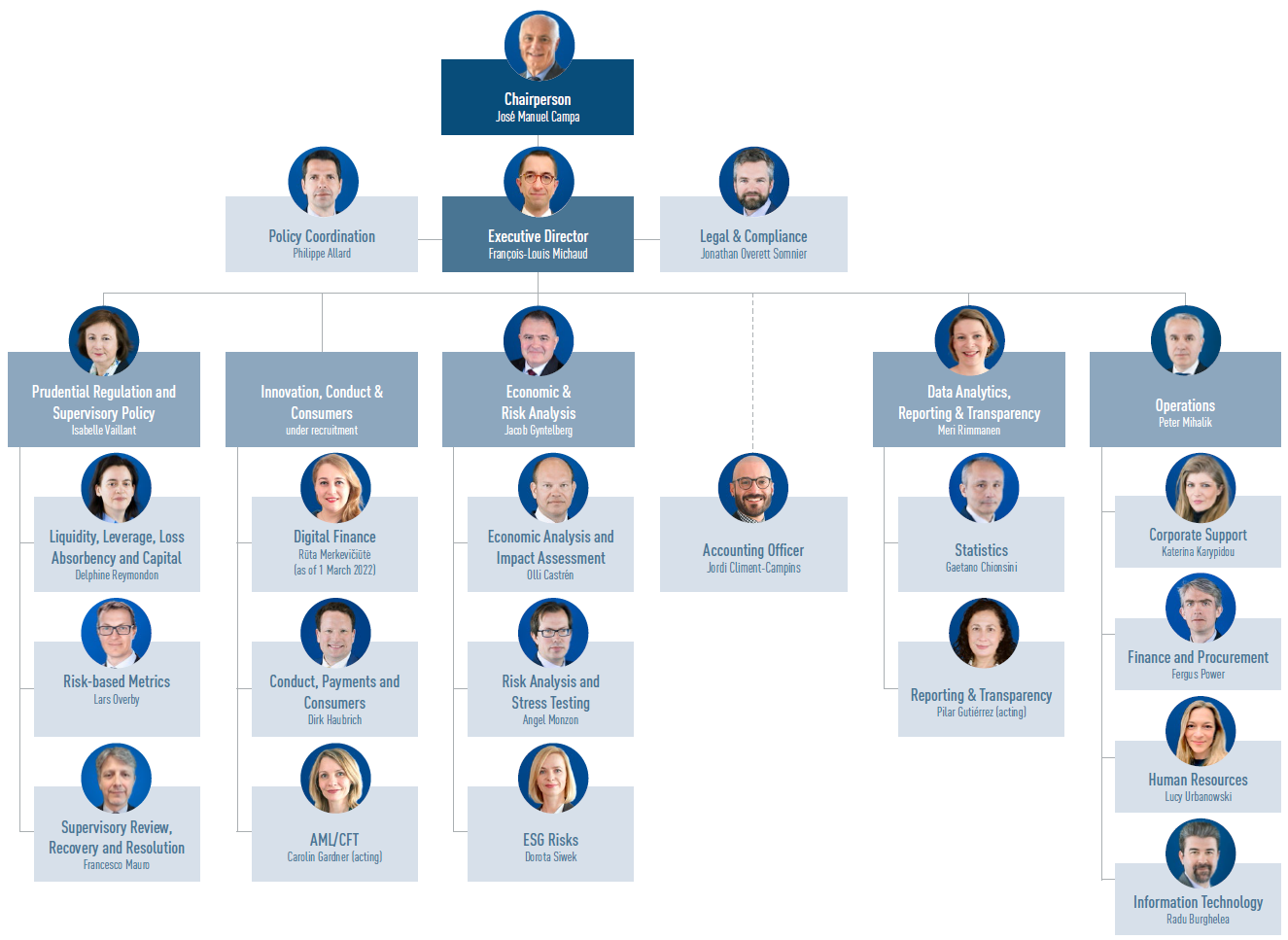

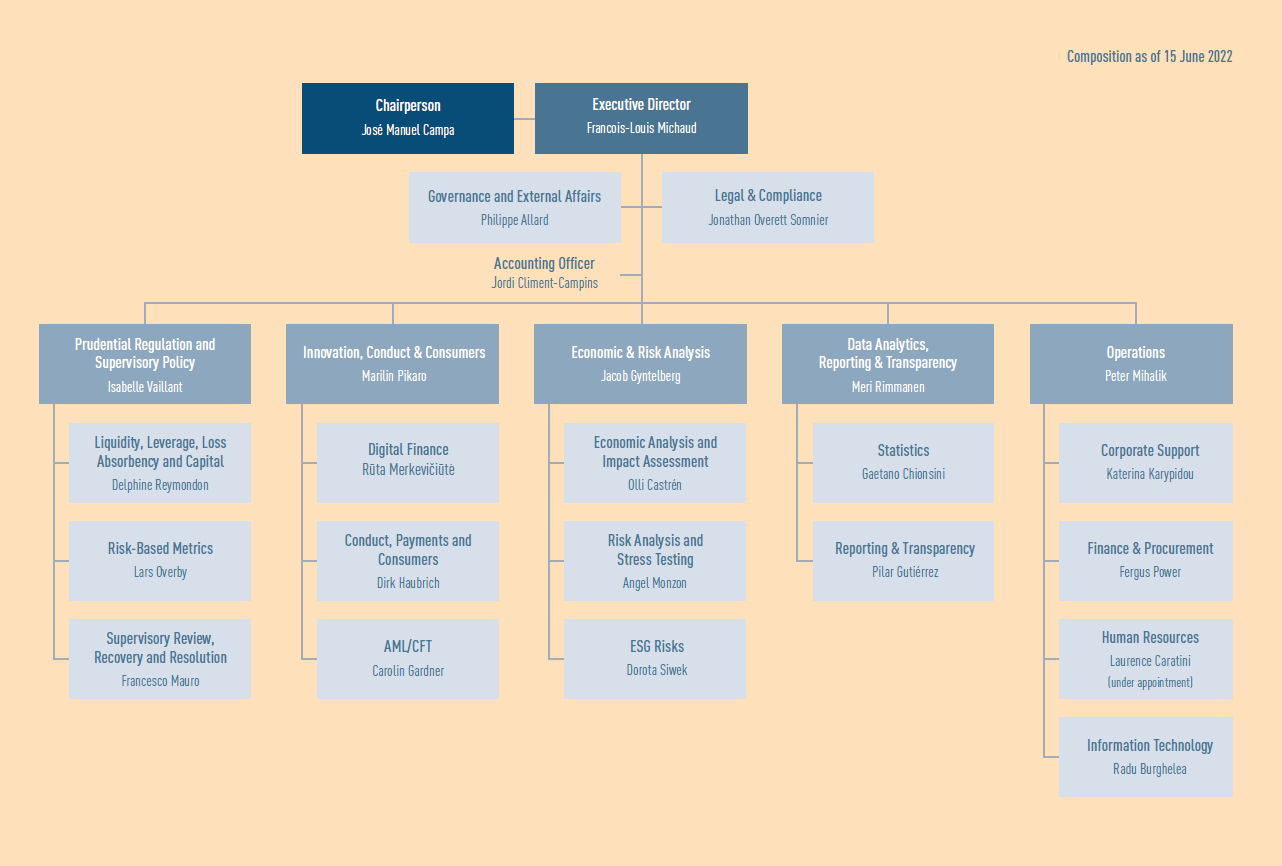

Now looking at our evolving multi-year priorities and mandates, it was also clear that our working model needed to be adjusted. In January, we started by strengthening the Legal and Compliance function to be better equipped to deal with complex ethics and data protection issues. In March, we introduced a new role of team leaders, to better respond and deal with key projects or processes which cut across the organisation. We could thus empower about 25 senior staff members. As the role is temporary, this will allow the organisation to stay agile and keep bringing new opportunities to our staff.

FRANÇOIS-LOUIS MICHAUD

Then, in June, we implemented a broader reorganisation of our teams. The goal was threefold: to increase focus in key areas, foster internal synergies, and create new opportunities for staff. In particular, we created a stronger Economic and Risk Analysis Department, with a new Unit dedicated to ESG risks, and a new Department focusing on the entire data value chain, from their definition to their acquisition, management, and dissemination. Finally, we created fully-fledged units focusing on Digital Finance and on AML-CFT.

Last but not least, we keep rolling out new technology to best support our teams and perform our work more efficiently. We are now largely using a collaboration platform which brings together a number of tools we need for our day-to-day work. We will also be implementing an e-recruitment tool and use electronic workflows in the area of finance and human resources. All in all, our objective is to mobilise all possible tools and arrangements to support the work of our teams and ensure we keep delivering high quality contributions in a rapidly evolving environment.

Sustainability has become a pressing issue for all organisations. How have you been addressing this issue at the EBA?

Sustainability is indeed front and centre for our economies and societies. The EBA, as part of its regulatory, convergence, and risk work, and as an organisation has a role to play, and also a responsibility.

ESG is a horizontal multi-year priority for the EBA. We work to incorporate the EU sustainability agenda into the regulatory and supervisory framework for EU banks and other financial institutions within our remit. In this context, collecting the evidence, closing the data gaps, especially thanks to more harmonised and more relevant disclosure of ESG factors is critical to allow policymakers and all stakeholders to take the right decisions, and organise an orderly transition. We are also working on reflecting these factors better in banks’ risk management standards, and on what could be a prudential treatment.

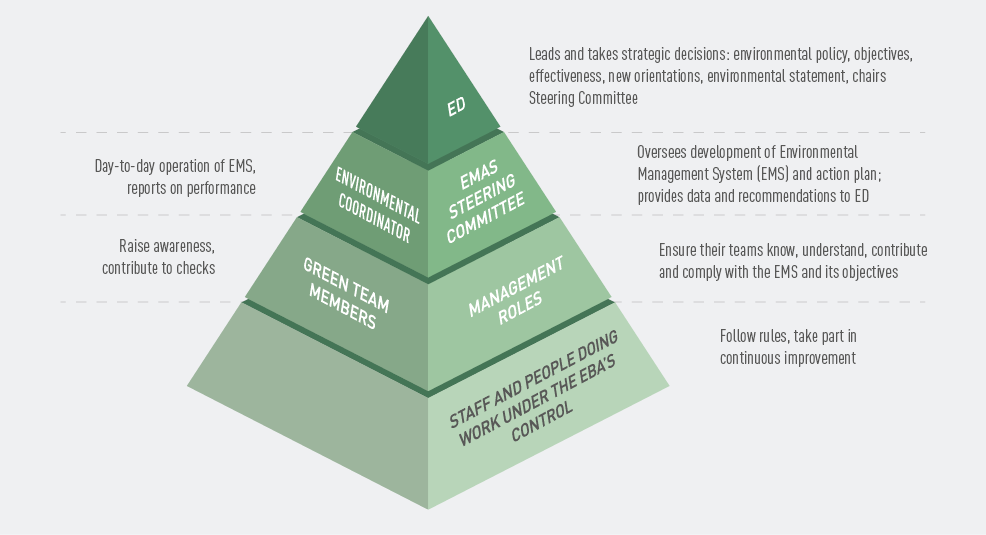

As an organisation, we also fully recognised our long-term responsibility for making a positive contribution to sustainable development through our activities. In 2021, we reached key milestones in our journey to implement an Environmental Management System (EMAS), which we expect to conclude in 2022. We take a systematic approach to our environmental footprint, focusing on four key areas: (i) missions, to minimise the impact on greenhouse gas emissions; (ii) energy, by building a strong relation with the landlord to improve our energy consumption performance; (iii) waste, by improving our segregation and recycling habits; and (iv) procurement, by maximising the use of electronic solutions and green public procurement.

Gender equality has been one of your key priorities since you took up this post as EBA Executive Director. What are the steps you have taken to make the EBA more gender balanced?

Public sector organisations should reflect the societies they are embedded in. They should thus ensure that nobody is or feels discriminated because of gender or because of any other reason. And by the way, there is also abundant empirical evidence that gender equality is a key driver for better policy and economic outcomes.

At the EBA we pay the highest attention to giving men and women equal chances. It is our responsibly to create an environment conducive to the development and promotion of all staff, preventing any kind of bias and discrimination. Since the last quarter of 2020, we have been systematically reviewing gender equality. We focus on three key pillars: i) promoting gender equality when recruiting; ii) embedding gender balance in the day-to-day work; iii) fostering staff awareness about gender balance issues.

To give a few examples: our vacancy notices now explicitly mention our gender equality objective and refer to its flexible working arrangements, which we keep enriching; we appoint balanced selection panels; when recruiting if the pools of candidates is not balanced vacancies may be prolonged or reopened; we check carefully gender balance when promoting staff. We also reach out to other organisations and inspiring leaders in this area, to learn from their experience.

All this has allowed us to consolidate some of our strengths, in particular our good overall balance at staff level, but also to significantly improve gender balance at managerial level, especially at Director level where two of the three new directors recruited in 2021 were females.

Gender equality is also an area in which we are doing interesting policy work, mainly assessing diversity and inclusion at banks and other financial entities. For instance, we issued Guidelines on internal governance highlighting the importance of diversity in the composition and selection of banks’ Board Members. We also publish industry benchmarking reports, including on gender pay gaps.

Supporting the deployment of the risk reduction package and the implementation of effective resolution tools

Improving and updating guidance for the supervisory review and evaluation process of credit institutions and enhancing the cooperation with anti-money laundering (AML) authorities

In line with its roadmap for the risk reduction measures package, the EBA updated the SREP guidelines for credit institutions in 2021 to reflect regulatory and supervisory developments since the guidelines were first revised in 2017. This second review aligned the SREP guidelines with the requirements laid down in the revised Capital Requirements Directive and Regulation (CRD V and CRR II), as well as with other EBA guidelines and technical standards. The update also reflects observations from the ongoing monitoring and assessment of the convergence of supervisory practices. The changes do not significantly alter the overall structure of the SREP framework but provide additional guidance to strengthen a common set of rules that are fit for purpose for the day-to-day work of supervisors.

In refining the SREP guidelines, the EBA has taken into consideration aspects that include the following.

- Proportionality: The revised framework updates the categorisation criteria, taking account of both the size and risk profile of institutions. The minimum engagement model has been reviewed and amended on this basis.

- Anti-money laundering/countering the financing of terrorism (AML/CFT): The revised framework proposes an integrated approach to factor money laundering/terrorist financing (ML/TF) risks from a prudential perspective into the relevant SREP areas and to foster cooperation between AML/CFT and prudential authorities.

- Risk of excessive leverage: This regulatory change helps competent authorities (CAs) to assess the risk of excessive leverage and provides guidance on determining the level and composition of additional own funds requirements.

- Determination of Pillar 2 requirements (P2R): The revised SREP guidelines clarify how the quantity and composition of P2R should be determined and further emphasise the institution-specific nature of such requirements.

- Communication of additional own funds requirements: The revised SREP guidelines enhance the supervisory dialogue by clarifying the minimum scope of information and justification of the results of the SREP to be provided to institutions.

- Methodology for setting Pillar 2 guidance (P2G): The revised SREP guidelines clarify the setting of the P2G, encompassing both the use of supervisory stress test results and possible adjustments.

- Sustainable finance: The EBA decided to implement a progressive approach, starting with the inclusion of environmental, social and governance (ESG) risk in the supervisory business model analysis.

Additional areas under review include (i) the assessment of governance and institution-wide controls and (ii) the assessment of risks (credit risk, operational risk, market risk, interest rate risk in the banking book (IRRBB) and credit spread risk in the banking book (CSRBB), as well as liquidity and funding risks).

The EBA also started developing guidance for the assessment of investment firms under the Investment Firms Directive (IFD). This included:

- SREP guidelines (to be developed jointly with the European Securities and Markets Authority, ESMA) for the assessment of investment firms based on the mandate included in Article 45(2) IFD (the tentative timeline for publication is July 2022);

- regulatory technical standards (RTS) on how to measure the risks and elements of risk in determining additional own funds requirements for investment firms based on the mandate included in Article 40(6) IFD (to be published in June 2022).

The draft joint SREP guidelines set out the process and criteria for assessing the main SREP elements such as:

- business model;

- governance arrangements and firm-wide controls;

- risks to capital and capital adequacy;

- liquidity risk and liquidity adequacy.

As part of this assessment, the EBA introduced a scoring system making it easier to compare firms. In addition, the proposed joint guidelines provide clarifications on how to monitor key indicators, apply SREP in a cross-border context and use supervisory measures.

While the proposed structure of SREP and the scoring system are similar to those used for credit institutions, the methodology provided is proportionate to the nature, size and activities of investment firms and takes into account the specific sources of risks to which they are exposed.

For determining additional own funds requirements for risks not covered or not sufficiently covered by Pillar 1 requirements, the joint SREP guidelines refer to the draft RTS on the additional own funds requirements.

DRIVING SUPERVISORY CONVERGENCE IN THE CONTEXT OF THE SREP

According to its founding regulation, the EBA must contribute to fostering supervisory convergence across the EU and play an active role in building a common supervisory culture and ensuring the consistent application of the Single Rulebook.

To pursue this mandate in the context of the SREP, the EBA identifies key topics each year for particular supervisory attention. It then follows up on their implementation. The 2021 convergence plan identified four key topics, which also served as the basis for assessing the degree of convergence in supervisory practices:

- asset quality and credit risk management;

- information and communication technology (ICT) and security risk, operational resilience;

- profitability and business model;

- capital and liability management.

These topics were also aligned with and driven by the implementation of the forward-looking Union Strategic Supervisory Priorities (USSPs) set by the EBA.

The EBA observed that these topics were well embedded in competent authorities’ supervisory priorities and, overall, well implemented in their supervisory practices. Nevertheless, some points would have benefited from further supervisory attention. This information will feed into the 2022 convergence cycle and inform the selection of the key topics for 2023.

Monitoring the implementation of global standards (Basel III)

The implementation of global standards in the European Union is key to the development of the Single Rulebook. The EBA regularly monitors and assesses the potential impact on the EU banking sector of implementing international banking regulation and/or best practices, such as the proposals of the Basel Committee on Banking Supervision (BCBS). This allows the EBA to submit its proposals to the European Commission on items of EU regulation that address the specificities of the EU banking system and ensure its safe and smooth functioning.

The EBA conducts a regular Basel III monitoring exercise analysing (i) the impact of the final Basel III rules on European credit institutions’ capital and leverage ratios and (ii) the associated shortfalls that would result from a lack of convergence with the fully implemented Basel III framework. In September 2021, the EBA published a report on monitoring the impact of implementing the final Basel III regulatory framework in the European Union using data as of December 2020. The report contains a breakdown of the impact on the total minimum required capital arising from credit risk, operational risk, leverage ratio reforms and the output floor. In December 2021, the EBA published a report on liquidity measures using data as of December 2020. The report monitors and evaluates the liquidity coverage requirements currently in place in the EU. It presents a thorough analysis of the liquidity coverage ratio (LCR) levels and their composition by country and business model, as well as giving a more in-depth analysis of potential currency mismatches in LCRs.

The main factors driving the impact of Basel III framework are the implementation of the output floor and the credit risk reform, with 7.1% and 5.1% respectively. The new leverage ratio is partially counterbalancing the impact of the Basel III risk-based reforms by 4.3%.

The EBA has also been active in providing the BCBS with input before the development of supervisory standards by conducting new data collection activities that allow the proposed policies to be better assessed. In addition, the EBA collaborates closely with the BCBS to develop methodologies that more accurately evaluate the impact of the proposed BCBS supervisory standards.

To enhance the representativeness of the sample and its consistency over time, the EBA made it mandatory (in EBA/DC/2021/373 as amended by EBA/DC/426) to submit core data for the Basel III monitoring exercise for a sample of banks (Consolidated sample of banks for the mandatory Basel III monitoring exercise) starting from the December 2021 reference date.

Figure 2: Basel III monitoring exercise – total minimum capital requirement impact by risk category (December 2020 reference date)

Source: snapshot of an EBA visualisation tool based on data published in September 2021

How the mandatory exercise works as of December 2021

In March 2021, the EBA published a decision to change the Basel III monitoring exercise from voluntary to mandatory with effect from December 2021. This change arises from the need to ensure representation from all EU/EEA jurisdictions and to expand the sample of the participating credit institutions to make it more representative and stable.

The EBA’s decision on the mandatory Basel III exercise will help the EBA to represent effectively the interests of EU institutions in the BCBS and to provide informed opinions and technical advice to the European Commission, the European Parliament and the Council regarding the implementation of the BCBS standards into the Union law.

The decision applies clear selection criteria for defining the country samples. Specifically, each Member State should apply the following criteria sequentially:

- all global and other systemically important institutions (G-SIIs and O-SIIs) are included in the country sample at the highest level of EU consolidation, irrespective of their size;

- if 80% risk-weighted assets (RWA) coverage is not exceeded and the jurisdiction’s sample size is smaller than 30 banks, additional large banks (Tier 1 capital > EUR 3 billion or total assets > EUR 30 million) that are not O-SIIs are included until 80% RWA coverage is exceeded;

- if 80% RWA coverage is not exceeded, additional medium-sized and small banks that are not O-SIIs are selected from the eligible population of three different broad business models according to predefined percentages per business model.

To address the principle of proportionality at jurisdictional level, the decision limits the participation of small Member States (RWA < 0.5% of the total EU RWA) to O-SIIs only, irrespective of whether the 80% RWA coverage is exceeded or not.

To address the principle of proportionality at bank level, the eligible population of credit institutions per business model excludes those with RWA < 0.1% of the Member State’s total RWA.

To address the principle of proportionality at data submission level, the EBA limits the mandatory fields to those considered necessary for the overall assessment of the Basel III impact and to those that appear to have the highest impact in previous (voluntary) submissions.

Contributing to the high-quality and consistent application of the IFRS 9 standard and expected credit loss frameworks

The EBA continues to work on assessing and monitoring the implementation of IFRS 9 and its interaction with prudential requirements. In November 2021, the EBA published a report summarising the findings from the monitoring activities conducted since the publication of its last report in December 2018. The report included findings from the EBA IFRS 9 benchmarking exercise as well as observations from the qualitative assessment aimed at monitoring EU institutions’ practices. The assessment also covered a period following the COVID-19 pandemic outbreak. The report aimed to assist supervisors in evaluating the quality and adequacy of IFRS 9 expected credit loss (ECL) models, so as to contribute to the high-quality and consistent application of the IFRS 9 standard in the EU. In addition, the report included the conclusions of the investigations around the classification and measurement of financial instruments, which served as a sound basis for reacting to the first phase of the post-implementation review of IFRS 9 carried out by the IASB.

In line with the staggered approach presented in the IFRS 9 roadmap, the EBA will continue to work on the integration of the high-default portfolios (HDPs)* in the IFRS 9 templates of the ITS on supervisory benchmarking and their extension to institutions by applying the standardised approach for credit risk; further consideration would be needed in this regard, given the more limited modelling experience.

* High Default Portfolios are considered to be exposures to Residential Mortgages, SMEs, Corporates (other than Large Corporates) and SME retail.

FindingS of the IFRS 9 assessment

The EBA noted that while EU institutions have made significant efforts to implement and adapt their systems to IFRS 9 since its first application date, the level of judgement embedded in the standard means that a wide variety of practices may be applied. While no single practice has turned out to be a strong driver of the ultimate levels of provisioning, some practices observed would benefit from further scrutiny from supervisors. In addition, the COVID-19 pandemic resulted in extraordinary circumstances that pushed IFRS 9 models outside their ordinary working hypothesis, thereby increasing the use of overlays at the level of IFRS 9 risk parameters or directly at the level of the final ECL amount. Therefore, going forward, the use of overlays across EU institutions should be subject to continued monitoring to understand whether (and to what extent) institutions will adjust their ECL models to incorporate the effects currently captured via overlays/manual adjustments and/or whether part of the overlays considered will be maintained and for how long.

Enhancing the governance and remuneration framework

Updating the internal governance framework

In line with the revised CRD V and publication of the EBA’s 10-point action plan on dividend arbitrage trading schemes, in July 2021 the EBA and ESMA published updated joint guidelines on the assessment of the suitability of members of the management body and key function holders (guidelines on fitness and propriety) and guidelines on internal governance. Both guidelines entered into force at the end of 2021. In accordance with the changes introduced by CRD V, the EBA guidelines on sound remuneration were also updated. The updates also consider further changes to the CRD that are included in the IFD. These guidelines have been applicable since 31 December 2021.

Establishing revised fitness and propriety guidelines

Credit institutions and investment firms are subject to the joint EBA-ESMA guidelines on fitness and propriety. While the previous guidelines largely harmonised the assessment criteria and processes, further revisions were necessary to accommodate regulatory changes. The main revisions concern (i) the scope of application, (ii) the explicit inclusion of money laundering or terrorist financing and (iii) the increased risk of money laundering or terrorist financing in connection with the institution or investment firm linked to the assessment of the suitability of the members of the management body (Article 91 CRD).

Where competent authorities have reasonable grounds to suspect that money laundering or terrorist financing is being or has been committed or attempted, or if there is increased risk thereof in connection with an institution or investment firm, the CRD requires the suitability assessments to take account of those facts. In such situations, the management body must have a particularly high level of competence and relevant experience in this area to ensure that there are strong controls to guarantee compliance with the requirements under the Anti Money Laundering Directive based on the institution’s additional exposure. However, in all institutions, the management body has overall responsibility for ensuring that the institution complies with such requirements. As a consequence, the AML aspect is relevant for the suitability assessment of all members of the management body in all institutions and investment firms.

The other changes of the guidelines relate to the requirements on the composition of the management body, the criteria for assessing the independence of mind of members of the management body and the suitability assessment in the context of early intervention.

It is also further specified that a gender-balanced composition of the management body is of particular importance. Institutions should respect the principle of equal opportunities for any gender and take measures to create a more gender-balanced pool of candidates for management positions over time.

Updating the guidelines on internal governance

Credit institutions are subject to the EBA guidelines on internal governance. The update also considers further changes to Directive 2013/36/EU that are included in Directive 2019/2034/EU (the IFD). The guidelines aim to ensure sound governance arrangements.

The main revisions of the guidelines, following the amendments introduced by the CRD V, concern (i) requirements that foster diversity and ensure equal opportunities for both genders, (ii) specific expectations regarding loans to and other transactions with members of the management body and their related parties, and (iii) provisions to tackle risks in the context of money laundering and terrorist financing.

Loans to and transactions with members of the management body and their related parties are a specific source of conflict of interest. To ensure proper internal controls on such loans and to enable CAs to review the compliance of institutions, additional documentation requirements have been included in the guidelines. Decision-making on loans or transactions should be objective and not influenced by conflicts of interest. The arm’s length principle safeguards independent and objective decision-making and ensures appropriate conditions for such loans or transactions.

Combating money laundering and terrorist financing is crucial for maintaining stability and integrity in the financial system. Therefore, uncovering any involvement of credit institutions and investment firms in money laundering and terrorist financing can have a detrimental impact on the institution’s viability and on the trust in the financial system. In this context, the guidelines clarify that identifying, managing, and mitigating money laundering and terrorist financing risk is part of sound internal governance arrangements and an institution’s risk management framework.

In line with the requirement for a gender-neutral remuneration policy as part of the overall governance arrangements, the revisions provide new guidance on the code of conduct to ensure that credit institutions take all necessary measures to guarantee equal opportunities to staff of all genders and to avoid any form of discrimination. Further specific actions have been provided in specific guidelines on remuneration policies.

Updated guidelines on sound remuneration policies

All institutions are required to apply sound and gender-neutral remuneration policies for all staff and specific requirements on the variable remuneration of staff whose professional activities have a material impact on an institution’s risk profile (identified staff).

Institutions are subject to these updated guidelines. The updates specifically take into account the requirement for remuneration policies to be gender-neutral. In this context, institutions should monitor the unadjusted gender pay gap.

Additional guidance is provided on the application of the derogations based on an institution’s total balance sheet and for staff with low variable remuneration that were introduced with CRD V on the requirements to defer and pay out in instruments a part of the variable remuneration of identified staff.

The guidelines also clarify how the remuneration framework applies on a consolidated basis to financial institutions that are subject to a specific remuneration framework (for example, firms subject to the IFD, the Undertakings for Collective Investment in Transferable Securities Directive (UCITS), or the Alternative Investment Fund Managers Directive (AIFMD)).

Finally, the sections on severance payments and retention bonuses have been revised based on supervisory experience for cases where such elements have been used by institutions to circumvent requirements on the link to performance or the maximum ratio between variable and fixed remuneration.

Establishing guidelines for investment firms on internal governance and remuneration policies

Directive 2019/2034/EU introduced a specific prudential framework for investment firms with specific governance and remuneration requirements. Many investment firms have already been subject to similar requirements under the CRD. These specific provisions apply to investment firms, unless they are small and non-interconnected (class 2 investment firms).

On 22 November 2021, the EBA in cooperation with ESMA published guidelines on internal governance and sound remuneration policies in accordance with the mandates set out under the IFD. Those guidelines apply from 30 April 2022.

The EBA guidelines on internal governance provide further details on how the IFD governance provisions should be applied by class 2 investment firms, specifying the tasks, responsibilities and organisation of the management body and investment firms, including the need to create transparent structures that allow for supervision of all their activities. The guidelines also specify requirements for ensuring the sound management of risks across all three lines of defence and, in particular, set out detailed conditions on the second line of defence (the compliance function and the independent risk management), where applicable, and the third line of defence (the internal audit function), also where applicable.

Setting out guidelines on sound remuneration policies for investment firms

The guidelines provide further details on how the provisions under IFD on remuneration policies and variable remuneration of identified staff should be applied by class 2 investment firms. The guidelines are as far as possible consistent with the existing guidelines under the CRD. Relevant differences between the IFD and the CRD (e.g. the absence of a bonus cap and differences in instruments and the length of deferral periods) have been taken into account.

All aspects of the remuneration policy must be gender-neutral in accordance with IFD remuneration requirements. Institutions should, therefore, comply with the principle of equal pay for equal work or equal value of work and monitor the gender pay gap. The provisions on anti-discrimination and equal opportunities mirror the framework under the CRD, as the underlying principles in the Directive on equal opportunities and the European Charter on fundamental rights apply in the same way to investment firms as to institutions. The guidelines aim to foster diversity and reduce the gender pay gap over time.

Contributing to the European Commission’s Capital Markets Recovery Package and the targeted amendments to the securitisation framework

The Capital Markets Recovery Package amended the Securitisation Regulation in several aspects, including creating a specific framework for simple, transparent and standardised (STS) on-balance-sheet securitisation to ensure that the Union securitisation framework provides for an additional tool to foster economic recovery in the aftermath of the COVID-19 crisis. It also amended the framework to cater for the specificities of the non-performing exposure (NPE) securitisations to enable the use of securitisation of NPE exposures while maintaining high prudential standards.

RTS specifying the requirements for originators, sponsors, original lenders and servicers related to risk retention in securitisations

In June 2021, the EBA launched a public consultation on draft RTS specifying the requirements for originators, sponsors, original lenders and servicers related to risk retention, in line with the Securitisation Regulation. The RTS aim to clarify requirements relating to risk retention, thus reducing the risk of moral hazard and aligning interests. The RTS also provide clarity on new topics, including risk retention in traditional securitisation of NPE. By providing additional clarity on risk retention in case of portfolios of NPE, these draft RTS are also part of the EBA’s comprehensive work on supporting the functioning of the secondary markets for NPE.

RTS on triggers for switching the amortisation system in STS synthetic securitisation

In December 2021, the EBA launched a public consultation on its draft RTS specifying and, where relevant, calibrating the minimum performance-related triggers for STS on-balance-sheet securitisations that feature non-sequential amortisation. These draft technical standards aim to provide technical clarification on these triggers.

Continuing the regulatory developments

Making progress in the development of the new prudential framework for investment firms

There are around 2,500 investment firms and 400 investment firm groups domiciled in the Union. Investment firms are authorised in accordance with the national transposition of the Market in Financial Instruments Directive (MiFID). However, MiFID does not cover the prudential requirements. Until 2020, the prudential requirements for investment firms used to be addressed under separate legislation, in that certain investment firms were subject to the same prudential requirements as credit institutions and others had specific treatment or were even wholly exempt. With the Basel III finalisation, it became increasingly evident that the credit institutions’ framework of the CRR was not appropriate for most investment firms. Accordingly, the European Commission proposed a new prudential regime more tailored to size and activities performed by investment firms. The new prudential framework, based on the Investment Firms Directive (IFD) and the Investment Firms Regulation (IFR), entered into force in December 2019 and has been applicable since June 2021.

Under the new framework, investment firms will be subject to risk-sensitive and proportionate prudential requirements based on their size and range of performed activities or financial services provided. Therefore, the principle of proportionality was a main driver of the policy choices taken during the development of the technical standards and guidelines. Most of the regulatory products have been developed in collaboration with ESMA and the prudential supervisors of the investment firms.

In order to facilitate the preparation of market participants and the transition to the new prudential framework, the EBA provided an overview of the expected timeline, process and deliverables related to IFD and IFR in the EBA investment firms roadmap. The roadmap envisages four phases, with 21 technical standards and six guidelines to be finalised by the end of 2022.

Ten technical standards were adopted and published in the official journal in 2021. They cover the areas essential for the implementation of the IFD and IFR, including, among others, further specifications of capital requirement methodologies, standards on reporting and disclosure requirements, reporting templates for investment firms and investment firm groups, standards for the identification of risk takers and of instruments for variable remuneration.

On top of the nine technical standards submitted to the EU Commission in 2020, the EBA developed nine technical standards and guidelines relating to the IFD and IFR in 2021. These cover several additional areas on the supervision of investment firms, such as the reclassification of certain investment firms as credit institutions, the functioning of colleges, the exchange of information among investment firms’ competent authorities, supervisory disclosure and investment policy disclosure.

Finalising the EBA’s roadmap on investment firms by 2022

The EBA also started the public consultation process on the remaining technical standards and guidelines, aiming to submit all of them to the Commission in 2022. At this juncture, the regulatory products for which the public consultation is in progress or recently closed are the guidelines on the SREP for investment firms, the technical standards on the capital add-ons, the guidelines on liquidity exemption, and the technical standards on specific liquidity measures. With this year’s scheduled finalisation of the technical standards on prudential consolidation of investment firm groups, the package would be complete, apart from the mandates relating to ESG risks.

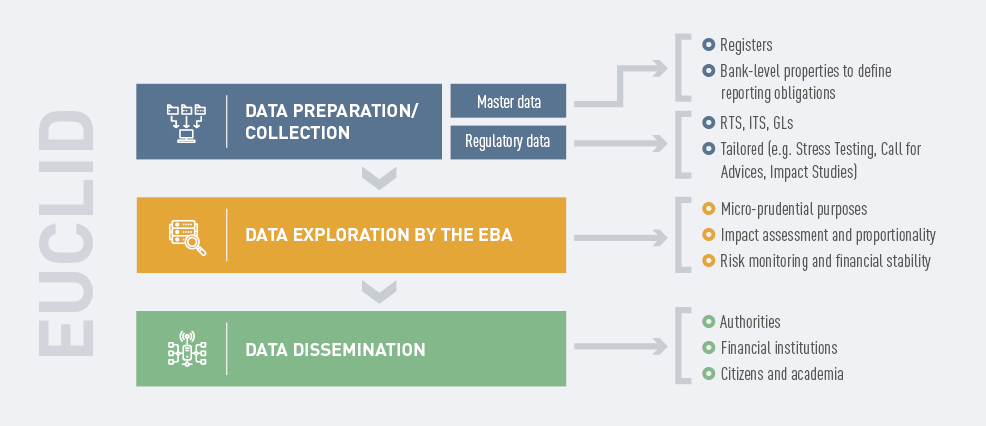

In accordance with the EBA’s general policy on the European Centralised Infrastructure for Supervisory Data (EUCLID) platform and the EBA as a single data hub, presented in Section 3.2, the EBA also started collecting an EU-wide set of data under the IFR reporting requirements. The upgrade of the EUCLID infrastructure to include investment firms’ own funds reporting will be completed in 2022. This will allow the EBA to have a detailed and comprehensive overview over all MiFID investment firms’ prudential requirements in the Union by early 2023. Among others benefits, this data will be representative for the IFD and IFR reviews envisaged for 2024.

Supplementing the regulatory framework in the area of market risk and markets infrastructure

Addressing market risk

In 2021, the EBA continued to deliver technical standards in the area of market risk in accordance with its roadmap for the new market and counterparty credit risk approaches published in June 2019. In March and April 2021, the EBA issued for public consultation three draft RTS of phase 3 of its roadmap: (i) draft RTS on gross jump-to-default (JTD) amounts, (ii) draft RTS on residual risk add-on (RRAO) and (iii) draft RTS on advanced economies. These RTS complete the specifications needed for calculating capital requirements under the alternative standardised approach for market risk in the CRR.

After taking into account the feedback from the public consultation, the EBA finalised, published, and submitted to the European Commission for adoption the draft RTS on gross JTD amounts and the draft RTS on RRAO in October 2021. The draft RTS on advanced economies were likewise published and submitted to the Commission shortly after in February 2022.

In addition, in July 2021 the EBA published its final guidelines clarifying the requirements for the data inputs used to compute the expected shortfall risk measure under the alternative Internal Model Approach. In particular, these requirements aim to ensure that data inputs are calibrated to historical data reflective of prices observed or quoted in the market. Those regulatory deliverables contribute to ensuring the smooth introduction in the European Union of the revised framework to calculate capital requirements for market risk.

Market infrastructures

In November 2021, the EBA published a consultation paper on draft RTS on initial margin model validation (IMMV) under Article 11(15)(aa) of the European Markets Infrastructure Regulation (EMIR). The consultation paper sets out the supervisory procedures for initial and ongoing validation of initial margin models to be used for determining the level of margin requirements for uncleared over-the-counter (OTC) derivatives.

The consultation paper proposes the application of supervisory procedures proportionate to the size of the counterparty. This entails: (i) a standard supervisory procedure to ensure an in-depth validation of the largest banking counterparties and (ii) a more pragmatic and simplified approach for smaller counterparties. In addition, the proposal foresees a phased-in implementation of the supervisory requirements to ensure a smooth model validation process, providing more time for smaller counterparties to comply with the new requirements. Finally, to minimise disruption, the validation of models already in place before the date of application of the new rules may be conducted via a non-objection procedure for a two-year transitional period from the application of those rules.

Continuing the development of an all-inclusive large exposures regime in the European Union

With the Regulatory Consistency Assessment Programme (RCAP) of the Basel Committee that assessed the large exposures framework in the European Union as compliant/largely compliant with the Basel standard on large exposures, institutions in the European Union can benefit from further clarity on the regulatory framework while at the same time aligning their operational procedures to standards adopted in other markets outside the European Union.

In 2021, the EBA directed part of its efforts towards enhancing the large exposures framework. Under a host of new mandates in the risk reduction measures package adopted by European legislators in 2019, the EBA developed guidelines to harmonise the way in which competent authorities assess and manage breaches of the large exposures limits by institutions. It also developed RTS to set out criteria for the identification of shadow banking entities for the purposes of reporting large exposures.

If, in an exceptional case, an institution breaches the large exposures limits, the value of the exposure must be reported immediately to the competent authority, which may allow the institution a limited period in which to restore compliance with the limit. The EBA published guidelines providing guidance to competent authorities to decide when it may allow an institution a limited period of time on to comply again with the limit , as well as criteria to determine the appropriate time for returning to compliance. Based on current practices by competent authorities, the approach in these guidelines is kept simple, ensuring a prudent and harmonised application and a level playing field among institutions in the Union.

Meanwhile, the EBA developed technical standards to specify the criteria for identifying shadow banking entities as entities performing banking services and activities but are not regulated and not supervised under any of the acts set forth in the technical standards forming the regulated framework. These technical standards take into account international developments and internationally agreed standards on shadow banking entities. When identifying shadow banking entities, any transaction with such entity is subject to the limits set out in the EBA guidelines on limits on exposures to shadow banking entities.

In 2022, the EBA will publish technical standards clarifying the circumstances under which institutions should form groups of connected clients. It will also start preparatory work on the amendments of the existing EBA guidelines on connected clients to ensure consistency with these technical standards. Finally, it will update the existing EBA guidelines on limits on exposures to shadow banking entities to ensure consistency with the final RTS on criteria for the identification of shadow banking entities.

The EBA will also finalise the mandates under the large exposures framework in 2022.

Continuing the monitoring of external credit assessment institutions’ mappings

In 2021, the European Banking Authority continued closely monitoring credit assessments issued by external credit assessment institutions (ECAIs), which serve to assess credit quality for determining capital requirements under certain provisions of the CRR. This is based on the correspondence (‘mapping’) of credit assessments with a prudential scale of credit quality steps, which is set out through implementing technical standards (ITS).

Regarding the Standardised Approach of Credit Risk, the Commission endorsed in November 2021 an amending Implementing Regulation, which reflected the registration in the EU of two additional ECAIs, therefore contributing to enhancing market competition. Further, existing mappings were subject to a monitoring exercise based on qualitative and quantitative criteria to assess if the performance of ratings continued to align with the prudential considerations underlying the allocated credit quality steps, therefore ensuring the robustness of the framework. Finally, in June 2021 a revised EBA Decision on the quality of unsolicited credit assessments was published, enabling unsolicited credit assessments issued by certain ECAIs to be used for the purposes of capital requirements determination.

In December 2021, the EBA published a consultation paper on an amendment to the mapping of ECAIs for securitisation positions; this reflected the enhanced risk sensitivity of the new credit quality step scheme brought by the CRR amendments, in turn triggered by the new Securitisation Regulation, therefore ensuring consistency across regulations. Further, the proposed amendments reflect the developments in the ECAI population registered since the original draft ITS was produced, hence allowing new market participants to become operational for capital determination purposes and fostering provision of credit assessment for securitisation instruments.

Using prudential consolidation to address shadow banking

In April 2021, the EBA published the final draft RTS specifying the conditions according to which consolidation should be carried out under Article 18 of the CRR. In developing these RTS, the EBA has taken into consideration the different initiatives undertaken at the international level to strengthen the oversight and regulation of the shadow banking system. Particular consideration has been given to the guidelines on the identification and management of step-in risk issued by the BCBS, with the aim of mitigating a potential spillover from the shadow banking system to banks. Building on these guidelines, the EBA has developed a list of indicators to guide the competent authority in identifying those undertakings that should be fully or proportionately consolidated for prudential purposes, taking into account the step-in risk that this would entail for the banking group.

As part of the amendments proposed by the European Commission to the CRR, a specific mandate has been included for the EBA to report on the completeness and appropriateness of the new set of definitions and provisions related to prudential consolidation. This would allow the EBA to further investigate whether the empowerments of the supervisors and their ability to adapt their supervisory approach to new sources of risks might be unintentionally constrained by any discrepancies or loopholes in the new regulatory provisions or in their interaction with the applicable accounting framework.

Promoting sounder market access rules, including for third-country groups

The EBA has carried out several regulatory and monitoring activities focusing on robust criteria and assessment methodology for sound access to the EU market, including from third countries.

Particular attention has been devoted to the authorisation of credit institutions, with the finalisation of the guidelines concentrating on a common assessment methodology for granting authorisation. These guidelines complete the RTS and ITS on information to be submitted with the application for authorisation as a credit institution and further the harmonisation of licensing practices across the EU. The guidelines are technology-neutral and apply to both traditional and innovative business models or delivery mechanisms. They embed AML/CFT assessment requirements and are in line with the CRD V requirement of stringent assessment of risk management processes and arrangement. Furthermore, they lay down a comprehensive business plan analysis for supporting the assessment of other areas of the application, such as the adequacy of internal governance arrangements and of capital.

In 2021, the EBA also took the lead in drafting a report on the withdrawal of authorisation for serious breaches of AML/CFT rules, in pursuance of a mandate set out in the Council Action Plan on AML of 2018. The report sets out the four action points of Objective 5 of the Action Plan and focuses on (i) the assessment of the degree of discretion and the legal grounds available under national or EU law to prudential supervisors to withdraw the authorisation for serious breaches of AML/CFT rules, (ii) the uniform interpretation of serious breaches of AML/CFT rules, (iii) the impact of the withdrawal of authorisation on critical functions and the involvement of resolution authorities and (iv) the supervisory tools and sanction measures available to supervisors to tackle ML/TF risk. The report, drafted in cooperation with European Securities and Markets Authority (ESMA) and European Insurance and Occupational Pensions Authority (EIOPA), deals with various regulatory, supervisory and crisis-related aspects and will be finalised in 2022.

Linked to market access are acquisitions or increases of qualifying holdings that need to undergo preliminary assessment in accordance with the criteria laid down in Article 23(1), letters (a) to (e) CRD, as further specified in the European Supervisory Authorities’ (ESAs’) joint guidelines on the prudential assessment of acquisition or increase in qualifying holdings. Such assessment must be undertaken according to the same criteria for acquisitions both in going concerns and at authorisation, as it represents a critical safekeeping function in respect of market access. In 2021, the EBA undertook a peer review of the application of these guidelines by the competent authorities under its remit, i.e. those designated under the CRD. In the light of its exclusive competence for the assessment of acquisitions or increases of qualifying holdings, the analysis of the practices followed by the European Central Bank (ECB) deserved special attention. The Peer Review Committee concluded that the guidelines are in general applied by the competent authorities, and it identified areas for improvement, particularly in relation to the first assessment criterion relating to the risk of ML/TF of the proposed acquirer, where more in-depth analysis and guidance may be needed. The case of complex transactions that may involve the assessment of several direct and indirect acquirers is also prone to divergent practices and requires clarification and simplification of the applicable requirements, particularly in relation to the proportionality principle.

In respect of access to the EU market from third countries, the EBA has focused the attention on two separate but related areas. The first relates to the determination of the EUR 40 billion threshold triggering the establishment of the intermediate parent undertaking (IPU); the second relates to the stock-take of national legislative requirements and supervisory practices applicable to EU branches of third-country credit institutions (third-country branches, or TCBs).

In respect of the first aspect, Article 21b CRD requires the establishment of an IPU in the form of a credit institution or (mixed) financial holding company for institutions where the total value of assets held by the EU entities belonging to the third-country groups (TCGs) is equal to or greater than EUR 40 billion. To achieve a common understanding of the calculation and monitoring practices of such threshold which is functional to the decision requesting the establishment of the IPU, the EBA published its final guidelines on the monitoring of the threshold and other procedural aspects on the establishment of IPUs as laid down in Article 21b of the CRD.

In respect of the second aspect, based on the mandate set out in Article 21b of the CRD, the EBA has developed and completed a report on the treatment of incoming TCBs. The report contains a mapping of TCBs currently established in the EU and illustrates the diversified national legislation and practices across the Union. Based on that analysis, the report lays down high-level recommendations for additional minimum harmonisation to address such regulatory differences and related potential arbitrage opportunities. The report emphasises the need for a uniform and centralised third-country equivalence assessment at EU level to avoid different national treatments of third-country credit institutions across the EU. With regard to prudential requirements, it recommends the introduction of capital endowment, such as a fixed amount to be harmonised across the EU or a percentage of the average liabilities, and as to liquidity, it takes a more prudent approach by suggesting the application of LCR requirements to be appropriately calibrated. Other recommendations focus on monitoring TCB operations and point towards transparency of booking arrangements – which are key for an adequate understanding of the risks associated with TCBs – and harmonisation of minimum core reporting requirements. As a last resort measure for ensuring prudential soundness and safety, the report envisages the introduction of a subsidiarisation mechanism to apply only in respect of those TCBs reaching a certain size and/or other quantitative and qualitative risk indicators, and of TCBs carrying out deposit-taking activities of covered deposits.

Implementing effective recovery and resolution plans and increasing institutions’ preparedness to crisis situations

Within the scope of its work on the convergence of supervisory practices, the EBA observed that overall, all competent authorities focused on the review and challenge of institutions’ recovery plans in line with the EBA statement on additional supervisory measures in the COVID-19 pandemic on institutions’ recovery plans.

Additionally, substantial work has also been conducted in supervisory colleges to assess the Group Recovery Plans (GRPs) and reach a joint decision in a timely manner, according to Articles 8 and 6 of the Bank Recovery and Resolution Directive (BRRD).

Overall, no material deficiencies have been identified in the GRPs and the interactions within the colleges closely monitored by the EBA in this regard proved to be fruitful. Notwithstanding the above, the EBA expects the quality of the recovery indicator framework to improve in next year’s assessment thanks to the new EBA guidelines on recovery plan indicators. This single set of guidelines provides institutions and CAs with the essential elements to be followed when developing the recovery plan indicator framework, especially regarding the treatment of recovery plan indicators in a crisis (e.g. application of supervisory relief measures).

The guidelines state that in a systemic crisis, there should no automatic recalibration of recovery plan indicators due to supervisory relief measures, apart from duly justified cases agreed with the CA; they also provide a common EU approach for the recovery plan indicators to ensure that they can promptly signal a stressed situation and enable the institution to consider timely and effective recovery actions.

In 2021, the EBA finalised its resolvability guidelines which represent a significant step in complementing the EU legal framework in the field of resolution based on international standards and leveraging on EU best practices.

Taking stock of the best practices developed so far by EU resolution authorities on resolvability topics, the guidelines set out requirements to improve resolvability in the areas of operational continuity in resolution, access to financial market infrastructure, funding and liquidity in resolution, bail-in execution, business reorganisation and communication. They implement the corresponding Financial Stability Board (FSB) standards at EU27 level.

They play a key role in the EU overall resolution policy framework in that they provide: (i) a harmonised enforceable basis for EU banks to progress on resolvability (banking union (BU) institutions – including both significant institutions (SIs) and less significant institutions (LSIs) – and non-BU institutions); (ii) a harmonised basis for policy discussions at the EBA table on the topic; and (iii) a harmonised basis for authorities to exchange and monitor progress on resolvability, particularly in colleges.

These guidelines are addressed primarily to institutions and provide key standards that institutions should adhere to for increasing their resolvability.

Institutions and authorities should comply with these guidelines in full by 1 January 2024. Compliance will not necessarily equate to being resolvable, as this remains for the relevant resolution authority or authorities to determine. Rather, they should be seen as the minimum steps that institutions should take towards resolvability.

Alongside the guidelines, a consultation was launched on a new set of guidelines on transferability. These guidelines aim to increase the feasibility and credibility of transfer strategies, encompassing requirements relating to the implementation of transfer tools when considered as the preferred or alternative strategies for institutions.

Transferability is defined as the elements of resolvability that will facilitate the transfer of an entity, a business line or portfolio of assets, rights and/or liabilities to an acquirer (‘transfer perimeter’), a bridge institution, or an asset management company. The guidelines deal with the transfer perimeter definition, separability (i.e. how to facilitate separation of an entity or a business from the rest of the group in resolution) and how to operationalise the transfer of this perimeter.

In 2021, the EBA launched the European Resolution Examination Programme (EREP). This first iteration introduced key topics for resolution authorities’ attention across the European Union for 2022. In line with its mission, the EBA proactively drives convergence in resolution practices through the selection of topics deserving European traction. The EREP topics are identified based on the EBA’s expertise in EU-wide policy development, its role in colleges and the practical experience of resolution authorities. The programme mirrors the European Supervisory Examination Programme (ESEP) that has applied to prudential supervision in recent years. The implementation of the key priorities will be monitored and captured in a report in 2023.

Contributing to the ongoing review of the crisis management and deposit insurance framework

In 2021, the EBA advised the EU Commission on funding in resolution and insolvency as part of the review of the crisis management and deposit insurance (CMDI) framework. The EBA response provided a quantitative analysis on banks’ capacity to access available sources of funding under the current framework and under various creditor hierarchies, and with regard to the minimum requirement for own funds and eligible liabilities (MREL).

The descriptive analysis showed the change to banks’ internal loss-absorption capacity under four scenarios of depositors’ preferences compared to the current creditor hierarchy applicable in each Member State. The analysis, whose findings were presented under several different capital depletion scenarios, drew two main conclusions: i) preferring deposits to other ordinary unsecured claims increases the number of banks that are able to meet the requirements to access resolution financing arrangements without the bail-in of any type of depositors; and ii) a single-tier depositor preference (i.e. all types of depositors rank pari passu) allows the highest contributions from deposit guarantee schemes (DGS) compared to the other policy options and the current situation. The modelling approach, which simulated an economic scenario similar to the global financial crisis, confirmed the findings.

In a third part, the report also investigated the issue of market access for MREL instruments for small and medium-sized banks. A limited number of these institutions had not yet issued senior MREL eligible instrument or AT1/T2 instruments as of end 2019. However, banks which are currently earmarked for liquidation are not considered in the analysis, so caution is needed in the interpretation of these results.

While it did not provide policy advice, the response provided a strong quantitative basis and evidence to inform the Commission’s work.

Identifying, assessing and monitoring risks in the EU banking sector

Improving the EU-wide stress testing framework

In line with the feedback received on the discussion paper on the future changes to the EU-wide stress testing framework, the EBA Board of Supervisors supported the exploration and implementation of a hybrid approach. While the status quo remains an option in the short term, the hybrid approach will mean that some selected elements will follow a centralised approach while the rest of the methodology will remain inherently bottom-up.

Investigating the role of top-down elements in the EU-wide stress test

The EBA Board of Supervisors has identified net interest income and net fee and commission income as suitable candidates for centralisation, potentially for the 2023 EU-wide stress test exercise. Due to the strict timelines for the finalisation of the methodology for the 2023 EU-wide stress test, the EBA Board of Supervisors decided to continue working in parallel on the bottom-up methodology considering the lessons learned in the 2021 EU-wide stress test exercise. A final decision on the implementation of some top-down elements in the 2023 EU-wide stress test is expected in the second quarter of 2022.

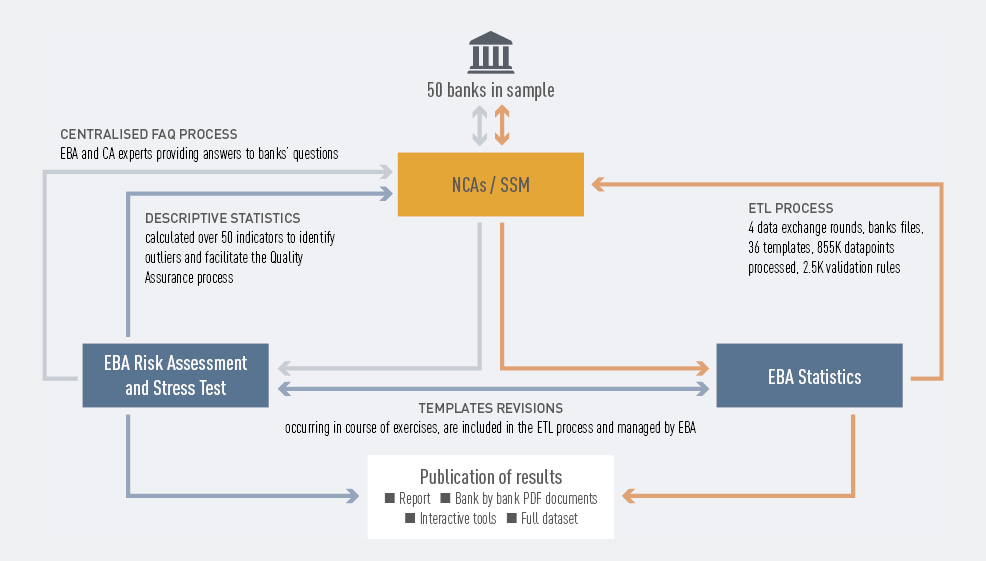

Figure 3: The process behind the EU-wide stress test

The 2021 EU-wide stress test: assessing banks’ capacity to withstand further shocks

In July 2021, the EBA published the results of the 2021 EU-wide stress test, which involved 50 banks covering broadly 70% of total EU banking sector assets. The 2021 EU-wide stress test exercise was initially planned for 2020 but postponed to allow banks to prioritise operational continuity while the COVID-19 pandemic was unfolding. The stress test helped supervisors assess banks’ capacity to withstand further shocks. Given the unprecedented macroeconomic shock due to the pandemic in 2020, the baseline scenario provided a useful yardstick for assessing and comparing the situation of EU banks, assuming an orderly exit from the pandemic. Hence, the stress test also helped provide a perspective on how the banking system could develop after the pandemic.

During 2020, EU banks continued to build up their capital base, with a CET1 ratio at the beginning of the exercise (i.e. at the end of 2020) of 15%, the highest since the EBA has been performing stress tests, despite the unprecedented decline in gross domestic product (GDP) and the initial effects of the COVID-19 pandemic in that year.

Under the adverse scenario, the average impact on the EU banking system was equal to a 485 bp decline in the CET1 fully loaded ratio for banks. In the baseline scenario, banks’ CET1 fully loaded ratio increased by 78 bps, bringing the sector’s average CET1 fully loaded ratio to 15.8% at the end of 2023. It is encouraging to see that overall, EU banks in aggregate remained above the 10% mark and hence would be able to continue lending despite a very severe adverse scenario.

In line with previous exercises, the EBA published granular stress test data at a bank-by-bank level, which is a must for fostering market discipline at times of increased uncertainty in the markets, while the results of the exercise represent a key input to the supervisory review and evaluation process (SREP).

The EBA is responsible for initiating and coordinating the EU-wide stress test, supplying the methodology, working with the ESRB and the ECB to provide a common scenario and publishing the results, including a report and granular bank-by-bank data together with analytical interactive tools. During the exercise, the EBA, together with the supervisory authorities, closely manage the data extraction, transformation, and loading (ETL) process to ensure a high level of data quality. More than 850,000 data points are processed and around 2,500 validation rules ensure that this is carried out properly. While the supervisory authorities take responsibility for ensuring the quality of the submissions received from banks with the results, the EBA facilitates the process by providing descriptive statistics and managing the process of clarifying methodological questions from banks through a centralised FAQ process.

Analysing risks and assessing idiosyncratic vulnerabilities

One of the EBA’s mandates is to help guarantee the stability, integrity, transparency and orderly functioning of the EU banking sector. To attain this, the EBA closely monitors market developments in order to assess potential risks and vulnerabilities in the European banking sector. This risk assessment feeds into the EBA’s policy decisions.

The risk assessment report (RAR), which is published annually, is one of the main tools utilised to provide external stakeholders with the EBA’s viewpoint on main microprudential risks and vulnerabilities in the EU banking sector. The report leverages on both quantitative information received through the supervisory data submitted to the EBA, as well as qualitative sources of information collected through surveys and microprudential qualitative information.

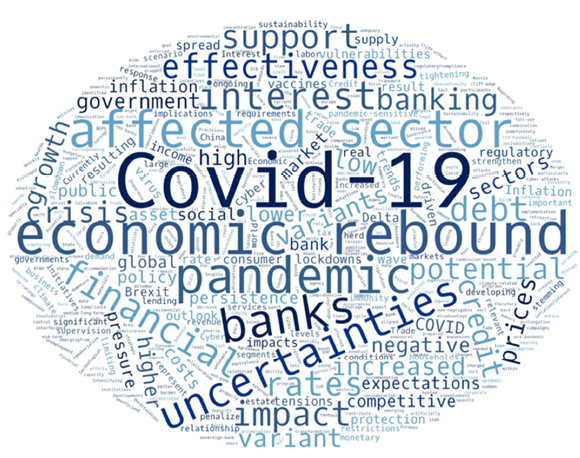

The 2021 RAR found that banks had strengthened their capitalisation and liquidity positions. They were helped by the robust economic recovery and the progress achieved in tackling the COVID-19 pandemic. In this environment, banks markedly increased lending to small and medium-sized enterprises and for residential real estate. Although asset quality improved overall, there are still concerns about loans to sectors mostly affected by the pandemic, such as the hospitality industry, or some exposures that benefited from COVID-19 support measures. As a result of these trends, the non-performing loan (NPL) ratio for total loans further decreased this year, but the NPL ratios of the exposures to the sectors most affected by the pandemic reported a substantial increase.

The risk assessment also notes that operational risk losses increased during the pandemic, as the growing usage of and reliance on technology were accompanied by an increase in and the impact of information and communication technologies and security-related incidents. This did not directly affect banks’ profitability, which was boosted by lower impairment costs, yet the assessment is that the banking sector is still faced with structural profitability challenges. For example, banks’ net operating income has not recovered to pre-pandemic levels, and the low or negative interest rate environment is still weighing on lending margins. This is added to competition pressures not only among banks, but also with FinTech and BigTech companies. The assessment also acknowledges that banks have made some progress on ESG risk considerations. The share of ESG bonds of total bank issuances has increased in recent years, reaching around 20% of banks’ total placements this year. Banks have started integrating ESG risk considerations into their risk management. However, the EBA cautions that more progress needs to be made, including in areas such as data, business strategies, governance arrangements, risk assessments and monitoring.

In 2021, the quarterly EBA risk dashboard (RDB) remained a leading element contributing to the regular risk assessment and in parallel fulfilling the EBA’s role of disseminating data to stakeholders. The EBA Risk Dashboard has become a reference point for granular EU aggregate and country-by-country supervisory data. It provides comprehensive, easy-to-use fundamental risk indicators for assessing the well-being of the EU banking sector, as well as comprehensive statistical tables for analysing trends and running peer analysis. For these reasons, the RDB has become a reference point of transparency for market participants with up-to-date relevant supervisory data. During 2021, the EBA continued to provide country-by-country data on volumes and asset quality-related indicators for those exposures that benefited from support programs. In addition, as a response to the rising uncertainty caused by the war in Ukraine, the EBA published new statistical tables in the fourth quarter of 2021 on asset (on and off-balance sheet) and liability exposures towards Ukrainian, Belarusian and Russian counterparties.

The risk assessment questionnaire (RAQ) is published twice per year, along with first-quarter and third-quarter RDBs, forming another essential monitoring and assessment tool used by the EBA to identify the main risks and vulnerabilities in the EU banking sector. The surveys consider banks’ and market analysts’ views on topics including profitability, asset development and quality, funding and operational risks, as well as FinTech, sustainable finance and AML-related questions. The answers received provide a reflection of the respondents’ views on the current and forthcoming developments in the EU banking sector, and they provide valuable qualitative input in the analysis of microprudential risks. The number of banks providing their views through the EBA’s RAQ was 59, covering in total 24 countries, while the number of analysts has ranged from 10 to 15.

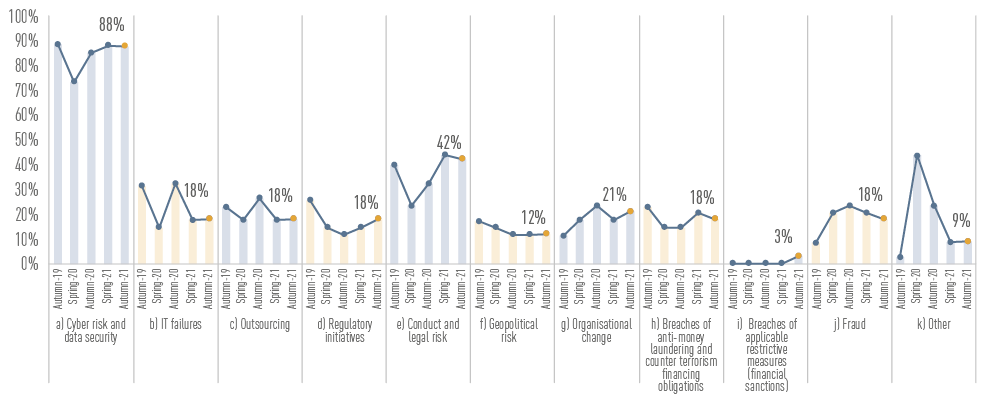

Figure 4: Looking at the EU banking sector, which other sources of risks or vulnerabilities are likely to increase further in the next 6 to 12 months?

Source: open question to banks in the autumn 2021 RAQ

The EBA also publishes two reports annually that monitor EU banks’ funding plans and asset encumbrance. These contribute to the ongoing monitoring of the composition of funding sources across the EU.