America’s bank branch bloodbath continues: Wells Fargo shutters 15 locations while Bank of America closes seven in a week – is YOUR local on the list?

Banks filed to close 24 branches last week – and to open just two – as part of an ongoing scramble to eliminate costly brick and mortar banking locations.

Wells Fargo notified its regulator of 15 planned closures, including three in Florida and two in California, Georgia and New Jersey.

Bank of America reported seven over the same week, between November 19 and November 25, according the latest bulletin published by the regulator, the Office of the Comptroller of the Currency (OCC).

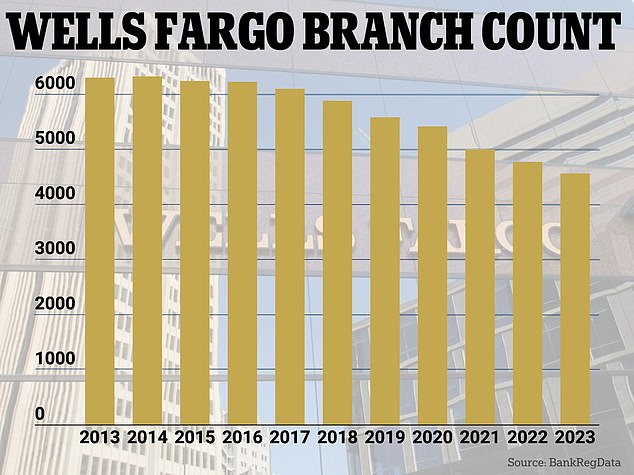

Wells Fargo has the second largest number of physical bank branches in the US with around 4,500 as of July – but that tally is continuing to dwindle.

In 2013 it had more than 6,000 locations, according to data from BankRegData.

Wells Fargo notified its regulator of 15 planned closures, including three in Florida and two in California , Georgia and New Jersey, according to the latest OCC bulletin

Wells Fargo had more than 6,000 branches until 2017, but its count fell to around 4,500 as of July, according to BankRegData

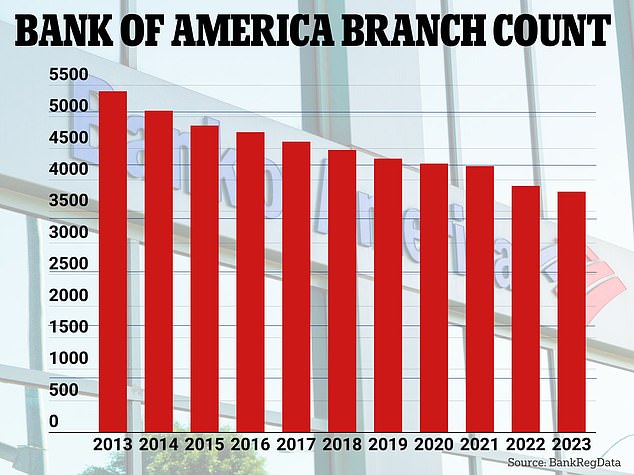

Bank of America has also been cutting its branch count, and began some years earlier than Wells Fargo.

The company had 5,400 branches in 2013 and around 3,800 this year, according to BankRegData.

A spokesperson for Bank of America told DailyMail.com that it was closing certain branches in response to diminishing customer traffic.

‘What we’re seeing across the industry is that our clients are using digital banking for more of their everyday needs. They only come into our financial centers when they want to have a conversation about their finances or something that’s a little more complex,’ they said.

As the habits of consumers are changing, so too are the way banks are set out, said the spokesperson.

In the past Bank of America branches were arranged in such a way that the teller line was at the front. That line is now often at the back of the branch to make space for customers to meet with bank employees privately nearer to the entrance.

Although the majority of consumer banks have been closing branches in recent years, the extent of the downscaling could begin to level off, the spokesperson suggested.

Another spokesperson for Wells Fargo, Amy Amirault, also told DailyMail.com that the bank is evolving with its customers.

‘As customer preferences and transaction patterns change, so will our branches,’ she wrote in a statement. ‘For example, we may open new branches where we combine two older existing branches into one better situated location.’

Of the seven branches Bank of America indicated it would close, two were in Fullerton, California. Others were scheduled in Georgia, Massachusetts, Missouri, New Jersey and New York.

The two banks that reported last week that they would be opening branches were Flagstar Bank and BankUnited.

Of the seven branches Bank of America indicated it would close, two were in Fullerton, California. Others were scheduled in Georgia, Massachusetts, Missouri, New Jersey and New York

Bank of America had 5,400 branches in 2013 and around 3,800 this year, also according to BankRegData

In the first half the year – between January 1 and July 31 – a total of 1,144 national and regional banks were closed, according to data from S&P reviewed by DailyMail.com.

An exclusive poll by DailyMail.com revealed 51 percent of consumers said they were very or somewhat concerned about the declining number of bank branches.

It also found that brick and mortar services were less accessible to black Americans. While 14 percent of black Americans said they did not have a local branch, that was only the case for 8 percent of white Americans.

Have bank branch closures been affecting you, or are you able to manage your financial affairs online? Write us an email at [email protected].

| Bank | City | State | Location |

|---|---|---|---|

| Wells Fargo | Santa Barbara | CA | 101 N. Milpas St. |

| Wells Fargo | San Diego | CA | 13255 Black Mountain Rd. |

| Wells Fargo | Holly Hill | FL | 1600 Ridgewood Av. |

| Wells Fargo | West Palm Beach | FL | 5849 Okeechobee Blvd. |

| Wells Fargo | Boca Raton | FL | 5355 Town Center Rd. |

| Wells Fargo | Atlanta | GA | 3019 Buford Highway, N.E. |

| Wells Fargo | Lawrenceville | GA | 3325 Sugarloaf Parkway |

| Wells Fargo | Davenport | IA | 104 West 2nd St., Suite 1A |

| Wells Fargo | Boise | ID | 421 North Orchard Av. |

| Wells Fargo | Asheville | NC | 1 Haywood St. |

| Wells Fargo | Gibbsboro | NJ | 50 E. Clementon Rd |

| Wells Fargo | Roselle | NJ | 201 Chestnut St. |

| Wells Fargo | Hartsdale | NY | 401 N. Central Av. |

| Wells Fargo | Phoenixville | PA | 101 S. Main St. |

| Wells Fargo | San Antonio | TX | 8903 West Military Dr. |

| Bank of America | Fullerton | CA | 2516 East Chapman Av. |

| Bank of America | Fullerton | CA | 1401 S. Harbor Blvd. |

| Bank of America | Atlanta | GA | 5695 Fulton Industrial Blvd., S.W. |

| Bank of America | North Reading | MA | 172 Park St. |

| Bank of America | Arnold | MO | 1301 Jeffco Blvd. |

| Bank of America | New Milford | NJ | 904 River Rd. |

| Bank of America | Washingtonville | NY | 23 East Main St. |

| Flagstar Bank | New York | NY | 261 Madison Av. |

| BankUnited | Winter Park | FL | 1121 North Orange Av. |