A corporate bank account overdraft happens when a business’ bank account has a negative balance, leading to the account holder incurring a debt.

It may be costly, as the outstanding negative balance must be returned in addition to possible fees and with an interest rate that is not typically low.

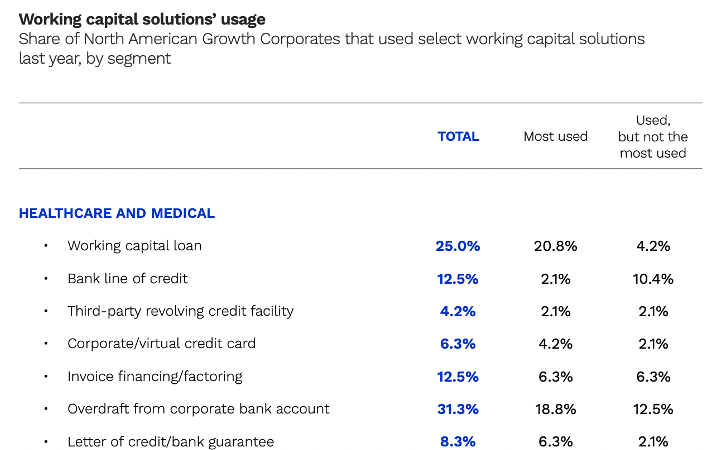

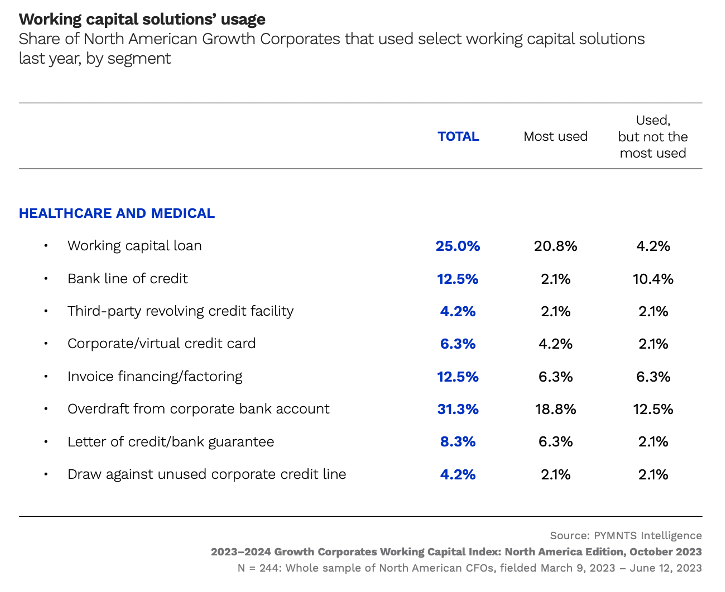

However, data shows that businesses are tapping overdrafts intentionally to improve cash flow management. Companies from different sectors, from healthcare to retail or agriculture, have turned to bank overdrafts as a working capital solution, according to “The 2023–2024 Growth Corporates Working Capital Index: North America Edition,” a PYMNTS Intelligence and Visa collaboration.

About the Numbers

The study examined the working capital solutions available to growth corporates in North America and the impact these solutions can have on their operational efficiency and business performance. Growth corporates are companies with annual revenues between $50 million and $1 billion — often considered mid-market companies — looking specifically at the agriculture, commercial travel, fleet and mobility, healthcare and marketplace sectors.

Bank Overdrafts as a Working Capital Solution

Among all reviewed sectors, fleet and mobility companies reported the highest use of overdrafts from corporate bank accounts as a working capital solution at 32%. Healthcare and medical services companies were close behind at 31%. Agriculture reported adoption at 15%, marketplaces were 8% and commercial travel companies reported 6%.

Healthcare companies use overdrafts more than business loans or lines of credit. With an authorized bank overdraft, no payments are late due to insufficient funds because the overdraft shoulders the deficit. This helps account holders avoid having to pay late fees to suppliers.

Additionally, compared to standard business loans or lines of credit, bank account overdrafts are relatively easy to handle, requiring minimal paperwork and reducing processing time, which makes them an effective working capital solution for business contingencies and low due balances.