In the heart of Derbyshire, a quiet revolution is unfolding. As the UK grapples with a relentless wave of bank branch closures, a novel solution has emerged: banking hubs. These hubs, which consolidate services from multiple banks under one roof, are redefining the concept of local banking, offering a glimmer of hope to communities left in the void.

A New Dawn for In-Person Banking

The traditional bank branch has long been the cornerstone of local economies, providing a vital touchpoint for personal and business banking needs. However, the landscape has shifted dramatically. The UK has witnessed over 5,000 branch closures in the past decade, with 249 more announced for 2024, primarily by Barclays, Lloyds, and Halifax. This trend is not merely a statistic but a significant disruption for customers, particularly in small towns and villages.

Derbyshire’s banking hub, operated by the Post Office, hosts five different banks, each on a specific weekday. This model doesn’t just preserve in-person banking; it reimagines it, creating a shared space where community and convenience converge. According to GlobalData’s 2023 Financial Services Consumer Survey, 29% of UK customers still use a branch at least monthly, underscoring the enduring value of face-to-face interactions, especially for critical transactions like mortgage applications or opening new accounts.

The Human Touch in a Digital Age

The rise of digital banking has transformed how we manage our finances, offering unparalleled convenience. Yet, the digital divide remains a stark reality for many, particularly the elderly and those in rural areas. The closure of traditional bank branches in these communities has not just limited access to financial services but also eroded a sense of community and personal connection that physical branches fostered.

Banking hubs, therefore, are more than a pragmatic response to operational cost pressures; they are a testament to the importance of the human touch in banking. They ensure that customers, regardless of their tech-savviness, have access to essential banking services, bridging the satisfaction gap highlighted by the decline in branch accessibility. Nationwide’s commitment to maintain its physical presence until at least 2026 reflects a broader recognition of this value.

Challenges and Opportunities Ahead

While banking hubs offer a promising solution, they are not without their challenges. Integrating services from multiple banks into a single location presents logistical and operational hurdles. Moreover, ensuring that these hubs meet the diverse needs of their communities, from personal banking to business services, requires careful planning and collaboration among the participating banks.

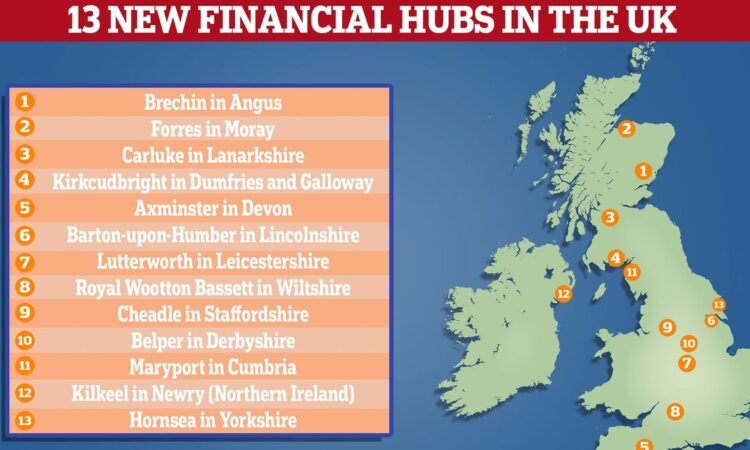

Yet, the potential benefits are significant. Beyond preserving access to banking services, hubs can become focal points for community engagement and financial education, fostering resilience in local economies. The initiative by LINK to assess the impact of closures and recommend new hubs is a step in the right direction, reflecting a commitment to ensuring that no community is left behind in the transition to a more digital banking landscape.

In conclusion, as the UK navigates the evolving banking ecosystem, banking hubs stand out as beacons of innovation and inclusivity. They represent a critical rethinking of how financial services can remain accessible and personal in an increasingly digital world. For communities like those in Derbyshire, these hubs are not just a replacement for lost branches; they are a new chapter in the story of local banking, one that promises to keep the human element at its core.