Macro Monday 49~Ireland – The Fastest Growing Economy in the EU for EURONEXT:ISEQ by PukaCharts — TradingView

Ireland – The Fastest Growing Economy in the EU

According to forecasts by the European Commission the European Union is set to grow by a humble 1.7% in 2024 however Ireland is the country which is forecasted to grow the most with an annual growth rate of 5% expected for 2024.

In Q1 2024, Ireland recorded a 1.1% increase compared to the previous quarter, indicating significantly strong economic performance against its closest peers at 0.8% by the likes of Hungary, Latvia and Lithuania.

For the 2023 year the top three European countries for GDP per capita (average economic value of the productivity of each person) were;

1. Luxembourg €143,304

2. Ireland €137,638

3. Switzerland €89,537

I might note briefly that the above figures change for REAL GDP which factors in inflation or changes in the price levels. It accounts for the impact of rising or falling prices on economic output. The real GDP figures for Luxembourg and Ireland are €76,176 and €67,149, respectively. The average real GDP for the EU is €31,740, placing Luxembourg 240% above the average and placing Ireland at 112% above the average, respectively. Real GDP figures highlight both countries as being well above the EU average.

Irelands Largest Exports

Ireland’s largest export in 2023 was pharmaceuticals, which accounted for 34.2% of the country’s total exports. The top export products included blood fractions including antisera, heterocyclic’s and nucleic acids, medication mixes in dosage, hormones including miscellaneous steroids, and electro-medical equipment. These major exports represented 54.5% of Ireland’s overall export sales.

The United States was the largest single goods export market for Ireland, accounting for a significant portion of the exports. The pharmaceutical sector, particularly, places Ireland among the world leaders for exporting blood fractions including antisera, and the country is also a major competitor in selling medical, surgical, or veterinary instruments on international markets.

The Best Performing Stocks In Ireland

The best performing stocks in Ireland for the year 2023 were led by Ryanair, with an impressive share price movement of 51%. Other top performers included Cairn Homes with 47%, Kingspan with 43%, Glenveagh Properties with 33%, and Glanbia with 31%. These companies showed significant growth and were among the most successful in the Irish market according to the data from Euronext Dublin based on the period from January to December 2023.

For the past 12 months leading up to May 2024, the best performing Irish stock was Adventus Mining (ADVZF) with a total return of 35.90%, followed by AIB Group (AIBGY) and Bank of Ireland Group (BKRIF). These stocks have shown resilience and growth, reflecting positive investor sentiment and strong market performance.

ISEQ

The Irish stock market is called Euronext Dublin, formerly known as the Irish Stock Exchange (ISE). It has been in existence since 1793 and is Ireland’s main stock exchange.

As for the equivalent of the S&P 500 in Ireland, there isn’t a direct counterpart that matches the scale and scope of the S&P 500. However, the closest equivalent in terms of a benchmark index for the Irish market would be the ISEQ All Share Index which has between 20 and 25 Irish based stocks in the index. The ISEQ tracks the performance of all companies listed on Euronext Dublin, making it a broad-based indicator of the overall Irish stock market performance.

Here are the weightings (expressed as percentages) of the top components in the ISEQ All-Share Index as of March 30, 2024:

1. Ryanair Holdings PLC: Consumer Discretionary sector – 23.96%

2.Kingspan Group PLC: Industrials sector – 15.58%

3.Kerry Group PLC: Consumer Staples sector – 13.81%

4.AIB Group PLC: Financials sector – 12.31%

5.Smurfit Kappa Group PLC: Industrials sector – 11.03%

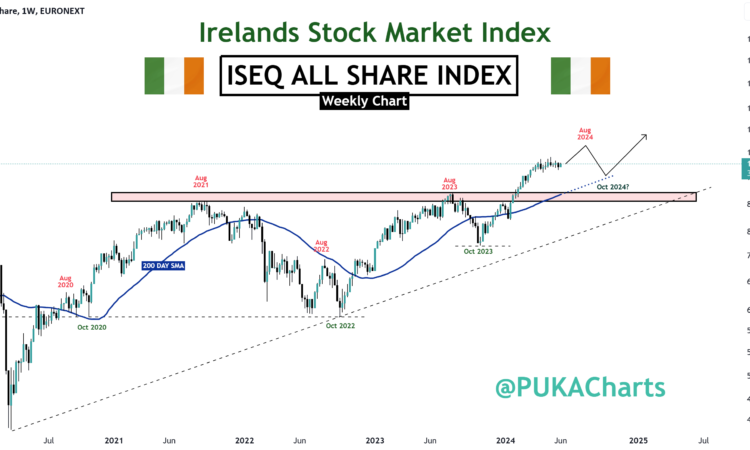

Let’s have a look at the ISEQ All Share Index Chart:

With Irelands economy firmly in growth mode and with most economist anticipating it to be the fastest growing economy in the EU for 2024, we can assume we will have some wind at our backs in entering a trade on the ISEQ all share index (no guarantees).

◻️ The chart demonstrates a pattern whereby the months of August since 2021 have not been good months however are followed by the ISEQ making lows in October, thereafter rallying into longer term bull periods. A pattern we could potentially take advantage of going forward. A sort of “Halloween Effect” in the Irish Economy, a term used to describe how markets in general perform well during the Halloween period to Christmas.

◻️ The chart speculates at a similar pattern this year for an August retraction followed by October continuation.

◻️ Entries in during these months should guided by the 200 Day SMA (blue line on the chart). Ideally you would want to be above this line or wait until we get above it or bounce from it (at present we are above it so we await a bounce for entry). You could place stops just below this moving average also having entered the trade.

With the Irish stock market index looking great and economists hailing a year of growth, lets pick out one individual stock we could take advantage of with an impressive looking chart set up.

GL9

Glanbia plc is an Irish global nutrition group with operations in 32 countries. It has a 2.2% allocation in the ISEQ All Share Index and is one of Ireland’s key players in the agri-food and nutrition industry. They handle dairy and grain processing, contributing to a €2 billion industry. You might recognize their popular brands like Avonmore, Kilmeaden, and GAIN Animal Nutrition. Glanbia Ireland plays a vital role in processing milk and creating various products for both local and global markets. Glanbia’s products are sold or distributed in over 130 countries.

This company utilizes one of Irelands greatest products, milk from the cows that feed on the greenest pastures the world has to offer, and distributes this goodness around the globe.

The unique product offering is matched by an impressive chart:

◻️ The chart has a long term cup and handle pattern and great Risk: Reward set up as illustrated. We are well above the 200 day moving average (blue line on the chart) and appear to be breaking higher.

This was one of the better charts I could find in Irelands top 20 stocks that are in the ISEQ All Share, however, Ryan Air appears to be bouncing off a strong resistance level at present having broken to new highs and is worth a review. I will skip it for now.

Pfizor is the Largest Pharma Company in Ireland

Interestingly, Pfizer is the largest pharmaceutical company in Ireland. They have a significant presence in the country, with seven locations across four counties and employing more than 3,300 people. Pfizer was one of the first pharmaceutical companies to establish operations in Ireland, setting up in 1969. Their work in Ireland includes research and development (R&D), manufacturing, shared services, treasury, and commercial operations. Over the years, Pfizer has invested more than $7 billion in its Irish operations, demonstrating its commitment to the country’s pharmaceutical sector

In 2022, Ireland was the world’s biggest exporter of vaccines, blood, antisera, toxins and cultures, with exports valued at $47.3 billion. This sector plays a significant role in Ireland’s economy, contributing to its position as a leading exporter in the pharmaceutical industry globally.

I’m not covering the chart for Pfizer but I thought this was an interesting edge in the Irish marketplace. Whilst Pfizer operates in Ireland, I cannot find it included in the ISEQ All Shares Index therefore holds multinational status operating within the country but not as an Irish entity.

An important Note on Irelands GDP

Irelands GDP figures have been highly contested by economists and investigative journalists for a host of reasons some of which are outlined below. These arguments hold weight and should be considered whilst factoring in an assessment of Irelands Economy:

1. Measurement Issues: Ireland’s GDP figures have been influenced by multinational corporations (MNCs) that use Ireland as a base for various financial activities, leading to concerns about the accuracy of these figures. The presence of MNCs can distort GDP calculations due to factors such as transfer pricing, intellectual property rights, and other financial engineering techniques.

2. Distortion from Corporate Re-domiciliation: The phenomenon of corporate re-domiciliation involves companies relocating their legal headquarters to Ireland without significant physical operations in the country. This can artificially inflate Ireland’s GDP figures without necessarily reflecting real economic activity within its borders.

3. Lack of Convergence with Other Economic Indicators: There have been concerns that Ireland’s reported GDP growth does not align with other indicators such as employment levels or wage growth, prompting skepticism about the accuracy of the reported figures.

4. Impact of Statistical Adjustments: The calculation methods used in determining GDP can lead to statistical adjustments that may not fully capture economic reality or provide an accurate representation of domestic production and income.

5. Potential Policy Implications: The contested nature of Ireland’s GDP figures has implications for economic policy decisions based on this data, potentially leading to misinformed policy choices if the underlying economic reality is not adequately captured.

Finally, it is clear that Irelands economy is in growth mode and could present some good opportunities for investment. Ireland is also of major importance to the EU as one of the only native English speaking nations remaining in the EU (since the UK exit – Brexit). One could expect Ireland to receive special consideration and attention from the EU for a host of reasons moving forward, good and bad. A small powerhouse country on the fringes of Europe that has a powerful economic punch to it, an educated and versatile workforce, and positionally is of geographical importance. This small island country has diversified itself as global leader in agriculture, pharma and manufacturing, and also acts as a host country for a range of tech giants. The future is bright for this little island nation however one wonders, would it be better off as a standalone economy outside the Euro Area, like Norway and Switzerland. For now it remains one of the 20 countries in the Euro Currency Area and of vital importance to the EU.

One could describe Ireland as being at the helm of Eurozone’s current trajectory, and with that, there is great risk and great promise. A nation in the balance.

All these charts are available on my Tradingview Page and you can go to them at any stage over the next few years press play and you’ll get the chart updated with the easy visual guide to see how Ireland’s stock market has performed. I hope its helpful.

PUKA