Is the economy booming or busting?

Depends on whom you ask.

The official data is buoyant — economic growth is solid, the job market is strong, and stocks keep hitting record highs.

Yet many Americans think the economy stinks.

The latest gloomy indicator is a Guardian-Harris survey in which 55% of respondents said they think the economy is shrinking and 56% think we’re in the midst of a recession.

Economic output, adjusted for inflation, grew by a solid 3% during the most recent 12-month period. The unemployment rate is 3.9%. And the US economy created over 3.5 million jobs in 2023.

You basically can’t have a recession when the economy is growing and employers keep hiring at this rate. But this Harris poll isn’t a one-off.

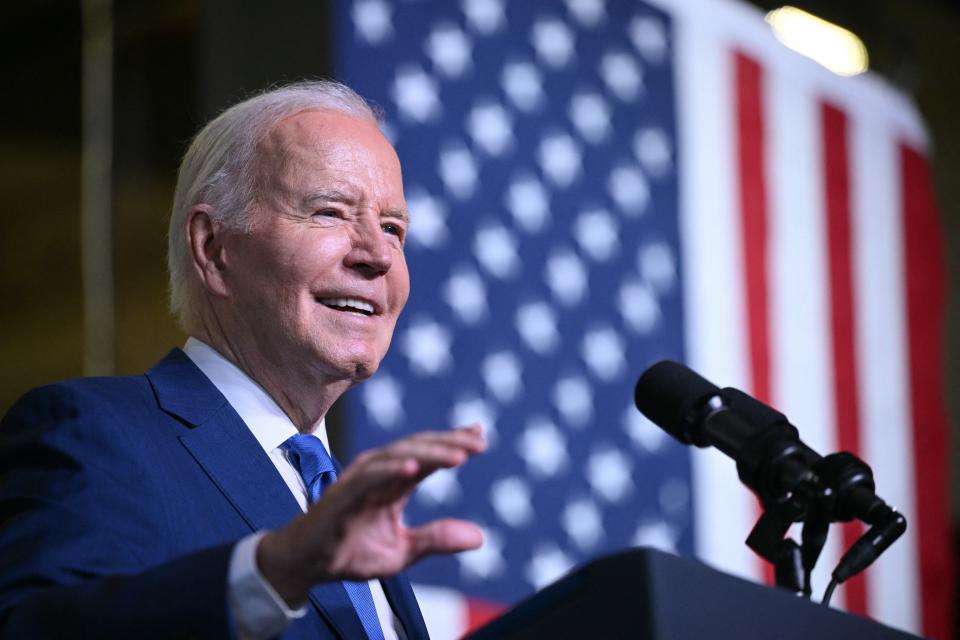

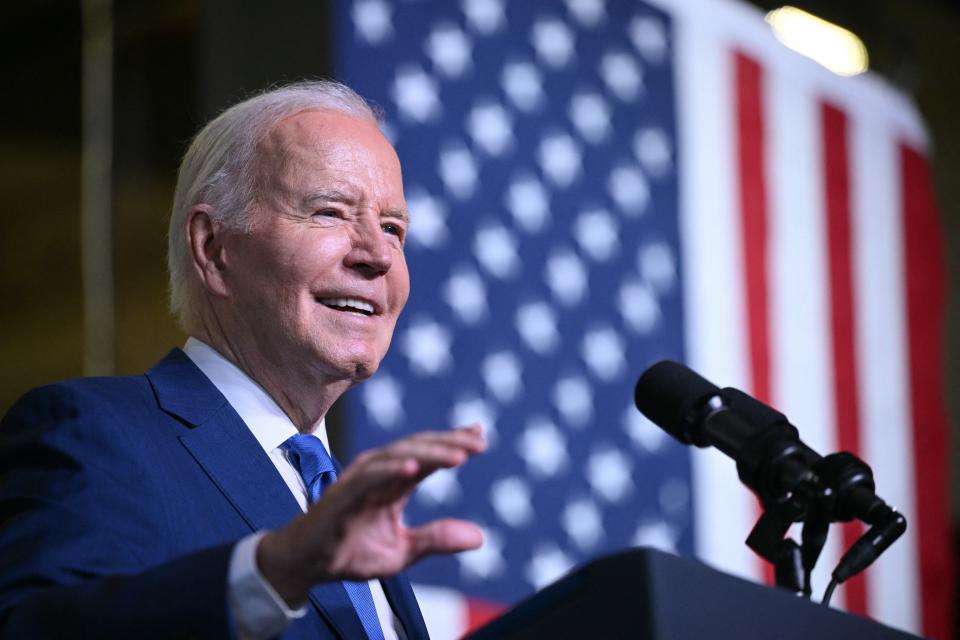

A leading measure of small business sentiment is near recessionary levels. So are some consumer confidence surveys. President Biden’s approval rating is in the tank, too, indicating many Americans associate the poor economy they think we have with the job Biden has done as president.

The Guardian-Harris survey also found that 49% of respondents think the S&P 500 index is down for the year. In reality, stocks have been ripping: The S&P 500 is up 13% this year on top of a 24% gain last year.

Something seems off with the Guardian-Harris finding that half of Americans think the stock market is in decline. In a different survey, Gallup found that 62% of Americans own stocks, mostly through retirement and investing accounts. If that’s true, wouldn’t most or all of those people know their portfolios are gaining value?

The Guardian-Harris poll didn’t specify how many respondents own stocks, but these two surveys seem to conflict. People know how much money they have, and stock market investors are either underrepresented in the Harris poll or overrepresented in Gallup’s.

Drop Rick Newman a note, follow him on Twitter, or sign up for his newsletter.

Statistical anomalies probably explain part of the reason why polls show people to be remarkably dour about an economy doing pretty well, but it would be a mistake to think this is just a measurement problem. Or worse, to think many people are just too dumb to know how good they have it.

This is perhaps Biden’s top problem as he seeks a second term in office: convincing Americans that the economy is working for them without talking down or sounding dismissive.

Inflation is obviously one of the main economic gremlins of the last three years.

Yahoo Finance’s Janna Herron recently explained how consumers consider the optimal level of inflation to be basically zero, considerably lower than the Federal Reserve’s 2% target.

If zero inflation is ideal for most people, inflation peaking at 9% in June 2022 served as a traumatic shock. Even the current rate of 3.4%, fairly close to the Fed’s target, is way too high if your hope is prices never go up.

There’s plenty of other evidence showing Americans continue to feel stung by prices that have gone up and stayed up, even if the annual rate of change is now more benign.

Another challenge for Biden is that many Americans are probably comparing today’s US economy to the economy in 2019. On that basis, yes, inflation is worse now, gas prices are higher, and there are unnerving wars in Europe and the Middle East.

Compared to the rest of the world, however, US economy looks fantastic. No economy emerged from the COVID pandemic stronger. Inflation, caused mainly by COVID-related supply chain snafus, emerged mostly everywhere, and it has fallen more quickly in the United States than in most other places. Telling voters it could be worse, however, is rarely a winning message.

It’s also irrational to compare the Biden economy to that of his predecessor, Donald Trump, who’s back this year making another run for the White House.

There’s a good chance the economy would have looked more or less the same from 2017 to 2021 if Biden were president instead of Trump. Same for the last three years, if Trump were in office instead of Biden.

The factors that have changed the US economy in the last few years are more influential than anything Trump or Biden has done.

Trump enjoyed a benign economic environment. And, importantly, American shale energy firms were competing for market share with Middle East oil drillers, which led to overproduction and low gas prices for consumers. On the other hand, Trump got slammed with the COVID outbreak in 2020 and the madness of lockdowns and business closures.

Biden took office as COVID vaccines were rolling out, allowing a gradual return to normal. But COVID disruptions generated the inflation that’s been the bane of Biden’s presidency.

Russia’s 2022 invasion of Ukraine sent energy prices soaring just as the OPEC+ nations were cutting output and American drillers were focusing on profitability over market share. All of that pushed energy prices higher, contributing to a big chunk of the soaring inflation in 2022 that still hangs over Biden’s economic record.

Something else that may be bumming people out is the end of COVID stimulus.

In annual surveys conducted by the Federal Reserve, Americans reported their best financial health in 2021 — when the economy was still making up lost ground from the pandemic-related downturn. The economy got progressively stronger in 2022 and 2023, but Americans said their financial situation deteriorated in each of those years as prices rose.

The peak thrust of $6 trillion worth of COVID-related stimulus for consumers and businesses flowed through in 2021. As those programs ended, the “excess savings” that built up while people were stuck at home receiving stimulus checks dried up and were basically gone by the end of 2023.

So, if Americans are comparing the economy now to one from three years ago that featured the government raining down helicopter money, then yeah, it’s a little tougher.

Now, do endless surveys asking people their opinions on the economy even matter? If Biden wins reelection in November, maybe not.

But if voters bounce Biden, it will be clear they’ve been signaling their displeasure for a good long while. Even if the data doesn’t totally back it up.

Rick Newman is a senior columnist for Yahoo Finance. Follow him on Twitter at @rickjnewman.

Read the latest financial and business news from Yahoo Finance